How Much Do Medicare Advantage Plans Cost

Here are some costs you may need to pay if you choose a Medicare Advantage plan:

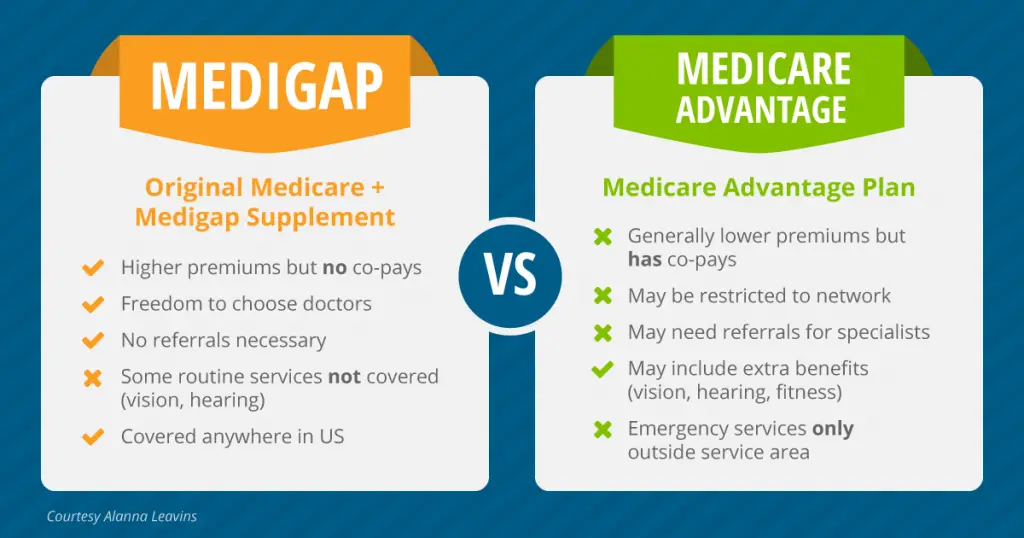

- Part B premium. Even if youre enrolled in Medicare Advantage, youre still responsible for paying the Part B premium. This amount can cost up to $170.10 per month. However, some Advantage plans cover a portion or even all of this premium cost.

- Coinsurance and copayments. Most Medicare Advantage plans charge a copayment or coinsurance amount for services rendered. These services could include a doctors office visit, specialists office visit, or even a prescription drug refill. Specific coinsurance and copayment amounts are set by the plan youre enrolled in.

- MedicareAdvantage plan costs. Medicare Advantage plans can charge a monthly premium thats separate from the Part B premium. Other Advantage plans may be premium-free. In addition, Advantage plans can charge separate drug and health plan deductibles.

Individual healthcare needs play a huge role in how much you may end up paying out of pocket for your Medicare Advantage plan. For example, your plan costs can be affected by:

- how often you seek services

- whether you visit out-of-network providers

- if you enroll in extra benefits

Original Medicare eligibility includes individuals who:

- are 65 years old or over

- have been receiving Social Security or Railroad Retirement Board disability benefits for 24 months

Medicare beneficiaries who are already enrolled in Medicare Part A and Part B are eligible to enroll in a Medicare Advantage plan.

S To Cancel A Medicare Advantage Plan

From January 1 to March 31, Medicare now calls this the Open Enrollment Period.

A more appropriate name would be the Disenrollment Period. Those without a plan cannot obtain one, so it is not open by any stretch.

If you wish to go from Medicare Advantage to a Medicare Supplement, here are the steps:

This process ensures that you do not prematurely cancel the only insurance you may be able to qualify for. By using an independent Medicare broker, like the Senior Savings Network, you can find out what Medicare Supplement companies will likely approve your application and guarantee that you will not be paying too much for the same coverage that is offered by all of the Medicare Supplement companies.

Medicare Advantage And Medicaid

You may be able to enroll in a Medicare Advantage plan when youre on Medicaid. For example, theres a type of Medicare Advantage plan called a Special Needs Plan, or SNP.

