How Much Does Medicare Part A Cost In 2022

Premiums for Medicare Part A are $0 if youre getting or are eligible for federal retirement benefits. Its also premium-free if youre under 65 and receiving Social Security disability benefits for 24 months, or are diagnosed with end-stage kidney disease. If youre eligible for Medicare, but not other federal benefits, youll pay a Part A premium of $274 or $499 each month, depending on how long youve paid Medicare taxes.

The deductible for Medicare Part A is $1,556 per benefit period. A benefit period begins the day youre admitted to a hospital and ends once you havent received in-hospital care for 60 days.

The Medicare Part A coinsurance amount varies, depending on how long youre in the hospital. Coinsurance is typically a percentage of the costs, but Medicare designates the coinsurance as a flat fee.

Heres how much youll pay for inpatient hospital care with Medicare Part A:

-

Days 1-60: $0 per day each benefit period, after paying your deductible.

-

Days 61-90: $389 per day each benefit period.

-

Day 91 and beyond: $778 for each “lifetime reserve day” after benefit period. You get a total of 60 lifetime reserve days until you die.

-

After lifetime reserve days: All costs.

The cost of a stay at a skilled nursing facility is different. This is what a skilled nursing facility costs under Medicare Part A:

-

Days 1-20: $0 per day each benefit period, after paying your deductible.

-

Days 21-100: $194.50 per day each benefit period.

-

Day 101 and beyond: All costs.

Medicare Advantage Plans Have An Out

When you enroll in a Medicare Advantage plan, you can ask about your specific policys out-of-pocket spending limit.

Original Medicare does not include an out-of-pocket spending limit. While its not common, you could potentially be responsible for thousands of dollars in out-of-pocket costs if you only have Original Medicare coverage and require extensive medical care throughout the year.

How Much Does Medicare Part D Cost In 2021

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers.

Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius. High-income Medicare beneficiaries are subject to an income-related monthly adjustment amount , meaning if you make more, youâll pay more. For 2020 plans, the additional costs will be based on your 2018 income.

Getting Medicare Part D requires enrolling in Original Medicare, so youâll pay any of those premiums, too.

The deductibles vary, but no Medicare Part D plan can have a deductible higher than $445 in 2021, up from $435 in 2020.

Copays and coinsurance vary by plan and tier and whether youâve hit the Medicare Part D coverage gap, or âdonut hole.â After the insurer has covered a certain amount on prescriptions, they will temporarily limit how much your plan will help pay for prescriptions.

You May Like: Does Medicare Cover Gastric Bypass Revision

Also Check: Does Medicare Pay For Mental Health Therapy

Cost Of Medicare Part B Copays And Deductibles

Premiums arent your only out-of-pocket cost for Medicare Part B. You also have to pay a deductible and copays. This makes it a little harder to know exactly how much itll cost you each month or year.

The Medicare Part B deductible is $233 a year

The Medicare Part B copay is 20% of the Medicare-approved amount.

Once youve met the Part B deductible in a given year, youll then start paying only the copay of 20% of the cost of the Medicare-approved amount for doctors visits and other outpatient care. However, most blood tests and preventive services are free with Medicare, Belk says.

Its important to know that Medicare usually only approves an average of about 15% to 20% of any medical bill, meaning youll only be responsible for 20% of the 15% to 20% Medicare-approved amount, Belk points out.

If you get an MRI and Medicare approves $600 for that MRI, you owe 20% of $600 or $120. Thats it, Belk says. It doesnt matter if the bill for that MRI was $4,000. Youre only responsible for 20% of Medicares approved rate, not the billing charge.

How Much Is Medicare B

Those who are automatically signed up for Original Medicare are:

- Individuals who are turning 65 years old and are already getting retirement benefits from the Social Security Administration or the Railroad Retirement Board

- Individuals less than 65 with a disability who have been receiving disability benefits from the SSA or RRB for at least 24 months

- Individuals with amyotrophic lateral sclerosis who are getting disability benefits

Note that despite the fact that youll be selected automatically, Part B is still a discretionary Medicare plan. You can decide to postpone Part B on the off chance that you wish to do so. One circumstance where this might happen is in case youre covered by another arrangement through work or a life partner.

Also Check: When Do I Apply For Medicare Part B

Medicare Part A Premiums

Medicare calculates Part A premium costs by how long you or your spouse have paid Medicare taxes.

Here is an explanation of monthly premiums for Plan A in 2022:

If you or your spouse paid Medicare taxes for 10 years or more

$274/mo.

