How Is Medicare Part D Funded

About 73% of the $105.8 billion in Medicare D spending is derived from general revenue. An additional 15% is generated by beneficiary premiums, while another 11% in funding comes from payments from the state for dual eligible beneficiaries who qualify for both Medicare and Medicaid because of having a low income.

Medicare Part D is an optional benefit that helps beneficiaries enrolled in Original Medicare pay for prescription drug coverage. Private insurance companies administer Part D prescription drug plans, charging beneficiaries premiums, deductibles and copays as part of the policies coverage of prescription drugs.

Combining Medicare Parts C And D

Around 88% of Medicare Advantage enrollees choose to add a Medicare Part D benefit through their plan, according to the KFF. Medicare Part D is the portion of Medicare that funds prescription drugs.

The Centers for Medicare and Medicaid Services require that all people aged 65 years and over have creditable drug coverage for their prescriptions.

If a person does not choose to cover prescription drugs through their Medicare Part C plan, they will need to purchase a separate Part D policy. If a person already has prescription drug coverage through Medicare Part C, they do not need an additional Part D policy.

In 2021, Part D costs take the following shape:

- A person will need to meet the Part D deductible that their Medicare Advantage plan sets. The deductible could be up to $445 before a person begins to pay their copayments or coinsurance.

- Once a person meets their deductible, they will pay coinsurance for medications. This should come to no more than 25% of the total drug cost, up to a limit of $4,130.

- Once a person reaches the $4,130 spending limit, they become responsible for their drug costs. This coverage gap is known as the donut hole. However, Medicare has an arrangement with drug manufacturers to provide these medications at no more than 25% of the original cost.

- Once a person spends $6,550 in the donut hole, they pay 5% of prescription drug costs.

D Late Enrollment Period

A Part D late enrollment penalty will be applied if you went 63 days or more without having Part D or another approved prescription drug plan following the close of your initial enrollment period.11 The amount of the penalty depends on the number of days you were without prescription drug coverage.

The penalty is calculated by taking 1% of the national base beneficiary premium and multiplying that by the number of months you were not enrolled. This figure is then added to your Part D premium and may be enforced for as long as you have Part D.11

Recommended Reading: How Do I Get Dental And Vision Coverage With Medicare

Also Check: What Is The Average Cost Of Medicare Part B

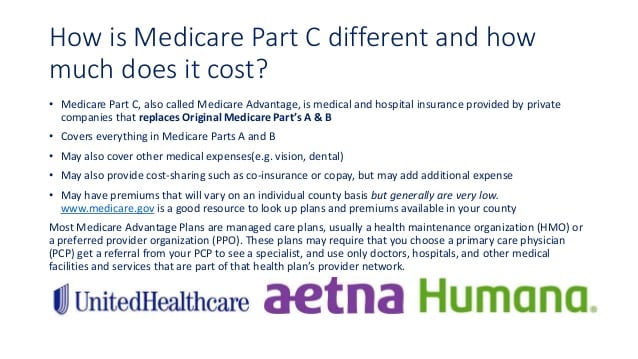

Medicare Part C Is Better Known As Medicare Advantage Plan Costs Vary Widely

Because Part C plans vary in price, it can be difficult to get a good understanding of how much you can expect to pay per month. This will vary for each person, so no article can give you a definitive answer to this question when it comes to your specific situation. However, well discuss what you should know about Part C medical insurance costs, so you can go into your search well informed

Find Cheap Medicare Plans In Your Area

For 2022, a Medicare Part C plan costs an average of $33 per month. These bundled plans combine benefits for hospital care, medical treatment, doctor visits, prescription drugs and frequently, add-on coverage for dental, vision and hearing. Keep in mind that what you pay for a Medicare Part C plan will be on top of the cost of Original Medicare.

