What Do You Pay For Hospital Inpatient Care Under Medicare Part A

You will generally be responsible for paying a portion of the inpatient care that Medicare Part A does not pay. Lets break down these expenses.

- Deductible: This is an amount you have to spend before Medicare starts to pay for covered services. The deductible amount may change from year to year.

- Coinsurance: This is the part of the Medicare-approved costs for hospital care you may be required to pay after youve met your deductible.

- Non-covered services: These include hospital services that you request or perhaps your doctor orders that are not covered under Medicare Part A. Examples of non-covered services may include such things as:

- Convenience items like razors

- Custodial care, if this is the only care you need. This care can be given by someone who is not medically skilledhelp with dressing, walking, or eating are examples.

- Private-duty nursing care

- A private room

- Inpatient days beyond the Medicare Part A coverage maximum number of days in a benefit period

Now, lets look at when you may incur these expenses.

Note that:

- Time spent in a skilled nursing facility where you may go for continuing skilled nursing care or rehab services after you leave the hospitalgenerally counts toward a benefit period.

- During the COVID-19 pandemic, you might be eligible to get renewed SNF coverage without starting a new benefit period.

- You might be able to get SNF care without a qualifying hospital stay if you were affected by COVID-19.

When Should You Apply For Medicare Part A

If you wont get Medicare Part A premium-free, try to sign up for it when youre first eligible, as you could face a late enrollment penalty. Your initial enrollment period begins when you become eligible for Medicare. You can also join during the Medicare open enrollment period, which runs annually from October 15 through December 7.

If youre looking to buy Part A premium and miss thewindow of when you’re first eligible, you may end up paying an extra 10% for monthly premiums and the penalty lasts more than a month or two. Medicare.gov states that youll be responsible for paying the higher premium for twice the number of years you could have had Part A but didn’t sign up.

Medicare Nursing Home Coverage

Part A does not pay for nursing home custodial care like bathing, dressing, eating and using the bathroom. But if you need skilled nursing facility care thats medically necessary , Part A may help cover it.2

Note: If you have a Medicare Advantage plan , contact your provider. You may have extra benefits for vision, hearing and dental that Original Medicare doesnt cover.3

Recommended Reading: Can You Get Dental On Medicare

Skilled Nursing Facility Care

After you are discharged from a hospital stay, you may still need care that you canât give yourself, like an intravenous injection. If thatâs the case, your doctor might order a stay at a skilled nursing facility where a skilled professional can administer your treatment and provide you with the proper medication.

Medicare will cover your stay at the nursing facilities after your qualifying hospital stay and if you have a legitimate medical condition. Medicare will not cover a nursing home stay if it is simply for personal care, like bathing and getting dressed .

Part A also covers the following services at nursing facilities when medically necessary:

-

Ambulance to the nearest hospital

-

Physical and occupational therapy

-

Medical social services

Skilled Nursing Facility Care Costs

The costs for a rehab stay in a skilled nursing facility are as follows:

- You usually pay nothing for days 120 in one benefit period, after the Part A deductible is met.

- You pay a per-day charge set by Medicare for days 21100 in a benefit period.

- You pay 100 percent of the cost for day 101 and beyond in a benefit period.

Medicare covers inpatient rehab in a skilled nursing facility after a qualifying hospital stay that meets the 3-day rule. The 3-day rule for Medicare requires that you are admitted to the hospital as an inpatient for at least 3 days for rehab in a skilled nursing facility to be covered. You must be officially admitted to the hospital by a doctors order to even be considered an inpatient, so watch out for this rule. In cases where the 3-day rule is not met, Medicare may cover outpatient rehab.

Also Check: Which Medicare Part Covers Prescriptions

How Much Medicare Pays For You To Stay In A Hospital

Medicare Part A pays only certain amounts of a hospital bill for any one spell of illness.

For the first 60 days you are an inpatient in a hospital, Part A hospital insurance pays all of the cost of covered services. After your 60th day in the hospital and through your 90th day, each day you must pay what is called a “coinsurance amount” toward your covered hospital costs, and Medicare will pay the rest of covered costs. In 2020, this daily coinsurance amount is $352 it goes up every year.

