How Do I Get My Social Security And Medicare Tax Back

How to get a Refund of Social Security and Medicare Taxes

What Income Is Not Subject To Medicare Tax

Also, qualified retirement contributions, transportation expenses and educational assistance may be pretax deductions. Most of these benefits are exempt from Medicare tax, except for adoption assistance, retirement contributions, and life insurance premiums on coverage that exceeds $50,000.

Medicare Advantage Open Enrollment Period

Medicare is a government-sponsored program designed to help eligible seniors and others pay for healthcare. Medicare Advantage plans offer an alternative to Original Medicare, which includes Part A and Part B coverage. The Medicare Advantage Open Enrollment Period is your opportunity to make changes to your plan. If you have Medicare Advantage, its important to understand how open enrollment works and when it takes place. Some details have changed for 2022, so staying on top of things will help you get the care you need. A financial advisor may also be able to help you stay in the know. Try using SmartAssets free advisor matching tool to find advisors that serve your area today.

What Is Medicare Advantage?

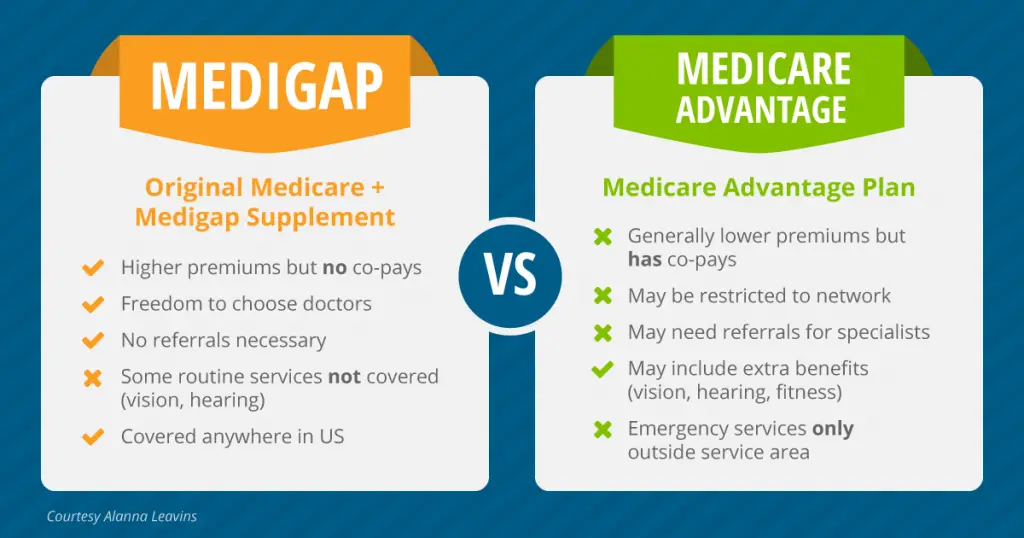

Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage plans are offered through private insurance companies and theyre sometimes referred to as Medicare Part C. These plans can provide additional coverage that you dont get with Medicare, including:

-

Prescription drug coverage

-

Dental care

-

Vision care

-

Wellness visits

When you enroll in Medicare Advantage, you dont pay the same thing that you would for Original Medicare. Instead, your out-of-pocket costs are based on:

What Is Medicare Advantage Open Enrollment?

During the Medicare Advantage Open Enrollment Period, you can do one of two things:

How to Compare Medicare Advantage Plans

For example, consider:

Switching From Medicare Advantage to Original Medicare

Bottom Line

You May Like: How To Get A Medicare Number As A Provider

Who Is Eligible For Medicare

Americans age 65 years old or over automatically qualify for Medicare. Permanent residents of the same age may be eligible as well. Americans under 65 are eligible for Medicare if they are receiving Social Security Disability Insurance for at least 24 months.

Younger Americans with end stage renal disease or Lou Gehrigâs disease are also eligible for the federal program.

| Type of Medicare |

|---|

| Premium, deductible, copay |

Medicare Tax For The Self

Under the Self-Employed Contributions Act , the self-employed are also required to pay Social Security and Medicare taxes. In 2021 and 2022, the Medicare tax on a self-employed individuals income is 2.9%, while the Social Security tax rate is 12.4%. The maximum Social Security tax for self-employed people in 2021 is $17,707.20, and $18,228 in 2022.

