Capitol Life: Most Widely Affordable Medicare Insurance Company

Capitol Life is an American insurance company founded in 1905, specializing in Medicare supplements and life insurance. The company is highly successful, receiving an A- rating by AM Best and an A rating by S& P.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

After over a century in business, Capitol Life remains a reliable Medicare insurance company. Capitol Life is committed to bringing low-cost Medicare Supplement plans to as many people as possible.

| Capitol Life Pros: | Capitol Life Cons: |

| Real-time instant approval is available for some clients who are in good health and answer the application questions thoroughly and honestly. | When completing the application process, you may require a phone health assessment with a Capitol Life representative to determine your health status. |

| Capitol Life tends to receive high rankings from clients. | Capitol Life recently began selling Medicare Supplement plan and are only available in certain states. |

Best Overall: Mutual Of Omaha

Mutual_of_Omaha

- No. States Available: Enter zip code to find out

- Providers In Network: Not disclosed

The company offers multiple plans, a comprehensive website that is user-friendly, and customer discounts.

-

Comparison charts for different plans

-

Customer reviews on the plan information page

-

Multi-step process to pay online

-

No app for Medicare Supplement insurance

In business since 1909, Mutual of Omaha offers high-quality, in-depth information through the company website. The website is simple, uncluttered, and includes a comparison checklist showing who each plan is best for, with the option to include further coverage . Mutual of Omaha also offers a 7% to 12% discount if your spouse or domestic partner has applied for, or is applying for, coverage with Mutual of Omaha or an affiliate company.

Plan availability differs by location, but you should have around three to five options. To get price estimates, just enter your ZIP code. You can contact them online or over the phone for a personalized quote, but the company does not offer a mobile app for its Medigap customers. Mutual of Omaha is ranked by AM Best at A++ for financial health.

Medicare Supplement Plans In Wisconsin

Wisconsin standardizes its Medicare Supplement Insurance very differently. For one thing, there is only one major Medigap policy available, the Basic plan.

This plan covers basic benefits:

-

Part A coinsurance for inpatient hospital services

-

Part B coinsurance for outpatient medical services

-

First three pints of blood

-

Part A coinsurance or copayment for hospice care

It also covers coinsurance for stays in skilled nursing home facilities under Part A, as well as 175 days per lifetime in inpatient mental health care, and 40 visits/year for home health care .

Beneficiaries can add riders to their policy to make it fit their needs better. The riders available are:

-

100% Part A deductible

Don’t Miss: When Is The Next Medicare Open Enrollment

Best For Client Transparency: Bankers Fidelity

Bankers Fidelity

-

Plans sold in 37 states

-

Must provide contact information to obtain quotes

Bankers Fidelity has provided insurance products since 1955 and holds an A- rating with AM Best. We ranked it among the best because it offers a wider variety of plans, depending on your geographic location. It offers Plans A, B, G, K, and N .

We also liked that it put customer reviews on its homepage. Most customers noted the companys responsive and courteous customer service. The page is clean, easy to read, and features links for educational materials. When you receive your quote, the amounts are easily visible and simple to understand. You can click on the plan details for an easy-to-read graph that explains each plans benefits.

Unfortunately, Bankers Fidelity doesnt sell its plans in all 50 states excluded are Alaska, California, Connecticut, Massachusetts, Maine, Minnesota, New Hampshire, New York, Oregon, Rhode Island, Washington, and Wisconsin. You also must provide contact information to obtain a quote.

Best Medicare Supplement Plans For 2022

Plan G is the most comprehensive Medigap policy in 2022, but it’s also one of the more expensive Medicare Supplement plans, averaging $190 per month.

Find Cheap Medicare Plans in Your Area

Medicare Supplement policies, also called Medigap, can prevent unexpected medical bills. Without a Medigap plan, Original Medicare policyholders will find tracking deductibles can be cumbersome and paying for regular medical treatment out of pocket can be expensive. The best Medicare Supplement plan for you will depend on your health and budget.

