Ask These Questions Before You Delay Medicare

Whether or not you can delay Medicare past 65 when youre working really depends on a few simple questions.

1. Do you have employer health coverage?

2. Does your employer have 20 or more employees?

3. Is the coverage considered creditable?

If you can answer Yes! to all the above, you likely qualify for a Medicare Special Enrollment Period and can delay enrolling without penalty. Whats the next step? and information sent directly to your inbox.

When Do I Have To Sign Up For Medicare

If youre collecting Social Security, youll automatically be enrolled in both Part A and Part B. If youre not receiving Social Security, then youll want to sign up manually during your Initial Enrollment Period.

Three months before your 65th birthday, your Initial Enrollment Period window will start. Your IEP is a once-in-a-lifetime enrollment window that you dont want to miss.

If you do happen to miss it, youll have another opportunity to enroll during another enrollment period. However, you could get a penalty for not signing up when you first become eligible. The only way around the penalty is if you have creditable coverage.

Do I Have To Sign Up For Medicare If I’m 65 Or Older And Still Working

If you’re age 65 or older, eligible for Medicare, and have insurance through your current job or your spouses current job, you need to make some important Medicare enrollment decisions.

If you don’t enroll on time, you may have to pay a penalty. Before you make any changes, it’s good to understand how your current coverage works with Medicare about four to five months before you become eligible for Medicare.

Ask your benefits manager or human resource department how your employer health insurance works with Medicare, and confirm this information with the Social Security Administration and Medicare .

When you retire or if you lose your employer coverage, you will get a Special Enrollment Period to sign up for Medicare. Be sure to review the rules carefully, so you don’t miss deadlines.

Note: If you have a Health Savings Account, you and your employer should stop contributing to it 6 months before you sign up for Medicare Part A to avoid an IRS tax penalty. As well, before you enroll in Medicare while still working, check with your employer to see if their employer group health plan coverage for prescription drugs is creditable coverage. If it is not creditable, you could face paying Medicare Part D penalties later on.

Read Also: What Does Medicare Part A And B Not Cover

What Else Do I Need To Know

- Medicare can help cover your costs for health care, like hospital visits and doctors services.

- Most people dont pay a premium for Part A, but you do pay a monthly premium for Part B.

- If you cant afford the monthly premium, there are programs to help lower your costs. Get details about cost saving programs.

Do You Have To Sign Up For Medicare When Youre 65

As long as you have creditable coverage, you dont have to enroll in Medicare when you are 65. Technically, you dont have to sign up for Medicare at all if you dont want to. Medicare is not mandatory, but it is important to be aware that if you choose to sign up later without creditable coverage, youll incur penalties that you may be stuck with for the rest of your life.

The most common reason a new beneficiary may delay enrolling in Medicare is that they have coverage through their employer. However, not all group coverage is creditable coverage. The size of your employer will determine if the coverage is creditable.

Read Also: What Is Medicare Chronic Care Management

Sign Up: Within 8 Months After Your Family Member Stopped Working

- Your current coverage might not pay for health services if you dont have both Part A and Part B .

- If you have Medicare due to a disability or ALS , youll already have Part A coverage.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Can I Sign Up For Medicare Plans Online

Enrolling in Medicare coverage options online is generally easy and quick. More and more people are signing up online, according to an eHealth study. During 2018, about 16% of people in the study enrolled in Medicare coverage options online. Thats up from only 10% in 2017. In other words, about 60% more people in the study used eHealths online enrollment tool to sign up in 2018 than in 2017.

Its interesting to note that online enrollment was even higher during Q4. Q4 means the 4th quarter of the year, October through December. Thats when Medicares Fall Open Enrollment happens for Medicare Advantage and Medicare prescription drug plans. Fall Open Enrollment goes from October 15 December 7 every year.