Self-employed individuals must pay double the Medicare and Social Security taxes that traditional employees pay because employers typically pay half of these taxes. But they are allowed to deduct half of their Medicare and Social Security taxes from their income taxes.

Also Check: What Is The Difference Between Medicare Advantage And Regular Medicare

Exemption From Social Security Or Medicare Taxes

Under certain circumstances, New York City employees may be exempt from Social Security and/or Medicare taxes. If you fall into one of the following categories, you may be exempt from Social Security or Medicare taxes:

- Not a pension member and contribute at least 7.5% or more to a single defined contribution plan, such as the Deferred Compensation 401 or 457 plans, or a 403 Tax Deferred Annuity . Get more information about Social Security & Medicare Tax Exemptions for Non-Members of Pension Plans.

- City pension plan member in 1957 electing not to have Social Security

- Half time CUNY student working at CUNY

- Non-resident student or teacher admitted to the US under certain visas

- Foster Grandparent working for the Department of Aging

- Election Inspector/Worker earning less than $2,000 from the Board of Elections in 2021

- Beneficiary of a deceased employee receiving payment after the calendar year of the employee’s death

- Temporary emergency relief employee.

Learn more about Social Security & Medicare Tax Exemptions for Other NYC Employees.

The Social Security Protection Act of 2004 requires newly hired public employees to sign a “Statement Concerning Your Employment in a Job Not Covered by Social Security”. Form SSA-1495 explains the potential effects of two provisions in the Social Security law on workers whose earnings are not covered under Social Security.

Medicare Taxes And The Affordable Care Act

The Affordable Care Act added an extra Medicare tax for high earners. This surtax is known as the Additional Medicare Tax. As of January 2013, anyone with earned income of more than $200,000 has to pay an additional 0.9% in Medicare taxes beyond the standard 1.45%. That entire 0.9% is the responsibility of the employee. It is not split between the employer and the employee.

If your income means youre subject to the Additional Medicare Tax, your Medicare tax rate is 2.35%. However, this Medicare surtax only applies to your income in excess of $200,000. If you make $250,000 a year, youll pay a 1.45% Medicare tax on the first $200,000, and 2.35% on the remaining $50,000.

Another result of ACA reforms is the Net Investment Income Tax . The NIIT, also known as the Unearned Income Medicare Contribution Surtax, is a 3.8% Medicare tax that applies to investment income and to regular income over a certain threshold. If your Modified Adjusted Gross Income exceeds $200,000 you may be subject to the NIIT. Examples of investment income that is subject to the NIIT include dividends, interest, passive income, annuities, royalties and capital gains.

The 3.8% tax applies to the lesser of either your net investment income or the amount by which your MAGI exceeds $200,000 . That means the NIIT acts as either an extra income tax or an extra capital gains tax. You can report your net investment income on IRS Form 8690.

Read Also: What Is The Extra Help Program For Medicare

Other Payroll Tax Items You May Hear About

-

FUTA tax: This stands for Federal Unemployment Tax Act. The tax funds a federal program that provides unemployment benefits to people who lose their jobs. Employees do not pay this tax or have it withheld from their pay. Employers pay it.

-

SUTA tax: The same general idea as FUTA, but the money funds a state program. Employers pay the tax.

-

Self-employment tax: If you work for yourself, you may also have to pay self-employment taxes, which are essentially the full load of Social Security and Medicare taxes. Thats because the IRS imposes a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings. Typically, employees and their employers split that bill, which is why employees have 6.2% and 1.45%, respectively, held from their paychecks. Self-employed people, however, pay the whole thing. A 0.9% additional Medicare tax may also apply if your net earnings from self-employment exceed $200,000 if youre a single filer or $250,000 if youre filing jointly. Because you may not be receiving a traditional paycheck, you may need to file estimated quarterly taxes in lieu of withholdings.

Find Cheap Medicare Plans In Your Area

Medicare tax is a deduction from each paycheck to pay for Medicare Part A, which provides hospital insurance to seniors and people with disabilities. The total tax amount is split between employers and employees, each paying 1.45%. High-income earners pay a slightly higher percentage, and those who are self-employed pay the tax with their quarterly filings.

