What Is Medigap Plan G What You Need To Know

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Medigap Plan G is one of 10 Medicare Supplement Insurance plans. Medigap plans cover certain expenses such as coinsurance, copayments and deductibles that aren’t covered under Medicare Part A and Part B, also known as Original Medicare.

Plan G is the most comprehensive Medigap plan that can be sold to new Medicare members.

What Are The General Medicare Rates

Although Medicare quotes arent available online, we can look at general Medicare rates explained by the U.S. Centers for Medicare and Medicaid Services. Heres a list of rates for Medicare Part A.

Medicare Part A Taxes and Rates Summary

| Medicare Taxes and |

|---|

Most people with Medicare dont pay monthly rates for Part A, which is also called premium-free Part A. If you buy Part A, youll pay up to $458 per month as of 2020. If you paid Medicare taxes for less than 30 quarters , the standard Part A rate is $458. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $252.

Lets look at another factor of Medicare Part A you might want to know about.

Medicare Part A Hospital Inpatient Deductible and Coinsurance Rates

| Hospital Inpatient Deductible and Coinsurance | Estimated Medicare Part A Deductible and Coinsurance Rates |

|---|---|

| Days 1-60: Coinsurance |

**Pay 20 percent of Medicare after the deductible is met

According to the U.S. Centers for Medicare & Medicaid Services, after your deductible is met, you pay 20 percent of the Medicare-approved amount for most medical care and doctor services including inpatient hospital services, outpatient therapy, and durable medical equipment services.

Compare insurance rates in your area by entering your ZIP code in the free comparison tool below.

Where Can I Learn More About Medicare Supplemental Plan G

There are several online resources available where you can learn more about Medicare Supplemental Plan G and the benefits it offers. Some of the best include health insurance comparison websites, government agencies such as medicare.gov, and your local insurance provider.

Additionally, consider speaking with an independent healthcare or financial advisor who can help you choose a plan that meets all your needs. Regardless of how you decide to get started, taking the time to do some research in advance is crucial if you hope to find the right coverage for your unique situation.

Recommended Reading: Which Medicare Plan Covers Prescription Medications

What Types Of Services Does Plan G Cover

Medicare Supplemental Plan G provides coverage for a wide range of medical services and supplies that basic Medicare does not typically cover. This can include prescription drugs, hospital stays, outpatient surgery, emergency room visits, lab work, x-rays, diagnostic testing, physical therapy and rehabilitation services, skilled nursing care, and more. Essentially anything medically necessary to treat or manage your condition will be covered by Plan G.

Why Should You Choose Medicare Supplement Plan G

Medicare Supplement Plan G is among the highest-rated and most popular Medicare Supplement plans. Whether you are new to Medicare or looking for a policy to better fit your budget or healthcare needs, Medigap Plan G may be the right fit.

Medigap Plan G covers 100% of your costs after the Medicare Part B deductible. So, you will see that by enrolling in this plan, you could save thousands of dollars per year on healthcare.

You May Like: Is Entyvio Covered By Medicare Part B

A Hospice Care Coinsurance Or Copayment

Hospice care is medical care for people suffering from terminal health conditions. Medicare offers this service, although copayments must be made. Typically, this copayment includes $5 for each prescribed medication to relieve symptoms as well as 5% from the federally funded reimbursement for inpatient respite care. This cost is fully covered under Plan G.

Medigap Policies Are Standardized

Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as “Medicare Supplement Insurance.” Insurance companies can sell you only a standardized policy identified in most states by letters.

All policies offer the same basic

but some offer additional benefits, so you can choose which one meets your needs. In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way.

Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

- Don’t have to offer every Medigap plan

- Must offer Medigap Plan A if they offer any Medigap policy

- Must also offer Plan C or Plan F if they offer any plan

Also Check: How Much Is Medicare Part C

How Much Does Medicare Supplement Plan G Cost

Since Medicare Supplement or Medigap plans are sold by private companies, the cost of your Medigap Plan may differ from company to company, according to the Medicare Interactive. Although all the companies offer the same set of benefits under Plan G, differences in the premiums that they charge can vary greatly.Therefore, when you decide to buy a Medigap policy, you should compare the plansâ premium between different companies.The cost of your Medigap Plan depends on which factors your insurance company has chosen to decide the premium of the plan. Factors that may affect the cost of your Medigap Plan are:

- Your marital status

- Your use of tobacco

âFor someone turning 65, a Plan G can be as inexpensive as $80/month or as much as $200/month in other areas,â Ball says. âPrices for Plan G are considerably higher in some states than others. Also, although coverage on a Plan G is the exact same from company to company, the pricing is set by the company and can vary considerably. It is always prudent to check rates from a handful of companies before making a decision.â

