Do We Recommend Coordinated Vs Uncoordinated Benefits

As auto accident attorneys, we always recommend that drivers choose uncoordinated No-Fault benefits.

We also recommend that drivers choose unlimited No-Fault PIP medical benefits coverage in their uncoordinated auto insurance policy.

It is important to choose both uncoordinated No-Fault and unlimited No-Fault PIP because:

How Fehb Other Health Insurance Coordinate Benefits

Federal Employees Health Benefits program carriers are obligated to follow standard coordination of benefit rules established by the National Association of Insurance Commissioners in order to make sure that payments to providers and customers do not duplicate payments of other health benefits coverages the member may have.

OPM allows retired enrollees to suspend FEHB coverage to enroll in any one of the following programs if eligible, thus eliminating the FEHB premium: a Medicare HMO, Medicaid, Tricare, or CHAMPVA. OPM does not contribute to any applicable premiums. If the individual later wants to re-enroll in the FEHB program, generally they may do so only at the next open season unless they have involuntarily lost the other coverage.

The most common instances where OPM coordinates with other programs are the following:

Tricare and CHAMPVA. FEHB carriers coordinate Tricare /CHAMPVA benefits according to their statutes. Tricare is the health care program for eligible dependents of military persons and retirees of the military. CHAMPVA provides health coverage to disabled veterans and their eligible dependents. When Tricare or CHAMPVA and FEHB cover the enrollee, FEHB pays first.

Medicaid. When the enrollee has Medicaid and FEHB, FEHB pays first.

No-fault coverage. FEHB carriers coordinate the payment of medical and hospital costs under no-fault or other automobile insurance that pays benefits without regard to fault according to the NAIC guidelines.

How Does Medicare Affect Car Accident Settlements In Michigan

If Medicare covers auto accident-related injuries that Michigan No-Fault insurance should have paid, then they will seek reimbursement for its conditional payments through a lien on the pain and suffering portion of any car accident settlement that the victim obtains in his or her case.

Additionally, once the No-Fault PIP medical benefits coverage levels become available in policies issued or renewed after July 1, 2020, its possible that Medicare may seek reimbursement of its conditional payments through a lien on a victims third-party tort recovery for excess medical benefits.

Read Also: What Is The Penalty For Not Enrolling In Medicare

What Is Medicare Part B Medical Insurance

Medicare Part B provides outpatient/medical coverage. The list below provides a summary of Part B-covered services and coverage rules:

This list includes commonly covered services and items, but it is not a complete list. Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

The 2021 Part-B premium is $148.50 per month

What Happens If Your Health Coverage Changes

If your health coverage changes, your insurers have to report it to Medicare. But it can take a long time to be posted to Medicares records in some cases.

To avoid problems, you should call the Benefits Coordination & Recovery Center toll-free at 1-855-798-2627 as soon as your health coverage changes.

Information to Have Ready When Calling the BCRC

- Your name

- The name and address of your health insurance plan

- Your policy number

- The date your coverage changed, was added or stopped and why

You should also let your doctor and other health care providers you use know that your coverage has changed.

Finally, call your insurer and make sure they reported the changes to Medicare so that your records are up to date and there wont be problems with your claims.

Also Check: What Month Does Medicare Coverage Begin

Does Medicare Pay For Everything

No. Medicare is a great program, but for most people it provides the first part, or foundation, of health insurance coverage in retirement. Through coinsurance, co-payments, and deductibles, both Parts A and B have out-of-pocket costs that can add up. For example, you will be responsible for 20% of the cost of most Part B eligible expenses, but this amount could be more if you see a doctor who does not accept the amount Medicare agrees to pay for the service.

What Other Medical Expenses For Car Accident Injuries Are Covered By Medicare

In general, any medically necessary treatment your doctor recommends for your car accident injuries is covered under Original Medicare . Specific benefits include:

This website and its contents are for informational purposes only.

Nothing on this website should ever be used as a substitute for professional medical advice. You should always consult with your medical provider regarding diagnosis or treatment for a health condition, including decisions about the correct medication for your condition, as well as prior to undertaking any specific exercise or dietary routine.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

NEW TO MEDICARE?

Read Also: How Much Does Medicare Cover For Home Health Care

Does Medicare Cover The Same Services As Michigan No

No. However, the same is true for the majority of health insurance plans. Therefore its important to understand the differences between other health care coverage, including Medicare, and No-Fault PIP medical coverage before choosing one of the limited PIP medical options.

