Does Medicare Cover Assisted Living Facilities

The services offered by most assisted living facilities typically qualify as custodial care for the purposes, and therefore usually are not covered by Medicare. Only skilled health-care services, such as treatment for wounds provided by a licensed nurse, may be eligible for Medicare coverage in most cases.

Medicare Part A may cover short-term stays in skilled nursing facilities, such as when youre recovering from an operation, if custodial care isnt the only care you need.

Are there any alternatives to an assisted living facility?

Original Medicare may cover qualifying stays in a skilled nursing facility if you are discharged to one immediately following an eligible inpatient hospital stay. A skilled nursing facility differs from an assisted living facility in that it provides a higher level of health-care services, according to the National Institutes of Health publication Medline Plus. Skilled nursing facility care might include nursing, physical, respiratory, and occupational therapy, speech-language pathology, medication management, and dietary and nutritional counseling. Part A benefits are limited to a certain number of days per benefit period and subject to requirements of medical necessity your health-care provider will help you decide if a skilled nursing facility is an option for you or your loved one.

What Should I Consider In Knee Surgery Cost After I Am Discharged From The Hospital

You may be sent home with prescription medications to manage pain, and reduce the risk of blood clots or infection. You will probably have one or more follow-up appointments with your surgeon. You may also need physical therapy or other rehabilitation services for a few weeks after the procedure.

Although there is generally no coverage under Original Medicare for prescription medications you take at home, Part B typically pays 80% of allowable charges for all medically necessary doctor visits and physical or occupational therapy services you need after your surgery. Part B usually also generally covers durable medical equipment such as a cane or walker if your doctor orders one for you to use during your recovery. Its a good idea to discuss your after-surgery care with your doctor so you know what to expect and can better plan for your out-of-pocket expenses.

In some cases, your doctor may recommend a brief stay in a skilled nursing facility after your knee replacement. In order to be eligible for Part A skilled nursing facility coverage, you must have a qualifying hospital stay of at least three days prior to your admission. If your stay is covered, you pay nothing for the first 20 days of skilled nursing facility care there is a daily coinsurance amount applied to days 21 and beyond.

What Is Part D Coinsurance

There are four payment stages or Part D policyholders.

- Your annual deductible: For 2022, it can be up to $480 per year. You pay this entirely out of pocket.

- Initial coverage, where youll pay your share of copay or coinsurance until the total amount spent on drugs reaches $4,430.

- The coverage gap , where you pay 25% of all costs until youve paid $7,050 out of pocket.

- Catastrophic coverage: For the rest of the year, youll owe 5% coinsurance or $3.95 for generic drugs and $9.85 for brand drugs, whichever is greater.

Also Check: Should I Get Medicare Supplemental Insurance

Eliquis Coverage Through Medicare Advantage

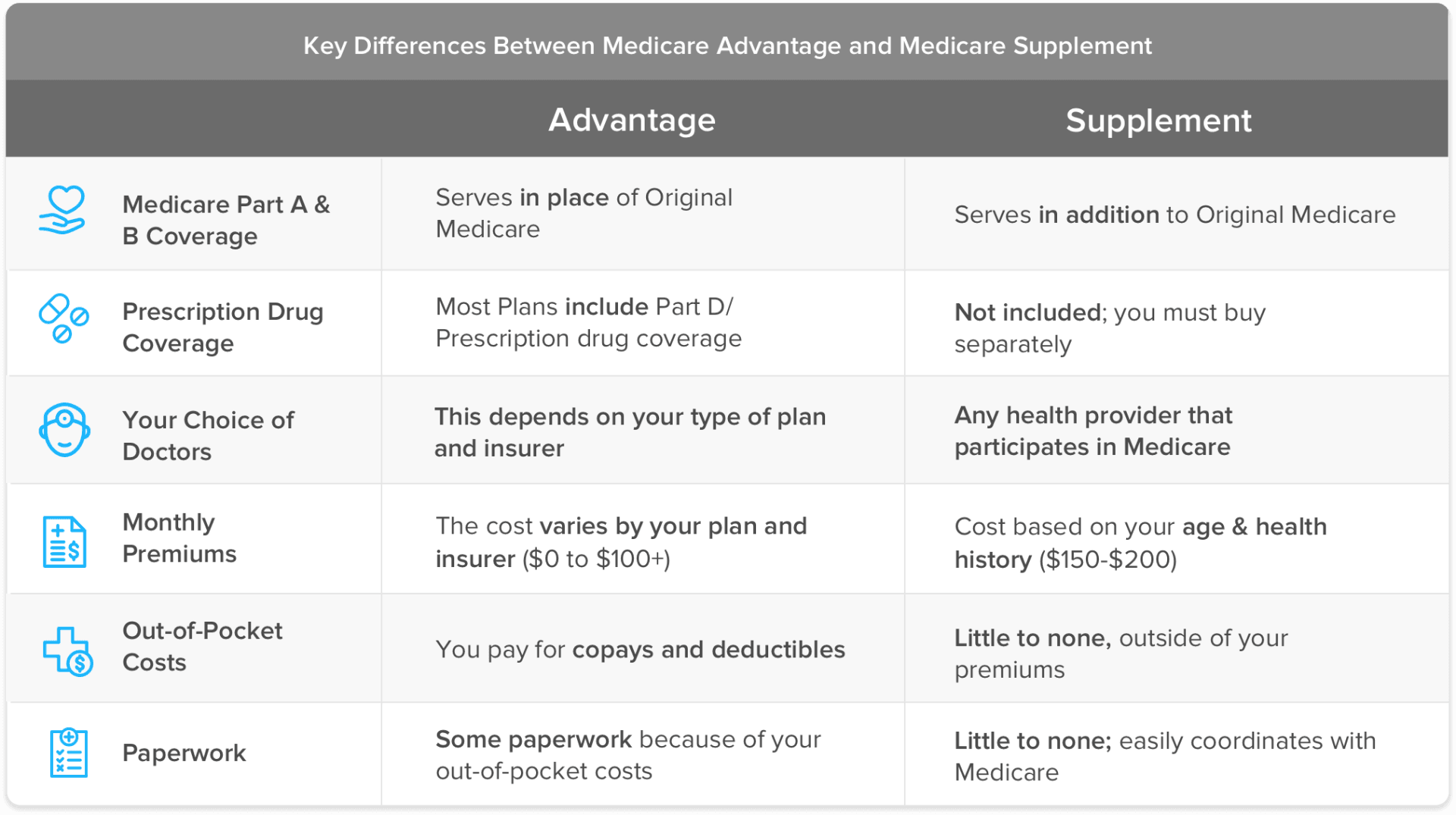

Medicare Advantage is a way to get your Medicare benefits through private insurance companies. Although these plans primarily cover Part A and Part B services, many of them also include at least some prescription drug costs.

When you buy a Medicare Advantage plan, you should make sure that Eliquis will be covered for you. 99% of Medicare Advantage plans will cover Eliquis, so this is an option you should consider if it is a prescription you will need. You will most likely be able to find a plan that works for you.

Does Medicare Advantage Cover Scooters

Medicare Advantage plans are an alternative way to get your Medicare benefits. All Medicare Advantage plans must cover, at a minimum, everything that Original Medicare Part A and Part B covers, except for hospice care, which is still covered under Part A. This means that Medicare Advantage plans must cover medically necessary mobility devices like power scooters if the above listed conditions are met.

However, because Medicare Advantage plans are offered by private insurance companies approved by Medicare, they are able to offer additional benefits to their members, such as Part D coverage for prescription drugs and coverage for routine vision and dental care. In many cases, copayments and deductibles are lower, or even waived for durable medical equipment like scooters.

Not every plan and benefit option may be available in all locations, however, and its important to remember that you must continue to pay your Part B premiums in addition to any other premium your plan requires.

Want to know more about how your Medicare coverage can help with mobility devices like power scooters? I am happy to give you more information and answer your questions. If you prefer, you can schedule a phone call or request an email by clicking on the buttons below. You can also find out about plan options in your area by clicking the Compare Plans button.

New To Medicare?

Don’t Miss: Does Medicare Pay For Dtap Shots

How Do You Enroll In Medicare

You can enroll in original Medicare directly through the Social Securitys website during your initial enrollment period. This period includes the 3 months before, the month of, and the 3 months after your 65th birthday.

If you miss your initial enrollment period or want to change or enroll in a different Medicare plan, here are the additional enrollment periods:

- General and Medicare Advantage enrollment: from January 1 to March 31

- Open enrollment: from October 15 to December 7

- Special enrollment: a number of months depending on your circumstances

The initial enrollment period is the time in which you can enroll into Medicare parts A and B. Once youre enrolled in original Medicare, though, you may decide that you would rather enroll into a Medicare Advantage plan.

Before you choose an Advantage plan, youll want to shop around to compare the different plans available in your area. Comparing benefits, health perks, and plan costs including copay amounts can help you choose the best Medicare Advantage plan for you.

How Can I Lower Medicare Costs

The Medicare Savings Program helps low-income beneficiaries pay Original Medicare premiums, copays, and deductibles. The Medicare Extra Help program assists low-income beneficiaries with prescription drug coverage.

Some Medicare beneficiaries are also eligible for Medicaid, the federal-and-state-funded health insurance program for low-income Americans. Eligibility varies by state â you can see our state-by-state guide to Medicaid here to find out if youâre eligible, and read more about Medicare vs Medicaid.

Beyond that, cost-saving comes down to finding the best plan and program structure for you. Some people may be looking for different Medicare benefits and more robust coverage than others. As weâve discussed, these elections and their costs will vary, depending on whatâs offered by your state and your income level.

Read Also: Can I Enroll In Medicare Online

Medicare Part A Deductible And Coinsurance

| Type of cost-sharing |

|---|

If you struggle to pay for coverage, you may qualify for a Medicare Savings Program, which is administered through state Medicaid offices and are generally available to beneficiaries with low income.

There are several versions of the program, each of which depends at least partly on your income. The options also come with limits on your available resources .

Depending on which program you qualify for, your Part B premiums could be paid, as well as other out-of-pocket costs such as deductibles, coinsurance and copayments.

How Much Does Medicare Part C Cost

Medicare Part C is the Medicare Advantage program. Medicare Part C costs can vary among plans. Medicare Advantage plans provide your Medicare Part A and Part B benefits through a private insurance company approved by Medicare.

- Monthly premium: Your Medicare Advantage premium might be as low as $0 per month. But you may want to look at other plan costs too like the deductible and coinsurance or copayments described below.

- Annual deductible: This cost is the amount you may have to pay before the plan covers services. As with other Medicare Advantage costs, it may be different from one plan to the next.

- Coinsurance or copayment: Medicare Advantage plans typically charge coinsurance or copayments as your share of covered services. Again, this cost may vary.

To figure out your Medicare Advantage costs, compare plans and look at how much each one charges for premiums, deductibles, and other cost sharing. Think about what services youll likely use. For example, if you find a Medicare Advantage plan with a $0 premium but a high deductible cost, and youre healthy and rarely need medical care, that kind of plan might work for you. If you go to the doctor a few times a year, you might want a lower deductible, even if it means paying a monthly premium. Take a careful look at each plan in your area to see which one may be a good fit.

You can get started comparing plans right now just enter your zip code in the box on this page.

Also Check: Should I Enroll In Medicare If I Have Employer Insurance

How Much Do Medicare Part A And Part B Cost In 2021

Part A and Part B of Medicare have standardized costs that are the same across every state.

- Most people qualify for premium-free Part A. To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years . Those 40 quarters do not have to be consecutive.

- If you pay a premium for Part A, your premium could be up to $471 per month in 20201.If you paid Medicare taxes for only 30-39 quarters, your 2021 Part A premium will be $259 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $471 per month.

- The standard Part B premium is $148.50 per month in 2021.Some beneficiaries may pay higher premiums for their Part B coverage, based on their income. This change in cost is called the IRMAA .

Find out whether you are required to pay a Medicare IRMAA in 2021.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

The Final Costs Of Medicare Advantage

There are many different factors to consider and types of coverage to choose from, which makes it tricky to determine exactly what your Medicare Advantage costs will be. The best way to keep costs down is to stay within your network of providers.

Research has shown that over the last five years, Medicare Advantage premiums have been slowly dropping. 42% of Medicare beneficiaries are enrolled in Medicare Advantage plans, more than doubling enrollments over the past decade . With enrollments increasing, premiums go down. Thanks to these lowered premiums, more and more Americans are accessing the comprehensive health care coverage they benefit from the most.

Medicare Advantage in 2021: Premiums, Cost Sharing, out-of-Pocket Limits and Supplemental Benefits. KFF, 29 July 2021, .

Medicare Advantage in 2021: Enrollment Update and Key Trends. KFF, 24 June 2021, .

You May Like: Why Is My First Medicare Bill So High

Find A $0 Premium Medicare Advantage Plan Today

1 MedicareAdvantage.com’s The Best States for Medicare in 2021 report. .

2 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

3 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

How Much Does Part B Cost For Most Enrollees

Most people new to Medicare will pay $148.50 for Part B premiums in 2021. This is the standard premium that most people pay based on income. Social Security will deduct your Part B premium from your Social Security check monthly. If you have not enrolled in Social Security income benefits yet, theyll bill you quarterly.

Since some people pay more based on income, use the tables below to determine your personal Medicare cost for Part B. It shows the amount that you will pay in 2021 for Part B, per the preview notice released by the Department of Health and Human Services in November.

The Medicare Part B deductible for 2021 is $203.

Don’t Miss: When Can Medicare Plans Be Changed

What Is The Average Cost Of Medicare Supplement Insurance Plans In Each State

There are 10 standardized Medicare Supplement Insurance plans available in most states.

Plan G is available in most states and is one of the most popular Medigap plans. Medigap Plan G is, in fact, the second-most popular Medigap plan. 17 percent of all Medigap beneficiaries are enrolled in Plan G.2

The chart below shows the average monthly premium for Medicare Supplement Insurance Plan G for each state in 2018.3

- Wisconsin, Hawaii and Iowa had the plans with the lowest average monthly premiums, around $102 per month.

- The highest average monthly Medigap premiums were in New York, at $304.72 per month.

| State |

|---|

Total 2021 Monthly Medicare Costs

When we total up all of your total monthly Medicare costs, hereâs what you can expect.

If you decide to use Original Medicare with a Medicare Supplement and a drug plan, your monthly costs would be:

- $148.50 for Medicare Part B

- Get a quote for your Medicare Supplement

- An average of $30 for your drug plan

If you decide to use a Medicare Advantage plan that includes a drug plan, your monthly costs would be:

- $148.50 for Medicare Part B

- A very low monthly premium for the MA plan

If you decide to get the Lasso Healthcare MSA and a drug plan, your monthly costs would be:

- $148.50 for Medicare Part B

- $0 premium for the MSA plan

- An average of $30 for your drug plan

For extra help, use the interactive Medicare Cost Worksheet to determine how much you will pay each month for Medicare.

Related Reading

Don’t Miss: What Is The Annual Deductible For Medicare

How Much Does Medicare Cost

There are several factors that weigh into the costs associated with Medicare, and they all depend on the level of coverage you choose to receive.

Original Medicare, which includes Part A coverage and Part B coverage requires payments in the form of monthly premiums, annual deductibles, copays, and coinsurance.

Premiums: A premium is the amount you pay for your health plan each month. If you or your spouse have paid Medicare taxes throughout your life, you likely wont need to pay a premium for Part A. In 2022, the Medicare Part B monthly premium will be $148.50. The average 2022 premium for Part D coverage will be $33 per month.

Deductibles: A deductible is the amount you pay before your plan starts to pay. The Part A deductible in 2022 will be $1,556 per benefit period. In 2022, the Medicare Part B deductible will be $217 per benefit period.

Coinsurance: Coinsurance is the percentage of costs of a covered health care service you pay after meeting your deductible. For Part A, the coinsurance is $0 for days 1 through 60 and increases after that. For Part B, you typically pay 20% of the Medicare-approved cost of most doctor services, medical equipment, and outpatient therapy.

If you need more information on what the different Medicare parts cover or would like a refresher on the ins and outs of Medicare, call Advise at 923-1869 , 8 a.m. 8 p.m. EST, M-F to request our free guidebook, Unlock Your Medicare.

How Much Does Medicare Part B Cost In 2021

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if youâre receiving Social Security benefits. You also may pay more â up to $504.90 â depending on your income. The higher your income, the higher your premium.

The deductible for Medicare Part B is $203 per year.

The Medicare Part B coinsurance amount is 20% for covered supplies and services.

Learn more about Medicare Part B, including Part B premiums prices based on income level.

Don’t Miss: Is Prolia Covered By Medicare Part B Or Part D

How Much Does A Medicare Supplement Insurance Plan Cost

- Medigap helps to pay for some of the healthcare costs that arent covered by original Medicare.

- The costs youll pay for Medigap depend on the plan you choose, your location, and a few other factors.

- Medigap usually has a monthly premium, and you may also have to pay copays, coinsurance, and deductibles.

Medicare supplement insurance policies are sold by private insurance companies. These plans help pay for some of the healthcare costs that arent covered by original Medicare. Some examples of the costs that may be covered by Medigap include:

- deductibles for parts A and B

- coinsurance or copays for parts A and B

- excess costs for Part B

- healthcare costs during foreign travel

- blood

The cost of a Medigap plan can vary due to several factors, including the type of plan you enroll in, where you live, and the company selling the plan. Below, well explore more about the costs of Medigap plans in 2021.

So what are the actual costs associated with Medigap plans? Lets examine the potential costs in more detail.