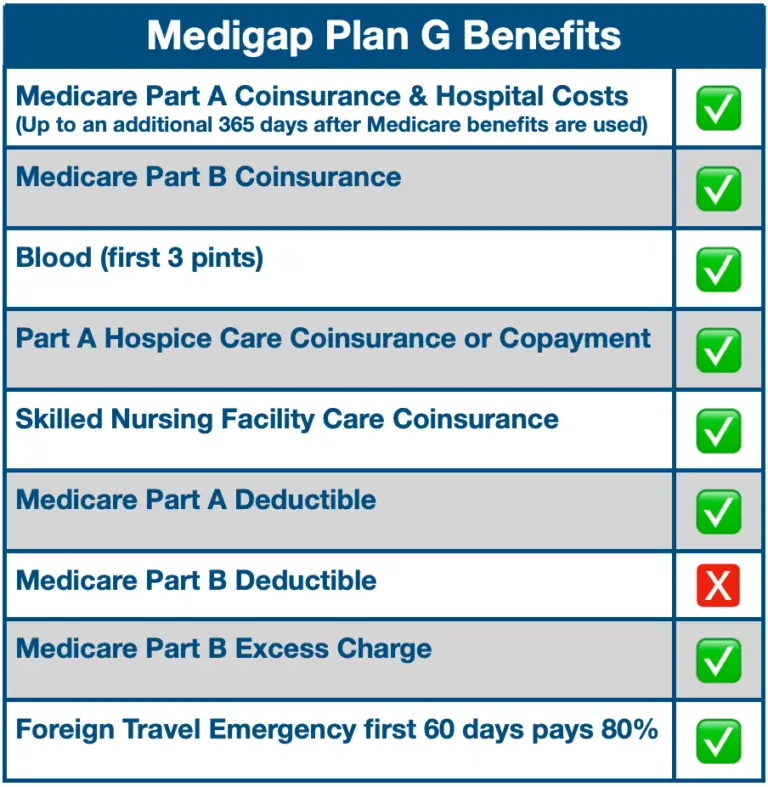

What Does Medicare Supplement Insurance Plan G Cover

Medicare Supplement Insurance Plan G generally covers:

- Hospital inpatient costs for up to a year after your Medicare coverage runs out

- Medicare Part B coinsurance/copays

- First 3 pints of blood if needed for a procedure

All standard Medicare Supplement insurance plans generally cover those benefits. Part G typically also covers:

- The Medicare Part A deductible

- Skilled nursing facility care coinsurance

- Medicare Part B excess charges*

- Emergency care outside the U.S. â 80% up to plan limits

*If you have Original Medicare, and the amount a doctor or other health care provider is legally permitted to charge is higher than the Medicare-approved amount, the difference is called the excess charge.

You May Like: Do People Pay For Medicare

Who Should Get A Medigap Plan G

If you rely on Original Medicare for your healthcare coverage, you should consider Plan G to offset the portion of costs that Medicare doesnt pay. Plan G gives you the most freedom of choice of providers because you can see any Medicare provider in the U.S., and it covers excess charges you may get if your provider doesnt take Medicare assignment. If you travel abroad, you have some coverage for emergency care. Plan G as a comprehensive Medicare supplement can give you peace of mind if you anticipate the need for frequent health care now or in the future.

