Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

There Are Also Ratings That Can Impact Your Future Medigap Insurance Rate

- Attained-Age Rated

- The cost of your Premium is based your age and your Medigap premium can increase as you get older. Your Medigap insurance premium can also increase due to rising cost of healthcare, inflation and more.

Detailed Medicare Cost Information For 2022

- Monthly premium:Learn more about Part A costs.

Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274.

- Late enrollment penalty:

- If you don’t buy it when you’re first eligible, your monthly premium may go up 10%.

Part A costs if you have Original Medicare

Recommended Reading: Does Medicare Pay For Cosmetic Surgery

How Much Does Medicare Part C Cost In 2022

The premium for Medicare Part C also called Medicare Advantage depends on your plan and the insurer, since these health plans are provided by private insurance companies.

Deductibles, copays and coinsurance for Medicare Part C vary by plan. However, there is a limit to how much you can spend on out-of-pocket expenses. After that limit, your Medicare Part C plan will pick up all the remaining cost of covered health care services. The out-of-pocket limit for Medicare Advantage cant exceed $7,550 a year for in-network services. That means you could save more money if you have a lower out-of-pocket expenses limit. The limit is $11,300 for out-of-network services.

The average out-of-pocket limit for Medicare Advantage enrollees was $5,059 in 2019, according to the Kaiser Family Foundation.

Learn more about Medicare Part C.

How Much Do Prescriptions Cost With Medicare

Its no secret that prescription payments are a common worry today. Naturally, those worries will linger when it comes to enrolling in Medicare and completing monthly payments. This is where Medicare Part D comes in handy.

Part D provides two options, given that youre already enrolled in Parts A and B. One is a prescription drug plan that can come through private insurance plans like Priority Health Medicare Advantage plans. The other is a stand-alone prescription drug plan . While the exact price of monthly premiums for these plans vary by provider, most will provide a formulary list that can tell you what specific drugs might be covered, which is another great way to get clear-cut answers for your health plan. If youre a Priority Health member, you can also use the Cost Estimator tool to help estimate potential costs for prescriptions and other specific services.

Read Also: What Is The Cost Of Medicare Supplement Plan F

Also Check: Does Medicare Pay For A Second Opinion

How Much Does Medicare Supplemental Insurance Cost

In addition to Parts A-D, private insurers usually offer a supplemental plan, usually known as Medigap. This can help over things that Original Medicare might not. This includes copayments, smaller deductibles and other out-of-pocket costs. It should be noted, though, that adding a Medigap plan can slightly bump up your monthly premiums. However, if you feel like the decreased out-of-pocket costs outweighs that, Medigap might be perfect for you.

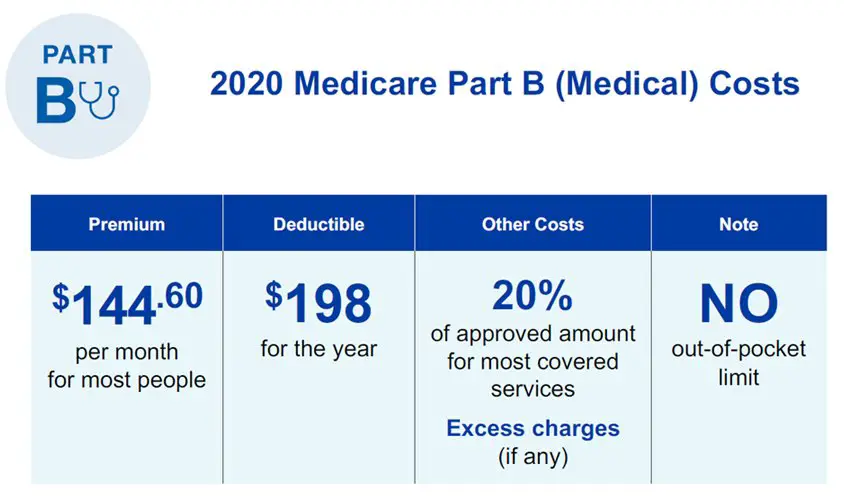

Medicare Part B Costs

Medicare Part B helps cover your medical bills. Lab tests, doctor visits, and wheelchairs are examples of some services and items that Medicare Part B would help pay for.

Medicare Part B does have a monthly premium, which is $170.10 per month.â¯This monthly premium tends to go up a little bit each year. Also,â¯if you have a high income, your premium will be higher.

This means itâs important to make sure you really need Medicare Part B, because if you donât, youâre paying for insurance you arenât using.

We always recommend individuals who are working past the age of 65 to contact us to make sure their current insurance setup is appropriate.

Medicare Part B does have a deductible, but itâs much cheaper than youâre probably used to seeing â itâs only $233 per year. After you meet that deductible, you typically pay 20% of the Medicare-approved amount for any services, tests, or items you need.

Don’t Miss: How Do I Replace A Lost Medicare Card

B Coinsurance: Percentage Based

The Part B coinsurance is fairly simple to understand. Basically, Medicare will pay for 80 percent of your medically-necessary services, and you will pay the remaining 20 percent of the Medicare-approved cost after your deductible has been met. There may be some services that Medicare covers in full, but generally speaking, you should expect to pay this 20 percent cost.

Note that in addition to outpatient care, Part B covers durable medical equipment meaning the Part B coinsurance will apply.

What Is The Best Medicare Supplement

As mentioned above, your best Medicare Supplement plan will be the plan that balances costs and coverage. In general, policies with more comprehensive coverage for deductibles and care will have higher monthly premiums.

For instance, Plan G is good for people who want very few medical bills and are willing to pay about $190 each month. This can give you peace of mind so that you won’t be surprised by unexpected medical costs. However, if you expect your out-of-pocket medical costs to be less than the plan’s annual cost of about $2,280, then a cheaper Supplement plan may be more cost-effective.

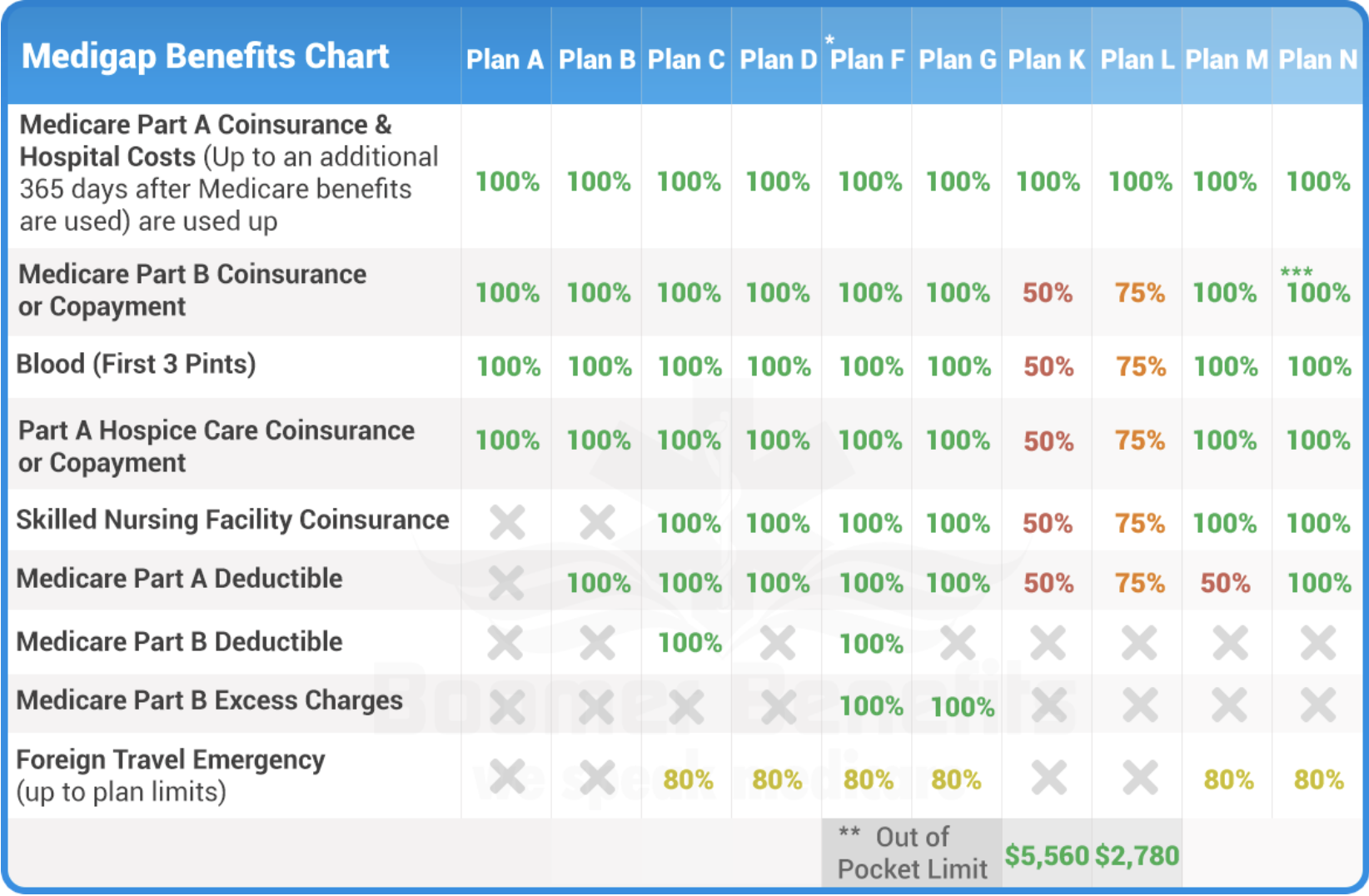

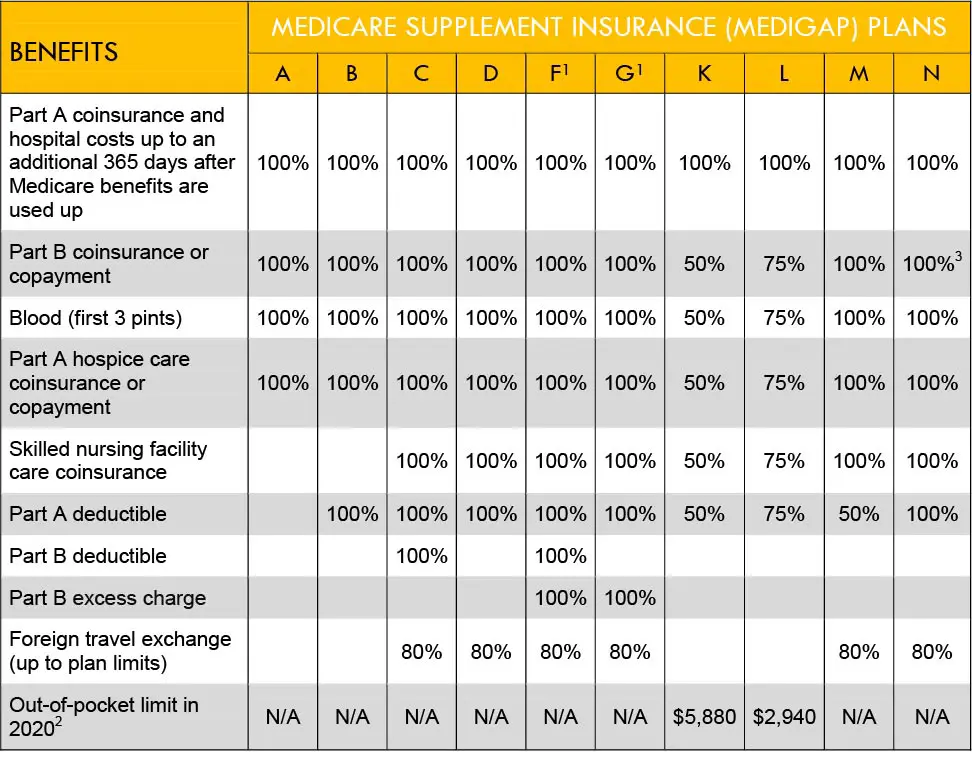

Note that because of a recent legislation change, Plans C and F are not available for new enrollees. Below you can find a chart of the level of coverage and 2022 monthly premium ranges for all of the Medicare Supplement plans. The Medigap plan names are along the top, and on the left are the coverage categories.

| Plan A |

|---|

Also Check: Does Medicare Cover Breast Prosthesis

What Affects Medicare Part D Costs Each Year

Several factors can play into determining the cost of a Medicare Part D plan, such as:

- Drug formularyEach Medicare Part D plan contains a formulary, which is a list of drugs covered by the plan. Covered drugs are divided up into different tiers. Generic drugs are typically on lower tiers and cost less, while brand name drugs and specialty drugs are typically on higher tiers and cost more.

- Local competitionMedicare Part D plans are sold by private insurance companies. These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers.

- Cost-sharingSome Medicare Part D plans have deductibles and copayments or coinsurance. The cost of your Part D premium may depend on the amounts of coinsurance or copayments you pay with your plan, as well as whether or not your plan has a deductible.

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

Copayments and coinsurance are the amounts that you must pay once your plans coverage does begin.

A copayment is usually a fixed dollar amount while coinsurance is most often a percentage of the cost . Plans might have different copayment or coinsurance amounts for each tier of drugs.

What Determines The Medicare Supplement Plan Premium

Factors that can influence the Medicare Supplement plan price are:

- Which plan you want: there are up to ten Medicare Supplement plans available labeled A, B, C, D, F, G, K, L, M and N. Medicare Supplement plan A doesnt cover everything that Medicare Supplement plan F covers, for example. Plans with more coverage may cost more.

- Which insurance company offers the plan

- The geographic area the plan covers

- How the plan is rated which is how they factor your age into your cost. Some plans charge the same monthly premium to everyone, regardless of age. Some plans charge according to the age you are when you buy the plan, and some plans charge according to your current age so your premium may increase yearly.

You May Like: Is Allergy Testing Covered By Medicare

Are There Any Hidden Costs

Insurance companies and providers must give a clear description of Medigap costs, including coverage limitationsLimitations are restrictions on your health insurance coverage. Either your plan won’t cover a service, or there may be cost limits on the coverage.. Your Medigap costs will be higher if you put off enrolling when youre first eligible.

Your open enrollment period includes guaranteed issueIf you have guaranteed issue rights, insurance companies are required to sell you a Medigap policy without any additional conditions. rights, which means you cannot be denied coverage because of your medical history.

If you wait to sign up for Medigap after your OEP, you may not have the same rates or coverage levels.

Medicare Part D Prescription Drug Coverage

What it covers:

- Medicare Part D covers prescriptions drugs.

- Plan premiums, the drugs that are covered, deductibles, coinsurance and copays will vary by plan, so you should check and compare plans each year based on your needs, the prescription drugs you take, etc.

What it costs:

- Like Medicare Advantage , prescription drug plans are offered by private insurance companies contracted by the federal government.

- Plans vary in cost, coverage, deductibles and copays.

This material is provided for informational use only and should not be construed as medical advice or used in place of consulting a licensed medical professional. You should consult your doctor to determine what is right for you.

Some links on this page may take you to Humana non-Medicare product or service pages or to a different website.

Y0040_GNHKHNSEN

You May Like: Does Medicare Help Pay For Nursing Home Care

What Is The Average Cost Of Medicare Supplement Plan F

Medicare Supplement Plan F offers the most comprehensive coverage of all the Medigap plans, making it the most popular plan for those who qualify. In the charts below, you will see that premiums for this plan are a bit more expensive than the other plans, ranging from $251 to $524 for our examples.

Get A Free Quote

| Gender Male, Age: 75 | $347.00 |

| *Please note: the above are sample rates. These are subject to change. Call us for your accurate, personalized quotes today. |

As you can see, Medicare Supplement costs, such as premium rates, vary by location. In most states, women pay less in premiums than men, as women tend to live longer. However, not every state follows this pattern. You may notice that New York is one of the states that does not. Because New York is a guaranteed issue state, most of their plans are community rated. Thus, monthly premium costs are the same, regardless of gender.

Youll also see its best to enroll in a Medicare Supplement plan when you become eligible at age 65 instead of waiting. You can see from the table above that your Medicare Supplement costs may be higher at 75 compared to 65 years old. Medicare Supplement costs, including premiums, are always subject to increase every year, but you will likely start with higher Medicare Supplement premiums the older you are when you enroll.

Which Benefits Do I Need

Think about the benefits you would use under each plan and your potential savings.

- Do you anticipate needing regular treatment or services? If so, how much are you paying for each visit?

- Would you use an out-of-network doctor, and if so, what is the added cost?

- Is there prescription drug coverage, or do you need to purchase a separate Medicare Plan D? Note: If you enroll in an HMO or PPO that does not have drug coverage, you cannot purchase a separate Part D plan.

- If youre taking regular medications, what are your prescriptions costs under each plan?

- Do you see a dentist regularly? What does it cost for routine cleanings under each plan?

- If youre unlikely to use a benefit, such as a fitness membership or non-emergency transportation, is there a plan without the benefit that may be cheaper?

Recommended Reading: Is A Chiropractor Covered By Medicare

You May Like: How To Qualify For Free Medicare

How Much Will Medicare Cost Me Per Month In 2022

Do you know how much Medicare will cost you each month in 2022?

Planning for retirement is really important, and if youâre going to be living off of a fixed income, you need to be aware of your expected insurance costs.

So, how much will Medicare cost you in 2022?

Is Medicare Supplement Plan N Better Than Medicare Advantage

The answer to this question depends on your health care needs and financial goals. For people who do not need to visit doctors often and find Medigap plans to be out of their price range, a Medicare Advantage plan may be the better choice.

Yet, if you do not want to deal with restrictive doctor networks, a Medigap plan such as Medicare Supplement Plan N will better suit your needs.

Often, those who enroll in Medicare Supplement Plan N over Medicare Advantage plans want a safety net in case of a medical emergency. Medigap Plan Ns low deductible and out-of-pocket costs make it an attractive option.

Don’t Miss: What Is The Difference Between Medicare Supplemental And Advantage Plans

How Do You Know If Youre Eligible For Medicare

If youre at least 65 and a U.S. citizen or a permanent legal resident for the past five years, youre eligible for Medicare. Some disabled people under the age of 65 are also covered by Medicare. After a two-year waiting period, people who receive Social Security disability insurance are usually eligible for Medicare. Those with end-stage renal disease are automatically included when they join up, while those with amyotrophic lateral sclerosis are eligible the month their impairment starts.

Read Also: Does Medicare Pay For Prep

Medicare Part D Plans And Entresto Coverage

Each Medicare prescription drug plan has its own rules about how much it will cover for each type of drug in its formulary . Some plans may place Entresto on a higher tier of their formulary , which means that patients will have to pay a higher coinsurance or copayment for the medication. Other plans may exempt Entresto from the annual deductible amount.

If an individual has a Medicare Part D prescription drug plan or a Medicare Advantage Prescription Drug plan, they will likely pay a monthly premium, an annual deductible, and coinsurance or copayments for their Entresto prescription medication. No Medicare drug plan may have a deductible of more than $480 in 2022 which means that you are responsible for the first $480 of out-of-pocket costs for your prescription drugs before your coverage commences. In the Donut Hole stage, there is a temporary limit to what Medicare will cover for your prescription medication. As such, you may pay more for this medication until you have met your annual deductible amount.

Also Check: What Is The Best Supplemental Insurance For Medicare

Be Sure To Compare The Same Policies

When you shop for a policy, be sure to compare the same policy against another. If you’re looking at Plan A from one company, look for Plan A from another.

You can get this information by calling insurance companies or your particular State Health Insurance Assistance Program, or by visiting Medicare.gov.

How Much Does Medigap Cost

To be eligibleSome health plans require you to meet minimum requirements before you can enroll. for a Medigap plan, first, you must be enrolled in Original Medicare . When you combine Medicare Part AMedicare Part A, also called “hospital insurance,” covers the care you receive while admitted to the hospital, skilled nursing facility or other inpatient services. Medicare Part A is part of Original Medicare. and Medicare Part BMedicare Part B is the portion of Medicare that covers your medical expenses. Sometimes called “medical insurance,” Part B helps pay for the Medicare-approved services you receive. with a Medigap plan, you pay a monthly premiumA premium is a fee you pay to your insurance company for health plan coverage. This is usually a monthly cost. for Medigap, as well as any Original Medicare premiums.

Recommended Reading: Does Medicare Pay For A Rollator

How Much Does Medicare Supplement Plan N Cost In 2022

The average cost of Medicare Supplement Plan N in 2022 is around $120-$180 per month. However, many factors determine premium cost. Premiums vary from one ZIP Code to another. Thus, in some areas, the monthly premium for Medigapt Plan N can be as much as $250 in others, it can be as low as $80.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Your state of residence, gender, age, and tobacco use all play a part in determining your premium rates.