Don’t Miss: Is Xarelto Covered By Medicare Part D

You Can Sign Up For Medicare Part D During Your Medicare Initial Enrollment Period

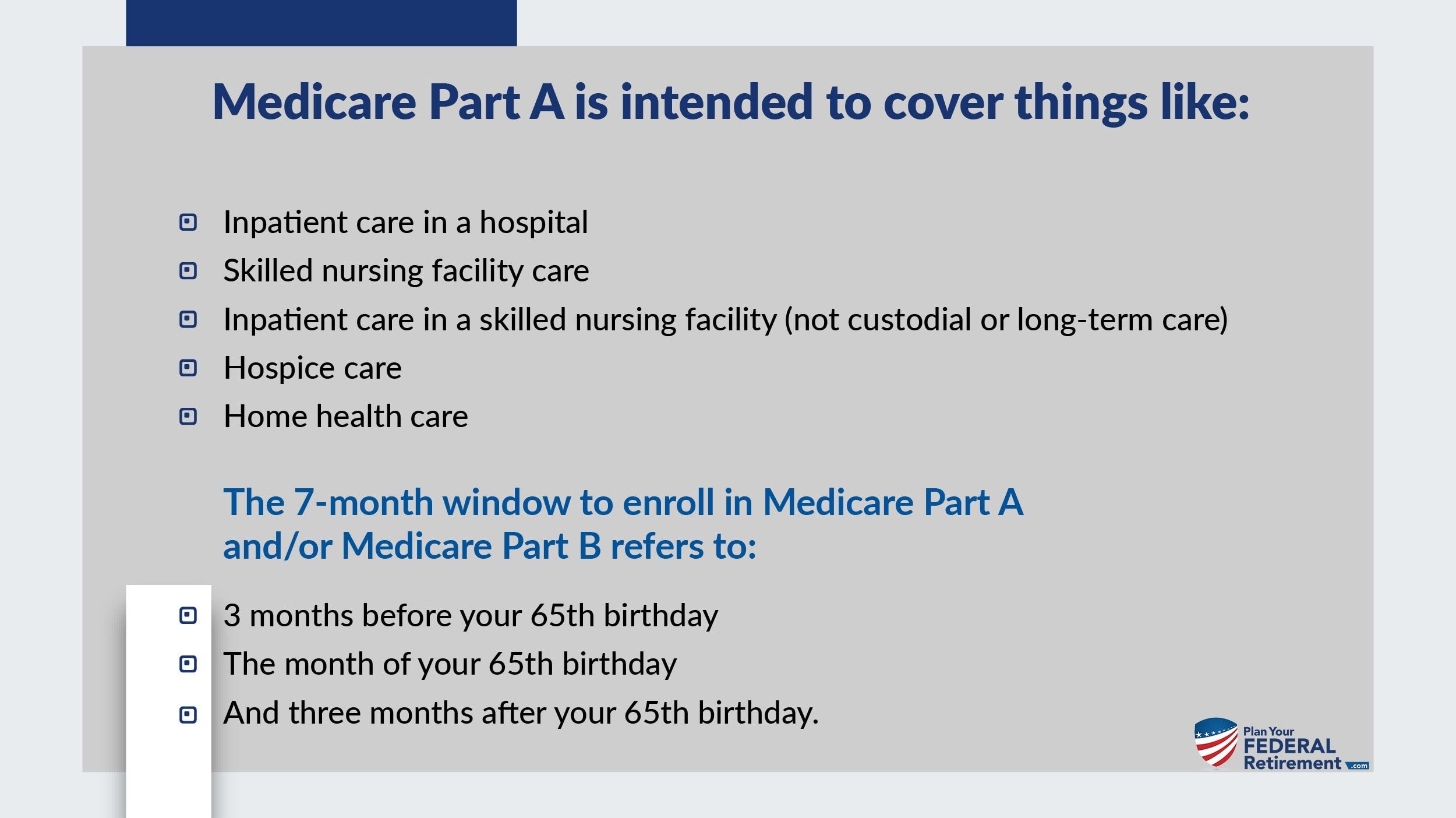

This is the time when you can first enroll in Original Medicare . Many people are automatically enrolled in Original Medicare during their IEP when their Medicare age is nearing 65. But you typically wonât be enrolled in a Medicare prescription drug plan at this time.For most people, the seven-month IEP begins three months before the month you turn 65, includes your birthday month, and ends three months after your birthday month.Your IEP at your Medicare age of 65 is also when youâre first eligible to sign up for Part D.

Choose Coverage For Prescription Drugs

Once youve completed Steps 1 and 2, youre ready to decide about your drug coverage.

Medicare doesnt cover the cost of most prescription drugs. Still, there are two ways to sign up for insurance that will help pay for your medications: If you stay on Original Medicare, Parts A and B, you can buy a standalone policy specifically for prescription drug coverage. This policy is called a Medicare Part D prescription drug plan.

Or, if you opt for a Medicare Advantage plan, prescription drug insurance is often included. Medicare.gov offers a tool to compare and shop for Part D and Medicare Advantage plans.

Read Also: How Is Part B Medicare Premium Determined

Will My Prescription Drugs Be Covered

When signing up for a Medicare plan, be sure you tell your insurance agent the prescriptions youre taking so they can search plan formularies and find you a plan that will cover your medications. On most plans, you will still have a copayment for non-generic drugs, but check with your agent before signing up for a PDP plan.

You Automatically Get Medicare

- You should already have Part A and Part B , because you have ALS and youre already getting disability benefits.

- We mailed you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up and pay a monthly late enrollment penalty.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

Don’t Miss: Does Medicare Cover Eye Exams For Glaucoma

What Will Happen To My Medicare Premiums If I Enroll In Medicare Before Social Security

If youre already at least 65 and you havent yet enrolled in Medicare when you activate your Social Security benefits, youll automatically be enrolled in Medicare Part A at that point.

Medicare Part A is premium-free in most cases. But your Part A coverage will be backdated by up to six months. Medicare Part A will disqualify Health Savings Account contributions for the part of the tax year you have Part A , so plan any contributions accordingly including contributions your employer makes.

You will not automatically be enrolled in Part B if your initial seven-month enrollment window for Medicare has already ended. Youll have an opportunity to enroll in Part B during the general enrollment period, which runs from January 1 through March 31 each year, with coverage effective in July. And you may owe a late enrollment penalty for Part B once you enroll.

If youre still working when you turn 65 and covered under your employers health plan, youll likely still enroll in at least Medicare Part A, which is premium-free for most people. If your employer-sponsored plan is considered primary coverage , you can probably delay your enrollment in Part B, and just have premium-free Medicare Part A. But if your employer is small enough that the coverage they offer will be secondary to Medicare, youll likely need to enroll in both Part A and Part B.

What Is The Medicare Part B Late

If you do not sign up for Medicare Part B when you are first eligible, you may need to pay a late enrollment penalty for as long as you have Medicare. Your monthly Part B premium could be 10% higher for every full 12-month period that you were eligible for Part B, but didnt take it. This higher premium could be in effect for as long as you are enrolled in Medicare. For those who are not automatically enrolled, there are various Medicare enrollment periods during which you can apply for Medicare. Be aware that, with certain exceptions, there are late-enrollment penalties for not signing up for Medicare when you are first eligible.

One exception is if you have health coverage through an employer health plan or through your spouses employer plan, you can delay Medicare Part B enrollment without paying a late-enrollment penalty. This health coverage must be based on current employment, meaning that COBRA or retiree benefits arent considered current employer health coverage.

Also Check: How Often Does Medicare Pay For A Mammogram

When Should You Apply For Medicare

In most cases, you should apply for Medicare as soon as you’re eligible. The initial enrollment period starts three months before the month you turn 65, includes your birth month, and extends three months past the month you turn 65, giving you a seven-month window to apply. Your Part B coverage will likely be delayed if you enroll the month you turn 65 , so apply early to avoid a gap in coverage.

Medicare imposes a hefty late enrollment penalty if you enroll in Part B or D after the initial enrollment period and don’t qualify for a special enrollment period .You might qualify for a SEP if you have coverage, including creditable drug coverage from an employer or a union . Medicare does not charge a late enrollment penalty for enrolling in a Medicare Advantage plan or Medicare Supplement plan after IEP. But it’s best to apply for Medigap as soon as you’re eligibleif you apply within the first six months of having Part B coverage, you can’t be denied a Medigap policy or be required to pay more because of health conditions. Here’s how enrollment works depending on whether or not you already receive Social Security benefits.

