B Deductible And Coverage Limits

The Part B deductible,A deductible is an amount you pay out of pocket before your insurance company covers its portion of your medical bills. For example:If your deductible is $1,000, your insurance company will not cover any costs until you pay the first $1,000 yourself. may go up or down year-to-year. Once you reach the deductible amount, you pay only 20% of Medicare-approved services for the rest of your benefit year. Medicare pays 80% of costs after deductible.

For example: After your deductible is satisfied, a $100 doctor visit will cost you $20 , and Medicare will pay $80.

Are you eligible for cost-saving Medicare subsidies?

What Is The Difference Between Parts B And D

Medicare Part B covers the care you get outside the hospital. It also covers some drugs and vaccines that Part D doesnt cover, such as:

-

Injectable and infused drugs

-

Pneumococcal vaccine

-

Most drugs for outpatient or at-home dialysis

Medicare Part D covers prescription medications you get at a pharmacy or other outpatient location that isnt a hospital or inpatient treatment center. With Part D, you can buy a stand-alone prescription drug plan from a private company or get coverage through a Medicare Advantage plan if you dont have creditable drug coverage from another source, such as a former employer or union. If you put off getting creditable drug coverage for too long, you could face a late enrollment penalty that lasts for as long as you have Medicare.

If youre Medicare-eligible or take care of someone who is, you can contact the State Health Insurance Assistance Program, or SHIP, with questions on anything Medicare related. Its trained benefits counselors offer unbiased guidance for free.

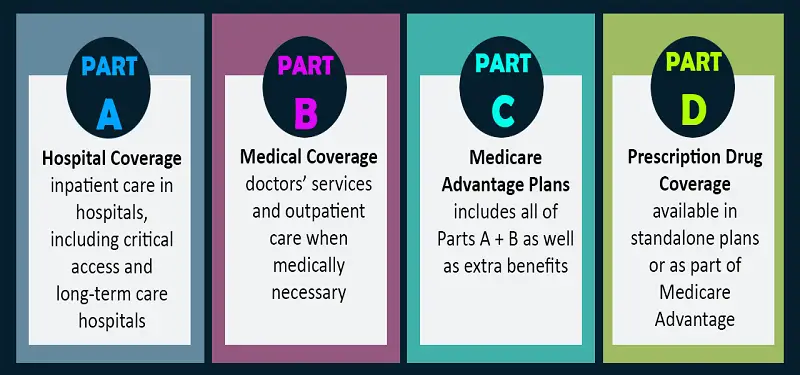

Medicare Parts and Coverage Basics

| Part A | |

| Doctor and healthcare provider visits Injectable and infused drugs Vaccines for flu, pneumonia, and hepatitis BMedical equipment like walkers and wheelchairs | |

| Part C | Medicare Advantage Private insurance alternative to traditional Medicare that bundles parts together, often with added benefits such as vision, hearing, and dental care |

| Part D | Outpatient prescription drug coverage |

Care Management Appears Somewhat Better For Beneficiaries In Medicare Advantage Plans Than For Beneficiaries In Traditional Medicare

Self-management of conditions. Across both types of Medicare coverage, most people age 65 and older said they felt confident they could manage and control their own health conditions . A somewhat larger share of people with diabetes in Medicare Advantage plans than people with diabetes in traditional Medicare felt confident they could manage their health conditions.

Among people age 65 and older with a health condition, a somewhat larger, though not statistically significantly different, share of those in Medicare Advantage plans than those in traditional Medicare that said they had a treatment plan for their condition. A larger share of Medicare Advantage enrollees said that a health care professional had given them clear instructions about symptoms to monitor and had discussed their priorities in caring for the condition .

Self-care among people with diabetes. Among beneficiaries with diabetes, no significant difference was observed by type of Medicare coverage in the proportion reporting their blood sugar was under control .9 While a larger share of SNP enrollees with diabetes engaged in self-care behaviors than their counterparts in other Medicare Advantage plans or traditional Medicare, the differences did not meet the statistical test for significance .

You May Like: Who Is Entitled To Medicare Part A

Don’t Miss: How Do You Contact Medicare

Prescription Drugs You Take At Home

PartB medical insurance covers only drugs that cannot be self-administered and thatyou receive as an outpatient at a hospital, a clinic, or at the doctor’soffice.

MedicarePart A covers drugs administered while you are in the hospital or in a skillednursing facility, and coverage for all other prescription drugs falls underMedicare Part D, which you must enroll in and pay for separately from Parts Aand B.

