How Are Payroll Deductions Reported

When reporting employee tax withholdings and filing the required employer tax payments to the federal government, you typically use the following forms:

These documents can be submitted via paper or e-file. Individual states have their own guidelines for reporting payroll deductions, so its important to check with your local authorities.

What Does Medicare Mean On My Paycheck

When Medicare was enacted as a federal law in 1965, the funds to support the program became a payroll tax on earned income. The payroll taxes required for the Federal Insurance Compensation Act are to support both your Social Security and Medicare benefits programs. Your employer makes a matching contribution to the Medicare program.

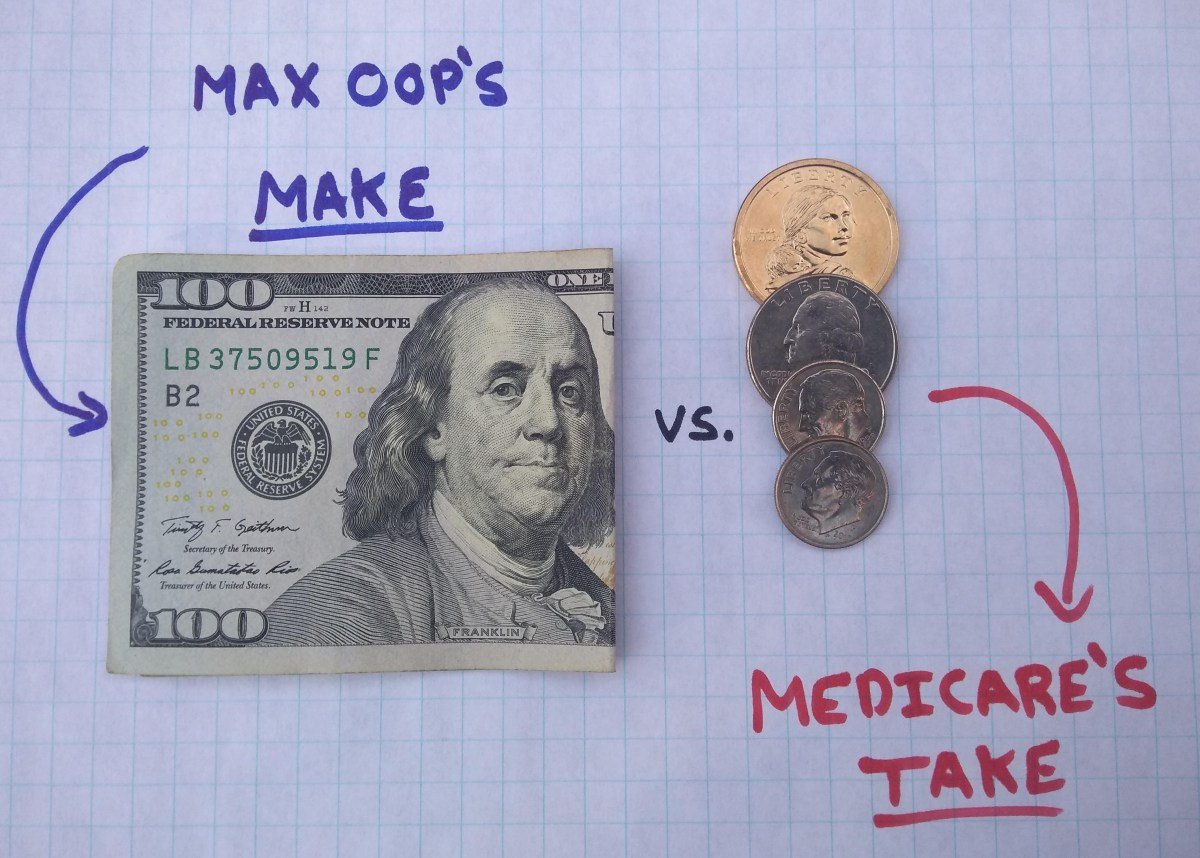

Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer. The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 and 2.90 percent regardless of the total amount you have earned. The benefit of placing funds into this program during your working career is the healthcare coverage you will receive at the time you become eligible for Medicare benefits.

Who Pays for Medicare?Every person who receives a paycheck is paying a Medicare tax. If you are retired and still working part-time, the Medicare payroll tax will still be deducted from your gross pay. Unlike the Social Security tax which currently stops being a deduction after a person earns $137,000, there is no income limit for the Medicare payroll tax. If you are self-employed, you are required to pay both the employee and employer tax for Medicare.

