How Does Medicare Work With Your Employer Insurance

If youre already eligible for Medicare and have plans to get one, it is recommended for you to do your research. Start by reading about how to enroll in Medicare and prepare all the necessary documents you might be required to comply with.

Original Medicare can provide comprehensive hospital and medical coverage. This is also the case when it comes to employer health plans.

Thus, its crucial to remember that these insurance coverages dont intend to replace each other. Instead, they can work together to provide for your covered expenses.

Can You Take Employer Coverage Again When On Medicare

If you return to work for an employer who offers health insurance, you can take it. You are allowed to have both Medicare and employer coverage, and you can use them together. One will act as primary coverage and one will act as secondary.

The only thing to keep in mind is that when you have Medicare and an employer plan, you cannot contribute to a health savings account if its offered.

Going Back To Work After Turning 65

The above scenarios apply to people who are still working when they turn 65 and become eligible for Medicare. But what if youre already retired and enrolled in Medicare but then return to a job that has employer health coverage?

If you return to work, the same rules apply according to the size of your employer. If you enrolled in Medicare Part B, you may cancel it upon enrolling in the employer coverage under no penalty.

When you retire again, you will be granted a Special Enrollment Period if you wish to re-enroll in Part B.

Don’t Miss: What Is My Monthly Medicare Premium

How Medicare Works With Other Health Insurance

Many people who have Medicare rely on it as their only health coverage. However, some Medicare beneficiaries have other insurance alongside their Medicare coverage.

Using Medicare with another type of insurance brings up a lot of questions, from What insurance is primary or secondary? to Can I keep my employer’s health insurance with Medicare?

This guide will answer many common questions about using Medicare alongside other insurance coverage. This will help you get a better understanding of how to maximize your benefits.

What Are The Different Penalties For Medicare Part A And Part B

-

Medicare Part A penalty:

Typically, Part A is completely free External Site to those who are eligible. But, if an employee isnt eligible for premium-free External Site Part A, and doesnt sign up for it when they are first eligible, their monthly premium may increase.

-

Medicare Part B penalty:

If an employee doesnt sign up for Part B when they are first eligible, they will pay a late enrollment fee External Site and will continue to pay this fee for as long as they continue with Part B. Note: If an employee remains on the active employer plan, then they will not incur Part B penalties by delaying enrollment.

Read Also: Does Medicare Cover Smoking Patches

What Can My Employees Do With Their Health Savings Account When They Switch To Medicare

When an employee enrolls in Medicare Part A, they are no longer eligible to contribute External Site pre-tax dollars to an HSA. The month an employees Medicare plan begins, they should switch their HSA to $0 per month. However, your employees can continue to withdraw money from an HSA after they enroll in Medicare to help pay for medical expenses .

What Insurance Is Primary Or Secondary

When you have more than one payer that is, more than one health insurance plan there are rules that determine which plan is the first payer. That plan is considered primary, and then the other plan is secondary.

When you have a health need, the primary plan provides coverage to the limits of its benefits and the secondary plan only pays if there are costs not covered by the primary plan.

However, that doesnt mean the secondary plan will pay all remaining costs. For example, you may have out-of-pocket costs like coinsurance or a copayment, or the services might not be part of what the secondary plan covers.

When Medicare is working with other insurance plans, Medicare is usually the secondary payer. If you have an employer group plan from your job or your spouses job, that plan pays first.

Here are some examples of Medicare working with other insurance, along with who pays first. If you have Medicare and:

Read Also: When You Turn 65 Is Medicare Free

Do I Need To Enroll At 65 If I Work For A Small Company

The laws that prohibit large companies from requiring Medicare-eligible employees to drop the employer plan and sign up for Medicare do not apply to companies with fewer than 20 people. In this situation, the employer decides.

You generally need to sign up for Medicare Parts A and B during your initial enrollment period, which begins three months before and ends the three months after the month you turn 65. If you dont, you could end up with large coverage gaps.

If the employer does require you to enroll in Medicare, which is most common, Medicare automatically becomes your primary coverage at 65 and the employer plan provides secondary coverage. In other words, Medicare settles your medical bills first, and the group plan pays only for services it covers but Medicare doesnt.

So if you fail to sign up for Medicare when required, you essentially will be left with no coverage.

Extremely important: Ask the employer whether you are required to sign up for Medicare when you turn 65 or are eligible to receive Medicare earlier because of a disability. If so, find out exactly how the employer plan will fit in with Medicare. If youre not required to sign up for Medicare, ask the employer to provide the decision in writing.

When Medicare is primary coverage and the employer plan is secondary, you have the right to buy Medigap later with full federal protections. But you must do so within 63 days of the employer coverage ending.