What You Need To Know

- Original Medicare does not help with teeth.

- It also skimps on coverage for eyes and ears.

With the increase of Medicare premiums, consumers should know what services are covered and not covered by Medicare plans to determine which one is best for them.

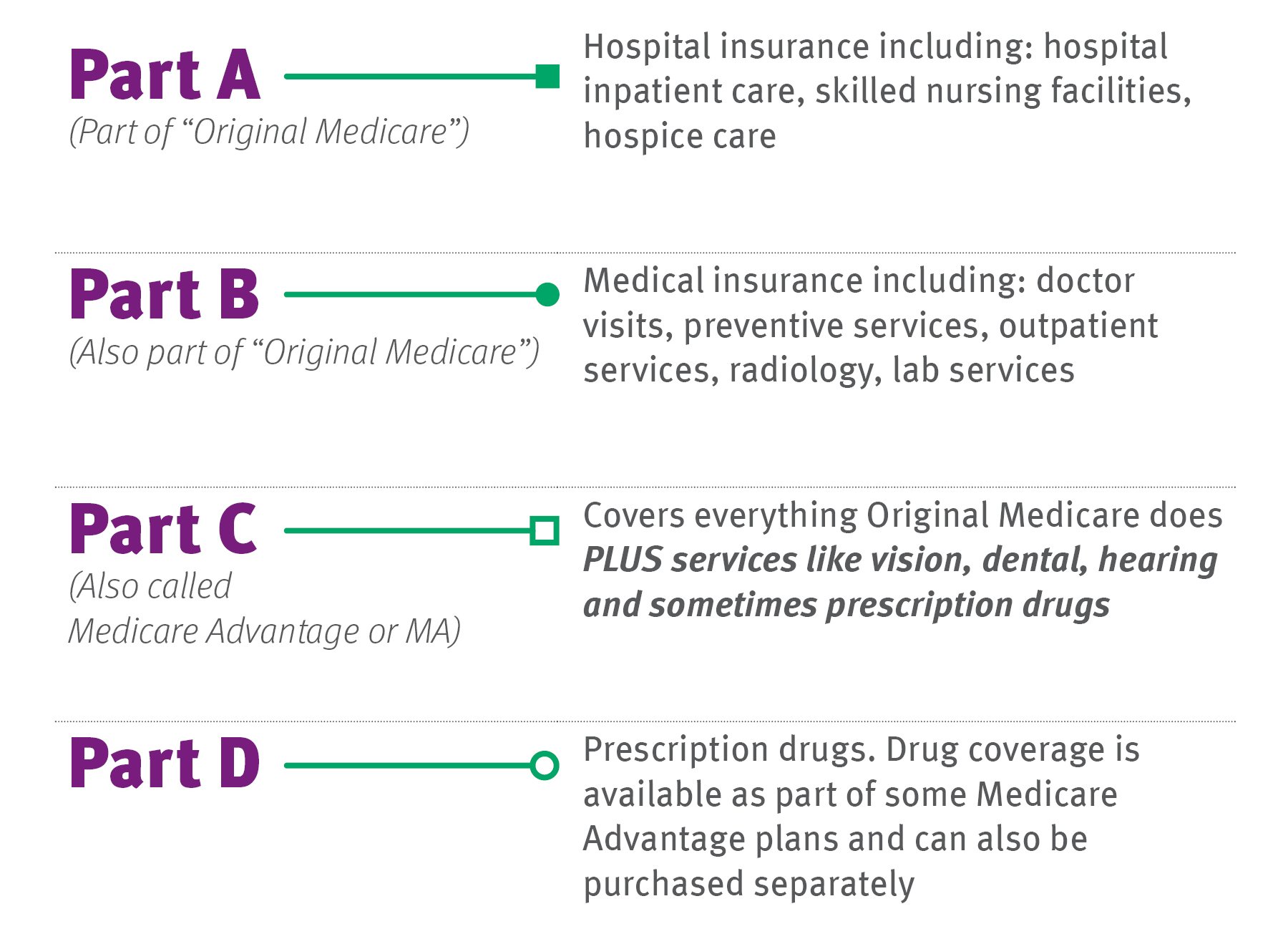

Medicare Part A is hospital insurance that helps cover inpatient hospital and skilled nursing facility stays, surgery, hospice care, and some home health care.

Medicare Part B is medical insurance that covers doctor visit bills, outpatient care bills, some preventative services, and some essential equipment.