If you already receive Social Security benefits:

You should also check out the Medicare Enrollment Booklet which contains clear, concise information about both Medicare Part A and Part B.

If you are not yet receiving Social Security benefits:

When to get prescription drug coverage:

Enrollment Periods For Medicare Part D

Initial Enrollment

Like all of the other initial enrollment periods for Medicare, Part D gives you 7 months to sign up for coverage, which are the 3 months before and after the month of your 65th birthday.

Open Enrollment

The Open Enrollment period for Part D is from . Any coverage you select during this time begins on January 1. You can select a new Medicare drug plan, switch Medicare drug plans, or drop your Medicare drug coverage entirely.

Also Check: Do Medicare Advantage Plans Cover Dentures

How To Sign Up For Medicare Advantage: When Can I Enroll

Medicare Advantage, also known as Medicare Part C, is another way to receive Original Medicare benefits and is offered through private insurance companies that have contracts with Medicare. At minimum, all Medicare Advantage plans must offer the same Medicare Part A and Part B benefits as Original Medicare. Some Medicare Advantage plans also include additional benefits, such as prescription drug coverage. You must have Original Medicare, Part A and B, to enroll in a Medicare Advantage plan through a private insurer.

You can enroll in a Medicare Advantage plan during two enrollment periods, the Initial Coverage Election Period and Annual Election Period.

You Can Enroll Three Months Before Your 65th Birthday But If Youre Still Working You May Want To Wait

I will be 65 soon. When do I sign up for Medicare?

You can enroll in Medicare as early as three months before the month you turn 65 and up to three months after the month you turn 65. Its best to sign up before your 65th birthday so that you can start receiving benefits as soon as possible. If youre just signing up for Medicare and not Social Security, you can use this link to apply online, or you can call the Social Security administration at 800-772-1213. Also see Social Securitys Apply Online for Medicare publication for more details.

If youre already collecting Social Security when you turn 65, you will automatically be enrolled in Part A and Part B, and the Part B premium will be deducted from your benefits. Keep in mind that although you are eligible for Medicare at 65, your full retirement age for Social Security is 66 or older, depending on the year you were born. See the Social Security Administrations full retirement age table.

If youre still working at 65 and decide to delay signing up for Part B, youll have eight months to do so after you lose your employer coverage. If you miss that deadline, youll have to wait until the next Part B open-enrollment period , and your monthly premium will increase by 10% for each 12-month period you delay. See Survive the Medicare Enrollment Maze for more information.

Also Check: How Do I Become A Medicare Provider

To Qualify For Medicare You Need To Get Disability Benefits From:

- Social Security

- Railroad Retirement Board

Youll automatically get Part A and Part B after you get disability benefits for 24 months. Well mail you a welcome package with your Medicare card.

If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

If you live in Puerto Rico or outside the U.S.

Do I Need Medicare Part B

We always advise our clients to contact their employer or union benefits administrator before delaying Part A and Part B to learn more about how their insurance works with Medicare. Employer coverage may require that you enroll in both Part A and Part B to receive full coverage.

Common reasons beneficiaries delay Part B include:

Also Check: Does Medicare Cover Hearing Aids In Michigan

Your Medicare Special Enrollment Period

If your employer has at least 20 employees and youre still working and covered under that plan when you turn 65, you can delay your enrollment in Medicare . In that case, youll get an eight-month special enrollment period to sign up for Medicare if and when you leave your job or your employer stops offering coverage. It will start the month after you separate from your employer, or the month after your group health coverage ends whichever happens sooner.

Sign up during those eight months, and you wont have to worry about premium surcharges for being late. And the eight-month special enrollment period is also available if youre delaying Part B enrollment because youre covered under your spouses employer-sponsored plan, assuming their employer has at least 20 employees.

But note that in either case, it has to be a current employer. If youre covered under COBRA or a retiree plan, you wont avoid the Part B late enrollment penalty when you eventually enroll, and you wont have access to a special enrollment period to sign up for Part B youll have to wait for the general enrollment period instead.

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to enroll in Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on behalf of your employer without your employers signature and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

Read Also: Can You Receive Medicare Without Social Security