Unlimited lifetime Personal Injury Protection medical coverage pays for all reasonable and necessary accident-related expenses. As long as the services are needed to promote recovery, there are no limits on the duration of treatment.

In contrast, Medicare only pays for specific services, and there are limitations on many of these, such as rehabilitative therapy. If a patient requires more physical or occupational therapy than Medicare allows, the patient could be responsible for the additional sessions.

Also, like most other health care plans, Medicare does not provide the same kind of coverage for many services that are covered under No-Fault policies with unlimited Personal Injury Protection medical benefits. And, most services covered by Medicare are subject to co-payments and deductibles.

Here are some examples of services that are not covered by Medicare :

- In-home attendant care

- Transportation to and from medical appointments

- Long-term custodial care

- Certain specialized therapies for traumatic brain injuries

- Home and vehicle modifications

The following services are covered by Medicare on a limited basis:

- Intermittent skilled nursing facility care

- Long-term rehabilitation therapy

Medicare Part A Vs Part B

Original Medicare is made up of two parts: Medicare Part A and Medicare Part B . Each part of Medicare covers different things.

Examples of the services that Medicare Part A helps cover include:

- Inpatient care in a hospital

- Skilled nursing facility care

- Hospice care

- Inpatient care in a skilled nursing facility

If you are admitted to the hospital due to your auto accident injuries, Medicare Part A may help cover your hospital stay and certain inpatient care costs.

Examples of the services that Medicare Part B helps cover include:

- Medically necessary services, including ambulance services and doctors services/supplies that are needed to diagnose or treat a medical condition

- Preventive services, including clinical research and routine check-ups

If your auto accident injuries require any doctors services, including an ambulance ride, these costs may be covered by Part B.

Some auto accident injury bills may be denied by your car insurance company. In this case, Medicare may help pay for covered services, and you are responsible for payment on any services that arent covered by Medicare.

You May Like: When Can Medicare Plans Be Changed

Coordinated Vs Uncoordinated No

The important distinguishing factors between coordinated and uncoordinated No-Fault benefits that drivers must be aware of include:

- Who pays first for a car accident victims medical expenses? With coordinated benefits, health insurance is the primary payer. With uncoordinated benefits, No-Fault is the primary payer.

- Is coordinated coverage optional? Coordinated coverage of No-Fault and health insurance benefits is optional for drivers. Its also optional for Michigan auto insurance companies because the law does not require that they offer coordinated coverage as an option to their insureds. If a driver elects to not have coordinated coverage, then by default he or she will have uncoordinated coverage.

- Is one cheaper than the other? Yes. Drivers who choose to coordinate coverage are guaranteed a reduced premium. Of course, the price reduction comes with its own cost because they will also be getting reduced coverage in the event they need medical care if theyre injured in a car accident.

Does Medicare Cover Auto Accident Injuries In Michigan

Yes, under certain circumstances, Medicare will cover auto accident-related injuries in Michigan. But unlike No-Fault auto insurance, it will want to be reimbursed and it will not cover all of the vital medical care services that a car accident victim needs.

The interplay between Medicare and No-Fault auto insurance for car accident victims has always been complicated. Frankly, even most auto accident lawyers do not understand this area of law.

But with the new , it is more important than ever for you to understand what Medicare covers for auto accidents, the limitations of its coverage versus being covered under No-Fault insurance, and how selecting lower PIP cap amounts after July 1, 2020 will impact you if you are injured in a car accident.

Don’t Miss: What Is The Best Medicare Supplement Insurance Plan

Does Medicare Cover Car Accident Injuries

Courtesy: MGN Online

If you receive health insurance benefits through Medicare, you can use your Medicare coverage to pay for your medical bills following a car accident. The same is true if you receive benefits through Medicaid.

But you cannot simply receive your treatment and move on with your life after an accident if you are a Medicare recipient. You must report the accident to Medicare, regardless of whether you file a personal injury claim. This is because Medicare must be reimbursed for the money it spends on your medical treatment for an injury resulting from an accident.

