How Do I Enroll In A Medicare Supplement Plan If I Am Under 65

Federal law doesnt require insurance companies to sell Medicare Supplement plans to people under 65 and Medicare beneficiaries under 65 generally dont have Medicare Supplement Open Enrollment Periods. If you are under 65 and have Medicare, you can apply for a Medicare Supplement plan at any time. However, in order to be eligible for Medicare when are you are under 65, you generally must have a disability or serious health condition. A Medicare Supplement plan can consider that disability or health condition and the cost to insure you and reject your application.

Some states have an open enrollment period for eligible individuals under the age of 65. If you are under 65, check with your state insurance department for guidelines.

When Should You Apply For A Medicare Supplement

If you are enrolled in an Advantage plan, the Medicare enrollment period of one year applies when you apply for a Medicare supplement. You must apply for a validity period of January 1. It is wise to submit an application at the beginning of the enrollment period to allow sufficient time for enrollment.

What Is The Marketplace Open Enrollment

The registration period is open. Determination of the open subscription period. The open enrollment period is the one-year period during which people can buy and buy health insurance in the market. Registration for 2017 starts on November 1, 2016 and ends on January 31, 2017.

Network cardHow do you check your network card? One of the easiest ways to test a network card is to ping a website that is known to be active most of the time. You can also test the network card by checking your PC’s Properties and Internet Protocol settings.What does a network card do in a computer?A network card is an electronic devicâ¦

Read Also: Is It Too Late To Change Medicare Advantage Plans

When Is The Best Time To Buy A Medigap Policy

Although you may be able to buy Medigap at a future time, the 6-month period after you turn 65 years old is considered the best time to enroll. This is because at this time:

- You can buy any Medigap policy sold in your state, regardless of your medical history or preexisting health conditions.

- You will generally get better prices.

- You cant be denied coverage.

During your open enrollment period, by federal law, insurance companies cant deny you coverage, and they must sell you a Medigap policy at the best available rate. This is true regardless of your current state of health or any preexisting conditions.

After this open enrollment period, however, insurance companies arent required to sell you a policy if you try to purchase one. And even if you are able to buy one, it may cost more, depending on your current or past health conditions.

If you apply for a Medigap policy outside of your open enrollment window, insurance companies offering Medigap are generally allowed to decide whether or not to accept your application.

They can also determine how much to charge you for the Medigap policy based on medical underwriting. This means that your medical history and current state of health may affect the amount youll pay.

Medicare Part D Prescription Drug Plan Enrollment

When youre eligible to enroll in Original Medicare, you also become eligible to enroll in a Medicare Part D prescription drug plan.

If you want Medicare prescription drug coverage, you typically have two options:

- Enroll in a Medicare Advantage plan that includes prescription drug coverage

- Enroll in a Medicare Part D standalone prescription drug plan

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent.

You can also enroll in a prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.1

Don’t Miss: Can Permanent Residents Get Medicare

When Should I Enroll In A Medicare Supplement Insurance Plan

Medicare Supplement insurance plans help cover out-of-pocket costs, such as coinsurance, copayments and deductibles, which Medicare doesnt pay. The best time to buy a Medicare Supplement insurance plan is typically during the Medicare Supplement Open Enrollment period. During this Open Enrollment period, you cannot be subjected to medical underwriting, where insurance companies could use a pre-existing health condition* as a reason to deny you coverage or charge you more for coverage.

