Do You Need Form 1095 To Pay Your Taxes

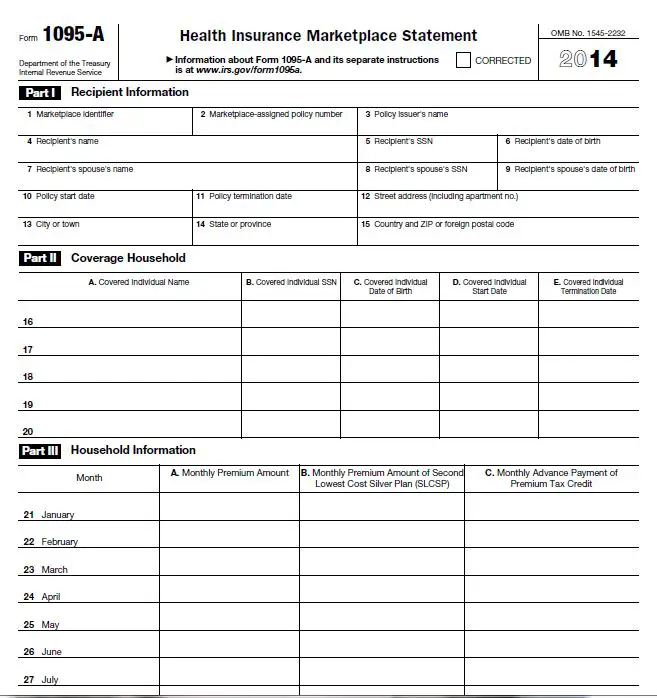

Your document may be called Form 1095-A, 1095-B, or 1095-C, depending on what type of health insurance you had last year.

- If you expect a 1095-A, you will need the form before you finish your taxes. People who receive health insurance subsidies generally get Form 1095-A.

- If you expect a 1095-B or a 1095-C, you can typically mail your taxes without the form, as long as you know whether or not you were insured. If you received health insurance through an employer or a government program like Medicaid or Medicare, youll probably get Form 1095-B or 1095-C.

Tax Forms And The Aca

If you had health insurance at any time during a calendar year, you may get a version of form 1095 for tax purposes.

This form details your health coverage. The table below explains the types of forms, where they come from, and who receives them.

Do I need form 1095 to file my taxes?

If you had insurance through healthcare.gov or a state exchange, you may need this form to help you fill out your taxes. But you dont need to send the form to the IRS.

If you had another type of health insurance, you dont need the form to file your taxes. Just keep it for your records.

For language services, please call the number on your member ID card and request an operator. For other language services: | | | | | | | | | | | | | | |

When Will My Form 1095 Arrive

For 2016 coverage and beyond, the deadline for exchanges, health insurers, and employers to send out the forms is January 31 of the following year. But every year thus far, the IRS has granted a deadline extension for the distribution of Form 1095-B and 1095-C. The deadline to distribute 2021 forms was pushed to March 2, 2022, and the IRS has proposed making this extension permanent.

Forms 1095-A for 2021 coverage still had to be sent to enrollees . They sometimes take a while to arrive, so it may have been February before you received yours as noted above, you can log into your exchange account online and see your 1095-A if you didnt receive it in the mail or have misplaced it.

So depending on where you got your health insurance in 2021, your form may have arrived in January, February, or March. If you dont get your form in a timely manner, you can contact the exchange, your health insurance carrier, or your employer, depending on who should be sending you a form.

Don’t Miss: Can You Be Dropped From Medicare

How Do I Know If I Have A 1095

If you purchased coverage through a state-based Marketplace, you may be able to get an electronic copy of Form 1095-A from your state-based Marketplace account. If you have not received your Form 1095-A or you received an incorrect 1095-A, you should contact the Marketplace from which you received coverage.

Because of the health care law, you might receive some forms early in the year providing information about the health coverage you had or were offered in the previous year. The information below is intended to help individuals understand these forms, including who should expect to receive them and what to do with them.