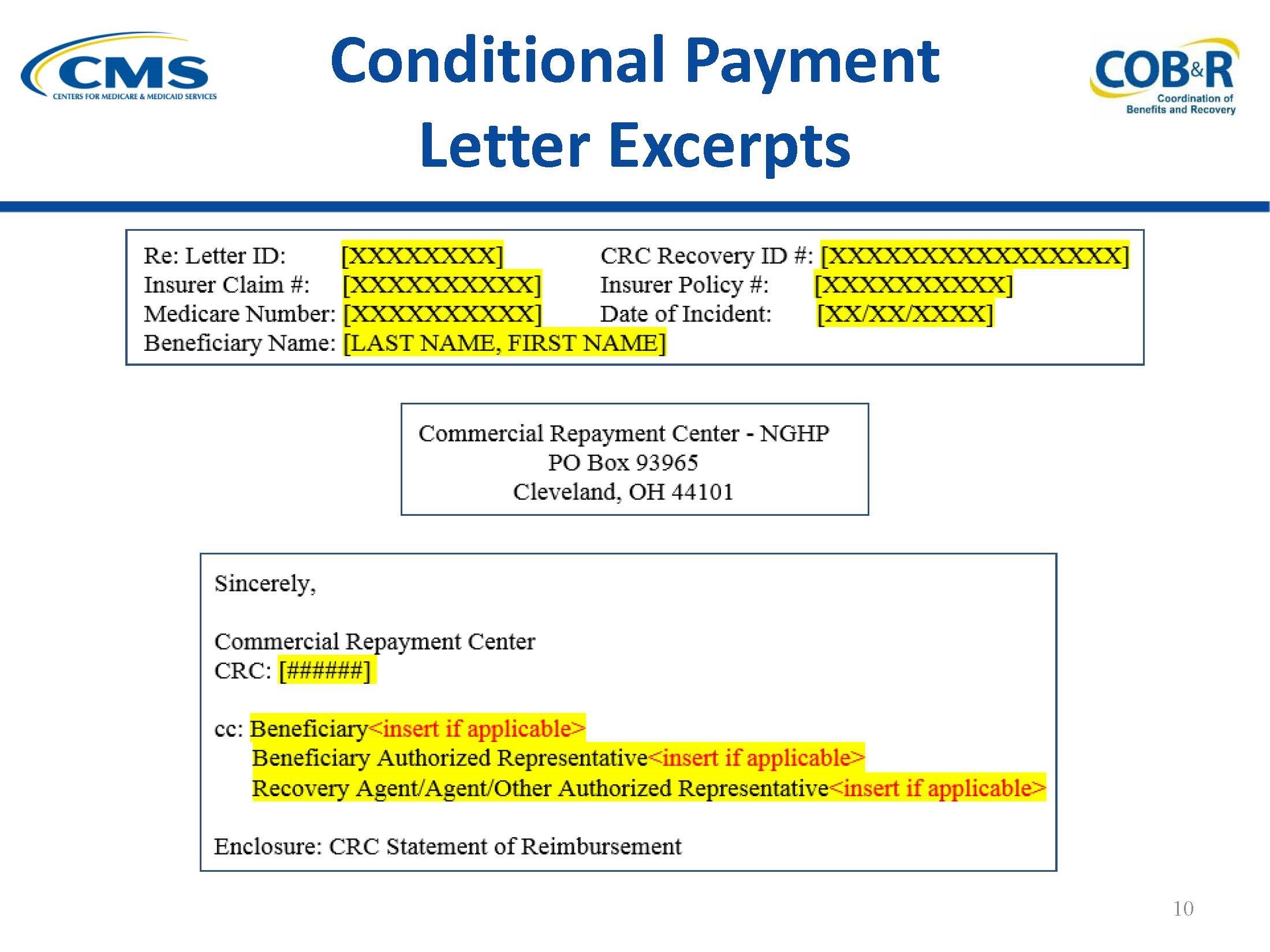

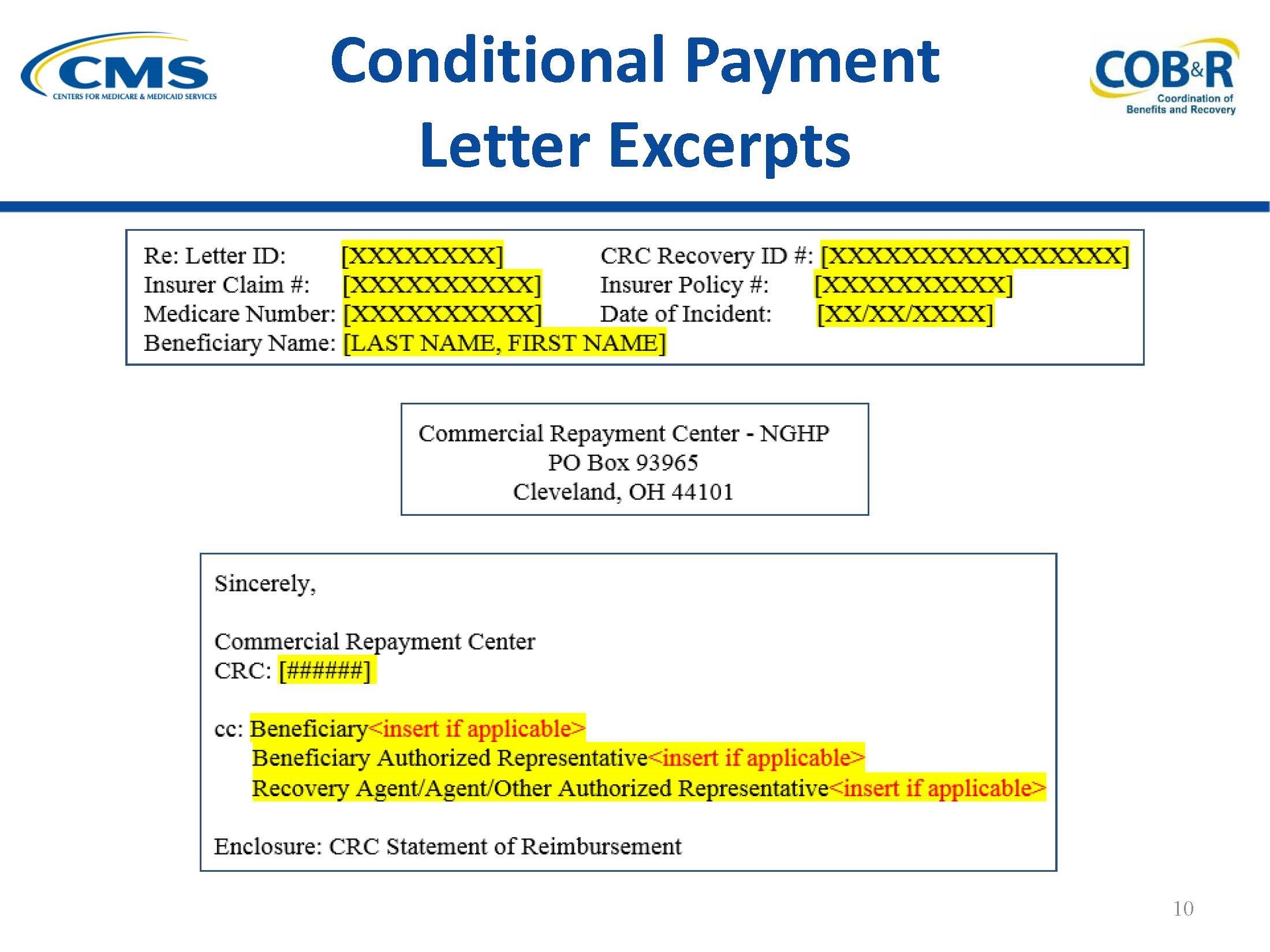

If you are a Medicare recipient, your lawyer will handle interactions with your assigned Medicare Coordination of Benefits contractor.

These interactions will include written correspondences about your accident and all of the medical care you receive related to the injury. You may be involved in these interactions as well, which your car accident attorney can guide you through.

When Do I Sign Up For Medicare

The initial enrollment period spans three months before to three months after your 65th birthday. You can sign up for Part A any time during or after your initial enrollment period. If you sign up for Part B after this period, and you dont have group coverage through your or your spouses employer, you will face a late enrollment penalty. If you are covered under a group plan, youll be able to enroll in Medicare up to 8 months after that coverage ends.

You can or in person at your local Social Security office.

Read Also: How Often Does Medicare Pay For A1c Blood Test

How Much Does Original Medicare Cost

If you or a working spouse have paid Medicare taxes for at least 10 years, you will be eligible for premium-free Part A. If not, your premium will depend on how long you have paid Medicare taxes. Most people receive Part A premium-free.

The standard monthly premium for Medicare Part B is $148.50 per month . It could be more if your income is over a certain amount, or if you do not sign up for Part B when you are first eligible. Most people pay the standard premium for Part B.

For Medicare Members: What Should I Know About Michigans No

Who is this for?