If you are in the hospital more than 90 days during one spell of illness, you can use up to 60 additional “lifetime reserve” days of coverage. During those days, you are responsible for a daily coinsurance payment of $704 per day in 2020. Medicare pays the rest of covered costs.

You do not have to use your reserve days in one spell of illness you can split them up and use them over several benefit periods. But you have a total of only 60 reserve days in your lifetime.

Will Medicaid Pay For Long

Many Medicare enrollees are qualify for Medicaid due to their limited incomes and assets. Unlike Medicare, Medicaid covers both nursing home care and Home and Community Based Services .

Due to the high cost of long-term care, many states have higher Medicaid income limits for long-term care benefits than for other Medicaid coverage. However, Medicaids asset limits usually require you to spend-down resources before becoming eligible.

Don’t Miss: How Do You File For Medicare

What Constitutes One Spell Of Illness

A spell of illness, called a “benefit period,” refers to the time you are treated in a hospital or skilled nursing facility, or some combination of the two. The benefit period begins the day you enter the hospital or skilled nursing facility as an inpatient and continues until you have been out for 60 consecutive days. If you are in and out of the hospital or nursing facility several times but have not stayed out completely for 60 consecutive days, all your inpatient bills for that time will be figured as part of the same benefit period .

Surgical Procedures Not Covered Under Medicare

A surgery must be considered medically necessary to qualify for Medicare coverage. Investigational procedures arent covered.

Medicare generally wont cover cosmetic surgery either, but there are a few exceptions.

Medicare may cover cosmetic surgery if it repairs an accidental injury or improves the function of a malformed body part.

Cosmetic Procedures Covered by Medicare

- Surgery to treat severe burns

- Surgery to repair the face after a serious car accident

- Therapeutic surgery that coincidentally serves a cosmetic purpose

For example, rhinoplasty to correct a malformed nasal passage and chronic breathing issues can simultaneously improve the appearance of your nose. Or a procedure that removes excessive eye skin to improve vision may also make your eyelids appear less droopy.

Its important to note that Medicare covers breast reconstruction procedures following a mastectomy or lumpectomy, as it doesnt consider these procedures to be cosmetic surgeries.

You May Like: Does Medicare Pay For A Portable Oxygen Concentrator

If Im Hospitalized For Coronavirus Will Medicare Cover My Medical Bills

As coronavirus has spread across the globe affecting millions of people, there is still a great deal of uncertainty regarding the disease. One of the common questions posed by many is: If I end up with complications from coronavirus and end up in the hospital, will Medicare help pay my bills? Having an illness is stressful enough, but having to worry out the financial impact of your medical needs can be devastating. Understanding your Medicare coverage can help.

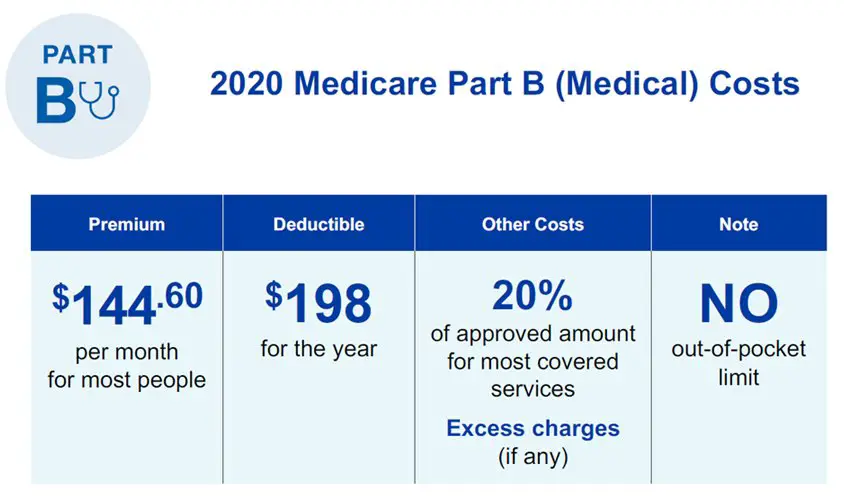

Does Medicare Cover Coronavirus Treatment and How Much Will It Cost?Most people who contract COVID-19, will have mild cases. In severe cases, you may require emergency medical treatment. If you initially go to the emergency department, your visit will be covered by Medicare Part B, which will also cover ambulance rides or physician visits.

