Whats The Current Medicare Tax Rate

In 2021, the Medicare tax rate is 1.45%. This is the amount youll see come out of your paycheck, and its matched with an additional 1.45% contribution from your employer for a total of 2.9% contributed on your behalf.

| 2021 Medicare tax rate |

|---|

| Your employer pays | 1.45% |

For those who are self-employed, the full 2.9% must be paid by the individual, rather than splitting the tax with an employer. This tax toward Medicare is included in the self-employment tax that is paid quarterly through estimated tax payments.

The self-employment tax amount is based on net earnings calculated using IRS form Schedule SE. Even though the tax rate is higher for the self-employed, its being paid on a smaller portion of income because the taxable income is 92.38% of net profit.

For high-income self-employed earners, the Additional Medicare Tax of 0.9% also applies for any income above the annual threshold.

| 2021 Medicare tax for self-employed | |

|---|---|

| Rate you pay on 92% of net earnings | 2.9% |

| Additional amount you pay on income above the annual threshold | 0.9% |

How To Complete Nashps Hospital Cost Calculator

Data Source/Resources Needed

A hospital-specific Medicare Cost Report is the only source of information needed to complete the National Academy for State Health Policys Hospital Cost Calculator.

See NASHPs new interactive Hospital Cost Tool, released in April 2022.

Download NASHPs Hospital Cost Calculator .

All Medicare-certified hospitals are required to file an annual MCR, using the Centers for Medicare & Medicaid 2552-10 format, comprised of a series of worksheets and schedules that describe a hospitals characteristics, financial information, costs, and charges.

The MCR includes hospital utilization data, costs and charges by cost centers and payers, related party and home office costs, and hospital reimbursements. In addition, it includes Medicaid cost, charges, and supplemental payments as reported by the hospital.

To gain access to a hospitals MCR, there are four possible options:

Why Use the Medicare Cost Report?

MCRs are required filings for Medicare-reimbursable facilities, such as hospitals, skilled nursing facilities, home health agencies, home offices, hospices, rural health clinics, federally qualified health centers, and comprehensive outpatient rehabilitation facilities. The facility must complete and file a cost report on a yearly basis, due five months after its fiscal year end. NASHPs Hospital Cost Calculator is designed for hospital reporting only, using CMS 2552-10 format.

How Can I Find Help To Set Up A Medicare Set

You can contact the Medicare Benefits Coordination & Recovery Center by calling 855-798-2627 for answers to many questions you may have about setting up a Medicare set-aside arrangement.

There are also many different professionals who can provide assistance in setting up your Medicare set-aside arrangement, including:

- private attorneys

- financial planners

- account administrators

It may be a good idea to get professional guidance, especially if your case is complex or your settlement amount is large.

An experienced professional can help you estimate the amount of your settlement that needs to go into your Medicare set-aside arrangement and get the account set up once it has been approved by Medicare.

If youd prefer to do it on your own, Medicare has a self-administration toolkit to guide you.

However, Medicare recommends that you use a professional if youre able. Properly managing your account helps make sure that Medicare will pay your figure claim after your Medicare set-aside arrangement runs out.

No matter how you manage your account, its a good idea to sign up for updates from Medicare.

Updates can provide you with important information and changes that affect Medicare and Medicare set-aside arrangement plans. You can use this link to enter your email and start receiving updates.

