What Happens When Medicare Runs Out Of Money

It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy, but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.

The Right Medicare Plan Can Save You Hundreds Of Dollars Each Month

See your options to find savings.

Key findings Among Medicare recipients 65 and older, men are more

Updated: June 14th, 2021ByDan Grunebaum×

We do not sell insurance products, but there may be forms that will connect you with partners of healthcare.com who do sell insurance products. You may submit your information through this form, or call 855-617-1871 to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

Our mission is to provide information that will help everyday people make better decisions about buying and keeping their health coverage. Our editorial staff is comprised of industry professionals and experts on the ACA, private health insurance markets, and government policy. Learn more about our content.

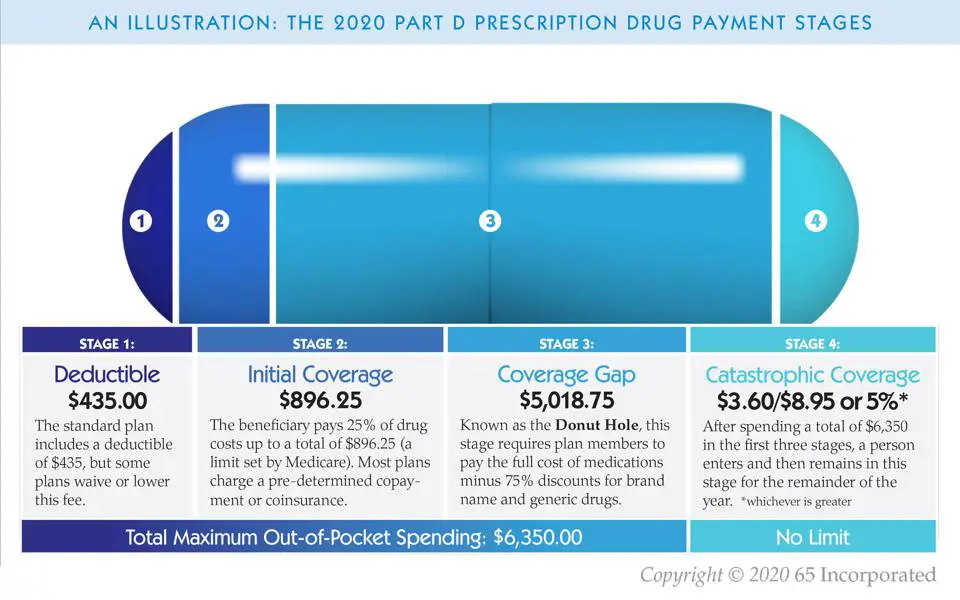

Millions Of People With Medicare Have Reached Catastrophic Part D Coverage

Medicare Part D, which covers outpatient prescription drugs for people with Medicare, has four phases of coverage: the deductible, when the beneficiary pays the full cost of the medication the initial coverage period, when the plan pays for most of the cost of the medication and the beneficiary pays a copay or coinsurance the coverage gap, also known as the donut hole, where the beneficiary pays 25% of the cost while the government, drug manufacturers, and the plan pay the rest and finally, the catastrophic coverage phase, where beneficiaries usually pay 5% of the cost and plan pays for the remainder.

In 2021, beneficiaries will reach catastrophic coverage phase when they have spent $6,550. But because there is no hard cap on beneficiary out-of-pocket spending in Part D, those who take high-cost medications may pay thousands of dollars above the catastrophic threshold5% of a $10,000 drug can add up fast.

This week, the Kaiser Family Foundation released a report showing that for millions of older adults and people with disabilities, this scenario is all too real. Over the five-year period from 2015-2019, 2.7 million enrollees had at least one year with spending above the catastrophic limit, and over the ten-year period from 2010-2019, 3.6 million did. Reaching catastrophic coverage can come with enormous expense. In 2019 alone, nearly 1.5 million Part D enrollees spent $1.8 billion on prescription medications after exceeding the threshold.

