Your Health Care Needs

- Do you take prescription drugs?

- Do you wear eyeglasses or hearing aids?

- Do you visit the dentist regularly?

If so, you might consider the benefits of enrolling in a Medicare Advantage plan.

- Do you have a health condition that requires frequent trips to the doctor or the use of medical equipment in your home?

- Do you expect to undergo surgery or other major procedures in your near future?

- Do you frequently travel outside of the U.S.?

If so, certain types of Medicare Advantage plans might be a good choice for you.

Am I Eligible To Enroll In A Medicare Advantage Plan

If you have or are eligible for Parts A and B of Medicare , you are eligible to enroll in a Part C, Medicare Advantage plan.

Pre-existing conditions do not disqualify you from enrollment. You must also live in the area of the plan you enroll in. Limited enrollment periods for these plans exist, and you are usually required to stay in your plan for a year.

How Can They Offer A $0 Premium Plan

The private insurance companies offering these Advantage plans contract with Medicare to manage paying your benefits. This means they receive a subsidy from the funds you pay into the Medicare system over the lifetime of your or your spouse’s work history and your Part B premiums. This allows competition for your business, driving premiums lower in some cases. In fact, some plans even offer a reduction in your Part B premium cost.

Recommended Reading: Are Lidocaine Patches Covered By Medicare

Local Conditions And Convenience

In some areas where physicians and hospitals are scarce, its important to check out both the networks of available Medicare Advantage plans and the locations of providers who accept regular Medicare. Are the doctors accepting new patients? Will you have to travel far to see a provider or be treated in an emergency room? Advice from local professionals, neighbors, and licensed insurance brokers can help you find Medicare Advantage plans that do business in your area. Compare plans to find one that may suit your needs.

Why Are Some Medicare Advantage Plans Free

When a Medicare Advantage plan has a $0 premium, often the company is able to offer that lower price by saving money on other costs, for example, using in-network healthcare providers. They pass those savings on to you by offering a premium at no charge. A $0 premium is also a great way for providers to attract customers. You will, however, still have other monthly costs.

You May Like: What Is The Annual Deductible For Medicare Part A

Who Should Get A Medicare Hmo Plan

Each type of Medicare Advantage plan offers its own advantages and disadvantages. A Medicare HMO plan makes the most sense if you are looking for the lowest possible monthly premiums, dont travel much, or need a great deal of speciality care.

HMOs may not be a fit if you are looking for freedom of selection of doctors, hospitals, and clinics, or are concerned with a known budget for your yearly cost of health care. If you prefer to stay with your own physician or to make your own decisions about what specialists you want to see, it is a good idea to review your HMOs list of in-network physicians to see whether your favorites are on the list. Remember that if they leave the network, you will not be able to follow them without switching plans during the next AEP or MA-OEP or incurring additional charges.

Things To Consider Before You Buy A Plan

Ask your medical providers If they’ll take the MA plan.

Ask the plan if It requires a referral for you to see a specialist.

If you live in another state part of the year, find out if the plan will still cover you. Many plans require you to use regular services within the service area , which is usually the county in the state where you live.

Find out if the plan includes:

- Monthly premiums

- Any copayments for various services

- Any out-of-pocket limits

- Costs to use non-network providers

If you have Medicaid or receive long-term care, or live in a nursing home, Special Needs Plans may be available in your area. If you choose other types of MA plans, find out if:

- The plan’s in-network providers you use are certified to accept Medicaid.

- In-network providers bill the plan correctly and/or refer to Medicaid providers as needed.

- The providers’ office knows what Medicaid covers and what the plan covers.

- You’ll have monthly premiums to pay. Medicaid will not cover MA plan premiums.

Also Check: Does Humana Offer A Medicare Supplement Plan

When Do You Sign Up For A Medicare Advantage Plan

You can wait to apply for Medicare until the month of your 65th birthday or the 3 months following your birthday. However, coverage can be delayed if you wait, so try to apply early.

If you decide not to enroll in a Medicare Advantage plan when you first turn age 65, you have another chance during Medicares annual open enrollment period.

From October 15 through December 7 each year, you can switch from original Medicare to Medicare Advantage. You can also switch from one Medicare Advantage plan to another or add, remove, or change a Part D plan.

What Are The Advantages And Disadvantages Of Medicare Advantage Plans

There are positives and negatives to everything, and Medicare Advantage is no exception. Lets start with the good news first!

Advantage plans have low premiums, and they include services Medicare doesnt. Medicare Advantage has your back if you need routine dental or vision. Some Advantage plans include Part D.

Some policies also include gym memberships, chiropractic care, and Long-Term Care. Further, there are plans that include over the counter drug cards. These are all fantastic things, but the fine print is the real kicker.

Top 3 disadvantages of Medicare Advantage plans:

As if thats not bad enough, Advantage plans can drop doctors without cause, and members MUST follow plan rules. Also, the benefits they promise can turn out to be less than you were lead to believe.

What would happen if your plan suddenly dropped one of your doctors? Sure, the low premium is enticing, but is it worth it?

Before we decide, lets take a look at why premiums are low and how Medicare Advantage plans make money while offering such cheap coverage.

Also Check: Does Medicare Pay Anything On Dental

Medicare Advantage Plans Change Every Year

As MedicareWire approaches its tenth anniversary, we have witnessed massive changes in plans, carriers, and availability. And 2021 presented the most changes of all.

On one hand, the expansion of plans into new markets is a very good thing because it increases competition and choice. On the other hand, the constant change, merging of companies, and new benefits create so much noise and confusion that many seniors simply ride out the same plan year after year.

The sheer complexity of choosing a Medicare Advantage plan causes most people to stay in a plan until the plan itself forces them to choose a new plan. This, in turn, causes member copays and coinsurance to go up because people resist change, and the national health plans drown out the small local HMOs with cost-saving features.

Medicare Advantage Plans Cant Turn You Down

When President G. W. Bush signed Medicare Advantage into law in 2003, he started the pre-existing conditionA pre-existing condition is any health problem that occurred before enrolling in a health plan. The Affordable Care Act law made it illegal for health plans to or charge more due to a pre-existing condition…. coverage revolution that went into The Affordable Care Act. Unlike Medicare supplement insuranceMedicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare health insurance coverage…., which only has one guaranteed-issue period, people with Medicare Advantage medical insurance can change plans every year without having to answer questions about their health.

Only those with ESRD , also known as kidney failure, is a condition that causes you to need dialysis or a kidney transplant. People with ESRD are eligible for Medicare coverage regardless of age….) and a few rare health conditions can be turned down. For these people, Medicare offers special coverage directly.

This is a significant benefit of the Medicare Advantage program that cannot be overstated. Millions of Americans, who would otherwise be bankrupted by healthcare costs in traditional Medicare, are able to get quality care through an MA plan.

Don’t Miss: How To Get Medicare For Free

The Benefit Of Coordinated Medical Care

Medicare Advantage is a great option for people looking for coordinated medical care, meaning your doctors and other healthcare providers will communicate and collaborate to coordinate your care.

A major benefit of this is that it can prevent unnecessary healthcare expenses and medication interaction errors.

Studies have found that having coordinated healthcare using a primary care physician, companies received higher ratings from policyholders as well as medical staff.

Medicare Advantage Plans Limit Your Annual Out

This is one of the most significant advantages of Medicare Advantage vs. Original Medicare. All Medicare Advantage plans have a maximum out-of-pocket limit that protects members from excessive health care costs. But it only applies to health service copays and coinsurance. It does not include monthly premiums, deductiblesA deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begins to pay its share…., or outpatient prescription costs. It also does not include costs of secondary services, like dental, vision, or hearing.

For the 2021 plan year, the Centers for Medicare and Medicaid ServicesThe Centers for Medicare & Medicaid Services is the U.S. Federal agency that runs the Medicare, Medicaid, and Childrens Health Insurance Programs…. set the maximum MOOP amount at $7,550 for in-networkDoctors, hospitals, pharmacies, and other healthcare providers that agree to health plan members’ services and supplies at a set price are in-network providers. With some health plans, your care is only covered if you get… services. When combined with monthly premiums, prescription drug coverage, and deductibles, thats potentially a crushing blow to the budget of most retirees.

Recommended Reading: What Is The Cost Of Medicare Supplement Plan F

Medicare Advantage Plans Coverage For Some Services And Procedures May Require Doctors Referral And Plan Authorizations

Medicare Advantage plans try to prevent the misuse or overuse of health care through various means. This might include prior authorization for hospital stays, home health care, medical equipment, and certain complicated procedures. Medicare Advantage plans often also require your primary care doctors referral to see specialists before they will pay for services.

