Who Qualifies For Medicare Part B Premium Reimbursement

Only the member or a Qualified Surviving Spouse/Domestic Partner enrolled in Parts A and B is eligible for Medicare Part B premium reimbursement. Only the member or a Qualified Surviving Spouse/Domestic Partner enrolled in Parts A and B is eligible for Medicare Part B premium reimbursement.

You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B

Medicare Part D Information

Medicare-primary Empire Plan enrollees and dependents will automatically be enrolled in the Empire Plan Medicare Rx, a Medicare Part D prescription drug program with expanded coverage designed especially for Empire Plan members.

The Employee Benefits Division is required to send a Medicare Part D Prescription Drug Program notice annually to all active and retired NYSHIP enrollees and dependents who are 65 or older, or eligible for Medicare due to disability. The notice attests to the creditable coverage status of the NYSHIP prescription drug program.

Annual Program Verification Notice

The Medicare Part B Premium Reimbursement Program is contingent upon approval by the County Board of Supervisors on an annual basis.

If the Board of Supervisors approves continuing the Medicare Part B reimbursement program, you will receive an Annual Medicare Part B Premium Reimbursement Program Notice from LACERA, listing the acceptable documentation from Social Security or Medicare for proof of the Part B premium amount, with instructions on how to submit verification and the timeline. Upon completion of verification, the Part B reimbursement will be processed accordingly. For Tier 1, the reimbursement is for up to two qualifying parties . For Tier 2, the reimbursement applies to the qualifying retiree or survivor only.

For inquiries related to Part B reimbursement, contact us.

Also Check: How Do I Know If I Have Part D Medicare

Effects Of The Patient Protection And Affordable Care Act

The Patient Protection and Affordable Care Act of 2010 made a number of changes to the Medicare program. Several provisions of the law were designed to reduce the cost of Medicare. The most substantial provisions slowed the growth rate of payments to hospitals and skilled nursing facilities under Parts A of Medicare, through a variety of methods .

PPACA also slightly reduced annual increases in payments to physicians and to hospitals that serve a disproportionate share of low-income patients. Along with other minor adjustments, these changes reduced Medicare’s projected cost over the next decade by $455 billion.

Additionally, the PPACA created the Independent Payment Advisory Board , which was empowered to submit legislative proposals to reduce the cost of Medicare if the program’s per-capita spending grows faster than per-capita GDP plus one percent. The IPAB was never formed and was formally repealed by the Balanced Budget Act of 2018.

Meanwhile, Medicare Part B and D premiums were restructured in ways that reduced costs for most people while raising contributions from the wealthiest people with Medicare. The law also expanded coverage of or eliminated co-pays for some preventive services.

Medicare Part B Premium Reimbursement For 2021

SPECIAL NOTICE: This article only applies to retired members of the Los Angeles Fire & Police Pension Plan

The Centers for Medicare and Medicaid Services has increased the standard Medicare Part B monthly premium to $148.50 effective January 1, 2021 however, you may pay a different amount determined by CMS.

- If you are a new Medicare Part B enrollee in 2021, you will be reimbursed the standard monthly premium of $148.50 and do not need to provide additional documentation.

- If you received a Medicare Part B reimbursement of $144.60 on your pension check in 2020, you do not need to provide documentation and your Part B reimbursement will automatically increase to $148.50 for 2021.

- If you received less than a $144.60 Medicare Part B reimbursement on your pension check in 2020, LAFPP will notify you by email or mail with instructions on how to update your Part B premium amount on record.

To update your Part B reimbursement for the 2021 calendar year, please submit a copy of your:

- Social Security New Benefit Amount statement for 2021 or

- Next Medicare monthly or quarterly billing statement

To update your Part B reimbursement for premiums paid during the 2020 calendar year, please submit a copy of your:

- Social Security Form 1099 for 2020 or

- First Medicare monthly or quarterly billing statement for 2020

Please send all documents to LAFPPs Medical and Dental Benefits Section via:

Frequently Asked Questions

You May Like: How Do I Call Medicare

Why Is Medicare Part B Cheaper In 2023

The Centers for Medicare and Medicaid Services recommended in May that any excess Supplementary Medical Insurance Trust Fund money be passed along to those with Medicare Part B coverage. This is to help decrease the costs of the premium and deductibles. While most Medicare recipients, get Part A for free, everyone has to pay for Part B.