Also Check: How Will Bernie Sanders Pay For Medicare For All

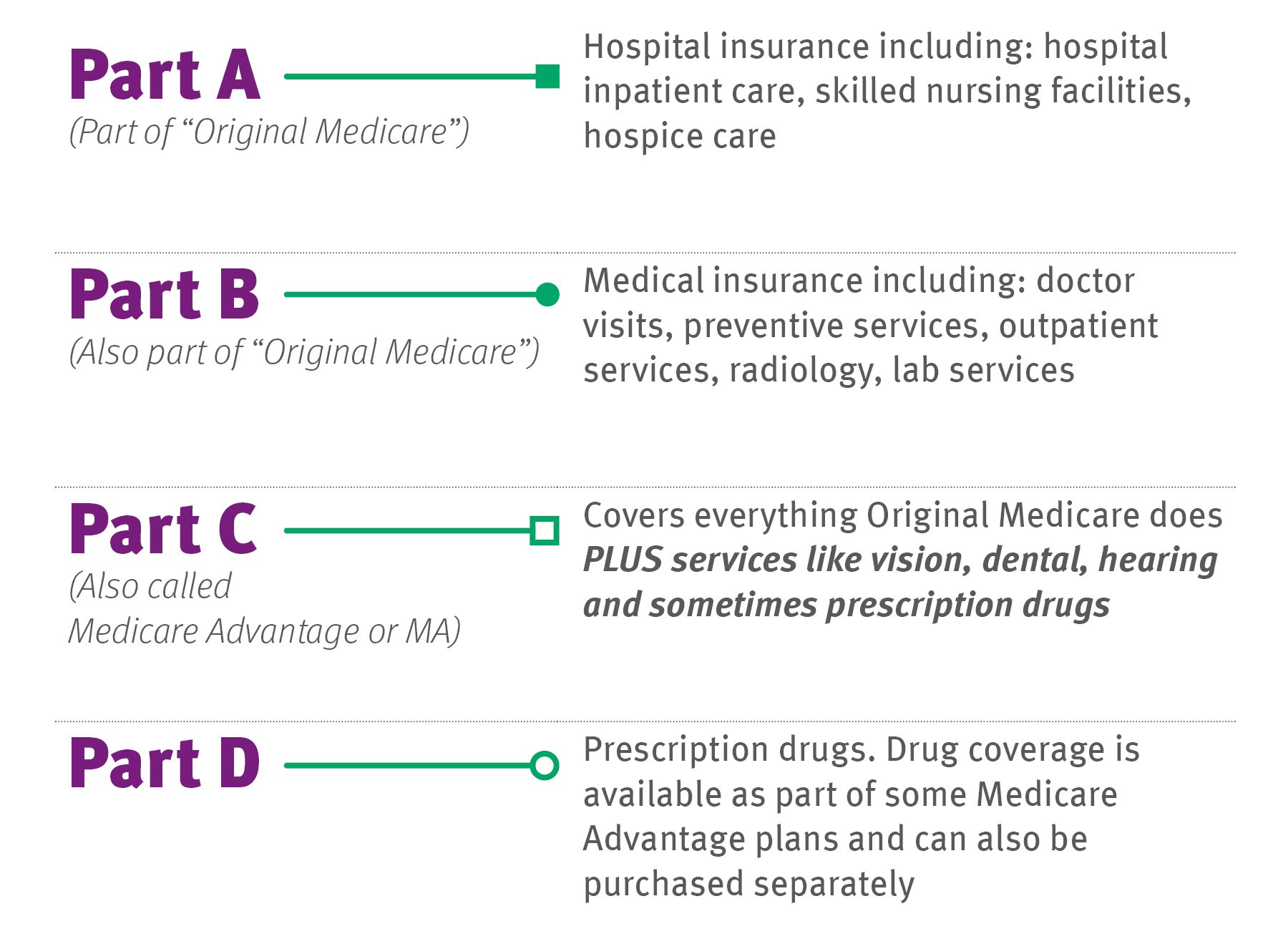

What Medicare Part C Covers

Medicare Part C plans offer all the benefits of Medicare Part A and Part B, with a few exceptions:

-

Clinical trials .

-

Hospice services .

-

Some new Medicare benefits, which temporarily are covered by Original Medicare.

Most Medicare Advantage plans include Medicare Part D prescription drug coverage. And the majority offer additional benefits that Original Medicare doesnt offer, such as cost help with dental and vision care, fitness benefits, transportation to doctor visits and over-the-counter drug allowances.

Medicare Part C isnt required to cover services that arent deemed medically necessary under Medicare.

Medicare Part D Prescription Drug Coverage

What it covers:

- Medicare Part D covers prescriptions drugs.

- Plan premiums, the drugs that are covered, deductibles, coinsurance and copays will vary by plan, so you should check and compare plans each year based on your needs, the prescription drugs you take, etc.

What it costs:

- Like Medicare Advantage , prescription drug plans are offered by private insurance companies contracted by the federal government.

- Plans vary in cost, coverage, deductibles and copays.

This material is provided for informational use only and should not be construed as medical advice or used in place of consulting a licensed medical professional. You should consult your doctor to determine what is right for you.

Some links on this page may take you to Humana non-Medicare product or service pages or to a different website.

Y0040_GNHKHNSEN

You May Like: Does Medicare Have A Maximum Out Of Pocket

What Benefits Can I Expect On Medicare Advantage

Medicare Advantage covers everything that original Medicare covers. However, Advantage plans also cover hearing, vision, and dental careâwhich arenât covered under original Medicare. Depending on the plan, Medicare Advantage may also cover things like gym memberships, transportation, and adult day-care.

