What Does Medicare Part A Cost

Many are eligible for premium-free Part A, which is exactly what it sounds likequalified Medicare beneficiaries arent required to pay a premium for Medicare Part A coverage. To be eligible for Medicare Part A for free, you must be over age 65 and meet one of the following requirements:

- You or your spouse paid Medicare taxes while employed with the government.

- You are eligible for Social Security or Railroad Retirement Board benefits but havent started collecting them yet.

- You currently receive retirement benefits from Social Security or the Railroad Retirement Board.

If you are under age 65, you might still be eligible for premium-free benefits if you meet one of two requirements:

- You have received Social Security or Railroad Retirement Board benefits for two years.

- You have End-Stage Renal Disease .

If you dont meet any of the five requirements above, youll have to pay a premium for Part A. For 2020, the monthly premium is $458 .1 Additional costs with Part A include coinsurance in specific situations and a deductible of $1,408 in 2020 to cover hospital inpatient care.2

Aarp/unitedhealthcare Medicare Supplement Insurance 2022 Review

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

AARPs Medicare Supplement Insurance plans are insured exclusively by UnitedHealthcare. The AARP and UnitedHealthcare co-branded plans are available in every state and Washington, D.C.

UnitedHealthcare is the largest provider of Medicare Supplement Insurance, or Medigap, and of Medicare Advantage plans .

AARP/UnitedHealthcare offers most Medigap plan types often with multiple options for pricing and extra benefits. Prices are competitive, and complaint rates for the companys Medicare Supplement Insurance plans are considerably lower than the market average.

Heres what you should know about AARP Medicare Supplement Insurance from UnitedHealthcare.

What Are My Medicare Part A Costs

Many people get Medicare Part A without a premium if theyve worked the required amount of time under Medicare-covered employment, generally 10 years or 40 quarters and paid Medicare taxes while working . However, your Part A coverage may still include other costs, even after Medicare has paid its share. This may include deductibles, copayments, and/or coinsurance, which can all change from year to year. Your costs may depend on the type of service youre getting and how often.

Medicare Part A cost-sharing amounts are listed below.

Inpatient hospital care:

- $0 coinsurance for the first 60 days of each benefit period

- $371 a day for the 61st to 90th days of each benefit period

- $742 a day for days 91 and beyond per each lifetime reserve day of each benefit period

- After lifetime reserve days are used up: You pay all costs

Skilled nursing facility care:

- $0 for days 1 to 20 for each benefit period

- $185.50 a day for the 21st to 100th days

- Days 101 and beyond: all costs

Don’t Miss: Do You Have To Get Medicare At 65

Retiree Drug Subsidy Vs Employer Group Waiver Plan Coverage

Retiree drug subsidies and employer group waiver plans are two ways that organizations give retirees subsidies for their Medicare-eligible prescription drug costs.

- Retiree drug subsidies are federal subsidies for continuing Medicare Part D prescription drug coverage. Retiree drug subsidies used to be the most common plan offered, as these plans were tax-exempt. However, that changed with the introduction of the Affordable Care Act in 2013, and many businesses moved to employer group waiver plans.

- Because organizations customize their employer group waiver plans, its challenging to compare employer group waiver plans with retiree drug subsidies directly. However, as employer group waiver plans often receive extra subsidies and tax advantages, they usually provide a higher base subsidy than a retiree drug subsidy. Data shows that retirees with EGWPs can get nearly four times greater benefits than people receiving retiree drug subsidies.Employer group waiver plans usually come with catastrophic insurance, which activates when members out-of-pocket drug costs exceed $7,050 to reduce their bills.

Enhanced employer group waiver plans with wraparound provisions help retirees save money when they are in the Part D donut hole coverage gap, with manufacturers offering 50% discounts on brand-name medications during this period.

Do You Have To Pay A Part A Premium

You may be wondering does Medicare Part A cover 100 percent? And while this is not the case, there are provisions in place to make Medicare affordable to beneficiaries.