What Is The Impact Of Enrolling In Medicare On Cobra

COBRA requires two things to occur before continuation coverage is available: a qualifying event and a loss of coverage. Although a loss of coverage occurs when employees voluntarily remove themselves from your health plan, obtaining other coverage, specifically Medicare, is not deemed a qualifying event.

However, if your employees spouse is on your plan when the employee enrolls in Medicare, but the spouse is not yet eligible, the spouse will have the opportunity to continue coverage through COBRA if you decide not to keep them on the plan moving forward.

Also Check: What Is The Coinsurance For Medicare Part B

Do I Need To Notify Anyone If Im Delaying Medicare

You don’t need to provide notice that you’d like to delay enrolling unless you’re receiving Social Security or Railroad Retirement Board benefits. If you are receiving either, you’ll be automatically enrolled in Medicare Parts A & B when you turn 65, and you’ll need to let Social Security know you wish to delay Part B. By law though, if you receive Social Security benefits and are eligible for Medicare, you must also have Medicare Part A.

Get Your Medicare When Working Past 65 Guide and Webinar AccessYou’ll get timely emails with important information to help you navigate your Medicare enrollment journey when working past 65. In this email series, you’ll receive a helpful PDF guide, exclusive access to six webinars and learn about Medicare basics, enrollment, plan options and more.

*Required fields

Thank you for signing up! Your Medicare When Working Past 65 guide and webinar access link will arrive in your inbox soon. Enjoy!

How Medicare Interacts With Your Current Coverage

Employer coverage and Medicare:

- If you work for a company with fewer than 20 employees, Medicare is considered your primary coverage. That means Medicare pays first, and your employer coverage pays second.

- If you work for a larger company, your employer-based coverage will be your primary coverage and Medicare your secondary coverage.

- Either way, after both insurers have paid their part of your medical bill, you only pay the balance.

Individual or Covered California health plans and Medicare:

- There is usually no reason to keep an individual or Covered California plan once you have Medicare.

- Once you have Medicare:

- It is illegal for someone to sell you a marketplace or individual market policy.

- You are not eligible for tax credits or other savings, which means you would pay full price for a marketplace plan.

Retiree insurance and Medicare:

- If you’re retired and receive health insurance through your former employer, you can still sign up for Medicare.

- Medicare pays first, and your former employers group health plan pays second.

- After both insurers pay, you pay the balance.

Coverage from your spouses employer and Medicare:

- If your spouses employer has fewer than 20 employees, Medicare pays first.

- If it’s a larger company, the business’s health plan pays first.

- After both insurers pay, you pay the balance.

Military retiree and Veterans Affairs benefits and Medicare:

Tricare and Medicare:

COBRA and Medicare:

Medicaid and Medicare:

Read Also: Does Humana Medicare Cover Incontinence Supplies

What Your Employer Cannot Do

When it comes to keeping health insurance from your employer after age 65, you have rights. Rules regarding health insurance past 65 arent always black and white, but the list below are some examples of actions your employer cannot do once you become eligible for Medicare.

- Your employer cannot require you to get on Medicare once you turn 65.

- Your employer cannot require you to get on a different kind of insurance .

- Your employer cannot offer you a different kind of insurance than people younger than you.

Note: The law that mandates the rules above only applies to businesses with more than 20 people. If you work for a business with less than 20 people, your employer may require you to enroll in Medicare Part B at age 65. Talk to your employer to learn more about your options.

What Happens When I Retire

It’s important to understand what your options are once you retire. The first step is to find out if you can keep the coverage you have now when you retire, and whether or not it can be combined with Original Medicare coverage. If you have group retiree health coverage, you’ll need to contact the plan’s benefits administrator to learn about how the coverage works with Medicare and what you need to do.

Read Also: What Year Did Medicare Start

What If My Employee Is On Their Spouse’s Insurance Plan Will Medicare Pay First

Take it from the experts at Medicare.gov: External Site

Medicare pays first if both of these situations apply:

- A domestic partner is entitled to Medicare on the basis of age.

- A domestic partner has group health plan coverage based on the current employment status of his/her partner.

Medicare generally pays second when:

- The employee’s domestic partner is entitled to Medicare on the basis of disability and is covered by a large group health plan.

- For the 30-month coordination period when the employee’s domestic partner is eligible for Medicare on the basis of end-stage renal disease and is covered by a group health plan on any basis.

- When the employee’s domestic partner is entitled to Medicare on the basis of age and has group health plan coverage on the basis of his/her own current employment status.