If you or your spouse paid Medicare taxes for more than 7.5 years but less than 10

If you paid Medicare taxes for fewer than 7.5 years

Medicare Part A Deductible

Most Part A costs come from the inpatientInpatient refers to medical care that requires admission to the hospital, usually overnight. hospital deductible. Inpatient care provided at a hospital or skilled nursing facilitySkilled nursing facilities provide in-patient extended care with trained medical professionals to recover from injury or illness and activities of daily living. These facilities provide physical and occupational therapists, speech pathologists and medical professionals assist with medications, tube feedings and wound care. Skilled nursing stays are usually covered under Medicare Part A. will require you to pay the annual deductible.

For the year 2022, the Plan A deductible increased from 2022:

- Medicare Part A deductible 2021: $1,484

- Medicare Part A deductible 2022: $1,556

Recommended Reading: Does Medicare Cover Orthotic Shoe Inserts

What Is The Average Cost Of Medicare Supplement Insurance Plans In Each State

There are 10 standardized Medicare Supplement Insurance plans available in most states.

Plan G is available in most states and is one of the most popular Medigap plans. Medigap Plan G is, in fact, the second-most popular Medigap plan. 22 percent of all Medigap beneficiaries are enrolled in Plan G.2

The chart below shows the average monthly premium for Medicare Supplement Insurance Plan G for each state in 2018.3

- Wisconsin, Hawaii and Iowa had the plans with the lowest average monthly premiums, around $102 per month.

- The highest average monthly Medigap premiums were in New York, at $304.72 per month.

| State |

|---|

| 25 |

What If I Can’t Afford Part B

If youre at least 65 and cant afford your Medicare Part B premium or deductible, there may be help. Medicare Savings ProgramsMedicare Savings Programs help those with low incomes pay premiums and sometimes coinsurance for Medicare expenses. are designed for low-income individuals who have trouble affording healthcare. To help you get started, here are the four types of MSPs, and their most-recent eligibility requirements from 2021:

- Qualified Medicare Beneficiary Program : helps pay premiums, copays, deductibles and coinsurance for Parts A and B.

- Whos eligible: individuals with income up to $1,094 per month couples making up to $1,472

If you need help finding an affordable Medicare plan, contact GoHealth. Our licensed insurance agents can help you navigate the different options and see what makes the most sense for you.

Also Check: Is Everyone Eligible For Medicare At 65

Monthly Medicare Premiums For 2022

The standard Part B premium for 2022 is $170.10. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $91,000 Married couples with a MAGI of $182,000 or less | 2022 standard premium = $170.10 |

| Your plan premium + $77.90 |

How Much Does Medicare Cost In 2021

Most people can get Medicare Part A for a zero-dollar premium Medicare Part B has a standard monthly premium of $148.50 in 2021.1 Medicare Part C has an average monthly premium of $21 in 2021,2 and Medicare Part D stand-alone plans are projected to have an average monthly premium of $41.3

There are four different parts of Medicare labeled A and B , C and D . Each comes with its own set of expenses. Lets take a closer look with a detailed breakdown of the costs associated with each part of Medicare.

Don’t Miss: How Much Does Medicare Pay For Hospice

Medicare Advantage Special Needs Plans May Have Lower Costs

A Medicare Special Needs Plan is a type of Medicare Advantage plan that is designed specifically for someone with a particular disease or financial circumstance.

Many Medicare SNPs cover most of the qualified health care costs for beneficiaries. All SNPs must include prescription drug coverage.

Some Medicare SNPs are designed for people who are dual-eligible, meaning they are eligible for both Medicare and Medicaid. These plans are commonly called Dual-Eligible Special Needs Plans .

Medicare Advantage Special Needs Plans can also cater more specifically to the needs of people with specific medical conditions, such as:

- Dependence issues with alcohol or other substances

- Autoimmune disorders

- Chronic lung disorders

- Strokes

Some SNPs can also be available to people who live in a long-term care facility such as a nursing home.

How Does Medicare Cover Cataract Surgery

Medicare covers cataract surgery to implant an intraocular lens, including hospital and doctor services during and after your operation and corrective lenses after your surgery. If you have the procedure as an outpatient, Medicare Part B will cover your treatment, and you may be responsible for any applicable deductibles, copays and/or coinsurance costs. If you are admitted to the hospital for surgery, youll be covered under Medicare Part A, and your coverage and costs will be different. Since your costs will vary depending on the specific services you receive and whether youre covered under Part A or Part B, its important to talk to your doctor beforehand to get a better estimate of how much your cataract surgery may cost.

After your surgery, Medicare Part B covers corrective lenses after youve had a cataract surgery to implant an intraocular lens. In this instance, Medicare may pay for one pair of glasses or contact lenses if you get them through a Medicare-enrolled supplier. You may owe a 20% coinsurance for the glasses or contact lenses, and the Part B deductible applies. Keep in mind that Medicare doesnt otherwise cover most routine vision services, and youll be responsible for paying for the cost for upgraded frames or additional vision care unrelated to your cataract surgery.