Don’t Miss: Is Bevespi Covered By Medicare

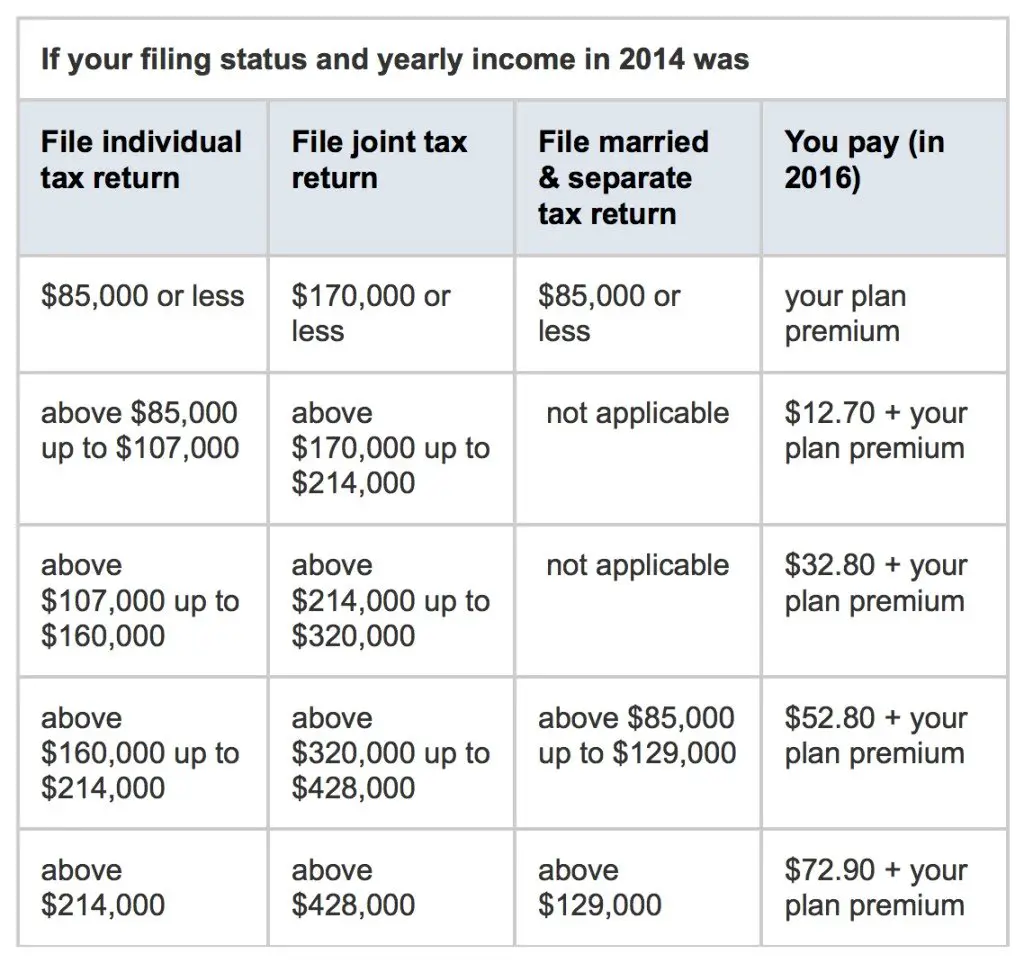

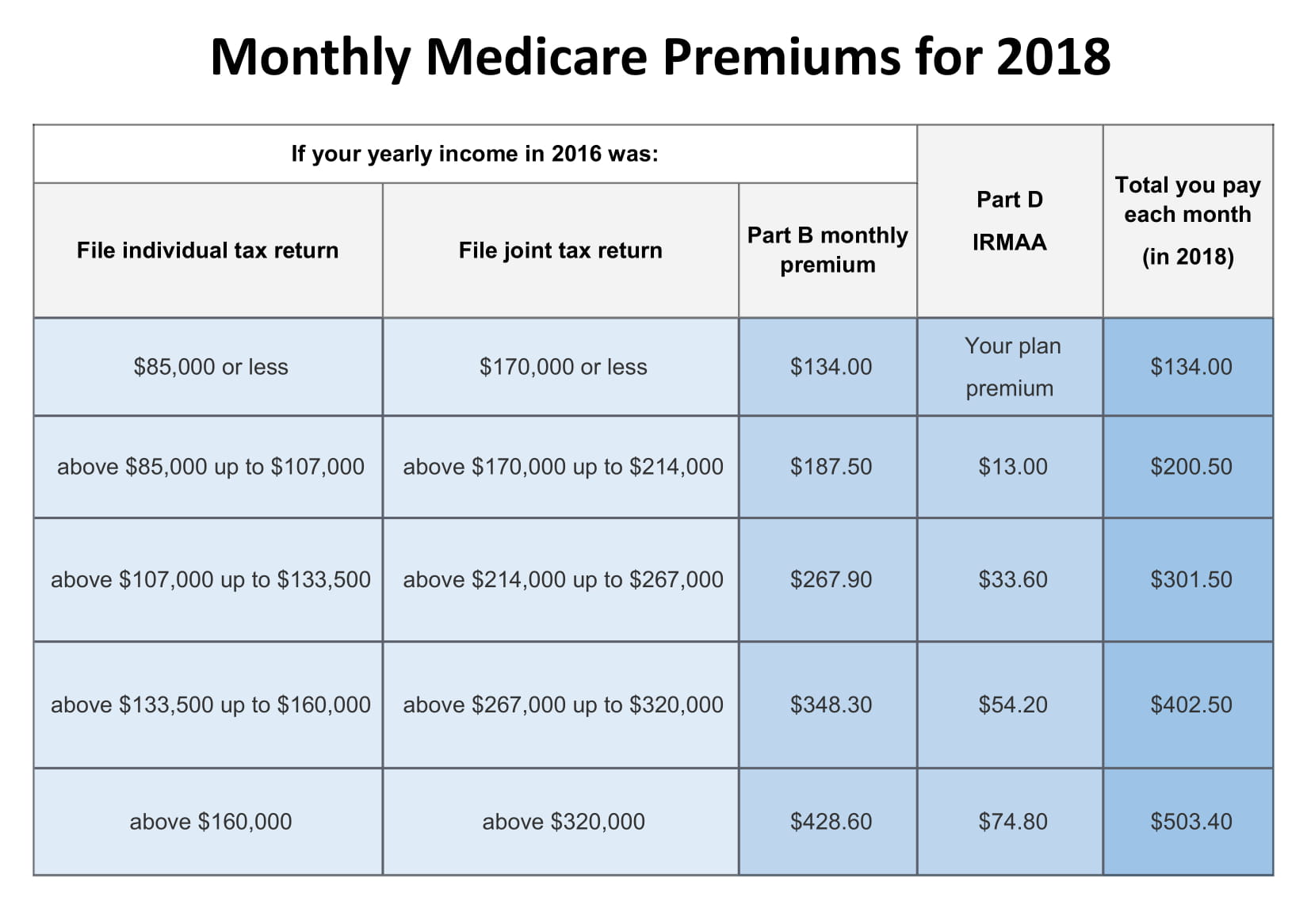

Medicare Part B Part D Irmaa Premium Brackets

September 14, 2021Keywords: AGI, health insurance, Medicare

Seniors age 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B that covers doctors services and Medicare Part D that covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount.

I havent seen any numbers that show how much collecting IRMAA really helps the government in the grand scheme. Im guessing very little. One report said 7% of all Medicare beneficiaries pay IRMAA. Suppose the 7% pay double the standard premium, it changes the overall split between the beneficiaries and the government from 25:75 to 27:73. Big deal?

The income used to determine IRMAA is your AGI plus muni bond interest from two years ago. Your 2020 income determines your IRMAA in 2022. Your 2021 income determines your IRMAA in 2023. The untaxed Social Security benefits arent included in the income for determining IRMAA.

* The last bracket on the far right isnt displayed in the chart.

How Do I Qualify For A Msa

CMS guidelines state that it will review new claims proposals for the following:

- The claimant is a Medicare beneficiary and the total settlement amount is greater than $25,000 or

- The claimant has a reasonable expectation of Medicare enrollment within 30 months of the settlement date and the anticipated total settlement amount for future medical expenses and disability/lost wages over the life or duration of the settlement agreement is expected to be greater than $250,000

Also Check: Does Medicare Have A Maximum Out Of Pocket

Add Extra Cancer Coverage

The lifetime risk of developing cancer is 1 in 2 for men and 1 in 3 for women. While Medicare covers medically necessary cancer costs, it doesnât help with non-medical expenses.

Examples of non-medical cancer costs include travel expenses, lodging, loss of income, experimental medications and trials, meals, counseling, clothing and hairpieces, and deductibles and copayments.

We recommend a lump-sum cancer policy to ensure youâre fully covered. The risks of cancer are high, and the insurance is very affordable. Thatâs why weâve added a small section to see what adding extra cancer coverage would mean for your total monthly premiums.

And hereâs what this section could look like once filled in:

Medicare Costs At A Glance

Listed below are basic costs for people with Medicare. If you want to see and compare costs for specific health care plans, visit the Medicare Plan Finder.

