Should I Get A Medicare Part C Plan

Enrollment in Medicare Part C plans has been growing, largely because Advantage plans offer more benefits than standard Medicare plans. Medicare Advantage plans usually arenât the best option for low-income recipients because they can often qualify for other Medicare savings programs. Medicare Advantage also isnât generally necessary if youâre still receiving employer-sponsored coverage.

Pros of Medicare Part C

-

Provides coverage for services Original Medicare does not, like vision or dental

-

Usually offers prescription drug coverage

-

Caps out-of-pocket expenses, unlike traditional Medicare

Cons of Medicare Part C

-

Likely have to pay two premiums, one for Medicare Part B and one for your Advantage Plan

-

Many types of individual plans, each with their own rules on the coverage and costs for using out-of-network providers

-

Your network of available health care providers is smaller than with Original Medicare plans

-

Not all in-network providers are necessarily accepting new patients

-

Canât be used in conjunction with employer-sponsored health care benefits that supplement Original Medicare

Medicare Part B: Medical Coverage

Medicare Part B covers outpatient services, doctors fees, preventative services, and the cost of using medical equipment. Some people, such as those who are enrolled for Social Security, are automatically enrolled in Part B. Others have to enroll online.

Premiums

Individuals who earn less than $88,000 per year or couples who file jointly and earn less than $176,000 per year pay the standard premium of $148.50. Those with higher incomes are tiered into different premium levels by their income.

Deductible

For 2021, the standard deductible for Part B costs $203. If you receive benefits through Social Security, the Railroad Retirement Board, or the Office of Personnel Management, your premium is automatically deducted from your benefits.

Copays and Coinsurance

Medicare works with doctors offices to set standardized prices that they will pay for services. After youve paid the deductible, Medicare will cover 80% of these medical expenses, while youll be expected to cover the remaining 20% of the approved amount.

Medicare Coverage Of Eliquis

If you have Medicare and need an Eliquis prescription, there are a few options available to you. Original Medicare doesnt cover self-administered prescription drugs. This includes Eliquis. There are no real exceptions here Original Medicare simply does not cover prescription drugs.

However, there are a variety of other options available for Medicare beneficiaries. These will vary in cost and coverage type, but lets take a look at them one by one. Remember, although the options discussed are part of Medicare, they are not part of Original Medicare. If you only have Original Medicare, you will need additional coverage to get Eliquis covered.

Don’t Miss: How Much Does Medicare Pay For Hospice

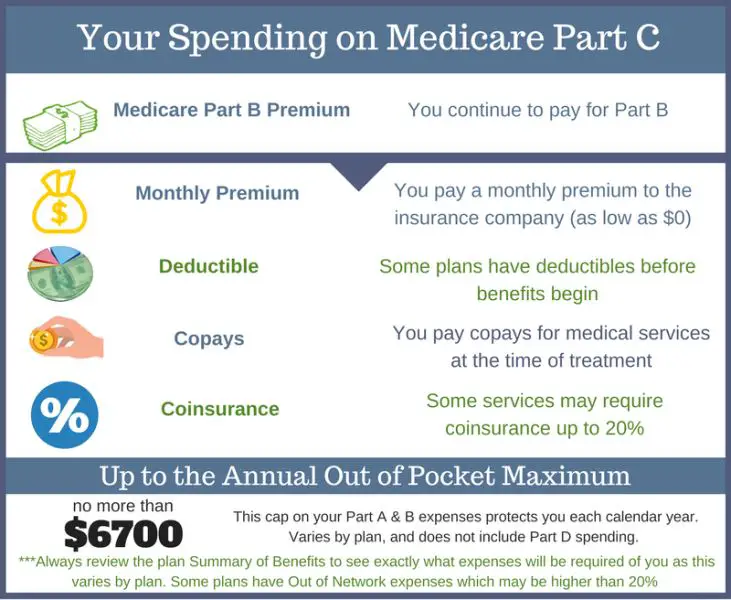

What You Pay In A Medicare Advantage Plan

Your

depend on:

- Whether the plan charges a monthlypremium. Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium .

- Whether the plan pays any of your monthlyMedicare Part B premium. Some plans will help pay all or part of your Part B premium. This is sometimes called a “Medicare Part B premium reduction.”

- Whether the plan has a yearlydeductible or any additional deductibles.

- How much you pay for each visit or service . For example, the plan may charge a copayment, like $10 or $20 every time you see a doctor. These amounts can be different than those underOriginal Medicare.

- The type of health care services you need and how often you get them.

- Whether you go to a doctor orsupplierwho acceptsassignmentif:

- You’re in a PPO, PFFS, or MSA plan.

- You goout-of-network.

B Late Enrollment Penalty

If you dont Part B when youre first eligible, you may be required to pay a late enrollment penalty.