Also Check: Does Medicare Pay For Foot Care

You May Like: Will Medicare Pay For Ymca Membership

Medicare Part A Deductible In 2022

Medicare Part A covers certain hospitalization costs, including inpatient care in a hospital, skilled nursing facility care, hospice and home health care. It does not cover long-term custodial care.

For 2022, the Medicare Part A deductible is $1,556 for each benefit period. If you re-enter the hospital or skilled nursing facility any time after your benefit period ends, you will have to pay the first $1,556 again as a new deductible.

Recommended Reading: Can We Apply For Medicare Online

How Much Is Taken Out Of Social Security For Medicare

If you receive Medicare health insurance benefits and Social Security retirement benefits at the same time, you can have your Medicare premiums automatically deducted from your Social Security check each month. This can save a lot of time and energy, as you wont have to worry about paying your premiums manually. This option is available for every part of Medicare, including private plans like Medicare Advantage and Medicare Part D.

This article explains everything you need to know to understand how much will be deducted from your Social Security benefits.

Also Check: Where To Send Medicare Payments

Using Medigap To Pay Medicare Deductibles

Medigap, also known as Medicare Supplement plans, can help pay some of your out-of-pocket costs, including your Medicare Part A deductibles.

These plans are sold through private insurers. There are eight standardized plans across 47 states and the District of Columbia. There are different standardized plans for Minnesota, Massachusetts and Wisconsin.

Each plan has a letter for a name. Some of these plans may cover all or a portion of your Part A deductible.

Medigap Plan Coverage of Part A Deductibles

| A |

|---|

Medicare And Medicaid Costs

Medicare is administered by the Centers for Medicare & Medicaid Services , a component of the Department of Health and Human Services. CMS works alongside the Department of Labor and the U.S. Treasury to enact insurance reform. The Social Security Administration determines eligibility and coverage levels.

Medicaid, on the other hand, is administered at the state level. Although all states participate in the program, they aren’t required to do so. The Affordable Care Act increased the cost to taxpayersparticularly those in the top tax bracketsby extending medical coverage to more Americans.

According to the most recent data available from the CMS, national healthcare expenditure grew 9.7% to $4.1 trillion in 2020. That’s $12,530 per person. This figure accounted for 19.7% of gross domestic product that year. If we look at each program individually, Medicare spending grew 3.5% to $829.5 billion in 2020, which is 20% of total NHE, while Medicaid spending grew 9.2% to $671.2 billion in 2020, which is 16% of total NHE.

Don’t Miss: When You Are On Medicare Do You Need Supplemental Insurance

Can Medigap And Medicare Advantage Help You Save

Its true you can get a Medigap plan to help pay some of your Part B out-of-pocket costs. But Medigap plans for new Medicare patients do not pay the Medicare Part B deductible. And the plans can get quite expensive.

Belk points out that a Medigap plan that starts out with, say, a $130 per month premium when youre 65 could balloon to $200 a month when youre 70, and so on.

Another option could be getting a Medicare Advantage plan, which is sold by private insurers and encompasses what youd get in Medicare Parts A and B, plus some extras. Medicare Advantage, also known as Medicare Part C, is a different way of getting your benefits.

These plans have different structures and costs, but have to follow Medicare rules and may cover some items Medicare doesnt coverfor example, an eye exam, hearing aids or a trip to the dentist to get a filling.

But while it may sound like Advantage plans simplify things, Belk says theyre anything but simple, and they might not save you money. These plans are deliberately confusing and, in every case, youre inviting a middleman to manage your benefits for you, Belk says. That can only ever cost more in the long run.

What Is Medicare Part A

Medicare Part A is a basic insurance plan that covers medical services related to inpatient hospitalization and skilled nursing care. It is offered at low or no cost to Americans who are 65 years old and have contributed toward Social Security, as well as other qualified individuals.

What Medicare Part A Covers:

Also Check: Does Medicare Offer Dental And Vision

Medicare Part B: How Much Does It Cost

For a monthly 170.10 dollar premium, Part B covers your medical insurance with the amount subject to change each year.

The amount will also have to be paid if no Part-B services are claimed. There might also be a penalty applied if you don’t sign up for Part B when an individual is first eligible for Medicare .

There is also a 233 dollar deductible that is due each year.

Finally Part B also includes a late enrolment penalty that might be applied for any of the following cases.

There’s a 10 percent extra tacked onto the cost if an individual could have signed up for Part B but didn’t. The Penalty is added to the monthly premium, though there might be a higher premium depending on the individual’s income.

The late fee isn’t a one-time penalty and the amount will include the penalty for as long as the individual uses the plan.

Finally, the penalty won’t be applied if the individual qualifies for a Special Enrolment Period. In order to qualify, the individual in question must still be working and you must have health coverage based on that job.

The cost for services is usually 20 percent of the cost for each Medicare-covered service or item after the deductible has been paid.