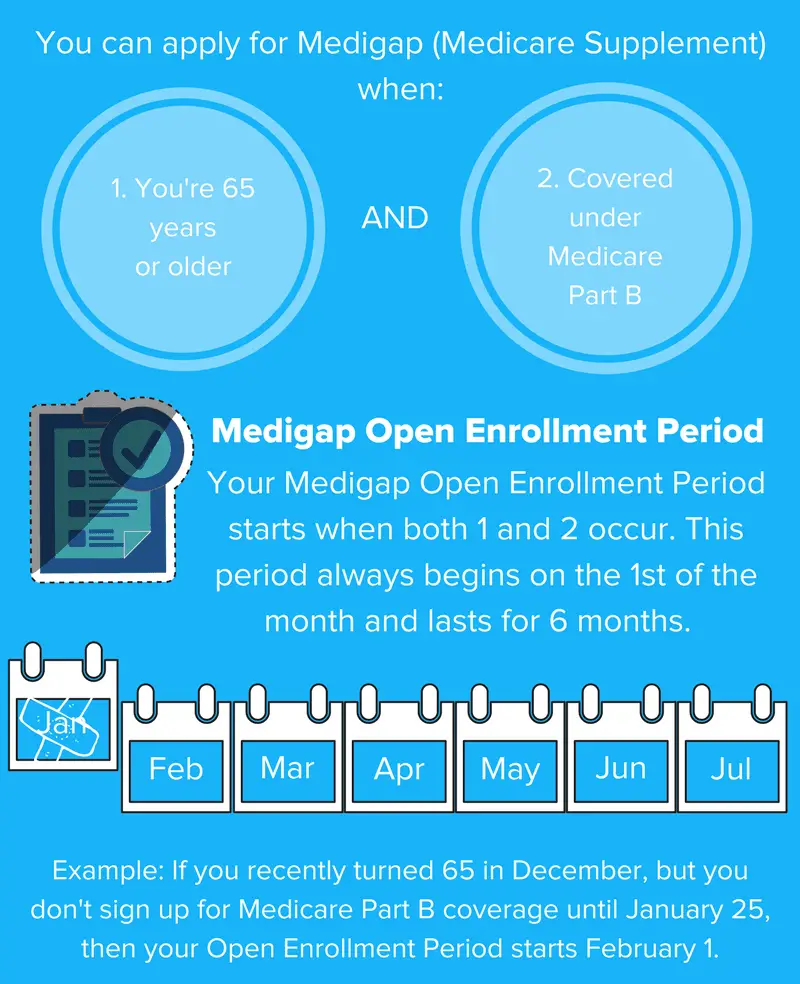

The Medicare Supplement Open Enrollment period lasts for 6 months and begins on the first day of the month in which youre both

- 65 or older

- Enrolled in Medicare Part B

Some states have additional Open Enrollment Periods including those for people under age 65.

Medicare Part D Prescription Drug Coverage

2022 Part D premiums:

- The average premium for stand-alone Medicare Part D coverage is about $43/month in 2022. There continue to be a wide range of Part D plan options available. Premiums for Part D plans start as low as about $7/month in 2022. On the higher end, plans can have premiums of up to $100/month or more, so there is a great deal of variation in price and benefits across the available plans.

- High-income enrollees pay a higher Part D premium. The threshold for high-income began to be indexed as of 2020. The income threshold for 2022 is $91,000 for a single person and $182,000 for a couple . In 2022, the additional premium for high-income enrollees ranges from $12.40/month to $77.90/month.

Part D deductible:

- Maximum of $480 in 2022, up from $445 in 2021. .

Part D out-of-pocket costs after deductible:

- Not to exceed 25% of the cost of brand-name and generic costs.

- There is no longer a donut hole in terms of the maximum amount that enrollees can be charged when they fill prescriptions. But the donut hole still exists in terms of how insurers design their coverage , how total drug costs are counted, and who covers the bulk of the cost of the drugs .

- After a beneficiarys costs reach the catastrophic coverage threshold , additional out-of-pocket costs are capped at the greater of 5% of the cost of the drug or a copay of $3.95 for generics and $9.85 for brand-name drugs.

Learn more about Medicare Part D.

Recommended Reading: Will Medicare Cover Cataract Surgery

Are There Other Times I Can Enroll In A Medicare Supplement Plan

If youre outside your Medicare Supplement Open Enrollment Period, you may be able to enroll in another Medicare Supplement plan if you have guaranteed issue rights. If you have guaranteed issue rights, a plan cant deny you coverage, refuse to cover your pre-existing conditions, or make you wait for coverage. Some situations that could qualify you for guaranteed issue rights are:

- Your Medicare Supplement plan committed fraud or mislead you

- Your Medicare Supplement plan went bankrupt

- You dropped your Medicare Supplement plan to use your trial right to try a Medicare Advantage plan. Less than a year has passed and you want to switch back.

- Your Medicare Advantage plan stops providing care in your area

- You move out of your Medicare Advantage plans service area

Do you want to search for a Medicare Supplement plan in your area? Just enter your zip code on this page.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Find Plans in your area instantly!

Evaluate Any Upcoming Year Budget/cost Changes

- Will your monthly premium payment be higher, the same or lower?

- If your plan uses pharmacy networks, will your pharmacy still be in your plans network?

- Will your medication still be on the plans drug list ? Is any of your medication changing to a higher drug tier and might cost more?

- Will there be changes to your deductible, copay or coinsurance amounts? Will you be paying more or less than you are now?

Recommended Reading: How Old Before You Qualify For Medicare

Special Scenarios Granting Guaranteed Issue Rights

- You joined Medicare Advantage at 65 and decided to switch back to Original Medicare within a year .