Also Check: What Age Do You Draw Medicare

Social Security And Medicare Tax Withholding Rates And Limits

| Tax | |

| Earnings over $200,000 in 2021 | |

| 0.9%, no employer contribution | Earnings over $200,000 in 2022 |

Employees are no longer required to pay the Social Security tax in a given year when their earnings hit the contribution and benefits base, often referred to as the taxable maximum. Youand your employerwould pay the Social Security tax on only the first $147,000 in 2022 if you earned $150,000, for example. That remaining $3,000 is Social Security tax-free.

The Social Security tax will apply again on January 1 of the new year until your earnings again reach the taxable minimum.

The Medicare taxes work somewhat in reverse. All income is subject to Medicare taxation, but the Additional Medicare Tax does not apply until after your income reaches a certain threshold: $200,000 for individual taxpayers in 2021 and 2022.

Will Inheritance Affect My Medicare Benefits

Medicare is a government program thats designed to help make paying for health care easier for eligible Americans. You can apply for Medicare the year you turn 65, though its also possible for certain younger people to qualify. If youre set to inherit money from aging parents or anyone else, you may be wondering if your inheritance will affect your Medicare benefits. The short answer is no, but receiving a financial windfall could affect what you pay for coverage. Receiving an inheritance can have other affects on your personal finances, so it may be a good idea to speak with a financial advisor. Try using SmartAssets free advisor matching tool to find advisors that serve your area.

Read Also: How To Change Medicare Direct Deposit

Who Can Use Medicare Easy Pay

Anyone who pays a Medicare Part A or B premium can sign up for Easy Pay at any time. To set up Easy Pay, you can contact Medicare for the appropriate form, or it can be printed online.

Once the form is submitted, however, ongoing participation in the Easy Pay program does not require Internet access.

You must have a bank account set up for the automated monthly payments to be withdrawn from.

Do You Get Your Medicare Tax Back

To claim a refund of Social Security and Medicare taxes, you will need to complete and submit IRS Form 843. When you apply for a refund from the IRS, include either: A letter from your employer stating how much you were reimbursed. A cover letter attesting that your employer has refused or failed to reimburse you.

Also Check: What Is The Difference Between Medigap Insurance And Medicare Advantage

The Bottom Line For Medicare Recipients

If you are a Medicare recipient, you have several ways to access free COVID-19 testing. First, you can go through your medical provider and ask them to order a test for you. You can order four free rapid COVID-19 tests online through www.covidtests.gov. More than 20,000 community testing sites offer COVID tests to seniors free of charge. If you have Medicare Advantage your plan may already offer free access to at-home COVID testscontact your plan provider to find out.

Finally, you can wait until rapid tests are available through local pharmacies and medical providers in early spring. Watch local news coverage or check at CMS.gov for information about the anticipated rollout of this new program.

How Fica Taxes Are Paid

You, the employee, pay half the FICA taxes, which is what you see deducted on your pay stub. Your employer must match these amounts and pay the other half to the government separately at regular intervals.

Independent contractors don’t have FICA taxesor income taxeswithheld from payments made to them, but they must nonetheless pay them. They must pay both halves of Social Security and Medicare as the self-employment tax.

Don’t Miss: Do I Need To Pay For Medicare

Until Then Request Four Free Over

In a statement issued Feb. 3, the Centers for Medicare & Medicaid Services said it will provide free over-the-counter rapid COVID-19 tests through “eligible pharmacies and other participating entities” beginning in the early spring.

Medicare beneficiaries have several other channels through which they can obtain free COVID-19 tests while waiting for the early spring rollout of this program.

The new policy will apply to over-the-counter COVID-19 tests approved by the Food and Drug Administration and covers anyone enrolled in either Original Medicare or Medicare Advantage . Once the program is active you will be able to pick up as many as eight tests per month for free.

How Do I Handle Overpayments Or Underpayments For The Medicare Tax

Employers have to withhold the appropriate taxes from your wages. Its the law. If you think your employer isnt doing this or you have concerns, contact the IRS directly at 800-829-1040.

Ultimately, though, income tax is your responsibility. Even if your employer isnt doing what they should, the IRS still expects you to cover your portion of the FICA taxes.

If you dont pay the FICA taxes or have them withheld from your paycheck, then you may not be eligible for Medicare, Social Security or unemployment benefits.