To get a Medicare quote over the phone, call 855-915-0881 TTY 711 to speak with a licensed agent today!

Agents available Monday-Friday 9am-8pm EST

Also Check: How Old To Collect Medicare

Does Medicare Plan F Cover My Prescriptions

Before Medicare Part D took effect in 2006, certain Medicare Supplement Plans offered prescription drug coverage. However, after January 1, 2006, companies were no longer allowed to sell these plans to new beneficiaries. People who had been on them previously were allowed to keep their plans as long as they did not sign up for Part D coverage.

That does not mean that people cannot get prescription drug coverage with the Medigap plans available today. Medicare Supplement Plan F pays toward prescription medications that are covered under Medicare Part B. Any medications under Medicare Part D, however, will not be covered.

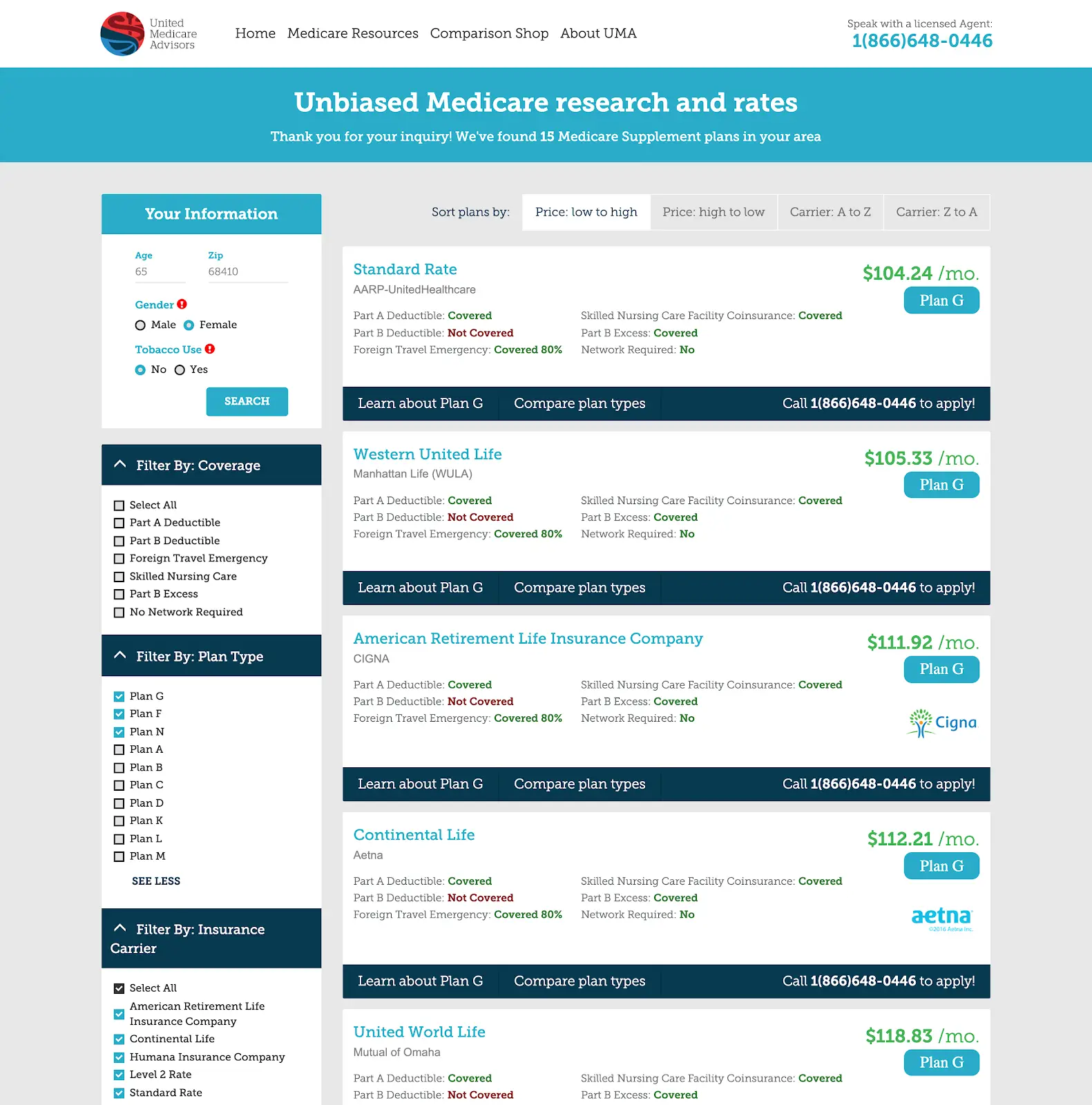

Comparing Medicare Supplement Insurance Companies

The list below includes some of the companies that sell Medicare Supplement Insurance plans in select states across the U.S.

Please note that our guide is meant to be informational and to help you as you start finding the right plan and plan carrier for your needs. Some of the companies listed below may not offer Medigap plans in your area, and you may find a Medicare Supplement carrier in your area that fits your need and isnt on this list.

This list identifies several of the top 10 insurance companies in no particular order.

- Medico Insurance Company

Its important to keep in mind that although each companys plan selection and pricing may differ, the coverage included in each type of Medigap plan remains the same, no matter where you purchase it.

In other words, Medigap Plan A sold by one company will include the same essential benefits as Medigap Plan A sold by any other insurance company. Their costs and the availability of the types of plans, however, may vary.

Medigap plans in Massachusetts, Minnesota and Wisconsin are standardized differently than they are in every other state.