Medicare Supplement Medigap Overview

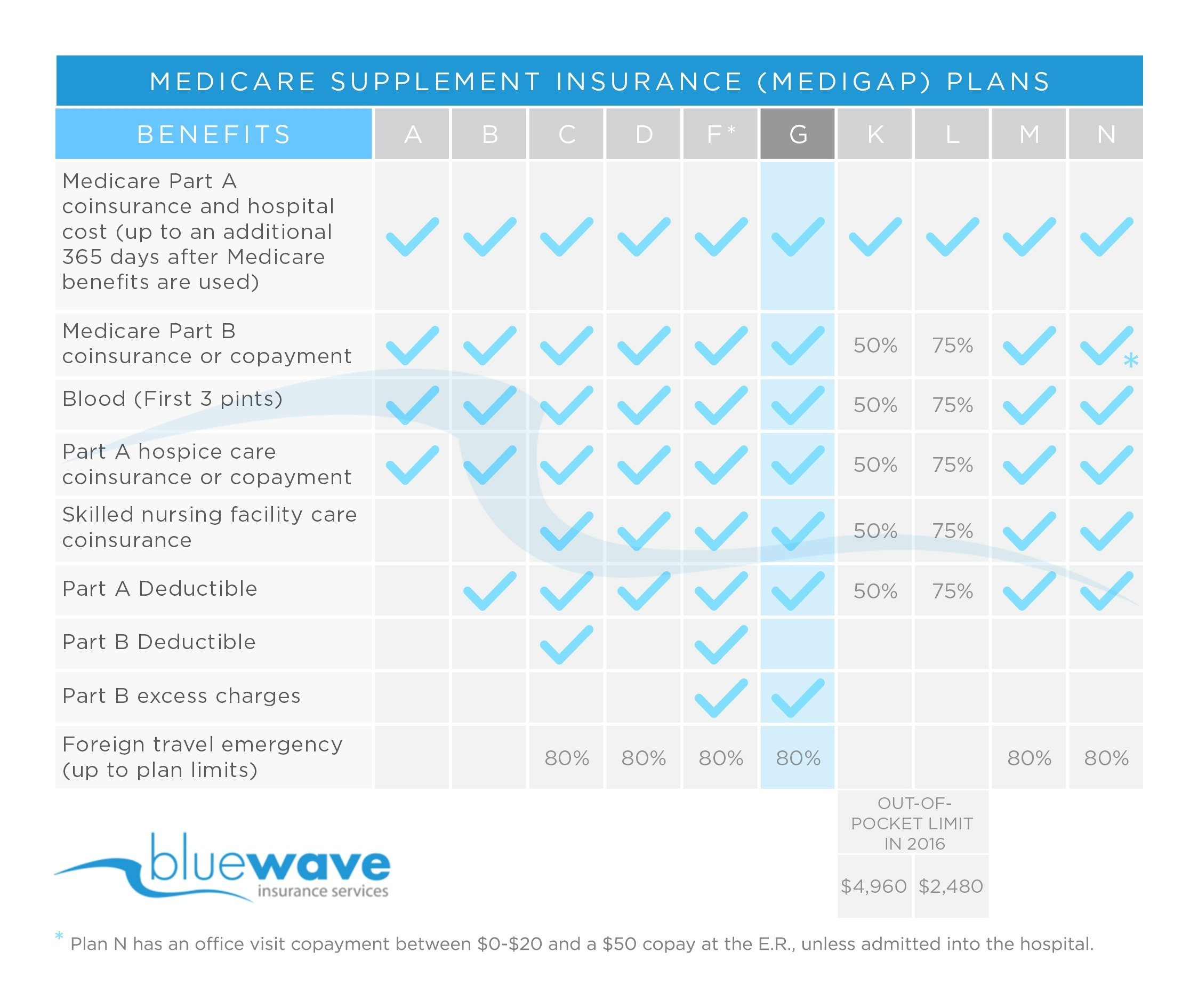

Currently, there are ten standardized Medigap plans that have been authorized for sale in 47 states: A, B, C, D, F, G, K, L, M, and N. All of these plans are designed to fill the gaps in Original Medicare that are a result of deductibles, copays, and coinsurance.

When you are enrolled in a Medicare Supplement plan you can use any physician, hospital, or other medical facilities that accept Medicare. All healthcare providers and facilities must be enrolled in Original Medicare and accept new Medicare patients.

Most but not all doctors and hospitals accept Original Medicare patients and will therefore accept any Medigap plan. Moreover, if you travel outside of the U.S., six of the 10 plans will cover emergency medical expenses outside the U.S., subject to your particular plans limits.

Also Check: How To Qualify For Oxygen With Medicare

Understanding The Part D Coverage Stages

During the year, you may go through different drug coverage stages. There are four stages, and itâs important to understand how each impact your prescription drug costs. You may not go through all the stages. People who take few prescription drugs may remain in the deductible stage or move only to the initial coverage stage. People with many medications may move into the coverage gap and/or catastrophic stage.

The coverage stage cycle starts over at the beginning of each plan year, usually January 1st.

Annual Deductible

You pay for your drugs until you reach your planâs deductible

If your plan doesnât have a deductible, your coverage starts with the first prescription you fill.

Initial Coverage

You pay a small copay or coinsurance amount.

You stay in this stage for the rest of the plan year.

- Total drug costs: the amount you and your plan pay for your covered prescription drugs. Your plan premium payments arenot included in this amount.

- Out-of-pocket costs: The amount you pay for your covered prescription drugs plus the amount of the discount that drug manufacturers provide on brand-name drugs when youre in the third coverage stage â the coverage gap . Your plan premiums are not included in this amount.

*If you get Extra Help from Medicare, the coverage gap doesnât apply to you.