Related articles:

If An Employee Is Exempt From Paying Social Security And Medicare Taxes Are They Responsible For Telling Their Employer

Your employer should determine if you need to pay FICA taxes. But if you already know that youre exempt, then it may be a good idea to bring it up with your employer. That way, they can get the appropriate paperwork to prove exemption status.

Just know that most people pay FICA taxes. There are exemptions for certain people, such as students working at their college or some city employees, but these are not common. Almost everyone pays into the system.

Read Also: What Does Regular Medicare Cover

The Additional Medicare Tax

The Additional Hospital Insurance Tax, more commonly referred to as the Additional Medicare Tax, is provided for by the Affordable Care Act . It became effective on November 29, 2013.

The purpose of this tax is to fund the provisions of the ACA as well as the Premium Tax Credit that went into effect under the ACA, and it was implemented with the express purpose of doing so. It works out to a rate of 0.9%, and employers do not have to match it, but it’s not applicable to all taxpayers.

Only those with incomes that exceed $200,000 annually are subject to this tax as of 2020 and 2021.

What Do You Pay For Medicare Drug Coverage

Youll want to consider additional coverage for medications if you dont already have coverage of equal value. You do this to avoid the Part D late enrollment penalty. You can buy a Medicare Part D plan while keeping Parts A and B or a Medicare Advantage plan instead. Medicare Advantage is an alternative to original Medicare and typically includes drug coverage.

With Part D, out-of-pocket costs come in four phases over the course of a calendar year, not counting premiums:

-

Deductible

-

Initial coverage, or what youre responsible for in copays and coinsurance after youve paid your deductible

-

Coverage gap, or donut hole, where youre responsible for up to 25% of the cost of covered drugs

-

Catastrophic coverage, which kicks in after youre through the donut hole, where your share typically drops to 5% for covered drugs

In 2021, the coverage gap begins once you and your plan have spent a combined $4,130 on covered drugs. Once youve spent $6,550 out of pocket, catastrophic, post-donut hole coverage kicks in. Depending upon income and resource limits, some people qualify forExtra Help, a program that helps with out-of-pocket costs and keeps beneficiaries out of the coverage gap

Read Also: Is Coolief Covered By Medicare

Social Security And Medicare Tax 2019

Following adjustments to the federal tax code made in recent years, individuals can expect 6.2 percent of their pay up to a maximum income level of $132,900 to be directed toward Social Security, and 1.45 percent of their paycheck income to be routed to Medicare. Federal tax deductions from paychecks will depend not only on the amount of income being earned but also the specific withholdings an individual has claimed on their W-4.

Do Medigap Costs Come Out Of My Social Security Check

Medigap premiums are paid directly to the private insurance carrier that provides the plan. In other words, you cannot deduct your Medigap premiums from your Social Security check.

Neither Medigap nor Original Medicare will cover outpatient prescription drugs, so enrollees can also purchase Part D prescription drug coverage, which would be another separate policy with a separate monthly premium.

Note: Some Medigap plans that were purchased prior to 2006 included limited prescription drug coverage, and some enrollees have maintained these plans. If you have one of those plans, please let us know and weâll adjust accordingly.

You May Like: How To Sign Up For Medicare And Tricare For Life

How Fica Tax Or Withholding Tax Are Calculated

The amount of tax your employer withholds from your check largely depends on what you put on your Form W-4, which you probably filled out when you started your job. Here are some things to know:

-

Form W-4 asks about your marital status, dependents and other factors to help you calculate how much to withhold. The less you withhold, the less tax comes out of your paycheck.

-

What you put on your W-4 then gets funneled through something called withholding tables, which your employer’s payroll department uses to calculate exactly how much federal and state income tax to withhold.

-

You can change your W-4 any time. Just , fill it out and give it to your human resources or payroll team.

Prohibited Paycheck Deductions During On

During an on-going employment relationship, employers cannot deduct any of the following:

- Reimbursement for a customer’s bad check or credit card

- Cash register shortages even when an employee counts their till at the beginning and end of their shift, has sole access to the cash register, and is short at the end of the shift.

- Customer walk-outs, theft, or unpaid bills

- Damages to or loss of company equipment

Overpayments

An overpayment occurs when an employer unintentionally or accidentally pays more than an employees agreed-upon wage rate or for more hours than they actually worked.

Employers can only deduct an overpayment from an employees paycheck if it is:

- Inadvertent,

- Infrequent, AND

- Discovered within 90 days of the overpayment.

If an overpayment is not detected within 90 days, the employer cannot adjust an employees current or future wages to recoup the overpayment.

