Does Medicare Part B Cover Drugs

If you receive prescription medications you would not normally give to yourself, Medicare Part B will cover the costs. Examples include medications administered by a physician in an outpatient setting.

To be outpatient, you must be able to leave the medical facility on the same day. However, Medicare Part B may not cover every drug you receive in an outpatient setting.

Ultimately, when it comes to overall drug coverage, Medicare Part B only covers a fraction of what Medicare Part D covers.

Medicare Part D typically covers prescription medication costs. You will usually use your Medicare Part D coverage at pharmacies or online pharmacies for the prescriptions you take at home.

Medicare Part B covers 585 drug products but produced a total spending of $37 billion in 2019 alone. This spending is due to the high cost of many Medicare Part B-covered drugs.

When looking at total Medicare Part B drug spending, 80% of costs come from 50 drugs alone. At the same time, the other 20% of the expenditure comes from the additional 535 drugs Medicare Part B covers. Thus, 80% of spending comes from less than 10% of covered drugs.

How Much Does Cataract Surgery With Medicare Cost

Medicare Part B benefits cover 80% of the Medicare-approved amount for cataract surgery. You pay 20% of the Medicare Part B copay plus any out-of-pocket costs such as your deductible, medication costs and physician fees.6

Original Medicare may even pay for corrective lenses if you have surgery to implant an intraocular lens . Your Part B benefits may also pay for 1 pair of prescription eyeglasses with standard frames or a set of contact lenses.7

Factors that can affect the cost of cataract surgery with Medicare include:

- your current Medicare Advantage plan

- type of surgery needed

- how long the surgery takes

- where you have the surgery

- other medical conditions you have

- potential complications

Medicare Drug List Frequently Asked Questions

If you have questions about your medications or how your Medicare Part D coverage works, were here to help.

Each Medicare prescription drug plan has its own list of covered drugs, known as a formulary.

Our pharmacists and doctors update the drug lists each year based on the latest medication and treatment information, which helps us include the safest and most effective prescription drugs available.

You can search our Medicare Part D drug lists to see if your prescriptions are covered by your plan.

As you look through our drug list, you may notice that your plan places drugs into different tiers.

Drugs in each tier have a different cost. Knowing what tier your drug is in together with looking at your plans benefits can help you predict how much that drug will cost. Drugs in lower tiers generally cost less than drugs in higher tiers.

For example, HealthPartners plans have five tiers:

- Tier 1: Preferred generic drugs This is the lowest tier. Lower-cost, commonly used generic drugs are in this tier.

- Tier 2: Generic drugs High-cost, commonly used generic drugs are in this tier.

- Tier 3: Preferred brand drugs Brand-name drugs without a lower-cost generic therapeutic equivalent are in this tier.

- Tier 4: Non-preferred drugs Higher-cost generic and brand-name drugs with a lower-cost generic therapeutic equivalent are in this tier.

- Tier 5: Specialty drugs This is the highest tier. Unique and/or very high-cost generic and brand-name drugs are in this tier.

Also Check: Is Medical Guardian Covered By Medicare

D Appeals And Grievances

Coverage Determinations and Exceptions

All Part D plans must have an appeal process through which members can challenge a denial of drug coverage. The Part D appeals process is based on and similar to the Part C appeals process.

Denials of drug coverage by a PDP or MA-PD are called coverage determinations. For example, a coverage determination may be issued by the plan if the drug is not considered medically necessary or if the drug was obtained from a non-network pharmacy. It is necessary to have a coverage determination in order to initiate an appeal. A doctors supporting statement is not required for this type of appeal, but it may be helpful to submit one. If the request for coverage is denied, the member may proceed to further levels of appeal, including redetermination by the plan, reconsideration by an Independent Review Entity , Administrative Law Judge review, the Medicare Appeals Council , or federal district court.

One type of coverage determination is called an exception request. An exception request is a coverage determination that requires a medical statement of support in order to proceed to appeal. There are two types of exceptions that may be requested:

Formulary Exceptions This type of exception is requested because the member:

- needs a drug that is not on the plans formulary,

- requests to have a utilization management requirement waived for a formulary drug).

What to do When a Drug is Denied at the Pharmacy

The Medical Statement

Grievances

Can I Get Help Covering Medicare Prescription Drug Costs

The Extra Help programrun by the Social Security Administrationis designed for Medicare beneficiaries with limited income and resources. It’s also known as the Part D Low-Income Subsidy . This program helps cover prescription drug plan premiums, annual deductibles and copays for people who qualify.