- Your Medicare Advantage plan shuts down or you move out of its service area.

- Your employer plan that supplements Medicare ends.

- Your Medigap plan shuts down.

There are a handful of scenarios that grant these Medigap protections, says Amanda Baethke, director of corporate development at Aeroflow Healthcare, a durable medical equipment provider that supplies patients with home healthcare solutions through insurance. She sees these scenarios regularly in her work. In those situations, insurance companies must sell you a Medigap policy, must cover all your pre-existing health conditions and cannot charge you more because of your past or present health problems.

When Is Medicare Supplement Open Enrollment

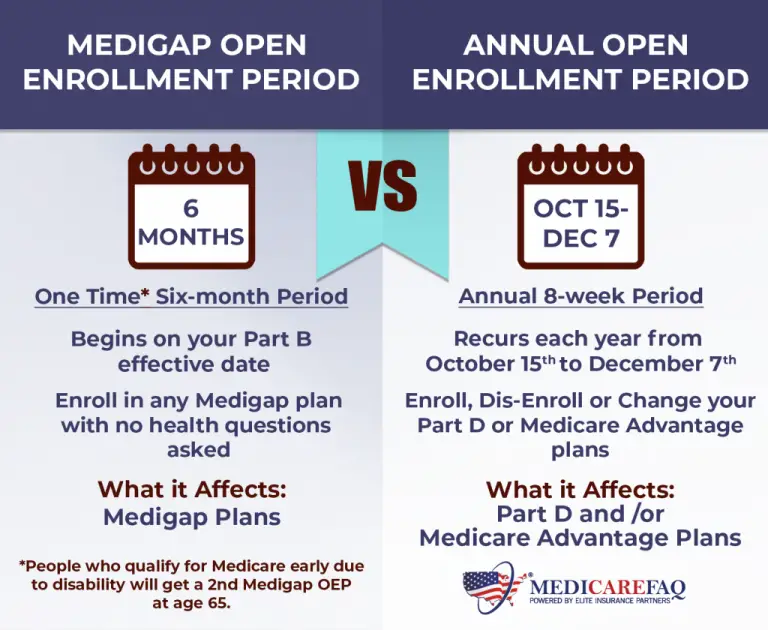

Its easy to be tricked into thinking that open enrollment for Medicare supplement insurance is in the fall. Thats because Medicare itself puts out so much information about the Annual Election Period , which starts each October 15th and ends December 7th. Even the Medicare supplement insurance companies go crazy with Medigap ads during the fall. However, AEP is really only for Medicare Advantage plans and your Medicare prescription drug plan.

Related Article:Can I Change Medicare Supplement Plans Anytime?

Medigap plans do not have an annual open enrollmentIn health insurance, open enrollment is a period during which a person may enroll in or change their selection of health plan benefits. Health plan enrollment is ordinarily subject to restrictions…. period and are not included in the fall AEP where you are free to switch plans no matter what. The reason for this is that supplemental insurance for Medicare does not have the same protections as Medicare Part CMedicare Part C is Medicare’s private health plan option. Also known as Medicare Advantage, Medicare Part C plans are a type of Medicare health plan offered by companies that contract with Medicare to provide all… and Medicare Part DMedicare Part D plans are an option Medicare beneficiaries can use to get prescription drug coverage. Part D plans provide cost-sharing on covered medications in four different phases: deductible, initial coverage, coverage gap, and catastrophic. Each… .

You May Like: Is Aetna Medicare Good Insurance

Cant Get A Medigap Policy Try Medicare Advantage

If no insurer will sell you a Medigap policy, you have an option. Medicare Advantage is another private health plan that can save you money. Plans have a maximum limit on out-of-pocket costs, typically $5,000. Some plans even have no monthly premium.

Medicare Advantage plans provide Part A and Part B, and often include Part D prescription drug coverage. You can have either a Medigap policy or Medicare Advantage plan, not both.

Now that you know when you can enroll in a Medicare Supplement plan and the types of plans available, youre better prepared to sign up. Remember that your Medigap Open Enrollment Period is a one-time event thats unique to you, so dont miss it!

When Is The Medicare Supplement Open Enrollment Period

Your Medicare Open Close begins on the first day of the month you turn 65 and your Part B begins. Many beneficiaries take advantage of this Medicare application deadline. For example, if your birthday was August 31 and the Part B effective date is October 1, your PEP will start on October 1.

Recommended Reading: When Is Open Enrollment For Medicare Supplement Plans

What Is Open Enrollment

- The free health insurance plan is a one-year period during which employees must choose coverage for the following year.

