What If I Have A Medigap Policy

Your Medigap policy may offer some additional coverage for health care services or supplies that you get outside the U.S.

A Medigap policy is health insurance sold by private insurance companies to fill “gaps” in the Original Medicare Plan coverage. In all states, except Massachusetts, Minnesota, and Wisconsin, a Medigap policy must be one of 12 standardized policies so you can compare them easily. Medigap Plans C, D, E, F, G, H, I, and J provide Foreign Travel Emergency health care coverage when you travel outside the U.S. These policies pay for 80% of the billed charges of medically necessary emergency care that must be the type that would have been covered by Medicare in the U.S. This care must begin during the first 60 days of each trip, after you meet a $250 deductible each year. Foreign Travel Emergency coverage with Medigap policies has a lifetime limit of $50,000.

Before you travel outside the U.S., talk with your Medigap company or insurance agent to get more information about your Medigap coverage while traveling. To learn more about Medigap policies, visit www.medicare.gov on the web and view a copy of “Choosing a Medigap Policy: Guide to Health Insurance for People with Medicare”, or call 1-800-MEDICARE for more information. TTY users should call 1-877-486-2048.

How Does Medicare Work

Medicare is divided into parts A, B, C, and D. Parts A and B make up Original Medicare and are usually automatically received at age 65. Part A covers hospital stays, care in a skilled nursing facility, and home healthcare under certain circumstances. Part B covers medical services received from a doctor and supplies that are medically necessary to treat your health condition.

Part C Plans are a type of Medicare health plan offered by private insurance companies that contract with Medicare. Medicare Advantage Plans provide all of Part A, Part B, and, in many cases, Part D benefits. Some Advantage Plans include worldwide emergency care services as well as dental, vision, gym memberships, and more.

Part D covers prescription drug coverage and must be purchased separately as a stand-alone Part D policy or in a Medicare Advantage Plan .

Medicare Supplement Plans, also called Medigap Plans, are offered by private insurance companies that contract with Medicare. They cover certain healthcare costs not covered by Original Medicare such as deductibles, copayments, and co-insurance. Some Supplement Plans offer worldwide coverage for urgently needed services. Please read the Evidence of Coverage carefully.

Does Medicaid Or Medicare Cover Me Abroad

If you are a Medicaid recipient, you may be dropped from enrollment in the medical plans if you do not keep a U.S. state residence or address or if you lose your SSI eligibility . Loss of enrollment creates a gap of coverage upon return home from traveling abroad, especially if the travel health insurance does not cover you in your home country.

Individuals who are entitled to Medicare and leave the United States are still enrolled in the Medicare program The issue is that Medicare will not make payments for services given or supplies sent outside the United States.*

If you are a U.S. citizen or permanent resident on Medicare, consider purchasing a Medicare supplement plan from a local insurance agent instead of getting separate international coverage. This supplement will cover you for the first 60 days of a trip outside of the United States. There is a $250 deductible. After meeting the deductible, the insurance will cover 80% of all billed charges up to a lifetime maximum of $50,000. This “Foreign Travel Emergency” benefit is just one of the many benefits included in the supplement package. The premium will likely be between $100 and $150 depending on your age, and if you already have a Medicare supplement, you may only need to add as little as $9.00 for overseas coverage.**

Contact the Social Security Administration and the Medicaid/Medicare office for more information .

** Information from: Good Neighbor Insurance, subject to change

Read Also: How Do I Enroll In Medicare Part A And B

Basic Rules On Qualifying For Coverage

Workers who have contributed at least 40 quarters to Social Security are eligible for Medicare coverage at age 65 even if your Social Security “full retirement age” is over 65.

Individuals who are eligible for railroad retirement benefits, or who have worked long enough in a US federal, state, or local government job can also qualify for coverage.

Certain other categories of individuals may qualify for one or more parts of Medicare earlier than age 65 or under certain conditions.

For greater detail on qualifying for Medicare, see: faq.ssa.gov/link/portal/34011/34019/Article/3771/What-is-Medicare-and-who-can-get-it

A succinct overview of Medicare can be found at: www.socialsecurity.gov/pubs/10043.html#a0=2

General information on Medicare is available at: www.medicare.gov/people-like-me/new-to-medicare/getting-started-with-medicare.html

Does Medicare Cover Me If I Travel Outside Of The United States

Original Medicare, Part A and Part B, does not cover medical services or items you get outside of the U.S. and its territories. If you have a medical emergency in the U.S., but the closest hospital is outside of the country, Medicare might cover care in the foreign hospital.