This is for Blue Cross Blue Shield of Michigan Medicare members who want to learn about Michigans new no-fault auto insurance law that goes into effect on July 1, 2020.

If youve recently had an accident and need the form to coordinate your auto and medical insurance, you can find it on our subrogation page.

You May Like: Does Medicare Pay For Teeth Implants

Using Other Health Insurance

If you have any health insurance other than TRICARE, it is called “other health insuranceHealth insurance you have in addition to TRICARE, such as Medicare or an employer-sponsored health insurance. TRICARE supplements dont qualify as “other health insurance.”.” It can be through your employer or a private insurance program. By law, TRICARE pays after all other health insurance, except for:

- Medicaid

- State Victims of Crime Compensation Programs

- Other Federal Government Programs identified by the Director, Defense Health Agency

This means your other health insurance processes your claim first. Then, you or your doctor files your claim with TRICARE.

Are you on active duty?

- You can’t use other health insurance.

- TRICARE is your only coverage.

Do you have Medicare?

- Medicare is a federal entitlement

- TRICARE pays last after Medicare and your other health insurance

- Visit the Medicare website to see which planMedicare or your other health insurancepays first

Human Resources University Of Michigan

The Coordination of Benefits rules allow health plans to coordinate benefits when you are covered by more than on group health plan. COB ensures that the level of payment, when added to the benefits payable under another group plan, will cover up to 100% of the eligible expenses as determined between the carriers but will not exceed the actual cost approved for your care.

Read Also: When Can I Start Collecting Medicare Benefits

How Medicare Works With Other Insurance

If you have

and other health insurance , each type of coverage is called a “payer.” When there’s more than one payer, “coordination of benefits” rules decide which one pays first. The “primary payer” pays what it owes on your bills first, and then sends the rest to the “secondary payer” to pay. In some rare cases, there may also be a third payer.

Learn More About Personal Injury Cases

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Read Also: How Much Is Medicare B Deductible

How Medicare Coordinates With Employer Health Care

By Joe Baker, Next Avenue Contributor

If youre 65 or older, working and have an employer group health plan based on your current work, you may have questions about how your job-based insurance coordinates with Medicare. On our Medicare Rights Center National Consumer Helpline, such questions are among the most frequent ones we get. Heres what you need to know:

For people who work and have job-based insurance, knowing when to enroll in Medicare falls on them. There is no formal notification from the Social Security Administration or Medicare. Some people are misinformed by employers or dont have reliable information about Medicare enrollment, leading them to delay enrollment in Medicare Part B and then incur penalties and high medical costs.

The Rules on Coordinating Medicare and Employer Coverage

Having job-based insurance does allow you to delay Medicare enrollment without penalty and delay paying the Medicare Part B premium . However, its important to know whether your job-based insurance will pay primary or secondary to Medicare.

Also on Forbes:

In most cases, you should only delay enrollment in Medicare if your job-based insurance is the primary payer and Medicare is secondary. There are additional enrollment considerations if you have a Health Savings Account if you enroll in Medicare Part A and/or B, you can no longer contribute pre-tax dollars to your HSA.

The Medicare Special Enrollment Period

Retiree Coverage, COBRA, Affordable Care Act and Medicare

What Does Michigan Auto Insurance And Coordination Of Benefits Mean

Coordination of benefits is when a person coordinates his or her health insurance with his or her Michigan auto insurance so that, in return for a reduced auto insurance premium, the persons health insurance is the primary payer for car accident-related medical expenses.

No-Fault insurances obligation as secondary payer is triggered once the health insurance plans coverage has been exhausted.

The law refers to this as an exclusion that is reasonably related to other health and accident coverage. )

Recommended Reading: How Much Is Medicare Copay For A Doctor’s Visit

If Your Or Your Spouse’s Employer Has 20 Or More Employees Then The Group Health Plan Pays First And Medicare Pays Second

If the

didn’t pay all of your bill, the doctor or

should send the bill to Medicare for secondary payment. Medicare will pay based on what the group health plan paid, what the group health plan allowed, and what the doctor or health care provider charged on the claim. You’ll have to pay any costs Medicare or the group health plan doesn’t cover.

Employers with 20 or more employees must offer current employees 65 and older the same health benefits, under the same conditions, that they offer employees under 65. If the employer offers coverage to spouses, they must offer the same coverage to spouses 65 and older that they offer to spouses under 65.