Open Enrollment For Texans With Disabilities

People under age 65 who get Medicare because of disabilities have a six-month open enrollment period beginning the day they enroll in Medicare Part B. This open enrollment right only applies to Medicare supplement Plan A.

Note: People who have Medicare because of disabilities have another open enrollment period during the first six months after turning 65.

What Are Part B Excess Charges

Medicare Part B excess charges happen when theres a difference between what Medicare will pay for medical services and what your doctor decides to charge for that same service.

Medicare sets approved payment amounts for covered medical services. Some doctors accept this rate for full payment, whereas others dont.

If your doctor doesnt accept the rate in the Medicare fee schedule as full payment, they are allowed under federal law to charge up to 15 percent more than the approved rate. The amount above the Medicare-approved rate is the excess charge.

With Medicare, you are responsible for paying any excess charges. Some people choose Medigap Plan G to assure that these fees are covered and avoid any unexpected costs after receiving medical care.

Joining A Medicare Drug Plan May Affect Your Medicare Advantage Plan

If you join a Medicare Advantage Plan, youll usually get drug coverage through that plan. In certain types of plans that cant offer drug coverage or choose not to offer drug coverage , you can join a separate Medicare drug plan. If youre in a Health Maintenance Organization, HMO Point-of-Service plan, or Preferred Provider Organization, and you join a separate drug plan, youll be disenrolled from your Medicare Advantage Plan and returned to Original Medicare.

You can only join a separate Medicare drug plan without losing your current health coverage when youre in a:

- Private Fee-for-Service Plan

- Certain employer-sponsored Medicare health plans

Talk to your current plan if you have questions about what will happen to your current health coverage.