Details Of The Annual Benefit Statement

When it mails

The annual benefit statement from the Social Security Administration is form SSA-1099/1042S. It is mailed to beneficiaries every January.

What it says

This form outlines the benefits you received from Social Security during the previous year.

How its used

The form provides information on the amount of Social Security income you received, which youll report to the IRS when you file your tax return.

How it relates to Medicare

This form has little to do with your healthcare or Medicare benefits. However, the information may be used to determine income-based eligibility for some Medicare programs.

If you did not receive this form, you can request a replacement online starting Feb. 1, by calling 800-772-1213, or by contacting your local Social Security Office.

Read Also: What Does Plan N Medicare Supplement Cover

Where Do I Find My 1095 Tax Form

Home> FAQs> Where do I find my 1095 tax form?

- Health insurance & health reform authority

Q. What are the tax forms associated with health insurance, and where do I get them?

A. There are three different forms that are used by exchanges, employers, and health insurance companies, to report health insurance coverage to the IRS. And there are two health insurance-related forms that some tax filers need to complete when they file their return.

If you have specific questions about your situation, consult a tax advisor or the Volunteer Income Tax Assistance Program. Heres an overview of the new forms that Americans have been receiving since early 2015:

You May Like: Does Medicare Advantage Cover Chiropractic Care

How To Find Or Request Your Form 1095

Form 1095-B will still be produced for all UnitedHealthcare fully insured members and will continue to be made available on member websites, no later than the annual deadline set by the IRS. Members can view and/or download and print a copy of the form at their convenience, if desired.

Additionally, a request for a paper form can be made in one of the following ways:

- Complete the 1095B Paper Request Form and email it to your health plan at the email address listed on the form

A Form 1095-B will be mailed to the address provided within 30 days of the date the request is received. If you have any questions about your Form 1095-B, contact UnitedHealthcare by calling the number on your ID card or other member materials.

If you have had an address change in 2019 or 2020, please call customer care to request a printed copy of the 1095B. A phone call is necessary in this situation because of the private and confidential nature of the 1095B form.

Recommended Reading: What Are The Costs Of Medicare Advantage Plans

What Is Form 1095

It is a letter from your insurance provider that lists each month you had health insurance. You generally needed to have coverage for 9 months to avoid a tax penalty. That was only applicable up until the 2018 plan year. Form 1095 serves as proof for tax purposes.

It may also include the information that youll need to file for health tax credits, which can be a huge help to you.

Information On Irs Form 1095

If you or someone in your household had health care coverage provided by the State of Michigan, you may receive a new tax form called 1095-B Health Coverage.

**This form is informational only and does not need to be filled out or sent back to the Internal Revenue Service or the Michigan Department of Health and Human Services.**

Why You are Getting this Form

The new health care law that began in 2010 called the Patient Protection and Affordable Care Act requires all US citizens to be enrolled in health care coverage that provides minimum essential coverage . If you will file an income tax return, you will be asked to confirm whether you had heath care coverage for any part of the year. The 1095-B form will have the information you need to answer this question. Each person that was enrolled in a State of Michigan MEC health care program will be sent a 1095-B form.

What To Do with the Form

If you do not need to file an income tax return for the tax year, you may choose to simply keep the form for your records.

What to Do if You Didn’t Get the Form and Think You Should Have

If you have not received your 1095-B form by the end of February, there could be a reason why:

While the information on this form may assist in preparing your tax return, it is NOT required and does NOT need to be attached to your tax return.

What to Do if Something on the Form is Wrong

You May Like: Does Medicare Pay For Laser Eye Surgery

Applied Behavior Analysis Medical Necessity Guide

The Applied Behavior Analysis Medical Necessity Guide helps determine appropriate levels and types of care for patients in need of evaluation and treatment for behavioral health conditions. The ABA Medical Necessity Guide does not constitute medical advice. Treating providers are solely responsible for medical advice and treatment of members. Members should discuss any matters related to their coverage or condition with their treating provider.