What Is A Deductable

The deductable refers to the amount a member is expected to pay before their coverage kicks in.

The deductible will increase from $203 to $230 in 2022. After the deductible has been reached, members will be required to pay twenty percent of the costs for various services including, most doctor services, outpatient therapy, and medical equipment.

What is causing the increase in costs?

The CMM provided a series of reasons as to why the price is increasing.

The first is that each year based on the continuous increase in the costs of providing health care. Each year, the premium increases a small amount to reflect this market-wide trend. However, from 2020 to 2021, the price only increased two percent, whereas from 2021 to 2022 it will be more than fifteen percent.

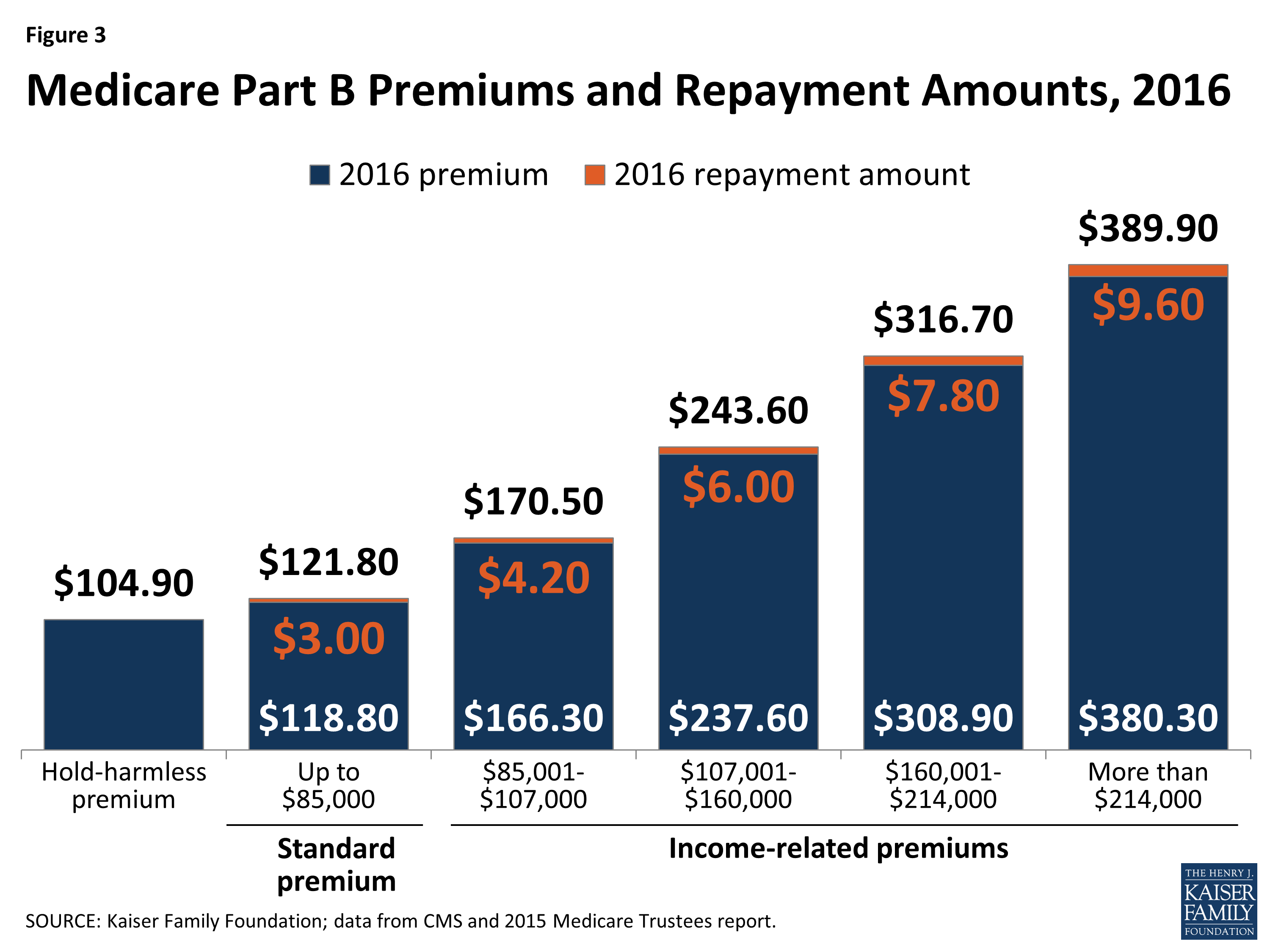

Another reason relates to Congressional action to lower the cost of premiums in 2021, âwhich resulted in the $3.00 per beneficiary per month increase in the Medicare Part B premium being continued through 2025.â

You May Like: What Are The Advantages And Disadvantages Of Medicare Advantage