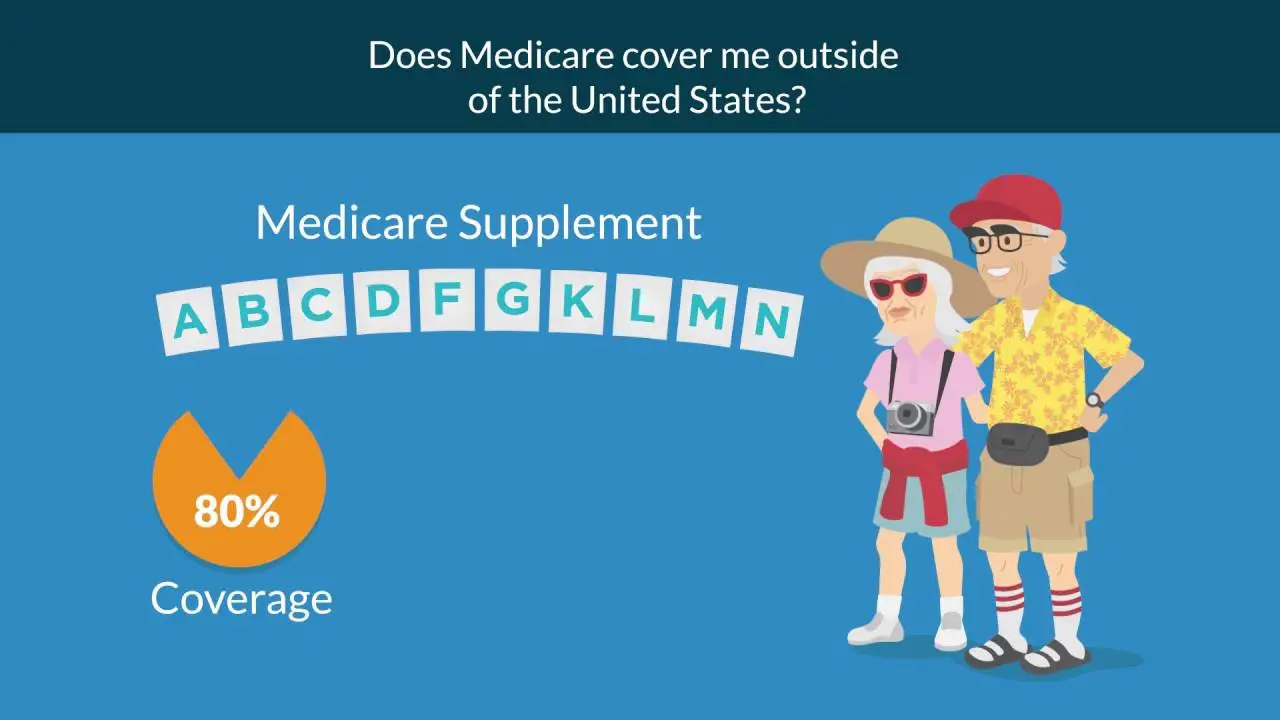

Medicare Supplement plans do offer coverage for out-of-country travel. These plans cover foreign travel emergency care if it begins during the first 60 days of your trip, and if Medicare doesnt otherwise cover the care. They pay 80% of the billed charges for certain Medically necessary emergency care outside the U.S. after you meet a $250 deductible for the year. This benefit does have a $50,000 lifetime limit.

You May Like: Can You Only Have Medicare Part B

Do I Still Have Coverage When I Return To Us

If you are traveling outside of the United States for an extended period of time, you may be disenrolled from your Medicare Advantage plan and placed back into Original Medicare. When this happens, you will receive a notification, and you will continue to pay the Part B premium. If you drop Part B and do not pay for your Medicare, then you will have to pay an enrollment penalty when you come back to the United States. Premiums are set to increase each year by 10 percent when not enrolled in Part B. Its important that you continue to maintain your health insurance even if you decide to travel for longer periods of time outside of the United States.Medicare Advantage plans are a great option if you plan to travel. If you want to switch to a Medicare Advantage plan for your trip, you just need to go to Medicare.gov or you can use our tools on MedicarePartC.com to find a plan thats right for your budget and medical needs. As always, you should carefully look at the plan before purchasing to ensure that it will cover you for what you need especially for when you go on vacation outside of the United States.