You May Like: What Are The Guidelines For Medicare

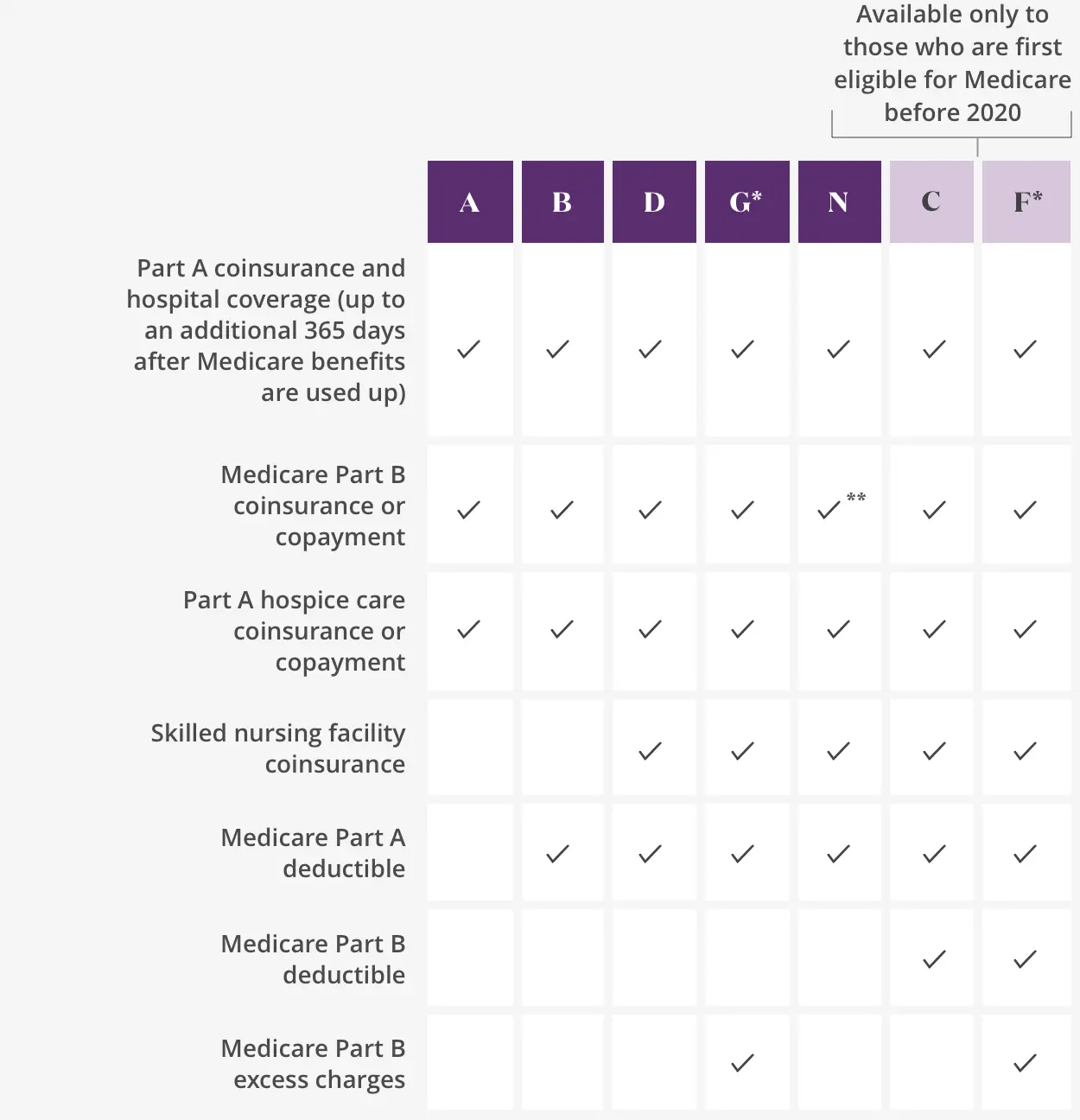

Medigap Plan G Coverage

Plan G provides comprehensive coverage and pays 100% of many healthcare costs, including:

Part A deductible

Part A coinsurance

Part A hospital costs up to an additional 365 days after your standard Medicare benefit ends

Part A hospice care

Part B coinsurance and copayments

Part B excess charge*

Skilled nursing facility care coinsurance

Up to 3 pints of blood for medical procedures

*These are additional charges outside of the Medicare-approved charge. This can happen if theres a difference between what Medicare will pay for medical services vs. what your doctor decides to charge for that service. Some doctors accept the full Medicare-approved rate for payment, while others do not, and they can charge up to 15% more than the approved rate.

Essentially, Plan G covers your share of any medical benefit that is covered by Original Medicare . This includes inpatient hospital costs and outpatient medical services like doctor visits, lab work, durable medical equipment , X-rays, ambulance transportation, outpatient surgeries and more.

Additionally, Plan G covers 80% of medical care received while traveling outside of the U.S. .

There Are 2 Ways To Get Medicare Drug Coverage:

1. Medicare drug plans. These plans add drug coverage to Original Medicare, some Medicare Cost Plans, some Private FeeforService plans, and Medical Savings Account plans. You must have

and/or

to join a separate Medicare drug plan.

or other

with drug coverage. You get all of your Part A, Part B, and drug coverage, through these plans. Remember, you must have Part A and Part B to join a Medicare Advantage Plan, and not all of these plans offer drug coverage.

To join a Medicare drug plan, Medicare Advantage Plan, or other Medicare health plan with drug coverage, you must be a United States citizen or lawfully present in the United States.

Visit Medicare.gov/plan-compare to get specific Medicare drug plan and Medicare Advantage Plan costs, and call the plans youre interested in to get more details. For help comparing plan costs, contact your State Health Insurance Assistance Program .

You May Like: Which Is Primary Medicare Or Private Insurance

Medicare Supplement Plan G For 2023

Get A Free Medicare Quote

Medicare Supplement Plan G is a comprehensive coverage option that covers most of the costs you would otherwise be responsible for with Medicare alone. Medigap Plan G is a great option because it has lower premiums and minimal out-of-pocket expenses. In this text, youll discover if Plan G is right for you.

How Is Medsup Plan G Different From Other Medsup Plans

Medicare Supplement Plan G and Plan F are very similar. The main difference between them is Plan F covers your Medicare Part B deductible while Plan G doesnt.

Some of the other Medicare Supplement plans available today are only slightly different from F and G while a few are quite different. For example:

- MedSup Plan C is like Plan F but doesnt pay your Medicare Part B excess charges.

- Plan N, on the other hand, doesnt pay your Part B deductible or excess charges.

Other MedSup plans pay just a portion of costs, like your Part A deductible or your Part B copay or coinsurance fees. Some come with yearly out-of-pocket limits, too.

Don’t Miss: What Is My Medicare Group Number

How Much Does Medicare Plan G Cost

The premium you pay for a Plan G policy may depend on where you live, your gender and depending on when you apply for Plan G your health status. According to MedicareSupplement.com, the average monthly premium for Plan G is $122.78 per month.

Its easy to see how Plan G can quickly save you money, depending on the health care services you need. All those Medicare copays and coinsurance costs for supplies and services can add up quickly.

How Much Does Medicare Supplement Cost

Medicare supplements vary in rate by carrier and plan choice. Not every carrier offers all plans, says Brandy Corujo, partner of Cornerstone Insurance Group in Seattle. Policy prices for Medigap are set by the individual insurance companies selling them. Companies set their premium pricing in one of three ways:

- Community-rated: Premiums are the same regardless of age.

- Issue or entry age-rated: Premiums are cheaper if the policy is purchased at a younger age. Premiums do not increase with age.

- Attained-age-rated: Premiums are based on your age at the time of purchase. As you age, your premium increases.