Read Also: When Can I Change Medicare Advantage Plans

What Is A Formulary

Medicare requires that each Part D plan provides a standard level of coverage.

Different insurers provide lists of covered medications that a person can view many refer to each list as a formulary.

Insurance companies have different formularies, and each can decide which medications it covers, the tiers a medication falls under, and the categories that a medication belongs.

Part D plans include both brand name and generic prescription medications, and a formulary must consist of at least two common prescription medications from each category. The insurer can decide which two medications to offer.

If the formulary does not include a particular prescription medication, a similar medicine may be available. A person may wish to discuss options with their prescribing doctor.

If a physician prescribes a medication that is not on the formulary or believes that the available medicines may not be suitable, an individual can:

- request an exception

- pay for the drug out of pocket

- file an appeal with the plan provider or insurer

Drug plans may change their formulary at any time, as long as they follow Medicare guidelines.

A drug plans formulary may change because of:

- a change in drug therapy

- the release of a new drug

- new medical information becoming available

Sometimes, a person is notified of a change after it has already happened, but notice is generally in writing and provided a minimum of 30 days before a change occurs.

Your Plan Could Change Its List Of Covered Drugs

As for choosing your 2023 coverage: While you aren’t required to take any action during open enrollment your current coverage generally would continue into next year plans often change their list of covered drugs and the price of them.

Additionally, each plan assigns individual drugs to different tiers, with the first tier generally being the least expensive and the fifth costing the most. From year to year, various drugs may move from one tier to another in any given plan which makes it important to check where your prescriptions fall for 2023.

Also be sure to look at the pharmacies included in the plan. Some are “preferred” meaning your medicine will be less expensive there than at a “standard” pharmacy.

“The pharmacy you use can really impact the price of what you pay for your prescriptions,” said Ari Parker, a senior advisor at Chapter, a Medicare advisory firm.

Recommended Reading: How To Find The Right Medicare Plan

Recent Articles And Updates

For older articles, please see our article archive.

References

The 2010 Medicare Part D $250 Donut Hole Rebate. Q1Group LLC, .

2020 Part D Income-Related Monthly Premium Adjustment. . .

2021 Medicare Part D Outlook. Q1Group LLC, .

2021 Part D Income-Related Monthly Premium Adjustment. . .

How Do Medicare Advantage Ppo Plans Work? Healthline Media, May 5, 2021, .

Analysis of Part D Beneficiary Access to Preferred Cost Sharing Pharmacies . . .

Announcement of Calendar Year 2021 Medicare Advantage Capitation Rates and Part C and Part D Payment Policies. . .

Assistance with Paying for Prescription Drugs. Center for Medicare Advocacy, November 30, 2015, .

How Medicare Part D Works. AARP, October 2016, .

Medicare Advantage Special Needs Plans . Healthline Media, May 3, 2021, .

Kirchhoff, Suzanne M. Medicare Coverage of End-Stage Renal Disease . . .

Original Medicare Does Not Include Prescription Drug Coverage For Self

Generally speaking, Original Medicare, which refers to Parts A and B, does not cover prescription drugs. However, Medicare will usually cover prescription drugs if they are part of a hospital stay, or if they are administered by your healthcare provider.

In addition to this, there is a distinct part of Medicare that specifically covers prescription drugs, and prescription drug coverage is also part of many Medicare Advantage plans. Well take a look at all of the details as well as which options you have.

Also Check: Does Medicare Cover Home Health Care Costs

How Does Medicare Part D Work With Other Insurance

If you already have prescription drug coverage through another plan, there will usually be some coordination of benefits between Medicare and your current drug coverage provider. Depending on your current coverage, Medicare will be either your primary or secondary payer for prescription drug coverage.

See Medicares to see coverage options that may apply to you.

How Much Does Medicare Part D Cost In 2022

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers.