Health Network Group – 1199 S. Federal Highway, STE 403, Boca Raton, FL 33432

Copyright © MedicarePartC.com | California Consumer Privacy | Privacy Policy | Terms of Use | About Us | Sitemap

Get A Custom Quote Right Now On A Medicare Plan – Simply Complete This Form Or Call Us Toll Free

Medicare Enrollment Questions? Speak with an Agent

What May Not Covered By Travel Health Insurance

Dont assume you have coverage for all injuries, illnesses, or travel mishaps you might face abroad. There are some types of expenses that many travel health insurance plans dont cover.

These could include:

- Routine medical exams or preventive care

- Mental health care

- Injury or illness due to certain extreme sports

- Drug-related injury

Read more about the different scenarios where your travel health insurance may not cover you.

*A general definition for a pre-existing condition is an injury, illness, disorder, disease, or other physical or mental condition that exists in a defined period before your policy goes into effect.

Recommended Reading: Is Xolair Covered By Medicare Part B

More On Medicare And Medical Services Abroad

It’s true: Medicare generally doesn’t cover health or medical care performed overseas. Don’t take my word for it–both medicare.gov and travel.state.gov make it pretty clear.

The good news is Medicare does pay for some international doctor visits, hospital stays, ambulance calls, and even dialysis treatments. Now for the bad news: it only pays for them in a limited number of circumstances.

Here’s what has to happen for Medicare to pick up even part of your foreign medical bill:

- You’re in the U.S. when amedical emergencyoccurs. A foreign hospital is closer than the nearest U.S. hospital that can treat your condition.

- You’re in Canada while traveling between Alaska and another U.S. state when a medical emergency occurs. A Canadian hospital is closer than the nearest U.S. hospital that can treat your condition.

- You live in the U.S. and a foreign hospital is closer to your home than the nearest U.S. hospital that can treat your condition.

Medicare also sometimes covers medical services received on a ship. The catch here, though, is the services must be “medically necessary.” Also, the ship has to be within the territorial waters of the U.S. If it’s more than six hours away from a U.S. port, Medicare won’t reimburse you for any portion of the resulting bill or bills.

Here’s a Medicare refresher for anyone who needs it:

Finally, Medicare drug plans never cover prescription medications bought outside the U.S.

Important Information About Medigap Policies C D F G M & N

Your Medigap plan may provide worldwide coverage benefits for health care needs when you travel outside the United States. Medigap policies C, D, F, G, M & N provide Foreign Travel Emergency health care coverage when you travel outside the United States. Under these plans, Medigap policies pay for 80% of the cost of emergency care during the first 60 days of each trip after you pay the $250 deductible. Foreign Travel Emergency coverage with Medigap policies have a lifetime limit of $50,000.

Since your Medigap plan has a lifetime limit of $50,000 of medical benefits that are paid for treatment outside the USA, you need a trip cancellation travel insurance plan or a travel medical plan that has Primary Travel Medical coverage. That way if you have a medical claim you are not using part of your lifetime limit.

Medicare is the health insurance program for people over the age of 65. People under the age of 65 can qualify for the Medicare program with certain disabilities, and any age with End-Stage Renal Disease .

Read Also: What Is The Best Medicare Advantage Plan In Washington State

Does Medicare Advantage Cover Travel

Medicare Advantage plans must cover the same limited foreign emergency care expenses as Original Medicare.

Some Medicare Advantage plans may offer additional coverage as well. Certain rules and restrictions may apply.

For example, your Medicare Advantage plan may require you to pay your expenses upfront and get reimbursed by the insurance company later. Other plans might cap overseas travel benefits.

Its important to check the details of your specific plan for more information. Make sure to contact your plan provider to ask about costs and coverage rules.

When To Sign Up For Medicare Plans

When you sign up for the various Medicare coverages and when each one comes into effect varies with the different Plans. A general outline follows specific situations or health conditions touch off a number of different enrollment periods. For fuller details see the publications.

Enrolling in Medicare parts A & B:

Part A

For qualified individuals, you should sign up during the “Initial Enrollment Period” of seven months around the month you turn 65 . Note that this may be before you can or choose to file for Social Security benefits. If you enroll prior to the birthday month, you will start being covered as of your birthday month. If you enroll during the last four months of the period, coverage will start with an additional month’s delay.

If you didn’t sign up for Part A during your Initial Enrollment Period, you can sign up during the “General Enrollment Period” between January 1 and March 31 each year. Coverage will begin July 1. If you are a qualified individual, there may be a penalty premium for late sign-up, as mentioned above .