This yearâs Part B premium was projected to cover spending for a new drug called Aduhelm, which is intended to treat Alzheimerâs disease. Since less money was spent on that drug and other Part B items, there were more reserves left over in the Part B account of the SMI fund, which will now be used to limit future Part B premium increases.

Medicare Part A premiums will rise a little in 2023.

Do Some Medicare Advantage Plans Pay For A Portion Of The Part B Premium

premium. Some plans will help pay all or part of your Part B premium. This is sometimes called a Medicare Part B premium reduction. The amount you must pay for health care or prescriptions before Original Medicare, your Medicare Advantage Plan, your Medicare drug plan, or your other insurance begins to pay.

Also Check: Is Skyrizi Covered By Medicare

Recommended Reading: How Much Is Premium For Medicare

Get Your Medicare Summary Notices Electronically

Go paperless and get your Medicare Summary Notices electronically . You can sign up by visiting MyMedicare.gov. If you sign up for eMSNs, well send you an email each month when theyre available in your MyMedicare.gov account. The eMSNs contain the same information as paper MSNs. You wont get printed copies of your MSNs in the mail if you choose eMSNs.

Can Cms Issue More Than One Demand Letter

For ORM, there may be multiple recoveries to account for the period of ORM, which means that CMS may issue more than one demand letter. When Medicare is notified of a settlement, judgment, award, or other payment, including ORM, the recovery contractor will perform a search of Medicare paid claims history.

Don’t Miss: What Is The Special Enrollment Period For Medicare

What Are The 2023 Income Adjustments For Medicare Part D

If you receive Medicare Part D for prescription drug coverage â which received a massive boost this year from the passage of the Inflation Reduction Actâ and earn more than a certain amount, youâll need to pay extra monthly. The adjustment amounts for each income tier havenât changed much at all from 2022, but the income brackets themselves all rose about 6%.

Also Check: When Is Open Enrollment For Medicare Supplement Plans

How Do I Pay My Medicare Premiums

You can pay your Medicare premiums several ways, depending on which Medicare part youre paying and if youre receiving Social Security benefits.

Typically, most people dont pay premiums for Medicare Part A but do for Part B, which is $170.10 a month in 2022 . People with high incomes pay even more.

Youll also have to pay premiums if you decide to buy extra policies from private insurers to help cover Medicares out-of-pocket costs. Private Part D prescription drug plans and Medicare supplement plans, also known as Medigap, have separate premiums. If you have coverage from a private Medicare Advantage plan instead of original Medicare, you may have extra premiums, too.

Recommended Reading: Do I Have To Pay For Medicare On Ssdi

You May Like: Do You Have Dental With Medicare

How To Find Plans That Offer The Giveback Benefit

Not all MA plans offer this benefit, so you must find a plan that does in order to take advantage of the opportunity. In 2022, these plans are offered in nearly all states, so you may find one close to you.

If you enroll in a plan that offers a giveback benefit, you’ll find a section in the plan’s summary of benefits or evidence of coverage that outlines the Part B premium buy-down. Here, you’ll see how much of a reduction you’ll get. You can also call us toll-free and one of our knowledgeable, licensed agents will answer your questions and explain your options.

C: Medicare Advantage Plans

| Learn how and when to remove this template message) |

With the passage of the Balanced Budget Act of 1997, Medicare beneficiaries were formally given the option to receive their Original Medicare benefits through capitated health insurance Part C health plans, instead of through the Original fee for service Medicare payment system. Many had previously had that option via a series of demonstration projects that dated back to the early 1970s. These Part C plans were initially known in 1997 as “Medicare+Choice”. As of the Medicare Modernization Act of 2003, most “Medicare+Choice” plans were re-branded as “Medicare Advantage” plans . Other plan types, such as 1876 Cost plans, are also available in limited areas of the country. Cost plans are not Medicare Advantage plans and are not capitated. Instead, beneficiaries keep their Original Medicare benefits while their sponsor administers their Part A and Part B benefits. The sponsor of a Part C plan could be an integrated health delivery system or spin-out, a union, a religious organization, an insurance company or other type of organization.

The intention of both the 1997 and 2003 law was that the differences between fee for service and capitated fee beneficiaries would reach parity over time and that has mostly been achieved, given that it can never literally be achieved without a major reform of Medicare because the Part C capitated fee in one year is based on the fee for service spending the previous year.