You May Like: Does Medicare Cover Full Body Scans

How Are Social Security And Medicare Withholdings Calculated For Employees

To calculate FICA tax contribution for an employee, multiply their gross pay by the Social Security and Medicare tax rates. For example, if an employees taxable wages are $700 for the week, their social security contribution would be: $700.00 x 6.2% = $43.40. These are also the amounts the employer would pay.

What Is The Additional Medicare Tax Used For

Even though it has Medicare in the name, the Additional Medicare Tax paid by high-income earners is used to offset the costs of the Affordable Care Act , according to the IRS.

In 2021, a total of about $12.3 billion is expected to be paid on employee earnings in excess of $200,000. These funds are used for the provisions of the ACA, including providing health insurance tax credits to make health insurance more affordable for more than 9 million people.

Recommended Reading: When Can You Have Medicare

Example Of How The Additional Medicare Tax Works

Single individuals can have a maximum income of $200,000 before they are subject to the Additional Medicare Tax. Should the cumulative income exceed that amount, they will then be required to pay the Additional Medicare Tax amount .

All wages currently subject to the Medicare Tax are also subject to the Additional Medicare Tax. An individual owes Additional Medicare Tax on all cumulative wages, compensation, and self-employment income that exceeds the threshold for their filing status.

What Is The Medicare Tax Rate

The 2020 rate for the Medicare tax is 1.45% for employers and 1.45% for employees. However, this rate varies depending on your annual income.

You can expect to be taxed at the 1.45% rate if you fall under the following categories:

-

For Single Taxpayers: The first $200,000 of your wages

-

For Married Taxpayers Filing Jointly: The first $250,000 of your wages

-

For Married Taxpayers Filing Separately: The first $125,00 of your wages

If your earnings exceed those amounts in your category, an additional 0.9% will be added to your Medicare tax for everything you earn above the threshold, totaling a 2.35% tax rate.

If you are self-employed, the 2020 Medicare tax rate is 2.9% on the first $137,700 of your yearly earnings. Dont forget to check the rates and income thresholds for your current tax year, as necessary.

Don’t Miss: What Does Medicare Cost Me

Fica Tax Rates And The Benefits They Fund

David J. Rubin is a fact checker for The Balance with more than 30 years in editing and publishing. The majority of his experience lies within the legal and financial spaces. At legal publisher Matthew Bender & Co./LexisNexis, he was a manager of R& D, programmer analyst, and senior copy editor.

Most W-2 employees’ pay stubs detail the taxes and deductions that are taken from their gross pay. You’ll almost certainly see two items among these deductions, in addition to federal and state or local income taxes: Social Security and Medicare taxes. These taxes are part of the Federal Insurance Contributions Act tax, a group of payroll taxes that are collected from both the employer and the employee.

An Additional Medicare Tax can be deducted from some employees pay as well. After federal and state income taxes, Social Security and Medicare, or FICA taxes, make up the bulk of taxes that are routinely withheld from your paychecks.

How Do I Know If Im Enrolled In Medicare Easy Pay

When processing for Medicare Easy Pay is complete, you will receive what looks like a Medicare Premium Bill, but it will be marked, This is not a bill. This is just a statement notifying you that the premium will be deducted from your bank account.

From that point on, you will see your Medicare premiums deducted from your bank account automatically. These payments will be listed on your bank statement as Automatic Clearing House transactions, and occur around the 20th of each month.

Read Also: Where Do I Apply For Medicare Card

How To Obtain Free Tests Now

Until free tests are available at local pharmacies and medical providers, Medicare beneficiaries can access free tests through a number of different channels, including by:

- Requesting four free over-the-counter tests for home delivery at covidtests.gov.

- Accessing COVID-19 tests through healthcare providers at over 20,000 free testing sites nationwide.

- Accessing free lab-based COVID-19 PCR tests and antigen tests performed by a laboratory when the test is ordered by a physician, non-physician practitioner, pharmacist, or other authorized health care professional at no cost.

- Medicare beneficiaries can also access one free lab-performed test without an order during the public health emergency.

- Medicare Advantage plans may offer coverage and payment for over-the-counter COVID-19 tests as a supplemental benefit in addition to covering Medicare Part A and Part B benefits, so Medicare beneficiaries covered by Medicare Advantage should check with their plan to see if it includes such a benefit.

All Medicare beneficiaries with Part B coverage are eligible for the new benefit, whether they are enrolled in a Medicare Advantage plan or not.