Thus, it is important to explore gaps in coverage to decide if Medicare Advantage , Medicare Part D , or Medicare supplement insurance should be incorporated into a beneficiarys health plan.

You May Like: What Is Medicare On My Paycheck

Eyesight And Hearing Exams Glasses And Hearing Aids

Medicaremedical insurance does not cover routine eye or hearing examinations. Neitherdoes it cover hearing aids, eyeglasses, or contact lenses, except for lensesrequired following cataract surgery. However, if your eyes or ears are affectedby an illness or injury other than simple loss of strength, the examination andtreatment by an ophthalmologistan eye doctor who is an M.D.or other physicianis covered.

Medicare Doesn’t Cover Most Dental Care

Medicare doesnt provide coverage for routine dental visits, teeth cleanings, fillings, dentures or most tooth extractions. Some Medicare Advantage plans cover basic cleanings and X-rays, but they generally have an annual coverage cap of about $1,500. You could also get coverage from a separate dental insurance policy or a dental discount plan. An alternative is to build up money in a health savings account before you enroll in Medicare you can use the money tax-free for medical, dental and other out-of-pocket costs at any age .

You May Like: When Must You File For Medicare

What Does Original Medicare Part B Cover

While Original Medicare Part A, with its coverage for hospital visits and skilled nursing care, can help you manage the big stuff, thats only part of the picture. Original Medicare Part B helps you get the care you need for a lot of the other stuff that requires a doctors care. And you can receive care from any doctor who accepts Medicare patients.

Original Medicare Part B helps cover:

- Medically necessary doctors services

What Is Original Medicare Parts A And B

Medicare was started in 1965 to provide medical insurance to people age 65 and older. Medicare is a public health insurance program available in two ways: Original Medicare and Medicare Advantage Plan . The basics of Medicare coverage are Part A, Part B, Part C, and Part D.

The most popular plan is Original Medicare , but there has been a steady rise in Medicare Advantage popularity. If youre new to Medicare, your coverage options may seem complicated. Dont worry. We have answers to common questions about Medicare.

If you or a loved one is looking into Medicare, well walk you through whats covered.

Find a local Medicare plan that fits your needs

Also Check: Do You Really Need Medicare Supplemental Insurance

What Is Original Medicare

En español | Original Medicare, also known as traditional Medicare, works on a fee-for-service basis. This means that you can go to any doctor or hospital that accepts Medicare, anywhere in the United States, and Medicare will pay its share of the bill for any Medicare-covered service it covers. You pay the rest, unless you have additional insurance that covers those costs. Original Medicare provides many health care services and supplies, but it doesnt pay all your expenses.

When you first sign up for Medicare Part A and Part B, Social Security automatically enrolls you in original Medicare. If you prefer to receive your care from a private Medicare Advantage plan, such as an HMO or PPO, instead of the original program, you must actively enroll in a plan thats offered in your area. If you prefer to stay in original Medicare, you can get prescription drug coverage by joining a private Part D drug plan for an additional premium and you can also choose to buy private supplemental insurance to cover some of your out-of-pocket costs in the original program.

Read Also: When Is The Next Medicare Open Enrollment

Medicare Part A Vs Part B

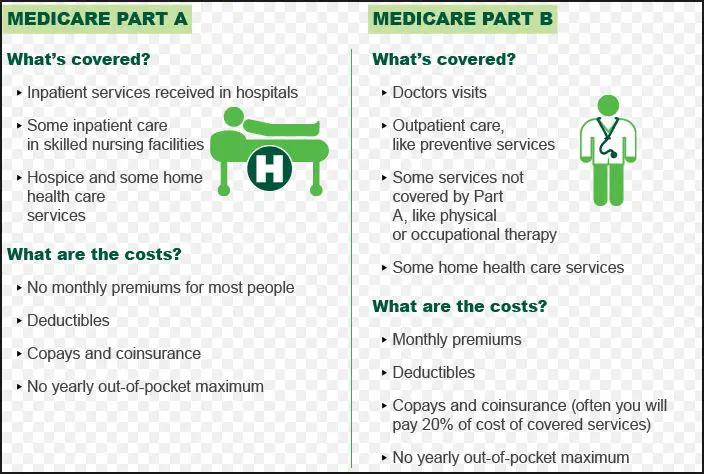

Original Medicare is divided into two parts designed to cover the majority of your medical needs. Medicare Part A covers hospital expenses, skilled nursing facilities, hospice and home health care services. Medicare Part B covers outpatient medical care such as doctor visits, x-rays, bloodwork, and routine preventative care. Together, the two parts form Original Medicare.