You May Like: Who’s Entitled To Medicare

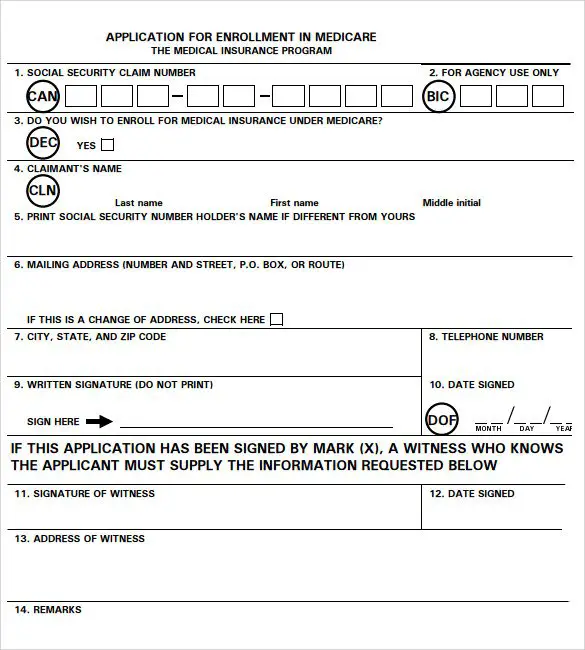

How Do You File A Medicare Reimbursement Claim

As we mentioned earlier, it is rare for you to have to file a claim if you have original Medicare and the service provider is a participating provider.

You can view any outstanding claims by checking your Medicare Summary Notice or by going to MyMedicare.gov.

Can Medicare Waive Recovery Of Demand

The beneficiary has the right to request that the Medicare program waive recovery of the demand amount owed in full or in part. The right to request a waiver of recovery is separate from the right to appeal the demand letter, and both a waiver of recovery and an appeal may be requested at the same time. The Medicare program may waive recovery of the amount owed if the following conditions are met:

You May Like: Can Doctors Limit The Number Of Medicare Patients

Working Only A Few Months Past Your 65th Birthday:

If you stop working and enroll in Medicare within three months after you reach age 65, your Medicare Part B coverage will be delayed. This is because Medicare considers you to be in your Initial Enrollment Period and filing after your birthday month causes a delay in coverage.

Remember, a delay in benefits means you may have a gap in coverage, depending on when your employer coverage ends. To avoid a coverage gap, sign up for Medicare during the three months prior to your 65th birth month, or enroll in your employers COBRA coverage until your Medicare is effective.

Medicaid Part B Reimbursement Options

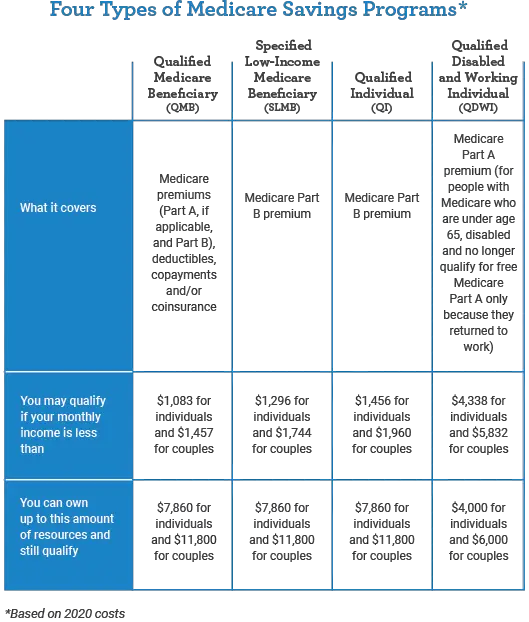

In an effort to promote access to Medicare coverage for low-income adults or those with disabilities, the Centers for Medicare & Medicaid Services developed a program to help dually eligible individuals with Part B costs. If you’re dually eligible, it means you have both Medicare and Medicaid.

If you qualify, your state will enroll you in Medicare Part B and pay the full Part B premium on your behalf.

In 2019, states paid the monthly Part B premiums for more than 10 million individuals, helping them afford healthcare and enroll in Medicare while freeing up their funds for other necessities. This buy-in ensures Medicare is the primary payer for Medicare-covered services for eligible beneficiaries, helping to reduce overall state healthcare costs.