However, if your treatment requires admission to the hospital, your treatment will be covered under Medicare Part A. For most people, there are no premium payments for Medicare Part A. In 2020, Part A carries a deductible of $1,408 for each benefit period.

Does Medicare Cover Coronavirus Testing?Many people want to get tested to see if they have COVID-19. The good news for Medicare recipients is that insurance will provide coverage for COVID-19 testing. This testing can be conducted at community testing sites, including drive-through and hospital off-site locations.

Related articles:

How Can Medigap Insurance Protect You

Fortunately, Medicare beneficiaries seeking financial protection against a long hospitalization can purchase a Medigap insurance policy. Also known as Medicare Supplement Insurance, Medigap policies are designed to pick up the healthcare costs not covered under Original Medicare Part A and Part B.

To avoid perhaps paying tens of thousands of dollars out-of-pocket during an extended hospital stay, more than 30% of Original Medicare beneficiaries purchase Medicare Supplement Insurance . These policies cover the cost of Part A coinsurance plus, they provide beneficiaries with 365 additional lifetime reserve days. Some plans also cover Medicare beneficiaries Part A hospital deductible. Others pay for healthcare expenses that Original Medicare does not cover, such as out-of-hospital prescription drugs.

To be sure, most people dont spend more than a week in the hospital. However, Medigap coverage is especially helpful for patients who have a chronic illness and therefore run the risk of needing extended hospital care. Purchasing a Medigap policy can protect them from racking up costly hospital bills, especially if they need to be hospitalized over 90 days in any one benefit period.

Medigap picks up the costs not covered under by Original Medicare.

Recommended Reading: How To Get Motorized Wheelchair Through Medicare

Should You Buy A Medigap Policy

If you think there is a reasonable chance you will face stiff out-of-pocket costs that a Medicare Supplement plan would cover, then purchasing a Medigap policy may be worth the roughly $150 a month premium youll be charged. There are up to 10 Medicare Supplement plans available in most states, labeled A, B, C, D, F, G, K, L, M, and N, though Plan C and Plan F are no longer available to new Medicare enrollees. Decide on the plans benefits you may need and then find a Medicare Supplement Plan featuring those benefits.

The bottom line: If you have Medicare coverage and want to keep a lid on expenses, explore your Medigap options and choose a plan that fits your needs and budget.

Does Medicare Cover Coronavirus Costs

Elderly people have been hardest hit by the coronavirus pandemic, with the greatest risk of complications and death occurring among older people. If youre an elderly person on Medicare, you might be wondering what medical costs related to coronavirus are covered by the programs. In this article well break down which costs are covered by Medicare, and what other services are provided and covered during this time.

Read Also: Does Medicare Require A Referral For A Colonoscopy

Premium Medicare Options For Hip Replacements

To pay for prescription drugs following hip replacement, you have two options. You can enroll in Part D prescription drug coverage which is provided by a private insurance company and paid for in part by Medicare. In this case, the average premium is $34 per month.

You can also receive Part D coverage through a Part C or Medicare Advantage plan. A Medicare Advantage plan is more expensive but it can provide more comprehensive coverage with fewer out-of-pocket costs after surgery. Medicare Advantage plans usually have copayments instead of coinsurance which is a percentage of the total cost. A copayment will be a known amount such as $100 to see a specialist.

A final option that may be available to you is a Medigap or Medicare Supplement plan. A Medigap plan is offered by a private insurance company and it essentially picks up the bill where Original Medicare left off. Medigap plans only cover your out-of-pocket costs like deductibles and coinsurance but you cant have both Medigap and Medicare Advantage coverage.

Its important to compare Medigap and Medicare Advantage plans as both can reduce the cost of hip replacement surgery: one by boosting coverage and potentially replacing coinsurance with a predictable and possibly lower copayment and the other by taking care of all out-of-pocket costs after Original Medicare pays for your treatment.