New to Medicare Advantage plans in 2020, non-medical needs like meal delivery, home air cleaners, and home modifications are now covered by many plans.

What Types Of Medicare Advantage Plans Are Available

There are various kinds of Medicare Advantage plans, such as HMO, PPO, and Private Fee-for-Service plans. HMOs and PPOs each have certain characteristics, whether they are part of a Medicare plan or part of a regular health plan.

For example, an HMO plan typically comes with lower costs but requires you to see providers within a network and get referrals before you see a specialist. A PPO plan typically costs more, but offers more flexible options for seeing providers and may not require any referrals to see specialists.

Don’t Miss: What Is The Medicare G Plan

Types Of Medicare Advantage Plans

Medicare Advantage Plans can be:

- Health Maintenance Organizations

- Medical Savings Account Plans

- Special Needs Plans

Health Maintenance Organizations A type of Medicare Advantage Plan that is available in some areas of the country. Plans must cover all Medicare Part A and Part B health care. Some HMOs cover additional benefits, like extra days in the hospital. In most HMOs, you can only go to doctors, specialists, or hospitals on the plans list, except in an emergency, and are typically required to obtain a referral from your Primary Care Physician before seeing a specialist. Your costs may be lower than in Original Medicare.

Preferred Provider Organizations A type of Medicare Advantage Plan in which you pay less if you use doctors, hospitals, and providers that belong to the network. You can use doctors, hospitals, and providers outside of the network for an additional cost. Referrals are not necessary to see a specialist.

Private Fee-for-Service Plans A type of Medicare Advantage Plan in which you may go to any Medicare-approved doctor or hospital that accepts the plans payment. The insurance plan, rather than the Medicare Program, decides how much it will pay and what you pay for the services you get. You may pay more or less for Medicare-covered benefits. You may have additional benefits Original Medicare doesnt cover.

Point of Service Plans An HMO option that lets you use doctors and hospitals outside the plan for an additional cost.

What Medicare Part C Costs

Out-of-pocket costs vary for Medicare Part C, but will typically include the following expenses:

-

A monthly premium: A large percentage of Medicare Advantage plans charge a $0 premium, but not all of them do.

-

Medicare Part B premium: Youll still be responsible for paying your Part B premium, which is $170.10 per month in 2022. But some Medicare Part C plans pay part or all of your Part B premium as a benefit of the plan.

-

Copays and coinsurance: Different plans charge different amounts each time you see a medical provider, in or out of network.

-

Deductible: The deductible is the amount of eligible medical costs you must pay out of pocket before your plan starts paying for care.

You May Like: Do I Qualify For Extra Help With Medicare

How Are Medicare Advantage Plans Priced

Its important to look beyond just the monthly premium when shopping for a Medicare Advantage plan. You need to consider your total Medicare costs. These include deductibles, copayments, coinsurance and maximum out-of-pocket costs.

Since Medicare Advantage plans are sold by private insurers, the companies can make several decisions that affect the price of each plan.

Business Decisions That Affect Medicare Advantage Plan Pricing

- Which plans a company chooses to offer

- How the company calculates the price and profit margin for premiums and cost-sharing

- Additional benefits the company offers

Unlike Medigap, which has 10 standardized plans across all companies, there are no standardized Medicare Advantage plans.

You will need to compare Medicare Advantage plans to find the right benefits and prices for your health care needs and personal finances.

Don’t Leave Your Health to Chance

Medicare Part D Premiums

Medicare Part D is prescription drug coverage. Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2022 is $33.37, but costs vary.

Your Part D Premium will depend on the plan you choose. Just like with your Part B coverage, youll pay an increased cost if you make more than the preset income level.

In 2022, if your income is more than $91,000 per year, youll pay an IRMAA of $12.40 each month on top of the cost of your Part D premium. IRMAA amounts go up from there at higher levels of income.

This means that if you make $95,000 per year, and you select a Part D plan with a monthly premium of $36, your total monthly cost will actually be $48.40.

Also Check: When Does Medicare Cover Nursing Home Care

How To Enroll In Medicare Advantage

Signing up for Medicare is an important step to saving money on your health insurance every year. With Medicare Advantage, you can still get plans for zero or little cost per month, but they are sold through private health insurance companies. You can enroll in Medicare Advantage during your initial eligibility period for Medicare as well as during Open Enrollment Periods . The following section discusses how to sign up and what to understand about these enrollment periods.

How Do I Choose The Right Medicare Advantage Plan

Before the open enrollment season, check out as many Part C plans as you can to determine which options work for your budget and health needs. Each year, from October 15 to December 7, open enrollment allows you to change, switch or initially enroll in a Medicare Advantage plan. The right choice may save you thousands of dollars every year and make it easier to get the help you need when you need it the most.

A Medicare Advantage plan must cover the same services as traditional Medicare plans. These plans also should take care of some costs that would normally come out-of-pocket, without supplemental coverage. Medicare Part C plans usually require that you use healthcare facilities, doctors, physicians and other professionals already existing in the health insurance plans network.

However, most plans offer you either HMO or PPO options. If you choose an HMO Medicare Advantage plan, you will have to choose a primary care physician and receive care within the network. If you go with a PPO, then you may have more of a choice with out-of-network doctors and still receive coverage. Regardless of what you choose, youll most likely have out-of-pocket costs in the form of copayments and coinsurance, which depend on carrier and plan type.

Read Also: Does Medicare Cover Nerve Blocks

Medicare Advantage Plan :

- Monthly premiums vary based on which plan you join. The amount can change each year.

- You must keep paying your Part B premium to stay in your plan.

- Deductibles, coinsurance, and copayments vary based on which plan you join.

- Plans also have a yearly limit on what you pay out-of-pocket. Once you pay the plans limit, the plan pays 100% for covered health services for the rest of the year.

A User Guide To Medicare Part C: Everything You Need To Know

Key Takeaways:

- Medicare Part C is also known as Medicare Advantage

- Medicare Part C includes all of the benefits included under Original Medicare , and often has other benefits included

- Generally, anyone eligible for Original Medicare can enroll in a Medicare Advantage plan

- Medicare Part C plans can decrease the out-of-pocket expenses that are commonly associated with Original Medicare. Part C plan premiums can start as low as $0 per month.

- The two types of costs associated with Medicare Part C are premium costs and expenses for certain services and procedures

Recommended Reading: Does Medicare Part B Cover Inpatient Hospital Services

What Types Of Plans Are There

Although private insurance plans are typically either an HMO or a PPO, Part C actually has more options than this. Depending on which type of plan you have, your costs can be lower or higher. There are also more complex possibilities, like lower premiums but an overall higher yearly cost. Lets take a look at these options one by one.

HMO plans usually have lower premiums, but a smaller network. The idea is that your options for fully covered health care are limited, but as a result, you pay less. In general, out-of-pocket fees will be similar to other types of plans. Your plan may have a high deductible, which translates to lower premiums. Although premiums are usually lower for HMO plans, this isnt always the case.

PPO plans usually have somewhat higher premiums, but give you more flexibility. Although there will still be a provider network, you will be able to visit physicians and healthcare providers that arent part of that network. This will usually cost more but still be covered to a large degree. PPO plans are good for those who want a bit more flexibility. Although they will typically cost more than HMO plans, in many cases the difference isnt huge.

SNP are plans that are restricted to only individuals with certain conditions. These can be health conditions, such as Alzheimers, or specific situations and living conditions, like skilled nursing facility patients.

Find A $0 Premium Medicare Advantage Plan Today

| TTY 711, 24/7

1 MedicareAdvantage.com’s internal analysis of CMS Medicare Advantage landscape source files, Nov. 2021. Data retrieved from www.cms.gov/Medicare/Prescription-Drug-Coverage/PrescriptionDrugCovGenIn.

2 Freed M, et al. . Medicare Advantage 2022 Spotlight: First Look. Kaiser Family Foundation. https://www.kff.org/medicare/issue-brief/medicare-advantage-2022-spotlight-first-look.

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Don’t Miss: Do You Really Need Medicare Supplemental Insurance

How To Apply For Medicare Part C

First, enroll in Original Medicare . You cannot enroll in Medicare Part C until you do this. If youâre on federal retirement benefits, meaning you have paid Medicare tax through your payroll taxes for at least 10 years, youâre automatically enrolled in Medicare on the first day of the month you turn 65. Youâre also automatically enrolled once youâve been receiving federal disability payments for 24 months regardless of your age.

If youâre 65, but not receiving federal retirement benefits, you have to enroll for Medicare by visiting your local Social Security office, calling 1-800-772-1213, or filling out an online application through the Social Security Administration website at ssa.gov.

Once youâre enrolled in Original Medicare, then you can shop for a Medicare Advantage plan. You can search for plans on the Medicare website and purchase the one you want directly from the insurer.

However, you can only enroll within a designated time period each year. New Medicare recipients have seven months to buy coverage, starting three months before the month you turn 65. This is your initial enrollment period. Outside of initial enrollment, these are the times you can purchase or make changes to a Medicare Advantage plan:

Learn more about how to apply for Medicare.