Medicare General Enrollment Period

If you don’t sign up during your Initial Enrollment Period and if you aren’t eligible for a Special Enrollment Period, the next time you can enroll in Medicare is during the Medicare General Enrollment Period.

The General Enrollment Period lasts from each year.

You can only sign up for Part A and/or Part B during this period, and your coverage starts on July 1. You may have to pay a late enrollment period for Part A and/or Part B, as detailed below.

|

Part B Late Enrollment Penalty: If you do not enroll in Medicare Part B during your Initial Enrollment Period but decide to enroll later in life, you will have to pay a late enrollment penalty. Your Part B monthly premium could go up 10 percent for each 12-month period that you were eligible for Part B but didn’t sign up. You pay the Part B late enrollment penalty for the rest of your life as long as you remain enrolled in Part B. |

Are You Considering A Medicare Supplement Plan

SHIIP’s interactive tool allows you to compare Medicare supplement by entering your age, gender the Medicare supplement plan you want to compare and whether or note you use tobacco products to receive a list of companies offering that plan along with their estimated premiums.

You will not be auto enrolled into a Medicare supplement policy and must make application directly with the insurance company. You will need to contact the insurance company that sells the specific policy that you wish to purchase, or you may contact an agent who sells the specific policy you want. We recommend that you apply at least 30 days before you want the policy to start. If you do not have thirty days, apply as soon as possible. Supplement premiums are paid directly to the insurance company and are not deducted from your Social Security payments.

What’s New for Medicare beneficiaries under age 65?

Medicare Supplemental Insurance federal regulations do not guarantee eligibility to individuals under age 65 who are eligible for Medicare due to disability. However, thirty-three states have adopted state legislation extending guarantee issue to that group of individuals. North Carolina is one of the states that legislatively mandates eligibility to individuals eligible for Medicare due to disability.

Below is the link to review the new regulation.

What is the Open Enrollment Period?

Cost of Medigap Policies

Medicare Prescription Drug Coverage

Medicare Part D is prescription drug coverage that is partially subsidized by the federal government. To be eligible, you must be entitled to benefits under Medicare Part A and/or enrolled under Part B. You must choose a plan, enroll, and pay a monthly premium to get the coverage. If you have limited income and resources, you may get this coverage for little or no cost by applying for the Low Income Subsidy.

To take advantage of this coverage, you may join a Medicare Prescription Drug Plan that covers prescription drugs only and keep Original Medicare or you can join a Medicare Advantage Plan that also offers prescription drug coverage.

Read Also: Does Medicare Pay For Foot Care

Special Scenarios Granting Guaranteed Issue Rights

- You joined Medicare Advantage at 65 and decided to switch back to Original Medicare within a year .

- Your Medicare Advantage plan shuts down or you move out of its service area.

- Your employer plan that supplements Medicare ends.

- Your Medigap plan shuts down.

There are a handful of scenarios that grant these Medigap protections, says Amanda Baethke, director of corporate development at Aeroflow Healthcare, a durable medical equipment provider that supplies patients with home healthcare solutions through insurance. She sees these scenarios regularly in her work. In those situations, insurance companies must sell you a Medigap policy, must cover all your pre-existing health conditions and cannot charge you more because of your past or present health problems.

What If You Continued Working Past 65

If youre still working past 65 and you or your spouse get health insurance through an employer or union with 20 or more employees or members, you may already have coverage thats similar to Part B. In this case, you can postpone Part B enrollment and you wont face a penalty when you enroll later.12 Part B has a standard monthly premium , so you can save money by not enrolling until you really need it.9

Your Medigap Open Enrollment Period will start once you sign up for Part B. Youll have six months to buy any plan sold in your state at the lowest possible rate with no medical questions asked.

Don’t Miss: When Do Medicare Benefits Kick In

Medicare Supplement Guaranteed Issue Rights

During your Open Enrollment Period you will automatically have the right to purchase any Medicare Supplement plan that is available in your state of residence. Certainly, this is the best time to purchase Medicare Supplement insurance but there are generally still a handful of situations when you can purchase a Medicare Supplement plan on a guaranteed issue basis as long as you are age 65 or older.

Typically you have this guarantee issue right if you have other health insurance that has significant changes in coverage or you lose that coverage and its not your fault. If this is your situation, a Medicare Supplement insurance company must offer to sell you a Medicare Supplement plan without excluding any preexisting conditions. You will also have guarantee issue rights for any of the following reasons:

Improvements To Medicare’s Preventative Care Coverage

Medicare beneficiaries pay nothing for most preventive services if the services are received from a doctor or other health care provider who participates with Medicare . For some preventive services, the Medicare beneficiary pays nothing for the service, but may have to pay coinsurance for the office visit to receive these services.

Medicare covers two types of physical exams one when you’re new to Medicare and one each year after that. The Welcome to Medicare physical exam is a one-time review of your health, education and counseling about preventive services, and referrals for other care if needed. Medicare will cover this exam if you get it within the first 12 months of enrolling in Part B. You will pay nothing for the exam if the doctor accepts assignment. When you make your appointment, let your doctor’s office know that you would like to schedule your Welcome to Medicare physical exam. Keep in mind, you don’t need to get the Welcome to Medicare physical exam before getting a yearly Wellness exam. If you have had Medicare Part B for longer than 12 months, you can get a yearly wellness visit to develop or update a personalized prevention plan based on your current health and risk factors. Again, you will pay nothing for this exam if the doctor accepts assignment. This exam is covered once every 12 months.

Recommended Reading: Does Costco Pharmacy Accept Medicare

Buy A Policy When You’re First Eligible

The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. You generally will get better prices and more choices among policies. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first month you have

and you’re 65 or older. It can’t be changed or repeated. After this enrollment period, you may not be able to buy a Medigap policy. If you’re able to buy one, it may cost more due to past or present health problems.

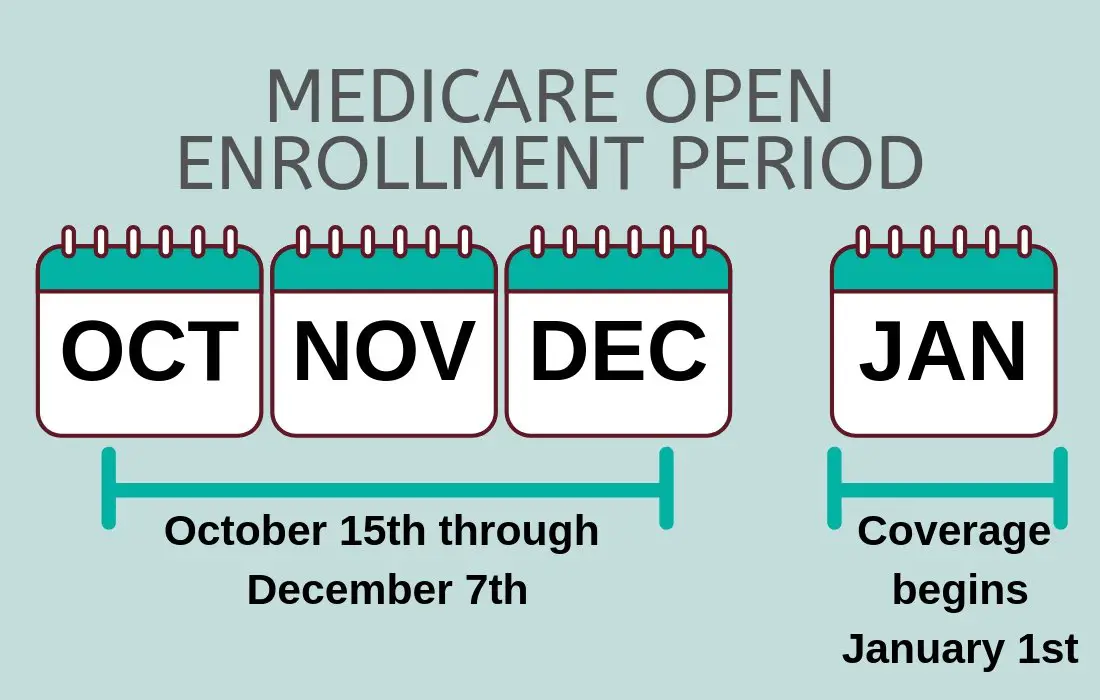

Medicare Open Enrollment: What You Cant Do

The annual Medicare open enrollment period does not apply to Medigap plans, which are only guaranteed issue in most states during a beneficiarys initial enrollment period, and during limited special enrollment periods.