The employer must provide advance written notice and documentation of the overpayment to the employee before any adjustment is made. This notice must include the terms under which the overpayment will be recouped. For example, an employer may offer to split the deductions for overpayment over multiple paychecks or deduct the entire amount at once. Recouping the overpayment may reduce the employee’s gross wages below the state minimum wage. See WAC 296-126-030 for complete information.

Note: This does not apply to employees working for public employers. See Chapter 49.48 RCW for more information.

Also Check: When Can You Get Medicare Health Insurance

Calculating The Medicare Surtax Withholding Amount

Unlike the 6.2 percent Social Security tax and the 1.45 percent Medicare tax, the 0.9 percent surcharge is imposed only on the employee. You withhold the surtax from employee wages, but there is never a matching payment required by the employer.

The employers and employees obligations with respect to the Medicare surtax are different. In some cases, there may be a mismatch between the amounts you are obligated to withhold and the amount of your employees surtax liability.

From the employees perspective, the 0.9 percent Medicare surtax is imposed on wages, compensation and self-employment earnings above a threshold amount that is based on the employees filing status. Once the threshold is reached, the tax applies to all wages that are currently subject to Medicare tax, to the Railroad Retirement Tax Act or to the Self-Employment Compensation Act.

The threshold amounts are as follows:

| Filing Status |

|---|

How Fica Tax And Tax Withholding Work In 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Payroll taxes, including FICA tax or withholding tax, are what your employer deducts from your pay and sends to the IRS, state or other tax authority on your behalf. Here are the key factors, and why your tax withholding is important to monitor.

Recommended Reading: How To Apply For Medicare Insurance

Can I Use Social Security Benefits To Pay My Medicare Premiums

Your Social Security benefits can be used to pay some of your Medicare premiums.

In some cases, your premiums can be automatically deducted If you receive Social Security Disability Insurance or Social Security retirement benefits.

However, this doesnt apply to all Medicare premiums. Each part of Medicare has its own premiums and rules for interacting with Social Security.

Well discuss how this works for each part next.

Why Medicare Deduction Is On Pay Check Stub

- Copy Link URLCopied!

Q: Can you explain Medicare deduction on my paycheck? I cant figure out what it is.–F. C.

A: Many employers are separately itemizing payroll deductions for Social Security and Medicare, rather than lumping them together as a single Social Security deduction. Why? Because beginning this year, Medicare taxes will be assessed on earnings up to $125,000 per year, nearly twice the $53,400 subject to Social Security taxes.

Heres whats happening: Since 1967, when the Medicare program was established, a portion of our Social Security taxes has gone to pay for it every year. This year, of the 7.65% payroll tax employees and employers each contribute to Social Security, 6.2% is strictly for Social Security while the remaining 1.45% is for Medicare. It was easier just to lump the taxes together under the general heading of Social Security when the taxes were applied evenly to earnings.

However, beginning this year, the amount of earnings subject to the 1.45% Medicare tax is nearly twice as high as those subject to the 6.2% Social Security tax. Many companies have decided to show the two taxes individually because they are levied separately.

For some workers this distinction wont matter because they dont earn more than the $53,400 that is subject to both taxes. But for wage earners in higher income brackets, the Medicare tax will continue long after the Social Security tax is satisfied.

There Are Ways to Give Without Reporting It

Recommended Reading: How To Purchase Medicare Insurance

Deductions Only Allowed From Final Paychecks

Except for the deductions listed above, any deductions from final paychecks may not take the employees final paycheck below the minimum wage.

The following deductions are allowed only when there is an oral or written agreement between the employee and employer and the incidents described occurred during the final pay period:

- For covering a cash shortage in the till if the business has established policies regarding cash acceptance, the employee has sole access to the till, and the employee counted the cash at the start and end of the shift.

- For covering the cost of a lost or damaged equipment if the equipment damage or loss can be shown to be caused by the employees dishonest or willful act.

- For acceptance of a bad check or credit card purchase if the business already has policies for check and credit card acceptance at the time of the incident.

- For worker theft if the employees actions are shown to be dishonest or willful and the employer files a police report.

It is the employers responsibility to prove the employees alleged actions and the existence of any policy, agreement, or procedure.

Employers should notify employees of all, policies, agreements, and procedures for final paycheck deductions. These policies should be made in writing and signed by employees.

What Does The Medicare Tax Pay For

Medicare tax payments go into a trust fund thats managed by the federal government. Its called the Hospital Insurance Trust Fund, and it helps pay for Medicare Part A. That includes the costs for Part A services, like hospital stays and skilled nursing facility care, as well as administrative costs for the Medicare program itself.

