When Can I Apply

- Initial enrollment period. This is a 7-month window close to your 65th birthday celebration when you can pursue Medicare. It starts 3 months before your birthday month, includes the month of your birthday, and then stretches on for a further 3 months after your birthday. During this time, you can take on all pieces of Medicare without a punishment.

- Open enrollment period . During this time, you can change from Original Medicare to Part C , or from Part C back to Original Medicare. You can likewise switch Part C plans or add, eliminate, or change a Part D arrangement.

- General enrollment period . You can select Medicare during this period on the off chance that you didnt sign up during your initial enrollment period.

- Special enrollment period. On the off chance that you postponed Medicare enrollment for a supported explanation, you can later sign up during a special enrollment period. You have 8 months from the finish of your inclusion or the finish of your work to join without punishment.

Medicare Part B Eligibility And Enrollment

Medicare Part B is available to U.S. citizens and legal residents who fall under one of the following criteria:

- Over the age of 65

- Under the age of 65 with a disability

- Have end-stage renal disease

- Have Lou Gehrig’s disease

If you contributed to Social Security while working and are getting benefits for at least four months prior to turning 65, you will be enrolled in Medicare Part A automatically. You’ll also be enrolled in Part B, but you can choose to decline it since you must pay a separate monthly fee for Part B insurance.

If you do not receive benefits from Social Security, then you’ll need to manually enroll in Medicare Part B. Enrollment begins three months before your 65th birthday and ends three months after the month you turn 65, for a total of seven months.

During this initial enrollment period, you can sign up for any part of Original Medicare. When you enroll before the month you turn 65, coverage begins on the first day of your birth month. If you sign up the month you turn 65 or in the final three months of your enrollment period, your Medicare policy will be effective on the first day of the following month.

If you delay enrolling in Medicare, you may have to wait for a general enrollment period to apply, which runs from Jan. 1 to March 31 each year. Your coverage would start on July 1 following the GEP.

When Can I Enroll In Plan A And Plan B

Your first chance to sign up for Original Medicare is during your Initial Enrollment Period The Initial Enrollment Period is the seven-month period around your 65th birthday when most people are eligible for the first time to enroll in Medicare.. To figure out your IEP, follow the seven-month rule your enrollment window includes the three full calendar months before the month you turn 65. It remains open during your birth month, and the three months after. For example: If your birthday is in June, your seven-month window will open Mar. 1 and close Sept. 30.

3 months before your 65th birthday: May, April, Mar.Your birth month: 3 months after you turn 65: July, Aug., Sept.

If you missed your IEP, there are other enrollment periods available. You may be eligible for a Special Enrollment Period due to a Qualifying Life Event Qualifying Life Events are life changes that allow you to enroll in a new health insurance plan during a Special Enrollment Period. These include having or adopting a child, losing other coverage, marriage, a change of income and moving.. There is also a designated time to change your Medicare plan. Learn all about Medicares different enrollment periodsand how GoHealth can help you.

Don’t Miss: How Much Does Medicare Part B Cost At Age 65

Find Cheap Medicare Plans In Your Area

Medicare Part B provides coverage for medical needs such as outpatient care and doctor visits. This health insurance policy and Medicare Part A combine to make up what is known as Original Medicare. Eligibility for the federal health insurance program requires you to be over the age of 65, to have a disability or to have a life-threatening disease.

In 2022, the standard monthly premium for Part B is $170.10, which is either deducted from your Social Security benefits or paid out of pocket. Part B coverage makes sense for most individuals due to its cheap monthly premiums, but you should evaluate your current health insurance coverage before enrolling in the federal plan.

How Do I Qualify For The Part B Premium Giveback Benefit

You may qualify for a premium reduction if you:

- Are enrolled in Medicare Part A and Part B

- Do not already receive government or other assistance for your Part B premium

- Live in the zip code service area of a plan that offers this program

- Enroll in an MA plan that provides a giveback benefit

This means anyone with Medicaid or other forms of assistance that pay the Part B premium cannot enroll in one of these Medicare Advantage plans.

Recommended Reading: What Are Medicare Part Abcd

If Your Income Has Gone Down

If your income has gone down due to any of the following situations, and the change makes a difference in the income level we consider, contact us to explain that you have new information and may need a new decision about your income-related monthly adjustment amount:

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy, or reorganization.

If any of the above applies to you, we need to see documentation verifying the event and the reduction in your income. The documentation you provide should relate to the event and may include a death certificate, a letter from your employer about your retirement, or something similar. If you filed a federal income tax return for the year in question, you need to show us your signed copy of the return. Use Form Medicare Income-Related Monthly Adjustment Amount Life-Changing Event to report a major life-changing event. If your income has gone down, you may also use Form SSA-44 to request a reduction in your income-related monthly adjustment amount.

Should You Enroll In Medicare Part B

To decide whether or not to enroll in Medicare Part B, ask yourself the below two questions.

1. Are You Receiving Social Security Benefits?

If you are already receiving Social Security benefits when you turn 65, you will automatically be enrolled in Parts A & B. Coverage will begin on the 1st of the month that you turn 65.

The government will deduct your Part B monthly premiums from your Social Security check.

To cancel your automatic enrollment in Part B, let your local Social Security office know, in writing, at least 15 days before your Initial Enrollment Period ends.

2. Do You Have Employer Health Coverage?

If you like the group health insurance coverage you have through your employer, you can stick with that.

If youre still working at 65, you can keep your employer coverage. If you lose that coverage, you will have 8 months to enroll in Medicare Part A & Part B.

This Special Enrollment Period will begin when you stop working OR when your employer coverage ends .

But youll want to plan and contact Social Security before your employer coverage ends, so you dont have a coverage gap.

You May Like: Is Obamacare Medicaid Or Medicare

Is There An Alternative To Original Medicare

Another Medicare plan type to consider is Medicare Advantage. These plans, sold through private health insurance companies, provide Medicare Part A, Part B and supplemental coverage, and often offer added benefits like dental and vision. Medicare Advantage policies can simplify your overall experience by having just one insurer to manage your health care needs, but they can sometimes be more expensive compared to Original Medicare.

If you’re considering a Medicare Advantage policy, keep the following in mind:

- You must enroll in and keep both Medicare Part A and Part B to join a Medicare Advantage plan.

- If you enroll in Medicare Advantage when you first become eligible, the same Medicare enrollment periods apply.

What Is Medicare Part B

Medicare Part B is important for Original Medicare and covers medical services and supplies that are clinically essential to treat your ailment. This can incorporate outpatient care, preventive services, ambulance services, and durable medical equipment. It additionally covers part-time or intermittent home health and rehabilitative services, like physical therapy, in case they are asked by a doctor to treat your condition.

Moreover, Medicare Part B covers doctor visits, lab tests, diagnostic screenings, clinical equipment, ambulance transportation, and other outpatient services. Part B includes more expenses , and you might need to hold up for some time when it comes to enrolling for it, in case you are still working and have insurance through your work or are covered by your spouses health plan. Be that as it may, on the off chance that you do not have other insurance and do not sign up for Part B when you initially enroll in Medicare, you will probably need to pay a higher monthly premium for as long as you are in the program.

A portion of the preventive services Medicare Part B covers incorporate a one-time Welcome to Medicare preventive visit, influenza and hepatitis B shots, cardiovascular screenings, cancer screenings, diabetes screenings, etc. Note that Medicare Part B will cover the Welcome to Medicare visit only during the first year you have Part B.

You May Like: Do You Have To Get Medicare When You Turn 65

How Much Does Part B Cost For Most Enrollees

Most people new to Medicare will pay $148.50 for Part B premiums in 2021. This is the standard premium that most people pay based on income. Social Security will deduct your Part B premium from your Social Security check monthly. If you have not enrolled in Social Security income benefits yet, theyll bill you quarterly.