Structures Of Personalized Plans

Medicare Advantage has a variety of plan options to suit your needs. An SNP Advantage plan, for example, can help with medical expenditures if you have a chronic health condition.

A PFFS or PPO plan may be more suitable for you if you prefer provider flexibility. Many Medicare Advantage plans include extra services such as dental, vision, and hearing.

Don’t Miss: When Do You Sign Up For Medicare

Research Cms Star Ratings

The CMS have implemented a 5-star rating system to measure the quality of health and drug services provided by Medicare Advantage and Medicare Part D plans. Every year, the CMS releases these star ratings and additional data to the public.

The CMS ratings can be a great place to start when shopping around for the best Medicare Advantage plan in your state. Consider researching these plans for more information on what coverage is included and how much it costs.

To see all available Medicare Part C and D 2021 star ratings, visit CMS.gov and download the 2021 Part C and D Medicare Star Ratings Data.

Best User Experience: Humana

-

Relatively limited educational information available on website

-

Unable to make payments via app

-

Several different types of plans can be overwhelming

Humana has an A- ranking from AM Best, indicating its strong financial state. We chose Humana for the Best User Experience because when you are comparing plans, Humana gives you the opportunity to choose what kind of plans you want to see whether its medical coverage only, prescription drugs only, or a plan that includes both. Once youve decided that, you can select the type of plan: HMOs, which are often offered without a premium but apply only for in-network providers PPOs or Private Fee-for-Service plans that offer in- and out-of-network coverage but with higher costs or the option to see all plans you qualify for.

The process is streamlined and straightforward, giving you the choice to enter your doctors name or prescription medication information to get an accurate estimate, all without having to register for an account, wait for an email, or input a lot of personal information. Humana provides recommended plans based on your situation, including listing coverage, premiums, specialists, and prescription costs.

Recommended Reading: How Much Does Medicare Cover For Home Health Care

Most Medicare Advantage Plans Bundle Prescription Drug Coverage With The Health Plan

At first glance, it might seem like having your prescriptions included with your health insurance plan is a good thing. And for many people, particularly healthy seniors, it works out just fine. However, what happens if your Advantage plan has favorable copays for the health services you use but the prescription drug plan portion has unfavorable copays on the medications you need most? Or vice versa.

This is exactly the position many seniors find themselves in with their Medicare Advantage plan, and it happens because plan features are difficult to compare, and insurers know it. It also happens when a healthy person joins a plan, because it has a zero-dollar premium, and is later diagnosed with a chronic illness.

The simple fact is that bundling Medicare Part DMedicare Part D plans are an option Medicare beneficiaries can use to get prescription drug coverage. Part D plans provide cost-sharing on covered medications in four different phases: deductible, initial coverage, coverage gap, and catastrophic. Each… prescription drug plans with Medicare Advantage plans makes it infinitely more difficult to choose the best plan. It works out great when you are healthy and your prescription needs are few, but the onset of chronic health issues makes plan selection challenging.

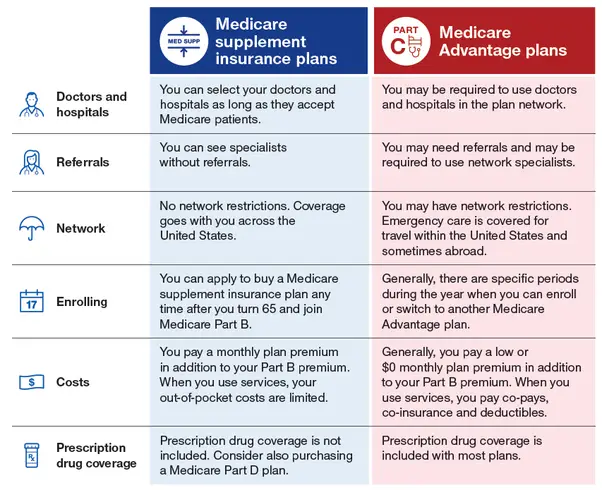

Medicare Advantage Plans May Limit Your Freedom Of Choice In Health Care Providers

With the federally administered Medicare program, you can generally go to any doctor or facility that accepts Medicare and receive the same level of Medicare benefits for covered services. In contrast, Medicare Advantage plans are more restricted in terms of their provider networks. If you go out of network, your plan may not cover your medical costs, or your costs may not apply to your out of pocket maximum.