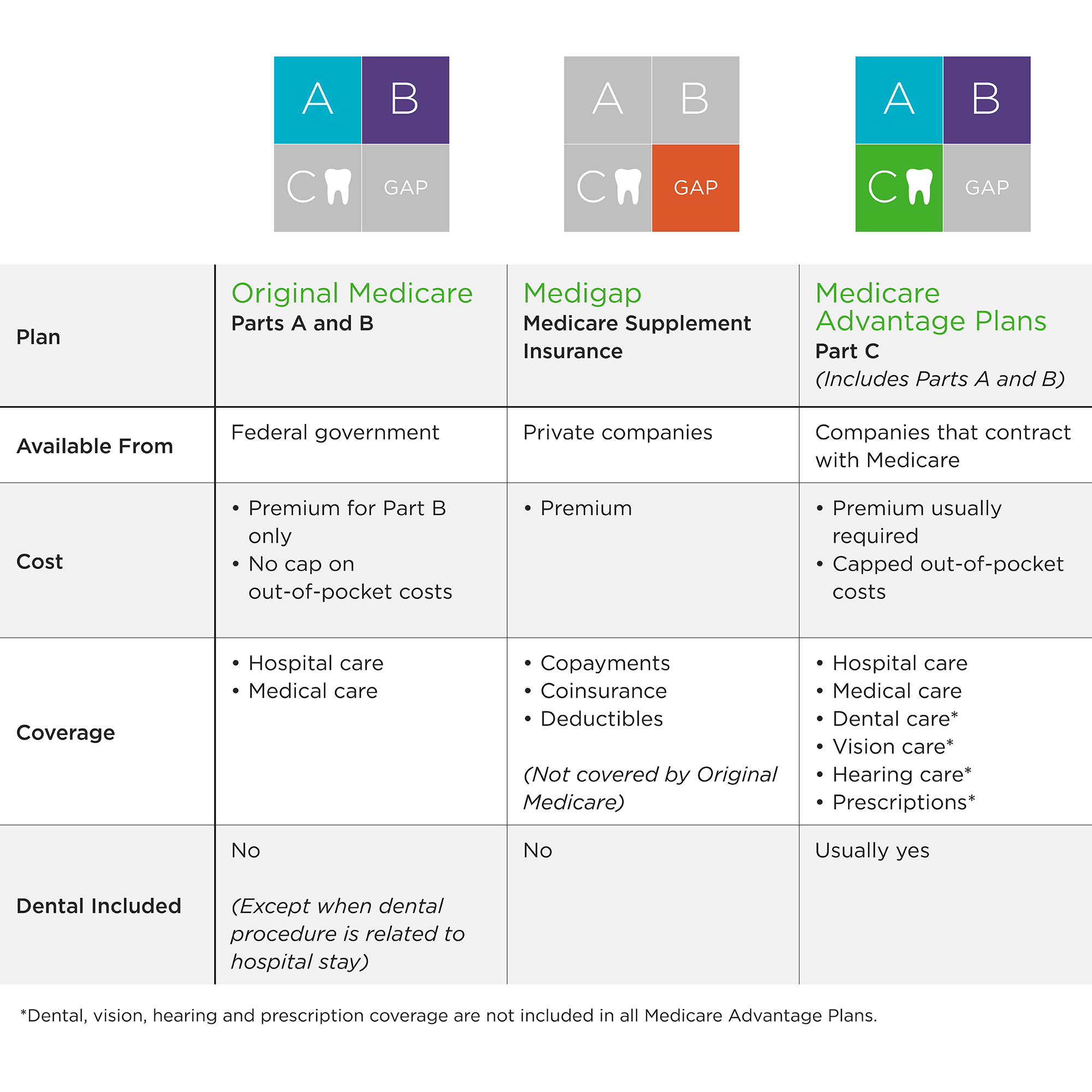

What Does Medicare Cover

Medicare helps pay for certain health care services and durable medical equipment. To have full Medicare coverage, Medicare beneficiaries must have Part A and Part B .

The following is a partial list of Medicare-covered services. The covered services listed below may require payment of deductibles and Co-Payments.

If you have questions about covered services, call Medicare at 1-800-633-4227.

Also Check: Should I Give My Medicare Number Over The Phone

Medicare As Primary Payer

Medicare is the primary payer when a person:

- is eligible for Medicaid

- is under 65 years of age, has a disability, has a group health plan, and works for a company with fewer than 100 employees

- has a group health plan and works for a company that has fewer than 20 employees

- is aged 65 years or older, retired, and the spouse of someone over the age of 65 years with a group health plan

- has a disability, is retired and under 65 years of age, and has insurance with a past employer

If a person aged 65 years or older has Medicare and more than one other health plan, they should contact the BCRC at 855-798-2627.

The National Association of Insurance Commissioners set the standard for the insurance industry. Under the coordination of benefits rules, the primary payer provides benefits as though a secondary plan does not exist.

The remaining charges will go to the secondary payer, which provides benefits based on the plan rules.

In this example, Medicare is the primary insurer.

A person has a charge of $100 for a consultation with a family doctor. They have met their yearly deductible.