Special Needs Plans are geared for people in specific situations. One type of SNP is specifically for dual eligibles people eligible for both Medicare and Medicaid. Please note:

- Medicare SNPs cover the same services and supplies that all Medicare Advantage plans are required to cover.

- Make sure your doctor accepts Medicaid to make sure youre covered. Of course, the doctor must also accept Medicare assignment. Your Medicare Advantage plan should be able to help you find doctors who accept both.

- You need to be enrolled in both Medicare Part A and Part B to qualify for a Medicare Advantage plan. You must also live within the plans service area.

- With any kind of Medicare Advantage plan, in most cases you must continue paying your Medicare Part B premium. However, the Medicaid program might pay your premium.

Don’t Miss: Can We Apply For Medicare Online

Should I Use A Rapid At

The two main types of COVID-19 tests are rapid antigen tests and PCR tests. Antigen tests can be taken at home and return results in about 10 to 15 minutes. PCR tests are more accurate but require lab work and generally don’t provide results for at least 12 hours or even up to 5 days.

Both tests typically use nasal swab samples, though some collect saliva: PCR tests administered by a professional may require a nasopharyngeal sample that involves a much deeper nostril swab. Rapid antigen tests usually require swirling a swab in the nostril less than an inch deep.

PCR tests amplify genetic material from the collected sample up to a billion times to detect even the slightest amount of COVID-19 genes, making them highly accurate. They’re also more expensive, usually costing more than $100 apiece.

Rapid antigen tests simply detect the presence of COVID-19 antigens — the substances that prompt your immune system to create antibodies — and work much like home pregnancy tests. If your sample contains COVID-19 antigens, the thin line of SARS-CoV-2 antibodies on the test strip will change color.

Because rapid tests are simply looking for the existence of antigens, they work best when someone is symptomatic. Rapid antigen tests are less successful with early infections and asymptomatic cases. The risk of a false negative is much higher with a rapid test than a false positive.