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

For example, if you waited three years after your Initial Enrollment Period to sign up for Medicare Part B, your late enrollment penalty could be 30 percent of the Part B premium.

You will continue to owe this penalty for as long as you remain enrolled in Medicare Part B.

As mentioned above, the 2022 standard premium for Part B is $170.10 per month. If you owe the standard Medicare Part B premium but sign up for Part B a year after you were initially eligible, the late enrollment fee can add another $17.01 per month to your Part B premium.

Also Check: When Can I Change Medicare Advantage Plans

Tx Medicare Eligibility & Enrollment

In order to sign up for a Medicare Advantage plan in Texas, you must enroll in Original Medicare .

To be eligible for Original Medicare at age 65, you must meet the following requirements:

- You must be a U.S. citizen or permanent legal resident who has lived in the U.S. for five continuous years.

- You or your spouse must be eligible to receive Social Security or Railroad Retirement benefits.

- You or your spouse must be government employees or retirees who have not paid into Social Security, but you’ve paid Medicare payroll taxes.

You could potentially be eligible for Medicare under 65 if:

- You receive Social Security disability benefits or certain Railroad Retirement Board disability benefits for at least 24 months.

- You have ALS .

- You have End-Stage Renal Disease , and you or your spouse have paid Social Security taxes for the required period of time.

If you have ESRD, you may be able to sign up for a Medicare Advantage plan or a Texas Medicare Special Needs Plan that is specifically designed to help meet your health care needs.

Am I Eligible For Medicare Part C And How Do I Qualify

If a Part C plan sounds like the right thing for you, you can follow the normal application process. However, the normal Medicare enrollment factors still apply:

- You must have both Part A and B Medicare to enroll.

- You must be a permanent Michigan resident and reside in our service area for at least six months of the year.

- You cant be denied for pre-existing conditions unless youve been diagnosed with end stage renal disease .

Read Also: Does Medicare Cover Dental Root Canals

What Is Medicare Part A Hospital Insurance

Medicare Part A covers the following services:

- Inpatient hospital care: This is care received after you are formally admitted into a hospital by a physician. You are covered for up to 90 days each benefit period in a general hospital, plus 60 lifetime reserve days. Medicare also covers up to 190 lifetime days in a Medicare-certified psychiatric hospital.

- Skilled nursing facility care: Medicare covers room, board, and a range of services provided in a SNF, including administration of medications, tube feedings, and wound care. You are covered for up to 100 days each benefit period if you qualify for coverage. To qualify, you must have spent at least three consecutive days as a hospital inpatient within 30 days of admission to the SNF, and need skilled nursing or therapy services.

- Home health care: Medicare covers services in your home if you are homebound and need skilled care. You are covered for up to 100 days of daily care or an unlimited amount of intermittent care. To qualify for Part A coverage, you must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care.

- Hospice care: This is care you may elect to receive if a provider determines you are terminally ill. You are covered for as long as your provider certifies you need care.

Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

Compare Medicare Part C Plan Costs In Your Area

Plan pricing is not always made readily available on an insurance companys website. But a licensed insurance agent can help you gather up the costs for the various Medicare Part C plans available in your area and help you better understand the terms and conditions of each. You can also compare plan costs online from multiple different insurance companies.

Read Also: Does Aetna Follow Medicare Guidelines

What Is The Average Cost Of Medicare Part D Prescription Drug Plans

In 2022, the average monthly premium for a Medicare Part D plan is $47.59 per month.1

Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location.

Learn about the average cost of Part D plans in your state.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.2

Depending on your income, you may be required to pay a higher Part D premium. As with Medicare Part B premiums, this adjusted amount is called the IRMAA .

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago .

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$77.90 + your plan premium |

Medicare Prescription Drug Plan Costs

Ill email you a link to my Part D e-book email shortly. Im updating the book now. It will show you how to weigh your options and see the prices for Connecticuts Part D prescription drug plans Its a little more complicated than looking at a table of the . But you can use that table to approximate the current rates. The Part D Medicare cost is about 8% to 20% of the rate for a well-priced Medicare Supplement Plan N.

Recommended Reading: Does Medicare A Have A Deductible

Top Rated Assisted Living Communities By City

In 2021, seniors paid an average of $21 a month for their Medicare Advantage plans. Available plans vary by state, and monthly premiums vary too: Some plans pay for a persons Medicare Part B premiums, while other plans include extra benefits, like dental and vision coverage. Usually, seniors can choose at least one plan with no monthly premium costs at all, although zero-premium plans often carry a higher deductible

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

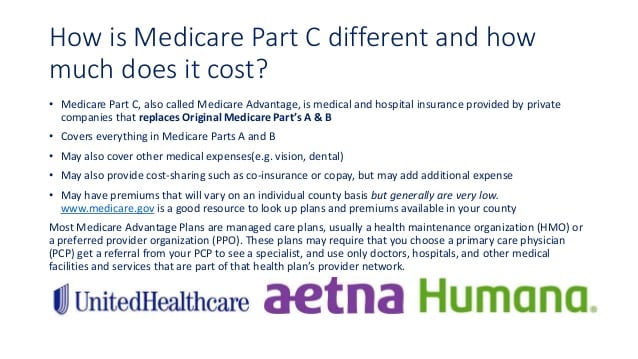

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Recommended Reading: Does Medicare Part C Cover

Eliquis Coverage Through Medicare Advantage

Medicare Advantage is a way to get your Medicare benefits through private insurance companies. Although these plans primarily cover Part A and Part B services, many of them also include at least some prescription drug costs.

