What Is Medicare Supplement Plan E

There are 10 Medigap plans that are currently offered in the marketplace: A, B, C, D, F, G, K, L, M, and N. Medicare Supplement Plan E is a previously offered Medigap plan that covered some Medicare Part A and Medicare Part B costs, plus blood transfusions, preventive services, and care needed during foreign travel.

In 2003 , the Medicare Prescription Drug, Improvement, and Modernization Act was enacted. This legislation made some big changes to original Medicare and Medigap plan offerings. Through this legislation, Medicare + Choice, the Medicare managed care program, became what we now know as Medicare Advantage . Medicare Part D, the prescription drug benefit program, also became available for all beneficiaries through private plans.

In 2008, the Medicare Improvements for Patients and Providers Act was enacted. This legislation made multiple improvements to Medicare, including some that greatly impacted Medigap offerings. Through this legislation, Medigap plans E, H, I, and J were all eliminated due to the Medicare changes.

As of , no new Medicare enrollees were eligible to enroll in Medigap Plan E. However, anyone who was enrolled in Medigap Plan E before it was discontinued in 2010 may be eligible to keep their plan and their plan benefits.

If you became eligible for Medicare after June 2010, there are a few current options that are similar to Plan J. Because Plan J was a very comprehensive plan, the two most similar plans offered today include Plan D and Plan G.

Medicare Part B Coinsurance Or Copayment

Medicare Part B helps cover costs for things like doctors appointments, medical devices and preventive care.

After you meet your Medicare Part B deductible , you are typically responsible for a coinsurance or copay of 20 percent of the Medicare-approved amount for covered services.For example, if you suffer a foot injury and need to use a wheelchair, Part B will help cover 80 percent of the cost of your wheelchair . For illustration purposes, if it costs $800 to buy the wheelchair and Medicare Part B covers it as durable medical equipment , your Part B coinsurance cost would be $160.

Medigap Plan C would fully cover your $160 Part B coinsurance.

Some Medicare Advantage Plans Have Zero Premium True

This is true there are Medicare Advantage plans that do not charge members a monthly fee. However, these plans require members to pay out of pocket a larger percentage of the medical costs they incur. A free plan, for example, could charge you $75.00 to see a specialist, while a plan with a monthly premium could cover that expense without requiring a copay.

Again, be sure to shop carefully and select a Medicare Advantage plan that best fits your healthcare needs and budget. Evaluate the plan to make sure you understand the potential future costs of coverage and what your true cost for healthcare will be.

Read Also: Is Keystone First Medicare Or Medicaid

What’s Medicare Supplement Insurance Coverage

Who is this for?

If you’re shopping for a Medicare plan for the first time or thinking of changing your current plan, this explains Medicare supplement, one of your options.

Medicare supplement insurance plans, sometimes called Medigap, have been around almost as long as Medicare. They’re sold by health insurance companies like us. They help people pay for their share of the costs for health care services covered by Medicare. Those costs include:

- A set amount called a deductible you pay before Medicare starts paying. Medicare has two deductibles: one for Part A, which covers hospital services, and one for Part B, which covers medical services.

- Hospital expenses remaining after you meet your Part A deductible. Medicare pays your expenses for the first 60 days you’re in the hospital. Then you start paying $389 per day in 2022. That amount increases the longer you’re in the hospital.

- A portion of the cost of most services after you meet your Part B deductible. Medicare pays 80 percent of your costs. You pay the other 20 percent.

So your costs can really add up. That’s where a Medicare supplement insurance plan can help. It’ll pay your 20 percent coinsurance. It’ll pay for your hospital expenses. Some Medicare supplement plans pay one or both of your deductibles. Some will pay for emergency care you need outside of the U.S.

General Features Of Medicare Supplement Insurance Plans

Medicare Supplement insurance plans work with Original Medicare to help with out-of-pocket costs not covered by Parts A and B. The following are also true about Medicare Supplement insurance plans:

- Predictable costs help you stay ahead of unexpected out-of-pocket expenses.

- No network restrictions mean you can see any doctor who accepts Medicare patients.

- You donât need a referral to see a specialist.

- Coverage goes with you anywhere you travel in the U.S.

- There is a range of plans available to fit your health needs and budget goals.

- Purchasing a Medigap plan and a Medicare Part D prescription drug plan could give you more complete coverage.

- Guaranteed coverage for life means your plan canât be canceled.

As long as you pay your premiums when due and you do not make any material misrepresentation when you apply for this plan.

For PA residents only: As long as you pay your premiums when due. You do not misstate one or more material facts when you apply for this plan. UnitedHealthcare has 2 years to act on misstatements. The 2 year limit does not apply to fraud.

Rates are subject to change. Any change will apply to all members of the same class insured under your plan who reside in your state. can provide peace of mind by helping with some of these costs.

Also Check: How Much Does Medicare Pay For Assisted Living Facility

What Do Medicare Supplement Plans Cover

Who is this for?

If you’re shopping for Medicare plans, this page will help you understand what you get from a Medicare supplement plan.

Medicare supplement plans don’t work like most health insurance plans. They don’t actually cover any health benefits. Instead, these plans cover the costs you’re responsible for with Original Medicare.

These costs can include:

- Hospital costs after you run out of Medicare-covered days

- Skilled nursing facility costs after you run out of Medicare-covered days

Here’s how it works: You pay a monthly premium for your Medicare supplement plan. These plans are also called Medigap. In return, the plan pays most of your out-of-pocket expenses. So when you go to the doctor, for example, you don’t have to pay the 20 percent coinsurance required by Medicare. Your Medigap plan pays it for you. With some Medigap plans, you might have a copay instead of the 20 percent coinsurance.

Medicare supplement plans aren’t your only option. Medicare Advantage plans help with your Medicare costs, too. They also offer additional health coverage that Medicare supplement plans don’t.

The table below breaks down the differences between Medicare supplement plans and Medicare Advantage plans. It might be a good place to start if you’re wondering which type of plan is right for you.

Medicare supplement vs. Medicare Advantage plans

| Medicare supplement |

|---|

Compare Medigap Plan N With Other Medicare Supplement Insurance Plans

Like all Medigap plans, the costs associated with Medigap Plan N may vary by carrier. How a certain insurance carrier rates the Medigap Plan N premiums determines how much an individual will pay to obtain a policy. Medigap Plan N may be an attractive option for those seeking broad coverage. It is not the most comprehensive Medicare Supplement insurance plan, so it is recommended that you review the details of all ten Medigap plans in order to find a Medigap policy that works best with your needs.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

NEW TO MEDICARE?

So you are enrolled in Original Medicare , what should you do next?

Research, from DEFT, suggests that those with Original Medicare only are not overly enamored with their coverage. There are a few ways you can find comprehensive Medicare coverage for the things that matter, such as routine vision, dental, and hearing care. Keep reading to find out which Medicare plans are right for you.

To get the best value and health insurance coverage for your situation, be sure to compare your employer coverage costs to your projected healthcare costs on Medicare. Youll need to do a little research to determine the best arrangement for you.

Also Check: Is Trump Trying To Get Rid Of Medicare

What Are Medicare Supplement Plans

Medicare Supplement plans are sometimes called Medigap plans because they help fill the coverage gaps left by Medicare Part A and Medicare Part B. You must enroll in Original Medicare Parts A and B to purchase a Medicare supplement insurance plan. Most Medigap plans cover some or all of the 20% not covered by Parts A and B.

Private insurance companies sell Medicare Supplement plans. Each plan is required by the Centers for Medicare & Medicaid Services to provide the same benefit coverage nationally, but premiums can vary from provider to provider. All policies are meant for individual coverage only, so if you and your spouse need a Medicare Supplement Plan, you must each purchase one separately.

Benefits Of Aarp Medicare Plans

There are many features and perks of AARP plans.

- Coverage is offered nationwide.

- You can use any doctor who accepts Medicare. This includes your current doctor.

- You donât have to be referred to other doctors you may need to see.

- Your policy cant be canceled or your premium increased because of health problems.

- A supplement plan can be joined with Medicare Part D to help lower your prescription drug costs.

Also Check: Does Medicare Pay For Eyeglasses For Diabetics

What Medigap Plans Cost In New Hampshire

Expect to pay about $81 to $302 each month for a Medigap plan A, G, or N in New Hampshire if you enroll during your open enrollment period. Premiums will vary depending on your insurer and how your premium is rated.

Medigap policies can be rated in three ways:

- Community rated : Your premium isnt based on your age and may only increase due to inflation or other factors. Everyone, regardless of age, is charged the same premium.

- Issue-age rated : Your premium is based on your age when you buy the policy and wont increase as you grow older. Your premium may only increase due to inflation or other factors.

- Attained-age-rated: Your premium is based on your age and can increase as you grow older and due to inflation and other factors.

Medicare Supplement Plans: Coverage Costs And More

As you approach age 65, navigating Medicare and all of its parts and plans may sound daunting, but it can be easier than you think. Original Medicare contains two parts: Part A and Part B. Medicare Part A covers hospital care, skilled nursing facility and hospice fees, and is usually premium-free. Medicare Part B covers medical and preventive services, as well as some medical equipment, for which there is a monthly premium .

In addition to Original Medicare, many people choose to purchase a Medicare Supplement plan to cover services like routine hearing, eye exams and other costs not covered by Parts A and B. Heres what you need to know about Medicare Supplement plans.

You May Like: Does Medicare Help Pay For Incontinence Supplies

Medicare Is A Government

Yes, this is true. But here again, there are complications because some forms of coverage you can buy, like Medicare Supplement and Medicare Advantage plans, are offered not by the government, but by private insurance companies.

While you cannot obtain those privately offered plans from the government, they are regulated by the government to be sure they comply with applicable standards, laws, and norms. Thats confusing, right? But despite these wrinkles, Medicare is a program that is run by the U.S. government.

Medigap F Cost Example

Gracie applies for a Plan F Medigap and the insurance company approves her. The following year she sees an orthopedic specialist about problems with her knee. Medicare pays 80% of the cost of this visit to her specialist. Plan F covers the other 20% owed under Part B. Gracie owes nothing.

The specialist sends her to an imaging facility to have an MRI done on her knee. Medicare pays 80% of the cost of her MRI. Medicare F pays the other 20%. Gracie pays absolutely nothing.

The results of the MRI show serious problems. Her orthopedic specialist tells Gracie that she is a candidate for a total knee replacement. She undergoes surgery at her local hospital and is in the hospital a couple of days. Gracie also has a home health care nurse come out to her home several times in the weeks following her surgery.

The total cost for Gracies surgery, hospital stay and follow-up care is $70,000. Medicare pays its share of the bills and sends the remainder of about $14,000 to Gracies Supplemental insurance carrier. The carrier pays the entire bill, and Gracie owes absolutely nothing for any of these Part A and Part B services. Her only out-of-pocket spending would be for medications.

That means the cost of Medicare Supplement Plan F is really only the premiums that you pay for the plan itself. Medicare Supplement Plan F rates will vary by insurance company, but you can rest assured there is no back-end spending.

Also Check: Is Medicare Part B Necessary

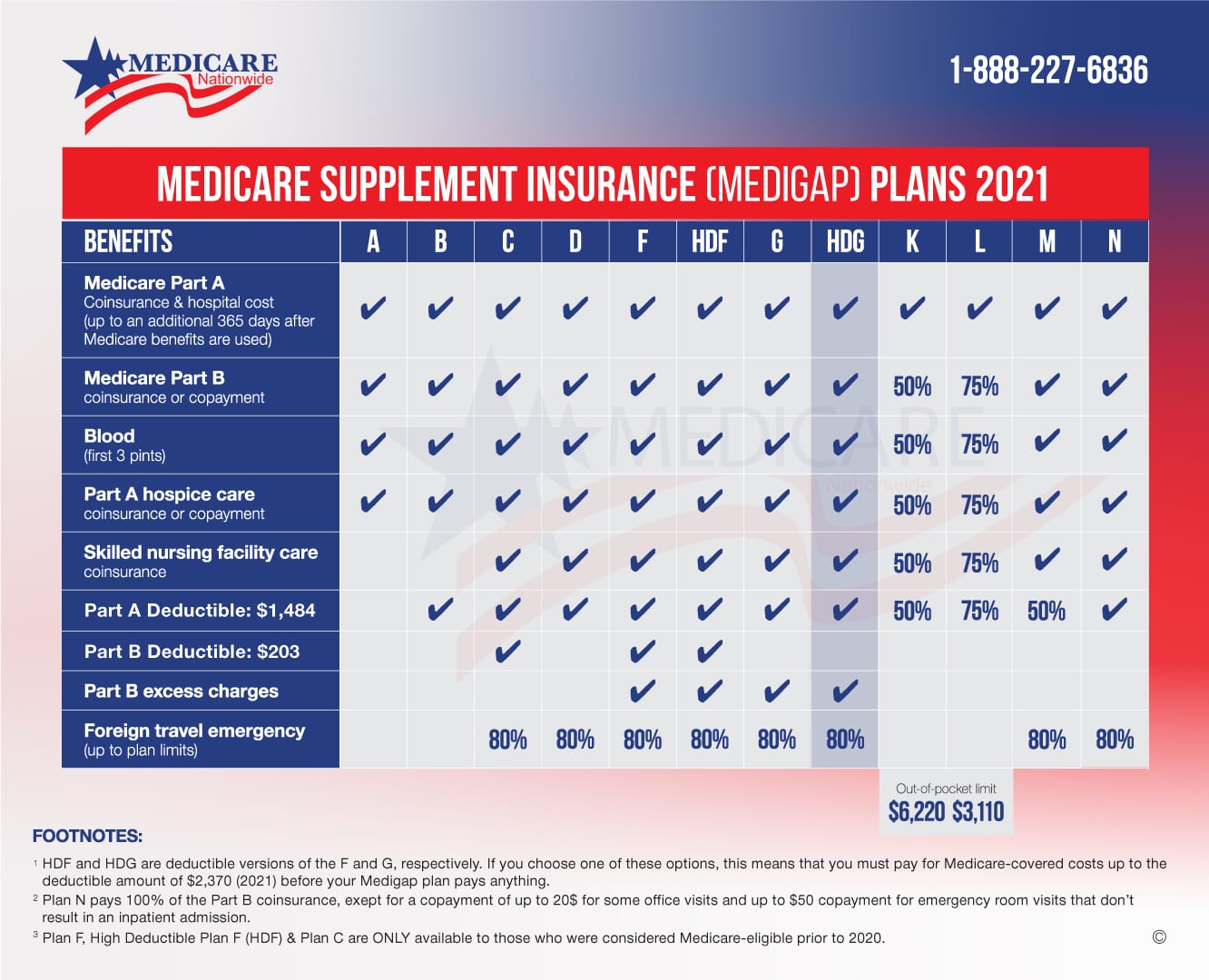

Medicare Supplement Deductibles By Plan

There are 10 standardized Medicare Supplement plans available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses.

Medicare Supplement Insurance plans are sold by private insurance companies. These plans help pay for Original Medicare deductibles and other out-of-pocket Medicare expenses like copayments and coinsurance.

Six types of Medigap plans provide full coverage of the Medicare Part A deductible, and another three plans provide partial coverage of the Part A deductible.

Two plans, Plan F and Plan C, provide full coverage of the Medicare Part B deductible, although these plans are only available to beneficiaries who became eligible for Medicare before Jan. 1, 2020. If you were eligible for Medicare before 2020, you may still be able to apply for Plan F or Plan C if theyre available where you live. If you already have either plan, you can keep your plan as long as you continue to pay your plan premiums.

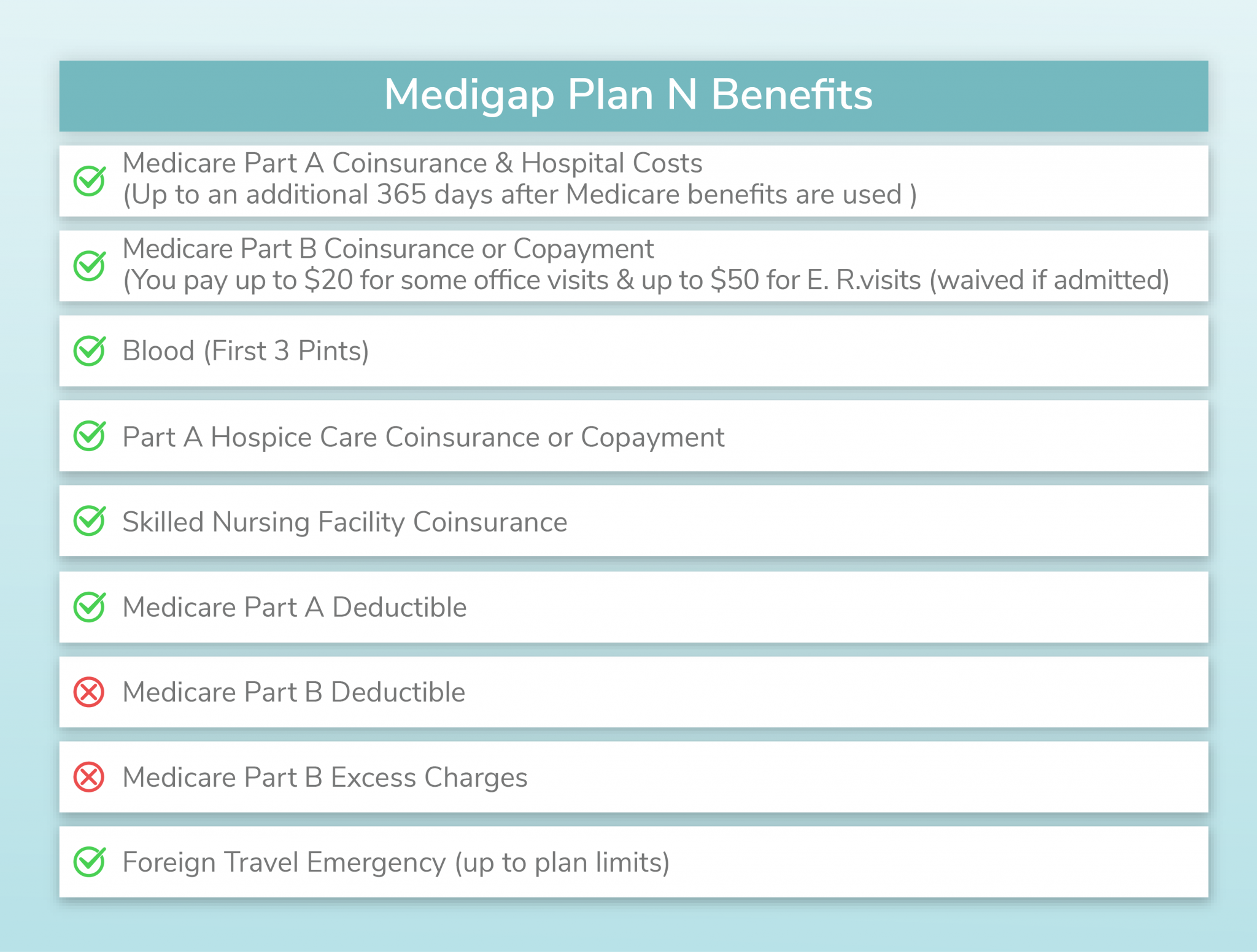

What Benefits Does Medicare Supplement Plan N From Aarp Include

Plan N is one of the newest Medigap plans. AARP offers it some areas because it helps seniors fill the gaps in their original Medicare benefits in a unique way.

Unlike Plan F and Plan G, with a Medicare Plan N policy, youll be required to pay a copayment of up to $20 for some doctor visits and up to $50 for emergency room care that does not require you to be admitted into the hospital. For healthy seniors, the co-pays add up to savings due to the lower monthly premiums.

Heres how Plan N covers you:

This plan also offers the following additional benefits:

With its lower cost and good coverage, it is easy to see why Plan Ns popularity is growing.

Generally, a Plan N costs about 25% less than the more comprehensive Plan F. The lower premium is available because Plan N covers fewer gaps in Original Medicare. In addition to the co-pays, be aware that this plan does not cover the Part B deductible or Part B excess charges. For this reason, this plan is best for people who do not have chronic health conditions.

You May Like: Does Medicare Cover When Out Of Country

Medicare Supplement Plan N Cost

Lets talk a little bit more about the differences between the two plans, and more specifically what other charges you could incur on Medicare Plan N.

Again, if youre somebody who doesnt go to the doctor very oftenand I have clients who never got to the doctor who loves Plan N because they pay lower premiums all year long.

So they absolutely love it. They know if something happens to them, theyve got outstanding coverage, but their out-of-pocket expenses are going to be minimal, even on a Plan N.

So they love Plan N because they dont go to the doctor very often, but they know they are protected very, very well, God forbid something major happens.

Medicare Supplement Insurance May Help Cover Deductibles

You can buy private Medicare Supplement insurance to cover Medicares out-of-pocket expenses, including the hospital deductible.

However, if youâre in a Medicare Advantage Plan, you can only purchase a Medicare Supplement plan if your Medicare Advantage plan coverage is ending.

Explore Medicare

This material is provided for informational use only and should not be construed as medical advice or used in place of consulting a licensed medical professional. You should consult your doctor to determine what is right for you.

Humana is a Medicare Advantage HMO, PPO and PFFS organization and a stand-alone prescription drug plan with a Medicare contract. Humana is also a Coordinated Care plan with a Medicare contract and a contract with the state Medicaid program. Enrollment in any Humana plan depends on contract renewal.

Some links on this page may take you to Humana non-Medicare product or service pages or to a different website.

Y0040_GNHKHNSEN

Also Check: Does Medicare Offer Gym Memberships

Recommended Reading: Is Synvisc Covered By Medicare In Australia