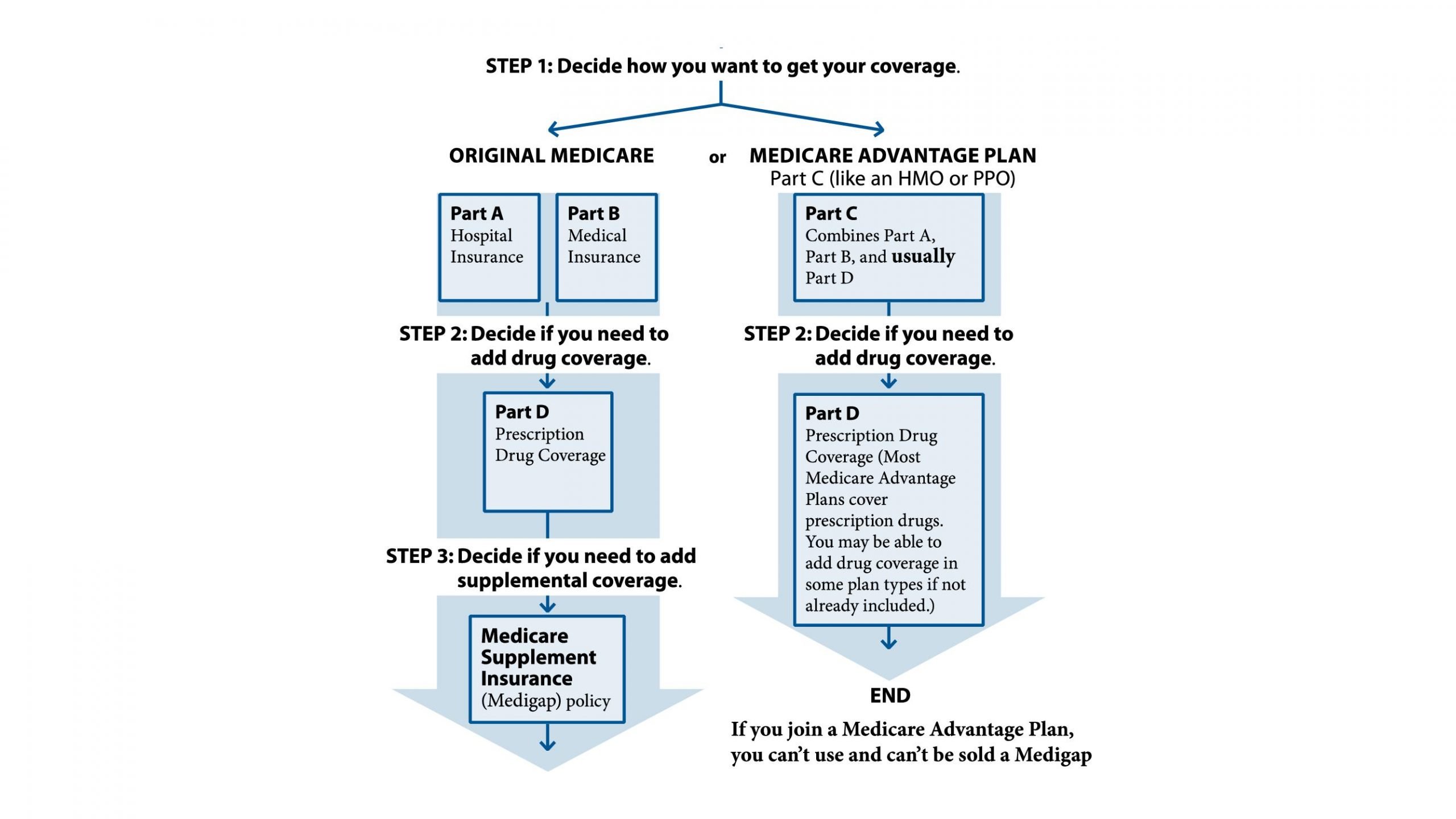

How Does Medicare Part C Work

Medicare Part C plans are sold by private insurance companies as an alternative to Original Medicare. Medicare Part C plans are required by law to offer at least the same benefits as Medicare Part A and Part B.

There are several different types of Medicare Advantage plans, such as HMO plans and PPO plans. Each type of plan may feature its own network of participating providers.

Don’t Miss: Can You Cancel Medicare Part B

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B . Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didnt sign up for it, unless you qualify for a “” .

If you dont enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a general enrollment period from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our publication for more information.

Enrolling In Original Medicare

If youre already receiving Social Security or Railroad Retirement Board benefits and youre a U.S. resident, the federal government automatically enrolls you in both Medicare Part A and Medicare Part B at age 65. Youll receive your Medicare card in the mail about three months before you turn 65, and your coverage will take effect the first of the month you turn 65.

Medicare Part B has a monthly premium, which will be deducted from your Social Security or Railroad Retirement check. The standard Part B premium is $170.10/month for 2022. Thats up from $148.50/month in 2021, and quite a bit higher than initially projected in the Medicare Trustees Report projects. But the Social Security cost-of-living adjustment for 2022 is the largest its been in 30 years, and will cover the increase in Part B premiums . However, the larger-than-expected increase in Part B premiums will eat up a significant portion of the Social Security COLA that many beneficiaries receive.

You can opt out of Part B and avoid the premiums, but its generally only a good idea to do that if youve got health insurance from your current employer or your spouses current employer, and the employer has at least 20 employees.

If youre disabled and receiving Social Security Disability benefits, your Medicare coverage will start automatically in the 25th month that youre receiving disability benefits.

Also Check: Who Must Enroll In Medicare

Improving The Medicare Customer Journeyyour Browser Indicates If You’ve Visited This Link

In laymen’s terms, you need to understand your customer base. And it’s no different in the Medicare space, which primarily serves the health care needs of America’s aging population . The senior population has grown drastically over the years: The number of Americans that are ages 65+ is projected to almost double from 52 million in 2018 to 95 million by 2060,

Think Advisor

Who Can Join A Medicare Advantage Plan

You can generally join one of these Medicare Advantage Plans:

If all of these apply:

- You live in the service area of the plan you want to join. The plan can give you more information about its service area. If you live in another state for part of the year, ask if the plan will cover you there.

