Is It A Good Idea For Couples To Choose The Same Medicare Insurance Plan

Q: Is it a good idea for couples to choose the same Medicare insurance plan?

A: No, you should normally choose Medicare coverage based on your own health care needs. The exception is if both spouses are offered retiree coverage, and in that case you both may end up in a more generous plan than what is available to most Medicare enrollees.

Also Check: Does Medicare Pay For Inogen Oxygen Concentrator

How Much Does Part B Cost For Most Enrollees

Most people new to Medicare will pay $170.10 a month for Part B premiums in 2022. This is the standard premium that most people pay based on income. Social Security will deduct your Part B premium from your Social Security check monthly. If you have not enrolled in Social Security income benefits yet, theyll bill you quarterly.

Since some people pay more based on income, use the tables below to determine your personal Medicare cost for Part B. It shows the amount that you will pay in 2022 for Part B, per the preview notice released by the Department of Health and Human Services in November.

The Medicare Part B deductible for 2022 is $233.

How To Get Health Insurance Before Youre Eligible For Medicare

Although you can retire at age 62 and still receive social security benefits, if you retire before the age of 65, you will need to find health insurance to cover your medical costs until youre eligible for Medicare. The price of health insurance can come as a shock to workers who are used to having their employers contribute to their plan premiums.

If possible, its good to research these costs and options before you retire so you can plan according to the market and your needs.

Also Check: Does Medicare Cover Biologics For Ra

Medical Conditions And Disabilities

If you have certain disabilities, you may be eligible for premium-free Medicare Part A benefits even if youre under 65 years old.

Social Security Disability Insurance recipients

If you have a disability and have been receiving SSDI benefits for at least 24 months , you will automatically be enrolled in premium-free Medicare at the beginning of the 25th month.

ESRD

If your doctor has diagnosed you with ESRD and youve received a kidney transplant or youre on dialysis, you qualify for Medicare benefits if one of the following criteria applies:

- you qualify for Social Security retirement benefits

- you qualify for Railroad Retirement Board benefits

- your spouse or parent worked long enough to be eligible for Social Security retirement benefits

When you become eligible for Medicare benefits depends on whether you receive dialysis at home or in a treatment facility:

- If youre receiving dialysis in your home, you can apply for Medicare the first day you begin your dialysis program. You need to be sure to apply before the third month of treatment.

- If you receive dialysis in a treatment facility, you can apply for Medicare on the first day of the fourth month of your treatment.

If youre scheduled to receive a kidney transplant, you can apply for Medicare on the first day of the month youre admitted to the hospital to start preparing for the transplant. But if your transplant is delayed, your Medicare benefits wont start until 2 months before the month your transplant takes place.

Getting Notified About Irmaaand What To Do About It

Each year, Social Security works with the IRS to determine who must pay the IRMAA surcharge and sends out notices to individuals explaining IRMAA in detail, including:

- The information used to compute IRMAA

- What you can do if the tax information is incorrect or out of date

- What you can do if your tax filing status changed, or you faced a life-changing event that caused a reduction in income

Examples of LCEs include:

- A work stoppage or work reduction

- The death of a spouse

- Divorce

IRMAA for Part B and Part D is based on information from 2 years ago. But what if your current income level has changed, making it more challenging to pay IRMAA charges? What can you do?

Recommended Reading: Are Blood Glucose Test Strips Covered By Medicare

What About The Part D Late

Medicare imposes a late enrollment penalty if you dont purchase Part D coverage before the end of your Initial Enrollment Period the seven-month period starting three months before the month you turn 65 or if youve gone 63 consecutive days or more without prescription drug coverage. This penalty is in addition to your monthly premium cost and generally remains in effect for as long as your Medicare drug coverage continues.

Medicare determines the penalty amount by multiplying the number of full months you were eligible for but didnt have drug coverage by 1%, then multiplying that product by the national base beneficiary premium . The result is rounded to the nearest 10 cents. This means the longer you wait to purchase drug coverage, the higher your penalty will be. In addition, because the national base beneficiary premium can change every year, the monthly penalty amount you owe may also increase over time.

Suppose that after your Initial Enrollment Period ended, you waited another full two years without purchasing prescription drug coverage. Your penalty would be 0.24 x $33.06 for a total of $7.93, rounded to $7.90. You would owe this $7.90 each month in addition to your premium cost for as long as you had Medicare drug coverage. This may not seem like much, but it adds up to almost $95 over a year and could get more expensive over time if the national base beneficiary premium rises.

To avoid the Part D late enrollment penalty:

Are Medicare Part D Premiums Based On Income

Medicare Part D is available to all individuals enrolled in Medicare. While there are no eligibility requirements to enroll in a Medicare Part D plan, Medicare Part D premiums may be higher for some individuals. If you are an individual or married couple with a higher income, enrollment in a Part D plan may look a little different for you. Keep reading to find out how your income may affect how much you pay for a Medicare Part D premium.