Read Also: How To Change Medicare Direct Deposit

Does Medicare Have A Cap

In general, theres no upper dollar limit on Medicare benefits. As long as youre using medical services that Medicare coversand provided that theyre medically necessaryyou can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

Recommended Reading: What Is Medicare Part A B C And D

What Is Catastrophic Health Insurance

Catastrophic health insurance is a type of health plan that offers coverage in times of emergencies as well as coverage for preventive care. Catastrophic health plans typically come with low monthly premiums and a high deductible. You pay for any emergency medical care you receive until you meet your deductible and most preventive care is covered at 100%. Catastrophic health coverage is available to people under 30, who are looking for minimal coverage and low monthly premiums, and, to those of any age who are eligible due to financial hardship.

Don’t Miss: How Is Bernie Paying For Medicare For All

Do I Need Medicare Part D If I Dont Take Any Drugs

Even if you dont take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

What Are Catastrophic Benefits

Catastrophic insurance coverage helps you pay for unexpected emergency medical costs that could otherwise amount to medical bills you couldnt pay. It also covers essential health benefits, including preventive services like health screenings, most vaccinations, your annual check-up, and certain forms of birth control.

Recommended Reading: Can You Have Medicare Before Age 65

Recent Articles And Updates

For older articles, please see our article archive.

References

The 2010 Medicare Part D $250 Donut Hole Rebate. Q1Group LLC, .

2020 Part D Income-Related Monthly Premium Adjustment. . .

2021 Medicare Part D Outlook. Q1Group LLC, .

2021 Part D Income-Related Monthly Premium Adjustment. . .

How Do Medicare Advantage Ppo Plans Work? Healthline Media, May 5, 2021, .

Analysis of Part D Beneficiary Access to Preferred Cost Sharing Pharmacies . . .

Announcement of Calendar Year 2021 Medicare Advantage Capitation Rates and Part C and Part D Payment Policies. . .

Assistance with Paying for Prescription Drugs. Center for Medicare Advocacy, November 30, 2015, .

How Medicare Part D Works. AARP, October 2016, .

Medicare Advantage Special Needs Plans . Healthline Media, May 3, 2021, .

Kirchhoff, Suzanne M. Medicare Coverage of End-Stage Renal Disease . . .

Read Also: How Much Does Dialysis Cost With Medicare

Changes To Deductibles Copays And The Donut Hole

Here are the annual updates to the standard Medicare Part D Defined Standard Benefit, including deductibles, Initial Coverage Limits , TrOOP , and Catastrophic Coverage copays:

The initial deductible will increase by $35 to $480 in 2022. This means youll pay slightly more before Medicare Part D begins paying its share if you have a plan with the highest possible deductible.

After you meet the deductible, you pay 25% of covered costs up to the initial coverage limit. Some plans may offer a $0 deductible for lower cost drugs.

The Initial Coverage Limit will go up from $4,130 in 2021 to $4,430 in 2022. This means you can purchase prescriptions worth up to $4,430 before entering whats known as the Medicare Part D Donut Hole, which has historically been a gap in coverage. Thanks to cost sharing with your Medicare Part D plan and the drug manufacturers, being in the Donut Hole isnt nearly as expensive as it used to be and exiting it may be easier than you think.

In the Donut Hole, youll pay 25% for brand-name drugs. The manufacturer will give you a 70% discount during this time, and your Medicare Part D plan will pick up the remaining 5%. The 25% you pay plus the 70% discount from the manufacturer will count toward your combined TrOOP , which is when you exit the Donut Hole.

The situation is different for generic drugs. You still pay 25% yourself, and your Medicare Part D plan covers the other 75%. However, only the 25% you pay yourself counts towards meeting your TrOOP.

Read Also: Why Is Medicare Advantage Free

D Plan Premiums And Benefits In 2022

Premiums

The 2022 Part D base beneficiary premium â which is based on bids submitted by both PDPs and MA-PDs and is not weighted by enrollment â is $33.37, a modest increase from 2021. But actual premiums paid by Part D enrollees vary considerably. For 2022, PDP monthly premiums range from a low of $5.50 for a PDP in Colorado to a high of $207.20 for a PDP in South Carolina . Even within a state, PDP premiums can vary for example, in Florida, monthly premiums range from $7.70 to $174.30. In addition to the monthly premium, Part D enrollees with higher incomes pay an income-related premium surcharge, ranging from $12.30 to $77.10 per month in 2021 .

