A Few Words On Medigap

Medigap is Medicare supplemental insurance that can ameliorate some of the costs that aren’t covered by Medicare Parts A and B. This insurance is provided by private companies, and typically requires that a beneficiary already have Medicare Parts A and B to enroll. Premiums are generally paid monthly, and it’s best to enroll as close as possible to enrollment in Parts A and B.

Why Do I Need To Buy A Private Health Plan

Private Medicare health plans like Medicare Advantage or Medicare Cost plans cover everything Original Medicare does, and usually include more coverage for services you might need. Plus, they can include extra perks and benefits.

Find out more in the article, 4 reasons to buy a private health plan.

Am I Eligible For Medicare

To receive Medicare, you must be eligible for Social Security benefits.

Part A Eligibility

Most people age 65 or older are eligible for Medicare Part A based on their own employment, or their spouse’s employment. Most people have enough Social Security credits to get Part A for free. Others must purchase it.

You are eligible for Medicare Part A if you meet one of the following criteria:

- You are eligible for Social Security or Railroad Retirement benefits, even if you do not receive those benefits.

- You are entitled to Social Security benefits based on a spouse’s, or divorced spouse’s work record, and that spouse is at least 62 years old.

- You have worked long enough in a federal, state, or local government job to be eligible for Medicare.

If you are under 65, you are eligible for Medicare Part A if you meet one of the following criteria:

- You have received Social Security disability benefits for 24 months.

- You have received Social Security benefits as a disabled widow, divorced disabled widow, or a disabled child for 24 months.

- You have worked long enough in a federal, state, or local government job and meet the requirements of the Social Security disability program.

- You have permanent kidney failure that requires maintenance dialysis or a kidney transplant.

- You are diagnosed with ALS or Lou Gehrig’s disease.

Part B Eligibility

If you are eligible for Part A, you can enroll in Medicare Part B which has a monthly premium.

Will I Need To Prove My Age?

Automatic Enrollment

Read Also: Does Medicare Pay For A Portable Oxygen Concentrator

What Do Medicare Parts A B C And D Mean

Who is this for?

If you’re new to Medicare, this information will help you understand the different parts and what they do.

There are four parts of Medicare. Each one helps pay for different health care costs.

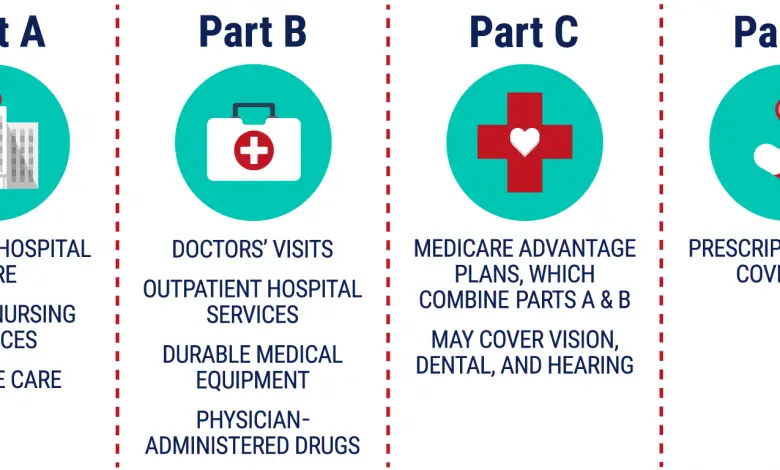

Part A helps pay for hospital and facility costs. This includes things like a shared hospital room, meals and nurse care. It can also help cover the cost of hospice, home health care and skilled nursing facilities.

Part B helps pay for medical costs. This is care that happens outside of a hospital. It includes things like doctor visits and outpatient procedures. It also covers some preventive care, like flu shots.

Parts A and B together are called Original Medicare. These two parts are run by the federal government. Find out more about what Original Medicare covers in our Help Center.

Part C helps pay for hospital and medical costs, plus more. Part C plans are only available through private health insurance companies. Theyre called Medicare Advantage plans. They cover everything Parts A and B cover, plus more. They usually cover more of the costs youd have to pay for out of pocket with Medicare Parts A and B. Part C plans put a limit on what you pay out of pocket in a given year, too. Some of these plans cover preventive dental, vision and hearing costs. Original Medicare doesnt.

You can see a list of the Medicare Advantage plans we offer and what they cover.

Enrollment Period For Medicare Part B

Youre eligible to enroll in Medicare Part B during the seven-month period around your 65th birthdaybeginning three months before the month of your 65th birthday, including your birthday month, and lasting up to three months after. This is called your Initial Enrollment Period . Enrollment in Part B is automatic if you are receiving Social Security or Railroad Retirement Board benefits.

You May Like: Can You Work And Get Medicare

What Is Medicare Part A

Medicare Part A is part of Original Medicare and covers your inpatient and hospital service costs. Benefits of Medicare Part A include skilled nursing facility care, home health services, and hospice. When you have Medicare Part A, you are responsible for daily copayments depending on how long you have received care. For most who enroll in Medicare Part A, there is a $0 monthly premium. However, you are responsible for the per occurrence Part A deductible.

To be eligible for zero-premium Medicare Part A you must have worked at least 10 years in the United States paying Medicare taxes. This contribution to Medicare covers your Medicare Part A premiums as long as you are enrolled in the federal healthcare program.

Faq: Does Medicare Cover Nursing Homes

This is a common question and one that can be confusing to find a clear answer for.

As a rule, short-term stays in skilled nursing facilities are covered under Part A, but long-term stays arent. The difference is medical necessity.

Medicare only covers stays in skilled nursing facilities under set conditions, including:

- The stay needs to follow a 3-day inpatient hospital stay.

- A doctor needs to order the care youll receive in the skilled nursing facility.

- You must require care such as nursing, physical therapy, or other skilled healthcare services.

Medicare will only pay for this care while its still considered medically necessary for a maximum of 100 days per benefit period.

This is different from a long-term move into a nursing home, assisted living facility, or any other form of what Medicare calls custodial care. Medicare never pays for this type of care.

Don’t Miss: What Is Original Medicare Mean

Unitedhealthcare Connected General Benefit Disclaimer

This is not a complete list. The benefit information is a brief summary, not a complete description of benefits. For more information contact the plan or read the Member Handbook. Limitations, copays and restrictions may apply. For more information, call UnitedHealthcare Connected® Member Services or read the UnitedHealthcare Connected® Member Handbook. Benefits, List of Covered Drugs, pharmacy and provider networks and/or copayments may change from time to time throughout the year and on January 1 of each year.

You can get this document for free in other formats, such as large print, braille, or audio. Call Member Services, 8 a.m. – 8 p.m., local time, Monday – Friday . The call is free.

You can call Member Services and ask us to make a note in our system that you would like materials in Spanish, large print, braille, or audio now and in the future.

Language Line is available for all in-network providers.

Puede obtener este documento de forma gratuita en otros formatos, como letra de imprenta grande, braille o audio. Llame al Servicios para los miembros, de 08:00 a. m. a 08:00 p. m., hora local, de lunes a viernes correo de voz disponible las 24 horas del día,/los 7 días de la semana). La llamada es gratuita.

Puede llamar a Servicios para Miembros y pedirnos que registremos en nuestro sistema que le gustaría recibir documentos en español, en letra de imprenta grande, braille o audio, ahora y en el futuro.

Proposals For Reforming Medicare

As legislators continue to seek new ways to control the cost of Medicare, a number of new proposals to reform Medicare have been introduced in recent years.

Premium support

Since the mid-1990s, there have been a number of proposals to change Medicare from a publicly run social insurance program with a defined benefit, for which there is no limit to the government’s expenses, into a publicly run health plan program that offers “premium support” for enrollees. The basic concept behind the proposals is that the government would make a defined contribution, that is a premium support, to the health plan of a Medicare enrollee’s choice. Sponsors would compete to provide Medicare benefits and this competition would set the level of fixed contribution. Additionally, enrollees would be able to purchase greater coverage by paying more in addition to the fixed government contribution. Conversely, enrollees could choose lower cost coverage and keep the difference between their coverage costs and the fixed government contribution. The goal of premium Medicare plans is for greater cost-effectiveness if such a proposal worked as planned, the financial incentive would be greatest for Medicare plans that offer the best care at the lowest cost.

Currently, public Part C Medicare health plans avoid this issue with an indexed risk formula that provides lower per capita payments to sponsors for relatively healthy plan members and higher per capita payments for less healthy members.

