Medicare Medicaid And Billing

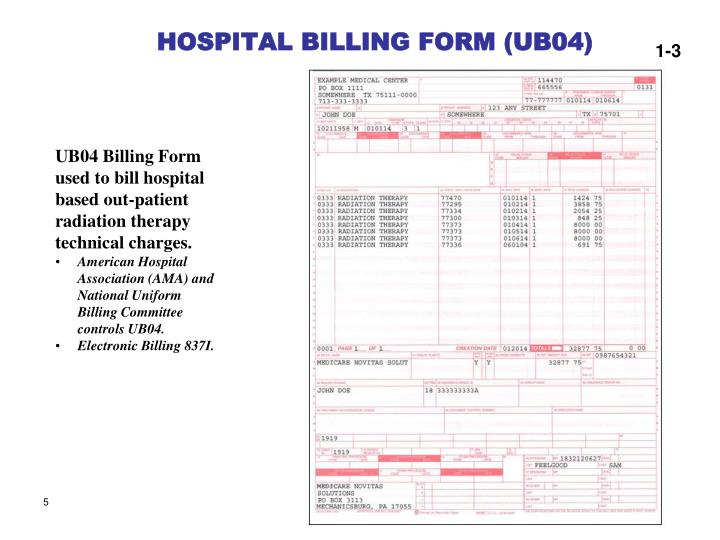

Like billing to a private third-party payer, billers must send claims to Medicare and Medicaid. These claims are very similar to the claims youd send to a private third-party payer, with a few notable exceptions.

Since these two government programs are high-volume payers, billers send claims directly to Medicare and Medicaid. That means billers do not need to go through a clearinghouse for these claims, and it also means that the onus for clean claims is on the biller.

What Information Do You Need To Fill Out This Form

Medicare will need you to fill out a patient request form with some basic information about yourself as well as the service or medical item you are filing about. Youll need to provide:

- Your name, date of birth, address and phone number

- Your Medicare number

- A description of the illness, injury or service for which you received treatment

- An itemized bill

- If applicable, youll also need to provide information about any health insurance coverage you have outside of Medicare, including a policy number.

Find Cheap Medicare Plans In Your Area

Medicare reimbursement is the process by which a doctor or health facility receives funds for providing medical services to a Medicare beneficiary. However, Medicare enrollees may also need to file claims for reimbursement if they receive care from a provider that does not accept assignment. In this case, some documents would be required to receive full reimbursement for a health procedure.

Don’t Miss: Is Passport Medicaid Or Medicare

Medicare Claims And Reimbursement

In most cases, you wont have to worry about filing Medicare claims. Here are some situations where you might or might not need to get involved in the claim process.

- If you have Original Medicare, Part A and/or Part B, your doctor and supplier are required to file Medicare claims for covered services and supplies you receive. If your doctor or the supplier doesnt file a claim, you can call Medicare at 1-800-MEDICARE . TTY users can call 1-877-486-2048. Phone representatives are available 24 hours a day, seven days a week.

- The process is a bit different when it comes to Medicare insurance plans like Medicare Advantage plans. Under the Medicare Advantage program, providers typically dont file claims with Medicare, because Medicare pays these Medicare-approved insurance companies a fixed monthly amount. If you go outside of the plans network for services, however, you may have to file a claim with the health insurance plan, not with the Medicare program. If you have questions or concerns about claims, contact your Medicare Advantage insurance company.

Any Medicare claims must be submitted within a year of the date you received a service, such as a medical procedure. If a claim is not filed within this time limit, Medicare cannot pay its share.

What Do I Do If My Doctor Does Not Accept Medicare

You can choose to stay and cover the costs out-of-pocket, but this is not an affordable option for most Americans. Instead, you can ask your doctor for a referral to another healthcare provider that does accept Medicare, do your own research, or visit an urgent care facility. Most urgent care offices accept Medicare.

Don’t Miss: Does Medicare Part B Cover Prolia Shots

How Long Do I Have To File A Claim

Original Medicare claims have to be submitted within 12 months of when you received care. Medicare Advantage plans have different time limits for when you have to submit claims, and these time limits are shorter than Original Medicare. Contact your Advantage plan to find out its time limit for submitting claims.

You Should Only Need To File A Claim In Very Rare Cases

Medicare claims must be filed no later than 12 months after the date when the services were provided. If a claim isn’t filed within this time limit, Medicare can’t pay its share. For example, if you see your doctor on March 22, 2019, your doctor must file the Medicare claim for that visit no later than March 22, 2020. Check the “Medicare Summary Notice” you get in the mail every 3 months, or log into your secure Medicare account to make sure claims are being filed in a timely way.