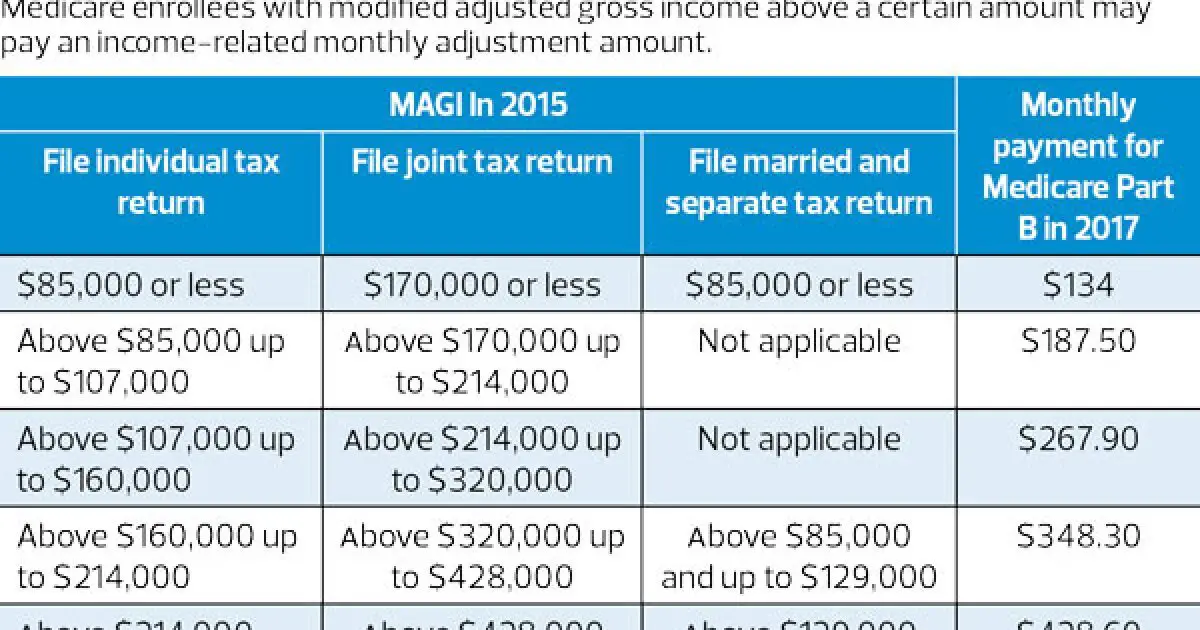

Since some people pay more based on income, use the tables below to determine your personal Medicare cost for Part B. It shows the amount that you will pay in 2021 for Part B, per the preview notice released by the Department of Health and Human Services in November.

The Medicare Part B deductible for 2021 is $203.

What Is The Medicare Part B Late Enrollment Penalty

If you dont sign up for Part B when youre first eligible, you may be required to pay a late enrollment penalty when you do choose to enroll. Additionally, youll need to wait until the general enrollment period .

With the late enrollment penalty, your monthly premium may go up 10 percent of the standard premium for each 12-month period that you were eligible but didnt enroll. Youll continue to pay this penalty for as long as youre enrolled in Part B.

For example, lets say that you waited 2 years to enroll in Part B. In this case, youd pay your monthly premium plus 20 percent of the standard premium.

You May Like: Does Medicare Medicaid Cover Dentures

Collection Of The Part B Premium

Part B premiums may be paid in a variety of ways.59 If an enrollee is receiving Social Security or Railroad Retirement benefits,60 the Part B premiums must, by law, be deducted from these benefits. Additionally, Part B premiums are deducted from the benefits of those receiving a Federal Civil Service Retirement annuity.61 The purpose of collecting premiums by deducting them from benefits is to keep premium collection costs at minimum. This withholding does not apply to those beneficiaries receiving state public assistance through a Medicare Savings Program because their premiums are paid by their state Medicaid program.

Part B enrollees who do not receive monthly Social Security, Railroad Retirement, or Civil Service Retirement benefits, or assistance through a Medicare Savings Program, pay premiums directly to CMS.62

What Else Should I Consider

Original Medicare is most common and has remained popular over the years. There are, however, other options that you may want to consider. For example:

Medicare Advantage: Also called Medicare Advantage Plan Medicare Advantage is health insurance for Americans aged 65 and older that blends Medicare benefits with private health insurance. This typically includes a bundle of Original Medicare and Medicare Prescription Drug Plan ., this is an alternative to Original Medicare that provides additional benefits like dental, vision and prescription drug coverage. These plans are regulated by Medicare but provided through private insurance companies. Its also important to know that Medicare Advantage also has its own Annual Enrollment Period .

Medigap:Medicare Supplement Insurance Medicare Supplement Insurance is designed to provide coverage that Original Medicare does not. Medigap policies are purchased in addition to Original Medicare and have their own monthly premiums you’ll need to pay. fills the holes in your policy that arent covered by Original Medicare. These are purchased in addition to your Medicare coverage and are offered by private insurance companies.