Some factors that may also influence your rates include your location, gender, marital status and lifestyle .

Medigap plans are purchased through a private insurance company, and you pay a monthly premium for the policy directly to the company. Medigap policies can be purchased from any insurance company licensed to sell one in your state, but available policies and prices will depend on your state. Medigap plans only cover one person, so married couples need to purchase separate policies.

You May Like: Does Medicare Come Out Of Your Paycheck

Does Medigap Plan G Cover Prescriptions

Prescription medications effectively treat illnesses and diseases, assist with rehabilitation, and prevent the development of certain conditions. Your doctor may prescribe certain medications to help you avoid invasive treatments or more intense therapies.

Many name-brand prescription drugs come at a high price. The cost of drugs varies and depends on many factors. This includes the medications availability, the amount of research money spent on it, and the availability of generic drug versions.

Continue reading to learn all about Medicare Supplement, AKA Medigap plans including what it is and what it covers.

Medicare Benefits Solutions

Medicare Part D Drug Coverage

A standalone prescription drug plan covers generic and brand-name drugs. Medicare sets the standard coverage level for all plans. Each plan must cover the same category of drugs but the specific drugs covered in those various classifications, like diabetes or asthma medications, care determined by the plan provider.

Each drug plan lists its covered drugs on a formulary. If the list does not have the medicine you need, there may be a similar option. Talk with your doctor to verify if alternative medications are acceptable.

Drug costs can vary from plan to plan. Researching plans based on tiered pricing and copays is essential, especially if you have a budget.

TIP: Learn more about Medicare stand-alone prescription drug coverage.

Find a new plan

Also Check: What Weight Loss Programs Are Covered By Medicare

How Does Medicare Prescription Drug Coverage Work

Medicare has designed a “standard benefit.” Companies may offer additional enhanced plans, but they must offer a standard benefit package that is at least equal in value to Medicare’s standard benefit as follows:

$435 deductible – You will be responsible for 100% of the first $435 in total prescription drug costs in each calendar year before your prescription drug benefit begins.

25% coinsurance – After the first $435, you will be responsible for 25% of the total cost of your prescription drugs. The Plan will pay 75% of your total drug costs until they reached a total of $4,020.100% coinsurance – After your total drug costs reach $4,020, you will be responsible for all of your prescription drug costs until you reach an annual out-of-pocket limit of $6,550. This is referred to as the “coverage gap.”

5% coinsurance – After your total out-of-pocket costs reach $6,550, you will pay very little for prescription drugs. You will pay only 5% for prescription drugs and your insurance company will pay the rest.

How Plan G Can Help You Save Money

Lets imagine a situation where the Plan G premium is $120 a month where you live. Thats $1,440 a year.

- If you are admitted to the hospital for inpatient care, you would have to pay a Part A deductible of $1,556 for each benefits period in 2022 before your Part A benefits kick in.

- Since Plan G pays for the Part A deductible, you would have saved $116 already in this example.

- If you need services like surgery, you are 100% covered for the surgery copays and coinsurance costs that Medicare Part A doesnt cover.

Even if you dont need inpatient hospitalization, your savings could potentially be substantial with Plan G if you have a chronic medical condition.

- Lets consider a hypothetical example that imagines you have diabetes. Over the course of a year, you will need several doctor visits, occasional lab tests, supplies like glucose test strips and lancets and maybe a new glucose meter. Those are covered by Part B.

- Without Plan G, your yearly cost for all that care would be the Part B deductible of $233 plus all the copays and coinsurance required for your diabetes supplies and care.

- With Plan G, once you pay the deductible, you are 100% covered for those costs you never pay another dollar that year.

Read Also: What Is Medical Vs Medicare

Is Medicare Supplement Plan G Available To Those Under 65

There are no federal mandates requiring Medicare Supplement plans to be available to those on Medicare under 65 due to disability. Yet, some states require insurance companies offering Medigap plans to provide at least one option to those under 65. Sometimes, these carriers allow you to enroll in Medicare Supplement Plan G.

The most common plan option available to those under 65 is Medicare Supplement Plan A. Medigap Plan A offers only the most basic benefits. However, some carriers understand the importance of widespread plan availability and will allow those on disability to enroll in Medicare Supplement Plan G.

However, when enrolling in a Medicare Supplement plan under age 65, it is important to know that your premium may be double or even triple that of someone over 65. Carriers increase the price to account for high medical costs due to your disability status.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Keeping Your Coverage If You Move

If you are moving to another county or state, make sure your Medicare plan will still be in effect after you move.

If you have original Medicare, federal rules usually allow you to keep your Medicare supplement policy. There are exceptions to this if you have a Medicare Select plan or if you have a plan that includes added benefits, such as vision coverage or discounts that were available only where you bought the plan.

