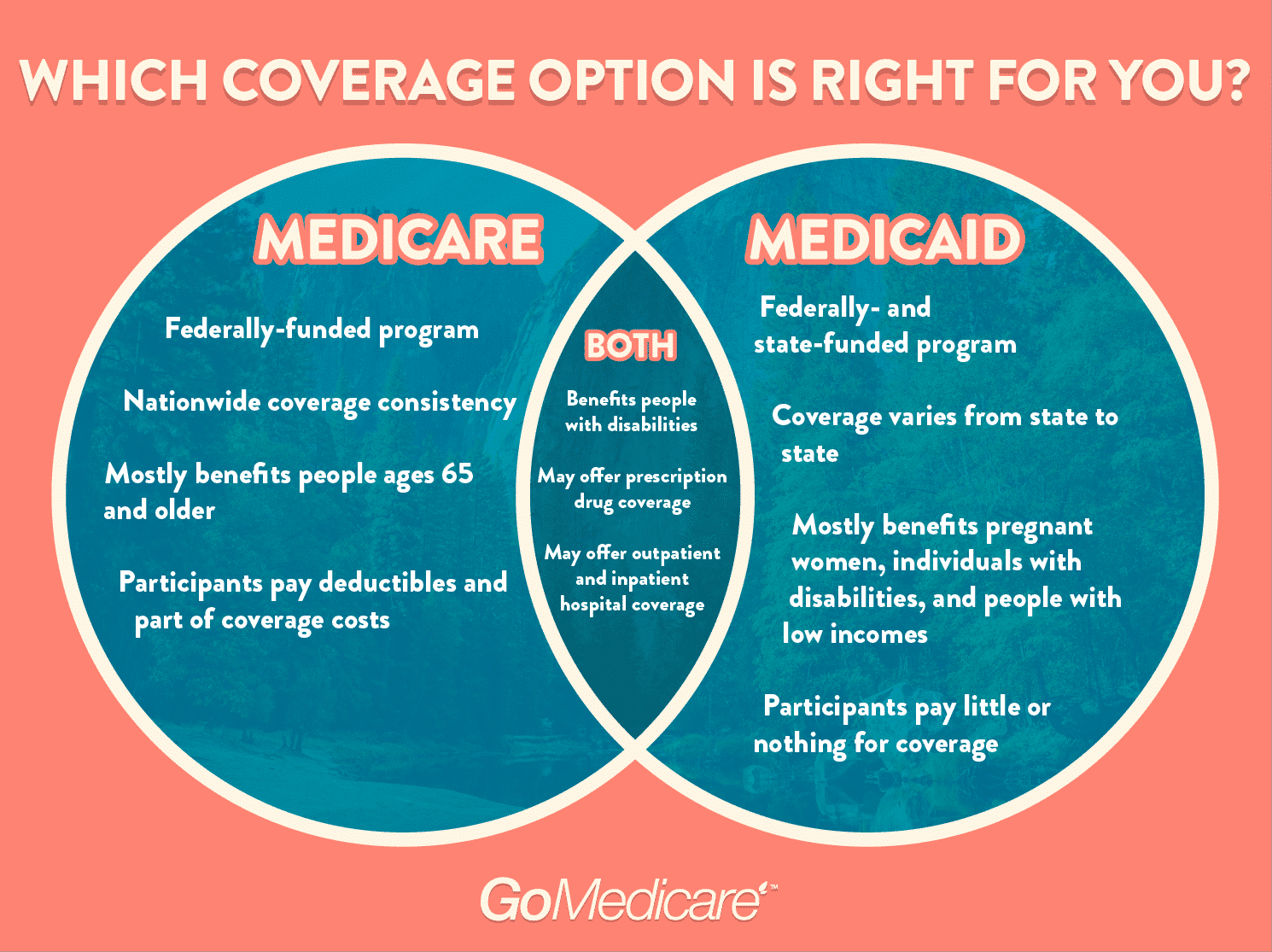

At A Glance: Medicare Vs Medicaid Key Differences Chart

| Medicare | ||

| for the full list of mandated and optional benefits. | ||

| What services of note are not covered? | Long-term nursing home or at-home careDental, vision, hearing aids | Chiropractic services may be covered in some states Some states dont cover dental or vision care for Medicaid enrollees. |

| What does it cost? | Medicare costs vary depending on the coverage you choose. Costs may include premiums, deductibles, copays, and coinsurance. | Medicaid costs depend on your income and the rules in your state. Medicaid may include low out-of-pocket costs. Some Medicaid expansion enrollees may have to pay premiums |

To help you better understand Medicare vs. Medicaid, lets look into each program with a little more detail.