Recommended Reading: How To Sign Up For Medicare In Arkansas

How To Apply For Medicare Part B

If youâre already receiving Social Security benefits, you get automatically enrolled in Medicare Part A and Medicare Part B on the first day of the month you turn 65.

Otherwise, you will need to sign up yourself during your initial enrollment period, which starts three months before you turn 65. You can also sign up for Medicare during Medicare Open Enrollment, which lasts from October 15th until December 7th.

You can apply by visiting your local Social Security office, calling Medicare at 1-800-772-1213, or simply filling out an application online at the Social Security Administration website. Here is a step-by-step guide to applying for Medicare.

Delaying Part B Coverage

Some people choose to delay enrolling in Part B. This is often the case if they are are still working and receive health insurance coverage through their workplace, or if theyâre on their spouseâs health insurance plan.

If your workplace has 20 more employees, you may choose to keep employer-sponsored coverage and save from paying the Part B monthly premium. Once you leave work and retire, you will be given an eight-month special enrollment period to apply for Medicare Part B.

If you donât sign up during special enrollment, youâll have to wait until general Medicare open enrollment starts on January 1 to sign up for coverage that wonât be effective until July 1. Youâll also have to pay a lifetime late-enrollment penalty â a monthly penalty that lasts as long as you have Part B.

Don’t Miss: Should I Get Medicare Part C

Enrolling In Part B Medical Insurance Coverage

When you are first eligible for Medicare, you may apply at any time during the 7-month initial enrollment period, which begins three months before the month of your 65th birthday and lasts until the end of the third month following your birth month.

You can apply for Part B by calling Social Security at 772-1213.

What happens if you dont sign up for Part B?

Suppose you do not enroll in Medicare Part B during your 7-month Initial Enrollment Period or 8-month Special Enrollment Period . In that case, you may have to pay a lifetime late enrollment penalty.

In addition, you will only be able to enroll in Part B during the Medicare General Enrollment Period , and your coverage wont start until July. This may cause a gap in your coverage.

Monthly Medicare Premiums For 2021

The standard Part B premium for 2021 is $148.50. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $88,000 Married couples with a MAGI of $176,000 or less | 2021 standard premium = $148.50 |

| Your plan premium + $77.10 |

Don’t Miss: How Much Is Medicare B

What Will Medicare Part B Cost In 2022

Next year, the standard Part B premium will be $170.10 a month. That’s an increase of $29.60 from 2021. It’s also a huge jump compared to recent increases.

For context, in 2020, the standard Part B premium was $144.60, which represented an increase of $9.10 a month from 2019. And, as mentioned, the standard premium in 2021 was $148.50, an increase of just $3.90 a month from 2020.

Not only is this year’s Part B premium spike substantial, but it’s also well more than what the Medicare trustees estimated in their annual report released in August. Back then, they were pointing to a standard Part B premium of $158.50 a month.

It’s also worth noting that while the standard Part B premium is rising to $170.10 a month in 2022, higher earners will pay a lot more. And by “higher earners,” we’re talking about individuals with a 2020 income above $91,000 or joint tax filers with a 2020 income above $182,000.

‘Invest in inflation’: As costs soar, putting more money into stocks may be good for your 401

Can You Delay Enrolling In Medicare Part B

A few groups might get Medicare Part A premium-free. However, several people need to pay a month-to-month premium for Medicare Part B. Since Medicare Part B accompanies a month-to-month premium, a few groups might decide not to join during their initial enrollment period in case they are right now covered under a business group plan .

In case you are as yet working, you should check with your medical benefits administrator to perceive how your protection would function with Medicare. If you postpone enrollment in Medicare Part B since you as of now have current manager wellbeing inclusion, you can join later during a Special Enrollment Period without suffering a late penalty. Furthermore, you can select Medicare Part B whenever that you are as yet covered by a gathering plan dependent on current business. After your managers wellbeing inclusion closes or your work closes, you have an eight-month special enrollment period to pursue Part B without a late punishment.

Remember that retired person inclusion and COBRA are not viewed as wellbeing inclusion dependent on current work and would not qualify you for a special enrollment period. On the off chance that you have COBRA after your boss inclusion closes, you ought not to delay until your COBRA inclusion finishes to pursue Medicare Part B. Your eight-month Part B special enrollment period starts following your present work or group plan closes. This is regardless of whether you get COBRA or not.

Don’t Miss: Do Teachers Get Medicare When They Retire