Read Also: Does Medicare Part D Cover Shingrix Vaccine

What Is Medicare Part A

Medicare Part A is sometimes referred to as hospital insurance. As the name implies, this is the Medicare plan that covers hospital stays and inpatient treatment. For treatment to be covered by Medicare Part A, it must be deemed medically necessary. This means a doctor has agreed that the treatment is required to prevent or treat a condition or illness.

Special Enrollment Period For Medicare Part A

If you lose your employer- or union-sponsored group hospital insurance, or if you were a volunteer serving in a foreign country, you may enroll in Medicare Part A immediately or during a Special Enrollment Period . This is the eight-month period that begins the month after your employment or other group coverage ends . If your employment ends during what would be your IEP, you would follow the standard rules for initial enrollment in Medicare Part A. You usually do not have to pay the late-enrollment penalty if you qualify for an SEP. Your Medicare Part A coverage will begin the first of the month after you enroll, and your Medicare card should arrive within 30 days of your enrollment.

Don’t Miss: Can I Get Medicaid If I Have Medicare

Take Noteyou May Need To Sign Up For Both Medicare Part A And B

Sometimes, people need to sign up for both Medicare Part A and Part B. The following are instances in which you should sign up for both parts:

- You arent getting or dont qualify for Social Security or Railroad Retirement Board benefits.

- You qualify for Medicare because you have ESRD.

- You live in Puerto Rico and want Part B.

Make sure you do your research and fully understand the difference between Medicare A and B before you start the enrollment process.

Can You Ever Get Both Part A And Part B Coverage At The Same Time

When youâre an inpatient in a hospital, itâs possible to get Part A and Part B coverage at the same time. For example, while Part A generally covers medically necessary surgery and certain hospital costs, Part B may cover doctor visits while youâre an inpatient.

Did you know that thereâs another way to get your Part A and Part B coverage? A Medicare Advantage plan delivers these benefits, and often more. Most Medicare Advantage plans include prescription drug coverage. Learn more about Medicare Advantage plans. You must pay your Medicare Part B premium when you have a Medicare Advantage plan, as well as any premium the plan might charge.

This information is not a complete description of benefits. Contact the plan for more information. Limitations, copayments, and restrictions may apply. Benefits, premiums and/or copayments/co-insurance may change on January 1 of each year.

Recommended Reading: Does Medicare Cover In Home Care For Seniors

Why Do I Need To Buy A Private Health Plan

Private Medicare health plans like Medicare Advantage or Medicare Cost plans cover everything Original Medicare does, and usually include more coverage for services you might need. Plus, they can include extra perks and benefits.

Find out more in the article, 4 reasons to buy a private health plan.

What Does Medicare Part A And Part B Cover

Original Medicare

- Hospice care

- Some home health care

You can enroll in Part A once you turn 65. If you’re already collecting Social Security disability benefits, you’ll be automatically enrolled in Part A.

Part B

- Some preventive services

Medicare pays 80 percent of approved charges and you pay about 20 percent.

Part B is optional because you have to pay a monthly premium and meet a deductible before Medicare will pay benefits.

Don’t Miss: Is Medicare Available For Green Card Holders

Wellcare Medicare Part D Plans Reviews And Ratings

Wellcares Medicare Part D and Medicare Advantage plans are rated by the Centers for Medicare and Medicaid Services . Other ratings and ranking entities provide insight into Wellcares parent company, Centene, or Wellcares health plans as a whole. See how Wellcare stacks up against other health insurance providers.

What Does Medicare Part B Cost

Medicare Part B, on the other hand, requires a monthly premium. The standard premium is $144.60 in 2020 and increases with income.3 You can choose to have this premium deducted automatically from your Social Security benefits, which can make things easier.

The annual deductible for Part B is $198 in 2020 .4 Once this is paid, youll only pay your coinsurance payments, which are 20% of covered expenses.

Some low-income and disabled people may be eligible for help paying Part B premiums through their state’s Medicare Savings Program . Those eligible for free Medicare Part B may qualify for free or lowered deductibles and coinsurance as well.

If you con’t qualify for an MSP, consider purchasing a Medicare Supplement plan to help cover the costs of both Parts A and B.

Learn more about Medicare costs.

