Medicare Part B Premium

Beneficiaries typically pay a monthly Medicare Part B premium, although if you have a low income, you may qualify for help paying it. This premium amount may vary, depending on your situation. Here are a few different scenarios:

- If you enrolled in Part B before 2016, your premium will generally be $104.90 per month.

- Youll generally pay $121.80 for your monthly premium if any of the following situations applies to you:

- You enroll in Part B for the first time in 2016.

- You arent receiving Social Security benefits yet.*

- You are billed directly for your Part B premium.

- You have both Medicare and Medicaid coverage , and Medicaid pays for your premiums.

*If you worked for a railroad, contact the Railroad Retirement Board to learn more about your Part B premium costs. You can contact the RRB at 1-877-772-5772, Monday through Friday, from 9AM to 3:30PM, to speak to an RRB representative. TTY users call 1-312-751-4701.

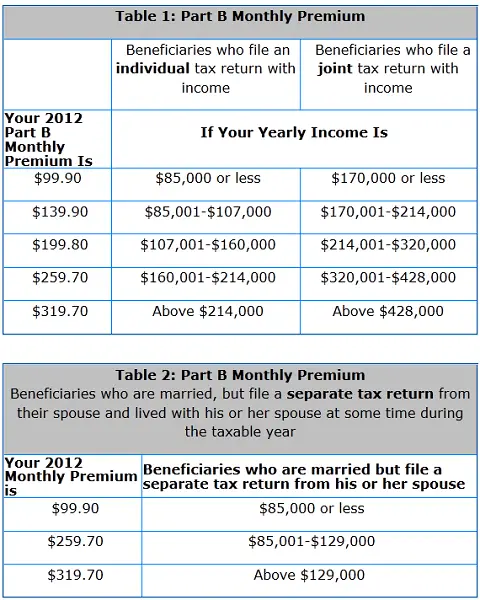

In some situations, your Part B premium may be higher than the above amounts. The government looks at your income as reported on your tax return from two years ago to set your Medicare Part B premium. This table refers to your 2014 income and your 2016 Medicare Part B monthly premium.

| More than $129,000 | $389.80 |

Your Medicare Part B premium payment is typically deducted from your monthly Social Security benefit. If you have to pay an income-related monthly adjustment amount, youll get a notice from Social Security.

Medicare Premiums By Type

Itâs important to note that most Medicare beneficiaries get Medicare Part A for free. Generally, if you paid Medicare taxes for 30-39 quarters you will not have to pay for your Medicare Part A coverage.

If you have been paying Medicare taxes for less than 39 quarters, the standard Part A premium is $274 for 2022.

f you have been paying Medicare taxes for less than 30 quarters, the standard Part A premium is $499 for 2022.

The standard Medicare Part B premium amount is $170.10 for 2022. However, if you are a Medicare beneficiary with an annual modified adjusted gross income above the IRMA threshold, you will have to pay more for your Medicare Part B coverage.

Medicare Savings Programs To Help Pay For Medicare Health Care Costs

You can get help from your state paying your Medicare premiums. In some cases, Medicare Savings Programs may also pay Medicare Part A and Medicare Part B deductibles, coinsurance, and copayments if you meet certain conditions. There are four kinds of Medicare Savings Programs:

- Qualified Medicare Beneficiary Program – helps pay for Part A and/or Part B premiums, and in addition Medicare providers aren’t allowed to bill you for services and items Medicare covers like deductibles, coinsurance, and copayments.

- Specified Low-Income Medicare Beneficiary Program – helps pay for Part B premiums.

- Qualified Individual Program – helps pay for Part B premiums and funding for this program is limited.

- Qualified Disabled and Working Individuals Program – helps pay for Part A premiums only.

If you qualify for a QMB, SLMB, or QI program, you automatically qualify to get Extra Help paying for Medicare prescription drug coverage.

Don’t Miss: How Much Is Medicare Part B Now

Summary Of Strategies To Decrease Magi

In summary, delay social security and pensions until you are 65. To avoid IRMAA, you may have to avoid these until later, especially if you plan to do partial Roth Conversions during your Tax Planning Window. Dont forget that pensions are also fully taxable! Remember that income from municipal bonds is added back as well.

Minimize IRA and 401k distributions and Roth conversions.