Recommended Reading: What Does Original Medicare Mean

Medicare Advantage Plans May Cost You Less

If you enroll in a Medicare Advantage plan, you continue to pay your Medicare Part B premium and you may pay an additional premium. The insurer determines the Medicare Advantage plans premium, which can vary from one Medicare Advantage plan to another. Some Medicare Advantage plans may have premiums as low as $0.

Your cost sharing may also be less under Medicare Advantage. For, example, if you visit a primary care physician under Medicare Advantage, you may pay a copayment of $10. However, if you visit a primary care physician under Original Medicare, you may have a coinsurance of 20%, which could be more than $10.

Also, a Medicare Advantage plan limits your maximum out-of-pocket expense. Once you have spent that maximum, you pay nothing for covered medical services for the remainder of the year. Original Medicare does not provide a maximum out-of-pocket cap, so your potential expenses are limitless.

Often a Medicare Advantage plan can be less expensive than comparable coverage you would receive if you stayed with Original Medicare. To get all the benefits of Medicare Advantage with Original Medicare, you would also need to enroll in a stand-alone Medicare Part D Prescription Drug Plan as well as a Medicare Supplement plan.

How Much Does A Medicare Hmo Plan Cost

The amount that you will pay to enroll in a Medicare HMO plan will depend upon several different factors. Because every plan is different, you need to ask the following questions:

- Is there a monthly premium, and if so, how much is it?

- Does the plan pay all or part of the Medicare Part B monthly premium?

- Is there a yearly deductible, and if so, how much is it?

- What is the copay/coinsurance that is charged for each visit or service?

- What is the annual limit on how much you will pay in out-of-pocket costs?

Beyond asking these questions, if you are considering an HMO you should think about your own medical and health care needs. If you have pre-existing medical conditions and require specialty care, you need to consider whether you are likely to follow the plans rules and restrict yourself to only using network providers. If you choose to receive care out-of-network,, you may want to ask whether the provider will accept the assignment. If not, consider whether it is worth it to you to pay the additional out-of-pocket expense to receive care.

You May Like: Is Unitedhealthcare A Medicare Advantage Plan

Other Options For Medicare Enrollees

Most people consider the following 3 options below when researching their senior health coverage.

Since Medicare Advantage has an out-of-pocket maximum, offers equivalent benefits to Medicare, and often includes drug coverage, MA usually provides more protection than Original Medicare. If you want more medical fee coverage, you should consider Medigap.

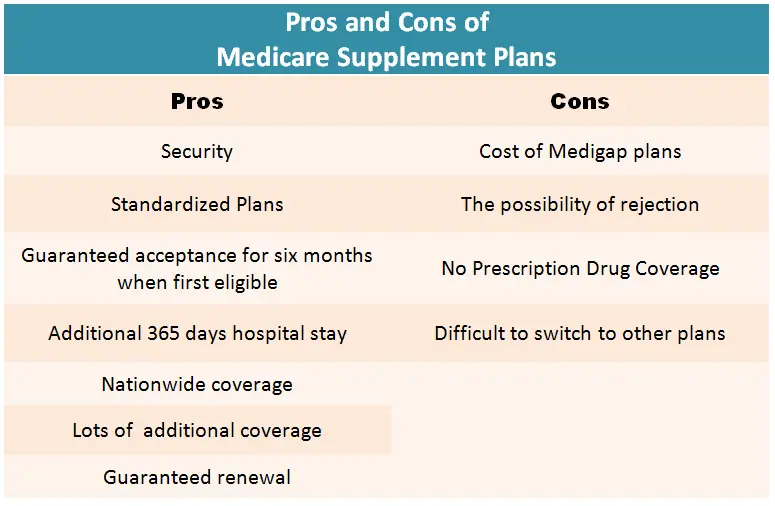

Medigap works very differently than MA. Medicare Supplement plans complement Original Medicare and can cover all Original Medicares deductibles, copays, coinsurance, and still offer additional coverage. Make sure you check out our Medigap Overview page or read Medigap Pros and Cons, to see if that is something you are interested in.

For further questions call 800-930-7956.