Benefits

The Part D defined standard benefit has several phases, including a deductible, an initial coverage phase, a coverage gap phase, and catastrophic coverage, although it does not have a hard cap on out-of-pocket spending. Between 2021 and 2022, the parameters of the standard benefit are rising, which means Part D enrollees will face higher out-of-pocket costs for the deductible and in the initial coverage phase, as they have in prior years, and will have to pay more out-of-pocket before qualifying for catastrophic coverage .

- The standard deductible is increasing from $445 in 2021 to $480 in 2022

- The initial coverage limit is increasing from $4,130 to $4,430, and

- The out-of-pocket spending threshold is increasing from $6,550 to $7,050 .

Figure 6: Medicare Part D Standard Benefit Parameters Will Increase in 2022â

Medicare Doesnt Cover Routine Vision Care

Medicare generally doesnt cover routine eye exams or glasses . But some Medicare Advantage plans provide vision coverage, or you may be able to buy a separate supplemental policy that provides vision care alone or includes both dental and vision care. If you set aside money in a health savings account before you enroll in Medicare, you can use the money tax-free at any age for glasses, contact lenses, prescription sunglasses and other out-of-pocket costs for vision care.

Don’t Miss: Does Medicare Cover Accu Chek Test Strips

D Spending And Financing

Part D Spending

The Congressional Budget Office estimates that spending on Part D benefits will total $111 billion in 2022, representing 15% of net Medicare outlays . Part D spending depends on several factors, including the total number of Part D enrollees, their health status and drug use, the number of high-cost enrollees , the number of enrollees receiving the Low-Income Subsidy, and plansâ ability to negotiate discounts with drug companies and preferred pricing arrangements with pharmacies, and manage use . Federal law currently prohibits the Secretary of Health and Human Services from interfering in drug price negotiations between Part D plan sponsors and drug manufacturers.

Part D Financing

Financing for Part D comes from general revenues , beneficiary premiums , and state contributions . The monthly premium paid by enrollees is set to cover 25.5% of the cost of standard drug coverage. Medicare subsidizes the remaining 74.5%, based on bids submitted by plans for their expected benefit payments. Higher-income Part D enrollees pay a larger share of standard Part D costs, ranging from 35% to 85%, depending on income.

Payments to Plans

Does Medicare Have A Maximum Out

There is no limit to your potential medical bills under Original Medicare. Under current rules, there is no Medicare out of pocket maximum if you have a chronic health condition or an unexpected health crisis, you could pay thousands in medical costs.

Under Original Medicare, you are responsible for your annual Part B deductible, a Part A deductible for each benefit period , and your coinsurance and copayment amounts.

You can get a Medicare Supplement insurance plan to help cover your Medicare out of pocket costs.