In addition, become familiar with your sources of income on schedule 1 to see if they can be decreased. Avoid harvesting capital gains .

What am I Supposed to Live On?

If you want help with your health care insurance costs, you have to decrease your income. The government does not care about your assets or net worth, only income.

How can you control your income regardless of your net worth?

Essentially, you have to live off cash and the basis of your brokerage account. Or tax-free income.

What else can you do? Contribute to an HSA or traditional IRA. If you have any self-employment income, use a SEP IRA or SOLO 401k to shelter the income from taxes and remove it from MAGI calculations.

Consider having international index funds in your brokerage account, as you are able to exclude the foreign income

Watch out for alimony from divorces prior to 2019.

What about my Standard or Itemized Deduction?

Pay special attention: The Standard Deduction is not used in calculation of MAGI! You dont get the $12,200 or $24,400 deduction as this is a below the line deduction.

How Medicare Can Be Coordinated With A Health Reimbursement Arrangement Or A Health Stipend

If youre an employee approaching age 65 and you have a health reimbursement arrangement through your employer, youre in luck. To participate in a stand-alone HRA, employees must have an HRA-eligible health insurance plan. Medicare is an eligible insurance plan, in addition to most major medical plans.

Integration between Medicare and HRAs can be tricky, but it’s very doable depending on what type of HRA you have. Out of the HRAs that are available, the qualified small employer HRA and individual coverage HRA can coordinate with Medicare.

HRA funds can help you pay your Medicare premiums and other qualified medical expenses not covered by your insurance. Integrated HRAs unfortunately cant be integrated with Medicare because they can only be used in conjunction with group health insurance plans.

If your employer offers you an employee stipend, you have even more flexibility. Health stipends provide employees with a fixed amount of money to use on healthcare. Since they are much less regulated than other health benefit options, stipends can be used to pay for Medicare premiums, health services, and out-of-pocket expenses, if your employer allows it.

With WorkPerks through PeopleKeep, employees can easily submit their premium and medical expenses to be reimbursed up to a set monthly allowance amount. The user-friendly dashboard makes it simple for employees of all ages to get their expenses reimbursed quickly and easily.

Read Also: Why Is My First Medicare Bill So High

At What Income Level Do Medicare Premiums Increase

Asked by: Ms. Monica Kuvalis II

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

Help With Medicare Part D Costs

If you have a low income, you might qualify for help paying your Medicare Part D costs through Medicares Extra Help program. If you qualify, youll generally pay a maximum of $2.95 per generic drug prescription and $7.40 per brand-name drug prescription. These are 2016 amounts, and they apply only to medications that your Medicare Prescription Drug Plan covers.

If you qualify for certain Medicare Savings Plans described above , youre automatically eligible for Extra Help.

Recommended Reading: Does Medicare Cover Bone Grafts

Do Certain People Really Pay More For Medicare

Around 93% of people with Medicare pay the regularly published Medicare premiums. Thatâs $170.10 per month for Medicare Part B and the regular premium for your specific Medicare Part D plan .

But around 7% of folks with Medicare pay more depending on how high their income was on their last tax return.

If youâre part of this wealthier bracket, youâll get an Initial IRMAA Determination notice in the mail from Social Security. That letter will let you know if youâll pay higher Medicare premiums.

If you do have to pay higher premiums, the surcharge will most likely come out of your Social Security benefits. If you aren’t drawing Social Security yet, you’ll be billed by Medicare.

Medicare Extra Help 2022 Income Limits

Medicare Extra Help annual income limits for 2022 are $20,385 for an individual or $27,465 for a married couple living together. There also are limits on your other financial resources: Your combined savings, investments and real estate can’t be worth more than $15,510 if you’re single or $30,950 if you are married and live with your spouse. You must meet each of these requirements to qualify for Extra Help.

| 2022 income limit |

|---|

|

Limits are slightly higher in Alaska and Hawaii. If you have income from working, you may qualify for benefits even if your income is higher than the limits listed.

The Medicare Extra Help program assists with monthly Part D costs including monthly premiums, annual drug deductibles and prescription copayments. In 2022, youâll pay a maximum of $3.95 for each generic or $9.85 for each brand-name prescription. Extra Help is estimated to save enrollees about $425 every month.

