Delaying Your Medicare Enrollment Could Be A Costly Mistake

Countless seniors rely on Medicare for health coverage in retirement. But knowing when to sign up can help you make the most of your benefits while avoiding needless penalties.

Your coverage under Medicare kicks in at exactly 65, but you dont need to wait until your 65th birthday to sign up. Rather, your initial enrollment window starts three months before the month you turn 65 and ends three months after the month in which you turn 65. So, all told, you get a solid seven months to sign up.

Now if you miss that initial enrollment window, you can still sign up during Medicares general enrollment period that runs from Jan. 1 through March 31 each year. But not signing up during your initial enrollment period could end up costing you a higher Part B premium for life.

Dont Miss: How Much Is Premium For Medicare

What Happens If You Dont Sign Up For Medicare At 65

When you near your 65th birthday, you will enter what is called your Initial Enrollment Period . This seven-month period begins three months before you turn 65, includes the month of your birthday and continues for three additional months. This is your first opportunity to sign up for Medicare.

If you choose not to sign up for Medicare during your IEP, there are a few scenarios that might play out depending on your situation.

Medicare Advantage plans do not have a late enrollment penalty. You can sign up for a Medicare Advantage plan at any age, as long as you are already enrolled in Medicare Part A and Part B.

Medicare Supplement Insurance does not technically have a late enrollment penalty. However, if you enroll in a Medigap plan during your Medigap Open Enrollment Period, insurance providers arent allowed to use medical underwriting to determine your plan premiums or deny you coverage. Your Medigap Open Enrollment Period lasts for six months and starts as soon as you are 65 and enrolled in Medicare Part B.

There are also some Medicare Special Enrollment Periods that may apply to a someone who is turning 65. For example, if you are living overseas at the time of your 65th birthday and then later return to the U.S., you may qualify for a Special Enrollment Period for which you can sign up for Medicare with no late enrollment penalty.

When And How To Sign Up For Medicare

If you aren’t automatically enrolled, you’ll have a seven-month initial enrollment period when you become eligible for Medicare. For those who are eligible based on age, this period includes the three months before the month you turn 65, the month you turn 65, and the next three months.

You can choose to sign up for Medicare Parts A and/or B during or after your initial enrollment period, and your coverage will begin when you sign up. However, if you don’t sign up during your initial enrollment period, you may have to pay a penalty for enrolling late.

If you don’t sign up during your initial enrollment period, you’ll be able to sign up during the general enrollment period, which runs from Jan. 1-March 31 each year. Or, if you’re covered under an employer’s plan when initially eligible, you may be able to sign up later during a special enrollment period, in which case you won’t have to pay any penalty. More on that shortly.

There are a few different options for signing up. The easiest and fastest way is to apply online at the Social Security Administration’s website. According to the SSA, the application should take less than 10 minutes and there are no forms to sign and no additional documentation requirements. Or you can apply at your local Social Security office , or over the phone. If you already have Medicare Part A and only need to sign up for Part B, there is a to use.

Read Also: Is Any Dental Covered By Medicare

Should I Sign Up For Medicare When I Turn 65

The popular perception is that your 65thbirthday marks the milestone in your life when you get to walk out the office, kick back and reap the fruits of your labor as you enjoy sunsets from your porch.

For some, that perception is becoming a thing of the past.

Nowadays, many people turning 65 and reaching Medicare eligibility are choosing to keep working. Some do it for financial reasons and others continue to work simply because they enjoy it.

The number of Americans 65 and older who said they were employed or looking for employment has increased from 10 percent in 1985 to 20 percent as of February 2019. And that number is expected to continue to rise according to the data from the Current Population Survey, a report by the U.S. Bureau of Labor Statistics. The Bureau estimates that by 2024, more than 13 million Americans 65 and older will be working.1

But regardless of why you may choose to work past 65, not enrolling in Medicare during the right enrollment period could cost you in the form of Medicare premium penalties if you miss certain dates. So its important to approach the decision to delay enrollingwith your eyes wide open.