You May Like: What Is The Difference Between Medicare And Managed Medicare

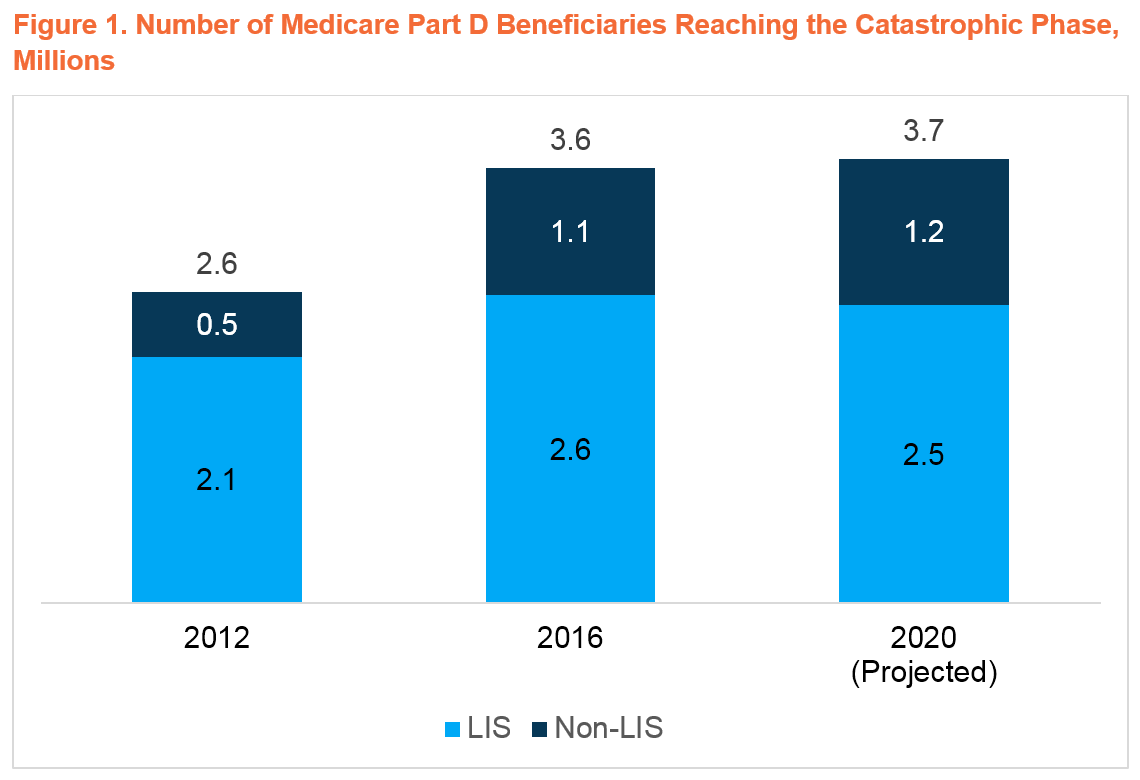

How We Conducted This Study

We identified Medicare Part D beneficiaries who entered catastrophic coverage using enrollment and claims data for Medicare Part D for 20132017. The sample consists of all prescription drug claims for a 20 percent sample of the Medicare population, which forms a nationally representative panel. The numbers in the brief have been scaled to be representative of all Medicare Part D beneficiaries in stand-alone prescription drug plans who had continuous coverage and did not die.

The claims data include detailed information on prescription drug characteristics, such as the total cost of the drug, the out-of-pocket amount paid by the beneficiary, and whether the drug was generic or brand name. The data also include personal characteristics of the beneficiaries, such as the prescription drug plan type, number of chronic conditions, portion of the benefit phase an individual is in, whether an individual receives a low-income subsidy, and basic demographic characteristics .

Because of the large sample size, there was sufficient power to analyze subgroups of the larger population. The study was able to investigate patterns in drug utilization by benefit phase of a beneficiary and receipt of low-income subsidies.

Find A $0 Premium Medicare Advantage Plan Today

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Also Check: Does Medicare Pay For Entyvio

What Happens If I Meet My Out

Yes, the amount you spend toward your deductible counts toward what you need to spend to reach your out-of-pocket max. So if you have a health insurance plan with a $1,000 deductible and a $3,000 out-of-pocket maximum, youll pay $2,000 after your deductible amount before your out-of-pocket limit is reached.

How Do I Qualify For An Exemption So That I Can Get Catastrophic Health Coverage

There are two main types of exemptions that would help you qualify for catastrophic insurancepersonal hardship and affordability exemptions. You could qualify for either exemption depending on the details of your specific situation.

Some common hardship qualifications include:

- Homelessness

- Death of a close relative

- Utility services being shut off

- Eviction

- Home foreclosure

- A fire, or a natural- or human-caused disaster that results in substantial property damage

There are also affordability exemptions. This means that your income is not enough to be able to afford regular health care coverage. If you qualify for an exemption, you would claim it on your annual tax return and get money back.