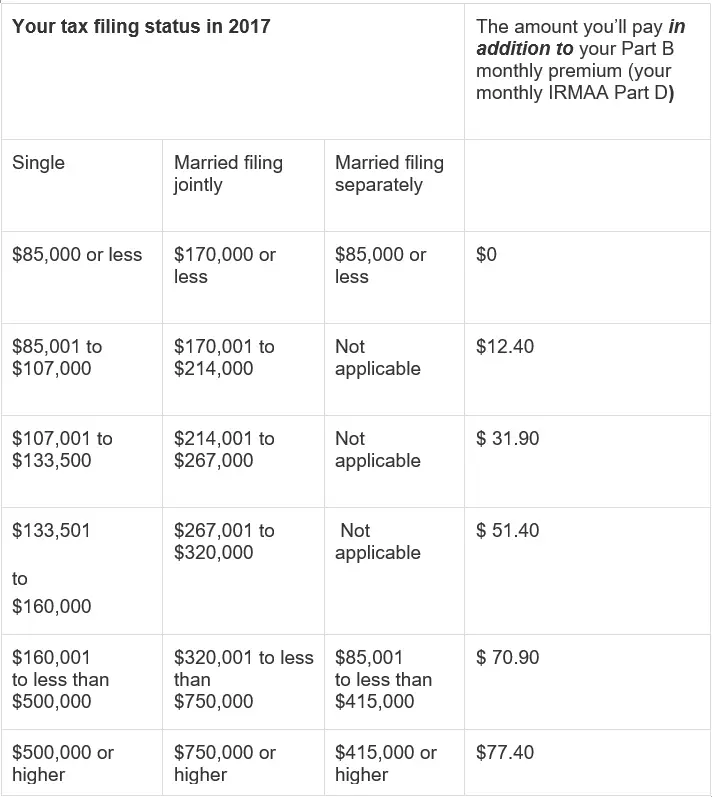

Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius. High-income Medicare beneficiaries are subject to an income-related monthly adjustment amount , meaning if you make more, youll pay more. For 2022 plans, the additional costs will be based on your 2020 income.

Getting Medicare Part D requires enrolling in Original Medicare, so youll pay any of those premiums, too.

The deductibles vary, but no Medicare Part D plan can have a deductible higher than $480 in 2022, up from $445 in 2021.

Copays and coinsurance vary by plan and tier and whether youve hit the Medicare Part D coverage gap, or donut hole. After the insurer has covered a certain amount on prescriptions, they will temporarily limit how much your plan will help pay for prescriptions.

Learn more about Medicare Part D plans and the donut hole here.

Read Also: Where Do I Get Medicare Part D

National Bipartisan Commission On The Future Of Medicare

Following the failure of President Clinton’s health care reform proposal in 1994, Republicans captured majorities in both houses of Congress. In 1995 the main policy issue regarding Medicare was not how to improve benefits but how to restructure the program and limit the federal government’s financial liability for existing coverage. The Medicare Preservation Act, which Congress passed as part of the Balanced Budget Act of 1995 but President Clinton vetoed, included major reforms and reductions in spending in Medicare and other government programs as well as substantial tax cuts. Republican strategists miscalculated both the president’s willingness to accept the legislation and the public’s reaction . Nonetheless, reducing the budget deficit remained a high political priority, and two years later, the Balanced Budget Act of 1997 cut projected Medicare spending by $115 billion over five years and by $385 billion over ten years .

The Balanced Budget Act created a new Medicare+Choice program, which encouraged beneficiaries to choose among the traditional fee-for-service Medicare, HMOs, and preferred-provider organizations. It also created Medicare medical savings accounts, changed payment policies and formulas for providers and health plans, strengthened efforts to prevent and prosecute fraud and abuse by Medicare providers, and created the National Bipartisan Commission on the Future of Medicare.

Are Bioidentical Hormones Covered By Medicare

Original Medicare has limited prescription drug coverage. It doesnt cover hormone therapy medications at all, even those for menopause.

If you need coverage for HRT, youll need a Medicare Part D Prescription Drug Plan. You can opt for a private insurance company. Or, you can add a stand-alone Part D Prescription Drug Plan to your original Medicare.

Another avenue is a Medicare Advantage Prescription Drug. This plan covers prescription drugs, including those for hormone therapy.

For a list of covered medications, see the plans formulary. A formulary is a list of covered medications. If your doctor prescribes a drug thats not on the formulary, you can request a substitute.

You May Like: Does Social Security Disability Qualify You For Medicare

Essential Facts About Medicare And Prescription Drug Spending

Prescription drugs play an important role in medical care for 60 million seniors and people with disabilities, and account for nearly $1 out of every $5 in Medicare spending. The majority of Medicare prescription drug spendingtotaling $129 billion in 2016is for drugs covered under the Part D prescription drug benefit, which is administered by private stand-alone drug plans and Medicare Advantage drug plans. Medicare Part B also covers drugs that are administered to patients in physician offices and other outpatient settings.

After a period of relatively slow growth, total and per capita Part D spending has increased more rapidly in the past few years mainly due to treatments for hepatitis C, and is projected to increase more rapidly in the next decade as more high-priced specialty drugs become available, according to the latest annual report of the Medicare Boards of Trustees.