- Senate

Also Check: Which One Is Better Medicare Or Medicaid

General Fund Revenue As A Share Of Total Medicare Spending

This measure, established under the Medicare Modernization Act , examines Medicare spending in the context of the federal budget. Each year, MMA requires the Medicare trustees to make a determination about whether general fund revenue is projected to exceed 45 percent of total program spending within a seven-year period. If the Medicare trustees make this determination in two consecutive years, a “funding warning” is issued. In response, the president must submit cost-saving legislation to Congress, which must consider this legislation on an expedited basis. This threshold was reached and a warning issued every year between 2006 and 2013 but it has not been reached since that time and is not expected to be reached in the 20162022 “window”. This is a reflection of the reduced spending growth mandated by the ACA according to the Trustees.

Medicare Supplements Or Medigap

Medicare Supplements, or Medigap plans, are provided by private insurance companies and can be used to supplement the gaps in Original Medicares coverage. These gaps include the deductible and co-pays a patient is required to pay when enrolled in Original Medicare. Read more about Medicare Supplements.

Read Also: Does Medicare Cover Eylea Injections

Medicare Isn’t Just One Insurance Plan

Medicare is a lot more complicated than you may realize. Many Americans know that it has two parts — Part A and Part B — that cover most garden-variety health services and major operations. However, there are also other parts that cover a plethora of additional services. Understanding each part of Medicare can help you make smart healthcare decisions during retirement.

Let’s go over the various parts of Medicare and the benefits they provide.

Signing Up For Original Medicare

Some people qualify for automatic enrollment, and others have to enroll.

- If youre already receiving Social Security or railroad retirement benefits youll be enrolled in Part A and Part B automatically on your 65th birthday. If youre under 65, its the 25th month you receive disability benefits.

- ALS patients are automatically enrolled in Medicare coverage when their Social Security disability benefits begin, regardless of age. If you have end-stage renal disease , you must manually enroll.

If youre eligible for Medicare but dont qualify for automatic enrollment, you can apply online, over the phone or in person at your local Social Security office.

If you worked for a railroad, youll need to contact the Railroad Retirement Board for information on enrollment.

Recommended Reading: Does Medicare Cover Oxygen At Home

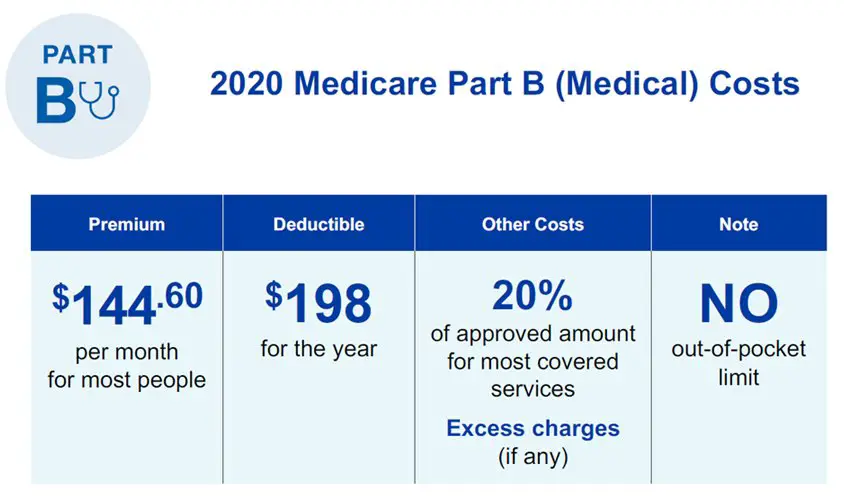

What Are My Costs

- Original Medicare

-

- For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance.

- You pay a premium for Part B. If you choose to join a Medicare drug plan, youll pay a separate premium for your Medicare drug coverage .

- There’s no yearly limit on what you pay out of pocket, unless you have supplemental coveragelike Medicare Supplement Insurance .

- Medicare Advantage

-

- Out-of-pocket costs varyplans may have different out-of-pocket costs for certain services.

- You pay the monthly Part B premium and may also have to pay the plan’s premium. Plans may have a $0 premium or may help pay all or part of your Part B premium. Most plans include Medicare drug coverage .

- Plans have a yearly limit on what you pay out of pocket for services Medicare Part A and Part B covers. Once you reach your plans limit, youll pay nothing for services Part A and Part B covers for the rest of the year.

Medicare In A Nutshell

In its current iteration, Medicare provides health insurance for Americans age 65 and up, and for individuals of any age with a permanent disability or end-stage renal disease . Medicare is made up of four parts:

- Part A provides hospital insurance

- Part B provides medical insurance

- Part C comprises Medicare Advantage Plans and

- Part D provides prescription drug coverage.

Since its signing into law in 1965 by President Lyndon B. Johnson, Medicare has undergone numerous revisions. The Centers for Medicare and Medicaid Services offers a timeline of key legislative milestones affecting Medicare and other health programs from 1965 to 2003.1

Read Also: How Do I Know If I Have Part D Medicare

Reimbursement For Part A Services

For institutional care, such as hospital and nursing home care, Medicare uses prospective payment systems. In a prospective payment system, the health care institution receives a set amount of money for each episode of care provided to a patient, regardless of the actual amount of care. The actual allotment of funds is based on a list of diagnosis-related groups . The actual amount depends on the primary diagnosis that is actually made at the hospital. There are some issues surrounding Medicare’s use of DRGs because if the patient uses less care, the hospital gets to keep the remainder. This, in theory, should balance the costs for the hospital. However, if the patient uses more care, then the hospital has to cover its own losses. This results in the issue of “upcoding”, when a physician makes a more severe diagnosis to hedge against accidental costs.

Who Is Eligible For Medicare Part C

Now, lets look at Medicare eligibility for Part C, or Medicare Advantage. Youre eligible to enroll if you already have both Part A and Part B.* Coverage is provided through Medicare-approved private insurance companies. Every plan has a service area that you must live in to receive benefits.

*You typically arent eligible for Medicare Advantage if you have ESRD . However, some insurers offer Special Needs Plans that cover ESRD. That will change in 2021 when enrollment restrictions are lifted for enrollees with ESRD.

Read Also: How To Get Help Paying Your Medicare Premium

Facts On The Basics Of Medicare

Medicare is a federal health insurance program that pays for a variety of health care expenses. Itâs administered by the Centers for Medicare & Medicaid Services , a division of the U.S. Department of Health & Human Services . Medicare beneficiaries are typically senior citizens aged 65 and older. Adults with certain approved medical conditions or qualifying permanent disabilities may also be eligible for Medicare benefits.

Similar to Social Security, Medicare is an entitlement program. Most U.S. citizens earn the right to enroll in Medicare by working and paying their taxes for a minimum required period. Even if you didnât work long enough to be entitled to Medicare benefits, you may still be eligible to enroll, but you might have to pay more.

There are four different parts to the Medicare program. Parts A and B are often referred to as Original Medicare. Medicare Part C, or Medicare Advantage, is private health insurance, while Medicare Part D offers coverage for prescription drugs. The details below tell you more about Medicare insurance plans, with an overview of the four parts.

D: Prescription Drug Plans

Medicare Part D went into effect on January 1, 2006. Anyone with Part A or B is eligible for Part D, which covers mostly self-administered drugs. It was made possible by the passage of the Medicare Modernization Act of 2003. To receive this benefit, a person with Medicare must enroll in a stand-alone Prescription Drug Plan or public Part C health plan with integrated prescription drug coverage . These plans are approved and regulated by the Medicare program, but are actually designed and administered by various sponsors including charities, integrated health delivery systems, unions and health insurance companies almost all these sponsors in turn use pharmacy benefit managers in the same way as they are used by sponsors of health insurance for those not on Medicare. Unlike Original Medicare , Part D coverage is not standardized . Plans choose which drugs they wish to cover . The plans can also specify with CMS approval at what level they wish to cover it, and are encouraged to use step therapy. Some drugs are excluded from coverage altogether and Part D plans that cover excluded drugs are not allowed to pass those costs on to Medicare, and plans are required to repay CMS if they are found to have billed Medicare in these cases.

Don’t Miss: Will Medicare Pay For Dental Care

Medicare Part C: Medicare Advantage Plans

Many people opt for Medicare Part C, also known as a Medicare Advantage plan, rather than Original Medicare.

Unlike Original Medicare, which is covered by the federal government, Medicare Advantage plans are issued by private health insurance companies. Medicare Part C plans combine the coverages of Part A and Part B, and they often cover benefits Original Medicare doesnt, including hearing, dental, or vision services. Many plans even offer prescription drug coverage as well.

In some cases, your out-of-pocket costs with a Medicare Advantage plan will be lower than they would be with Original Medicare, making them an affordable alternative. In fact, the average premium is just $21 per month in 2021, in addition to your Medicare Part B premium.