What Does Medicare Part A Cover

Medicare Part A covers the hospital charges and most of the services you receive when you’re in the hospital.

What is covered by Medicare Part A

Hospital stays and inpatient care, including:

Medications for pain and symptom management:

Up to $5 per prescription

Durable medical equipment used at home and respite care:

Home hospice patients may pay a small coinsurance amount for inpatient respite care or durable medical equipment used at home.

*Lifetime reserve days are a set number of covered hospital days you can draw on if youre in the hospital longer than 90 days. You have 60. Each lifetime reserve day may be used only once, but you may apply the days to different benefit periods. Lifetime reserve days may not be used to extend coverage in a skilled nursing facility.

Recommended Reading: How Much Is Medicare Copay For A Doctor’s Visit

Medicare Doesn’t Cover Routine Vision Care

Medicare generally doesnt cover routine eye exams or glasses . But some Medicare Advantage plans provide vision coverage, or you may be able to buy a separate supplemental policy that provides vision care alone or includes both dental and vision care. If you set aside money in a health savings account before you enroll in Medicare, you can use the money tax-free at any age for glasses, contact lenses, prescription sunglasses and other out-of-pocket costs for vision care.

Can Medicare Beneficiaries Get Extended Supplies Of Medication

The Department of Homeland Security recommends that, in advance of a pandemic, people ensure they have a continuous supply of regular prescription drugs. In light of the coronavirus pandemic, a provision in the CARES Act requires Part D plans to provide up to a 90-day supply of covered Part D drugs to enrollees who request it during the public health emergency.

According to CMS, for drugs covered under Part B, Medicare and its contractors make decisions locally and on a case-by-case basis as to whether to provide and pay for a greater-than-30 day supply of drugs.

Also Check: How Does Geha Work With Medicare

The Difference Between Medicare Part A And Medicare Part B

Medicare Part B covers outpatient and preventative screenings and services. Think of it as doctor insurance. You can check your Medicare card to see if you have Part B it will be designated with the word âMEDICAL.â The following chart broadly illustrates what type of services each part covers.

Medicare Part A vs. Medicare Part B

| Covered benefit | |

|---|---|

| Not covered | Not covered |

Medicare Part A and Medicare Part B work in tandem. You enroll in them, or opt for Medicare Advantage plans through Part C. Advantage plans are provided by private insurance companies that approved by the Medicare program. Lastly, prescription drug coverage is provided by Medicare Part D.

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

| TTY 711, 24/7

Original Medicare and all Medicare Advantage plans provide full coverage for the following services and treatments related to COVID-19:

- Virus tests

- Antibody tests

- Vaccine

This means you wont pay a dime out-of-pocket for Medicare-approved COVID-19 tests or a vaccine.