Here are some important points to keep in mind as you approach your 65thbirthday.

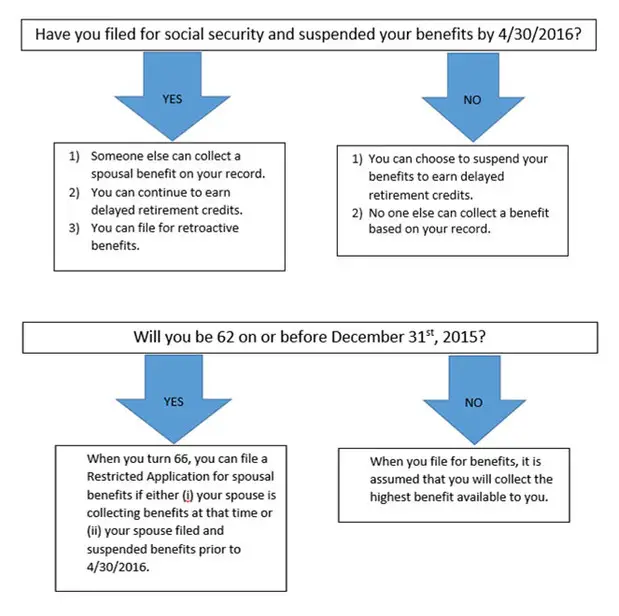

How Social Security Benefits Can Affect Medicare Enrollment

If you are receiving Social Security benefits when you turn 65, youll be automatically enrolled in Medicare Parts A and B, even if youre working. Your Medicare card will arrive in the mail about 3 months before your 65thbirthday.

Once youre enrolled in Medicare, a monthly Part B premium will be automatically deducted from your Social Security check. If you dont want Medicare Part B, you need to notify Medicare to opt out. There will be instructions for doing this on the back of your Medicare card.

If youre not receiving Social Security or Railroad Retirement Board benefits, you will need to enroll yourself in Medicare when you become eligible.

Also Check: What Is The Minimum Medicare Premium

What Are Cases When Medicare Automatically Starts

Medicare will automatically start when you turn 65 if youve received Social Security Benefits or Railroad Retirement Benefits for at least 4 months prior to your 65th birthday.

Youll automatically be enrolled in both Medicare Part A and Part B at 65 if you get benefit checks. According to the Social Security Administration, more than 30% of seniors claim Social Security benefits early.1 For those seniors, Medicare Part A and Part B will automatically start when they reach the age of 65.

When do You Get Your Medicare Card?

You can expect to receive your Medicare card in the mail three months before your birthday. Your Medicare card will come with a complete enrollment package that includes basic information about your coverage. Your card wont be usable until you turn 65, even though youll receive the card before that time.

What Are Your Costs?

Keep in mind that youll still have to pay the usual costs of Medicare, even though youre automatically enrolled. Once your Medicare is active, the cost of your Part B premium will be deducted from your Social Security or RRB benefits.

What If You Already Enrolled in Medicare?

What about Medicare Supplement ?

What If I Switch to Medicare Advantage?

And if you want to switch to Medicare Advantage , youll have a one-time Initial Enrollment Period for Medicare Advantage that begins 3 months before the month you turn 65 and lasts for 7 months.

What I Have Part A?

How Much Does Medicare Cost At Age 65

The bottom line is â it depends.

As much as we wish we had a hard and fast answer to this question, the cost of Medicare will likely vary from person to person, based on their income, needs, and plan choices.

Medicare Part A usually does not have a premium, but you do still have to pay an inpatient deductible at the hospital and coinsurance. The deductible for each benefit period is $1,484 with each period of coinsurance correlating with a rise in cost. For example:

- Days 1â60: $0 coinsurance

- Days 61â90: $371 coinsurance per day

- Days 91 and beyond: $742 coinsurance per each âlifetime reserve day,â which everyone has 60 of over their lifetime. After your lifetime reserve days run out, you will be responsible for all costs.