Dont Miss: Does Medicare Pay For Insulin Pumps

Where To Purchase Medicare Supplement Plan G

Once you decide that Medicare Supplement Plan G is suitable for you, purchasing your plan through a top carrier is crucial. Working with a brokerage with access to all the top carriers in your area is the best way to ensure that you are enrolling in the best plan possible.

If you contact a carrier directly, you only receive that carrierâs Medigap Plan G option. So, by working with a broker you will receive Plan G options from various carriers.Thus, you can decide which carrier and plan are right for you.

- Was this article helpful ?

You May Like: Is Zephyr Valve Covered By Medicare

What Is Not Covered In Medicare Annual Wellness Visit

The annual wellness visit generally doesnt include a physical exam, except to check routine measurements such as height, weight and blood pressure. The UNC School of Medicine notes, Medicare wellness visits are designed to improve your overall health care by providing a more detailed look at your health risks

What Does Medicare Part B Cover

Part B services covered at 80% include outpatient care in an emergency room or hospital, and diagnostic tests such as X-rays. For many preventive services, the coinsurance and the deductible do not apply such as standard flu shots, mammograms, bone density tests, glaucoma tests, and many cancer screenings. Some preventive services have criteria you need to meet before getting the preventive service without the coinsurance and/or deductible. If you dont meet the criteria, the service will be covered under Part B but with the coinsurance and deductible.

Part B also covers doctors visits, ambulances, mental healthcare, outpatient surgeries, home health care, durable medical equipment such as blood sugar monitors and test strips, lancet devices, walkers, and wheelchairs. Home health care is also covered under Medicare Part A if certain conditions are met.

You May Like: What Does Plan C Cover In Medicare

Should I Change From Plan F To Plan G

If youre considering switching from your grandfathered Medicare Plan F to Plan G, it can feel like a constant game of tug-of-war. Some Medicare Supplement plans are guaranteed issue, which means you cant be refused for pre-existing conditions. But, its important to note that you might be required to undergo underwriting when switching Medicare Supplement plans. That means a plan carrier can increase your rate based on age and health factors or decide not to sell you the plan at all.

Dont Miss: Does Medicare Cover Speech Therapy

What Are Some Other Benefits Of Using Medicare Supplemental Plan G

In addition to providing comprehensive coverage for a wide range of medical services, Medicare Supplemental Plan G can also help to protect you from unexpected out-of-pocket expenses if your medical bills outweigh the coverage limits of basic Medicare. This can help ensure you get the care you need without worrying about being hit with a large, unexpected bill later on.

You May Like: Do I Need Medicare If I Have Tricare

Medicare Part N Reviews

Our three best Medicare Supplement companies, Aetna, Cigna, and AARP/UnitedHealthcare, all offer Plan N. By selecting Plan N over Plan G from these providers youll save an average of $31 a month.

Your actual Medicare Supplement plan N prices can change depending on your age, region, and other factors.

Keep in mind that Medicare supplement plan N coverage is uniform so that you will receive the same medical benefits from all providers. However, pricing, customer service, and supplemental benefits vary amongst carriers. Lets check out Medicare plan N reviews.

Medicare Supplement Aetna

The cost of Aetnas Medigap insurance is consistently less than that of its primary rivals, and the companys general commitment to providing its customers with excellent customer service makes it one of our top recommendations.

According to the NAIC customer complaint index, Aetna did poorly, rating a 1.57 for its Medicare Supplement product, much worse than the national average of 1.00.

Cigna Medicare Supplement

Despite being offered by Cigna in 48 states, the business only provides the four Medigap insurance A, F, G, and N in 46 states. Since these are the most widely used Medigap plans, beneficiaries in these states will probably discover a plan they prefer.

Long wait times, other service delays, and problems having claims authorized or reimbursed are some of the customer service issues that Cigna members and providers raise in their complaints.

