List Of Medicare Supplement Insurance Companies

The Medicare Supplement Insurance information listed below shows the companies that are currently or actively offering Medicare Supplement Insurance policy plans for individuals and/or groups under 65 years of age and over 65, along with the company’s reported explanations and consumer contact information . The company’s name is a hyperlink to the respective company’s website for additional information.

For more Medicare Supplement Insurance information, please select Guide to Medicare Supplement.

The Following Is A Brief Explanation Of The Other More Common Codes:

Code B claimant is drawing on their living spouses work record. B applies to a wife drawing on a husbands record, while B1 is for a husband drawing on a wifes record. Numerical suffixes continue to 9 . The spouses or ex-spouses Social Security Number will be the first nine numbers for anyone with the suffix code in the B category.

Code C this category applies to child Medicare beneficiaries. Numerical suffixes following C indicate the childs relationship to the primary claimant. The youngest child gets code C1, the next youngest gets C2, and so on through C9 and then from CA to CZ.

Code D this category is for anyone claiming based on a deceased spouse solely due to age. D and D1 represent a widow or widower over 60 and are the most common codes. Other codes apply to surviving divorced spouses, as well as widows and widowers who remarry.

Code E this category applies to widows and widowers who are also parents of qualifying children. E is a particularly complicated category given the many variations.

Code F this is the parent category. These codes are assigned to dependent parents of the worker who earned Medicare benefits. All F codes are followed by a number to signify the relationship.

Code H indicates Medicare eligibility due to disability. HA means you are a disabled claimant. HB means you are the wife of a disabled claimant. HC means you are the child of a disabled claimant.

What Is A Medicare Supplement Plan

Medicare supplement plans are one health insurance option for people with Original Medicare. There are standardized Medicare supplement insurance plans available that are designed to fill the gaps left by Original Medicare . These are sold by private insurance companies as individual insurance policies and are regulated by the Department of Insurance. After age 65 and for the first six months of eligibility for Medicare Part B, beneficiaries have an Open Enrollment Period and are guaranteed the ability to buy any of these plans from any company that sells them. Companies cannot deny coverage or charge more for current or past health problems. If you fail to apply for a Medicare supplement within your Open Enrollment Period, you may lose the right to purchase a Medicare supplement policy without regard to your health.

Recommended Reading: Can You Apply For Medicare After 65

What Does Medicare Supplement Insurance Cost

The primary goal of a Medicare Supplement insurance plan is to help cover some of the out-of-pocket costs of Original Medicare . As a general rule, the more comprehensive the coverage, the higher the premium, however, premiums will also vary by insurance company, and premium amounts can change yearly.

What Should I Do If I Get This Notice

Medicare will mail you a purple letter to let you know you automatically qualify for Extra Help. Keep this for your records. You dont need to apply for Extra Help if you get this letter. If you dont already have Medicare drug coverage, you must get it to use this Extra Help. If you dont have drug coverage, Medicare may enroll you in a separate Medicare drug plan so that youll be able to use the Extra Help. If Medicare enrolls you in a plan, youll get a yellow or green letter letting you know when your coverage begins, and youll have a Special Enrollment Period to change plans if you want to enroll in a different plan than the one Medicare enrolled you in.

Don’t Miss: Are Medicare Part D Premiums Based On Income

What To Focus On

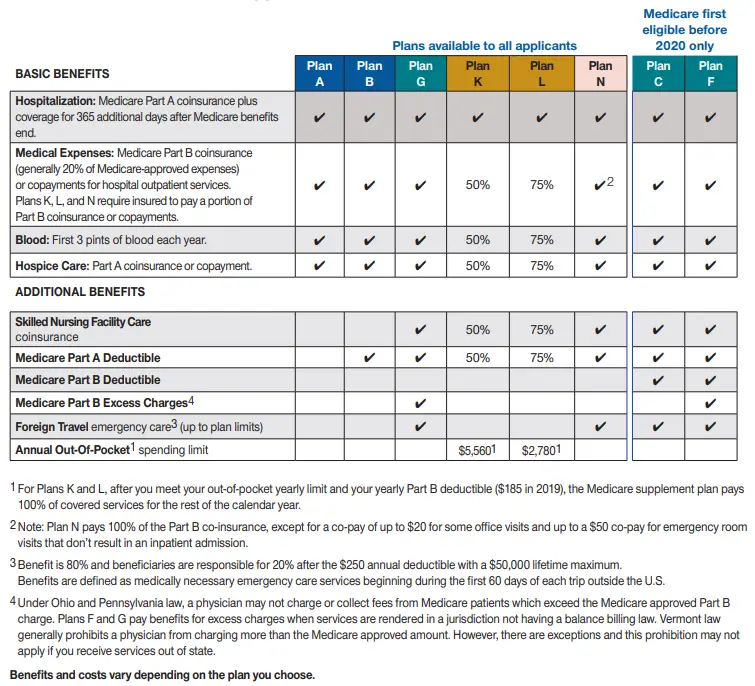

The governments comparison chart shows 10 health care costs that could be covered by a Medigap policy. Some come into play more than others, so you should focus most on those big-ticket items. They include:

- Your 20 percent share of the cost of doctor visits

- Your 20 percent share of the cost of lab tests and other outpatient services

- The deductible for each time you are admitted to a hospital

- The coinsurance costs of hospital stays or stays in a skilled nursing facility after being in a hospital

There are other considerations, as well. For instance, while other plans cover 100 percent of Part B coinsurance, plans K and L have higher cost-sharing but also an out-of-pocket limit. Once youve paid that amount, they take care of 100 percent of covered services for the rest of the year. In 2020, the limit for the K plan is $5,880, and the limit for the L is $2,940. These limits increase each year, based on inflation.

Remember, Medigap does not cover prescription drugs or dental, vision or most other needs that Original Medicare doesnt cover.

What Is Medicare Part C

A Medicare Advantage Plan is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called Part C or MA Plans, are offered by private companies approved by Medicare.

If you join a Medicare Advantage Plan, the plan will provide all of your Part A and Part B coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs. Most include Medicare prescription drug coverage .

Medicare pays a fixed amount for your care every month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare. However, each Medicare Advantage Plan can charge different out-of-pocket costs and have different rules for how you get services . These rules can change each year.

Don’t Miss: How Do You Apply For Medicare Part B Online

Medigap Policies Are Standardized

Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as “Medicare Supplement Insurance.” Insurance companies can sell you only a “standardized” policy identified in most states by letters.

All policies offer the same basic

but some offer additional benefits, so you can choose which one meets your needs. In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way.

Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

- Don’t have to offer every Medigap plan

- Must offer Medigap Plan A if they offer any Medigap policy

- Must also offer Plan C or Plan F if they offer any plan

Medigap F Cost Example

Gracie applies for a Plan F Medigap and the insurance company approves her. The following year she sees an orthopedic specialist about problems with her knee. Medicare pays 80% of the cost of this visit to her specialist. Plan F covers the other 20% owed under Part B. Gracie owes nothing.

The specialist sends her to an imaging facility to have an MRI done on her knee. Medicare pays 80% of the cost of her MRI. Medicare F pays the other 20%. Gracie pays absolutely nothing.

The results of the MRI show serious problems. Her orthopedic specialist tells Gracie that she is a candidate for a total knee replacement. She undergoes surgery at her local hospital and is in the hospital a couple of days. Gracie also has a home health care nurse come out to her home several times in the weeks following her surgery.

The total cost for Gracies surgery, hospital stay and follow-up care is $70,000. Medicare pays its share of the bills and sends the remainder of about $14,000 to Gracies Supplemental insurance carrier. The carrier pays the entire bill, and Gracie owes absolutely nothing for any of these Part A and Part B services. Her only out-of-pocket spending would be for medications.

That means the cost of Medicare Supplement Plan F is really only the premiums that you pay for the plan itself. Medicare Supplement Plan F rates will vary by insurance company, but you can rest assured there is no back-end spending.

You May Like: When Can You Change Your Medicare Supplement Plan

Plan F Vs Plan G Comparison

We often get questions about Plan F vs Plan G. We compare prices for both Plan F vs Plan G for nearly all new clients.

Quite often, we find that our clients can sometimes save $200 -$300 per year by looking at Plan G options. So what is the difference between Medigap Plan F and G and which is better?

The coverage is very similar to Medicare Supplement Plan F with one minor exception: the Part B deductible. On Plan G, you pay the once-annual Part B deductible yourself. However the premiums can be quite a bit cheaper, and you pocket the savings.

Plan G might help you keep more of your money in your own pocket instead of an insurance companys coffers. We can demonstrate the savings for you get quotes for Plan F vs Plan G today. We can also provide quotes for Medicare Plan N, which is the third most popular Medicare Supplement plan.

Our agency works with about 30 carriers in every state. These include Mutual of Omaha Medicare Supplements, Aetna Medicare Supplements and Cigna Medicare Supplements. All three of these carriers have competitive Plan G rates in 2022. Youll easily learn which insurance carriers offer you the greatest long-term savings and benefits.

What Is A Medigap Policy What Does It Cover

Medigap policies, which supplement Original Medicare, are sold by private health insurance companies. While Original Medicare covers most things, there are out-of-pocket costs like deductibles, copayments, and coinsurance. Those gaps can be covered by purchasing Medicare Supplement Plans F, G, or N. These policies are standardized across states, meaning they all must provide roughly the same coverage no matter which state you live in.

In Massachusetts, Minnesota, and Wisconsin, however, Medigap policies are standardized differently, meaning they package the coverage in slightly different ways in those states.3

Typically, Medigap policies wont cover long-term care, vision, dental, eyeglasses or private nursing care.

Whats more, some carriers are adding perks to their plans such as deeply discounted health club or fitness center memberships.4

Quick Overview

Plan G provides more coverage than Plan N, but Plan N could save you money on lower premiums. Plan F is the most comprehensive option but its not available to everyone.

Don’t Miss: Does Medicare Cover Ambulance Fees

Medicare Supplement Insurance Plan Basics

Under Medicare Supplemental insurance, each Medicare Supplement insurance plan offers a different level of basic benefits, but each lettered plan must include the same standardized basic benefits regardless of insurance company and location. For example, Medicare Supplement Plan G in Florida includes the same basic benefits as Plan G in North Dakota. Please note that if you live in Massachusetts, Minnesota, or Wisconsin, your Medicare Supplement insurance plan options are different than in the rest of the country. Medicare Supplement insurance plans do not have to cover vision, dental, long-term care, or hearing aids, but all plans must cover at least a portion of the following basic benefits:

- Medicare Part A coinsurance costs up to an additional 365 days after Medicare benefits are exhausted

- Medicare Part A hospice care coinsurance or copayments

- Medicare Part B coinsurance or copayments

- First three pints of blood used in a medical procedure

Some plans include additional basic benefits. For example, Medicare Supplement Plan F*, the most comprehensive standardized Medigap insurance plan, carries the following additional benefits:

- Medicare Part A deductible

- Part B preventive care coinsurance

- Skilled Nursing Facility care coinsurance

- Foreign travel emergency care

Some plans may include additional innovative benefits.

I Am Turning 65 And Going On Medicare What Do I Need To Know About Medicare Supplement Insurance

Buying Medicare supplement insurance is a way to protect yourself from some of the costs not covered by Medicare. It is also called Medigap or Med Supp insurance. There are 10 standardized Medicare supplement plans identified by the letters “A” through “N.” Plans F and G are also available as a high deductible plans. Plans C and F are only available to individuals eligible for Medicare prior to January 1, 2020.

The benefits in each plan are identical from company to company. Click the link below to view the free SHIIPSMP guide that explains Medicare supplement insurance.

You May Like: Can Young People Get Medicare

What Do The Medicare Letters Mean

The four different parts of Medicare are each identified by a letter: A, B, C and D. The number displayed on your Medicare card, however, is known as the Medicare Beneficiary Identifier and is randomly generated for you.

What is the meaning of these Medicare letters? Here we break them down so that you can have a clearer understanding of your Medicare coverage.

Medigap Alphabet Letters A Through N Explained

- 0

- 0

A Medigap plan, or Medicare Supplement, pays after Medicare to help cover your deductibles, copays, and coinsurance that you would otherwise be responsible for. Medigap plans do not replace your Medicare Part B.

Medigap policies are identified by letters A through N. Each policy that goes by the same letter must offer the same basic benefits, and usually the only difference between same-letter policies is the cost. Medicare Supplement Plan F is the most popular policy because of its comprehensive coverage, but as of 2020, Plan F is unavailable for new enrollees. The closest substitute for Plan F is Plan G, which pays for everything that Plan F did except the Medicare Part B deductible.

Read Also: Is Humana Medicare Part D

Medicare Costs And Medicare Supplement

Original Medicare doesn’t pay for everything. When you have a Medigap plan to work with Original Medicare it can help with some of the following costs that you would have to pay on your own:

- About 20% in out-of-pocket expenses not paid by Medicare Part B for doctor and outpatient medical expenses .

- Part A coinsurance, and most plans include a benefit for the Part A deductible

- Hospital coverage up to an additional 365 days after Medicare benefits are used up.

- Part A hospice/respite care coinsurance or copayment.

What Do The Letters After A Social Security Or Medicare Number Mean

The Social Security number followed by one of these codes is often referred to as a claim number. We assign these codes once you apply for benefits. These letter codes may appear on correspondence you receive from Social Security or on your Medicare card. They will never appear on a Social Security card.

For example, if the wage earner applying for benefits and your number is 123-45-6789, then your claim number is 123-45-6789A. This number will also be used as your Medicare claim number, once you are eligible for Medicare.

|

Code |

|

| Aged wife, age 62 or over | |

| B1 | Aged husband, age 62 or over |

| B2 | Young wife, with a child in her care |

| B3 | Aged wife, age 62 or over, second claimant |

| B5 | Young wife, with a child in her care, second claimant |

| B6 | Divorced wife, age 62 or over |

| Young husband, with a child in his care | |

| C1-C9 | Child Includes minor, student or disabled child |

| D | Aged Widow, age 60 or over |

| D1 | Aged widower, age 60 or over |

| D2 | |

| Surviving Divorced Wife, age 60 or over | |

| E | |

| Aged wife of disabled claimant, age 62 or over | |

| M | Uninsured Premium Health Insurance Benefits |

| M1 | Uninsured Qualified for but refused Health Insurance Benefits |

| T | Uninsured Entitled to HIB under deemed or renal provisions or Fully insured who have elected entitlement only to HIB |

| TA | Medicare Qualified Government Employment |

| TB |

NOTE: This list is not complete, but shows the most common beneficiary codes.

Recommended Reading: Which Medicare Plans Cover Silver Sneakers

How To Use The Msn And Eob

Whether you receive a Medicare Summary Notice or an Explanation of Benefits, it is important to save copies of these statements for your records. You can compare them against any medical bills you receive. It is encouraged that you also keep a log of any services you receive and on what days to make sure you are not being improperly billed.

Look for unfamiliar facility names. Odds are you know where you received your care. If your statement lists services at an unfamiliar location, find out if your healthcare provider works in multiple offices. He may bill all services he performs from one office and the charges could be legitimate.

Look for unfamiliar provider names. If you are unfamiliar with a medical provider’s name, ask yourself why. Is this the name of another provider in an office that cared for you? Was another healthcare provider covering for your usual healthcare provider in their absence? Were you hospitalized and saw a number of healthcare providers during your stay?

Verify dates of service. Make sure that any dates of service match up with dates you actually received care.

Look for duplicate charges. Duplicate charges may be justified or they could be in error.

Compare your actual medical bills with the “Maximum You May Be Billed”: Healthcare providers cannot charge you more for a Medicare-approved service to make up for what Medicare does not pay. That is called balance billing and it is against the law.