Medicare covers 80% of the consultation cost, leaving 20% to pay:

20% x $100 = $20

Should I Take Medicare Part B

You should take Medicare Part A when you are eligible. However, some people may not want to apply for Medicare Part B when they become eligible.

You can delay enrollment in Medicare Part B without penalty if you fit one of the following categories.

Employer group health plans may cover items normally not covered by Medicare Part B. If so, and you meet one of the categories above or below, then you may not need to enroll in Medicare Part B and pay the monthly premium.

If you are:

- a spouse of an active worker

- a disabled, active worker

- a disabled spouse of an active worker

and choose coverage under the employer group health plan, you can refuse Medicare Part B during the automatic or initial enrollment period. You wait to sign up for Medicare Part B during the special enrollment period, an eight month period that begins the month the group health coverage ends or the month employment ends, whichever comes first.

You will not be enrolling late, so you will not have any penalty.

If you choose coverage under the employer group health plan and are still working, Medicare will be the “secondary payer,” which means the employer plan pays first.

If the employer group health plan does not pay all the patient’s expenses, Medicare may pay the entire balance, a portion, or nothing. An employer group health plan must be primary or nothing.

Read Also: Does Medicare Pay For Hip Replacement Surgery

Can I Have Medicare And Employer Coverage At The Same Time

Yes, you can have both Medicare and employer-provided health insurance.

In most cases, you will become eligible for Medicare coverage when you turn 65, even if you are still working and enrolled in your employers health plan. You are welcome to drop the employer coverage and have only Medicare if you so choose, but you are not required to do so.

When enrolled in both Medicare and employer insurance, each type of coverage is called a payer. Which type of coverage pays first depends largely on the size of your employer.

The primary payer pays up to the limits of its coverage, and the secondary payer pays any covered costs not paid by the primary payer. Even with two payers, you may still have some out-of-pocket costs for your care.

*An exception to the above scenarios is with HSA-compatible health plans. If the employer coverage you are enrolled in is a high deductible health plan coupled with a health savings account, you or your employer will not be able to make any contributions to the HSA while enrolled in Medicare.

What Forms Do I Need To Show Creditable Coverage From An Employer

You will need your employer to fill out the CMS-L564 form. This form is a request for employment information and will provide proof of creditable coverage to Medicare. Once the employer completes Section B of the form, send in the document with your application to enroll in Medicare. You can avoid the Medicare Part B penalty if you do this correctly.

You May Like: What Is Medicare On My Paycheck

Can I Combine Employer Health Insurance With Medicare

If you or your spouse are working and covered through an employer, you can also decide to keep this coverage and enroll in Original Medicare, Part A and/or Part B to get additional health coverage. If youâre receiving Social Security benefits, in most cases you will be automatically enrolled into Medicare Part A and Part B at age 65. If you decide to enroll in Medicare Part A and/or Part B while keeping your employer coverage, there is a process in place to determine which insurance will be considered the primary payer called âcoordination of benefits.â If your employer coverage is determined to be your primary insurer, it pays your health-care costs first. Medicare then covers a certain amount of the remaining Medicare-approved expenses. When your employer plan is the secondary insurer, it only covers a specific amount of leftover expenses. In this scenario, Medicare is the primary insurer and pays its share first.

When you enroll in Medicare Part A and/or Part B, you should list out any other insurance you have in your Initial Enrollment Questionnaire , which lets Medicare know about other health insurance you may have that could be a âprimary payerâ . Examples of other coverage include employer coverage, veteransâ benefits, and workersâ compensation.

If you have questions about how Medicare and other insurance work together, contact your current benefits administrator for more information.

How Does Medicare Affect Your Employer Health Insurance

As people approach their 65th birthday , they often ask this question: How does Medicare work with other insurance? If youve asked the same question, todays topic is for you. We look at how Medicare works with other insurance, plus give you a few real-life examples of how Medicare affects your additional insurance when you first enroll in Medicare. Lets dive right in.

How Medicare Works With Other Insurance

There are several different ways Medicare coordinates with other insurance. To explain this, lets look at a few scenarios.

Scenario #1: You Are Still Working

For this scenario, lets assume you or your spouse are still working, meaning you’re covered by an employer-provided plan. How does Medicare work if youre still on an employers plan? First, the size of the group at work will determine how Medicare is going to coordinate your coverage.

If you’re in a small group plan , Medicare will pay first and your group plan will pay second. On the other hand, if you’re in a larger group plan , then your group plan will pay first, and Medicare will pay second.

Now, many times it’s in your best financial interests to drop the group plan, place Medicare in the first payor position, and get other insurance. Other times its best to stay on your group plan.

For example, if you have great coverage in your group plan or you have a younger spouse or children still on the group plan, then its probably best to stick with that plan.

Scenario #2: You Are Retired

Don’t Miss: Does Medicare Come Out Of Your Social Security