Even with Medicares prescription drug coverage, beneficiaries can face substantial out-of-pocket costs, particularly if they use specialty drugs or multiple high-cost brand-name drugs. The following chart series examines trends in Medicare and beneficiary out-of-pocket spending on prescription drugs, and what the public thinks about different options for keeping drug costs down.

What To Do If Your Drug Isnt Covered

If you have trouble getting the medication that you want covered, you may be able to appeal. You and your doctor can submit a formal request for an exception to a drug coverage rule. For example, you could send a request to get coverage for a drug thats not in your formulary. You could also send a request to waive a step therapy requirement to use a lower-tier drug.

Also Check: Will Medicare Pay For A Bedside Commode

Original Medicare Drug Cost

After you meet your Medicare Part B deductible, Medicare covers 80% of services. This leaves you responsible for 20% of all Medicare-covered service costs.

1 in 10 beneficiaries spent at least $5,000 on Medicare Part B drug cost-sharing liability.

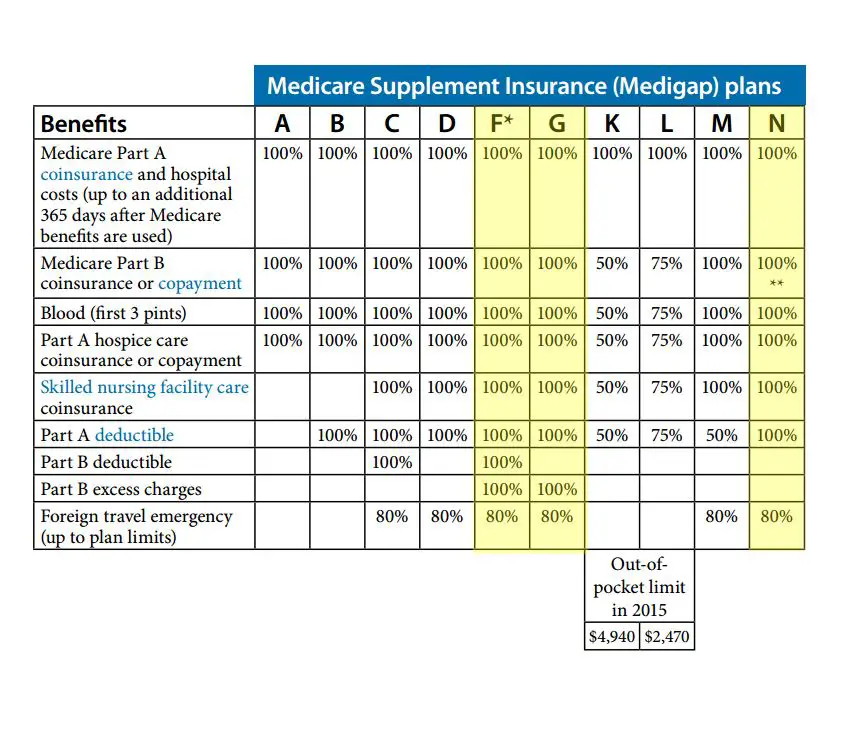

Of the Original Medicare beneficiaries who utilized Medicare Part B drug coverage, the number who used Medicare Supplemental coverage is unclear. However, if these beneficiaries were utilizing supplemental coverage, their out-of-pocket cost-sharing responsibilities could have been much lower.

For example, a Medicare beneficiary with coverage through Medicare Supplement Plan G may have only been responsible for costs up to the Medicare Part B deductible. Once they met the deductible, Medicare Supplement Plan G would cover 100% of the remaining charges.

Additionally, a beneficiary with Medicare Supplement Plan N would be responsible for costs up to the Medicare Part B deductible and an additional $20 copayment for seeing a physician.

Does Medicare Cover Low T Treatment Medicare & Medicare

Recommended Reading: Who Is Eligible For Medicare Part B Reimbursement

Opt For Medicare Advantage

Also known as Medicare Part C, Medicare Advantage is a type of private insurance that functions as an alternative to Original Medicare. It offers all of the benefits included in Medicare Parts A and B. Additionally, many Medicare Advantage plans cover things like dental, vision, hearing, and prescription drugs. They also place limits on yearly out-of-pocket costs.

To sign up for a Medicare Advantage plan, you must be Medicare-eligible or already enrolled Medicare Parts A and B. You also need to live in a Medicare Advantage service area.

There are numerous Medicare Advantage plans to choose from. You can use the official U.S.government website for Medicare to compare the plans available to you. While shopping, pay close attention to premiums, deductibles, and coinsurance. Each of these factors will affect your overall drug coverage costs. You can also use the official U.S. government website for Medicare to learn how the various plans in your area have been rated.