Most people do not pay a monthly premium for Medicare Part A because they pay into the system during their working lives. If you reach Medicare eligibility age and have 40 work credits determined by Social Security then you get Part A for free. If not, youll have a monthly premium that varies each year.

If youre concerned about your work credits or want to make sure youre on the right track for premium-free Part A, check with Social Security.

Note: you may not have a premium for Medicare Part A, but everyone has cost sharing. That means you will have a deductible and other out-of-pocket costs when you get care. The trust fund is not large enough to cover 100% of the cost of medical care for the Medicare population.

Recommended Reading: Does Medicare Cover Private Home Care

When Do You Get Medicare If You Are On Social Security

Youll get Medicare automatically if youre already receiving Social Security retirement or SSDI benefits. For example, if you took retirement benefits starting at age 62, youll be enrolled in Medicare three months before your 65th birthday. Youll also be automatically enrolled once youve been receiving SSDI for 24 months.

Also Check: How Can I Calculate What My Social Security Will Be

Medicare Taxes: The Basics

Like Social Security benefits, Medicares Hospital Insurance program is funded largely by employment taxes. If you work under the table you wont pay into these systems. Thats why payroll tax withholding, although it takes a chunk out of your take-home pay, is actually providing you with something in return for those lost dollars in your paychecks.

Medicare HI taxes began in 1966, at a modest rate of 0.7%. Employers and employees were each responsible for paying 0.35%. Employees paid their share when their employers deducted it from their paychecks. Since 1966 the Medicare HI tax rate has risen, though its still below the Social Security tax rate. The current Social Security tax is 12.4% with employees and employers each paying 6.2%.

Today, the Medicare tax rate is 2.9%. Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes.

Also Check: What Is Uhc Medicare Advantage

How Much Is Deducted From Social Security For Medicare Part A

For most people, Medicare Part A hospital insurance is premium-free. This doesnt mean it is actually free, because you still have to pay your deductible, co-insurance, and other out-of-pocket costs. However, you will have no monthly premium fees if you qualify.

You are eligible to receive premium-free Part A coverage at age 65 if:

- You or your spouse paid Medicare taxes for ten years or longer

- You already receive Social Security retirement benefits or Railroad Retirement Board benefits

- You are eligible for these benefits but havent yet received them

- You or your spouse had Medicare-covered employment through the government

You can also get premium-free Part A if you are under 65. This will happen if you have received Social Security or Railroad Retirement Board disability benefits for over 24 months, or if you have end-stage renal disease and meet certain other qualifications.

Part A is paid for through income taxes that you pay for while you work. This is why the amount of years that you paid this tax is used to determine how much you pay in premiums.

The Tax On Combined Types Of Income

An adjustment can be made on Form 8959 beginning at line 10, if you’re calculating the AMT on both self-employment income and wages. This adjustment functions to ensure that the Additional Medicare Tax is calculated only once on wages and only once on self-employment income when they’re combined and exceed the threshold amount.

Individuals with wages subject to the FICA tax and self-employment income subject to the self-employment tax can calculate their liabilities for Additional Medicare Tax in three steps:

- Step 1: Calculate the Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld.

- Step 2: Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

- Step 3: Calculate the Additional Medicare Tax on any self-employment income in excess of the reduced threshold.

Net self-employment income can’t be less than zero for purposes of calculating the Additional Medicare Tax, so business losses can’t reduce the tax owed on wage compensation.

Read Also: How Much Does Medicare Pay For Urgent Care Visit

Withholding For The Additional Medicare Tax

The Additional Medicare Tax applies when a taxpayer’s wages from all jobs exceed the threshold amount, and employers are required to withhold Additional Medicare Tax on Medicare wages in excess of $200,000 that they pay to an employee. The same threshold applies to everyone regardless of filing status.

This $200,000 rule can result in underpayment when a taxpayer holds two jobs, neither of which pays more than the threshold amount, so neither employer withholds for this additional tax.

Employees are accustomed to having Medicare taxes withheld from their wages by their employers, and to having the right amount of Medicare tax withheld. But the rules for AMT withholding are different from the rules for calculating the regular Medicare tax. This can result in an employer withholding an amount that’s different from the correct amount of tax that will ultimately be owed.

The number that employees arrive at when they calculate the AMT on their tax returns might or might not match up with what was withheld from their earnings. An employee is liable for the Additional Medicare Tax even if the employer doesn’t withhold it.

It’s best to figure out in advance what your additional Medicare surtax will be, if possible, and then cover this tax cost. You can do this in a few ways: