How To Enroll In A Medicare Part D Plan

What Does Medicare Part B Not Cover

Medicare Part B only covers specific services performed by medical professionals who accept Original Medicare Coverage.

Medicare Part B does not cover:

- Prescription drug coverage

Further, it does not cover anything not considered medically necessary or preventive, nor any medical services provided by non-Medicare-participating providers. Finally, all inpatient services will be covered under Medicare Part A coverage.

Documents You Need To Apply For Medicare

To begin the application process, youll need to ensure you have the following documentation to verify your identity:

- A copy of your birth certificate

- Your drivers license or state I.D. card

- Proof of U.S. citizenship or proof of legal residency

You may need additional documents as well. Make sure to have on hand:

- Your Social Security card

- W-2 forms if still active in employment

- Military discharge documents if you previously served in the U.S. military before 1968

- Information about current health insurance types and coverage dates

If you are already enrolled in Medicare Part A and have chosen to delay enrollment in Medicare Part B, you must complete the additional forms .

- 40B form:This allows you to apply for enrollment into Medicare Part B only. The 40B form must be included in your online application or mailed directly to the Social Security office.

- L564 form:Your employer must complete this form if you delayed Medicare Part B due to creditable group coverage through said employer. You must also include the completed L564 form in your online application, or mail it directly to the Social Security office.

Recommended Reading: Is Allergy Testing Covered By Medicare

What Is The Medicare Part B Late Enrollment Penalty

If you dont sign up for Medicare Part B when you are first eligible, you may be subject to a penalty. The penalty is a 10% increase in your monthly premium for every year you delay signing up. The penalty stays in place for as long as you have Part B. 12

How Can You Avoid Paying the Medicare Part B Late Enrollment Penalty?If you sign up for Medicare Part B during the seven months surrounding your 65th birthday, you can avoid paying a late enrollment penalty. If you or your spouse continues working past 65 and has health coverage through the employer, you will not be penalized for signing up once that coverage ends. However, the rules can be complex so check here to see if your coverage will be acceptable.

Medicare Part A Enrollees Are Getting Increases

While Medicare Part B is seeing a decrease in premiums next year, those who receive Medicare Part A will see increases in 2023. Here’s a breakdown of what’s going up.

Inpatient hospital deductible: $1,600 in 2023, an increase of $44 from $1,556 in 2022.

Daily coinsurance for the 61st through the 90th day: $400 in 2023, an increase of $11 from $389 in 2022.

Daily coinsurance for lifetime reserve days: $800 in 2023, an increase of $22 from $778 in 2022.

Skilled Nursing Facility coinsurance: $200 in 2023, an increase of $5.50 from $194.50 in 2022.

You May Like: Why Are Medicare Advantage Plans So Cheap

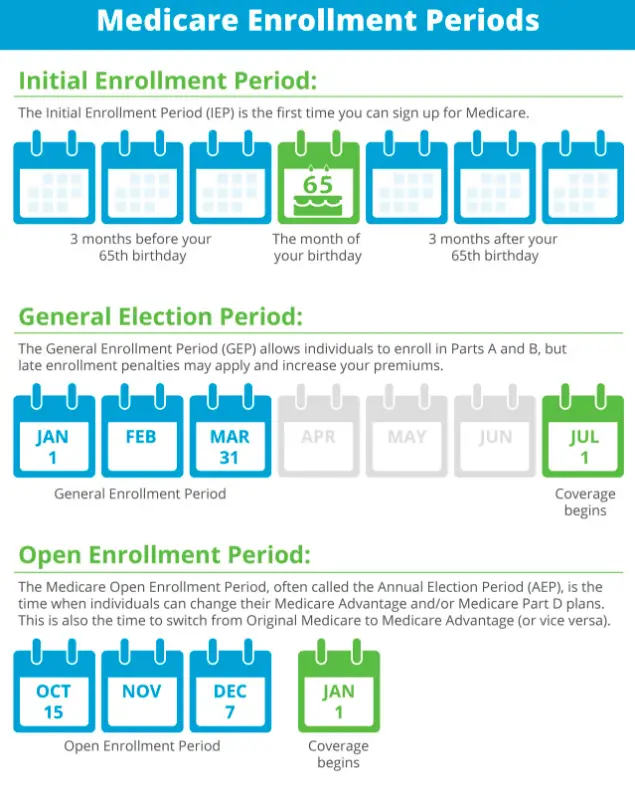

When Is The General Enrollment Period

If you didnt sign up for Medicare when you were first eligible, and dont qualify for special enrollment, you can sign up during the General Enrollment Period. This period is from January 1 to March 31 each year. Your coverage will start on July 1. You may have to pay a higher premium for missing the Initial Enrollment Period.

The Cost Of Medicare Part B

Unlike Medicare Part A, Medicare Part B requires a premium from everyone. The standard premium for Medicare Part B in 2021 is $148.50 a month, which applies to most people, including new enrollees. That premium changes each year, usually increasing. In 2022, the Part B premium jumps to $170.10 a month.

Youll also have an annual deductible of $233 in 2021 as well as a 20 percent coinsurance rate for covered services under Part B.

There are penalty fees for not signing up during your Initial Enrollment Period , but well discuss those in a separate section.

While most people pay the standard amounts for premiums and deductibles, some people will pay more, depending on their income. The more you make, the higher your likelihood will be for paying more than the standard amount. The extra fee per month is called the Income Related Monthly Adjustment Amount . How much more can you expect to pay if you fall outside of the standard range? The Medicare website offers a handy chart on the rates for those with higher incomes, which is updated each year. These are the rates for 2022, based on the income reported on your 2020 tax return:

These amounts reflect individual incomes only. Married couples will pay the same rates, but for different, higher thresholds. For example, a couple that earns over $182,000 per year and files a joint tax return will pay $238.10 per month for Medicare Part B premiums. Married couples who file separate tax returns also have different thresholds.

You May Like: How To Get 1095 B Form From Medicare Online

Nobody Can Force You To Sign Up For Medicare But You May Face Lifelong Late Enrollment Penalties Once You Do Join

When you turn 65, or are diagnosed with a qualifying disability, you are eligible to sign up for Medicare. Original Medicare is made up of two parts: Part A and Part B .

While most people should enroll when they are first eligible, some may choose to delay coverage, specifically Part B coverage. There are a few reasons you would want to do so, but there are also risks. Understanding how delaying or dropping Part B coverage would affect you is important when determining whether or not you should consider it.

When Is The Medicare Part D Annual Election Period

If you did not enroll in prescription drug coverage during IEP, you can sign up for prescription drug coverage during the Annual Election Period that runs every year from October 15 to December 7.

During AEP, you can:

- Sign up for a Medicare prescription drug plan.

- Drop a Medicare prescription drug plan.

- Join a Medicare Advantage plan that includes prescription drug coverage.

- Switch from a Medicare Advantage plan that doesnât include prescription drug coverage to a Medicare Advantage plan that does .

Outside of the Part D Initial Enrollment Period and the Annual Election Period, usually the only time you can make changes to prescription drug coverage without a qualifying Special Election Period is during the Medicare Advantage Open Enrollment Period but only if you are dropping Medicare Advantage coverage and switching back to Original Medicare. The Medicare Advantage Open Enrollment Period runs from January 1 to March 31.

Medicare Part A and Part B do not include prescription drug coverage, and if you switch back to Original Medicare during the Medicare Advantage Open Enrollment Period, you will have until March 31 to join a stand-alone Medicare prescription drug plan.

Read Also: What Is The Best Medicare Supplement Plan In Arizona

Sign Up: Within 8 Months After Your Family Member Stopped Working

- Your current coverage might not pay for health services if you dont have both Part A and Part B .

- If you have Medicare due to a disability or ALS , youll already have Part A coverage.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

I Didnt Sign Up For Part B When I First Became Eligible But Want To Sign Up Now I Know There Is A Penalty For Late Enrollment Is There Any Way To Avoid The Penalty

Generally, no. In most cases, if you missed your Part B enrollment window, which runs from the three months before the month of your 65th birthday through the three months after the month of your 65th birthday, you will face a late enrollment penalty once you do enroll, which will be added to your premium costs for the remainder of your enrollment. The penalty equals 10% of the standard monthly premium for each 12-month period that you delayed enrollment.

If you did not enroll for Part B during your initial enrollment period, you may qualify for a Special Enrollment Period to sign up for Part B anytime as long as you or a spouse is working and youre covered by a group health plan through that employment. For people age 65 or over who have coverage through a group health plan, there is also an 8-month SEP which starts the month after the employment ends or the group health plan coverage ends. If you sign up during an SEP, the late enrollment penalty will not apply.

Read Also: Does Medicare Take Care Of Dental

What If I Want To Re

If you change your mind, you may re-enroll at a later time. Keep in mind you may have to pay late enrollment penalties if you didnt have appropriate coverage in place. In some cases you may be able to re-enroll online, though if you have Part A and not part B, you must print, sign and submit new forms.

In some cases you may need to prove you had adequate employer-sponsored or other coverage to avoid penalties. Once this happens, youll be granted a special enrollment period so you can re-enroll. During this time, you may also be able to add Part D drug coverage, Medicare Advantage or Medigap coverage as well.

How To Apply For Medicare By Phone

Applying for Medicare by phone is just as easy as applying for Medicare online. Contact Social Security at 1-800-772-1213 and tell the representative that you wish to apply for Medicare. If you have Railroad Retirement, you can contact the U.S. Railroad Retirement Board at 1-877-772-5772. Sometimes you will be helped immediately. If the volume of calls is high, Social Security will schedule a telephone appointment with you to take your application over the phone.

Your SS representative may send you some forms to complete. Generally these forms are simple. One caveat about phone applications for Medicare is that they take longer. The forms have to be mailed to you, and then you complete them and mail back. This can cause delays. Use the phone enrollment option only if you have a month or two lead time before your intended Medicare effective date.

Finally, there are some people who just feel better handling their Medicare enrollment in person. So lets close by going over how to apply for Medicare in person.

Don’t Miss: Does Medicare A Or B Cover Prescriptions

What Happens When I Drop Part B

If you follow the above steps and delay or drop Part B coverage, this means you are relying on your existing group health plan or private coverage for medical insurance. You will not have to pay Part B premiums .

However, there are some cases in which you should carefully consider whether or not to drop Part B. If you have health insurance that is secondary to Medicare, meaning it will pay after Medicare does, and drop Part B coverage, you risk having your insurance plan deny claims that Medicare would have paid for. If this happens, you may have to pay the full cost out of your pocket. You may also face late penalties.

To avoid late penalties and having to pay out-of-pocket, you should consider keeping Part B if:

- You have health insurance you purchased on the open insurance market, not provided by an employer.

- You have health insurance through an employer, but there are fewer than 20 employees.

- You have retiree benefits from a former employer.

- You have health benefits from TRICARE.

How Can I Reenroll In Medicare Part B

An individual who wants to reenroll in Medicare Part B may have to pay a late enrollment penalty. Generally, the penalty cost is linked to the length of the gap in coverage.

The monthly premium also increases by 10% for each 12-month period an individual was eligible for, but did not have, Part B.

Advice is available from the SHIP about reenrolling in Part B and about penalties.

To reenroll in Medicare Part B, people need to complete an application form on the Social Security Administration website.

The application process requires supporting documentation. The exact documents required depends on an individualâs circumstances, such as if a person enrolled in an employerâs healthcare insurance plan.

Read Also: Does Medicare Have A Catastrophic Cap

When To Sign Up For Medicare And How To Apply

Home / FAQs / General Medicare / When to Sign Up for Medicare and How to Apply

Its not uncommon for new beneficiaries to have questions when signing up for Medicare. It is important to be confident that you enroll correctly to ensure you have the necessary health coverage. Below, we tell you how to effectively apply for Medicare.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Can I Buy Medigap And Medicare Advantage At The Same Time

No. If you have a Medicare Advantage plan, you arenât allowed to enroll in a Medigap insurance plan unless youâre also switching your Medicare Advantage plan back to Original Medicare. If you want to enroll in Original Medicare and buy a Medigap policy, youâll need to contact your Medicare Advantage plan and ask if you can disenroll from it. You may be able to do so only during certain times of the year, known as âenrollment periods.â

Recommended Reading: Which Is Primary Medicare Or Private Insurance

Why Would I Delay Medicare Coverage

In most cases, you should only decline Part B if you have group health insurance from an employer you or your spouse is actively working at, and that insurance is primary to Medicare, meaning it pays before Medicare does.

Here are a few situations that may apply to you, and what you should do when it comes to enrollment.

If one of the below scenarios is applicable, you may want to consider delaying Parts A and/or B coverage however, its important to work with your group health plan, employer, or other health insurance provider to understand the coverage rules. Ask your plan how it works with and without Medicare, and understand what your options are.

- Youre currently working and have coverage through your job. If your employer has fewer than 20 employees, you should sign up for Parts A and B because Medicare will pay before your other coverage. You may have to pay a Part B late enrollment penalty if you dont enroll on time, or you may also have a gap in coverage.

If your employer has more than 20 employees, check that you have group health plan coverage. If so, you may be able to delay enrolling in Parts A and B without a late penalty down the road. In this case, you dont need to do anything when you turn 65.

Once your employment coverage ends, you may:

Once your employment coverage ends, you may:

Medicare General Enrollment Period

If you did not enroll during the IEP when you were first eligible, you can enroll during the General Enrollment Period. The general enrollment period for Original Medicare is from January 1 through March 31 of each year. Keep in mind that you may have to pay a late enrollment penalty for Medicare Part A and/or Part B if you did not sign up when you were first eligible.

Read Also: Does Medicare Supplemental Insurance Cover Pre Existing Conditions

When Do You Use This Application

Use this form:

- If youre in your Initial Enrollment Period and live in Puerto Rico. You must sign up for Part B using this form.

- If youre in your IEP and refused Part B or did not sign up when you applied for Medicare, but now want Part B.

- If you want to sign up for Part B during the General Enrollment Period from January 1 March 31 each year.

- If you refused Part B during your IEP because you had group health plan coverage through your or your spouses current employment. You may sign up during your 8-month Special Enrollment Period .

- If you have Medicare due to disability and refused Part B during your IEP because you had group health plan coverage through your, your spouse or family memberscurrent employment.

- You may sign up during your 8-month SEP.

NOTE: Your IEP lasts for 7 months. It begins 3 months before your 65th birthday and ends 3 months after you reach 65 .

When Is The Medicare Advantage Plan Annual Election Period

You can also add, drop, or change your Medicare Advantage plan during the Annual Election Period , which occurs from October 15 to December 7 of every year. During this period, you may:

- Switch from Original Medicare to a Medicare Advantage plan, and vice versa.

- Switch from one Medicare Advantage plan to a different one.

- Switch from a Medicare Advantage plan without prescription drug coverage to a Medicare Advantage plan that covers prescription drugs, and vice versa.

Recommended Reading: What Is Your Medicare Number