Each benefit plan defines which services are covered, which are excluded, and which are subject to dollar caps or other limits. Members and their providers will need to consult the members benefit plan to determine if there are any exclusions or other benefit limitations applicable to this service or supply.

The conclusion that a particular service or supply is medically necessary does not constitute a representation or warranty that this service or supply is covered for a particular member. The members benefit plan determines coverage. Some plans exclude coverage for services or supplies that Aetna considers medically necessary.

Please note also that the ABA Medical Necessity Guide may be updated and are, therefore, subject to change.

What Is The Health Insurance Deduction On Schedule 1

The deduction which youll find on Line 16 of Schedule 1 allows self-employed people to reduce their adjusted gross income by the amount they pay in health insurance premiums during a given year.

What medical expenses are tax deductible?

If you face high medical bills and itemize your deductions, you might be able to deduct some of your medical expenses. The deduction found on Schedule A of your income tax return covers a wide range of medical expenses, and also includes premiums you pay for health insurance or qualified long-term care.

Can I deduct health insurance on my taxes in 2020?

Self-employed persons can deduct health insurance above the line on their 2020 Schedule 1, which also eliminates the hassle and limitations of itemizing. Other taxpayers can deduct the cost of health insurance as an itemized deduction only if their overall medical and dental expenses exceed 7.5% of their adjusted gross incomes in 2020.

Recommended Reading: When Can You Get Medicare At What Age

How Do I Get My Form 1095

If you question how do I get my Form 1095-B from Medicare online?heres the answer:

You may receive Form 1095-B from Medicare via mail. You dont need to download the form yourself. If you need a replacement Form 1095-B, call 1-800-MEDICARE.

If you need Form 1095-B from another government-sponsored program such as Medicaid or the Childrens Health Insurance Program, visit the programs online portal or contact them to request a copy.

Enable Online Access In Paperless Settings

Step 1. Log into your Excellus BCBSUnivera Healthcare account. If you do not have an account, you can easily create an account.

Step 2. Click the Account Settings link. The link is located in the upper right-hand corner.

Step 3. Click on Paperless Settings.

Step 4. Click on the General Member Communications.

Step 5. Click the Online button and then click the Save button to enable online access to the document.

Read Also: What Is The Yearly Deductible For Medicare

Is All Apple Health Coverage Minimum Essential Coverage

No. Not all Apple Health coverage is minimum essential coverage, including Family Planning, Spenddown, Alien Emergency Medical , and the Medicare Savings Program. If you or someone in your household had Apple Health coverage that is not minimum essential coverage, it will not be included on the 1095-B form. You may be exempt from the minimum essential coverage requirement. For more information, consult a tax professional or visit: irs.gov.

Recommended Reading: What Diabetic Supplies Are Covered By Medicare Part B

States With Individual Insurance Mandates Such As Nj Dc

Members living in states with laws that require reporting of health coverage will continue to receive a paper copy of the Form 1095-B for state filing tax purposes. Subscribers filing taxes in one of these states are encouraged to retain a copy of their 1095B for their state tax records. If you are filing taxes for an individual mandate state and do not have a copy of your 1095B, you may download one immediately from your member website or request one by calling the number on your ID card or other member materials. By retaining a copy of the 1095B form, you will be prepared for any questions about your state return. If you are unsure whether your state has an individual mandate, check with your state revenue department or a tax professional.

You May Like: What Does Medicare Supplemental Insurance Cost

Why Did I Receive A 1095

The 1095-B Qualifying Health Coverage Notice is a tax form that was developed in response to a provision of the 2010 Affordable Care Act . The ACA was phased in over several years, and in 2014, everyone was required to have health insurance through the individual mandate provision.

If you had Medicare Part A or Medicare Part C, you met the individual mandate. If you didnt have health insurance coverage, though, you were subject to a penalty fee, which was calculated as a percentage of your income.