You can apply for Medicare Extra Help online, at your local Social Security office or over the phone by calling 800-772-1213 .

Extra Help is only available if you’re on Original Medicare and a separate Part D prescription plan. You can’t use Extra Help to reduce drug costs on a Medicare Advantage plan.

You May Like: Can I Add Medicare Part D At Any Time

Helpful Tips For Members

- Use your formal, legal name. No nicknames or initials. Be consistent.

- If you change your name, make sure Social Security updates all three of their databases:

If you have more questions about this program please contact our Customer Contact Center.

Program Contact: , 303-866-5402

What Are The Income Limits For Medicare In 2022

If you filed individually and reported $91,000 or less in modified adjusted gross income on your 2020 tax return, you won’t be charged higher rates for Medicare Part B and Part D in 2022. For joint filers, the income limit is $182,000 or less.

Medicare income limits determine your monthly payment amount for Medicare Part B and Medicare Part D plans. If your income was over the Medicare limits, you’ll pay more for Part B and Part D.

You May Like: Does Medicare Cover The Shingrix Shot

How Social Security Determines You Have A Higher Premium

We use the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your modified adjusted gross income . Your MAGI is your total adjusted gross income and tax-exempt interest income.

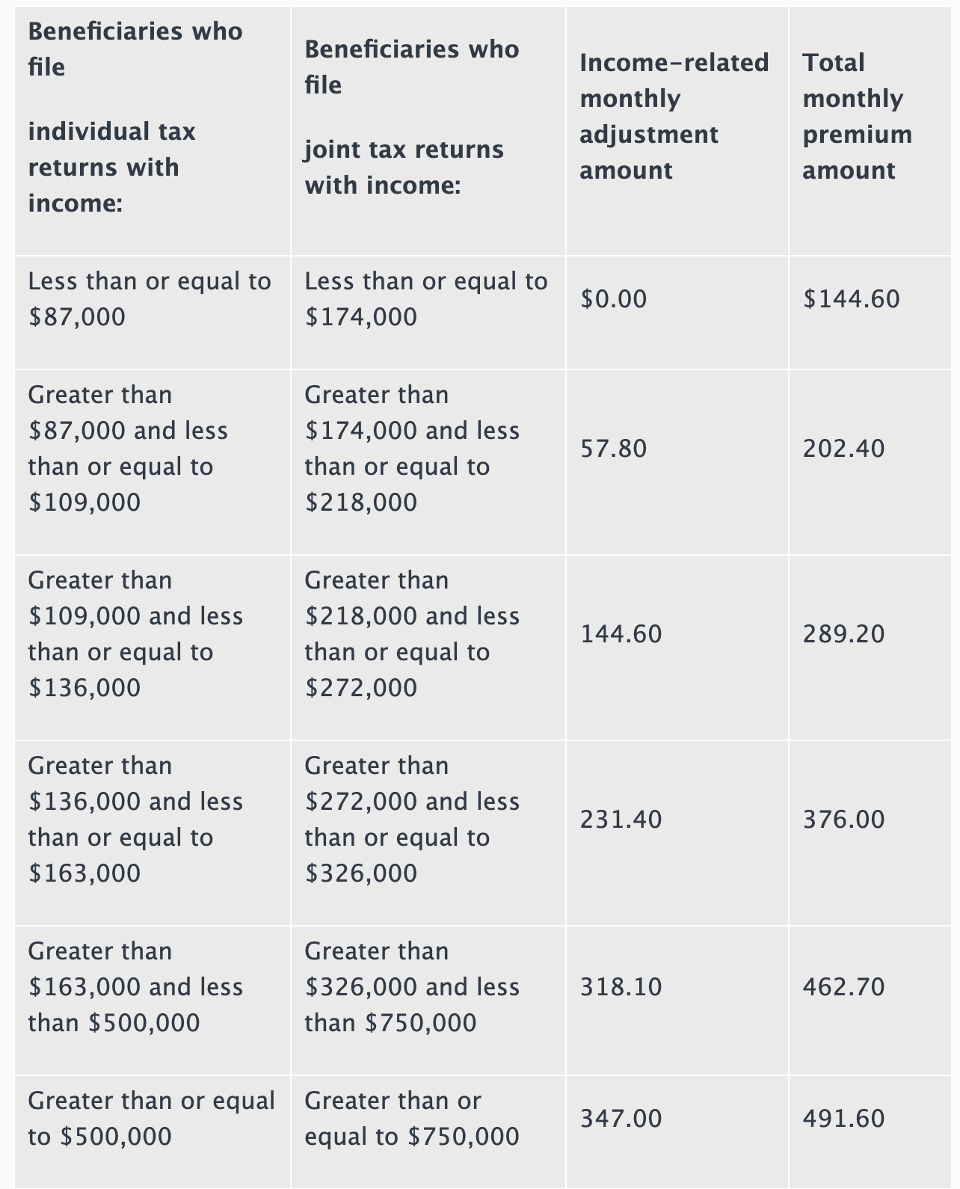

If you file your taxes as married, filing jointly and your MAGI is greater than $182,000, youll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, youll pay higher premiums. See the chart below, Modified Adjusted Gross Income , for an idea of what you can expect to pay.

If you must pay higher premiums, well send you a letter with your premium amount and the reason for our determination. If you have both Medicare Part B and Medicare prescription drug coverage, youll pay higher premiums for each. If you have only one Medicare Part B or Medicare prescription drug coverage youll pay an income-related monthly adjustment amount only on the benefit you have. If you decide to enroll in the other program later in the same year, well apply an adjustment automatically to the other program when you enroll. You must already be paying an income-related monthly adjustment amount. In this case, we wont send you another letter explaining how we made this determination.

Remember, if your income isnt greater than the limits described above, this law does not apply to you.

Supplemental Security Income Benefits

SSI is a cash benefit paid by Social Security to people with limited income and resources who are blind, 65 or older, or have a disability. SSI benefits arent the same as Social Security retirement benefits. You may be able to get both SSI benefits and Social Security benefits at the same time if your Social Security benefit is less than the SSI benefit amount, due to a limited work history, a history of low-wage work, or both. If youre eligible for SSI, you automatically qualify for Extra Help, and are usually eligible for Medicaid.