Don’t Miss: Why Is My Medicare So Expensive

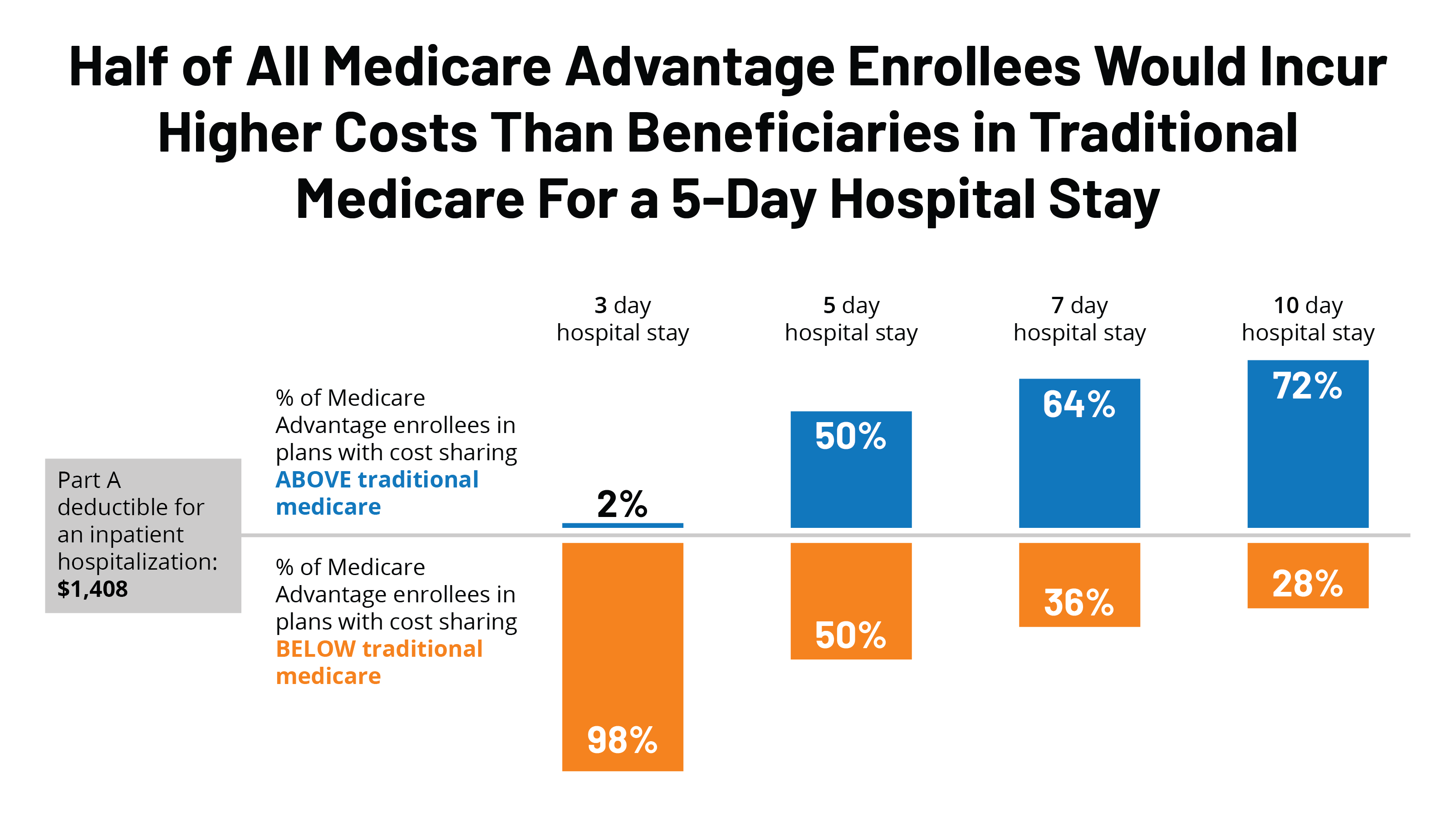

Hospital Stay Coverage Under Medicare Advantage

You may choose to receive your Medicare Part A and Part B coverage through a local Medicare Advantage plan. Medicare Advantage plans are offered by private insurance companies that are approved by Medicare and cover at least the same level of benefits as Original Medicare Part A and Part B . Many Medicare Advantage plans cover extra benefits beyond Original Medicare.

Keep in mind that Medicare Advantage plans have some flexibility in setting their rates and charges you may be responsible for a monthly plan premium, deductibles, and/or copayments or coinsurance. Under a Medicare Advantage plan, you may need to receive care from hospitals and doctors participating in the plans network. Consult your Medicare Advantage plan or benefit information for coverage details.

You can do some research on your own to get familiar with Medicare plan options in your area by clicking on the Compare Plans button on this page.

The product and service descriptions, if any, provided on these eHealth web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

How Does Coinsurance Work With Medicare Part A

If youre admitted to a hospital, you will have to pay your Medicare Part A deductible . Your admission starts the clock on your cost-sharing, because your out-of-pocket costs are based on benefit periods.

After you pay your deductible, the first 60 days in a hospital are free of coinsurance. If youre in the hospital for more than 60 days, youll then be responsible for coinsurance each day.

| Youre responsible for all costs. |

Recommended Reading: Which Is Better Medicare Supplement Or Medicare Advantage