You May Like: How To Qualify For Free Medicare

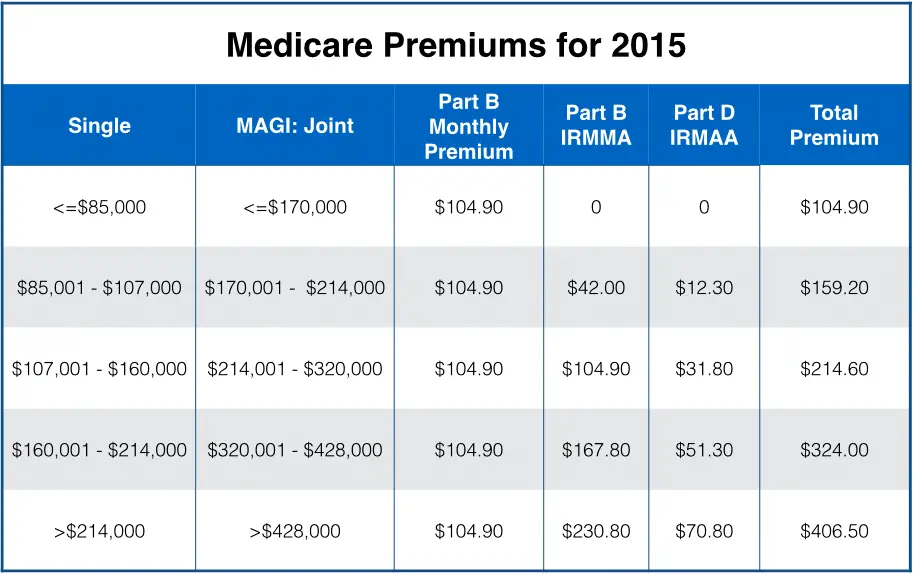

Medicare Part D Costs By Income Level

Like Medicare Part B, Medicare Part D prescription drug plans use the IRMAA to determine plan premium costs by income level.

2021 Medicare Part D plan premiums, based on income level from 2019, are as follows:

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $412,000 |

$77.10 + your plan premium |

There are some assistance programs that can help qualified lower-income beneficiaries afford their Medicare Part D prescription drug coverage.

Part D plans are sold by private insurance companies, so additional costs such as copayment amounts and deductibles can vary from plan to plan.

Are you looking for Medicare prescription drug coverage?

You can compare Medicare drug plans available where you live and if youre eligible enroll in a Medicare prescription drug plan online.

Find Medicare drug plans in your area

Or call 1-800-557-6059TTY Users: 711 24/7 to speak with a licensed insurance agent.

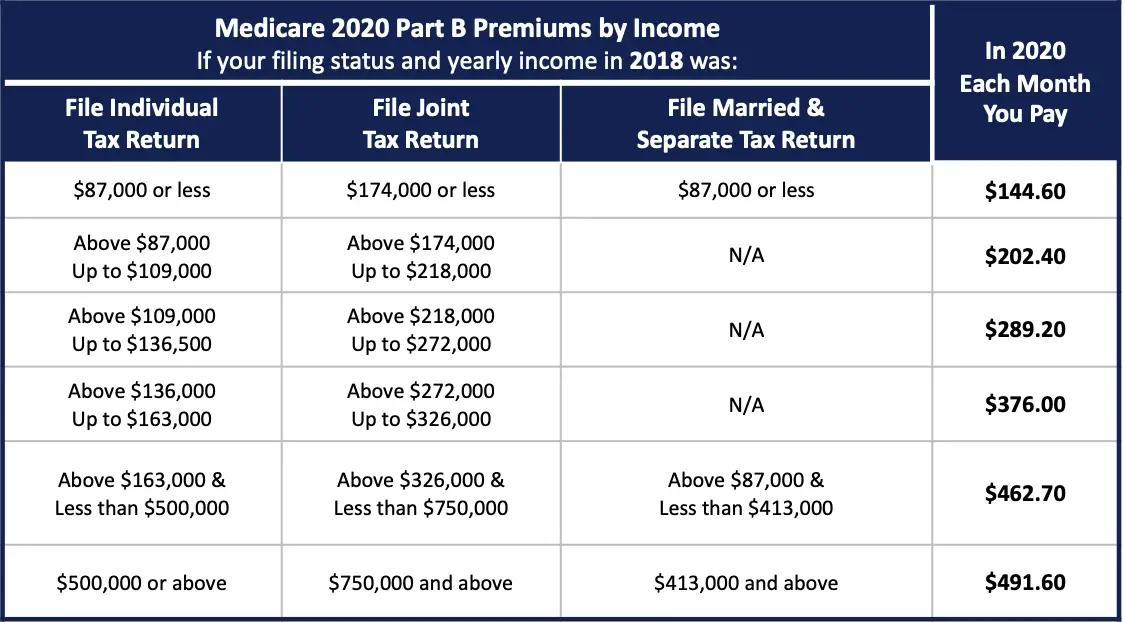

Medicare Part B Premiums

For Part B coverage, youll pay a premium each year. Most people will pay the standard premium amount. In 2022, the standard premium is $170.10. However, if you make more than the preset income limits, youll pay more for your premium.