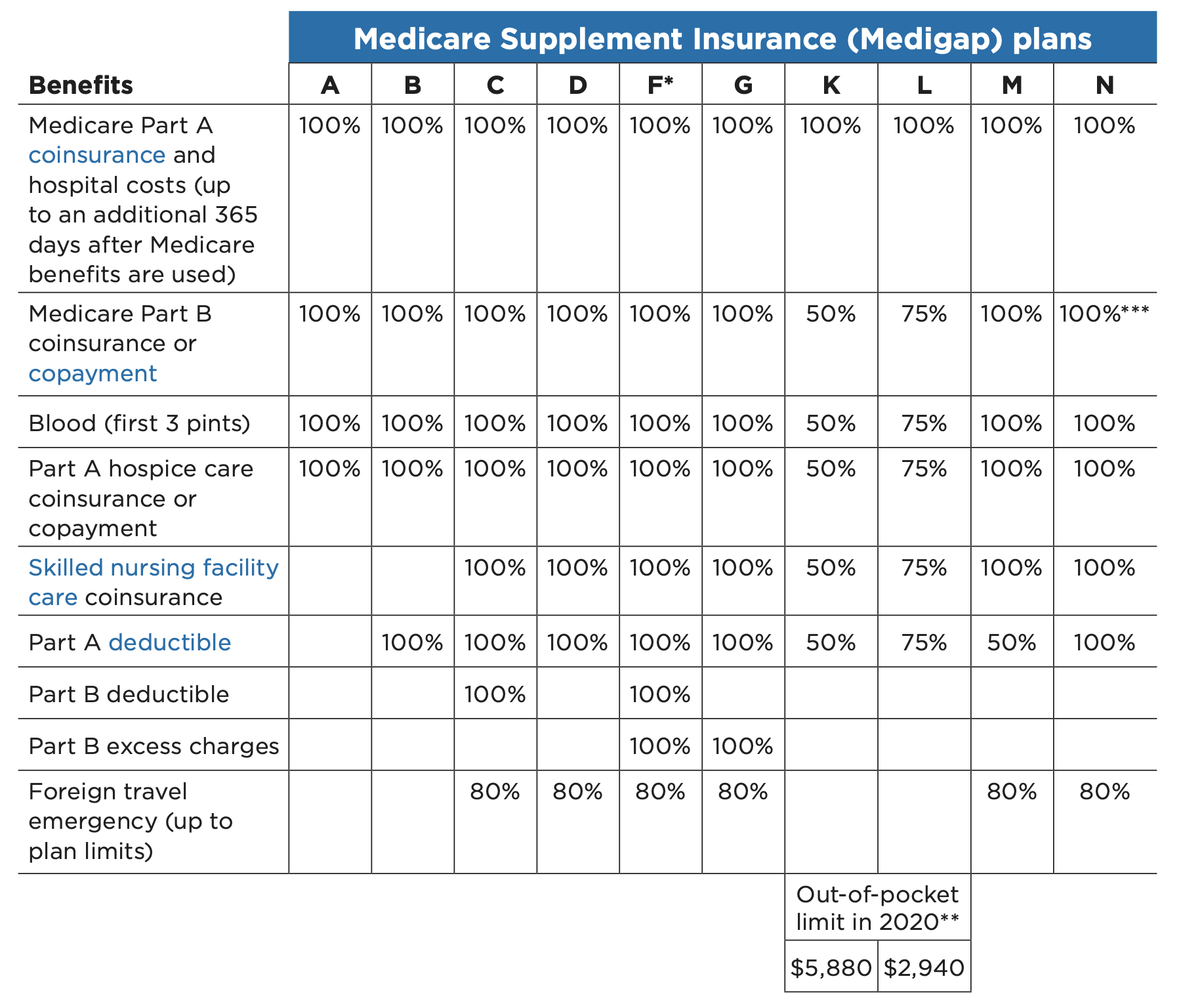

You can use the chart below to compare each type of 2022 standardized Medicare Supplement plan.

| 80% | 80% |

Don’t Miss: Does Medicare Pay For Ensure

What Does Medicare Supplement Insurance Cover

Medicare Supplement insurance is sold in 12 standard plans. Plans C and F are only available to people who were eligible for Medicare before January 2020.

Every company must sell Plan A, which is the basic plan, or the “core benefit” plan. The standard plans are labeled A through L. Remember, the plans are standardized. So, Plan F from one company will be the same as Plan F from another company. Select the supplement policy which fits your needs, and then purchase that plan from the company which offers the lowest premiums and best customer service. Core Benefits: Included in all plans.

- Pays Part A Hospital copayment

- Pays for an additional 365 days of hospitalization after Medicare benefits end.

- Pays Part B copayment

You will have to pay part of the cost-sharing of some covered services until you meet the annual out-of-pocket limit. Plan K has a $6,220 out-of-pocket limit. Plan L has a $3,110 out-of-pocket limit . Once you meet the annual limit, the plan pays 100% of the Medicare copayments, coinsurance, and deductibles for the rest of the calendar year. These amounts can change each year.

Blue Cross Blue Shield: Best Medicare Insurance Company Mobile App

Blue Cross Blue Shield has been a prominent insurance company since 1929. Receiving an A rating from AM Best and a B rating from S& P, BCBS is one of the most highly recognized Medicare insurance companies.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Blue Cross Blue Shield focuses on customer satisfaction. The company offers typical Medigap plans and policies bundling dental, vision, and hearing coverage. One of their best assets is an easy-to-use mobile app for customers to track their claims history and payments.

| Blue Cross Blue Shield Pros: | Blue Cross Blue Shield Cons: |

| Customizable Medicare Supplement options can bundle additional benefits into your policy for an extra monthly fee. | Uses several affiliate partners nationwide, so your plan carrier may change if you move to another state. |

| Discounts are available to almost every member . | Monthly premiums tend to be higher than other Medicare Supplement plan carriers. |

Also Check: What Is The Monthly Premium For Medicare Part B

Get Help From A Medicare Specialist

Medigap plans are nuanced when it comes to pricing. For example, not everyone understands that there is only one Medigap Enrollment Period in your lifetime, not an annual one like other Medicare plans. Signing up late can cause your rates to go up based on preexisting conditions. Your local State Health Insurance Assistance Program or State Insurance Department can help you with issues like this. You can also ask your broker for details.

