Monthly Medicare Premiums For 2022

The standard Part B premium for 2022 is $170.10. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $91,000 Married couples with a MAGI of $182,000 or less | 2022 standard premium = $170.10 |

| Your plan premium + $77.90 |

How Much Will I Pay For Premiums In 2022

Most people will pay the standard amount for their Medicare Part B premium. However, youll owe an IRMAA if you make more than $91,000 in a given year.

For Part D, youll pay the premium for the plan you select. Depending on your income, youll also pay an additional amount to Medicare.

The following table shows the income brackets and IRMAA amount youll pay for Part B and Part D in 2022:

| Yearly income in 2020: single | Yearly income in 2020: married, joint filing | 2022 Medicare Part B monthly premium | 2022 Medicare Part D monthly premium |

|---|---|---|---|

| $91,000 | |||

| $578.30 | your plans premium + $77.90 |

There are different brackets for married couples who file taxes separately. If this is your filing situation, youll pay the following amounts for Part B:

- $170.10 per month if you make $91,000 or less

- $544.30 per month if you make more than $91,000 and less than $409,000

- $578.30 per month if you make $409,000 or more

Your Part B premium costs will be deducted directly from your Social Security or Railroad Retirement Board benefits. If you dont receive either benefit, youll get a bill from Medicare every 3 months.

Just like with Part B, there are different brackets for married couples who file separately. In this case, youll pay the following premiums for Part D:

- only the plan premium if you make $91,000 or less

- your plan premium plus $71.30 if you make more than $91,000 and less than $409,000

- your plan premium plus $77.90 if you make $409,000 or more

You can request an appeal if:

Medicare Advantage Plan :

- Monthly premiums vary based on which plan you join. The amount can change each year.

- You must keep paying your Part B premium to stay in your plan.

- Deductibles, coinsurance, and copayments vary based on which plan you join.

- Plans also have a yearly limit on what you pay out-of-pocket. Once you pay the plans limit, the plan pays 100% for covered health services for the rest of the year.

Read Also: Are Lymphedema Pumps Covered By Medicare

Help With Medicare Part A And Part B Costs

Please note that the income and resource limits listed here are for 2016.

If youre disabled or have a low income, you might qualify for a Medicare Savings Program through Medicaid. Besides helping with your Medicare Part A and/or Part B premiums, some MSPs might help with other Medicare Part A and Part B costs, such as coinsurance. There are four types of MSPs, each with different eligibility criteria:

Resources include, but arent limited to, money you have in the bank, stocks, and bonds they dont include certain possessions, such as your home. To find out if you qualify for a Medicare Savings Program, contact your state Medicaid office.

B Deductibles In Previous Years

The Part B deductible has generally increased over time, although there have been some years when it stayed the same or even decreased. The increase for 2022 is the largest year-over-year dollar increase in the programs history. Heres an historical summary of Part deductibles over the last several years :

Also Check: When To Sign Up For Medicare For First Time

Can You Delay Medicare Enrollment Even If You Are Eligible

The short answer here is yes, you can choose when to sign up for Medicare. Even if you get automatically enrolled, you can opt out of Part B since it requires a monthly premium. But there are good reasons to join on time when you first become eligible.

A Delay In Coverage Can Result In Increased Costs, Especially Long Term

First, signing up during your initial eligibility window guarantees that you have coverage sooner. Waiting to enroll in Medicare until after your 65th birthday can mean waiting for effective coverage for up to three months after you turn 65. Three months might not sound like a long time, but when you need medical care or prescription drugs, that 3-month gap can be expensive.

If you dont sign up at all during your initial eligibility window, then youll have to wait until the general enrollment period to enroll, which runs from January 1 through March 31 each year. Coverage then starts in July.

Heres An Example Scenario:

- You turn 65 in June, but you choose not to sign up for Medicare during your IEP .

- In October, you decide that you would like Medicare coverage after all. Unfortunately, the next general enrollment period doesnt start until January.

- You sign up for Parts A and B in January.

- Your coverage starts in July, over a full year from when you turned 65.

Penalty Fees For Not Enrolling On Time

What Counts As An Asset

Medicare Savings Programs are only open to people who qualify based on income and asset requirements. So, what counts as an asset when it comes to qualifying?

