What Is A Medicare Advantage Plan

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

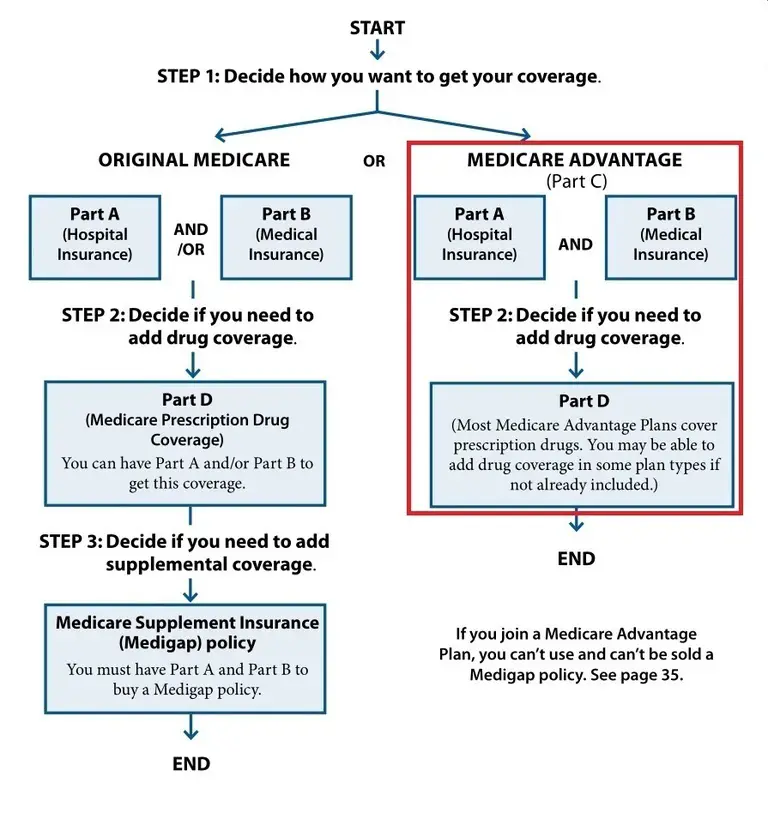

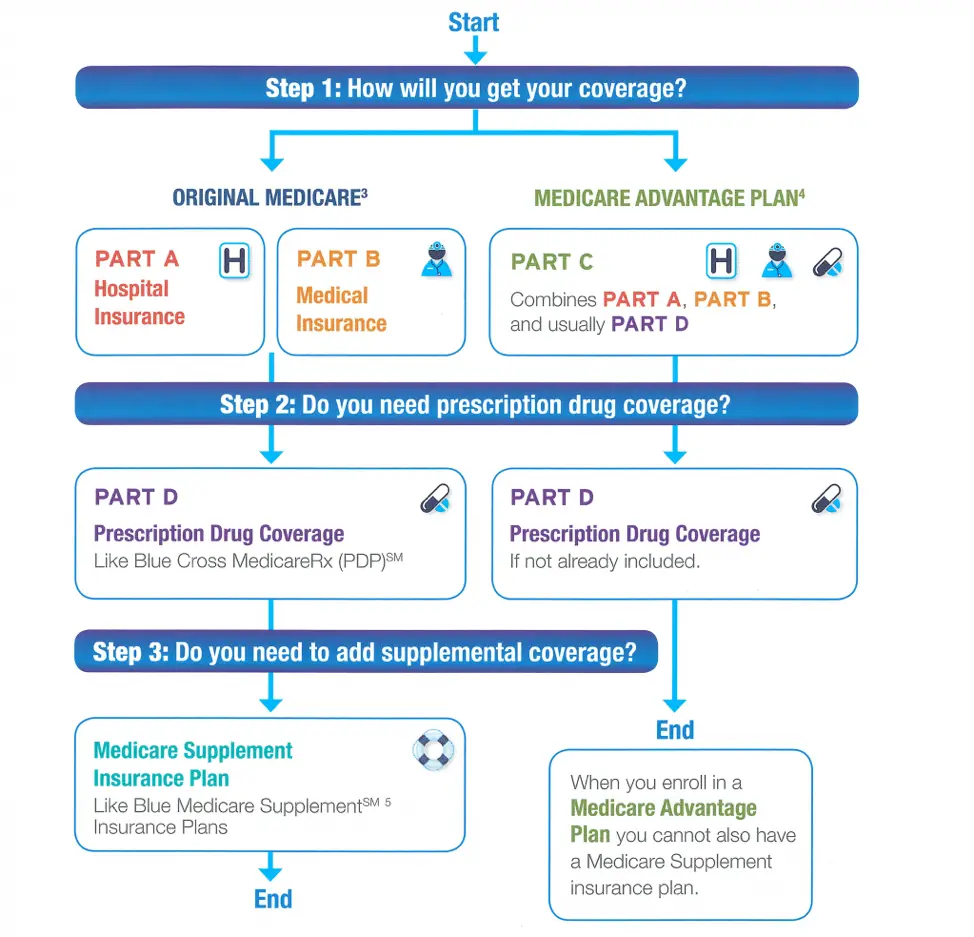

Medicare Advantage, also known as Medicare Part C, is a bundled alternative to Original Medicare. Private insurers that offer Medicare Advantage plans contract with the federal government to provide health insurance benefits to people who qualify for Medicare.

About four in 10 people eligible for Medicare are in Medicare Advantage plans.

» MORE:NerdWallet’s best Medicare Advantage plans

What Are Medicare Replacement Plans

Medicare replacement plans are private insurance policies that pay healthcare expenses instead of Medicare. The policies are called Medicare Advantage plans and are also called Medicare Part C. These are not Medicare supplement plans and have a completely different benefit structure. If you would like to compare the two types of Medicare plans and discuss which type of plan fits your Medicare needs, give us a call at

Compare Medicare supplement quotes from the nations top rated carriers for FREE.

Compare Medicare supplement quotes from the nations top rated carriers for FREE.

What Is A Medicare Replacement Plan

Medicare is health insurance that is used by thousands of individuals age 65 or older. There are several parts to Medicare and sometime it can confuse people on which Part they should be enrolled in and what is best for them. To avoid confusion, some seek Medicare replacement plans instead. These plans offer much of the same, if not exact, coverage as Medicare and are more streamlined. These plans offer a bit more clarity and ease of understanding to those that want health coverage and qualify for such plans.

You may also be interested in: Turning 65 and want to know about Medicare?

Medicare replacement plans are offered by insurance companies. These companies offer the same benefits as the original Medicare coverage the individual had or wanted. There are some disadvantages to using replacement plans, however. Some people have had difficulty receiving what was promised and instead receive less benefits as well as ineffective health care that was supposed to be readily given. Those who use Medicare Replacement Plans may be surprised to find out that some benefits are denied when under Medicare they would have not been questioned or refused. This can happen in inopportune moments of illness or injury. Careful investigation and understanding of your Replacement Plan coverage is essential.

Recommended Reading: Does Medicare Cover Inogen One G4

The Pros And Cons Of Medicare Advantage

Medicare Advantage plans have benefits and drawbacks. While they’re a slam-dunk choice for some people, they’re not right for everyone.

Pros:

-

Potentially lower premiums for coverage.

-

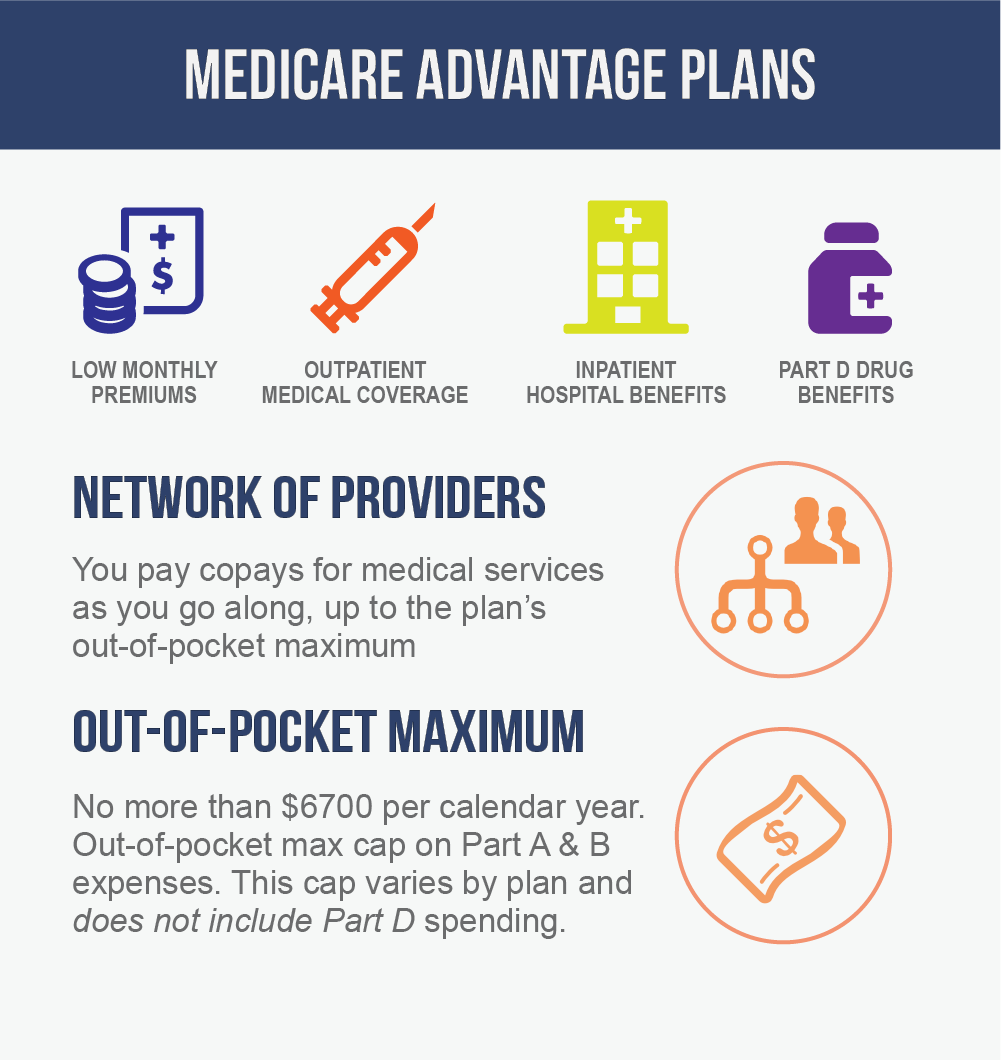

Limits on how much you may have to pay out of pocket for hospital and medical coverage. This limit is determined by the Centers for Medicare & Medicaid Services, and in 2022 it is $7,550.

Cons:

-

Less freedom to choose your medical providers.

-

Requirements that you reside and get your nonemergency medical care in the plans geographic service area.

-

Limits on your ability to switch back to Original Medicare with a Medicare Supplement Insurance policy.

-

The potential for the plan to end, either by the insurer or by the network and its included medical providers.

What Is Msa Plan

Medicare Medical Savings Account Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account. The plan deposits money from Medicare into the account. You can use the money in this account to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.

Read Also: Does Medicare Cover Any Dental Surgery

What Is Medicare Part A And Part B

Medicare replacement plans bundle together Medicare Part A, which is inpatient hospital insurance, and Medicare Part B, which is outpatient medical insurance. The plans usually also provide the prescription drug benefits of Medicare Part D. Medicare Advantage plans are available to those who are eligible for Medicare and live in the region …

How To Switch Medicare Advantage Plans

If you want to change Medicare Advantage plans, you can do so once a year, either during Medicare’s fall open enrollment period or the Medicare Advantage open enrollment period .