Read Also: When Is Someone Medicare Eligible

How The Tricare Catastrophic Cap Affects Your Health Care Costs

Tricare medical coverage is one of the biggest benefits of military service, and one of the greatest things about Tricare is the low catastrophic caps that limit the total amount you’ll pay on covered medical care in a year. Sometimes called an out-of-pocket maximum, catastrophic caps vary based upon status, the date the sponsor entered the military and Tricare coverage, but they’re all quite low compared to most civilian plans. For 2021, the catastrophic caps range from $1,000 per year to $3,703 per year.

Specialty Drug Tier May Lower Costs

Many Medicare Part D plans place drugs on different tiers that determine what percentage patients pay in cost sharing. Patients typically pay 25% to 50% of the cost for drugs on the highest-priced specialty tier and all drugs on the specialty tier have the same level of cost sharing.

But starting in 2022, Centers for Medicare & Medicaid Services will allow Medicare Part D plans to have a lower preferred specialty tier. This means plans can negotiate with drug makers to get better discounts on specialty tier drugs in exchange for being listed on the preferred tier. Plans can then pass the savings along to patients.

You May Like: Should I Apply For Medicare If Still Working

Does Traditional Medicare Cover Cataracts

Cataract surgery is a common eye procedure. Its generally safe surgery and is covered by Medicare. While Medicare doesnt cover routine vision screening, it does cover cataract surgery for people over age 65. You may need to pay additional costs such as hospital or clinic fees, deductibles, and co-pays.

Recommended Reading: Must I Take Medicare At 65

Is There A Limit On Out

There is no out-of-pocket spending limit with Original Medicare .

Medicare Advantage plans, however, do feature an annual out-of-pocket spending limit for covered Medicare expenses.

While each Medicare Advantage plan carrier is free to set their own out-of-pocket spending limit, by law it must be no greater than $7,550 in 2022. Some plans may set lower maximum out-of-pocket limits.

Medicare Advantage plans are offered by private insurance companies. When you enroll in a Medicare Advantage plan, it replaces your Original Medicare coverage and offers the same benefits that you get from Medicare Part A and Part B.

Most Medicare Advantage plans provide prescription drug coverage, which is not typically covered by Original Medicare.

Some Part C plans also offer other benefits that Original Medicare doesnt cover, which may include:

- Routine hearing, dental and vision coverage

- Non-emergency transportation to approved locations

- Over-the-counter medication allowances

- Health and wellness programs, such as SilverSneakers

Depending on where you live, you may be able to find $0 premium Medicare Advantage plans.

Read Also: Does Medicare Cover Annual Gyn Exam

What Is The Medicare 100 Day Rule

Medicare covers up to 100 days of care in a skilled nursing facility each benefit period. If you need more than 100 days of SNF care in a benefit period, you will need to pay out of pocket. If your care is ending because you are running out of days, the facility is not required to provide written notice.

Conference Report Filed In House

Medicare Catastrophic Coverage Act of 1988 – Title I: Provisions Relating to Part A of Medicare Program and Supplemental Medicare Premium – Subtitle A: Expansion of Medicare Part A Benefits – Amends part A of title XVIII of the Social Security Act to require that an inpatient hospital deductible be paid only for the first period of continuous hospitalization in a calendar year. Removes durational limitations on the coverage of inpatient hospital services, except with respect to inpatient psychiatric hospital services. Eliminates the coinsurance requirement for inpatient hospital services.

Establishes the monthly part A premium, required of individuals who wish to buy into the Hospital Insurance program, at the monthly actuarial value of part A services provided to beneficiaries age 65 and over. Imposes a coinsurance rate, equal to 20 percent of the average per diem reasonable cost of post-hospital extended care services, for the first eight days of an individual’s receipt of such services in a calendar year.

Establishes the Federal Hospital Insurance Catastrophic Coverage Reserve Fund into which shall be transferred amounts equivalent to outlays for part A catastrophic coverage, excluding outpatient drug benefits.

Directs the Secretary of the Treasury to conduct a study and report to the Congress by November 30, 1988, on Federal tax policies to promote private financing of long-term care.

Sets forth miscellaneous outpatient drug study and reporting requirements.

Recommended Reading: How Do I Replace A Lost Medicare Card