- The house you live in

- One vehicle like a car, motor home or motorcycle

- Household items

- Burial funds up to $1,500 per person

There are four types of Medicare Savings Programs designed to help with paying costs for Original Medicare or Medicare Part B. They are distinguished by their income limits and what costs they help pay for. The programs include:

- Qualified Medicare Beneficiary Program

- This program helps to pay Part A and Part B premiums and copayments. It also helps to pay deductibles and coinsurance for both Part A and Part B.

- Asingle person can qualify for the program in 2022 with an income up to $1,153 per month.

- A couple can qualify with a combined income of $1,546 per month.

- The asset limits are $8,400 for an individual and $12,600 for a couple.

- Specified Low-Income Medicare Beneficiary Program

- This program helps to pay premiums for Part B.

- A single person can qualify in 2022 with an income up to $1,379 per month.

- A couple can qualify with a combined income of $1,851 per month.

- The asset limits are $8,400 for an individual and $12,600 for a couple.

It is important to note that income limits to qualify for these programs are slightly different in Alaska and Hawaii. To learn more about the income limits in those states, see details on the Social Security Administration website.

Read Also: What Does Aarp Medicare Supplement Cost

How Much Is Coinsurance For 2020

In 2020, beneficiaries must pay a coinsurance amount of $352 per day for the 61st through 90th day of a hospitalization in a benefit period and $704 per day for lifetime reserve days . For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in …

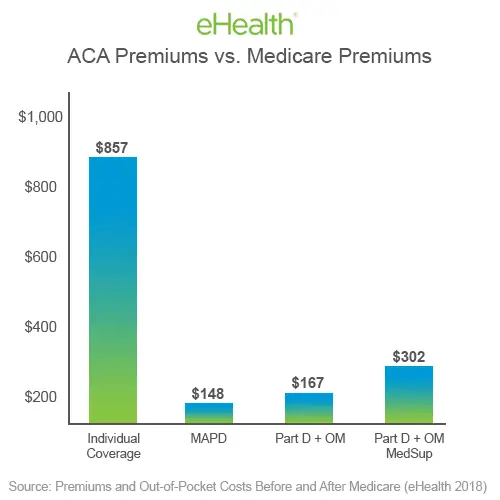

What Is The Increase For Medicare Part B In 2021

$148.50/month In 2021, the regular Medicare Part B premium is $148.50 per month. This is a monthly premium increase of less than $4 over the normal 2020 rate of $144.60. The Medicare Part B deductible remains at $185.

This article covers how Medicare’s Part B premium changes for 2021. It does not address other costs associated with Medicare such as Part A premiums or deductibles, which vary depending on your age and health status. It also does not discuss how some medical services may be paid for under Part B instead of Part A.

In general, older people who need more expensive medical care will pay more out of their own pockets for their coverage. Young people who don’t need much health care can get it for free from their parents’ plan until they turn 26 years old. When they do need care, they can buy their own policy at any age with no extra cost to them.

People can still enroll in Medicare Part B during the open enrollment period that starts on October 15th and ends on December 7th each year. Enrollment determines what kind of premium you pay and when you start paying it. If you decide not to continue with your current plan, you can drop it at any time without losing coverage.

Recommended Reading: Is Medicare Part B Based On Income

B Premium Can Be Limited By Social Security Cola But That Hasnt Been An Issue For Most Beneficiaries Since 2019

In 2022, most enrollees will pay $171.10/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2021 , in 2020 , and in 2019 . Some enrollees pay more than the standard premium, if theyre subject to a high-income surcharge .

But thats in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium. The standard premium in 2018 was actually $134/month, but the cost of living adjustment for Social Security wasnt quite large enough to cover all of the increase from 2017s premium for most enrollees. Thats why most people paid about $130/month.

The standard Part B premium increased by about $9/month in 2020. But the 1.6% Social Security COLA for 2020 increased the average beneficiarys Social Security benefit . Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees paid the standard premium in 2020. And for 2021, the 1.3% COLA was adequate to cover the increase to the new standard premium for virtually all enrollees. The COLA for 2022 was the largest it had been in 30 years, and more than adequate to cover even the substantial increase in Part B premiums.