In certain cases, if you did not sign up for Plan A when initially eligible because you were covered under a group health plan based on current employment, you can sign up later during a “Special Enrollment Period”. See Publication 11219 for details.

Part B :

Part C and Part D :

Some addiitonal information on Medicare sign up can be found at the following non-US government links:

Don’t Miss: Do Medicare Advantage Plans Have Dental Coverage

Do I Have Medicare Coverage Abroad

No, in most cases, Medicare does not offer coverage for medical treatment outside the US or its territories. Medicare does not cover international travel. The instances where you could potentially be covered abroad are very limited, as follows:

- Youre within the US when you have a medical emergency, but a foreign hospital is closer to your location than the closest US hospital than can treat your emergency.

- You are within Canada, on your way back from Alaska. If you have a medical emergency as you are travelling across Canada without unreasonable delay* directly between Alaska and another US state and a Canadian hospital is closer than a US hospital.

- Non-emergencies: Only if you live in the US but the hospital that can treat your medical condition closest to you is a foreign hospital rather than a US hospital.

*To be determined by Medicare on a case-by-case basis.

If you fit into one of the situations described above, then you can be reimbursed for medical expenses as follows:

- Inpatient hospital care, when you have been admitted in a foreign hospital with a doctors order

- Emergency services . This includes the services you receive immediately prior to and during your hospital stay.

Basically, in the instances described above and only those, you will be covered in the same manner as you would in the US, including all coinsurance/copayments and deductibles.

Medicare Doesn’t Cover Most Dental Care

Medicare doesnt provide coverage for routine dental visits, teeth cleanings, fillings, dentures or most tooth extractions. Some Medicare Advantage plans cover basic cleanings and X-rays, but they generally have an annual coverage cap of about $1,500. You could also get coverage from a separate dental insurance policy or a dental discount plan. An alternative is to build up money in a health savings account before you enroll in Medicare you can use the money tax-free for medical, dental and other out-of-pocket costs at any age .

Don’t Miss: What Age Do You Draw Medicare

Why Doesnt Original Medicare Cover Travel

Original Medicare coverage for enrolled travelers is limited. While there are some instances where you can receive medical treatment, the instances of the usage being viable is very small. There are actually only three ways that you may receive care outside of the United States if you have Medicare and need to see a doctor while traveling.

One thing to remember is that if you do encounter these situations, Medicare only pays for the Medicare-covered services that you receive in a foreign hospital.

If You Are Retired And Neither You Nor Your Spouse Works While Abroad:

In this situation, you have a difficult decision to make: Either pay monthly Medicare Part B premiums for coverage you cant use outside the United States, or delay enrollment until you return to the U.S. and then become liable for permanent late penalties.

There is one exception to this Catch-22 rule. Some people dont qualify for Medicare Part A benefits without paying monthly premiums for them because they or their spouses havent contributed enough in payroll taxes at work. In this situation, you cannot sign up for Part A or Part B outside the United States. Therefore, in this specific circumstance, you can delay Medicare enrollment until your return, without being subject to late penalties regardless of how long you lived outside the U.S. or how many years have passed since you turned 65. Your special enrollment period begins during the month of your return as a U.S. resident and expires at the end of the third month following. Coverage begins on the first day of the month after you enroll.

If you decide to sign up for Part B while abroad, you can do so by contacting the nearest U.S. embassy or consulate in the country where you live. You can find contact information on the Social Security Administrations international website.

Don’t Miss: What Is Centers For Medicare And Medicaid Services

If Your Plan Does Provide Some Coverage Abroad Ask These Additional Questions:

- Does my insurance policy cover emergency medical evacuation?

Emergency medical evacuation, or medevac, is the emergency transport of an individual from an inadequate medical facility to one that is more suitable for treating the condition at hand. This is important when traveling abroad because many regions of the worldespecially those that are isolatedmay have sparse access to quality medical services.

NOTE: Even the U.S. health insurance plans that do offer international coverage may not offer coverage for medical evacuation.

- Do I need pre-authorization for treatment, hospitalization, or other medical services?

Its possible that your insurance only covers treatments that your provider deems medically necessary beforehand. If this is the case, ask your provider what those treatments are and what procedures you would need to follow to obtain these covered services.

- What are my deductibles/co-pays/limits for out-of-network services?

Policies for international, out-of-network coverage are likely to differ from your standard coverage. In many cases, you should be prepared to pay these fees out of pocket and file a claim for reimbursement later.