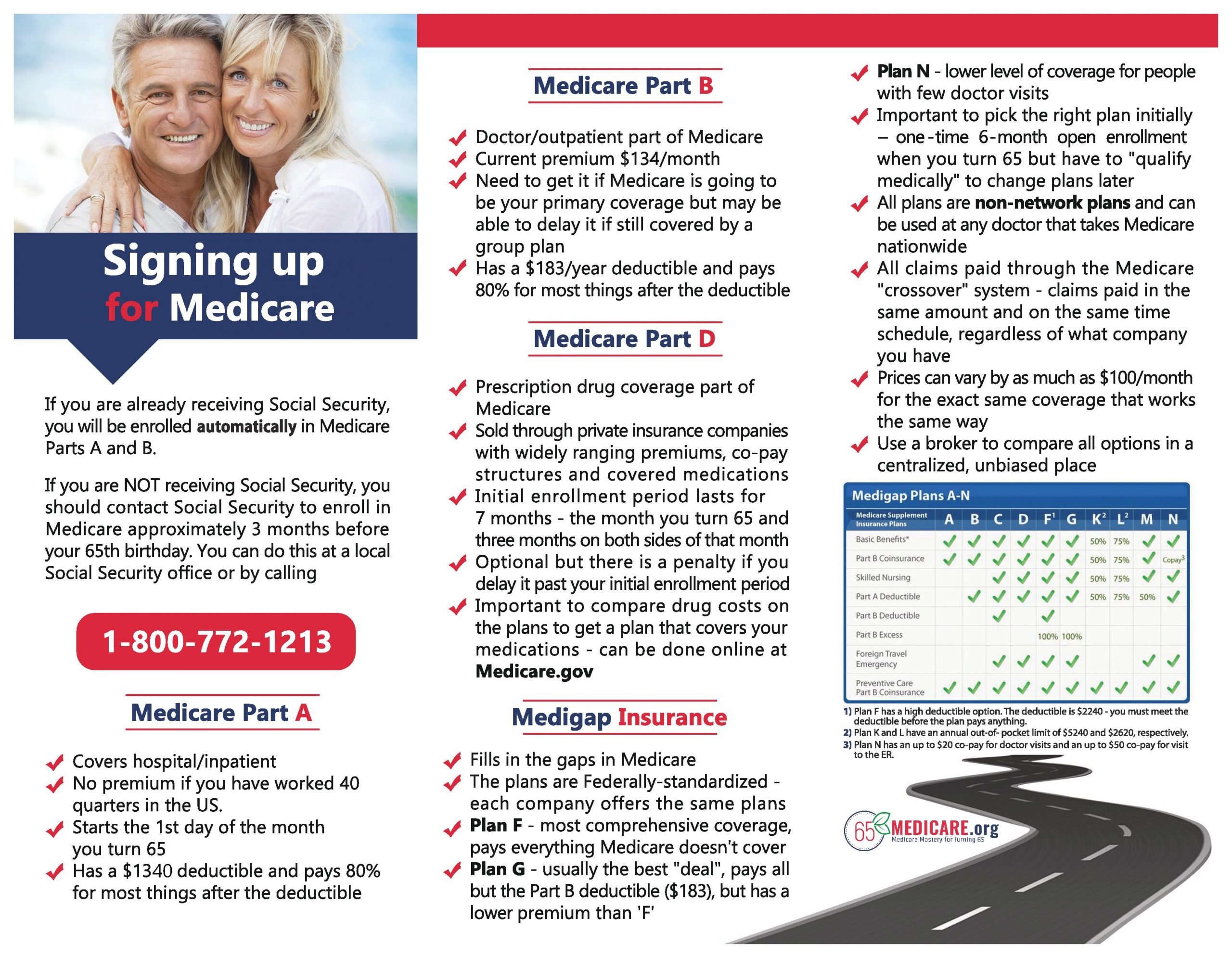

Enrollment In A Medicare Supplement Plan

There are different rules for enrolling in a supplemental insurance plan, also known as Medigap.

According to Centers for Medicare & Medicaid Services, the best time to buy a Medigap policy is the first six months after the month you turn 65.

For example, if you turn 65 in June and enroll in Part B the same month, you should buy a Medigap policy between June and November.

You must be enrolled in Medicare Part B to sign up for a Medigap policy.

After this six-month window, your Medigap options may be limited and policies may cost more.

Keep in mind that some states may have additional Medigap policy open enrollment periods.

Recommended Reading: Are Blood Glucose Test Strips Covered By Medicare

Applying For Medicare With Employer Coverage

Can you still enroll in Medicare coverage, even if youre not yet seeking retirement? The answer is yes! Medicare coverage can coincide with your group coverage through your employer. If your employer has more than 20 employees, your group coverage will work as your primary insurance, and Medicare will be your secondary insurance.

You can choose to apply for Part B, or you can wait until leaving your employer group coverage. For more information on the benefits of obtaining Medicare while receiving group coverage through work, give our team a call, and we can review the pros and cons.