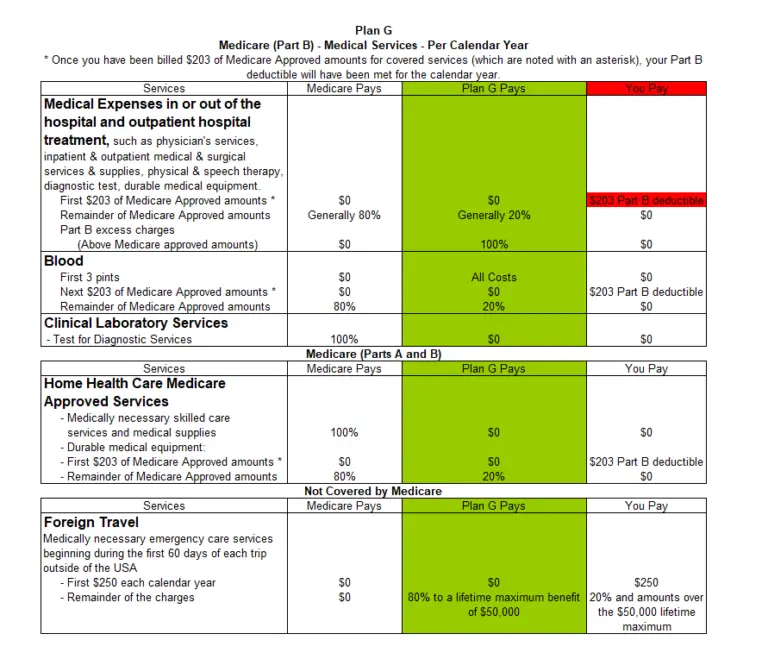

Medicare Medical Serviceswhat Plan G Pays

Includes expenses in or out of the hospital and outpatient hospital treatment, such as physicians services, inpatient and outpatient medical and surgical services and supplies, physical and speech therapy, diagnostic tests, and durable medical equipment.

A doctor may charge an amount for services that exceeds what Medicare covers. This is called an excess charge. Medicare puts a 15% limit on the extra amount a doctor can charge.

Also Check: Who Can Bill Medicare For Mental Health Services

What Does Medicare Part G Cover

Medigap policies supplement original Medicare benefits, and plans must follow standardized Medicare rules.

To have a Medicare Plan G policy, a person must have original Medicare parts A and B. One Medigap plan covers one person only. Additional beneficiaries must have a Medigap policy of their own.

Medigap Plan G covers:

It may be beneficial for a person to think about their current healthcare needs when researching plan options.

How We Chose The Best Medicare Supplement Plan G Companies

When we set out to select the five best Medicare Supplement Plan G providers, the first thing we looked at was geographical coverage. We made sure that the plans we mention here cover at least 40 states to allow for the most possible coverage for as many people as possible. From there, we determined the five best plans by studying pricing, ease of website use and application, educational information, extra benefits, and more.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE 24 hours a day/7 days a week to get information on all of your options.

MULTIPLAN_HCIDOTDASH01_2023

Read Also: How Do I Apply For Medicare When I Turn 65

What Is Medicare Plan G

Medigap, also called Medicare Supplement Insurance, is a separate insurance policy sold by private companies to cover the healthcare costs that are not covered by Original Medicare, states the Centers for Medicare and Medicaid Services. Original Medicare covers most but not the entirety of medical services and supplies costs.

You still have to pay coinsurance, copayment, and deductible with Original Medicare. So, if you buy a Medigap policy along with Original Medicare, it will help take care of those extra expenditures. Also, some Medigap policies may give you coverage for medical care when you travel outside the United States.

Few things to remember before you buy a Medigap policy:

- You should have Medicare Part A and Part B before you buy Medigap.

- You have to separately pay a monthly premium for your Medigap policy.

- Medigap covers only one person. So, you and your partner have to buy separate Medigap Policies.

- You cannot buy Medigap if you have a Medicare Advantage plan.

- Your Medigap policy can not be canceled by the company as long as you pay the premium.

Medigap policies are offered by different private companies, but each policy is standardized by the US government. There are up to 10 different Medigap policies to choose from- A, B, C, D, F, G, K, L, M, and N . Each policy with the same letter offers the same benefits, no matter which company is selling it. However, the premium you pay may differ between companies.

How Much Do Medicare Supplement Plans Cost

Medicare supplements vary in rate by carrier and plan choice. Not every carrier offers all plans, says Brandy Corujo, partner of Cornerstone Insurance Group in Seattle. Policy prices for Medigap are set by the individual insurance companies selling them. Companies set their premium pricing in one of three ways:

- Community-rated: Premiums are the same regardless of age.

- Issue or entry age-rated: Premiums are cheaper if the policy is purchased at a younger age. Premiums do not increase with age.

- Attained-age-rated: Premiums are based on your age at the time of purchase. As you age, your premium increases.

Some factors that may also influence your rates include your location, gender, marital status and lifestyle .

Medigap plans are purchased through a private insurance company, and you pay a monthly premium for the policy directly to the company. Medigap policies can be purchased from any insurance company licensed to sell one in your state, but available policies and prices will depend on your state. Medigap plans only cover one person, so married couples need to purchase separate policies.

Read Also: Does Medicare Cover Transportation To Physical Therapy