What Is The Most Popular Medicare Supplement Plan

Learn more about popular Medicare Supplement plan options and get important information about Plans F, G, and N.

Everyday Health may earn a portion of revenue from purchases of featured products.

Whats the most surprising thing about Original Medicare? Most enrollees say its the unpredictable out-of-pocket costs. Medicare deductibles, coinsurance, and copayment costs can wreak havoc on a carefully planned budget. Thats why over 40 percent of people enrolled in Original Medicare buy a Medicare Supplement plan.

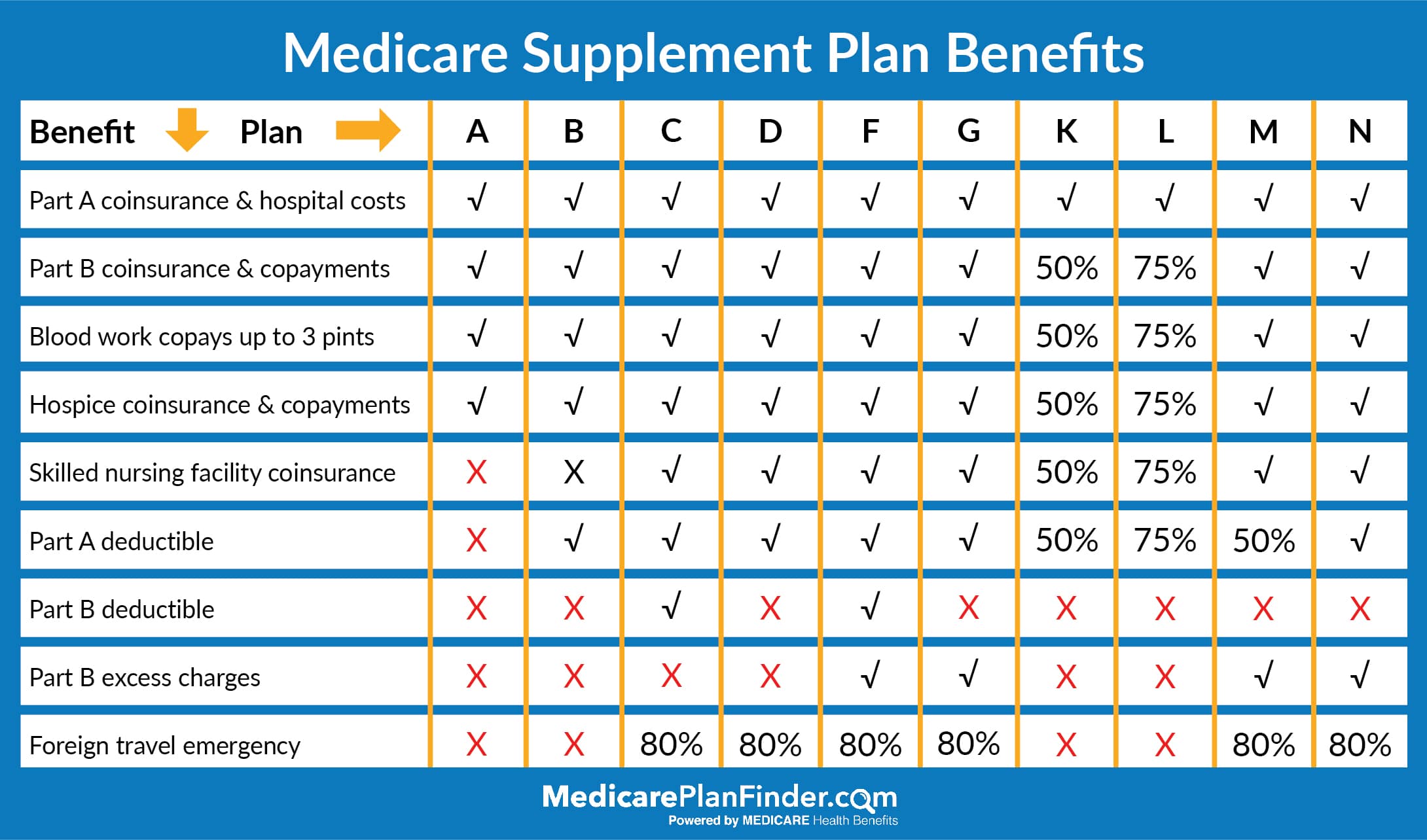

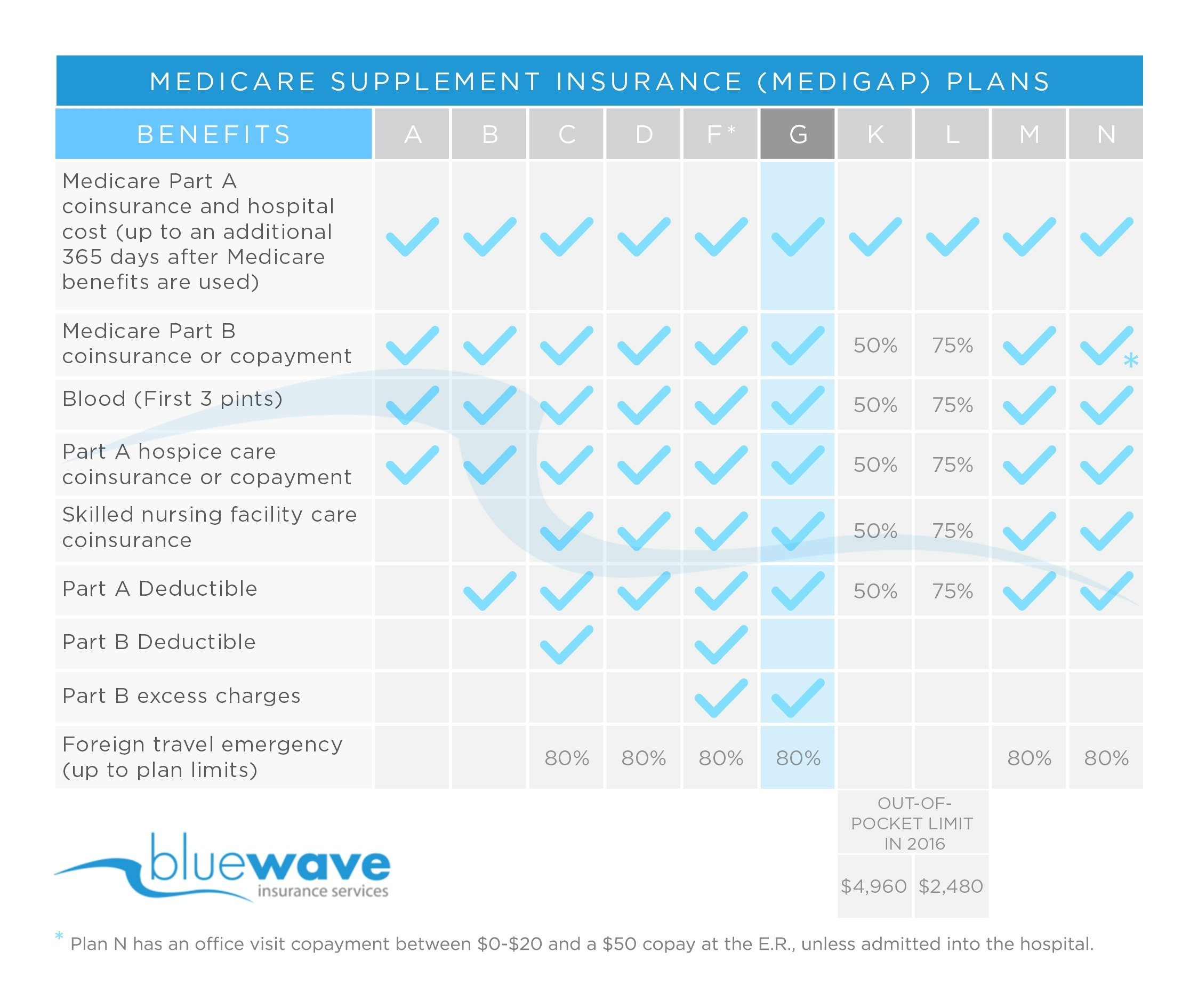

When choosing Medigap coverage, it is important to note that it isnt a one-size-fits-all solution for coverage. There are 10 different Medicare Supplement plans approved by Medicare, each with a different level of provided benefits. Three plans Plan F, Plan G, and Plan N are the most popular . Heres an in-depth look at this trio of Medicare Supplement plans, and the reasons so many people choose them.

Medicare Supplement Plan Explained

First things first, before we dig deeper into the costs associated with the Medicare Supplement plan, lets make sure were on the same page with what this plan is.

Medicare Supplement Insurance, commonly known as Medigap, can be bought from private insurance companies to complement your Medicare policies. Simply put, the Medicare Supplement insurance plan covers your healthcare costs that are not covered by other policies included in Medicare.

Now, an essential thing to know about Medigap coverage is the fact that it is only available for people who already take part in Medicare Parts A and B. Thats because, as mentioned above, Medigap plans are designed to supplement Parts A and B, not replace them. So, note that you need to pay the private insurance company a monthly premium for a Medicare Supplement plan in addition to the monthly premiums you pay for Medicare Part A and B.

One more thing to know about getting a Medicare Supplement is that you can buy it from any insurance company that is licensed in your state to sell such policies. Whats more, a private Medigap insurance provider can not refuse to renew your Medicare Supplement insurance plan even if you have health problems. So, as long as you pay your monthly premium, the insurance company cant cancel your Medigap policy.

What Is Medicare Supplement Insurance

Original Medicare enrollees without supplemental coverage will incur a variety of out-of-pocket costs including coinsurance and deductibles, in addition to any medical expenses incurred during travel outside the United States and its territories.

To cover those expenses, millions of people more than 40% of all Original Medicare beneficiaries purchase Medicare Supplement insurance, also known as Medigap. These plans are designed to fill in the gaps in Medicare and limit enrollees out-of-pocket exposure.

Also Check: Does Medicare Cover Palliative Care For Dementia

How Much Does Medicare Cost

The total cost of Medicare for you will depend on what parts and plans you select for your coverage. Even though costs vary, below is an overview of what many people typically pay for each part of Medicare.

| Medicare plan |

|---|

- Monthly cost: Usually free

- Annual deductible in 2022: $1,556

According to the Medicare program, 99% of enrollees get Medicare Part A for free. Those who do not qualify will pay between $274 and $499 per month in 2022, with the exact amount based on how much they or their spouse have paid in Medicare taxes.

Medicare Part A costs nothing for most enrollees due to their previous participation in the workforce. If you have worked for more than 10 years or 40 quarters, then you are eligible to pay $0 for Medicare Part A. This is because, during your working years, you contributed to Social Security and Medicare payroll taxes.

A large cost for Medicare Part A is the deductible, which is the amount you have to pay for medical care out of pocket before the plan’s benefits begin.

For 2022, the Medicare Part A deductible is $1,556. That’s a $72 increase from 2021. However, this cost is usually covered if you enroll in a Medigap policy or Medicare Advantage.

How Much Does Medicare Part A Cost In 2022

Premiums for Medicare Part A are $0 if youre getting or are eligible for federal retirement benefits. Its also premium-free if youre under 65 and receiving Social Security disability benefits for 24 months, or are diagnosed with end-stage kidney disease. If youre eligible for Medicare, but not other federal benefits, youll pay a Part A premium of $274 or $499 each month, depending on how long youve paid Medicare taxes.

The deductible for Medicare Part A is $1,556 per benefit period. A benefit period begins the day youre admitted to a hospital and ends once you havent received in-hospital care for 60 days.

The Medicare Part A coinsurance amount varies, depending on how long youre in the hospital. Coinsurance is typically a percentage of the costs, but Medicare designates the coinsurance as a flat fee.

Heres how much youll pay for inpatient hospital care with Medicare Part A:

-

Days 1-60: $0 per day each benefit period, after paying your deductible.

-

Days 61-90: $389 per day each benefit period.

-

Day 91 and beyond: $778 for each “lifetime reserve day” after benefit period. You get a total of 60 lifetime reserve days until you die.

-

After lifetime reserve days: All costs.

The cost of a stay at a skilled nursing facility is different. This is what a skilled nursing facility costs under Medicare Part A:

-

Days 1-20: $0 per day each benefit period, after paying your deductible.

-

Days 21-100: $194.50 per day each benefit period.

-

Day 101 and beyond: All costs.

You May Like: Does Humana Advantage Replace Medicare

What Is Medicare Part A

Part A is Medicare coverage responsible for hospital-related expenses. In most cases, Medicare Part A doesnt require a monthly premium as it was funded through you paying a minimum of 10 years of Social Security taxes through payroll.

Consequently, most people earn Medicare Part A.

In the event someone didnt earn Medicare Part A, it can be purchased. For those who need to purchase Medicare Part A they will spend up to $413 per month in 2021.

Below are some examples of Medicare Part A covered services:

- Blood

- Inpatient hospital care

- Skilled nursing facility care

Gaps in coverage with Medicare Part A can result in some of the highest financial risks for your clients which is why many agents often cross sell ancillary insurance.

Do You Need License To Sell Insurance

Are you wondering whether you need a license to sell insurance? As a requirement, all insurance agents must have a license to sell insurance. In most states, selling property and casualty insurance versus life and health insurance requires different licenses. Licensed insurance agents must take continuing education seminars every two years in most states. Agents can enroll in continuing education courses to learn more about other insurance plans or to stay up to date on changing tax laws and government regulations that affect the insurance sector.

Dont Miss: Who Must Apply For Medicare

Also Check: Does Blue Cross Blue Shield Offer A Medicare Advantage Plan

Understanding The Cost Of Medicare Supplement Plans

Now that you know Medicare supplement plans are standardized, and that you can choose the coverage you want, its time to learn about the cost of Medicare supplement plans .

Many people ask questions like, How much does Medicare Supplement Plan G cost? It makes sense that Plan F and Plan G are the most expensive plans because they have the most coverage, and people want to know the cost of Medicare supplement plans. But, the pricing is different for everyone.

Insurance carriers have more than one way to rate their plans for an initial premium and rate increases. Also, insurance companies must factor in the number of people in their insurance pool, including their demographics. As a result, rates can differ wildly even when the same coverage is offered in the same local area. Thats why it is difficult to give the average cost of supplemental Medicare insurance.

When a private insurance company has more members it generally has better financial stability, rates are lower, and rate increases dont come as frequently in comparison to smaller companies with a smaller member pool.

Rate increases are a delicate balance for insurance companies. As premiums increase, healthy people shop around for better rates to reduce their costs. As a result, the pool of healthy people shrinks and the insurance company has to raise their rates even more to cover costs.

. Theres no obligation, and they offer more plan options than any other national agency.

Medicare Costs And Medicare Supplement

Original Medicare doesn’t pay for everything. When you have a Medigap plan to work with Original Medicare it can help with some of the following costs that you would have to pay on your own:

- About 20% in out-of-pocket expenses not paid by Medicare Part B for doctor and outpatient medical expenses .

- Part A coinsurance, and most plans include a benefit for the Part A deductible

- Hospital coverage up to an additional 365 days after Medicare benefits are used up.

- Part A hospice/respite care coinsurance or copayment.

Recommended Reading: How Much Do You Get From Medicare

Buying Medicare Leads Through Nectar

Some independent agents prefer not to work through someone elses platform. If youd rather opt to be your own boss and possibly run your own firm someday, consider buying Medicare leads directly through Nectar.

Nectar is ideal for agents who are less enthused about marketing and networking. Maybe you believe these skills arent your forte, youre currently in the process of ramping up your marketing efforts, or youd rather not have marketing eat up valuable selling time.

Quality high-intent leadsâ

With Nectar, you wont have to gamble with cold leads or stress over having enough leads to get you through a week. As a result, you can cut way down on the amount of time and money you spend on marketing. Nectar does the sourcing for you. Nectar does the sourcing for you.

Nectar draws on a variety of marketing methods to identify high-intent shoppers across several different websites. It then matches the right shopper to the right agent based on the shoppers needs and the agents portfolio. This keeps the shoppers experience personal and excellent.

Every lead you receive through Nectar will be real and fresh. Its the same kind of qualification youd do on your own, only you dont have to do it all yourself. Instead, you can leave the bulk of the work to Nectar and focus on selling.

Earnings you keep

Start talking to Medicare shoppers today

Find Medicare Supplement Insurance Near You

You can search for Medicare Supplement Insurance in your area on Medicare.gov. Just enter your ZIP code, and for more accurate pricing, consider entering your age, sex and tobacco usage on the page that follows.

Once you pick your Medigap plan, the finder will show you companies in your area that offer it.

Don’t Miss: How To Get Medicare Eob Online

How Much Does Medicare Supplemental Insurance Cost

If youre shopping for Medicare supplemental insurance, one of the most important factors to consider is the cost of the policy.

Also known as a Medigap policy or Medicare Gap, supplemental insurance helps cover the gaps when Original Medicare does not fully cover your medical bills. They can be especially helpful, such as when unexpected medical situations or high healthcare costs arise.

Because Medicare supplemental insurance policies are provided by private insurance companies, they set the premium prices. Figuring out which Medigap policy is right for you can be confusing enough. Add in trying to navigate the costs of these policies, and supplemental insurance shopping can be a frustrating experience.

Below, well explore how supplemental insurance works, how policy prices are set and what you need to know when comparing plans so that you get the coverage you need for the price you pay.

Can New Beneficiaries Buy Medigap Plans That Cover The Part B Deductible

There are two Medigap plan designs Plan F and Plan C that cover the Medicare Part B deductible. As a result of HR2 , which was signed into law in 2015, those plans are no longer available to people who werent already eligible for Medicare prior to 2020.

People who were already enrolled in Plan C and Plan F can keep their coverage. And people who were Medicare-eligible prior to the start of 2020 can still apply for Plan C or Plan F.

But people who become eligible for Medicare in 2020 or beyond can no longer purchase Plan C or Plan F. The idea was to eliminate first-dollar coverage under Medigap plans in an effort to prevent over-utilization of healthcare . So people who become eligible for Medicare in 2020 or later can still buy Medigap plans that cover nearly all of their out-of-pocket costs for Medicare-covered services, but they will have to pay the Part B deductible on their own if and when they need outpatient care.

As of 2022 the Part B deductible is $233. Anyone who becomes eligible for Medicare in 2020 or later is not able to purchase a Medicare Supplement plan that covers that charge. But there are plans available that cover the rest of the out-of-pocket expenses for covered services under Original Medicare, leaving the beneficiary with only the Part B deductible to cover themselves.

Recommended Reading: When Does One Sign Up For Medicare

Average Cost Of Medicare Supplemental Insurance

When you reach retirement age, Medicare insurance offers basic medical insurance protection for your health needs. However, this coverage is basic and does not cover all of the costs for covered medical services and supplies. Medicare supplemental insurance policies are known as Medigap insurance and they fill in the gaps in Medicare coverage. A financial advisor could also help you create or adjust a financial plan for your medical care needs in retirement. Lets break down the average cost of Medicare supplemental insurance.

How Much Are Medicare Supplement Insurance Premiums

If you have Original Medicare, you may be interested in purchasing a Medicare Supplement insurance policy to help with the costs Original Medicare may not cover.

A Medicare Supplement insurance policy is a type of supplemental insurance policy that is sold by private insurance companies.1 It is designed to cover some of the out-of-pocket expenses, like copayments, coinsurance, and deductibles that Original Medicare does not cover.1 In order to be eligible for a Medical Supplement insurance policy, you must first be enrolled in Medicare Part A and Medicare Part B.1

There are many different insurance companies that sell Medicare Supplement insurance policies, and there are several different plans to choose from.

How much can you expect to pay for a Medicare Supplement insurance policy?

Also Check: Does Medicare Cover Cataract Exams

Is There A Best Time To Purchase A Medigap Policy

The best window of time in which to buy a Medigap policy begins on the first day of the month in which youre at least 65 and enrolled in Medicare A and B . This is the start of your initial enrollment period, and it lasts for six months. Under federal rules, Medigap coverage in every state is guaranteed during this window.

If youre eligible for Medicare because of a disability, the majority of the states offer at least some sort of guaranteed issue enrollment periods for those under 65. So it pays to research your states health care regulations. .

If you wait to buy a policy until after your initial enrollment period, your carrier generally has the option of denying the application or charging a higher premium based on the companys underwriting requirements, as there is no federal requirement that Medigap plans be guaranteed-issue outside of the initial enrollment window and very limited special enrollment periods. But states can set their own regulations for Medigap plans:

Check with your state SHIP or your states Department of Insurance for more information about state-based regulations regarding Medigap.

What Determines The Medicare Supplement Plan Premium

Factors that can influence the Medicare Supplement plan price are:

- Which plan you want: there are up to ten Medicare Supplement plans available labeled A, B, C, D, F, G, K, L, M and N. Medicare Supplement plan A doesnt cover everything that Medicare Supplement plan F covers, for example. Plans with more coverage may cost more.

- Which insurance company offers the plan

- The geographic area the plan covers

- How the plan is rated which is how they factor your age into your cost. Some plans charge the same monthly premium to everyone, regardless of age. Some plans charge according to the age you are when you buy the plan, and some plans charge according to your current age so your premium may increase yearly.

You May Like: What Part Of Medicare Covers Dental

Telesales: How To Sell Medicare Supplements Over The Phone

Selling Medicare supplements from home or over the phone is a growing trend. We are seeing more agents trying to get out of the field and transition to selling Medicare over the phone.

Can it be done?

Absolutely. In fact, we have an agent who consistently sells 10+ Medicare supplements over the phone each week utilizing the exact process listed below. There isnt a magic bullet, its just about staying focused on efficiency.

And, most recently we launched a telesales team that placed more than 3,000 policies in their first 7 weeks.

Want to Learn How to Sell Medicare Over the Phone?

Remedigap Can Help Make Sense Of It All

Our service is free. We help Georgia Medicare Insurance beneficiaries who are new to Medicare or already using Medicare.

If you have a Medigap plan, we can review your coverage and find lower rates to save you money on the same exact plan.

We are independent agents

That means we shop the market and offer you choices. Were not bound to any insurance company.

We dont work for the Medicare Supplement companies.

We work for you.

Well find you the absolute highest value with your Medicare Supplement coverage by shopping all of the insurance companies that offer Georgia Medigap coverage.

Be an informed buyer and comparison shop your Georgia Medicare Supplement Insurance plans and rates.

Just to request a quote or call us at 411-1329 for personal service.

Read Also: What Is The Monthly Premium For Medicare Plan G