Read Also: Are Sleep Studies Covered By Medicare

Is Social Security Considered Income

Unearned Income is all income that is not earned such as Social Security benefits, pensions, State disability payments, unemployment benefits, interest income, dividends and cash from friends and relatives. In-Kind Income is food, shelter, or both that you get for free or for less than its fair market value.

Does Social Security Count As Income

Since 1935, the U.S. Social Security Administration has provided benefits to retired or disabled individuals and their family members. … While Social Security benefits are not counted as part of gross income, they are included in combined income, which the IRS uses to determine if benefits are taxable.

Also Check: How Medicare Works With Other Coverage

What Does Modified Adjusted Gross Income Include

According to Investopedia, your modified adjusted gross income is “your household’s adjusted gross income with any tax-exempt interest income and certain deductions added back.”

Your adjusted gross income equals your gross income minus allowable deductions, such as health savings account contributions, retirement plan and IRA contributions, and student loan interest. To find your MAGI, you add back some of those deductions. This includes:

- Deductions you claimed for taxable Social Security payments and IRA contributions

- Interest earned on EE saving bonds that went toward higher education costs

- Passive income or losses

Although Medicare Eligibility Has Nothing To Do With Income Your Premiums May Be Higher Or Lower Depending On What You Claim On Your Taxes

Unlike Medicaid, Medicare eligibility is not based on income. However, the income you report on your taxes does play a role in determining your Medicare premiums. Beneficiaries who have higher incomes typically pay a premium surcharge for their Medicare Part B and Medicare Part D benefits. Known as the Income-Related Monthly Adjustment Amount, or IRMAA, Social Security will notify you if your income places you in this higher bracket.

Less than 5 percent of Medicare beneficiaries have to pay the IRMAA surcharge.

Read Also: Does Medicare Pay For Oral Surgery

I Am About To Turn 65 And Go On Medicare And My Income Is $120000 I Know That People With Higher Incomes Are Required To Pay Higher Premiums For Medicare Part B And Part D How Will These Higher Premiums Affect Me

Medicare beneficiaries with incomes above $88,000 for individuals and $176,000 for married couples are required to pay higher premiums. The amount you pay depends on your modified adjusted gross income from your most recent federal tax return. To determine your 2021 income-related premium, Social Security will use information from your tax return filed in 2020 for tax year 2019. If your income has gone down since you filed your tax return, you should contact Social Security and provide documentation regarding this change. At your current income level, in 2021, you would pay just over $4,300 in annual Medicare premiums combined for Part B and Part D .