- You have Medicare Part A and Part B.

- You’re a U.S. citizen or lawfully present in the U.S.

| Note |

|---|

|

Starting January 2021, people with ESRD can choose either Original Medicare or a Medicare Advantage Plan when deciding how to get Medicare coverage. Learn more. |

Don’t Miss: Does Medicare Cover Dental Root Canals

How To Enroll In A Medicare Advantage Plan: Understand When You Can Sign Up

Medicare Advantage plans have certain enrollment periods.

- When youre first eligible for Original Medicare, Part A and Part B, you get an enrollment period called the Initial Enrollment Period . That period spans seven months. It starts three months before your birthday month, includes the birthday month, and continues three more months.

- If you delay Part B enrollment, however, you cant enroll in a Medicare Advantage plan during your IEP. Thats because you have to have both Part A and Part B to qualify for Medicare Advantage. But you can typically get another enrollment period when you do sign up for Part B. Its called the Initial Coverage Election Period.

- Another enrollment period that comes up every year is the Fall Open Enrollment, also called the Annual Election Period. It goes from October 15 to December 7 every year. You can enroll in a Medicare Advantage plan, switch from one plan to another, or make certain other coverage changes. Read about the Medicare Annual Election Period.

- You can also get a one-time opportunity to switch between Medicare Advantage plans. Read about the Open Enrollment Period for Medicare Advantage.

- There may be situations where you qualify for a Special Election Period to enroll in a Medicare Advantage plan.

What Is Covered Under Medicare Part C

Medicare Part C plans provide all of the same benefits as Original Medicare. Most Medicare Advantage plans also offer prescription drug benefits, which Original Medicare doesn’t cover.

Some Medicare Advantage plans may also offer a number of additional benefits that can include coverage for things like:

You May Like: How Much Medicare Is Taken Out Of Social Security Check

Medicare Part D Prescription Drug Coverage

2022 Part D premiums:

- The average premium for stand-alone Medicare Part D coverage is about $43/month in 2022. There continue to be a wide range of Part D plan options available. Premiums for Part D plans start as low as about $7/month in 2022. On the higher end, plans can have premiums of up to $100/month or more, so there is a great deal of variation in price and benefits across the available plans.

- High-income enrollees pay a higher Part D premium. The threshold for high-income began to be indexed as of 2020. The income threshold for 2022 is $91,000 for a single person and $182,000 for a couple . In 2022, the additional premium for high-income enrollees ranges from $12.40/month to $77.90/month.

Part D deductible:

- Maximum of $480 in 2022, up from $445 in 2021. .

Part D out-of-pocket costs after deductible:

- Not to exceed 25% of the cost of brand-name and generic costs.

- There is no longer a donut hole in terms of the maximum amount that enrollees can be charged when they fill prescriptions. But the donut hole still exists in terms of how insurers design their coverage , how total drug costs are counted, and who covers the bulk of the cost of the drugs .

- After a beneficiarys costs reach the catastrophic coverage threshold , additional out-of-pocket costs are capped at the greater of 5% of the cost of the drug or a copay of $3.95 for generics and $9.85 for brand-name drugs.

Learn more about Medicare Part D.

How Do I Enroll In A Medicare Advantage Plan

En español | You must first enroll in original Medicare and then switch into the separate Medicare Advantage program, which is an alternative to original Medicare.

You can review the Medicare Advantage plans sold in your area by using Medicare’s online Plan Finder program at www.medicare.gov/find-a-plan/questions/home.aspx. For individual assistance, call Medicare at 800-633-4227 or contact your local State Health Insurance Assistance Program at 877-839-2675 or go to www.shiptacenter.org/.