The added premium amount is known as an income-related monthly adjustment amount . The Social Security Administration determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago.

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income.

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. Youll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

You May Like: Is Keystone First Medicaid Or Medicare

Medicare Part A Premium

Most beneficiaries qualify for premium-free Medicare Part A. This insurance isnt income-based rather, the premium depends on how many years you worked and paid Medicare taxes. Heres a breakdown of the Part A monthly premium in 2016. If youve worked while paying Medicare taxes:

- For at least 10 years while paying Medicare taxes, you dont pay a premium

- For 30 to 39 quarters, you pay $226

- For less than 30 quarters, you pay $411

The Right Medicare Plan Can Save You Hundreds Of Dollars Each Month

See your options to find savings.

What You Need to KnowMedicare beneficiaries still face a coverage gap for…

Updated: December 21st, 2021ByKate Ashford×

We do not sell insurance products, but there may be forms that will connect you with partners of healthcare.com who do sell insurance products. You may submit your information through this form, or call 855-617-1871 to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

Our mission is to provide information that will help everyday people make better decisions about buying and keeping their health coverage. Our editorial staff is comprised of industry professionals and experts on the ACA, private health insurance markets, and government policy. Learn more about our content.

Read Also: Does Medicare Cover Grab Bars

Employers Often Bear Costs

But many employers do pay the lions share of the cost to add family members, even though theyre not required to do so. In 2020, the average total premiums for family coverage under employer-sponsored plans was $21,342, and employers paid an average of nearly 74% of that total cost.

But the amount the employers paid varies considerably depending on the size of the organization smaller firms are much less likely to pay a significant portion of the premium to add dependents and spouses to their employees coverage.

Also Check: What Does Regular Medicare Cover

How To Get Help With Medicare Part D Costs

Our agents are here to help you find the most affordable option that will give you the most benefits. They will add all of your prescriptions to a list to make sure they are not only covered but to let you know what you can expect to pay for each one. Give us a call now, or use our compare rates form to see rates in your area on Part D plans now.

Recommended Reading: Does Humana Medicare Cover Incontinence Supplies

How Much Are Part B Irmaa Premiums

If an individual makes $91,000 or more or a jointly filing household makes $182,000 or more then the IRMAA assessment increases the 2022 Part B premium to the amounts shows in Table 1.

| Table 1. Part B 2022 IRMAA |

|---|

| Individual |

Source: CMS

This level has risen from 2019, when the income requirements were $85,000 and $170,000 respectively. 2020 was the first year that these MAGI income requirements were adjusted for inflation. Going forward, the Modified Adjusted Income requirements will continue to be adjusted by inflation .

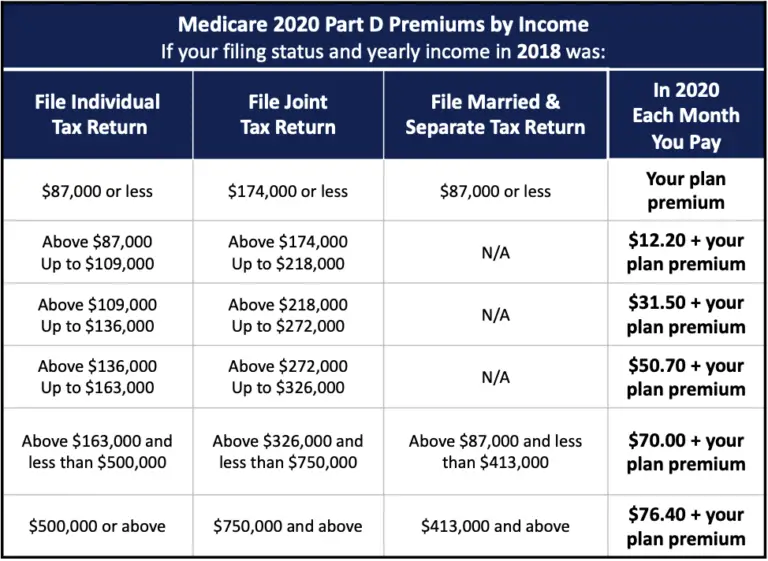

How Does Income Affect The Medicare Part D Premium

Medicare requires that some people whose income is higher than a certain amount pay an additional premium for Medicare Part D.