If you didnt enroll in Medicare when you were first eligible, you cannot use the fall open enrollment period to enroll. Instead, youll use the Medicare general enrollment period, which runs from January 1 to March 31.

Medicares general enrollment period is for people who didnt sign up for Medicare Part B when they were first eligible, and who dont have access to a Medicare Part B special enrollment period. Its also for people who have to pay a premium for Medicare Part A and didnt enroll in Part A when they were first eligible.

If you enroll during the general enrollment period, your coverage will take effect July 1.

Learn more about Medicares general enrollment period.

You May Like: What Age Is For Medicare

How Do I Enroll In Medigap

There are two main ways to enroll in Medigap: you can join on your own. Most private insurance companies have access on their websites or by phone a licensed insurance agent can help you find the right plan and enroll. It does not cost you anything to speak with a GoHealth licensed insurance agent.

How To Cancel A Medicare Supplement Plan

There is not a required disenrollment period for canceling your Medicare Supplement plan. You may drop your Medigap policy at any time by requesting a cancellation through your insurance company however, if you decide to leave, you may not be able to buy a Medicare Supplement Insurance plan at another time, unless you have a trial right or guaranteed issue right .

Need help choosing a Medicare Supplement Plan? No matter where you are in your Medicare journey, Medicare.orgs information and resources can help make it easy to find the quality and affordable Medicare plan thats right for you. We offer free comparisons for Medicare Advantage Plans , Medicare Supplement Plans , and Medicare Prescription Drug Plans .

Get an online quote for Medicare plans that fit your health care needs today! Or call TTY 711 to get answers and guidance over the phone from an experienced licensed sales agent.

Related Information:

Read Also: When You Are On Medicare Do You Need Supplemental Insurance

When Can I Enroll In Medigap

The easy answer: as soon as youre eligible. For traditional Medigap customers, the Medicare supplement open enrollmentMedicare Advantage Open Enrollment: The annual period when individuals enrolled in Medicare Advantage plans can make a one-time plan change to any other Medicare Advantage, Medicare Advantage Part D, Part D Prescription Drug plan or go back to Original Medicare. Medicare Advantage Open Enrollment is from January 1 – March 31. The Open Enrollment Period for under 65 runs from November 1 to December 15. If you dont enroll by Dec. 15, you wont be eligible for coverage unless you qualify for a Special Enrollment Period. period lasts for six months. This window begins the month you turn 65 and enroll in Medicare Part B. You must meet both qualifications to be eligible for Medigaps open enrollment period.

For example, if you turn 65 in January, but your Part B enrollment begins in February, your eligibility begins on Feb. 1 and runs through the end of July.

Medicare Part D Prescription Drug Coverage

2021 Part D premiums:

- The average premium for Medicare Part D coverage is about $38/month in 2021. There continue to be a wide range of Part D plan options available. Premiums for Part D plans start as low as about $7/month in 2021, down from a low of about $13/month in 2020. On the higher end, plans can have premiums of up to $100/month or more, so there is a great deal of variation in price and benefits across the available plans.

- High-income enrollees pay a higher Part D premium. The threshold for high-income began to be indexed as of 2020. The income threshold for 2021 is $88,000 for a single person and $176,000 for a couple. Its expected to increase to $91,000 and $182,000 as of 2022 .

Part D deductible:

- Maximum of $480 in 2022, up from $445 in 2021. .

Part D out-of-pocket costs after deductible:

- Not to exceed 25% of the cost of brand-name and generic costs.

- There is no longer a donut hole in terms of the maximum amount that enrollees can be charged when they fill prescriptions. But the donut hole still exists in terms of how insurers design their coverage , how total drug costs are counted, and who covers the bulk of the cost of the drugs .

- After a beneficiarys costs reach the catastrophic coverage threshold , additional out-of-pocket costs are capped at the greater of 5% of the cost of the drug or a copay of $3.95 for generics and $9.85 for brand-name drugs.

Learn more about Medicare Part D.

Recommended Reading: How Much Does Medicare Part A And B Cover

I Want To Enroll In Medicare What Are My Next Steps

Once you’re ready to enroll in Medicare, you’ll want to consider the following next steps:

What Cant You Do During Open Enrollment

However, not all plan changes can be made at this time. The main thing you may not able to do is buy a Medigap plan.

There are only certain times when you can add a Medigap policy to your plan. The Medigap enrollment periods are:

- Initial enrollment period. You are eligible to apply for a Medicare plan, and add a Medigap policy during the 3 months before, 3 months after, and month of your 65th birthday.

- Open enrollment period. If you miss initial enrollment, you can apply for a policy during the Medigap open enrollment period. If youve already turned age 65, this period begins when you enroll in Part B. If youre turning age 65, this period runs until 6 months after your turn 65 years old and have enrolled in Part B. During this enrollment period, youre guaranteed to be accepted by a Medigap plan and to get a good rate.

You may be able to buy Medigap plans outside of these windows. However, you wont have the same guarantees. Insurance companies arent required to sell you a Medigap policy, especially if youre under age 65. And after your enrollment window, Medigap plans can deny your application or charge you a much higher rate.

You May Like: What Are The Advantages And Disadvantages Of Medicare Advantage

Get Coverage Outside Of Open Enrollment

You only get one Medigap Open Enrollment Period. But there are other times, depending on the circumstances, when you can qualify for a Medicare Supplement. This is called a guaranteed issue right, also called Medigap protections.

Guaranteed issue rights mean that in certain situations, insurance companies are required to offer you certain Medigap policies. The insurance company also must cover all your pre-existing health conditions and cannot charge more because of these conditions. The guaranteed issue right occurs mostly when you have other health coverage that changes, like you lose your health coverage in certain circumstances. But it can also occur when you try a Medicare Advantage Plan during a trial period, change your mind, and then still decide to buy a Medigap policy.

In the following situations, you have a guaranteed issue right.

- Insurance companies must offer a Medicare Supplement, with no medical exclusions, when an insurance company goes bankrupt, doesnt follow the rules, or you lose coverage through no fault of your own.

- You have Original Medicare as well as an employer health plan , or union coverage, that pays after Medicare pays, and that plan is ending.

- You decide to disenroll from a Medicare Advantage plan during a 12-month trial period. There are two times this happens.

- You enroll in a Medicare Advantage plan when initially eligible, at age 65.

- You have a Medicare Supplement and drop this coverage to try a Medicare Advantage plan.

Enrolling In A Medicare Supplement

During your initial Medigap enrollment period you cant be denied Medigap coverage or be charged more for the coverage because of your medical history.

But after that window ends, Medigap insurers in most states can use medical underwriting to determine your premiums and eligibility for coverage.

If youre under 65 and eligible for Medicare because of a disability, there are 33 states that provide some sort of guaranteed issue period during which you can purchase a Medigap plan. But in the majority of those states, the carriers can charge additional premiums for people under 65. You can click on a state on this map to see how Medigap plans are regulated in the state.

To find out about Medigap policies in your state, contact your State Department of Insurance or your State Health Insurance Assistance Program, or call 1-855-593-5633 to speak with one of our partners, who can help you find a plan in your area.

Read Also: How To Renew Medicare Benefits

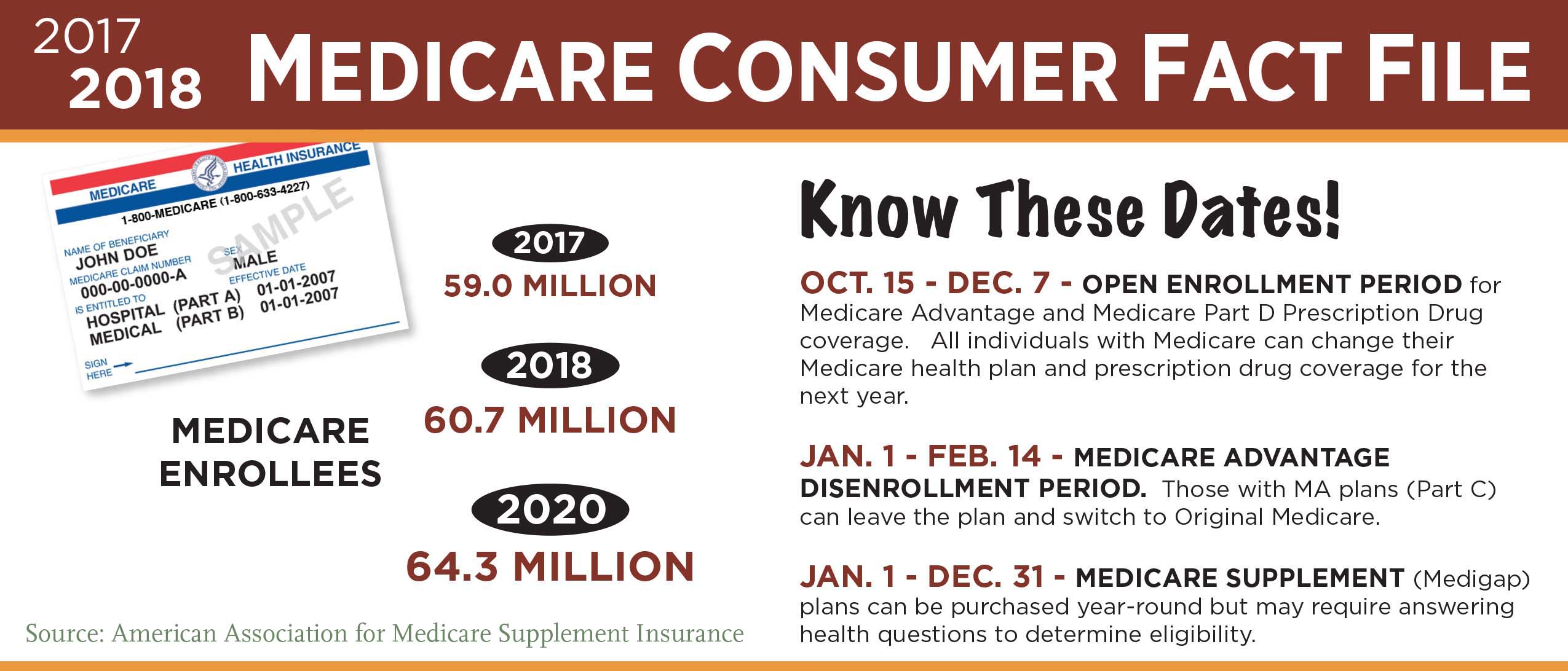

Medicare Open Enrollment 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Signing up on time for all the different parts of Medicare is key to getting the most out of this government-sponsored health coverage. Hitting your deadlines can help you avoid paying higher premiums caused by late penalties.

To better understand when to enroll in Medicare, lets first take a quick look at the various types of Medicare coverage available.

Original Medicareconsists of Medicare Part A and Medicare Part B .

MedicareAdvantage plans are sold by private insurers as an alternative to Original Medicare. Medicare Advantage plans may offer additional benefits, including dental and vision coverage. And, Medicare Advantage policies may incorporate Part D prescription drug coverage into the plan.

MedicarePart D prescription drug coverage is also administered by private insurers. Part D is an optional program that helps cover the cost of prescription drugs.

Medicare Supplement Insurance plans help pay for out-of-pocket health care costs you incur with Original Medicare parts A and B.

Use the information below to make sense of the main Medicare enrollment periods.