Selecting The Right Medicare Supplement Company

Choosing the right Medicare supplemental insurance company means finding the Medigap plan that best meets your situation and needs. Youll need to carefully weigh your health and financial situation and what each plan offers.

How to Select the Best Medigap Company

- Determine Your Eligibility

- To be eligible for Medigap coverage, you first have to be enrolled in Original Medicare . You cant buy Medicare supplemental insurance if you have Medicare Advantage.

- Price and Budget

- If you want additional coverage against unexpected medical bills and are willing to pay an additional premium on top of Medicare Part B, Medigap may be right for you.

- Health and Financial Needs

- If you are in good health and dont expect expensive medical care, certain Medigap plans may be the right choice for you. Plans A, K and L provide only basic coverage and may be a better option. You may also prefer a Medicare SELECT plan if you want to keep your premiums low.

- Services and Benefits

- Consider if the company also sells Medicare Part D prescription drug coverage. You may also find discounts if you bundle your Medigap policy with home, auto or other coverage from the company.

- Research and Compare Prices

- Be sure to research the background of the company and compare its Medigap plan prices to the same plans offered by several other companies. Remember that the same plan may cost much less at another company.

Don’t Leave Your Health to Chance

Don’t Miss: How Much Is Withheld From Social Security For Medicare

Medicare Advantage Vs Medicare Supplement

Medicare Advantage plans serve as a substitute for Original Medicare, providing that same coverage plus additional benefits like prescription drugs coverage . Meanwhile, Medicare Supplement plans, or Medigap plans, are sold by private insurance companies to people enrolled in Original Medicare to help fill the gaps of that coverage.

The 10 types of Medigap plans provide standardized coverage to beneficiaries nationwide and help pay for things like deductibles, coinsurance and copays. Because plan coverages are standardized, only monthly premium rates vary from provider to provider. Its also important to note that Medigap policies dont cover prescription drugs. A person enrolled in Original Medicare who wants prescription drug coverage needs to purchase a separate Medicare Part D plan in addition to any Medicare Supplement plan.

Meanwhile, Medicare Advantage policies are only standardized in that they must provide the same benefits of Original Medicare, as the plans serve as a direct substitute. After this threshold is met, private insurance providers can add any number of benefits and services to a planprescription drugs, dental care, vision care and moreto make them more comprehensive . Monthly premium rates for Medicare Advantage plans tend to vary dramatically based on location and the list of benefits provided.

Best Medicare Supplement Insurance Companies In 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Medicare Supplement Insurance, or Medigap, covers gaps in Original Medicare coverage, such as certain out-of-pocket expenses like copays, coinsurance and deductibles.

Medigap plans are sold by private insurance companies, but the plans Medicare coverage is regulated by the government. So, for example, Medigap Plan G has the same Medicare benefits regardless of which insurance company you choose.

In most states, there are 10 standardized Medigap plan types. The insurance companies are responsible for which plan types they sell, what they charge and whether to include extra perks, as well as providing customer service. Each company has different strengths and weaknesses.

Read Also: Is Pneumonia Shot Covered By Medicare

Picking A Concealed Carry Insurance Policy

Insurance coverage is a way of living for most of us. We have life insurance, medical insurance, vehicle insurance coverage, and homeowner insurance coverage. Theres dental insurance coverage, vision insurance, even pet insurance coverage! Insurance coverage is purchased to safeguard you and your family versus the unanticipated. It insures you will be taken care of when things happen

How Your Company And Workers Gain From Supplemental Insurance

Increasing health-care expenses have actually caused businesses to try to find ways of cutting down on staff member benefits or cut out entirely, causing decreased spirits, task dissatisfaction, and stress and anxiety. When companies add supplemental or voluntary insurance coverage products to workers major medical protection, this can produce a win-win situation for both.