Many people dont pay a monthly premium for Medicare Part A. For example, if you worked at least ten years while paying taxes, you dont pay a premium for Part A. If you worked for fewer than 30 quarters, you generally pay $471 per month in 2021. If you worked more than 30 but fewer than 40 quarters, your premium is $259 per month in 2021

Recommended Reading: Does Medicare Cover Whooping Cough Vaccine

When Can I Enroll In Medicare Part B

If you are receiving retirement benefits before age 65 or qualify for Medicare through disability, generally youre automatically enrolled in Medicare Part A and Part B as soon as you become eligible.

If you do not enroll during your initial enrollment period and do not qualify for a special enrollment period, you can also sign up during the annual General Enrollment Period, which runs from January 1 to March 31, with coverage starting July 1. You may have to pay a late enrollment penalty for not signing up when you were first eligible.

If youre not automatically enrolled, you can apply for Medicare through Social Security, either in person at a local Social Security office, through the Social Security website, or by calling 1-800-772-1213 from 8AM to 7PM, Monday through Friday, all U.S. time zones.

Keep in mind that once you are both 65 years or older and have Medicare Part B, your six-month Medigap Open Enrollment Period begins. This is the best time to purchase a Medicare Supplement insurance plan because during open enrollment, you have a guaranteed-issue right to buy any Medigap plan without medical underwriting or paying a higher premium due to a pre-existing condition**. Once you are enrolled in Medicare Part B, be careful not to miss this one-time initial guaranteed-issue enrollment period for Medigap.

Enrollment Period For Medicare Part A

Youre eligible to enroll in Medicare Part A during your Initial Enrollment Period , which is the seven-month period around your 65th birthday. Your IEP begins three months before the month of your 65th birthday, includes your birth month, and lasts up to three months after your birthday month.

When you apply for Social Security benefits, youre automatically enrolled in Medicare Part A.

Don’t Miss: Does Medicare Cover Kidney Transplant

Net Investment Income Tax

The net investment income tax, also known as the unearned income Medicare contribution surtax, is an additional 3.8% tax applied to net investment income as of 2021. Like the additional Medicare tax, there is no employer-paid portion.

Net investment income may include taxable interest, dividends, nonqualified annuities, capital gains, and rental income. It does not include income that is already excluded for income tax purposes, such as tax-exempt municipal bond interest. Net investment income tax is applied to an individuals net investment income or the excess modified adjusted gross income over certain thresholds, whichever is less.

For example, lets say a married couple filing jointly earned $225,000 in wages. During the same tax year, the couple also received $50,000 in investment income, bringing their MAGI to $275,000. The net investment income tax threshold for married couples filing jointly is $250,000. The couple is required to pay 3.8% tax on the lesser of the excess MAGI or the total amount of investment income . In this case, the couple would owe a net investment income tax of $950 .

How Much Does Medicare Part B Cost

Medicare Part B comes with some costs on your end. Theres a monthly premium, and there may be deductibles, coinsurance and/or copayments. Lets get into these one at a time.

The Medicare Part B monthly premium may change from year to year, and the amount can vary depending on your situation. For many people, the premium is automatically deducted from their Social Security benefits.

The standard monthly Part B premium: $148.50 in 2021.

If your income exceeds a certain amount, your premium could be higher than the standard premium, as there are different premiums for different income levels.

If you are receiving Social Security, Railroad Retirement Board, or federal retirement benefits, your Part B premium will be deducted directly from your monthly benefit. If not, you will be sent a bill every three months.

The chart below shows the Medicare Part B monthly premium amounts, based on your reported income from two years ago . These amounts may change each year. A late enrollment penalty may be applicable if you did not sign up for Medicare Part B when you were first eligible. Your monthly premium may be 10% higher for each 12-month period that you were eligible, but didnt enroll in Part B.

| Medicare Part B monthly premium in 2021 |

| You pay |

| $412,000 or more |

Also Check: Does Medicare Cover Hepatitis A Vaccine

General Enrollment Period For Medicare Part A

If you delayed enrolling in Medicare Part A, you may enroll during the next available General Enrollment Period, unless you are eligible for a Special Enrollment period . The General Enrollment Period occurs each year from January 1 to March 31. If you sign up during general enrollment, your coverage will begin July 1 of that year, and your Medicare card will arrive about three months before your coverage begins.