Option : Original Medicare

- Medicare is primary and Medi-Cal is secondary. In Original Medicare, also known as fee-for-service, it is important to present providers with both Medicare and Medi-Cal cards. With Original Medicare you can choose any medical provider that accepts Medicare and Medi-Cal, no referrals to a specialist is needed.

- In addition to the Medicare and Medi-Cal card, beneficiaries also have a CalOptima Member Identification card and a Part D Prescription Drug Plan card.

- Medi-Medi beneficiaries that do not enroll in a Part D Plan or a Medicare Advantage Plan will automatically be enrolled in a Part D benchmark plan. Medi-Medi beneficiaries are automatically eligible for Extra Help, the program that helps pay for prescription drug plan co-payments.

Can You Get Insurance To Help Cover Part A And Part B Expenses

As youve seen in this article, Medicare Part A and Part B generally come with out-of-pocket costs for you to pay. Did you know that you might be able to buy a Medicare Supplement insurance plan to help cover those expenses? There are up to 10 standardized Medicare Supplement plans available in most states. Learn more about Medicare Supplement insurance.

You can compare Medicare Supplement plans and Medicare coverage options anytime you like, with no obligation. Type your zip code in the box on this page to begin.

The product and service descriptions, if any, provided on these Medicare.com Web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

You May Like: Are Hearing Aids Covered By Medicare Part B

What To Know About Medicare And Urgent Care

-

An urgent care center provides outpatient care for sudden illnesses and injuries.

-

Emergency rooms, primary care physicians, and retail clinics provide similar services to urgent care, but each facility has its capabilities.

-

Understanding the federal Medicare program makes navigating unforeseen circumstances easier. Discussing options with a licensed insurance agent or a licensed health insurance agency may be helpful.

An urgent care center is a walk-in facility that provides medically necessary services for sudden, but not life threatening, health conditions. However, does Medicare cover urgent care centers? In most cases, yes, Medicare will cover urgent care, and many urgent care locations accept Medicare plans. However, there are a variety of factors that contribute to ones overall cost and what is covered.

Additionally, there may be medical events where a visit to the emergency room, retail clinic, or primary care physician may be more appropriate. As such, understanding exactly what urgent care is, as well as how it works with Medicare, will make navigating the medically unexpected far easier for Medicare beneficiaries. This ensures one receives the best, most cost-effective healthcare for a given situation.

Medicare Vs Medicaid Compare Benefits

In the context of long term care for the elderly, Medicares benefits are very limited. Medicare does not pay for personal care . Medicare will pay for a very limited number of days of skilled nursing . Medicare will also pay for some home health care, provided it is medical in nature. Starting in 2019, some Medicare Advantage plans started offering long term care benefits. These services and supports are plan specific. But they may include:

- Adult day care

Also Check: Does Kaiser Medicare Cover Dental

What Is Medicare Part A

Medicare Part A is hospital insurance. It may cover your care in certain situations, such as:

- Youre admitted to a hospital or mental hospital as an inpatient.

- Youre admitted to a skilled nursing facility and meet certain conditions.

- You qualify for hospice care.

- Your doctor orders home health care for you and you meet the Medicare criteria. Medicare Part A may cover part-time home health care for a limited time.

Even when Medicare Part A covers your care:

- You may have to pay a deductible amount and/or coinsurance or copayment.

- There may be some services you get in a hospital or other setting that Medicare doesnt cover.

- Its possible that your Part A coverage will run out for example, if you stay in the hospital for more than 90 days in a row, you might have to pay all costs. Learn more about Medicare Part A

- Medicare typically wont pay for a private room or non-medical items such as toiletries or a television in your room.

What Do Medicare Part A And Part B Have In Common

Medicare Part A and Part B share some characteristics, such as:

- Both are parts of the government-run Original Medicare program.

- Both may cover different hospital services and items.

- Both may cover mental health care .

- Both may cover home health care.

- Both have annual deductibles, as well as coinsurance or copayments, that may apply to certain services.

- Both have monthly premiums, although many people dont have to pay the Part A premium .

Recommended Reading: When Must You File For Medicare

Difference Between Medical And Medicare

Medical vs Medicare

If you are a senior citizen or have old parents to take care, it is advisable to have a medical insurance policy to remain prepared for the high expenses that are incurred during hospitalization and treatment of diseases. Medical care and assistance has become very costly in the last few years, necessitating having a financial cover, at least in the old age. While most people know about Medicare as an insurance program funded by the federal government that takes care of hospitalization and medical services, not many are aware of a similar program called Medical. It is possible to have the umbrella of Medical even while having the protection of Medicare. The two programs are different as will be clear after reading this article.