Protect Your Wedding Event Financial investment

Weddings take months to plan and typically expense 10s of thousands of dollars. Why is it that many people do not protect this investment? Here are some suggestions on what a good Occasion Insurance policy covers and techniques to insure you have a perfect day.

Best For Aarp Members: Aarp/unitedhealthcare

AARP/UnitedHealthcare

-

Nationwide coverage

-

Plans may be competitively priced depending on your health

-

Electronic transfer payment discount and same household discounts

-

Must be an AARP member or live in the same household with an AARP member to qualify

-

Many plans cost more than many of the companys competitors

If you’re an AARP member or live with someone who is, you might be able to get coverage through AARP/UnitedHealthcare which insures over 4 million people nationwide with Medicare Supplemental Insurance plans A, B, C, F, G, K, L, and N .

Some states also offer Plans G and N, but they may not be available in all areas of the state. AARP reports that claims are processed quickly, with an average turnaround time of 98% processed within 10 business days. Discounts such as multi-insured household members and Electronic Funds Transfer can help make pricing more competitive.

Other features of the plans include a free Renew Active Fitness program that offers a gym membership as well as an online brain health program, plus free access to local health and wellness events, a 24/7 nurse line, pharmacy savings, and vision and hearing discounts

AARP doesnt charge more as you grow older. This is especially helpful if you are still covered under your employer’s insurance and may require coverage after the age of 65. In states where insurers use an attained-age rating , AARP can be competitively priced by offering discounts.

Also Check: Does Medicare Part A Cover Dental

Is A Medicare Supplement Plan Worth The Money

The average American without supplemental Medicare coverage spends about $7,473 in out-of-pocket costs while a person with Medigap spends about $6,621. The advantages of Medicare Supplement Plans is their ability to save you money and provide peace of mind about your finances if you experience an illness or accident. The disadvantage is that you may pay for coverage you do not use or need.

How Do You Select A Medicare Supplement Insurance Company That Works For You

After researching and comparing companies, you will select a supplemental insurance company that works best for you. You will want to consider things like the reputation and reviews of the insurance company as well as how easy it is to navigate their website and apply for coverage. Additional factors to consider include types of plans available, pricing, and deductibles. You may also want to select a company that has an app so you can manage your policy on the go.

Don’t Miss: Does Medicare Cover Ear Nose And Throat Doctors

How Do Medicare Advantage Plans Work

Medicare pays private insurance companies to administer the benefits of Medicare Advantage plans they sell. These plans then function the same way Original Medicare does, with the addition of benefits the private insurance provider elects to include in a given plan.

Depending on the provider and plan you choose, Medicare Advantage coverage works similarly to employer-sponsored health insurance with which you may be familiar. For a monthly premium in addition to the Medicare Part B premium, an MA plan provides set copays, coinsurance rates and deductibles for various components of care, as well as additional coverage benefits and perks.

Medicare Supplement Plans In Massachusetts

Like we mentioned above, Medicare Supplement Insurance plans are structured differently in Massachusetts. Residents of the Bay State only have two plans to choose from: the Core Plan and the Supplement 1 Plan.

-

Coinsurance for Part A services plus 365 additional hospital days

-

Coinsurance and copayments for hospice costs under Part A

-

Coinsurance for medical services under Part B

-

First three pints of blood

Screenshot from “Choosing a Medigap Policy,” July 8, 2019.

Additionally, both plans cover state-mandated insurance benefits, such as annual Pap smears and mammograms. A full list of mandated insurance benefits can be seen here. The state government establishes maximum benefit amounts for some of these benefits. You can find complete plan details for 2019, along with plan premiums, on this link.

In addition to the basic benefits and mandated benefits, the Core plan covers 60 days of hospitalization in a mental health facility. It does not cover any deductibles for Medicare Part A or Part B.

Best for: People who can afford their Part B deductible, especially those who do not have a history of mental health hospitalizations and who do not foresee a need for nursing home or inpatient care. Depending on the insurer, premiums for the Core plan can be much lower than the Supplement 1 plan.

You May Like: When Can You Change Your Medicare Part D Plan