If you are not eligible for premium-free Medicare Part A and did not enroll when you were first eligible, you may be subject to a late-enrollment penalty when you do sign up.

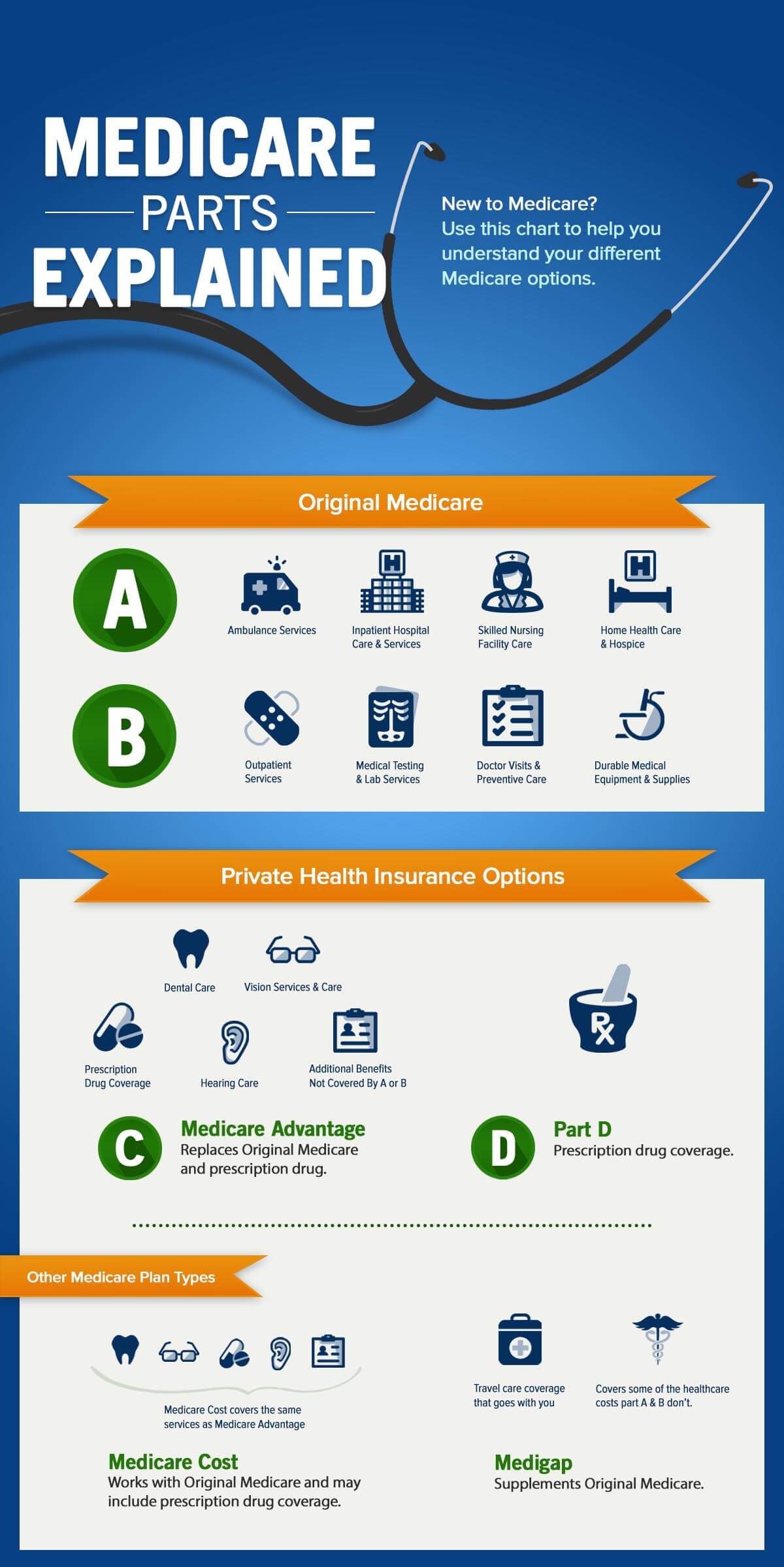

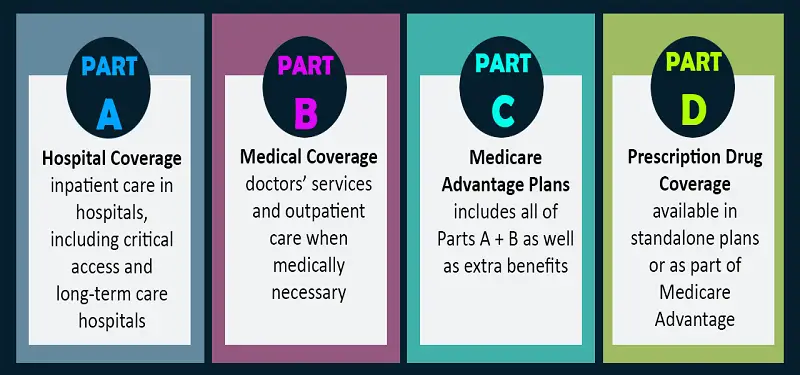

Whats The Difference Between Medicare Part A And Medicare Part B

Part A is the hospital services part of Medicare. This benefit covers inpatient care, hospital stays, skilled nursing facility care, hospice care, and medically needed home health care services.

Part B is the medical services part of Medicare. It covers many of the medically necessary services not covered in Part A, such as outpatient and preventive services. This involves things like x-rays, bloodwork, doctors visits, and outpatient care. It will also cover other medical items such as diabetic test strips, nebulizers, and wheelchairs.

You May Like: Can Medicare Be Used Out Of State

Medicare Part B: Medical Insurance

Medicare Part B is medical insurance, and is the other half of Original Medicare. It pays for medically necessary services that you need to diagnose or treat your condition that meet the accepted standards of care. It also covers preventative care, such as most vaccines and early-detection screenings.

Medicare Part B coverage includes:

- Yearly wellness doctor visits

- Ground ambulance transportation

- Durable medical equipment, including blood sugar monitors and wheelchairs but not medical alert systems

Unlike Medicare Part A, which typically doesnt have a premium, you have to pay a monthly premium for Medicare Part B. According to the U.S. Centers for Medicare & Medicaid Services, the Part B premium in 2021 is $148.50 per month.

Available Medicare Supplement Insurance Plans

AARP and UnitedHealthcare offer these Medicare Supplement Insurance plans in at least some locations for any Medicare member:

-

Medigap Plan A the basic benefits included in every Medigap plan without any extras.

-

Medigap Plan B basic benefits plus coverage for the Medicare Part A deductible.

-

Medigap Plan D a mid-cost option that covers most Medigap benefits.

-

Medigap Plan G the highest-coverage option available to new Medicare members.

-

Medigap Plan K the lowest-cost Medigap plan, with 50% coverage for most benefits.

-

Medigap Plan L a low-cost option with 75% coverage for most benefits.

-

Medigap Plan N a plan with lower premiums but higher copays.

Plans A, B, G, K, L and N are generally available in all locations, while Plan D is less widely offered.

Medigap Plan C and Medigap Plan F are also available for beneficiaries who were eligible to enroll in Medicare prior to 2020. Newer Medicare members cant buy these plans from any insurer.

In addition, AARP and UnitedHealthcare offer plans in Massachusetts, Minnesota and Wisconsin according to each state’s Medigap plan standards, which differ from the standardization system used in the majority of the country.

Read Also: Does Medicare Pay For Home Care Services

Is Medicare Part A Free At Age 65

Premium-free Part A coverage is available if you or your spouse paid Medicare taxes for a certain amount of time while working. You can receive this if:

- You already get benefits from Social Security or Railroad Retirement Board.

- Youre eligible for Social Security or Railroad benefits but havent filed yet.

- You or your spouse has Medicare-covered government employment.

If youre under 65, you get premium-free Part A if:

- You have Social Security or Railroad Retirement Board disability benefits for 24 months.

- You have End-Stage Renal Disease or Amyotrophic Lateral Sclerosis and meet certain requirements.

Department Of Financial Services

What is Medicare Select?