Medicare Part B has a premium that is income-dependent. The deductible is $203 in 2021. Once you reach your deductible,you will pay 20% of the Medicare-approved amount for most services.

If you have a Medicare Supplement plan, you likely won’t pay any of the costs associated with having Part A, and you will most likely only be responsible for the $203 Part B deductible . The exact benefits will depend on which Medicare Supplement plan you choose.

You May Like: What Are The Benefits Of Having Medicare

Making Prescription Drugs Free For People 65 And Over

Expanding OHIP+ Will Make Prescription Drugs Free for Nearly One in Two Ontarians

Premier Kathleen Wynne today announced Ontarios plan to make prescription drugs free for people 65 and over, ensuring millions of people can afford the care they need during this period of economic change and uncertainty.

Through an expansion of OHIP+, more than 4,400 prescription drugs will be available free of charge to everyone 65 and over. The Premier was joined by Minister of Health and Long-Term Care Helena Jaczek and Minister of Seniors Affairs Dipika Damerla at the Leaside Curling Club to lay out the governments plan to expand OHIP+ and make life more affordable for 2.6 million seniors and their families.

Starting August 1, 2019, anyone aged 65 or older will no longer have to pay a deductible or co-payment and would be able to present their eligible prescription and OHIP number at any Ontario pharmacy and receive their medication for free. On January 1, 2018, Ontario introduced OHIP+ Children and Youth Pharmacare, which made eligible prescription drugs free for everyone 24 and under and is the largest expansion of medicare in a generation. By expanding OHIP+ to seniors in Budget 2018, people 65 and over will now save an average of $240 every year. Prescription drugs covered by this program include medications for cholesterol, hypertension, thyroid conditions, diabetes and asthma.

Quick Facts

Also Check: When Can Medicare Plans Be Changed

If You’re Covered By An Employer’s Health Insurance Plan

You may or may not need to sign up for Medicare if you already have health coverage through an employer or former employer.

If you’re about to turn 65, you should ask your employer or benefits administrator if they require you to sign up for Medicare when you initially become eligible. If they don’t, you can sign up later on — the initial enrollment period and its penalties won’t apply to you. If you’re over 65 and still working , you don’t have to sign up for Medicare until you retire or lose that coverage.

A special enrollment period lasts for eight months and begins the month after your employment ends or your health coverage based on that employment ends, whichever comes first.

It’s also important to mention that if you’re retired and have health insurance through a former employer or if you have COBRA, it is not considered employment-based coverage and a special enrollment period doesn’t apply. Once you apply for Medicare, it becomes your primary insurance, and healthcare costs not covered by Medicare can be submitted to your other plan.

Don’t Miss: Do You Pay Medicare After Retirement

The Bottom Line: Know Your Options Enroll On Time

Dont delay making Medicare decisions and dealing with Medicare enrollment. Learn about the choices you have can you delay, must you enroll and then understand the implications of both as they relate to your overall health and financial well-being.

Late-enrollment penalties for Medicare Part B and Medicare Part D are permanent and can have a meaningful impact on your finances so think carefully about what you do and when.

Not sure where to start? A good first step for anyone approaching Medicare eligibility is to know when your enrollment dates are. You can quickly find your dates for your Initial Enrollment Period using our enrollment date calculator.

Footnote

Does Everyone Over 65 Have To Pay For Medicare

Asked by: Mr. Camden Bode V

Nearly every American 65 or older is eligible for Medicare, and almost all of them are eligible for Medicare Part A with no premiums. Although about three-quarters of Medicare beneficiaries are satisfied with their coverage,1 not everyone in this age group wants to receive Medicare.

Read Also: Will Medicare Pay For Breast Augmentation

What If You Worked 10 Years Or Less

Most people will qualify for coverage by paying Medicare and Social Security taxes for 10 years through any combination of employers. Youll need to have spent 10 years doing taxable work to enroll in Medicare Part A for free. If youve worked for less than 10 years in the US, youll need to pay monthly premiums for Medicare Part A.