What Income Is Used To Determine Medicare Premiums

Did you know that not everyone pays the same amount for Medicare premiums? As you are planning for retirement or if you are already in retirement, it is important to understand the effects that your financial decisions can have on your Medicare premiums. It could be the difference of hundreds of dollars a month.

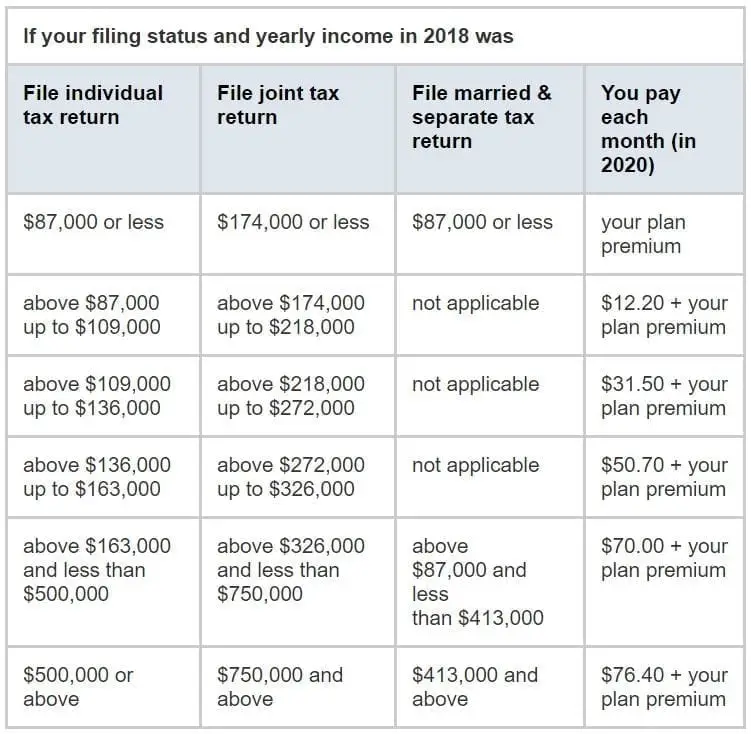

The cost of Medicare B and D premiums are based on your modified adjusted gross income . If your MAGI is above $87,000 , then your premiums will be subject to the income-related monthly adjustment amount . Below are two charts from the Centers for Medicare and Medicaid Services showing how IRMAA can affect premiums at different MAGI levels.

Also Check: Can You Get Medicare Insurance At 62

You May Like: Does Medicare Pay For Stelara

What Is A Hold Harmless

If you pay a higher premium, you are not covered by hold harmless, the rule that prevents most Social Security recipients from seeing their benefit payment go down if Medicare rates go up. Hold harmless only applies to people who pay the standard Part B premium and have it deducted from their Social Security benefit.

Monthly Medicare Premiums For 2022

The standard Part B premium for 2022 is $170.10. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $91,000 Married couples with a MAGI of $182,000 or less | 2022 standard premium = $170.10 |

| Your plan premium + $77.90 |

Recommended Reading: When Does Medicare Part D Start

Medicare Part A Costs Are Not Affected By Your Income Level

Your income level has no bearing on the amount you will pay for Medicare Part A . Part A premiums are based on how long you worked and paid Medicare taxes.

Medicare Part A premium costs in 2022 are as follows:

2022 Medicare Part A Premium Cost|

Number of quarters you paid Medicare taxes |

2022 Medicare Part A monthly premium |

|---|---|

|

40 or more |

|

|

$499 |

Most Part A beneficiaries qualify for premium-free Part A coverage.

Two of the Medicare Savings Programs that may help pay Part A premium costs for qualified individuals include:

- Qualified Medicare Beneficiary Program

- Qualified Disabled and Working Individuals Program

Medicare Advantage and Medigap costs by income level

Medicare Part C plans and Medicare Supplement Insurance plans are sold by private insurance companies. The cost of plans can vary from one provider to the next.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.