Medicare Select is a type of Medigap policy that requires insureds to use specific hospitals and in some cases specific doctors in order to be eligible for full benefits. Other than the limitation on hospitals and providers, Medicare Select policies must meet all the requirements that apply to a Medigap policy. Medicare Select policies may have lower premiums because of this requirement.

When you use the Medicare Select network hospitals and providers, Medicare pays its share of approved charges and the insurance company is responsible for all supplemental benefits in the Medicare Select policy. In general, Medicare Select policies are not required to pay any benefits if you do not use a network provider for non-emergency services. However, Medicare will still pay its share of approved charges no matter what provider you use.

The availability of Medicare Select coverage is limited to the geographic areas of the state serviced by the particular policys network of hospitals and doctors.

Also Check: What Medicare Supplement Plans Cover Hearing Aids

What Does Part A Cost

With Medicare Part A, you may have to pay copays and deductibles for hospital stays, but may not have to pay a monthly premium. Copays and deductibles apply to hospital benefit periods, which start when you enter a hospital or skilled nursing facility, and end 60 days after youve left the facility . Its important to note that:

- For each hospital benefit period, you pay a deductible.

- You pay a copay if youve stayed in a hospital for more than 60 days.

- Theres no deductible or copayment for home health care or hospice care.

For many people, Part A comes without a monthly premium. You may have no monthly premium if you paid a certain amount toward Medicare taxes while working. In this case, you are often automatically enrolled in premium-free Part A.

If you dont automatically get premium-free Part A, you may be able to buy it if you :

- Are age 65 or older and allowed to Part B to meet the citizenship and residency requirements.

- Are under age 65 and are disabled but no longer get premium-free Part A because you returned to work.

Signing Up For Original Medicare

Some people qualify for automatic enrollment, and others have to enroll.

- If youre already receiving Social Security or railroad retirement benefits youll be enrolled in Part A and Part B automatically on your 65th birthday. If youre under 65, its the 25th month you receive disability benefits.

- ALS patients are automatically enrolled in Medicare coverage when their Social Security disability benefits begin, regardless of age. If you have end-stage renal disease , you must manually enroll.

If youre eligible for Medicare but dont qualify for automatic enrollment, you can apply online, over the phone or in person at your local Social Security office.

If you worked for a railroad, youll need to contact the Railroad Retirement Board for information on enrollment.

Don’t Miss: Do Any Medicare Supplement Plans Cover Dental And Vision

Initial Enrollment In Medicare Part A

If you turn 65 and are already receiving Social Security retirement benefits or benefits from the Railroad Retirement Board , enrollment in Medicare Part A is usually automatic. Medicare Part A benefits begin the first day of the month you turn 65. If your birthday is on the first day of the month, your benefits will begin the month before you turn 65. If you enrolled in Medicare Part B when you applied for retirement, your Part B coverage will begin at the same time. Your red, white, and blue Medicare card will arrive about three months before your 65th birthday.

If you do not qualify for Social Security retirement benefits or benefits from the Railroad Retirement Board then you must enroll in Medicare Part A manually during your Initial Enrollment Period. You can do so through the Social Security website, by visiting a local Social Security office, or by calling 1-800-772-1213 , Monday through Friday, from 7AM to 7PM.

The seven-month IEP begins three months before your 65th birthday, includes the month you turn 65, and ends three months later. The start of your coverage depends on which month you enroll during your IEP. Be careful not to wait until the last minute to enroll. If you do not enroll during your seven-month IEP, you will be required to wait until the next general enrollment period to enroll.

What Is Medicare Part A

November 3, 2021 / 11 min read / Written by

- Medicare Part AJump to

- Medicare Part A hospital care coverageJump to

- Medicare Part A home health care benefitsJump to

- Medicare Part A nursing home coverageJump to

- Medicare Part A hospice coverageJump to

- Eligibility for Medicare Part AJump to

- Initial Enrollment in Medicare Part AJump to

- General Enrollment Period for Medicare Part AJump to

- Special Enrollment Period for Medicare Part AJump to

View More

Recommended Reading: Who Is Eligible For Medicare In Georgia