- It’s important for employers to review it carefully before deciding which health insurance plans to offer to employees.

- The pandemic is making it difficult to register openly as many employees work from home.

Is There An Open Enrollment Period For Medicare Supplement Plans

Under federal law, you have a six-month open enrollment period that begins the month you are 65 or older and enrolled in Medicare Part B. During your open enrollment period, Medigap companies must sell you a policy at the best available rate regardless of your health status, and they cannot deny you coverage.

Don’t Miss: Does Medicare Cover Fall Alert Systems

Your Guide To Medicare Supplement Open Enrollment

About 10,000 people turn 65 years old every day in the U.Sa significant birthday signaling eligibility for MedicareEmpowering Beneficiaries and Modernizing Medicare Enrollment. Better Medicare Alliance. Accessed 09/22/2021. . If enrollment in Medicare is on the horizon for you or a loved one, its also worth looking into Medicare Supplement insurance, commonly known as Medigap.

Read on to learn more about your health insurance options, including details on Medicare Supplements and information to help you navigate the open enrollment process.

When Can I Be Denied A Switch Of Medigap Policies

You may wish to switch from one Medigap policy to another for reasons such as wanting a less expensive policy, paying for unnecessary benefits, or needing more benefits. However, you wont have a right to change Medigap policies under federal law unless youre within the 6- month Medigap open enrollment period or already eligible under a specific circumstance, or have a guaranteed issue right.