However, if your spouse who is 62 or older has enough quarterly credits or receives Social Security benefits, then youll still qualify. You may also be able to qualify based on your spouses work record if youre widowed or divorced.

Medicaid Or Medicare Savings Programs

Medicare beneficiaries with limited income or very high medical costs may be eligible to receive assistance from the Medicaid program. There are also Medicare Savings Programs for other limited-income beneficiaries that may help pay for Medicare premiums, deductibles, and coinsurance. There are specified income and resources limits for both programs. Contact your local county Department of Social Services or SHIIP to apply for one of these programs.

Don’t Miss: Which Medicare Plans Cover Silver Sneakers

Does Medicare Cover The Costs Of Diabetic Supplies

Yes, Medicare does cover certain supplies if you have diabetes. Part B covered supplies include blood sugar self-testing equipment and supplies, insulin pumps, and therapeutic shoes or inserts. To get Medicare drug coverage, you must join a Medicare prescription drug plan. These plans typically cover insulin, anti-diabetic drugs, and certain diabetes supplies such as syringes and needles. The Medicare Coverage of Diabetes Supplies and Services booklet provides a comprehensive look what diabetes related services are covered.

Who Qualifies For Medicare Part D

Medicare Part D covers prescription drugs and, like Medicare Part C, is available through private insurance companies that are approved by Medicare. To be eligible to enroll in a Medicare Part D prescription drug plan, you must have Medicare Part A and/or Part B and you must live in the service area for the prescription drug plan in which you want to enroll. To be eligible to enroll in a Medicare plan with prescription drug coverage, you must have Medicare Part A and Part B, and you must live in the service area for the plan youâre considering.

Read Also: Does Medicare Cover Speech Therapy

Who Qualifies For Medicare Part C

Medicare Part C is an alternative way to get your Medicare Part A and Part B benefits. Medicare Advantage plans are available through Medicare-approved private insurance companies. To be eligible for Medicare Part C, you must already be enrolled in Medicare Part A and Part B, and you must reside within the service area of the Medicare Advantage plan you want. You can get more information about and enroll in a Medicare Advantage plan by contacting a licensed health insurance agent or broker, such as eHealth.

The Medicare Advantage plan Initial Coverage Election Period is generally the same as the Initial Enrollment Period for Medicare Part A and Part B . Or, you can sign up during the Annual Election Period from October 15 to December 7 for coverage effective January 1 of the following year. You can also enroll during a Special Election Period , if you qualify.

Please note: If you have end-stage renal disease , hereâs a change you may want to know about. Starting in 2021, you may qualify for a Medicare Advantage plan if you have end-stage renal disease and meet the usual requirements listed below.

Medicare Part C is optional, and there is no penalty for not signing up. But you must have Medicare Part A and Part B to get Part C, and live in the service area of a Medicare Advantage plan.

Ask These Questions Before You Delay Medicare

Whether or not you can delay Medicare past 65 when youre working really depends on a few simple questions.

If you can answer Yes! to all the above, you likely qualify for a Medicare Special Enrollment Period and can delay enrolling without penalty. Whats the next step?and information sent directly to your inbox.

Also Check: Does Medicare Cover Life Line Screening

How Do I Enroll In A Prescription Drug Plan

The Medicare Prescription Drug Plans are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDPs effective date. All people with Medicare are eligible to enroll in a PDP however, unless you are new to Medicare or are entitled to a Special Enrollment Period, you must enroll or change plans during the Open Enrollment Period for Medicare Advantage and Medicare Part D, Oct. 15 through Dec. 7. There is a monthly premium for these plans.

For assistance with Part D plan comparisons and enrollments, please call our team of Medicare specialists at 1-855-408-1212 or you may log onto MyMedicare.gov to shop for prescription drug plans available in your area.

If you have limited income and assets/resources, assistance is available to help pay premiums, deductibles and co-payments. You may be entitled to Extra Help through the Social Security Administration. To apply for this benefit contact SHIIP at 1-855-408-1212 or the Social Security Administration at 800-772-1213 or www.socialsecurity.gov.