Also Check: How Do I Choose The Best Medicare Advantage Plan

How Do I File A Medicare Claim

Medicare beneficiaries occasionally have to submit their own healthcare claims instead of relying on a provider to submit them. | Photo credit: Helloquence | Unsplash

Q: How do I file a healthcare claim with Medicare or my insurer?

A: Medicare beneficiaries occasionally have to submit their own healthcare claims instead of relying on a provider to submit them. Heres what you need to know about filing a Medicare claim.

When You May Need To File A Medicare Claim

With Original Medicare you might need to file a Medicare claim if:

- Your health provider or supplier cant file a claim

- Your health provider or supplier wont file a claim

- Your health provider or supplier isnt enrolled in Medicare

Check your Medicare Summary Notice issued every month to see whether you have outstanding claims. In most cases, your health provider will resolve these if you bring them to their attention. However, if they are unable to or simply refuse, you will need to file your own Medicare claim.

Don’t Miss: Who Pays For Part A Medicare

How To Submit A Claim

Need to submit a claim? Download and complete the appropriate form below, then submit it by December 31 of the year following the year that you received service. . If you have questions, please contact your local Blue Cross and Blue Shield company.

If you use a provider outside of our network, you’ll need to complete and file a claim form to be reimbursed. Use this form to submit a health benefit claim for services that are covered under the Blue Cross and Blue Shield Service Benefit Plan. Submit a separate claim for each patient.

- Complete the form following the instructions on the back.

- Include itemized bills for covered services or supplies.

- Print and mail the form to the Blue Cross and Blue Shield company in the state that the services were rendered by December 31 of the year following the year you received service. Find your local company’s address.

Use this form to submit a claim to be reimbursed for services that are covered under Service Benefit Plan dental benefits. Submit a separate claim for each patient.

- Download the dental claim form: English

- Complete the form following the instructions on the back.

- Print and mail the form to your local Blue Cross and Blue Shield company by December 31 of the year following the year you received service. Find your local companys address.

Use this form to submit a claim to be reimbursed for paying Medicare Part B premiums. Submit a separate claim for each member.

What Should I Do If My Provider Doesnt File My Claim

Before receiving care, ask your providers office whether they will submit your bill to Original Medicare. While they arent required to do so, some non-participating providers will still file your claims with Medicare.

The same situation applies for Medicare Advantage enrollees who see out-of-network providers. These providers dont have to file claims with your Advantage plan, but may choose to do so.

If you have Original Medicare and a participating provider refuses to submit a claim, you can file a complaint with 1-800-MEDICARE. Regardless of whether or not the provider is required to file claims, you can submit the healthcare claims yourself. You can file an Original Medicare claim by sending a Beneficiary Request for Medical Payment form and the providers bill or invoice to your regional Medicare Administrative Contractor . Keep copies of everything you submit.

, Home Health Advance Beneficiary Notice, or Skilled Nursing Advance Beneficiary Notice if they believe Medicare will not cover your care. Providers normally will not bill Medicare after they issue an ABN.

You have the right to demand bill, which is when you demand that the provider or facility submit a claim to Medicare for your care. In order to demand bill, you must sign the ABN and agree to pay the charges if Medicare denies coverage. Demand billing can be used to generate a formal Medicare coverage denial, which gives you further appeal rights.)

Also Check: Is Unitedhealthcare Dual Complete A Medicare Plan

If You Have A Medigap Policy Or Retiree Plan

Your Medigap company or retiree plan receives claims for your services 1 of 3 ways:

Note: You may need to pay a provider bill before you get your quarterly MSN. In this case, check your MSN when you receive it to see if you overpaid. If so, call your provider to request a refund. If you have any questions about the bill, call your provider. You can also contact your local Health Insurance Counseling & Advocacy Program office online or at 1-800-434-0222.

You will also receive an Explanation of Benefits from your Medigap company or retiree plan. The EOB will show you how much was paid. If you dont receive an EOB within 30 days of the service date, call your plan to ask about the status of your claim.

Follow these pointers when you call to discuss your claims.

Claiming On Medicare Supplement Insurance

Medicare supplement insurance, or Medigap, is a privately administered plan that may help an individual with traditional Medicare meet their out-of-pocket expenses. However, new Medigap plans do not cover the Part B deductible.

There are 10 standardized Medigap insurance plans. An individual can compare different Medigap plans on the Medicare website. The states of Massachusetts, Minnesota, and Wisconsin standardize their plans differently.

If an individual has traditional Medicare and a Medigap plan, the law requires that a healthcare provider files claims for their services. An individual should not need to file a claim for reimbursement.

People should present their Medicare and Medigap cards together when they receive a healthcare service. Medicare must approve the traditional Medicare claim first before they approve pay from Medigap.

If the provider does not submit a claim, an insured person must submit a Medigap claim. To do so, they should:

Request a claim form from the insurance company. Complete the form and attach copies of itemized bills from the service provider. Include a copy of the MSN, which details the bills. Submit the claim to the private insurance company that administers the Medigap plan.