If you have a Medicare Advantage plan, ask the plan whether its available in your new ZIP code. If the plan isnt available, youll have to get a new one. You can switch to another Medicare Advantage plan in your new area or to original Medicare.

Read Also: Does Medicare Offer Life Insurance

How Much Does Medicare Supplement Plan G Cost In 2022

The cost of Medicare Supplement Plan G varies depending on multiple factors, including where you live, your age, tobacco-use status, and gender. Still, Medigap Plan Gâs cost ranges from around $100-$300 per month.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

As a rule of thumb, monthly Medicare Supplement premiums tend to be more expensive in areas with higher costs of living.

If you find the benefits of Medicare Supplement Plan G attractive but cannot pay the monthly premium, you have another option. Medicare Supplement High Deductible Plan G offers the same benefits for a lower monthly premium. However, in exchange for the low monthly cost, you must reach a higher deductible before receiving 100% coverage.

Understanding The Part D Coverage Stages

During the year, you may go through different drug coverage stages. There are four stages, and it’s important to understand how each impact your prescription drug costs. You may not go through all the stages. People who take few prescription drugs may remain in the deductible stage or move only to the initial coverage stage. People with many medications may move into the coverage gap and/or catastrophic stage.

The coverage stage cycle starts over at the beginning of each plan year, usually January 1st.

Annual Deductible

You pay for your drugs until you reach your plan’s deductible

If your plan doesn’t have a deductible, your coverage starts with the first prescription you fill.

Initial Coverage

You pay a small copay or coinsurance amount.

You stay in this stage for the rest of the plan year.

- Total drug costs: the amount you and your plan pay for your covered prescription drugs. Your plan premium payments arenot included in this amount.

- Out-of-pocket costs: The amount you pay for your covered prescription drugs plus the amount of the discount that drug manufacturers provide on brand-name drugs when youre in the third coverage stage — the coverage gap . Your plan premiums are not included in this amount.

*If you get Extra Help from Medicare, the coverage gap doesn’t apply to you.

You May Like: Does Medicare Cover Aba Therapy

When Is The Best Time To Sign Up For Medicare Supplement

The best time to enroll in a Medicare Supplement plan is during your initial Medigap Open Enrollment Period, the six-month window that begins on the first day of the month in which youre both 65 or older and enrolled in Medicare Part B. This enrollment period is the only timeframe in which insurance companies cannot deny you a policy based on your health status or any medical condition.

Attempting to enroll in a Medicare Supplement plan at any other time outside this enrollment period could result in penalty fees or denial of coverage.

Confused About Medicare Supplement Insurance Options?

Find committed, licensed agents who work to understand your coverage needs and find you the best Medicare option. Click Get A Quote or call 866-402-0504 to speak with a licensed insurance agent today.

Medicare Supplement Insurance Plans

A Medicare Supplement Insurance Plan works with Original Medicare. While Medicare Parts A and B cover a lot of health care costs, they dont cover all costs. A Medicare Supplement Insurance Plan covers the costs that Original Medicare doesnt, like:

Coinsurance Copayments Deductibles

Medicare can change these amounts each year, but Medicare Supplement Insurance Plans adjust to always cover them.

Plans are identified by the letters A, B, C, D, F, G, K, L, M and N. Each plan covers a different set of costs. Some plans only cover basic benefits. Other plans cover a wider range of health care costs and benefits.

Medicare Supplement Insurance Plans do not cover hearing, dental or vision care, or prescription drugs. However, prescription drug plans are available. Some Medicare Supplement Insurance Plans cover foreign travel care.

These plans have the same benefits for everyone. Plan G from one company has the same coverage as Plan G from another company. The only differences are premiums and service. You can use any doctor, specialist or hospital that accepts Medicare.

You can enroll in a Medicare Supplement Insurance Plan year-round, but only during the open enrollment period is acceptance guaranteed. This period starts the first month that you are 65 and enrolled in Medicare Part B. After the open enrollment period, youll need to meet certain requirements to be accepted and may have to pay more once youre a member.

Also Check: Are We Getting New Medicare Cards

Medicare Prescription Drug Plans

Get help covering the cost of your prescription drugs. A stand-alone Medicare prescription drug plan can help pay for your medication. You can also get prescription drug coverage as part of a Medicare Advantage plan.

You must live in the service area of the Part D plan to enroll, and some plans will have a network of pharmacies they work with. With prescription drug coverage, in addition to costs varying by plan and provider, your costs may be different based on if a pharmacy is considered in-network or out-of-network, as well as if your drugs are separated into different cost levels, or tiers.

Note for Veterans: People who have benefits through the Veterans Affairs may be able to get prescription drug coverage through the VA and may not need Medicare drug coverage. Talk with your VA benefits administrator before making any decisions.