Medicare

Medicare is a social insurance program that is funded by the federal government. People who make contributions to Social Security are eligible for benefits under this program. There are several parts of Medicare such as Part A that deals with hospital insurance, Part B that provides for Medical insurance, Part C that deals with network plan and finally Part D that looks after the cost of prescription drugs. Medicare is not dependent upon the financial needs of a person and it is available for all people over the age of 65 provided they meet the criteria of eligibility.

Medical

What is the difference between Medical and Medicare?

Medical is not related with Medicare.

How Are Medicare Part A And Part B Different

Although both Medicare Part A and Part B have monthly premiums, whether youre likely to pay a premium and how much depends on the part of Medicare.

Most people dont have to pay a monthly premium for Medicare Part A.

- If youve worked and paid Medicare taxes for at least 10 years , you typically dont pay a premium.

- If you worked 30-39 quarters, youll generally pay $240 in 2019.

- If you worked fewer than 30 quarters, youll generally pay $437 in 2019.

On the other hand, most people do pay a monthly premium for Medicare Part B. The standard premium in 2019 is $135.50, but you may pay more if your income is above a certain level. If you have a low income or no income, in some cases Medicaid might pay your Part B premium.

You May Like: What Does Medicare Part A And B Not Cover

Should I Apply For Medicare

Yes! Parts A and B for sure, possibly D as well in some cases. Each part of the program covers different types of care:

- Part A is for hospitalization, stays in skilled nursing facilities , home health care , and hospice.

- Part B covers doctors bills and outpatient costs, like laboratory work, medical equipment, and physical and speech therapy.

- Part C functions like a private insurance plan that replaces the need for Parts A and B

- Part D covers prescription drugs. Most veterans will get better coverage for drugs under your VA plan, so the only reason to consider Part D is if you want more options in terms of who prescribes your drugs and where you can get them filled.

Part A wont cost you anything extra, so theres really no reason not to sign up. Part B costs a little over $100 a month, and C and D will both have varying monthly premiums based on the plans you consider.

How Do The Benefits Differ

Private insurance and original Medicare plans provide varying benefits and coverage.

Most of both types of plans cover hospital care and outpatient medical services, including doctors visits, physical therapy, and diagnostic tests.

However, Medicare may have gaps in coverage that private insurers cover. For example, Medicare does not cover prescription drugs, meaning that a person needs to get a Medicare Part D plan. However, private insurance plans often include prescription drug coverage.

Medicare Advantage plans, which replace original Medicare, may offer coverage that more closely resembles that of a private insurance plan. Many Medicare Advantage plans offer dental, vision, and hearing care and prescription drug coverage.

Don’t Miss: Does Humana Offer A Medicare Supplement Plan

Further Explanation Of Medicaid

Medicaid is the other government program that assists Americans with their health care. There are over 70 million people who are receiving assistance through Medicaid, and it may also be an option that is open to you.

Whereas Medicare is administered entirely by the federal government, it is both the federal and state governments that are responsible for financing Medicaid.

The federal government puts regulations in place for the minimum coverage required in Medicaid programs, but state governments make the call on how much above the minimum their program will provide for their residents.

Medicaid can be especially confusing to understand since it goes by a lot of different names and benefits differ depending on the state. For purposes of clarity, I will just use Medicaid to talk about each of the states programs. The name and full scope of benefits for your states Medicare program will depend on the state of your residence.

Original Medicare: Part A And Part B

![Medicare vs. Medicaid [INFOGRAPHIC] Medicare vs. Medicaid [INFOGRAPHIC]](https://www.medicaretalk.net/wp-content/uploads/medicare-vs-medicaid-infographic-health-care.jpeg)

Medicare Part A and Part B make up the federal program known as Original Medicare. Learn more about how you qualify for Medicare.

- If youre eligible for Medicare Part A and Part B, you might be enrolled automatically.

- If youre getting Social Security benefits when you turn 65, youre typically enrolled without having to do anything.

- If youre under 65 and get disability benefits, you may be enrolled in Medicare Part A and Part B automatically. Read the details of when youll get enrolled in Part A and Part B if you qualify for Medicare due to disability.

Be aware, though, that sometimes youre not automatically enrolled, and you have to take steps to enroll in Medicare. For example:

- If you have end-stage renal disease , you might qualify for Medicare before youre 65, but you have to sign up through Social Security.

- If you live in Puerto Rico, even if youre automatically enrolled in Medicare Part A, you need to enroll manually in Medicare Part B.

- If you delayed enrollment in Medicare Part A and/or Part B beyond your Medicare Initial Enrollment Period, you need to enroll manually.

This might not be a complete list of occasions when you have to enroll manually.

Recommended Reading: Do You Have To Resign Up For Medicare Every Year

Medicaid Eligibility And Costs

The federal/state partnership results in different Medicaid programs for each state. Through the Affordable Care Act , which was signed into law in 2010, President Barack Obama attempted to expand healthcare coverage to more Americans. As a result, all legal residents and citizens of the United States with incomes of up to 138% of the poverty line qualify for coverage in Medicaid participating states.

