Summary Of Medicare Benefits And Cost

The chart below is a comprehensive list of Medicare Part A and B costs, including premiums, deductibles and coinsurance. Medicare supplemental insurance, known as Medigap, can help cover some of the gaps in coverage and pay for part or all of Medicares coinsurance and deductibles, depending on the policy. Some Medicare Advantage plans may also help cover these costs. See Medigap: Medicare Supplemental Insurance and Medicare Advantage for more information.

Government May Scale Back Medicare Part B Premium Increase

- This year’s standard premium, which jumped to $170.10 from $148.50 in 2021, was partly based on the potential cost of covering Aduhelm, a drug to treat Alzheimer’s disease.

- The manufacturer has since cut the estimated per-patient annual treatment cost to $28,000, from $56,000.

- Medicare officials are expected this week to issue a preliminary determination of whether or to what extent the program will cover the drug.

There’s a chance that your Medicare Part B premiums for 2022 could be reduced.

Health and Human Services Secretary Xavier Becerra on Monday announced that he is instructing the Centers for Medicare & Medicaid Services to reassess this year’s standard premium, which jumped to $170.10 from $148.50 in 2021.

About half of the larger-than-expected increase was attributed to the potential cost of covering Aduhelm a drug that battles Alzheimer’s disease despite not knowing yet to what extent the program would cover it. Either way, the manufacturer has since cut in half its estimated per-patient price tag to $28,000 annually from $56,000 meaning Medicare’s cost estimate was based on now-dated information.

More from Personal Finance:

“With the 50% price drop of Aduhelm on Jan. 1, there is a compelling basis for CMS to reexamine the previous recommendation,” Becerra said.

A CMS spokesperson said the agency is “reviewing the secretary’s statement to determine next steps.”

How Much Will I Pay For Premiums In 2022

Most people will pay the standard amount for their Medicare Part B premium. However, youll owe an IRMAA if you make more than $91,000 in a given year.

For Part D, youll pay the premium for the plan you select. Depending on your income, youll also pay an additional amount to Medicare.

The following table shows the income brackets and IRMAA amount youll pay for Part B and Part D in 2022:

| Yearly income in 2020: single | Yearly income in 2020: married, joint filing | 2022 Medicare Part B monthly premium | 2022 Medicare Part D monthly premium |

|---|---|---|---|

| $91,000 | |||

| $578.30 | your plans premium + $77.90 |

There are different brackets for married couples who file taxes separately. If this is your filing situation, youll pay the following amounts for Part B:

- $170.10 per month if you make $91,000 or less

- $544.30 per month if you make more than $91,000 and less than $409,000

- $578.30 per month if you make $409,000 or more

Your Part B premium costs will be deducted directly from your Social Security or Railroad Retirement Board benefits. If you dont receive either benefit, youll get a bill from Medicare every 3 months.

Just like with Part B, there are different brackets for married couples who file separately. In this case, youll pay the following premiums for Part D:

- only the plan premium if you make $91,000 or less

- your plan premium plus $71.30 if you make more than $91,000 and less than $409,000

- your plan premium plus $77.90 if you make $409,000 or more

You can request an appeal if:

Recommended Reading: How Do I Pay Medicare Premiums

Some Medicare Advantage Plans May Feature $0 Premiums

Your Medicare Part C plan premium is the cost you must pay typically monthly to belong to the plan.

In 2022, the average premium for a Medicare Part C plan is around $63 per month. This varied from plans with premiums as low as $38 per month in Maine and South Carolina to as high as over $100 per month in North and South Dakota, Massachusetts, Michigan and Rhode Island.1

Its important to note that many areas of the U.S. may feature $0 premium plans. In fact, over half of all beneficiaries of Medicare Advantage plans with prescription drug coverage pay no premium for their plan.2

Medicare Part C Premiums

Medicare Part C plans, also known as Medicare Advantage plans, are sold on the private marketplace. Plan premiums will vary by provider, plan and location.

89 percent of Medicare Advantage plans include prescription drug coverage in 2021 . More than half of all 2021 MA-PD plans charge no premium, other than the Medicare Part B premium.1

The average 2022 Medicare Advantage plan premium is $62.66 per month.2

Medicare Advantage plans are required to offer the same benefits as Original Medicare , and some Medicare Advantage plans may also offer additional benefits for things like routine dental and vision coverage, non-emergency transportation, caregiver support, allowances for over-the-counter items and more.

And according to Medicare expert John Barkett, Medicare Advantage monthly premiums dropped in 2020 by as much as 14 percent. Hear more about this in the video below.

Recommended Reading: When Do You Stop Paying For Medicare

Get Help From A Medicare Savings Program

Medicare Savings Programs, or MSPs, are special programs designed to help low-income seniors pay their Medicare expenses Part B premiums included. These programs are funded via Medicaid, so theyre run at the state level .

To qualify, your monthly income cant exceed a certain limit. Also, your personal resources must fall within a specific limit. But if youre deemed eligible for assistance via an MSP, you could lower your Part B premium costs.

To apply for one of these programs, youll need to visit or call your local Medicaid office.

Maurie Backman has been writing professionally for well over a decade, and her coverage area runs the gamut from healthcare to personal finance to career advice. Much of her writing these days revolves around retirement and its various components and challenges, including healthcare, Medicare, Social Security, and money management.

How Can I Avoid Paying For Medicare

Delaying enrollment in Medicare when youre eligible for it could result in a penalty that will remain in effect for the rest of your life.

Read Also: How Soon Before Turning 65 Should You Apply For Medicare

How Much Does Medicare Part D Cost In 2022

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers.

Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius. High-income Medicare beneficiaries are subject to an income-related monthly adjustment amount , meaning if you make more, youâll pay more. For 2022 plans, the additional costs will be based on your 2020 income.

Getting Medicare Part D requires enrolling in Original Medicare, so youâll pay any of those premiums, too.

The deductibles vary, but no Medicare Part D plan can have a deductible higher than $480 in 2022, up from $445 in 2021.

Copays and coinsurance vary by plan and tier and whether youâve hit the Medicare Part D coverage gap, or âdonut hole.â After the insurer has covered a certain amount on prescriptions, they will temporarily limit how much your plan will help pay for prescriptions.

Learn more about Medicare Part D plans and the âdonut holeâ here.

Medicare Part B Coinsurance

Coinsurance is a cost-sharing term that means insurance pays a percentage and you pay a percentage. With Medicare Part B, you pay 20 percent of the cost for the services you use. So if your doctor charges $100 for a visit, then you are responsible for paying $20 and Part B pays $80.

There is no limit on Part B coinsurance costs, which could add up if you have a lot of doctor visits or need other services.

With a Medicare Advantage plan, your costs will be different and may include copays for doctor visits or other services. However, your out-of-pocket costs are limited to the annual plan maximum. Once youve paid that amount, the plan pays 100 percent for Medicare-covered services through the end of the year.

If Medicare costs are a concern, you may want to take advantage of financial protection and other benefits offered by Medicare Advantage plans.

Also Check: Does Medicare Cover Cataract Exams

What Affects Medicare Part C Premiums

Some variables that can affect the cost of a Medicare Part C premium include:

- Plan typeThere are several different types of Part C plans, each of which can vary in cost. For example, HMO plans tend to have lower premiums than PPO plans.

- LocationLocal market competition and cost-of-living can have an effect on the cost of a plan.For example, the average Medicare Advantage plan premium in South Carolina in 2022 is only $38 per month, while the same average premium in New York in 2022 is $71 per month.1

- CoverageSome Medicare Part C plans can include a variety of extra benefits that arent covered by Original Medicare .Most Medicare Advantage plans cover prescription drugs, and some plans may offer coverage for dental and vision care, hearing care, fitness club memberships, non-emergency transportation and more. Plans that offer more extra benefits may cost a little more than plans that offer less coverage.

- Cost-sharingSome Part C plans may charge a higher premium but feature a lower deductible or coinsurance, while other plans may pair a lower premium with higher cost-sharing requirements.

- Insurance companiesEach insurance company is free to set their own price for a Medicare Advantage plan. You may find two similar plans sold by two different companies in the same zip code, at very different prices. A licensed insurance agent can help you compare plans that are available where you live in order to find the premium costs that fit your budget.

How Much Does Medicare Cost A Cost Breakdown

Several factors determine how much you pay for your Medicare, including your age, your annual income, the type and amount of Medicare services you enroll for, how much you use the services, and whether or not youre covered under any other health insurance plan.

Additionally, Medicare expenses consist of several types of costs: monthly premiums, deductibles, , copays, , and coinsurance . There is also a late enrollment fee that you may have to pay if you enroll after the age of 65.

Read Also: How Much Medicare Is Taken Out Of Social Security Check

Why Do Some People Pay Less For Their Medicare Part B Premium

Some people who get Social Security benefits will still pay less than $170.10 in 2022. This affects around 2 million Medicare beneficiaries. Legislation prevents the cost of Medicare Part B from increasing more than the Social Security annual cost-of-living increase.

In recent years, we have had low COLA increases, so these individuals have only been paying less than the standard base Part B premium. Though the Social Security COLA increases for the last couple of years have been somewhat larger, there is still a small group of beneficiaries being protected by the hold harmless provision.

Though this all very confusing, remember that you do not have to calculate this yourself. Again, Social Security will determine your Part B premium for 2022 and notify you by mail if you exceed the Medicare income limits and must pay a higher adjusted amount.

Most Medicare beneficiaries qualify for premium-free Part A. However, the Medicare Part B premium is deducted from your Social Security check if you are receiving Social Security benefits. In 2022, the Part B premium is $170.10.

You can also request your Part D premium be deducted from your Social Security check.

Most People Pay the Standard Part B Premium

Youll pay the standard Medicare Part B premium amount if:

For Medicare Premiums 2021 Look For Modest Increases In Premiums And Out

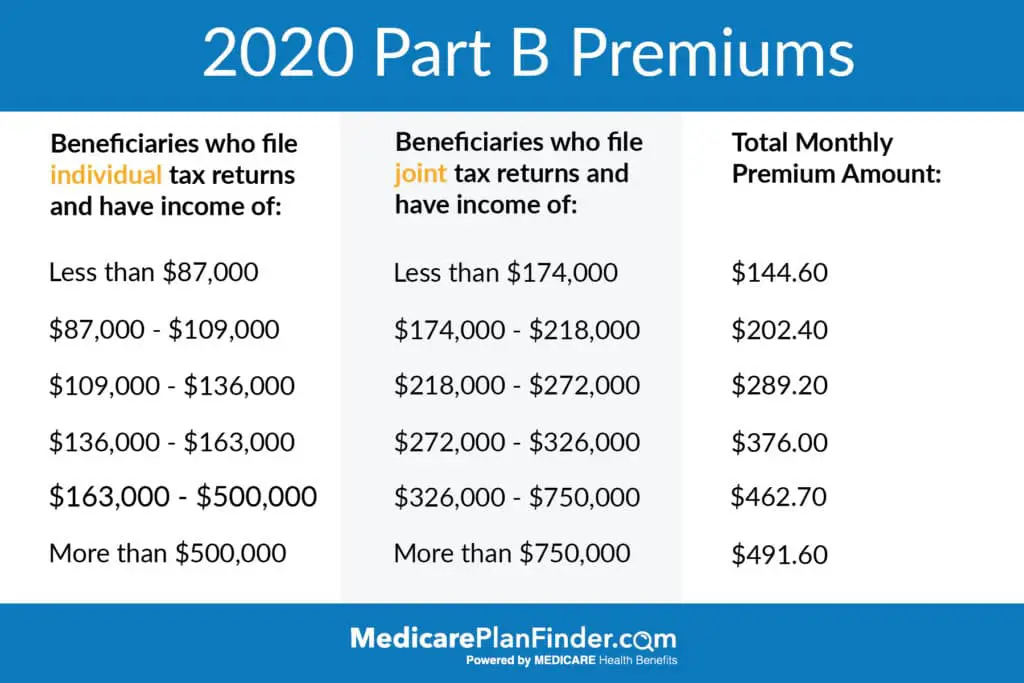

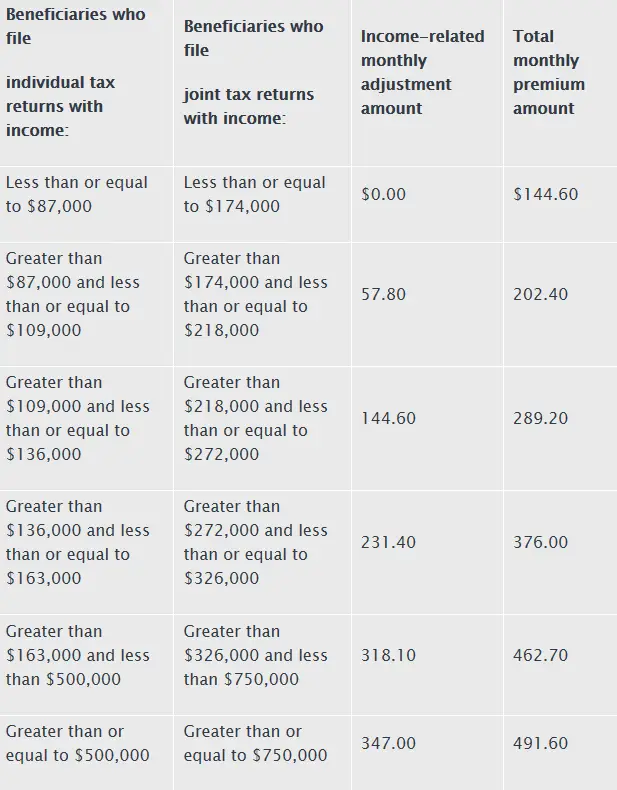

The New Year will usher in a host of adjustments to Medicare that both new enrollees and existing beneficiaries will need to navigate. In order to get the most from your plan, its important to understand your out-of-pocket costs, which will vary depending on your income and the type of plan you choose. Heres a rundown of what you can expect in 2021.

Medicare Part B Premium 2021. Although Part A, which pays for hospital care, is free for most beneficiaries, youll pay a monthly premium for Part B, which covers doctor visits and outpatient services. In 2021, the standard monthly premium will be $148.50, up from $144.60 in 2020.

But if youre a high earner, youll pay more. Surcharges for high earners are based on adjusted gross income from two years earlier. In 2020, beneficiaries with 2018 AGI of more than $87,000 paid $202.40 to $491.60 per month for Part B. Surcharges in 2021 for beneficiaries with 2019 AGIs of more than $88,000 range between $207.90 and $504.90.

Mind the gap. If youre new to Medicare, you may be surprised to discover what it doesnt cover. Part B pays for only 80% of doctors visits and other outpatient services. In addition, Medicare doesnt cover dental care, eye appointments or hearing aids.

Also Check: How To Apply For Medicare Through Spouse

Your Guide To 2021 Medicare Premiums And Costs

With so many coverage options to choose from, it can be difficult to estimate your Medicare costs for the year. Read this guide for help crunching the numbers.

Everyday Health may earn a portion of revenue from purchases of featured products.Shutterstock

Trying to estimate your Medicare costs can be a challenging task. A variety of coverage options are available, and each comes with its own premiums and other costs.

You will encounter different costs while enrolled in Medicare, so its important to know about the programs that offer financial assistance in case you qualify.

Pay Your Premiums Directly From Your Social Security Benefits

Seniors who are enrolled in Medicare and Social Security simultaneously have their Part B premiums deducted directly from their Social Security benefits. Doing so isnt just a convenience, though in some cases, it can save you from rising premium costs thanks to Medicares hold-harmless provision.

This provision protects you from losing out on Social Security income when Part B premium increases surpass the cost-of-living adjustments that are applied to benefits each year. This means that if Part B increases by $30 a month in a given year, but your cost-of-living adjustment only raises your monthly benefits by $24, you save yourself the extra $6 by not having to pay it.

Also Check: How To Submit A Medical Claim To Medicare

Do Low Income Seniors Have To Pay For Medicare

If you have low income and assets, you may qualify for help with some of your Medicare costs from one or more of the programs below. Californias Medicaid program, known as Medi-Cal, pays for certain care Medicare doesnt, and helps pay the cost-sharing for the benefits and services Medicare does cover.

What Is Medicare Part C

Medicare Part C, or Medicare Advantage, is a bundled Medicare plan. Private insurance companies sell and administer Part C plans, but they work with Medicare to make sure that they provide the full benefits available.

The private insurance companies work with Medicare to offer parts A and B, as well as some additional services, such as Part D. Some Part C plans also fund services that traditional Medicare may not cover, such as vision care.

An estimated 36% of all people enrolled in Medicare are covered under Medicare Advantage plans, according to the KFF.

The number of people with Medicare Advantage plans has grown by approximately 9% between 2019 and 2020.

Don’t Miss: Does Medicare Cover Dementia Care Facilities

Do Medicare Advantage Plans Have Coinsurance Or Copays

Cost-sharing measures are the share of medical bills that you must pay after your deductible has been met.

Cost-sharing can typically come in two forms:

- CopaymentsThis is a flat-fee. A $20 copayment on a bill of $300 means you would pay $20 and your plan would cover the remaining $280.

- CoinsuranceCoinsurance is a percentage of your medical bill. A 20 percent coinsurance requirement on a $300 bill means youll pay $60 , while your plan takes care of the remaining $240.

Cost-sharing such as coinsurance and copays with Medicare Part C plans may vary by plan.

Cost For Medicare Advantage Plans

Medicare Advantage plans, also called Medicare Part C, are sold by private companies that have contracted with the federal government. There are no fixed premiums, deductibles or coinsurance. Instead, they vary from plan to plan. You first have to have Original Medicare Parts A and B before you can buy a Medicare Advantage plan.

The companies that administer the plans set the amounts charged for premiums, deductibles and coinsurance once a year. Medicare does not have a hand in determining the costs. Changes take effect on Jan. 1 of the following year.

Cost-Determining Factors of Medicare Advantage Plans

- Whether your Part B premium is included in the Advantage plan. Some Medicare Advantage plans cover all or part of your Part B premium.

- Whether you have Medicaid or other state assistance.

- Whether the plan charges for extra benefits you need.

- Whether or not the plan charges a premium since some plans do not.

- The type of Medicare Advantage plan you have and whether a doctor or other health care provider accepts it.

- The type of health services you use.

- The annual limit your plan sets for out-of-pocket costs for health care.

- The amount of your coinsurance or copay, which can differ from Medicare Part B.

- The amount of the Medicare Advantage plan deductible or whether it even has a deductible.

- How often you use health services.

- Added costs of seeing a health care provider outside your plans network.

Recommended Reading: How To Verify Medicare Eligibility Online