They call this the income-related monthly adjustment amount . Medicare determines this amount using the monthly adjusted gross income from the enrolleeâs most recent tax return.

A person does not pay their IRMAA to the insurance company that holds their plan. Instead, Medicare will often deduct this amount from their Social Security check.

If a person does not receive a check, they may have to pay a bill directly to Medicare or the Railroad Retirement Board.

The IRMAA premiums vary depending on whether a person files an individual, married filing jointly, or married filing separately return.

A person will start to pay if they are filing individually and earn more than $87,000 per year, or if they are filing jointly and earn more than $174,000 per year. The minimum IRMAA is $12.20 for 2020, and the maximum is $76.40.

Read Also: Does Medicare A Have A Deductible

How Is The Additional Amount Collected

If Social Security determines your income qualifies for Part D IRMAA, you will have to pay an additional amount each month on top of your monthly Part D premium. The additional amount is paid directly to Medicare and is separate from your Part D plan premium. Medicare will either deduct the extra amount directly from social security or send a monthly bill with the IRMAA amount owed.

It is important to note, unlike the Part D late enrollment penalty, which can last as long as you have Medicare coverage, Part D IRMAA is calculated each year. If you fall under a higher income bracket, it is important to enroll in Part D coverage as soon as you are eligible in order to avoid a costly late enrollment penalty in addition to the Part D IRMAA.

Do I Automatically Get Medicare When I Turn 65

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

Most people who automatically get Medicare at age 65 do so because they have been receiving Social Security benefits for at least four months before turning 65. Traditionally, Medicare premiums are deducted from your Social Security check. For the longest time, you could retire with full Social Security benefits at 65 and start on Medicare at the same time.

You are still automatically enrolled in Medicare Part A and Part B at 65 if youre drawing Social Security, but not as many people draw Social Security that early these days because of changes to the eligibility age for full Social Security benefits.

In 2000, the Social Security Amendments of 1983 began pushing back the standard age for full Social Security benefits. The progressive changes are nearing their conclusion: Beginning in 2022, the standard age for full benefits will be 67 for anyone born after 1960.

Besides the Medicare eligibility age of 65, what remains unchanged is that you can opt to begin drawing partial Social Security benefits as early as age 62. So, if you opt for accepting partial Social Security benefits before age 65, you are automatically enrolled in Medicare.

A smaller group of people also automatically get Medicare at age 65: people who receive Railroad Board benefits for at least four months before 65.

Read Also: How To Apply For Medicare In Oklahoma

Can My Spouse Use My Health Insurance

Some employers will not allow you to cover your spouse on your plan if your spouse can get their own coverage from their employer. Each spouses plan may have a different provider network with different doctors. Make sure you and your family have enough coverage. Get peace of mind by comparing health insurance plans.

You May Like: Does Humana Offer A Medicare Supplement Plan

How Much Does Medicare Part D Cost In 2022

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers.

Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius. High-income Medicare beneficiaries are subject to an income-related monthly adjustment amount , meaning if you make more, youâll pay more. For 2022 plans, the additional costs will be based on your 2020 income.

Getting Medicare Part D requires enrolling in Original Medicare, so youâll pay any of those premiums, too.

The deductibles vary, but no Medicare Part D plan can have a deductible higher than $480 in 2022, up from $445 in 2021.

Copays and coinsurance vary by plan and tier and whether youâve hit the Medicare Part D coverage gap, or âdonut hole.â After the insurer has covered a certain amount on prescriptions, they will temporarily limit how much your plan will help pay for prescriptions.

Read Also: Does Medicare Pay For Mental Health Services

You May Like: Is Aetna A Medicare Advantage Plan

How Much Does Medicare Part B Cost

Q: How much does Medicare Part B cost the insured?A: In 2021, most people earning no more than $88,000 pay $148.50/month for Part B. And in most cases, Part B premiums are just deducted from beneficiaries Social Security checks.

The Part B premium increase from 2020 to 2021 was smaller than initially projected, thanks to a short-term government spending bill that was enacted in the fall of 2020, and that included a provision to cap the increase in the Part B premium for 2021.

You May Like: How Long Does It Take For Medicare To Become Effective

Why Do You Have To Pay For Medicare

After paying into Medicare while you were working, you may be surprised to find out that Medicare isnât free after you retire.

The payroll taxes you paid when working only pay for 34% of the cost of the Medicare program, leaving a gap in how the health care benefits are paid.

And although the cost for Medicareâs monthly premiums can seem high when youâre enrolled, they only pay an additional 15% of the cost of the Medicare program. This means that the benefits you receive from the Medicare program are worth much more than what you pay each month.

Recommended Reading: When Will Medicare Cover Hearing Aids