If you are not joining Medicare for the first time, you have to wait until the annual open enrollment period from Oct. 15 through Dec. 7 in order to enroll in a Medicare Advantage plan. Your new coverage will begin Jan. 1 of the following year.

Read Also: Does Medicare Offer Gym Memberships

Are Medicare Advantage Plans The Same As Medicare Supplements

A Medicare Advantage plan is not a supplement to Original Medicare. Supplements to Medicare are called Medicare Supplements or Medigap plans.

These plans are additional insurances that have premiums. Original Medicare is your primary coverage then these plans help fill the gaps. They do not include drug coverage. You must take a Part D plan to receive drug coverage if you choose this path.

How To Find Plans That Offer The Giveback Benefit

Not all MA plans offer this benefit, so you must find a plan that does to take advantage of the savings opportunity.

To enroll in an MA plan, you must live within its service area. This means you may have a limited number of options, or the reduction program may not be offered by plans in your area.

You can use Medicare’s Plan Finder to find plans in your area that offer the giveback benefit. If you look under the “premiums” section in the Plan Details, plans with a giveback will have a “Part B premium reduction” listing and amount. This tells you the plan offers this program, as well as how much you’ll receive each month.

Depending on how many Medicare Advantage plans are offered in your area, this may take considerable time. Some zip codes only have a few, while others have literally dozens. You can save time and get all of your Medicare questions answered by calling us toll-free at 1-855-537-2378 and speaking to one of our knowledgeable, licensed Medicare agents. They’ll help you compare your plan options, including the full out-of-pocket cost, make sure the plan you choose includes your prescriptions, and much more.

Also Check: How Do I Know What Medicare Coverage I Have

How Much Does Medicare Pay Ma Plans

The exact amount Medicare pays these private carriers gets a bit complex, but itâs based on a bidding process and a risk adjustment. The funding is different for each county.

Medicare is mainly funded by payroll taxes, so ultimately, all of us are funding the Medicare Advantage plans that offer a $0 monthly premium.

Make Changes To Your Medicare Plan Coverage During The Right Time Of Year

One especially useful time to review your Medicare coverage is during the fall Annual Enrollment Period, or AEP.

The Medicare AEP lasts from every year. During this time, Medicare beneficiaries may do any of the following:

- Change from Original Medicare to a Medicare Advantage plan

- Change from Medicare Advantage back to Original Medicare

- Switch from one Medicare Advantage plan to another

- Enroll in or drop Medicare Part D coverage

- Switch from one Part D plan to another

Outside of AEP, your opportunities to make changes to your Medicare plan can be limited.

Another time you may be able to change your Medicare plan include:

- Special Enrollment Periods You could potentially qualify for a Special Enrollment Period at any time throughout the year, if you meet one of a set of certain circumstances. This can include moving out of the area serviced by your current plan, losing your current plan because it is no longer offered in your area, and a number of other certain circumstances.

Don’t Miss: What Does Part A Of Medicare Pay For

Don’t Give Personal Information To Plan Callers

Medicare plans aren’t allowed to call you to enroll you in a plan, unless you specifically ask to be called. Also, plans should never ask you for financial information, including credit card or bank account numbers, over the phone.

No one should call you without your permission, or come to your home uninvited to sell Medicare products. Call 1-800-MEDICARE to report a plan that does this. Learn more about how to prevent Medicare fraud and abuse.

Does Medicare Pay For Uber

In the last few years, popular ridesharing services like Uber and Lyft provide transportation for Medicare beneficiaries with Advantage plans. Certain Medicare Advantage plans include Uber rides to and from doctors appointments.

Yet, this depends on your Medicare Advantage coverage. Its best to check with your provider to see if you have these benefits. Uber launched Uber Health in 2018, which allows people to book rides that their plan will cover. Since March 2020, Uber Health has collaborated with over 1,000 partners to improve customer experience and build new features. The future of Medicare Advantage transportation through ridesharing apps shows no signs of slowing down.

Recommended Reading: Does Medicare Pay For Skilled Nursing