For specific cost information (like whether you’ve met your

, how much you’ll pay for an item or service you got, or the status of a

| 2021 costs at a glance | |

|---|---|

| Part A premium | Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $471 each month in 2021 . If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471 . If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259 . |

| Part A hospital inpatient deductible and coinsurance | You pay:

|

| Part B premium | The standard Part B premium amount is $148.50 . |

| Part B deductible and coinsurance | $203 . After your deductible is met, you typically pay 20% of theMedicare-Approved Amountfor most doctor services , outpatient therapy, anddurable medical equipment |

| Part C premium |

Also Check: Does Medicare Pay For Cialis

Medicare Cost Calculator 2022

Medicare can be confusing. Fortunately, we can make things simple!

Fill out our Medicare cost calculator to see just how much you will need to spend for different Medicare plans in your area.

If you are on mobile select Get quote to use the calculator.

How Does It Work?

Zipcode

Medicare plans vary greatly depending on your zip code and area. Make sure this is right to see accurate quotes.

Effective Date

The effective date is when you want the Medicare plan to start and when the first payment will be.

Plan Code

Which Medicare plan do you want? There is Plan A-N. If youre not sure, dont worry. You can change plans while looking at different rates and companies. The most popular plans are Plan F, G, & N.

Rates are higher for males. Sorry fellas.

Your age will determine the price of your Medicare plan for most types of plans. However, some are community-rated that give everyone the same rate regardless of age.

Nicotine Use

Rates are higher for smokers, but fortunately, not that much more.

Contact Info

Wed love to help and serve you when it comes to Medicare. Also know that we will never share your information with anyone, EVER. Only one person from Seniors Mutual will call you and thats it!

Summary

We take pride in showing instant online quotes comparing 15+ different Medicare plans and companies to you.

Most websites will make speak to someone to get quotes, but we are very transparent.

We look forward to speaking with you.

FAQs

Medicare Part A Costs Are Not Affected By Your Income Level

Your income level has no bearing on the amount you will pay for Medicare Part A . Part A premiums are based on how long you worked and paid Medicare taxes.

Medicare Part A premium costs in 2022 are as follows:

2022 Medicare Part A Premium Cost|

Number of quarters you paid Medicare taxes |

2022 Medicare Part A monthly premium |

|---|---|

|

40 or more |

|

|

$499 |

Most Part A beneficiaries qualify for premium-free Part A coverage.

Two of the Medicare Savings Programs that may help pay Part A premium costs for qualified individuals include:

- Qualified Medicare Beneficiary Program

- Qualified Disabled and Working Individuals Program

Medicare Advantage and Medigap costs by income level

Medicare Part C plans and Medicare Supplement Insurance plans are sold by private insurance companies. The cost of plans can vary from one provider to the next.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Read Also: Who Is The Medicare Coverage Helpline

Calculating Costs For Home Health Agencies

Unlike inpatient costs, which analysts calculate by day or based on the patients length of stay, analysts calculate HHA costs per visit. HHAs can be freestanding, hospital-based, or SNF-based, and for each type of HHA, the method for calculating costs is the same. Analysts use the HHA cost reports for freestanding HHAs and use the HHA subprovider worksheets from the hospital and SNF cost reports for the hospital-based and SNF-based HHAs, respectively. The HHA cost report version has not been updated since 1994 , whereas the hospital and SNF cost reports have both 1996 and 2010 versions.

How Does Social Security Determine Whether You Pay Extra

The Social Security Administration bases the IRMAA determination on federal tax return information received from the IRS. The adjustment is calculated using your modified adjusted gross income from two years ago. In 2022, that means the income tax return that you filed in 2021 for tax year 2020.

If Social Security determines you have to pay higher premiums, they send you a letter detailing what your premium will be and how they arrived at their decision. If you have both Part B and Part D, you’ll pay a higher premium for each. But if you only have one, you’ll only owe the adjusted amount on the “part” you have. If later in the year you sign up for whichever part you don’t currently have, the adjusted amount is automatically added and you will not receive a second notification.

Again, less than 5 percent of Medicare beneficiaries owe the IRMAA surcharge.

Recommended Reading: Does Medicare Pay For Diabetic Strips

How Much Does Medicare Part D Cost In 2022

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers.

Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius. High-income Medicare beneficiaries are subject to an income-related monthly adjustment amount , meaning if you make more, youâll pay more. For 2022 plans, the additional costs will be based on your 2020 income.

Getting Medicare Part D requires enrolling in Original Medicare, so youâll pay any of those premiums, too.

The deductibles vary, but no Medicare Part D plan can have a deductible higher than $480 in 2022, up from $445 in 2021.