You May Like: Does Medicare Cover Aquatic Therapy

Quality Of Beneficiary Services

A 2001 study by the Government Accountability Office evaluated the quality of responses given by Medicare contractor customer service representatives to provider questions. The evaluators assembled a list of questions, which they asked during a random sampling of calls to Medicare contractors. The rate of complete, accurate information provided by Medicare customer service representatives was 15%. Since then, steps have been taken to improve the quality of customer service given by Medicare contractors, specifically the 1-800-MEDICARE contractor. As a result, 1-800-MEDICARE customer service representatives have seen an increase in training, quality assurance monitoring has significantly increased, and a customer satisfaction survey is offered to random callers.

Your Plan Options Will Change

After you submit proof of Medicare enrollment to STRS Ohio, your STRS Ohio plan options will change. Plans for Medicare enrollees include the Aetna Medicare Plan, the Medical Mutual Basic Plan or a regional plan if available in your area.

You can review your new plan options and premiums in your Online Personal Account or call STRS Ohio for this information.

Also Check: How To Submit A Medical Claim To Medicare

Do You Have To Pay Medicare Bill After An Appointment

For some patients, this means paying the full amount of the bill when checking out after an appointment, but for others , it may mean providing private insurance information and making a co-insurance or co-payment amount for the services provided. For Medicare recipients, however, the system may work a little bit differently.

Ial Medicare Part B Premium Reimbursement

Service retirement and disability benefit recipients who are enrolled in an STRS Ohio medical plan and provide proof of Medicare Part B enrollment may receive partial reimbursement to offset the standard monthly premium charged by Medicare for Part B coverage.

Partial reimbursement of the benefit recipient’s future standard Medicare Part B premium cost will begin after STRS Ohio receives proof of Medicare Part B enrollment. If STRS Ohio receives proof by the 15th of the month, partial reimbursement will begin the first of the following month. If verification is received after the 15th of the month, partial premium reimbursement will begin the first day of the second following month. Partial reimbursement is not applied retroactively based on your Medicare effective date. You will receive reimbursement for future monthly premiums only after you submit proof of Medicare Part B coverage.

If you are eligible to receive a Medicare Part B premium reimbursement through more than one Ohio public retirement system, specific guidelines apply. Its your responsibility to contact STRS Ohio to determine which system is responsible for providing your reimbursement you may not receive more than one Part B premium reimbursement. Please call STRS Ohio for Medicare Part B premium reimbursement guidelines.

Recommended Reading: How Old To Receive Medicare Benefits

What You Need To Know

Each year the Centers for Medicare and Medicaid Services announces the Medicare Part B premium. The 2022 Standard Medicare Part B premium amount is $170.10 .

According to CMS, most Medicare beneficiaries will pay the standard Medicare Part B premium amount.

If your Modified Adjusted Gross Income , as reported on your IRS tax return, is above the set threshold established by CMS, youll pay the standard Medicare Part B premium amount plus an additional Income-Related Monthly Adjustment Amount . If you are required to pay an IRMAA, you will receive a notice from the Social Security Administration advising you of your Medicare Part B premium cost for 2022, and how the cost was calculated.

What Is The Part B Superior Prevention Work For

The new giveback benefit, or Part B advanced protection, is when a part C Medicare Advantage plan reduces the amount you have to pay toward their Region B month-to-month superior. The reimbursement count could consist of less than $1 to the full superior matter, thats $ for the 2022.

When you usually do not technically receive money straight back, you are doing afford the faster superior count, which will keep cash on your own wallet. In the event the superior arrives of your own Public Coverage have a look at, their advanced payment will reflect the low amount. Take note it can easily take the Public Safeguards Management to ninety days in order to process their superior promotion. After that timing, you will see a rise in their take a look at count.

Otherwise shell out your monthly Medicare Area B premiums as a consequence of Social Defense, the fresh giveback work for was paid towards the monthly report. As opposed to make payment on complete $, you would only pay the amount on giveback benefit deducted.

Eg, for those who generally shell out $ monthly, your MA plans giveback work for try $fifty, you do not get $fifty back monthly. Alternatively, you might pay only $ per month . If for example the package now offers an entire $ refund, you would not have a part B monthly advanced to blow.

Don’t Miss: Does Medicare Offer Gym Memberships