Why Do Some People Pay Less For Their Medicare Part B Premium

Some people who get Social Security benefits will still pay less than $170.10 in 2022. This affects around 2 million Medicare beneficiaries. Legislation prevents the cost of Medicare Part B from increasing more than the Social Security annual cost-of-living increase.

In recent years, we have had low COLA increases, so these individuals have only been paying less than the standard base Part B premium. Though the Social Security COLA increases for the last couple of years have been somewhat larger, there is still a small group of beneficiaries being protected by the hold harmless provision.

Though this all very confusing, remember that you do not have to calculate this yourself. Again, Social Security will determine your Part B premium for 2022 and notify you by mail if you exceed the Medicare income limits and must pay a higher adjusted amount.

Most Medicare beneficiaries qualify for premium-free Part A. However, the Medicare Part B premium is deducted from your Social Security check if you are receiving Social Security benefits. In 2022, the Part B premium is $170.10.

You can also request your Part D premium be deducted from your Social Security check.

Most People Pay the Standard Part B Premium

Youll pay the standard Medicare Part B premium amount if:

You May Like: When Can I Get Medicare

Medigap Eligibility In 2021

Eligibility for Medigap lasts for six months, starting from the month you turn 65 and have Medicare Part B in place. In other words, you must be 65 and enrolled in Medicare to sign up for a Medigap policy. Once youre 65 and enrolled in Part B, you have six months to enroll in Medigap without being subject to medical underwriting. During this initial eligibility window, you can:

- Buy any Medigap policy regardless of health history

- Buy a plan knowing that youll pay the same rate as someone without any medical problems

- Buy any Medigap plan available in your state as long as its sold by an approved Medigap seller

Once that 6-month window closes, you can still sign up for Medigap, but the conditions change. Outside of the initial signup window, youre no longer guaranteed coverage if you have medical problems. And if you find a plan at all, it will likely cost much more because itll be based on medical underwriting. The best time to sign up for supplemental coverage through a private Medigap policy is when you first become eligible i.e., when you turn 65 and enroll in Medicare Part B.

What If You Need Help With Other Medicare Costs, Like Prescription Drug Coverage?

