Medicare Part A Costs

Medicare Part A helps cover bills from the hospital. So, if you are admitted and receive inpatient care, Medicare Part A is going to help with those costs.

If youâve worked at least 10 years or can draw off a spouse who has, Medicare Part A is free to have.â¯That means you donât have any monthly costs to have Medicare Part A.

This doesnât mean that Medicare Part A doesnât have other costs like a deductible and coinsurance â because it does â but you wonât have to pay those costs unless you actually need care.

For most people, having Medicare Part A is free.

The Medicare Part A deductible, as well as the coinsurance for care, fluctuates slightly every year, but here are the current Part A costs for 2022:

- $1,556 deductible

- Days 1 â 60: $0 coinsurance

- Days 61 â 90: $389 coinsurance

- Days 91+: $778 coinsurance per âlifetime reserve day,â which caps at 60 days

- Beyond lifetime reserve days: You pay all costs

For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in a benefit period will be $194.50 in 2022.

How Does Age Affect Medicare Supplement Insurance Premiums

There are three different age-related pricing models that Medicare Supplement Insurance companies use to determine their Medigap plan rates in 2022.

Each type of cost model can affect the average price of a given Medigap plan.

-

Community-rated Medigap plansWith community-rated Medigap plans, every member of the plan pays the same rate, regardless of age.

For example, an 82-year-old who enrolls in a community-rated Plan G will pay the same Medigap premiums as a 68-year-old beneficiary who has the same Plan G in the same market.

-

Issue-age-rated Medigap plansWith issue-age-rated Medigap plans, premiums are based on your age at the time you enrolled in the plan.

You will typically pay less for an issue-age-rated plan if you enroll in the plan when you’re younger. Your premiums also won’t increase based on your age.

-

Attained-age-rate Medigap plansAttained-age-rated Medigap plans set their premiums based on your current age. As you age, your Medigap plan premiums will gradually increase each year.

Medigap premiums can increase over time due to inflation and other factors, regardless of the pricing model your insurance company uses.

Detailed Medicare Cost Information For 2022

- Monthly premium:Learn more about Part A costs.

Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274.

- Late enrollment penalty:

- If you don’t buy it when you’re first eligible, your monthly premium may go up 10%.

Part A costs if you have Original Medicare

You May Like: Is Genetic Counseling Covered By Medicare

How Much Will Medicare Cost Me In 2022

How Much Will Medicare Cost Me In 2022. Medicare premiums are monthly fees beneficiaries pay for their medicare coverage. The standard monthly premium for medicare part b enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021.

Some medicare beneficiaries may pay more or less per month for. This rate is adjusted based on income, and those earning more than $91,000 will pay higher premiums. How much is the part a late enrollment penalty?

Source: yar.zabanstation.com

The standard monthly premium for medicare part b enrollees was $148.50 for 2021, increasing $3.90 from $144.60 in 2020. How much does medicare part d cost?

Source: yar.coft-oklahoma.org

A premium is the amount you pay for your health plan each month. This partial premium increased $15 from last years $259 to $274 each month in 2022.

Source: www.gomedigap.com

This partial premium increased $15 from last years $259 to $274 each month in 2022. Medicare premiums are monthly fees beneficiaries pay for their medicare coverage.

Source: ashfordinsurancegroup.com

The average monthly premium for a medicare part d plan is around $30 per month in 2022. A premium is the amount you pay for your health plan each month.

Source: yar.coft-oklahoma.org

Medicare cost for part a in 2022. Some medicare beneficiaries may pay more or less per month for.

Source: finance.yahoo.comSource: lah.splunkyard.comSource: www.medicareplanfinder.comSource: yar.splunkyard.com

Medicare Advantage Plan :

- Monthly premiums vary based on which plan you join. The amount can change each year.

- You must keep paying your Part B premium to stay in your plan.

- Deductibles, coinsurance, and copayments vary based on which plan you join.

- Plans also have a yearly limit on what you pay out-of-pocket. Once you pay the plans limit, the plan pays 100% for covered health services for the rest of the year.

Recommended Reading: How Do You Pay Medicare

How Do I Make My Medicare Payments

If youre on federal retirement benefits, your Medicare Part B premiums get deducted from your Social Security checks. You can elect to get your Medicare Part D premiums deducted from your benefit checks, too. Contact your insurer.

If youre not on federal retirement benefits, youll get a Medicare Premium Bill for any parts of Medicare that youre paying for each month. You can pay this bill via your banks online service or by mailing back a credit card, debit card, check or money order payment.

However, Medicare Easy Pay is probably the simplest way to pay your Medicare Premium Bill. It automatically deducts your payment from a linked bank account around the 20th of each month. Deductibles and copays are generally paid directly to health care providers at the time of service.

Medicare Costs Vary Widely Depending On The Type Of Coverage You Have And How Healthy You Are

Medicare cost per person per month can depend on a number of factors, including how you receive your benefits and how much you use them each month.

Costs associated with Medicare include monthly premiums, deductibles, copays and coinsurance. And, if you dont enroll in Medicare when youre eligible, you may be subject to late enrollment penalties for as long as youre enrolled in Medicare.

Most people are eligible for premium-free Part A, but must pay a deductible and coinsurance. Part B has a monthly premium, deductible and copays/coinsurance costs as well.

Private insurance companies offer other ways to receive your benefits, such as through a Medicare Advantage plan or Medigap policy, which can vary in price. Part D prescription drug plans can also vary in price, but typically have a premium and copays/coinsurance for prescription drugs.

Understanding the costs associated with Medicare, and roughly calculating how much you may spend on healthcare, can help you budget and prepare for the year appropriately.

Read Also: What Is The Age Of Medicare

Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

Nhe By State Of Residence 1991

- In 2020, per capita personal health care spending ranged from $7,522 in Utah to $14,007 in New York. Per capita spending in New York state was 37 percent higher than the national average while spending in Utah was about 26 percent lower.

- Health care spending by region continued to exhibit considerable variation. In 2020, the New England and Mideast regions had the highest levels of total per capita personal health care spending , or 25 and 23 percent higher than the national average. In contrast, the Rocky Mountain and Southwest regions had the lowest levels of total personal health care spending per capita with average spending 17 and 16 percent lower than the national average, respectively.

- Between 2014 and 2020, average growth in per capita personal health care spending was highest in New York at 6.1 percent per year and lowest in Wisconsin at 3.0 percent per year .

- The spread between the highest and the lowest per capita personal health spending across the states has remained relatively stable over 2014-20. Accordingly, the highest per capita spending levels were 90 to 100 percent higher per year than the lowest per capita spending levels during the period.

- Medicare expenditures per beneficiary were highest in Florida and lowest in Vermont in 2020.

- Medicaid expenditures per enrollee were highest in North Dakota and lowest in Georgia in 2020.

For further detail, see health expenditures by state of residence in downloads below.

Read Also: Does Medicare Cover Flu Shots

Nhe By Age Group And Gender Selected Years 2002 2004 2006 2008 2010 2012 And 201:

- Per person personal health care spending for the 65 and older population was $19,098 in 2014, over 5 times higher than spending per child and almost 3 times the spending per working-age person .

- In 2014, children accounted for approximately 24 percent of the population and about 11 percent of all PHC spending.

- The working-age group comprised the majority of spending and population in 2014, almost 54 percent and over 61 percent respectively.

- The elderly were the smallest population group, nearly 15 percent of the population, and accounted for approximately 34 percent of all spending in 2014.

- Per person spending for females was 21 percent more than males in 2014.

- In 2014, per person spending for male children was 9 percent more than females. However, for the working age and elderly groups, per person spending for females was 26 and 7 percent more than for males.

For further detail see health expenditures by age in downloads below.

Who Pays The Least For Medicare Supplement Insurance

The first factor that determines the cost of your Medigap plan is your age. The younger you are, the cheaper the plan will be.

Most Medicare Supplements are based on âattained ageâ pricing. This just means that the price of the plan is based on your current age â the age you have âattained.â The price of the plan will go up each year.

Medicare.gov gives the following two examples to help us understand how this common pricing structure works:

âMrs. Anderson is age 65. She pays a $120 monthly premium. Her premium will go up every year. At age 66, her premium goes up to $126. At age 67, her premium goes up to $132. At age 72, her premium goes up to $165.

Mr. Dodd is age 72. He buys the same Medigap policy as Mrs. Anderson. He pays a $165 monthly premium. His premium is higher than Mrs. Andersonâs because it is based on his current age. Mr. Doddâs premium will go up every year. At age 73, his premium goes up to $171. At age 74, his premium goes up to $177.â

There are two other pricing structures, which are called âissue ageâ and âcommunity rated.â Issue age policies are based on the age you are when you buy your policy, and community rated policies have the same monthly premium for everyone.

As you can see, being 65 will give you a lower premium than being 75 or 80.

Secondly, women tend to live longer than men. This means women will ultimately pay more â in the long run â than men, so companies can afford to lower that monthly premium.

You May Like: What Is Medicare A And B Coverage

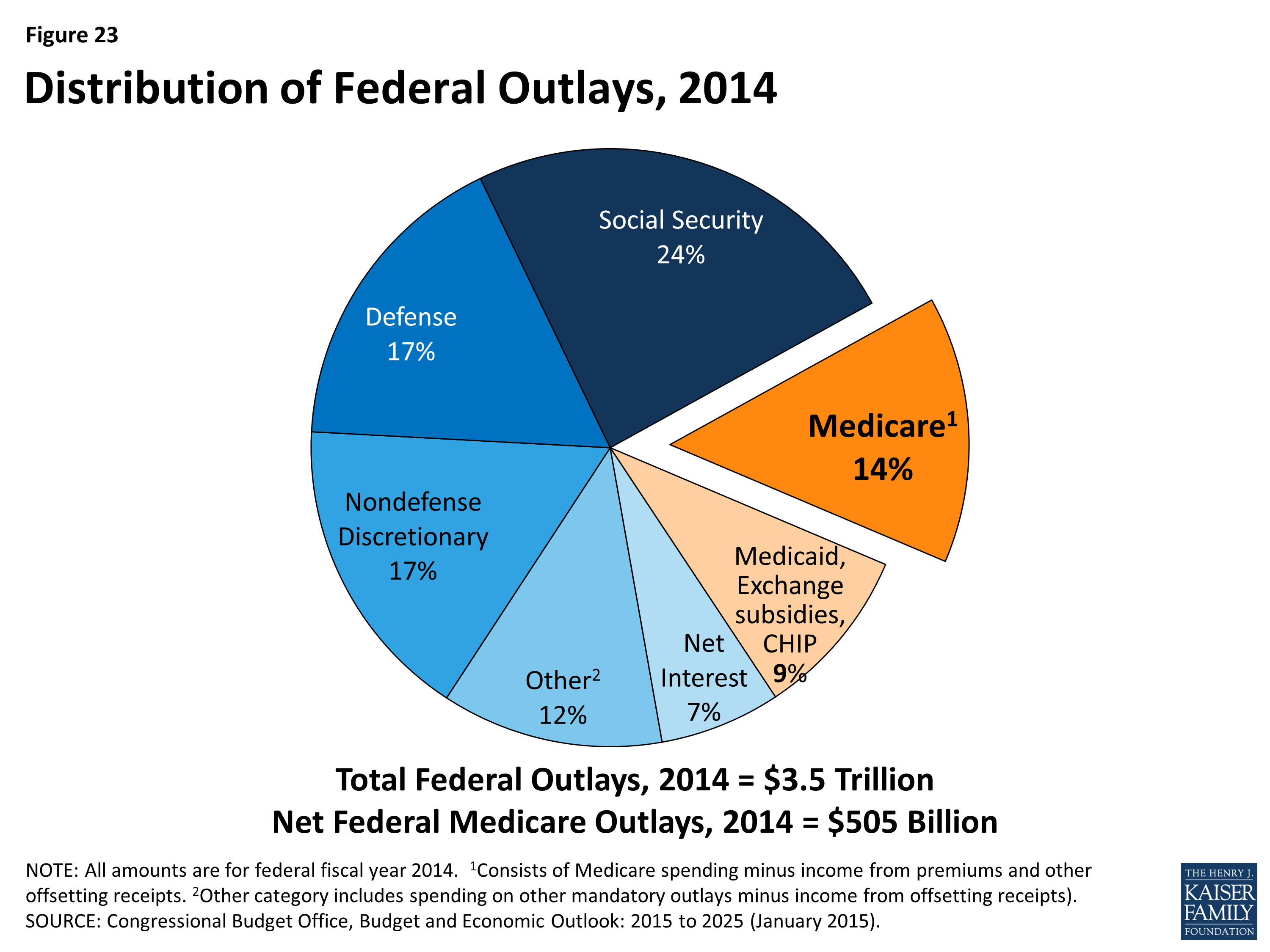

How Is Medicare Financed

Medicare is funded primarily from general revenues , payroll taxes , and beneficiary premiums .

Figure 7: Sources of Medicare Revenue, 2018

- Part A is financed primarily through a 2.9 percent tax on earnings paid by employers and employees . Higher-income taxpayers pay a higher payroll tax on earnings .

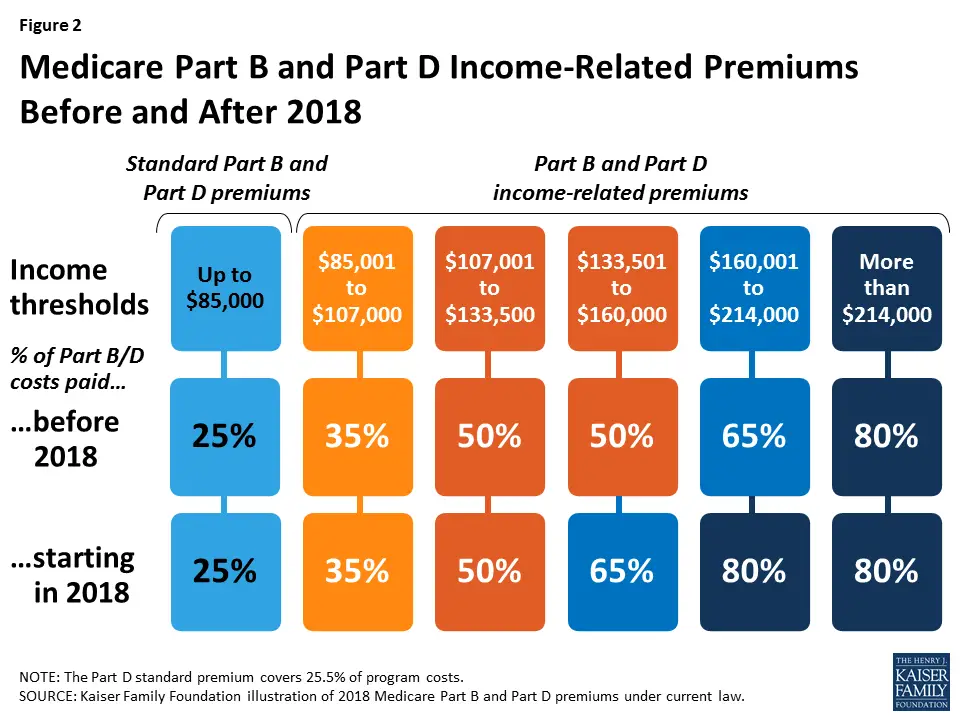

- Part B is financed through general revenues , beneficiary premiums , and interest and other sources . Beneficiaries with annual incomes over $85,000/individual or $170,000/couple pay a higher, income-related Part B premium reflecting a larger share of total Part B spending, ranging from 35 percent to 85 percent.

- Part D is financed by general revenues , beneficiary premiums , and state payments for beneficiaries dually eligible for Medicare and Medicaid . Higher-income enrollees pay a larger share of the cost of Part D coverage, as they do for Part B.

- The Medicare Advantage program is not separately financed. Medicare Advantage plans, such as HMOs and PPOs, cover Part A, Part B, and Part D benefits. Beneficiaries enrolled in Medicare Advantage plans pay the Part B premium, and may pay an additional premium if required by their plan about half of Medicare Advantage enrollees pay no additional premium.

How Much Do Medicare Beneficiaries Spend Out Of Pocket On Different Types Of Health

The graphic below shows average out-of-pocket spending for specific health and long-term care services by traditional Medicare beneficiaries in 2016, with comparisons across different groups of beneficiaries.

Average Out-of-Pocket Health Care Spending by Traditional Medicare Beneficiaries in 2016, by Type of Service

Of the total average per capita spending on health and long-term care services in 2016 , Medicare beneficiaries spent the most on long-term care facility services, which are not covered by Medicare , followed by medical providers and supplies , prescription drugs , and dental services . These estimates are averaged across all traditional Medicare beneficiaries including users and non-users of each service average spending among users would be higher than the averages presented here.

Average out-of-pocket spending by service varies across different groups of beneficiaries. For example:

Read Also: How To Change Medicare Direct Deposit

The Bottom Line On Healthcare Expenses For Retirees

Above all, remember that these are just averages, and other than Medicare premiums, out-of-pocket healthcare expenses can vary tremendously in retirement from person to person. Therefore it may be a good idea to prepare by considering a Medicare Advantage plan and saving extra money before you retire for the specific purpose of paying for healthcare expenses.

The Motley Fool has a disclosure policy.

Premium Additions For Higher Incomes

Medicare Part D charges higher premiums for people with higher reported income. This means youll pay any premium that is mandated by your selected plan in addition to a flat fee based on your reported income.

Like Part B, the income used to determine your extra premium payment is based on the income you reported on your IRS tax return from two years prior. The table below breaks down what a 2022 Medicare Part D enrollee would have pay for a premium.1

| Annual 2020 Income |

| Plan premium + $77.90 |

You May Like: Does Medicare Call To Verify Information

What Is The Average Cost Of Medicare Supplement Insurance

The average premium paid for a Medicare Supplement Insurance plan in 2019 was $125.93 per month.3

Its important to note that each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

Other factors such as age, gender, smoking status, health and where you live can also affect Medigap plan rates.

Medicare Supplement Insurance plans help pay for some of the out-of-pocket expenses youll face when you use Medicare Part A and Part B benefits. Medigap plans are sold by private insurance companies.

These costs can include certain Medicare deductibles, coinsurance, copayments and other charges.

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover.

Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

| 80% | 80% |

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Medicare Coverage Of Dialysis

Although Medicare will cover dialysis for all individuals with ESRD, it is essential to understand what parts of your dialysis treatment will be covered and by which sections of Medicare. Below is a breakdown of what Medicare Part A and B cover, respectively.

Dialysis Services Covered by Medicare

| Service |

|---|

| â |

Inpatient Dialysis vs. Outpatient Dialysis

Part A of Medicare will cover your dialysis procedure as long as the procedure is performed at a Medicare-approved facility. Find a Medicare-approved dialysis facility near you with this website.

Part B will cover 80% of the costs for outpatient dialysis once you reach your annual deductible. Part B will also cover lab testing, dialysis equipment, and all medications needed to conduct outpatient dialysis. These medications include topical pain relievers, heparin, and agents to treat anemia associated with dialysis.

Recommended Reading: Why Do Doctors Hate Medicare Advantage Plans

Costs Not Covered By Medicare

There are certain services Original Medicare simply doesnt cover. In general, you must pay all your own costs for:

- Dental care, including checkups, fillings, root canals, and dentures

- Vision care, including eye exams, eyeglasses, and contact lenses

- Hearing exams or hearing aids

- Routine foot care, such as callus removal

- Cosmetic surgery

- Long-term care in a nursing home or assisted living facility

- Any medical care received outside the U.S.

You can get some of these expenses, such as dental and vision care, covered under a Medicare Advantage plan. However, it depends on the plan you choose. Neither Original Medicare nor Medicare Advantage ever covers costs for care received outside the country. However, some Medigap policies provide this coverage.

According to the 2020 AARP analysis, the average Medicare recipient in 2017 spent $1,551 on health care costs not covered by Medicare. This amount was $932 for beneficiaries under 65 and $1,662 for those 65 and up.

A Late Enrollment Penalty

If youre not automatically enrolled in Part A and you dont sign up for Part A during your initial enrollment period, you must pay a late enrollment penalty when you do sign up.

The enrollment penalty is 10 percent of the cost of the monthly premium. Youll have to pay this cost each month for twice the number of years youre eligible for Part A, but didnt sign up.

For example, if you waited for 24 months to sign up, youll pay the penalty each month for 4 years.

You May Like: Can You Get Medicare Advantage Without Part B