Don’t Miss: What Is Medicare Premium Assistance

What Parts A And B Don’t Cover

The largest and most important item that traditional Medicare doesn’t cover is long-term care if the only care you need is custodial. If you are diagnosed with a chronic condition that requires ongoing long-term personal care assistance, the kind that requires an assisted-living facility, Medicare will cover none of the cost. However, Medicare will cover the costs for acute-care hospital services, for patients who are transferred from an intensive care or critical care unit. Services covered could include head trauma treatment or respiratory therapy.

Whats The Difference Between Medicare Part A And Medicare Part B

Part A is the hospital services part of Medicare. This benefit covers inpatient care, hospital stays, skilled nursing facility care, hospice care, and medically needed home health care services.

Part B is the medical services part of Medicare. It covers many of the medically necessary services not covered in Part A, such as outpatient and preventive services. This involves things like x-rays, bloodwork, doctors visits, and outpatient care. It will also cover other medical items such as diabetic test strips, nebulizers, and wheelchairs.

Don’t Miss: What Does Medicare Supplement Plan N Cover

What Services Are Not Covered Under Medicare Part B

En español | Medicare Part B covers a very wide range of medical care from routine services like flu shots and X-rays to big-ticket items such as organ transplants, delicate surgery to repair serious injuries, expensive cancer treatments and many others. It also covers a variety of preventive measures , often at no cost to you. But there are still some services that Part B does not pay for.

If youre enrolled in the original Medicare program, these gaps in coverage include:

Note: Medicare Advantage plans, such as HMOs or PPOs, must cover all the same Part B services that the original Medicare program does. But they may also offer extra benefits that cover some of the gaps listed above. Some plans, for example, provide coverage for routine hearing, vision and/or dental care, fitness programs and gym memberships, and emergency care abroad. Check with your plan.

Medicare Doesn’t Cover Deductibles And Co

Medicare Part A covers hospital stays, and Part B covers doctors services and outpatient care. But youre responsible for deductibles and co-payments. In 2022, youll have to pay a Part A deductible of $1,556 before coverage kicks in, and youll also have to pay a portion of the cost of long hospital stays — $389 per day for days 61-90 in the hospital and $778 per day after that. Be aware: Over your lifetime, Medicare will only help pay for a total of 60 days beyond the 90-day limit, called lifetime reserve days, and thereafter youll pay the full hospital cost.

Part B typically covers 80% of doctors services, lab tests and x-rays, but youll have to pay 20% of the costs after a $233 deductible in 2022. A medigap policy or Medicare Advantage plan can fill in the gaps if you dont have the supplemental coverage from a retiree health insurance policy. Medigap policies are sold by private insurers and come in 10 standardized versions that pick up where Medicare leaves off. If you buy a medigap policy within six months of signing up for Medicare Part B, then insurers cant reject you or charge more because of preexisting conditions. See Choosing a Medigap Policy at Medicare.gov for more information. Medicare Advantage plans provide both medical and drug coverage through a private insurer, and they may also provide additional coverage, such as vision and dental care. You can switch Medicare Advantage plans every year during open enrollment season.

You May Like: When Can Someone Apply For Medicare

Who Is Eligible For Medicare Part A And Part B

In order to be eligible for Medicare Part A and/or Part B, you must meet each of the following eligibility requirements:

- You are at least 65 years old OR have a qualifying disability

- You are a U.S. citizen OR a permanent legal resident of at least five consecutive years

- You are eligible for retirement benefits from either the Social Security Administration or the Railroad Retirement Board, OR you have been receiving disability benefits from either one for at least two years

As mentioned above, Medicare Part B is optional.

What Are The Two Main Medicare Coverage Options

Traditional Medicare

- Traditional Medicare covers Part A and Part B .

- Individuals also have the option to add Part D coverage for prescription drugs alongside their Part A and B coverage if they choose.

- Under Traditional Medicare, there is no annual limit on out-of-pocket costs. To help with the cost of coverage, individuals in traditional Medicare can buy Medicare Supplemental Insurance , which is extra insurance available from a private company. Medicare beneficiaries with limited income and resources may qualify for supplemental coverage under Medicaid.

Medicare Advantage , also referred to as Part C

- As a coverage alternative to traditional Medicare, beneficiaries have the option to enroll in Medicare Advantage.

- MA plans are run by private health insurers that follow the rules set by the Medicare program and are then paid by Medicare to provide services.

- Unlike traditional Medicare, MA plans usually include Part D as part of a bundle with Part A and Part B.

- Under MA, annual out-of-pocket costs are limited. Once an enrollee reaches the MA plans limit, the plan pays 100 percent of the cost of covered services for the remainder of the year.

Don’t Miss: Does Social Security Disability Qualify You For Medicare