What Is A 50490

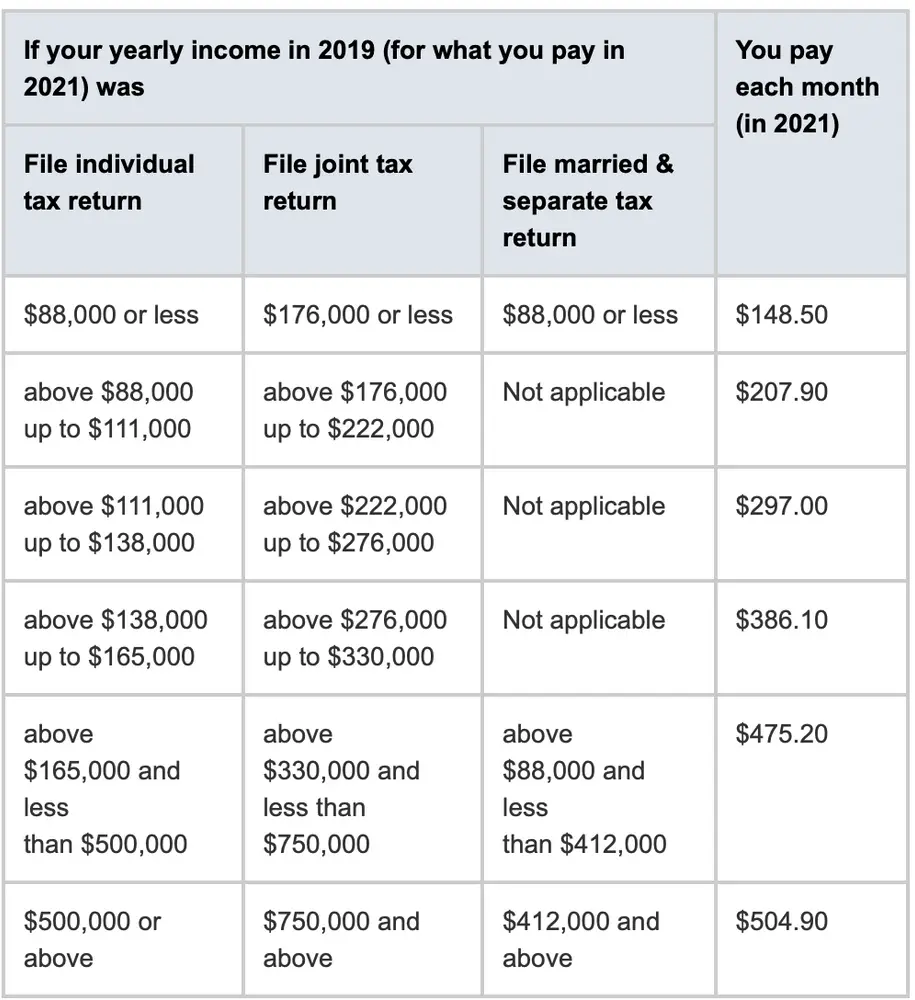

504.90. Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follow s: Beneficiaries who are married and lived with their spouses at any time during the year, but who file separate tax returns from their spouses:

You May Like: Does Medicare Help Pay For Incontinence Supplies

Medicare Part A Premium

Most beneficiaries qualify for premium-free Medicare Part A. This insurance isnt income-based rather, the premium depends on how many years you worked and paid Medicare taxes. Heres a breakdown of the Part A monthly premium in 2016. If youve worked while paying Medicare taxes:

- For at least 10 years while paying Medicare taxes, you dont pay a premium

- For 30 to 39 quarters, you pay $226

- For less than 30 quarters, you pay $411

How Much Does Medicare Part D Cost

What it helps cover:

- helps cover prescriptions drugs.

- Plan premiums, the drugs that are covered, deductibles, coinsurance and copays will vary by Part D plans, so you should check and compare plans each year based on your needs, the prescription drugs you take, etc.

What it costs:

- Like Medicare Advantage , prescription drug plans are offered by private insurance companies contracted by the federal government.

- Plans vary in cost, coverage, deductibles and copays.

You May Like: Does Medicare Pay For Physical Therapy After Knee Surgery

Medicare Part B Premiums

For Part B coverage, youll pay a premium each year. Most people will pay the standard premium amount. In 2022, the standard premium is $170.10. However, if you make more than the preset income limits, youll pay more for your premium.

The added premium amount is known as an income-related monthly adjustment amount . The Social Security Administration determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago.

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income.

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. Youll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

How Much Does Part B Cost For Most Enrollees

Most people new to Medicare will pay $170.10 a month for Part B premiums in 2022. This is the standard premium that most people pay based on income. Social Security will deduct your Part B premium from your Social Security check monthly. If you have not enrolled in Social Security income benefits yet, theyll bill you quarterly.

Since some people pay more based on income, use the tables below to determine your personal Medicare cost for Part B. It shows the amount that you will pay in 2022 for Part B, per the preview notice released by the Department of Health and Human Services in November.

The Medicare Part B deductible for 2022 is $233.

You May Like: Do I Have To Get Part B Medicare

How Much Will Medicare Cost In 2022

Find Cheap Medicare Plans in Your Area

For all Medicare plans, costs will vary depending on what plans you decide to purchase, the company you purchase your plan from, your income and sometimes your age. For this reason, you should carefully balance your coverage needs and the costs of the plans when choosing the right mix of Medicare policies.

How Much Does Medicare Part C Cost

What it helps cover:

- Medicare Advantage plans are required by law to provideat minimumthe same coverage, benefits and rights provided by Original Medicare Part A and Part B, with the exception of hospice care.

- Many Medicare Advantage plans also choose to offer prescription drug coverage, as well as coverage for routine dental, vision and hearing benefits.

What it costs:

- Medicare Advantage plans are offered by private insurance companies contracted by the federal government, so they vary in cost, coverage, deductibles and copays.

- Many Medicare Advantage plans offer affordable or plus a variety of coverages and benefits not offered by Original Medicare .

Don’t Miss: What Does Part B Cover Under Medicare

What Is The Medicare Deductible For 2021

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase …