Make Sure Youre Enrolled In Medicare

You can enroll for the first time during a seven-month period known as the initial enrolment period. This time begins three months before the month in which you turn 65 and concludes three months after the month in which you were born. Medicares open enrollment period, which runs from October 15 to December 7 each year, provides another opportunity to sign up for the program. You can enroll in a Medicare Advantage plan from January 1 through March 31 of each year if youre contemplating doing so.

What Is The Medicare Benefit Period

The Medicare benefit period for Part A is the period of time your deductible will cover your care in a hospital or skilled nursing facility . In 2022, the Part A deductible is $1,556. Any healthcare provider fees, however, will be charged to Medicare Part B and are not included as part of the Part A benefit.

Most health insurance plans have you pay a deductible once a year. With Medicare, you could face multiple Part A deductibles over the course of the year depending on your need for hospital care.

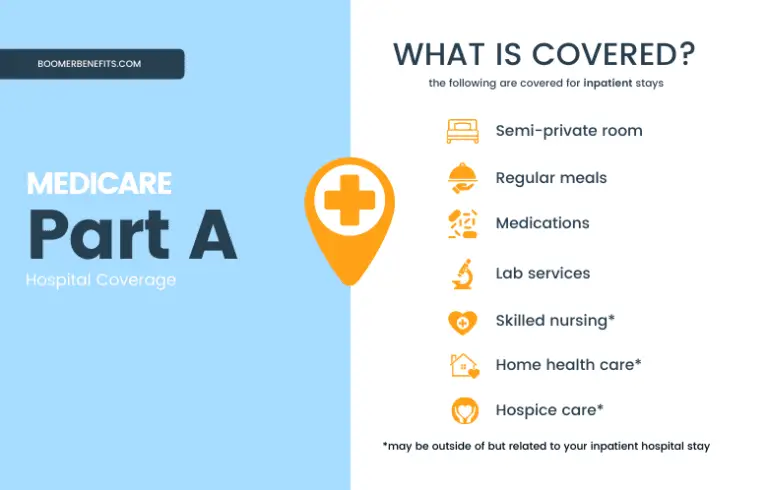

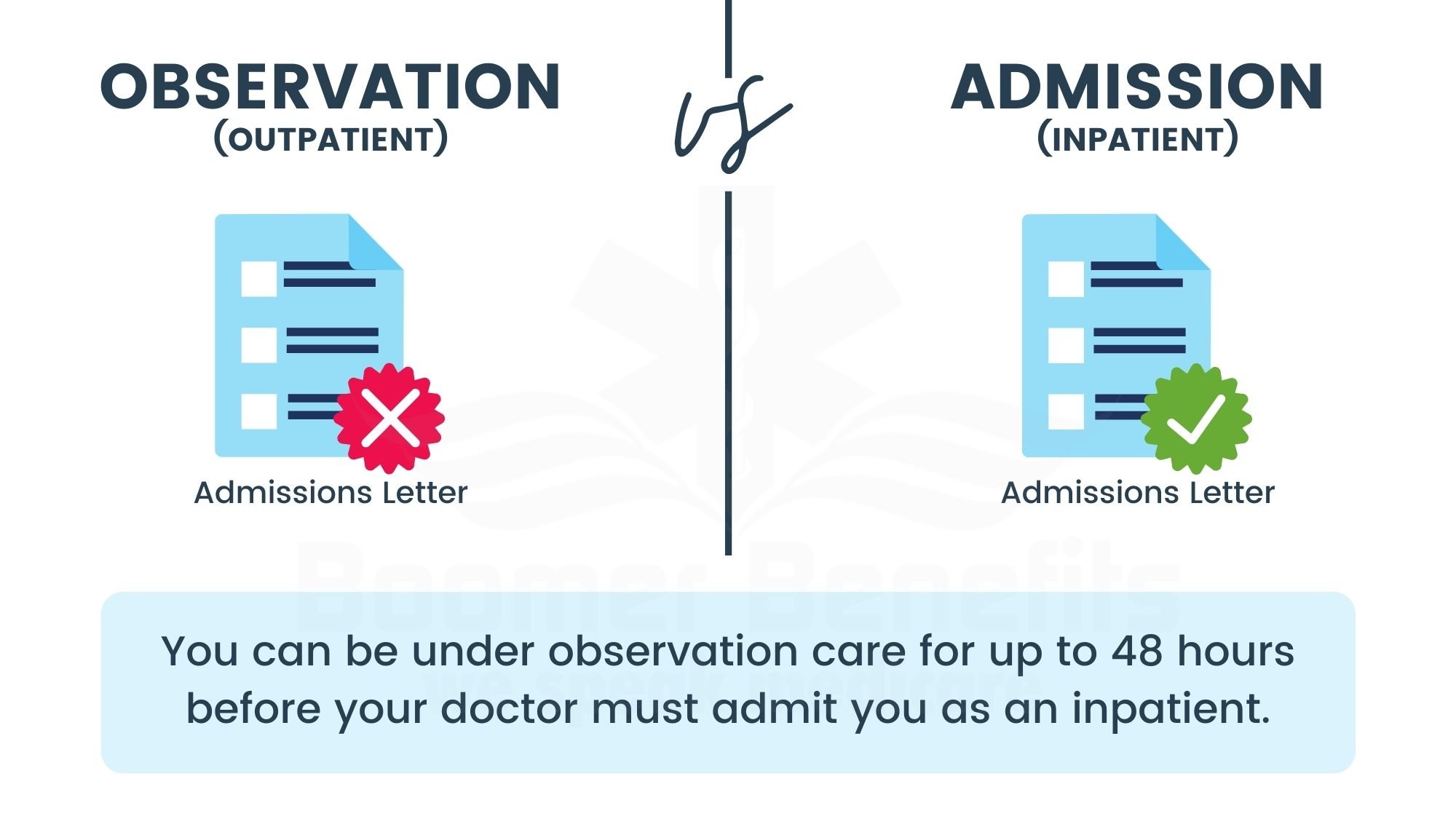

It is important to understand that the Medicare benefit period applies to inpatient hospital stays only. Staying overnight or even several days in a hospital does not necessarily qualify as an inpatient stay.

You could be placed under observation during that time, and Medicare Part B would be used for coverage. Be sure to ask your healthcare provider what orders are in place whenever you stay in the hospital.

Unlike Part A, Medicare Part B does not have benefit periods. With the exception of certain preventive care tests, you would be expected to pay 20% of all Part B costs. Also, any days you are in the hospital under observation do not count toward your Medicare Part A benefit period.

In order to understand the Medicare benefit, you need to understand the following four rules.

Medicare Part A Coinsurance

Once the deductible is paid fully, Medicare will cover the remainder of hospital care costs for up to 60 days after being admitted.

If you need to stay longer than 60 days within the same benefit period, youll be required to pay a daily coinsurance. The coinsurance applies to an additional 30-day period or days 61 through 90 if counted consecutively.

As of 2020, the daily coinsurance costs are $352.

After 90 days, youve exhausted the Medicare benefits within the current benefit period. At that point, its up to you to pay for any other costs, unless you elect to use your lifetime reserve days.

A more comprehensive breakdown of costs can be found below.

Don’t Miss: Is Eye Care Covered Under Medicare

Skilled Nursing Care Vs Custodial Care

An important aspect to understand about Medicare nursing home coverage is the difference between skilled nursing care and custodial care.

- Skilled nursing care refers to the duties that can only be performed by a licensed professional, such as physical therapy, medicine shots, medical evaluations and other types of treatment. Skilled care provided in a skilled nursing facility is covered by Medicare. Custodial care may also be covered is a Medicare, but only if the beneficiary is also receiving skilled nursing care.

- Custodial care, or personal care, refers to assisted living tasks such as bathing, dressing, eating, toileting and moving from a bed to a chair or to other parts of a room or home. If you stay in an assisted living center or a nursing home and custodial care is the only type of care you need, Medicare wont cover the costs of your care. Many nursing home stays may involve custodial care, and those services not covered by Original Medicare .

Its important to note that some Medicare Advantage plans may cover more services than Original Medicare covers. If you have a Medicare Advantage plan, be sure to check with your plan carrier directly to find out if your plan offers any nursing home care coverage or assisted living benefits.

You May Like: Is Shingrix Vaccine Covered By Medicare

Enrollment With A Premium

If you do not meet one of the above conditions, you may be able to enroll in Part A. You will have to pay a large monthly premium. You can enroll with a monthly premium if:

- You are over 65 and either a US citizen or an alien lawfully admitted for permanent residence who has been present in the US for at least 5 years or

- You are a person with disabilities who has stopped receiving Social Security Disability benefits because of your employment income.

Since January 2017, the premium cost is $413 per month for people who have less than 30 quarters of Medicare-covered employment. The price is $226 per month for people having 30-39 quarters of Medicare-covered employment. A quarter is 3 months in a year.

Read Also: Should I Sign Up For Medicare Part A

Medigap Plans That Cover Medicares Yearly Deductibles

One way to avoid paying for deductibles is by purchasing Medicare Supplement, also called a Medigap plan. There are 12 Medigap plans, letters A-N. Each plan varies by price and benefits. All Medigap plans, with the exception of Plan A, cover the Part A deductible. Letter plans K, L, & M cover a percentage of the Part A deductible. Only Medigap plans C and F cover the deductible under Part B.

Requiring Daily Skilled Nursing Care

Your doctor must certify that you require daily skilled nursing care or skilled rehabilitative services. This care can include rehabilitative services by professional therapists, such as physical, occupational, or speech therapists, or skilled nursing treatment that require a trained professional, such as giving injections, changing dressings, monitoring vital signs, or administering medicines or treatments. This daily care must be related to the condition for which you were hospitalized.

If you are in a nursing facility only because you are unable to feed, clothe, bathe, or move yourself, even though these restrictions are the result of your medical condition, you are not eligible for Medicare Part A coverage. This is because you do not require skilled nursing care as defined by Medicare rules. However, if you require occasional part-time nursing care, you may be eligible for home health care coverage. For more information, see our article on Medicare’s home health coverage.

Recommended Reading: How Do I Apply For Medicare In Ohio

Medicare’s Nursing Home Coverage Has Stringent Requirements

These requirements that patients must meet in order for Medicare to cover nursing home stays are fairly stringent, and the most important thing to remember is that even if these requirements are met, Medicare will only pay for a limited period. For this reason, it is important to consider other alternatives for payment long before nursing home care may be required.

How Medicare Measures Skilled Nursing Care Coverage

During benefit periods, Medicare evaluates the usage and coverage of skilled nursing care services. This is a difficult idea to grasp, and it frequently causes confusion among elders and family caregivers. Whenever a Medicare beneficiary is admitted to the hospital on an inpatient basis, a benefit period begins on the day of his or her admission. The time spent at the hospital as an outpatient or as an observer does not count toward the start of a benefit period. In order to be eligible for any coverage of rehab treatment in a skilled nursing facility after a benefit period has begun, a beneficiary must first complete a three-day inpatient hospital stay that meets the requirements of the plan.

A benefit period ends when a beneficiary has not received inpatient hospital or skilled nursing facility treatment for a period of 60 days consecutively.

There is no limit to the number of benefit periods that a recipient can receive under this arrangement.

Recommended Reading: Does Medicare Part D Cover Dental

How Do I Register A Complaint Against A Doctor

Since the provinces and territories, rather than the federal government, are primarily responsible for the administration and delivery of health care services and the management of health human resources, you should contact your local provincial/territorial Ministry of Health – the phone numbers and websites are located inside the back cover of the current Canada Health Act Annual Report. You can also contact your province or territory’s College of Physicians and Surgeons, which is the organisation that governs physician licensing and conduct. Links to each provincial and territorial medical regulatory authority can be found on the College of Physicians and Surgeons of Canada website.

Canada Health Act Division

How Can I Find A Medicare

You can call Medicare to find out about Medicare-certified skilled nursing facilities in your area. Call Medicare at 1-800-MEDICARE and speak with a counselor they answer the phones 24 hours a day, seven days a week, except on certain federal holidays. Or you can visit Medicares web site at Medicare.gov to search and compare skilled nursing facilities. At this web site you may also want to read the guide to choosing a nursing home and/or the checklist of questions to ask when you are visiting skilled nursing facilities.

Can I help you further with your questions about skilled nursing facilities or your options when it comes to Medicare coverage? You can use the links below to schedule a phone appointment or have me email personalized information to you. If you would like to compare plans on your own, you can use the Compare Plans or Find Plans buttons on this page.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

Don’t Miss: How Do You Sign Up For Medicare Part B Online

How Much Will Medicare Cover

Medicares coverage for skilled nursing facilities is broken down into benefit periods. A benefit period begins the day you are admitted as an inpatient to the hospital or skilled nursing facility.

Different amounts are paid throughout the benefit period. The benefit period ends when 60 days in a row have passed without a need for hospital or skilled nursing care. If you go back to the hospital after that 60-day window, a new benefit period begins.

Here are the costs that apply throughout the benefit period:

- Days 1 through 20: Medicare covers the entire cost of your care for the first 20 days. You will pay nothing.

- Days 21 through 100: Medicare covers the majority of the cost, but you will owe a daily copayment. In 2020, this copayment is $176 per day.

- Day 100 and on: Medicare does not cover skilled nursing facility costs beyond day 100. At this point, you are responsible for the entire cost of care.

While you are in a skilled nursing facility, there are some exceptions on what is covered, even within the first 20-day window.

There are some additional rules about Medicare coverage that you should know, including:

Medicare Coverage For Inpatient Rehabilitation

While youre in rehab, you can talk to a Medicare representative about your coverage limitations. Additionally, your doctor, a representative from your supplementary insurance provider, and a care planner at your rehabilitation facility may all be able to give you with the information you want. Planning your coverage with a Medicare benefits consultant or a senior financial planner is another option you have. Professionals in this field can provide you with current information and assist you in planning your Medicare coverage for rehabilitation.

- A skilled nursing facility, an inpatient rehabilitation facility , an acute care rehabilitation center, and a rehabilitation hospital are all examples of skilled nursing facilities.

In order for inpatient rehabilitation to be reimbursed, your doctor must certify that the following conditions apply to your medical condition: 1. It requires extensive rehabilitation. There is a requirement for ongoing medical supervision. The treatment you get must be coordinated by your physicians and therapists, who must work together. During your stay, Medicare will cover your rehab services , a semi-private room, your meals and snacks, nursing services, prescriptions, and any other hospital services and supplies that you receive.

Recommended Reading: What Does Cigna Medicare Supplement Cover

How Long Will Medicare Cover Rehab In An Inpatient Rehabilitation Facility

When inpatient rehabilitation in an inpatient rehabilitation facility is deemed medically essential, Medicare will pay for the treatment. After a major medical incident, such as a stroke or a spinal cord damage, you may require rehabilitation in an IRF. If your doctor determines that your medical condition necessitates the following treatment in an inpatient rehabilitation center, you will be eligible for care.

- Rehab that is intensive

- Coordinated treatment from a team of physicians and therapists who are working together

Skilled Nursing Facility Care Under Medicare: Whats Covered And When

- Strict limitations apply to Medicare coverage for skilled nursing facilities. A hospital stay is required prior to receiving skilled nursing facility coverage. Following a hospitalization, medical services are covered for the first 100 days after discharge. Copayments are required after the original coverage term has expired.

If you believe that Medicare will cover skilled nursing care, you are not entirely incorrect. However, coverage restrictions might be difficult to understand, and there are some standards you must complete before you can book your trip. Briefly stated, Medicare will cover some short-term skilled nursing facility stays in particular circumstances. If you require continuous or long-term care in a skilled nursing facility, you will be required to pay for these services out of pocket or to rely on other government programs to cover the costs.

Medicare is a government health-care program that provides coverage for adults over the age of 65, as well as those with certain medical conditions. Medicare coverage is divided into a number of distinct schemes, each of which provides a different level of coverage at a different price.

Read Also: When Can I Start Getting Medicare

Inpatient Observation Outpatient Admitted Distinctions

- Inpatient: A patient starting when youre formally admitted to a hospital with a doctors order. The day before youre discharged is your last inpatient day.

- Observation: A patient who is in the hospital with an expected length of stay of one midnight. Example: You fall and break your arm in the afternoon, you go to the emergency room and after you see the doctor you are told that you will stay in the hospital overnight, have surgery in the morning and go home late in the afternoon.

- Outpatient: A patient who is seen in the emergency room, a patient who receives outpatient services such as an x-ray, wound care, laboratory tests, imaging studies or surgery that does not require hospitalization during recovery. If the doctor hasnt written an order to admit you to a hospital as an inpatient, youre an outpatient even if you spend the night at the hospital.

- Admitted: A synonym for an inpatient. Patients who are expected to be in the hospital for two or more midnights. For example, you break your hip and are taken to the emergency room. You are admitted to the hospital to have surgery the next morning. You have surgery and two days later you are discharged to continue recovering at home.

What Do I Do If My Address Changes Or If I Lose My Health Card

The provinces and territories, rather than the federal government, are responsible for the administration of their health insurance plans, which includes issuing, cancelling or renewing health cards. You should call or email your provincial/territorial Ministry of Health- the phone numbers and websites are located inside the back cover of the current Canada Health Act Annual Report.

Also Check: Is Trump Trying To Get Rid Of Medicare

Other Ways To Pay For Skilled Nursing Care

Other sources of assistance are available to assist with the cost of skilled nursing and related services. If a seniors income and resources are restricted, he or she may be qualified for the Medicaid program offered by their state. Medicaid offers assistance with the cost of skilled and/or custodial care, drugs, and other medical expenditures for those who qualify. If they are qualified for both Medicare and Medicaid, they are referred to as dual eligible beneficiaries, and the majority of their health-care expenses are often paid by the government.

Find A $0 Premium Medicare Advantage Plan Today

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

You May Like: Can You Be Dropped From Medicare

What Is The Interruption Window And How Is It Defined

The interruption window is the maximum period of time that may elapse between discharge from an SNF and a subsequent readmission to the same SNF before the Interrupted Stay Policy no longer applies, and the subsequent stay is considered a new stay. CMS has defined this interruption window as three days or less.

How Long Can You Stay In A Skilled Nursing Facility

The time spent in skilled nursing may not seem like nearly enough. Understanding how the process works and decisions are made will keep you on your toes to ensure the best outcome.

Time will be short, so we recommend advocating for and motivating your loved one to maximize their stay.

Categories:

Recommended Reading: When Can I Get My Medicare Card