Copays and coinsurance vary by plan and tier and whether youâve hit the Medicare Part D coverage gap, or âdonut hole.â After the insurer has covered a certain amount on prescriptions, they will temporarily limit how much your plan will help pay for prescriptions.

Learn more about Medicare Part D plans and the âdonut holeâ here.

How Are Medicare Premiums Calculated

Medicare Part A is free to most beneficiaries and covers hospital stays, care in a skilled nursing facility, hospice care, and some health care. However, premiums for Part B and Part D depend on a beneficiarys income.

In other words, beneficiaries with higher incomes pay higher premiums. Its important to note that this affects less than five percent of Medicare beneficiaries. For 2020, if a beneficiary has a MAGI above $85,000 per year and above $170,000 per year , they will pay higher premiums for Part B and Part D .

Read Also: When Does Medicare Part D Start

Overview Of Medicare Cost Reports

Institutional providers certified by the Medicare program are required to submit cost reports to Medicare Administrative Contractors annually . CMS makes cost report data available for providers who have passed all HCRIS edits, similar to an auditing process. HCRIS may reject some cost reports, and in these cases, the MACs are responsible for correcting and resubmitting data.

Each year of cost report files includes a report and raw data, which are linkable using a unique identifier. The report contains the provider number, dates, and report status . The alphanumeric data file includes all text entered on the cost report, such as name, address, and fields requiring yes/no responses the numeric file includes fields such as costs, charges, and ratios. These files are available by fiscal year and are updated quarterly.

How Much Social Security Income Is Taxable

Not all taxpayers are required to pay federal income taxes on their Social Security benefits. Typically, only those individuals who have substantial income in addition to their Social Security benefits are required to pay federal income taxes on Social Security Benefits. If you do have to pay taxes on your Social Security benefits, you can either make quarterly estimated tax payments to the IRS or elect to have federal taxes withheld from your benefits.

How much of your Social Security income is taxable is based on your combined income. Your combined income is calculated by adding your adjusted gross income, nontaxable interest, and one-half of your Social Security benefits.

If you file your federal income taxes as a single person, and your combined incomeis between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $34,000, up to 85% of your benefits may be taxable. If your combined income is below $25,000, all of your Social Security income is tax-free.

If you are married and file a joint return, and you and your spouse have a combined income that is between $32,000 and $44,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $44,000, up to 85% of your benefits may be taxable. If your combined income is below $32,000, all of your Social Security income is tax-free.

You May Like: What Age Is For Medicare

How Much Does Medicare Part A Cost In 2022

Premiums for Medicare Part A are $0 if youâre getting or are eligible for federal retirement benefits. Itâs also premium-free if youâre under 65 and receiving Social Security disability benefits for 24 months, or are diagnosed with end-stage kidney disease. If youâre eligible for Medicare, but not other federal benefits, youâll pay a Part A premium of $274 or $499 each month, depending on how long youâve paid Medicare taxes.

The deductible for Medicare Part A is $1,556 per benefit period. A benefit period begins the day youâre admitted to a hospital and ends once you havenât received in-hospital care for 60 days.

The Medicare Part A coinsurance amount varies, depending on how long youâre in the hospital. Coinsurance is typically a percentage of the costs, but Medicare designates the coinsurance as a flat fee.

Hereâs how much youâll pay for inpatient hospital care with Medicare Part A:

-

Days 1-60: $0 per day each benefit period, after paying your deductible.

-

Days 61-90: $389 per day each benefit period.

-

Day 91 and beyond: $778 for each “lifetime reserve day” after benefit period. You get a total of 60 lifetime reserve days until you die.

-

After lifetime reserve days: All costs.

The cost of a stay at a skilled nursing facility is different. This is what a skilled nursing facility costs under Medicare Part A:

Hospice care is free.

Read more about how Medicare Part A covers these costs here.

Medicare Advantage Plan Could Help You Save On Out

Do you have more questions about how your Medicare costs are calculated? Are you looking for ways to lower some of your out-of-pocket health care costs?

A Medicare Advantage plan could potentially help you save money on costs such as dental care, prescription drugs and other costs.

A licensed insurance agent can help you compare the Medicare Advantage plans that are available where you live. You can compare benefits, coverage and the costs of each plan and then choose the right fit for your needs.

Compare Medicare plan costs in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Recommended Reading: Does Medicare Plan F Cover International Travel