Read Also: What Is The Best Medicare Part D Plan For 2020

Avoiding The Need For Claims

Make sure that your doctor accepts Medicare assignment. For Original Medicare, Part A and Part B, this means that your doctor or provider agrees to be paid by Medicare, and that they accept the Medicare-approved amount for a particular service. When your doctor accepts Medicare assignment, it also means she or he agrees not to bill you for more than the Medicare deductible and/or coinsurance. Private insurance companies contracted with Medicare may bill Medicare differently.

If your health-care provider doesnt accept Medicare assignment, you may have to pay the full cost for the service up front, and get reimbursed by Medicare. You also might have to pay more than the Medicare-approved amount. In most cases, the doctors office should file the reimbursement claim for you. If you have to file your own claim, see below.

You May Like: How Is Part B Medicare Premium Determined

Other Reasons To File A Claim

In addition to the above reasons, an individual may also file a claim if the treating doctor delayed submitting the claim. Also, if the doctor or healthcare provider refused to submit a claim or if they were unable to file the claim, a person can complete the form.

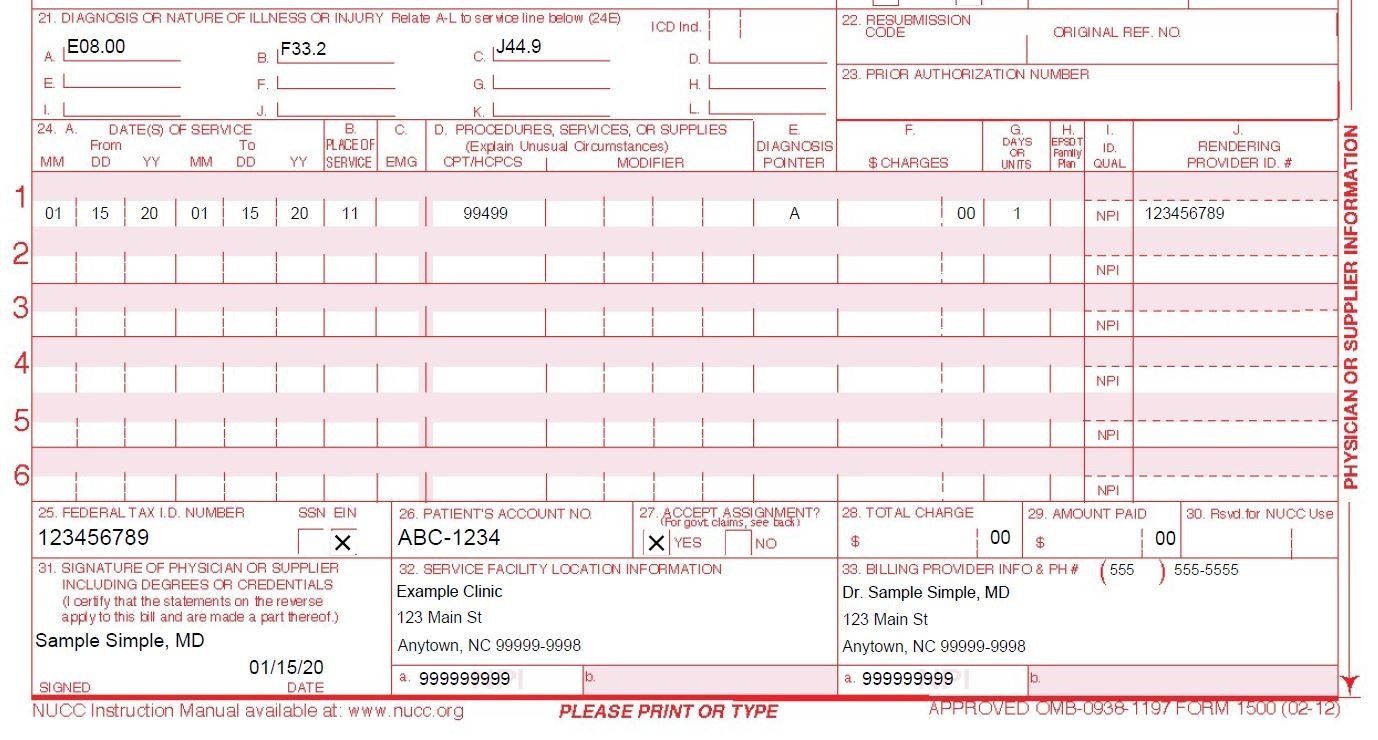

To file a Medicare claim, a person needs to download and print the CMS form #14906, which is the patient request for medical payment. The form should be completed in full.