While the ACA has worked to expand both federal funding and eligibility for Medicaid, the U.S. Supreme Court ruled that states are not required to participate in the expansion in order to continue receiving already established levels of Medicaid funding. Many states have chosen not to expand funding levels and eligibility requirements.

Those covered by Medicaid pay nothing for covered services. Unlike Medicare, which is available to nearly every American of 65 years and over, Medicaid has strict eligibility requirements that vary by state.

However, because the program is designed to help the poor, many states require Medicaid recipients to have no more than a few thousand dollars in liquid assets in order to participate. There are also income restrictions. For a state-by-state breakdown of eligibility requirements, visit Medicaid.gov and BenefitsCheckUp.org.

Which Is Better For Those With Dependents

Typically, private insurance is a better option for people with dependents. While Medicare plans offer coverage only to individuals, private insurers usually allow people to extend health coverage to dependents, including children and spouses.

Age can also be a factor when deciding between enrolling in Medicare or a private insurance plan. To qualify for Medicare, an individual must be at least 65 years of age or have certain conditions that meet the eligibility criteria, such as end stage renal disease. On the other hand, private insurance is available to anyone, regardless of age.

Also Check: Is Oral Surgery Covered By Medicare

Do I Need Medicare Or An Obamacare Plan

When it comes to choosing between Medicare or Obamacare, theres no single right answer.

You can check with healthcare.gov to determine your eligibility and to make sure you dont let your health insurance coverage lapse.

To learn more about Medicare Advantage plans that may be available in your area, a licensed insurance agent can help you compare plan specifics such as costs, coverage networks and benefits.

Learn about Medicare Advantage plans in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

1 CMS. Medicare Enrollment Dashboard. Retrieved Dec. 2020, from https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Dashboard/Medicare-Enrollment/Enrollment%20Dashboard.html.

2 Kaiser Family Foundation.. Retrieved Dec. 2020, from www.kff.org/health-reform/state-indicator/marketplace-enrollment.

3 MedicareAdvantage.com’s The Best States for Medicare in 2021 report. .

4 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

5 Kaiser Family Foundation. . Retrieved Dec. 2020 from https://www.kff.org/health-reform/state-indicator/average-marketplace-premiums-by-metal-tier.

About the author

Where you’ve seen coverage of Christian’s research and reports:

What Is Medicare What Is Medicaid

Medicare is a federal program generally for people who are 65 or older or have a qualifying disability or medical condition. Medicare Part A and Part B are provided by the federal government, and Medicare Part C and Part D, while federally governed, are provided by private insurance companies.

Medicaid is a state government program that helps pay health care costs for people with limited income and resources, and different programs exist for specific populations. Medicaid plans vary from state-to-state but follow federal guidelines for benefits.

Read Also: What Is The Coinsurance For Medicare Part B

Group Coverage Through Larger Employer

Whether you have group insurance through the company you work for or your spouses employer, Medicare is your secondary coverage when the employer has more than 20 employees. Some Medicare beneficiaries will choose to delay their Part B enrollment if their group coverage is cheaper. However, most of the time after evaluating their coverage they find that Medicare will cost them less and provide better coverage if they let Medicare be their primary coverage.

Medicare Vs Medicaid For Seniors

Both Medicare and Medicaid offer basic and extended health services for enrollees. Their core populations of beneficiaries are different, but seniors with low or fixed incomes may qualify for both insurance plans.

Because the enrollment, coverage and benefit details vary from person to person, and each state has its own rules about participation in Medicaid, it is always best to speak with a qualified Medicare or Medicaid counselor before making decisions about long-term health coverage.

Most plans also have case workers who can answer questions about Medicare vs Medicaid, coverage types and how to get your benefits working together.

Read Also: How To Disenroll From A Medicare Advantage Plan

Medicare Vs Private Insurance Costs

Making a direct cost comparison between Medicare and private insurance plans is challenging due to several factors, such as:

- Employers who provide private insurance plans may also pay for some or all of the monthly premium.

- Some people sign up for privately administered Medicare Advantage plans, which also vary in cost but may be more cost effective than original Medicare for some people.

- A Medigap policy cover costs such as deductibles and copays, but the monthly premium for Medigap policies varies.

- Medicare premiums only cover one person. However, private insurers may extend coverage to other family members, such as dependents.

Other factors affecting the cost of private insurance include:

- the age of the person

- where they live

- the benefits of the plan

- the out-of-pocket expenses

Generally, private insurance costs more than Medicare. Most people qualify for a $0 premium on Medicare Part A.