You also can change to Original Medicare during these periods, but it could be hard to get a Medicare Supplemental Insurance policy if you switch after the first year. In most states, insurers are required to issue you Medigap policies only during your initial Medigap enrollment period , or if you switch out of your Medicare Advantage plan in the first year. After that, insurers may deny you a Medigap policy if you have health problems, or they can require a waiting period before your preexisting conditions are covered.

Recommended Reading: What Age Do You Register For Medicare

How To Get Help Understanding Medicare Replacement Plans

To review your options and decide whether a Medicare Advantage plan is best for you, our licensed agents are here to help! You can get in contact with one of our Medicare experts today by completing our online rate comparison form or by calling the number above to receive rates and information in your area.

- Was this article helpful ?

Who Should Consider Replacing Original Medicare

Many seniors who first enroll in Original Medicare Part A and Part B are generally excited about their coverage because theyve been paying a lot for health insurance. And, although Original Medicare is considered comprehensive coverage, most seniors soon realize the significant out-of-pocket healthcare costs that are a result of deductibles, coinsurance, and copayments.

However, with a Medicare Advantage Plan , seniors can get prescription drug, dental, hearing, and vision coverage in a single plan that in some cases will have a zero premium. Moreover, since Medicare Part C is administered by private insurance companies, many of them offer additional benefits as they compete for your business.

Read Also: Does Medicare Cover Varicose Vein Treatment

Choosing Between Medicare Advantage And Medigap

Heres a kicker for anyone considering signing up for a Medicare replacement or Medicare Supplement plan: You are not allowed to have both at the same time. You may only choose one or the other.

Two of the biggest things to consider when choosing between these types of coverage is how you plan to pay for the things not covered by Original Medicare and how you like to utilize your care.

Because Original Medicare does not provide coverage for prescription drugs, dental, vision or hearing aids, beneficiaries must determine how they will pay for such care. You can get coverage for all of those things bundled in a Medicare Advantage plan. Or you can piece them out and get drug coverage from a Medicare Part D plan and get your vision and dental coverage from standalone plans and rely on discounts for hearing aids if necessary.

Then you must ask yourself how you like to use health care. Most Medicare Advantage plans will generally restrict your care to a network of participating health care providers. Should you snowbird in another state or travel frequently, you may be out of your coverage range when you need it most. Medigap plans are accepted anywhere Original Medicare is accepted, so that coverage goes with you wherever you go within the U.S. and U.S. territories.

About the Author

No compensation was received for posting this article.

A Small Share Of Medicare Advantage Enrollees In Individual Plans Have Access To Special Supplemental Benefits For The Chronically Ill But A Larger Share Of Enrollees In Snps Have Access To These Benefits

Beginning in 2020, Medicare Advantage plans have also been able to offer extra benefits that are not primarily health related for chronically ill beneficiaries, known as Special Supplemental Benefits for the Chronically Ill . The majority of plans do not yet offer these benefits. Fewer than half of all SNP enrollees are in plans that offer some SSBCI. The share of Medicare Advantage enrollees who have access to SSBCI benefits is highest for food and produce , meals , transportation for non-medical needs , and pest control .

Don’t Miss: Is Skyrizi Covered By Medicare

Medicare Advantage Policy Guidelines Terms And Conditions

Please read the terms and conditions below carefully

The Medicare Advantage Policy Guidelines are applicable to UnitedHealthcare Medicare Advantage Plans offered by UnitedHealthcare and its affiliates.

UnitedHealthcare has developed Medicare Advantage Policy Guidelines to assist us in administering health benefits. These Policy Guidelines are provided for informational purposes, and do not constitute medical advice. Treating physicians and healthcare providers are solely responsible for determining what care to provide to their patients. Members should always consult their physician before making any decisions about medical care.

Benefit coverage for health services is determined by the member specific benefit plan document* and applicable laws that may require coverage for a specific service. The member specific benefit plan document identifies which services are covered, which are excluded, and which are subject to limitations. In the event of a conflict, the member specific benefit plan document supersedes the Medicare Advantage Policy Guidelines.

*For more information on a specific member’s benefit coverage, please call the customer service number on the back of the member ID card or refer to the Administrative Guide.

**CPT® is a registered trademark of the American Medical Association.

The Policy Guidelines and corresponding update bulletins for UnitedHealthcare Medicare Advantage plans are listed below.

Open the sections below to view more information.

Things To Consider Before You Buy A Plan

Ask your medical providers If they’ll take the MA plan.

Ask the plan if It requires a referral for you to see a specialist.

If you live in another state part of the year, find out if the plan will still cover you. Many plans require you to use regular services within the service area , which is usually the county in the state where you live.

Find out if the plan includes:

- Monthly premiums

- Any copayments for various services

- Any out-of-pocket limits

- Costs to use non-network providers

If you have Medicaid or receive long-term care, or live in a nursing home, Special Needs Plans may be available in your area. If you choose other types of MA plans, find out if:

- The plan’s in-network providers you use are certified to accept Medicaid.

- In-network providers bill the plan correctly and/or refer to Medicaid providers as needed.

- The providers’ office knows what Medicaid covers and what the plan covers.

- You’ll have monthly premiums to pay. Medicaid will not cover MA plan premiums.

You May Like: What Age Can I Apply For Medicare

Which Of The Following Would A Medicare Supplement Policy Cover

Medicare Supplement insurance Plan A covers 100% of four things: Medicare Part A coinsurance payments for inpatient hospital care up to an additional 365 days after Medicare benefits are used up. Medicare Part B copayment or coinsurance expenses. The first 3 pints of blood used in a medical procedure.

What Is The Best Supplemental Insurance To Have With Medicare

The short answer is that a Medicare Advantage plan replaces your Original Medicare coverage hence the term replacement plan while a Medicare supplement plan supplements your Original Medicare benefits. To put it another way, Medicare Advantage is used in place of Original Medicare, while a Medicare Supplemental plan is used on top of

You May Like: Can I Get Braces With Medicare

Transition Of Coverage For Part D

Members who are taking Part D drugs that are not on the plan’s formulary, or that are subject to utilization management requirements, can get a transition supply of their drug under certain circumstances. They can work with you to complete a successful transition and avoid disruption in treatment.

Most Medicare Advantage Enrollees Have Access To Some Benefits Not Covered By Traditional Medicare In 2022 And Special Needs Plan Enrollees Have Greater Access To Certain Benefits

Medicare Advantage plans may provide extra benefits that are not available in traditional Medicare. The cost of these benefits may be covered using rebate dollars paid by CMS to private plans. In recent years, the rebate portion of federal payments to Medicare Advantage plans has risen rapidly, totaling $432 per enrollee annually for non-Medicare supplemental benefits, a 24% increase over 2021. The rise in rebate payments to plans is due in part to incentives for plans to document additional diagnoses that raise risk scores, which in turn, generate higher rebate amounts that make it possible for plans to provide extra benefits. Plans can also charge additional premiums for such benefits, but most do not do this. Beginning in 2019, Medicare Advantage plans have been able to offer additional supplemental benefits that were not offered in previous years. These supplemental benefits must still be considered primarily health related but CMS expanded this definition, so more items and services are available as supplemental benefits.

Also Check: Is Nursing Home Covered By Medicare

Coverage Choices For Medicare

If you’re older than 65 and not already getting benefits from Social Security, you have to sign up for Medicare Part A and Part B. It doesn’t happen automatically. However, if you already get Social Security benefits, you’ll get Medicare Part A and Part B automatically when you first become eligible .

There are two main ways to get Medicare coverage:

Disadvantages Of Ma Plans

- MA plans are annual contracts. Plans may decide not to negotiate or renew their contracts.

- Plans may change benefits, increase premiums and increase copayments at the start of each year.

- You may have higher annual out-of-pocket expenses than under Original Medicare with a Medicare supplement plan.

- Your current doctors or hospitals may not be network providers or may not agree to accept the plan’s payment terms.

- In most cases, you cannot keep your stand-alone Medicare Part D plan and the Medicare Advantage plan.

Read Also: Are Chemotherapy Drugs Covered By Medicare

Important: Annual Medicare Compliance Program Requirements

New and existing participating providers in our Medicare Advantage , Medicare-Medicaid , Dual Eligible or Fully Integrated Special Needs Plans are required to meet the Centers for Medicare & Medicaid Services compliance program requirements for first-tier, downstream and related entities as identified in the and/or training.

Additional Compliance Information

- MA/MMP: Providers who participate only in our MA/MMP plans do not need to complete an annual FDR Attestation.

- MA/ D-SNP/FIDE: Providers who are in states/regions that offer MA/D-SNP/FIDE plans are required to complete an Annual and attestation.

- Delegated Entities: Provider attestation collection for the FDR compliance requirements continue to be required for Delegated Entities.

Annual notification regarding requirements will be sent to providers via Adobe Acrobat Sign email or postcard. Providers continue to be notified via OfficeLink Newsletters during the summer months. You can access the training and attestation at the link below. Our Compliance Department completes random audits to ensure compliance on an annual basis.

About Half Of All Medicare Advantage Enrollees Would Incur Higher Costs Than Beneficiaries In Traditional Medicare For A 7

Medicare Advantage plans have the flexibility to modify cost sharing for most services, subject to limitations. Total Medicare Advantage cost sharing for Part A and B services cannot exceed cost sharing for those services in traditional Medicare on an actuarially equivalent basis. Further, Medicare Advantage plans may not charge enrollees higher cost sharing than under traditional Medicare for certain specific services, including chemotherapy, skilled nursing facility care, and renal dialysis services.

Medicare Advantage plans also have the flexibility to reduce cost sharing for Part A and B benefits, and may use rebate dollars to do so. According to MedPAC, in 2022, about 43 percent of rebate dollars were used to lower cost sharing for Medicare services.

In the case of inpatient hospital stays, Medicare Advantage plans generally do not impose the Part A deductible, but often charge a daily copayment, beginning on day 1. Plans vary in the number of days they impose a daily copayment for inpatient hospital care, and the amount they charge per day. In contrast, under traditional Medicare, when beneficiaries require an inpatient hospital stay, there is a deductible of $1,556 in 2022 with no copayments until day 60 of an inpatient stay .

Also Check: When Applying For Medicare What Documents Do I Need

How Do You Choose A Medicare Advantage Plan

Its important to compare the benefits between your current coverage and the different types of Medicare Advantage plans . Be sure that you understand the additional benefits and any benefits that you may lose.

You may want to consider:

- If you can change your current doctors

- If your medications are covered under the plans formulary

- The monthly premium

- The cost of coverage. This could include annual deductible, copays, and coinsurance.

- What additional services are offered

- Any treatments you need that arent covered by the plan

Do You Need Medicare Supplement

Not everyone needs a Medicare supplement policy. If you have other health coverage, the gaps might already be covered. You probably dont need Medicare supplement insurance if:

- You have group health insurance through an employer or former employer, including government or military retiree plans.

- You have a Medicare Advantage plan.

- Medicaid or the Qualified Medicare Beneficiary Program pays your Medicare premiums and other out-of-pocket costs. QMB is a Medicare savings program that helps pay Medicare premiums, deductibles, copayments, and coinsurance.

If you have other health insurance, ask your insurance company or agent how it works with Medicare.

Read Also: Can I Enroll In A Medicare Advantage Plan Anytime

When A Medicare Supplement Policy Is Replaced

When you switch from one Medicare Supplement insurance plan to another, you typically get 30 days to decide if you want to keep it. This 30-day free look period starts when you get your new Medicare Supplement insurance plan. You’ll need to pay the premiums for both your new plan and your old plan for one month.