How Policy Prices Are Set

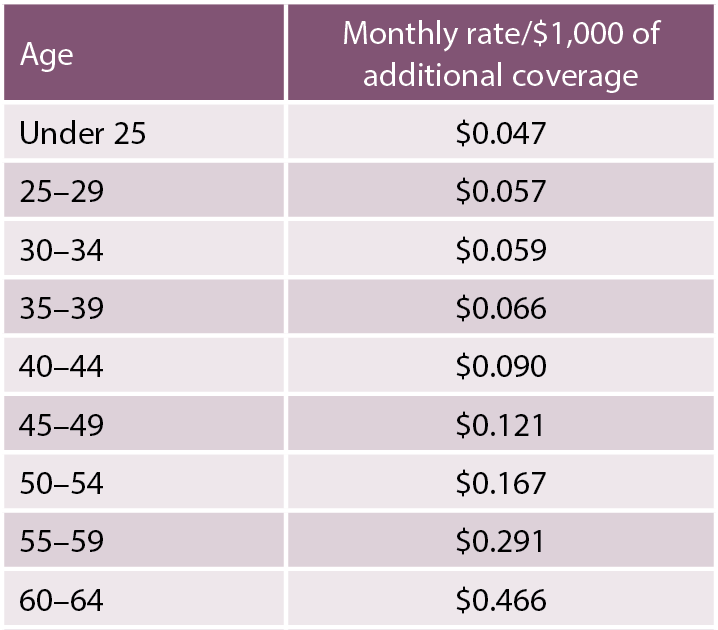

Each insurance company chooses the price, or premium, of each supplemental insurance policy. Its important to note that supplemental insurance costs vary based on quite a few factors, including:

- Where you live

- Type of plan you need

- Your age

- If you are a smoker

- The insurance carrier

For instance, if youre a65-year-old non-smoker in Los Angeles County, and youre purchasing Medicare Supplement Plan F, the price would be approximately $180 to over $200 per month.

According to the U.S. Department of Health and Human Services, Medigap policies are priced three ways:

- Community-rated

- Issue-age-rated

- Attained-age-rated

Other factors, such as where you live, medical underwriting and discounts may impact the cost of your premium as well. Looking at these three factors below will better help you understand how much a Medigap policy may cost you now and in the future.

Community-rated

If a policy is community-rated, that means everyone who has the Medigap policy pays the same premium, regardless of age or gender. Premiums may rise for other reasons, such as inflation or other factors, but will never go up because of your age.

Issue-age-rated

Attained-age-rated

What Is The Cost Of Supplemental Health Insurance For Seniors

The average cost of supplemental health insurance for seniors will depend on where you live, the health insurance company, type of plan, and benefit level you select. While these amounts will vary greatly, we can still give you an idea what you may spend. These average monthly premium price can range from $150 to $200.1

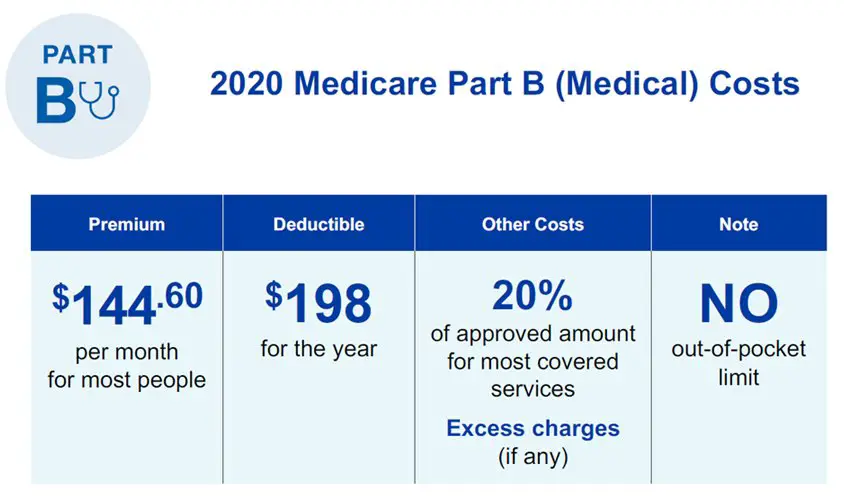

Medicare Is Helping Out A Large Number Of Citizens Every Year To Help Cover Medical Expenses But Will It Cost You Anything If You Pursue It If Yes How Much

Paying for health insurance is an enormous part of the vast majoritys financial plans, and it is anything but an expense that disappears once you reach 65 and can get insurance through Medicare. Realizing the amount you will pay for Medicare is critical to ensuring you have the assets to cover those costs. In any case, since there are many different parts of Medicare, which you can buy independently, the total expense of Medicare can change fundamentally. So how much does Medicare cost? Let us find out.

Don’t Miss: Does Medicare Cover Wheelchair Repairs

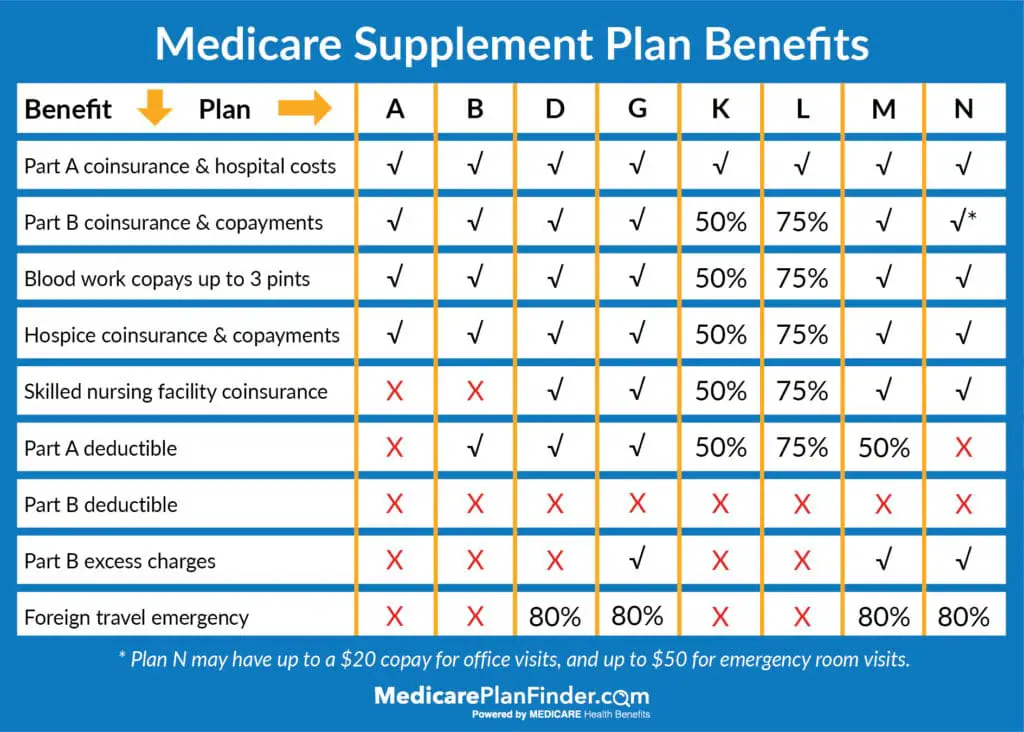

What Does Plan N Cover

Plan N has almost the same standard coverage list and requirements as all other plans. However, it does not provide coverage for a Part B deductible and Part B excess charge. It also only covers 80% of your plan limit for foreign travel exchange plans.

In some cases, your provider may have unique benefits in addition to Plan Ns standard coverages. Unique benefits from Cigna include a healthy rewards program, a health information line and foreign travel emergency benefits.

Required Benefits of Plan N in Maine

- Medigap BenefitDoes Plan N Cover?

- Part A co-insurance and hospital costs up to an additional year after Medicare benefits are used upYes

- Foreign travel exchange 80%

Average Cost Of Medicare Supplemental Insurance

When you reach retirement age, Medicare insurance offers basic medical insurance protection for your health needs. However, this coverage is basic and does not cover all of the costs for covered medical services and supplies. Medicare supplemental insurance policies are known as Medigap insurance and they fill in the gaps of Medicare coverage. A financial advisor could also help you create or adjust a financial plan for your medical care needs in retirement. Lets break down the average cost of Medicare supplemental insurance.

Also Check: How Does Medicare Work For Nursing Homes

Durable Medical Equipment & Supplies

Durable medical equipment refers to machines intended to reduce pain or assist movement that isnt considered medical devices. Examples include braces for treating foot deformities, walkers, wheelchairs, and scooters. Medicaid typically covers the cost of purchasing durable medical equipment after using other methods to treat the condition without success. Your insurer can explain whether this applies to you. Your insurance company can refuse to pay for certain medical products check with them if you have questions about coverage.

How Much Does A Medicare Supplement Insurance Plan Cost

- Medigap helps to pay for some of the healthcare costs that arent covered by original Medicare.

- The costs youll pay for Medigap depend on the plan you choose, your location, and a few other factors.

- Medigap usually has a monthly premium, and you may also have to pay copays, coinsurance, and deductibles.

Medicare supplement insurance policies are sold by private insurance companies. These plans help pay for some of the healthcare costs that arent covered by original Medicare. Some examples of the costs that may be covered by Medigap include:

- deductibles for parts A and B

- coinsurance or copays for parts A and B

- excess costs for Part B

- healthcare costs during foreign travel

- blood

The cost of a Medigap plan can vary due to several factors, including the type of plan you enroll in, where you live, and the company selling the plan. Below, well explore more about the costs of Medigap plans in 2021.

So what are the actual costs associated with Medigap plans? Lets examine the potential costs in more detail.

Also Check: What Does Medicare Cost Me

What Are The Benefits To Medicare Advantage

Medicare Advantage covers more than Medicare , allowing patients more options and flexibility. Patients can customize their Medicare Advantage to cover specific needs like wheelchair ramps, adult day care, and respite care. Additionally, the 2020 CARES Act expanded Medicares network to cover more telehealth services.

What Is The Medicare Supplement Cost For Plan F

The cost of Medicare Supplement Plan F is the highest of all Medicare Supplemental Plans because it provides the most benefits. The Supplement Plan F covers 100% of all Medicare approved services for Part A and Part B.

Remember, the Medicare Supplement Plans average cost will vary by things like, age, gender, zip code and more.

Using data provided by Senior HealthCare Solutions, our examples below for the average cost of supplemental health insurance .

Plan F also offers a high-deductible option, which offers a premium as low as $40 per month. This plan provides the same benefits as the standard plan F but requires the member to pay the deductible prior to the plan paying 100%. To learn more or compare these Medigap Plans, call our team at Senior HealthCare Solutions.

We are licensed in over 30 states and have access to over 25+ highly rated Medicare insurance carriers. Its easy to get your Plan F quote today, just call 866-MEDIGAP and be ready to answer some simple questions, like your age, zip code and tobacco use.

Read Also: Do You Automatically Get Medicare When You Turn 65

Best Set Pricing: Aarp

-

Must join AARP to enroll

-

Need birthday and current Medicare information for price details

-

No link to Medicare Supplement coverage from the main website

AARP is a nonprofit, nonpartisan membership organization that helps people who are ages 50-plus with a variety of services and information. One of the most trusted names for retirees and other seniors, the organization boasts 38 million members and is insured through UnitedHealthcare, which earns an A rating from AM Best for financial strength.

We chose AARP as best for its set pricing for Medicare Supplement coverage because it doesnt charge more as you grow older. This is especially helpful if you are still covered under your employer’s insurance and may require coverage after the age of 65.

AARP covers Parts A, B, C, F, G, K, L, and N, though its important to note that plans C and F are only available if you were enrolled in Medicare before January 2020. You can get pricing information easily by entering your ZIP code, and there’s a Spanish language website as well.

How Do Medicare Supplement Insurance Plans Work With Original Medicare

Medicare Supplement plans work alongside your Original Medicare coverage to help cover some of the costs you would otherwise have to pay on your own. These plans, also known as “Medigap”, are standardized plans. Each plan has a letter assigned to it, and offers the same basic benefits. The basic benefit structure for each plan is the same, no matter which insurance company is selling it to you. Note: The letters assigned to Medicare Supplement plans are not the same things as the parts of Medicare. For example, Medicare Supplement Plan A is not the same as Medicare Part A .

Read Also: Does Medicare Cover Glucose Monitors

Is Medigap The Same As Medicare Advantage

No, these are two different options that seniors have for their healthcare needs. Medigap policies take care of the unpaid costs of Original Medicare. By comparison, Medicare Advantage policies are an alternative to Original Medicare and offer different levels of benefits that Medigap policies do not. Advantage Plans also help pay uncovered medical expenses that Original Medicare doesnt.

With a Medigap policy, youll have multiple insurance policies and insurance cards for your care, but you can see any doctor that accepts Medicare. Medicare Advantage is more like insurance that you had during your working years. You pay one company for your insurance and many Advantage Plans include extra benefits like dental, vision and prescription drug coverage. However, many Advantage plans require you to see in-network doctors and may not cover out-of-network care.

What If I Need Help Paying Medicare Costs

If you have limited income and assets, you may qualify for help with your Medicare costs, including those that you pay for care you receive. There are several programs that help pay Medicare costs. Many people who could qualify never sign up, so be sure to apply if you think you might qualify. Dont hesitate to apply. Income and resource limits vary by program.

Also Check: When Can I Get My Medicare Card

How Much Does Each Medigap Plan Cost

The chart below shows the average monthly premium for each type of Medicare Supplement Insurance plan sold nationwide in 2018.1

The average Medigap premium cost across all plans in 2018 was $152 per month, but some types of Medigap plans have far fewer enrollees than other types of plans. This difference in enrollment affects the average monthly premium that is actually paid by Medigap beneficiaries.

That’s why the weighted average Medigap plan premium paid by a beneficiary in 2018 was $125.93 per month.

| Medicare Supplement Insurance Plan | |

| All plans | $152.00 |

* Medigap Plan J was discontinued for new enrollees in 2010. Only beneficiaries who enrolled in the plan prior to that time may be currently enrolled in Plan J.

How Supplemental Insurance Works

Supplemental insurance helps cover some of the costs Original Medicare insurance does not. If youre enrolled in an Original Medicare policy, Medicare will pay its share of the Medicare-approved health care costs first. Then, your supplemental insurance policy kicks in, paying the remaining portion that the policy covers.

In most states, private insurance companies that sell these supplemental insurance plans only sell standardized policies. That means each policy must offer the same benefits, no matter the insurance company.

Examples of what Medigap policies cover include:

- Coinsurance

- Deductibles

- Emergency foreign travel expenses

They do not cover long-term care like nursing homes, vision or dental care, hearing aids, eyeglasses and private-duty nursing.

To address gaps in coverage under Original Medicare, insurance companies offer Supplement Plans A, B, C, D, F, G, K, L, M, and N. More details about these plans can be found in our article, A Guide To Medicare Gap Insurance.

Also Check: How To Avoid Medicare Part D Penalty

Compare Medicare Supplement Insurance Plans

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Medicare Supplement Insurance, or Medigap, is insurance that pays for some costs that arent covered in Original Medicare. A Medicare Supplement Plan might cover copayments, coinsurance or deductibles you owe under Original Medicare.

Medicare Supplement Plans operate as additional not primary insurance coverage. You must have Medicare Part A and Part B to buy a Medigap plan. These policies are sold by private companies, and the plans are standardized, so Medicare Supplement Plan G in New York will offer the same coverage as Medicare Supplement Plan G in Ohio .

Comparing The Costs Of Medigap Plans

There are 10 Medigap plan types, and each is identified by a letter.

Medicare requires each plan type of the same letter to offer basic, standardized benefits.

While the coverage in Medigap plans is standardized, costs are not.

If you want to save money, its important to shop around, compare coverage, get quotes and ask questions.

However, according to Vice President of Senior Market Sales Brian Hickey, picking the right Medigap plan isnt all about price.

There are other factors that should be considered, including rate increase history, financial stability, customer service experiences and claims history, Hickey told RetireGuide.com. Talking to a professional that has experience across all plans is key in making the right decision.

If you are trying to switch to a better plan and you are in poor health, make sure to ask if the insurer considers your current health status before enrolling.

Also Check: How To Find Someone’s Medicare Number

Maine Medicare Supplement Plans Comparison Chart

You need to be eligible for Medicare to buy a Medicare Supplement Plan. All Medigap plans have different levels of coverage, and some are only available based on your eligibility for Medicare.

If you are a new enrollee, you may not be able to buy Plan F and C. However, you might be eligible for Plans G and D. Use MoneyGeeks chart to compare coverages and average rates.

Medicare Supplement Comparison Chart

Choosing Traditional Medicare Plus A Medigap Plan

As noted above, Original Medicare comprises Part A and Part B . You can supplement this coverage with a stand-alone Medicare Part D prescription drug plan and a Medigap supplemental insurance plan. While signing up for Medicare gets you into Parts A and B, you have to take action on your own to buy these supplemental policies.

Read Also: Is Fehb Better Than Medicare

Also Check: Can A Green Card Holder Apply For Medicare

How Much Does Supplemental Insurance For Medicare Cost On Average

Medicare is the federal health insurance program that covers some medical expenses for people age 65 or older and younger people with disabilities. Yet, the program doesnt cover all medical costs of most long-term care.

Medicare has four main federal components that offer healthcare benefits to retired people or people with disabilities, including Part A, B, C, and D. Whats more, the program also has the Medicare Supplement option, which is private insurance, meant to help with covering out-of-pocket costs such as copays, coinsurance, and deductibles.

Now, if youre enrolled in Medicare, or youve just found out that youll soon be eligible for the program, you may be considering buying a Medicare Supplement Insurance plan as well to help cover your major healthcare costs alongside your Part A and B coverage.

Naturally, you want to find out more about Medicare Supplement insurance and how much you should expect to pay for it. Keep reading below to find out more!

Plan N Monthly Premiums

If you enroll in a Medigap plan, youll have to pay a monthly premium. This will be in addition to your Medicare Part B monthly premium.

Because private insurance companies sell Medigap policies, monthly premiums will vary by policy. Companies can choose to set their premiums in a variety of ways. The three main ways they set premiums are:

- Community rated. Everyone with the policy pays the same monthly premium, regardless of his or her age.

- Issue-age rated. Monthly premiums are set based on how old you are when you purchase your policy. Individuals who buy at a younger age will have lower monthly premiums.

- Attained-age rated. Monthly premiums are set based on your current age. Because of this, your premiums will increase as you get older.

Read Also: Who Pays For Medicare Part B Premiums

How Much Will I Have To Pay If I Qualify

With Original Medicare coverage , eligible seniors will pay nothing for home health care services that are ordered by a doctor and provided by a certified home health agency. Any additional services provided outside of the approved care plan will not be covered and must be paid for out of pocket.

Be aware that before services begin, the home health agency should provide an itemized receipt or plan of care that identifies what is eligible for Medicare coverage and what is not. A written notice called the Advance Beneficiary Notice of Noncoverage will detail any services and durable medical equipment that Medicare will not pay for as well as the costs the patient will be responsible for.

Medicare Advantage Plan :

- Monthly premiums vary based on which plan you join. The amount can change each year.

- You must keep paying your Part B premium to stay in your plan.

- Deductibles, coinsurance, and copayments vary based on which plan you join.

- Plans also have a yearly limit on what you pay out-of-pocket. Once you pay the plans limit, the plan pays 100% for covered health services for the rest of the year.

Recommended Reading: When Can I Apply For Medicare In California