The following information will usually need to be sent with the form:

- Medicare ID number

- doctor or healthcare providers name and billing address

- date and place of service

- charges for each service and itemized bill

It is a good idea for a person to make a copy of all the forms and documents, and keep the information with their own records.

A person will then send the completed form to the Medicare administrative contractor in their state. The patient request for medical payment form usually has the contractors details or a person can call Medicare 1-800-MEDICARE for the address.

After a person submits the form, Medicare may take up to 60 days to process and review the claim.

You May Like: Does Medicare Cover A1c Test

Medicare Reimbursement For Medicare Prescription Drug Coverage

Original Medicare does not typically cover prescription drugs you take at home. If you want this kind of coverage, you need to enroll in a stand-alone Medicare Part D Prescription Drug Plan. Or you can enroll in a Medicare Advantage Prescription Drug plan as an alternative way to get your Original Medicare benefits, and thus get all of your Medicare coverage through a single plan. You still need to pay your monthly Medicare Part B premium, in addition to any premium the Medicare Advantage plan may charge.

If you have a Medicare Prescription Drug Plan or Medicare Advantage Prescription Drug plan that doesnt cover a prescription medication your doctor prescribes, you can file an appeal. However, you might first want to speak with your doctor to see if any prescription drug your plan does cover can be substituted.

This website and its contents are for informational purposes only. Nothing on the website should ever be used as a substitute for professional medical advice. You should always consult with your medical provider regarding diagnosis or treatment for a health condition, including decisions about the correct medication for your condition, as well as prior to undertaking any specific exercise or dietary routine.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

Types Of Provider And How They Assign Out

A healthcare provider can have one of the following statuses in relation to Medicare reimbursement:

- A Medicare-certified provider: Providers can accept assignments from Medicare and submit claims to the government for payment of their services. If an individual chooses a participating provider, they must pay a 20% coinsurance.

- A non-participating provider: These providers have not signed an agreement with Medicare to accept assignments, but they can choose to accept individual patients. They can choose to charge more than the Medicare reimbursement amount for a particular service.

- An opt-out provider: An individual may still be able to visit a healthcare provider who does not accept Medicare. However, they may have to pay the full cost of treatment upfront and out-of-pocket.

Choosing a Medicare-approved healthcare provider means that a person is only responsible for the relevant out-of-pocket cost.

Don’t Miss: Will Medicare Pay For A Bedside Commode

The Cares Act Of 2020

On March 27, 2020, President Trump signed a $2 trillion coronavirus emergency stimulus package, called the CARES Act, into law. It expanded Medicare’s ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increases flexibility for Medicare to cover telehealth services.

- Increases Medicare payments for COVID-19ârelated hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarifies that non-expansion states can use the Medicaid program to cover COVID-19ârelated services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

Who Normally Files A Claim

Typically, your Medicare claims should be sent directly from your provider to Medicare. Your provider will then be paid a reimbursement rate according to the programs regulations and legislation. Your medical provider is required by law to submit these claims so it is typically not your individual responsibility.

Enter your zip code above and make sure you have the best Medicare provider your state has to offer!

Recommended Reading: Does Medicare Cover Fall Alert Systems

How Hsa Distributions Are Taxed And Reported

If you use your HSA to buy a qualified medical expense, you will not have to pay income taxes on those funds. If you use your HSA for something other than a qualified medical expense, that distribution is taxable income. And you can be subject to a 20 percent penalty for early withdrawal. When an HSA account holder reaches the age of 65 or becomes disabled, they are no longer subjected to that 20 percent penalty.

In terms of reporting HSA tax information, the HSA trustee or custodian keeps all reports of distributions. The trustee then shares that information to the account owner through IRS Form 1099-SA. HSA account holders are responsible for reporting their own distributions to the IRS through Tax Form 8889. Its recommended that HSA owners keep records of all their distributions, in the event, they ever become audited by the IRS.

Mail Completed Form And Supporting Documents To Medicare

Submit your completed Patients Request for Medical Payment form, itemized medical bill or bills, and any supporting documents to your states Medicare contractor. All claims must be submitted by mail you cant file a Medicare claim online. You can find the mailing address for your states contractor in a number of ways:

- View the second page of the Medicare instructions for your Medicare claim type

- View your Medicare Summary Notice. If you dont have a hard copy on hand, you can view an electronic version when you log in to MyMedicare.gov

- Visit the CMS.gov website

The Medicare website can also answer many questions about filing a Medicare claim before you submit your paperwork. If you still have questions, contact Medicare and speak to a representative.

As a beneficiary, you have one calendar year after receiving medical services to file your Medicare claim. If you file your claim after 12 months has elapsed, it will probably be rejected.

Following the right steps will make sure your claim is approved in a timely fashion. We invite you to share this post with your social media contacts so they know how to correctly file a Medicare claim.

Recommended Reading: Is Medicare A Social Security Benefit