When you buy a Medicare Advantage plan, you should make sure that Eliquis will be covered for you. 99% of Medicare Advantage plans will cover Eliquis, so this is an option you should consider if it is a prescription you will need. You will most likely be able to find a plan that works for you.

Eliquis And Medicare Advantage

Although Medicare Advantage, also known as Part C, primarily serves as a person’s main health insurance and as a substitute for Original Medicare, some plans also include prescription drug coverage. If you have a Medicare Advantage plan and it includes drug coverage, then you wont be able to add an additional drug plan to your coverage. For this reason, its important to make sure that your Part C plan provides you with the coverage that you need.

The costs for Part C prescription drug coverage will be roughly the same as Part D. And, again, its important to remember that they can vary widely depending on where youre located and other life details. If you have a Part C drug plan, Eliquis will likely appear somewhere on the plan formulary or drug list, but you should make sure that the costs are appropriate for what youre able to pay if you know you need Eliquis before you choose your plan.

Read Also: What Is The Cost Of Medicare Supplement Plan F

Saving Money On Medicare

Despite some of the costs of Medicare, there are ways to save money and maximize your coverage.

46890-HM-0121

The Key Takeaways On Part C Monthly Cost

Part C has many benefits, and for some, that includes cost. However, remember that the cost of Part C plans is more than just the premium. Although low premiums can seem enticing, you may end up paying this cost elsewhere in the plan. Part C should be on the table for anybody who has Medicare, simply because there are so many options to choose from. And, low-premium plans may be a great fit for you. But, remember to analyze the plan cost holistically, and to always look past the premiums.

Read Also: How To Pick A Medicare Plan

Benefits Of A Medicare Advantage Plan

Many individuals beyond retirement age opt for Medicare Advantage Plans because they reduce annual out-of-pocket health care costs. They feel familiar, too, because theyre essentially the same as other health insurance plans. Seniors can choose plans with dental and vision coverage, and they can also pick from a wide range of deductible and coinsurance options.

Some Medicare Advantage plans pay for a persons Medicare Part B benefits automatically. While they seem more expensive at first glance, these plans make life easier because policyholders no longer have to remember to send a separate check to the government every month.

Tx Medicare Advantage Plans By Plan Type

The major types of Medicare Advantage plans include:

- HMOIf you have a Texas Health Maintenance Organization plan, you’ll typically be required to visit doctors, hospitals and pharmacies that are part of your plans network .An HMO plan will also typically require you to get a referral from your primary care physician in order to see a specialist.

- PPOIf you have a Medicare Preferred Provider Organization plan, you may be able to see providers outside of your plans network, but you’ll typically pay higher out-of-pocket costs for going outside of the plan network.You’ll typically pay less out of pocket if you seek medical services from providers within your plans network.PPO plans typically do not require you to get a referral before you can see a specialist.

- PFFSA Private Fee-For-Service plan will typically determine how much you are required to pay for health care services at the point when care is received.With a PFFS plan, you can typically receive care from any doctor, hospital or health care provider that accepts Medicare as well as your plans terms. Not all providers will accept these terms, however.

- SNPA Special Needs Plan is a type of Medicare Advantage plan that is limited to people with certain chronic health conditions and other specific characteristics.SNP plans are required to provide prescription drug coverage.

Read Also: What States Have Medicare Advantage Plans

How Much Does Medicare Advantage Cost

Medicare Advantage plans are private, Medicare-approved health insurance plans that provide Part A and Part B coverage, and may also include other types of coverage, such as vision or dental. The costs of these plans varies, depending on the benefits provided. Each plan offers different coverage and associated premiums, deductibles, and copay. Participants must also pay their Part B premium, along with the adjustment for high earners, if applicable.

Average premiums for 2022 are expected to drop to $19 a month.9

What Other Cost Details Should I Be Aware Of

You will get Annual Notice of Change and Evidence of Coverage notices each year when youre enrolled in a Medicare Advantage Plan.

The annual notice is an explanation of expected changes for the next year, including coverage and costs. You should receive this information by September 30. Evidence of Coverage explains your plan and how much you pay. You should receive this notice by October 15.

Also Check: How To Find A Medicare Doctor