In 2019, the U.S. Department of Justice and federal appeals courts ruled that the individual mandate was unconstitutional. As a result, the penalty was abandoned starting with the 2019 tax filing year. The minimal essential coverage requirement, which set a standard for what health plans had to cover, was also abandoned as was the penalty for not meeting this requirement was.

Also Check: Which Medicare Plan Covers Prescription Medications

What Should I Do If I Get This Notice

- Keep your Form 1095-B with your other important tax information, like your W-2 form and other tax records.

- You dont need to:

- Take any immediate action.

- Send this form to the IRS when you file your taxes.

- Send this form back to Medicare.

Read Also: Does Medicare Cover Dental Root Canals

Form : Proof Of Health Insurance

The 1095 form provides documentation of your individual health insurance information. This form is sent to you annually by your insurance provider. Individuals can use the information on the 1095 to complete the “Health Care: Individual Responsibility” line on Form 1040. For more information, see www.HealthCare.gov.

This form will be postmarked by February 28. If you do not receive a 1095 form by March 15, contact your insurance provider to request a duplicate. It is not necessary to have a 1095 in hand to file your income tax return if you know you had health coverage throughout the year. If you misplaced your copy or find incorrect information, contact your insurance provider as soon as possible.

If you were enrolled in Medicare:

- For the entire year, your insurance provider will not send a 1095 form. Retirees that are age 65 and older, and who are on Medicare, may receive instructions from Medicare about how to report their health insurance coverage.

- For part of the year, you may receive a 1095 from your insurance provider reporting the coverage you had while you were not enrolled in Medicare. For example, if you were enrolled in the IYC Access Plan and your Medicare Part A and Part B became effective on May 1st, your insurance provider will send you a 1095 form reporting your coverage from January through April.

How Do 1095 Forms Relate To My Tax Returns

If you used premium tax credits to pay for your marketplace health insurance costs, these would be listed on your Form 1095-A. An advance premium tax credit helps lower your monthly health insurance premium. The sum of the credits and related details are required when filing your tax return, as any differences between what you used and the amount you are eligible for would need to be reconciled.

To reconcile this information, check the 1095-A form:

- If you used more credits than you were due, you would owe additional tax for the difference between the two amounts.

- If you used less than you were eligible for, you would receive a tax refund for the difference.

You do not need to file a tax return solely because you received either Form 1095-B or 1095-C. For instance, if you are enrolled in Medicaid, you would receive the 1095-B. If you had no other tax-filing obligations, there would be no need to file a tax return.

Recommended Reading: Do I Qualify For Extra Help With Medicare

What Is The 1095

- The 1095-B is an informational form that lets each Medical Assistance member know which months during the previous calendar year he/she had health coverage. Individuals who show that they had the required coverage are not liable for the penalty imposed on those without such coverage. Starting with the 2020 plan year , the penalty no longer applies. This information is also provided to the IRS.

- Georgia Medical Assistance will need this form to file their taxes beginning in 2016.

Do I Need To Prove I Have Health Insurance For My Tax Returns

Starting with the 2019 tax year, you no longer need to prove you have health insurance on your tax returns. But you may still receive tax forms with insurance information, and those with marketplace insurance will need those details to complete their returns.

Anyone who has health insurance should receive one of three tax forms for the 2021 tax year: Form 1095-A, Form 1095-B or Form 1095-C.

The form you receive is based on how you obtained your health insurance: through a health insurance marketplace or exchange, the government or your employer. Form 1095-A is sent to people with marketplace insurance. It provides coverage dates, total premiums paid and information necessary to reconcile or request premium tax credits. If you received advance premium tax credits or want to submit the tax credits on your return, you will need the 1095-A information to file your taxes. You won’t need any information from the 1095-B or 1095-C to file, and none of the three forms need to be attached to your tax return.

The forms are important, as they provide information needed for your tax return, such as total premiums paid and the time frame you were covered. You also can use this information if you plan to itemize health care expenses, including premiums, on your taxes. If you don’t use the information on your tax form, you’ll still want to keep the documents for your records.

Read Also: Do Medicare Advantage Premiums Increase With Age