Don’t Miss: What Is A Medicare Discount Card

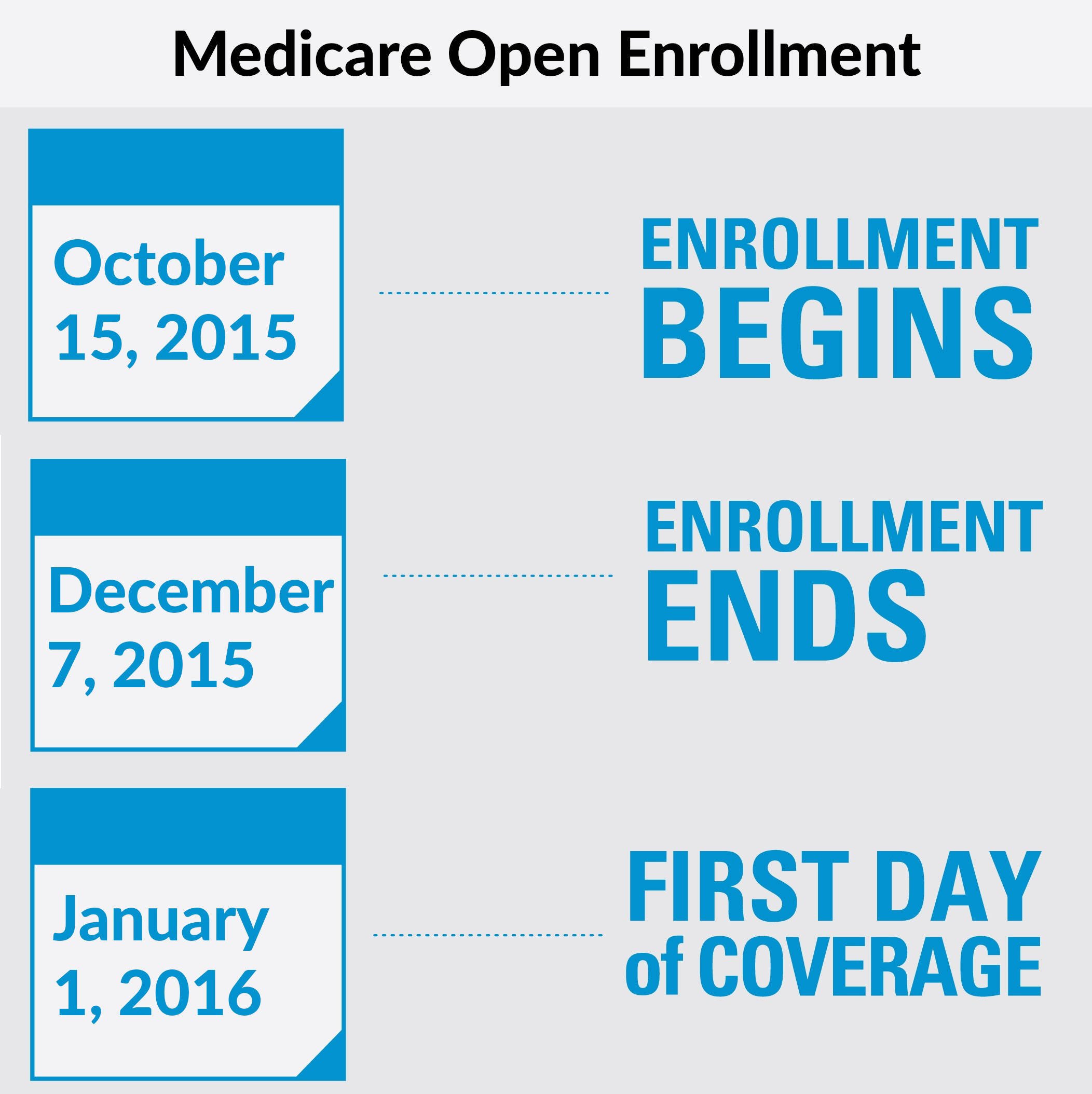

What Happens During Medicare Open Enrollment 2021

During Medicare Open Enrollment in 2021, you can change your Medicare Part D coverage to another prescription drug insurance policy or buy Medicare Part D for the first time. You can also change your Medicare Advantage plan or switch from Original Medicare to Medicare Advantage.

Healthcare open enrollment dates If you missed these dates, you still have a chance to enroll for health insurance from marketplace, if you are eligible for a special enrollment period.Healthcare plansIf your health plans are affiliated with your job then your open enrollment periods may be different. Check with your employer.You can apply and enroll any time in the year in MEDICAID or childrenâs health inâ¦

Medicare Initial Enrollment Period

The earliest time you can enroll in Original Medicare, a Medicare Advantage plan or a Medicare Part D prescription drug plan is during your Medicare Initial Enrollment Period .

Your Initial Enrollment period lasts for seven months:

- It begins three months before you turn 65

- It includes your birth month

- It extends for another three months after your birth month

If you are under 65 and qualify for Medicare due to disability, the 7-month period is based around your 25th month of disability benefits.

Don’t Miss: When Do You Stop Paying For Medicare

Making The Most Of Your Medigap Open Enrollment Period

Timing can affect how much you pay for coverage, how easy coverage is to obtain, and it can what options are available to you. The Medigap OEP is the only time that allows you to enroll in any Medigap letter plan without needing to answer any health questions. By law, the carrier must approve your application for coverage, regardless of any health issues.

After your individual Medigap Open Enrollment Period ends, a carrier can choose to deny you coverage based on your current health status. Many new beneficiaries have pre-existing health problems that could end up preventing them from getting coverage.

If you enroll during your Medicare Supplement Open enrollment period, these health problems will not prevent them from getting coverage. Thats why we strive to educate our clients on the importance of enrolling during this once-in-a-lifetime window.

What Is Medicare Supplement Open Enrollment Period

Medicare Supplemental Open Enrollment is a 6-month period beginning on the first day of the month in which you are 65 years of age or older and enrolled in Medicare Part B. During this period, you may enroll in a Medicare Supplement Plan without existing medical conditions or acceptance restrictions.

Also Check: How Much Does Medicare Pay For Urgent Care Visit

When Is The Medicare Special Enrollment Period

You can qualify for Medicare special enrollment if you didnât enroll in Medicare when you became eligible at age 65 because you had health insurance through your job or your spouse’s job.

If you meet the qualifying circumstances, signing up for Medicare through a special enrollment period can help you avoid a Medicare Part B late penalty.

There are limits and specifics when navigating between Medicare and employer health coverage, and we recommend you talk to someone at Medicare or your State Health Insurance Assistance Program to discuss the timing and documentation needed for you to qualify for a special enrollment period.

Note that special enrollment will only help you avoid the Medicare Part B penalty. Thereâs no way to avoid the Medicare Part A penalty.

What Is The Medicare General Enrollment Period

From January 1 to March 31 each year, those who are eligible for Medicare can sign up for the first time, but you may have a late penalty if you’re signing up after your initial enrollment period.

The Medicare general enrollment period is for new enrollees who do not have any type of Medicare. If you want to change parts of your existing Medicare coverage, youâll probably need Medicare open enrollment in the fall. During general enrollment, you’ll have the same options as during initial enrollment â you can sign up for Medicare Part A, B, C or D. The coverage you select will begin on July 1.

However, enrolling in Medicare after your initial enrollment period means you could pay a penalty. This isn’t a one-time fee. Instead, it’s an increase in your monthly costs based on how long you didn’t have coverage.

Read Also: Does Medicare Cover Bed Rails