Sometimes beneficiaries dont want to apply for Part B when they initially become eligible because of employer health coverage. Should you lose your health insurance through your employer, or if you prefer to switch over to Medicare, you can apply any time while receiving coverage through your employer.

The Bottom Line: Know Your Options Enroll On Time

Dont delay making Medicare decisions and dealing with Medicare enrollment. Learn about the choices you have can you delay, must you enroll and then understand the implications of both as they relate to your overall health and financial well-being.

Late-enrollment penalties for Medicare Part B and Medicare Part D are permanent and can have a meaningful impact on your finances so think carefully about what you do and when.

Not sure where to start? A good first step for anyone approaching Medicare eligibility is to know when your enrollment dates are. You can quickly find your dates for your Initial Enrollment Period or Special Enrollment Period using our enrollment date calculator.

Read Also: Do You Really Need Medicare Supplemental Insurance

Full Retirement Age By Year

Full retirement age is the age you begin to receive full Social Security benefits. If you start to draw your Social Security benefits before reaching your full retirement age, the payment you receive will be less.

An easy way to think about full benefits and retirement age is this,

- Social Security will reduce your payments if you choose to receive your benefit before full retirement age. The percentage of reduced amount is highest at age 62 and decreases until you reach full retirement age.

- If you choose to receive Social Security payments when you reach full retirement, you will get the total amount.

- Suppose you choose not to receive Social Security payments when you reach full retirement and delay your benefit. In that case, you can increase the amount of your payment by earning delayed retirement credits.

If youre not sure when you reach full retirement age, our table provides the years and months you need to know for full retirement.

When Do I Get My Medicare Card

In most circumstances, youll get a Medicare I.D. card several weeks after your initial application. However, waiting times can be up to 90 days. If you are automatically enrolled in Medicare because you already get Social Security benefits, you will receive your I.D. card two months before turning 65.

Don’t Miss: Does Humana Medicare Cover Incontinence Supplies

Delaying Medicare Due To Work: Special Enrollment Period

If you didn’t enroll in Medicare because you were still working, and you were covered under a group health plan based on employment, you have a Special Enrollment Period during which you can sign up for Part A and/or Part B. While you or your spouse are still working and you’re still covered under a group health plan, you can sign up anytime.

After your or your spouse’s employment ends, your Special Enrollment Period lasts eight months, starting the month after the employment or group health plan ends . However, you have only two months after the employment or group health plan ends to sign up for a Medicare Advantage plan or Part D prescription drug plan . You can enroll in a Medicare Advantage plan starting three months before your Medicare Part B enrollment is due to take effect up to the day before your Part B coverage startsbut again, enrollment must take place within two months of your employment or group health plan ending.

Example:

Judy’s last day of work is July 1 and her group health plan ends July 31. She has eight months, until April 30, to sign up for Part B without a penalty. But if she wants to join a Medicare Advantage plan, she needs to do so by September 30 . Instead, on June 15, Judy signs up for Part B coverage to begin on August 1, so that she won’t have a gap in coverage. She has only until July 31 to add a Medicare Advantage plan . Her Medicare Advantage plan will start August 1.

When Do I Apply

If you are turning 65, you can apply for Medicare up to 100 days prior to your 65th birthday.

a) You have a 7-month period to enroll in Medicare – 3 months before your birthday, the month of, and 3 months after.

b) If you are already receiving SS benefits, your new MBI will be sent to you automatically.

c) If you are not taking SS benefits yet, you will need to manually enroll with Social Security

d) If you are still working and have Employer Group Health Coverage and staying on the plan, you will need to contact your HR representative to determine if you should enroll in Part B

e) If you are coming off an Employer Group Health Plan, youmay have an 8-month special enrollment period.

Recommended Reading: How Do I Know What Medicare Coverage I Have

Applying For Medicare At Age 65

If you are eligible for Medicare, there is a 7-month enrolment period to sign up for Part A and/or Part B. Youll qualify for Medicare at age 65 if:

- You are a citizen of the United States or a legal resident living in the United States for a minimum of 5 years at the time of the window of this 7 year period.

- You or your spouse has worked long enough to qualify for Social Security or Railroad Retirement Board benefits .

- You or your spouse is a government employee or retiree who has not paid into Social Security but paid Medicare payroll taxes while employed in that position.

The Initial Enrolment Period begins 3 months before you turn 65, includes your birthday month, and ends 3 months after the month you turn 65.

For example, if you turn 65 on May 1, your IEP will begin on February 1 with an end date of May 31 for a total of 7 months. The total window is 7 months long, but that doesnt mean you should apply 7 months before your 65th birthday! Remember, take your birth month and could that as one month, and then the window is 3 months before that birth month, and 3 months after that birth month.

Note: If you are already receiving benefits from Social Security or the Railroad Retirement Board, you will be automatically enrolled in Medicare Part A and Part B. You should receive your Original Medicare package and Medicare card around 30 days before your 65th birthday. Make sure that your address and everything on file is up to date!

How To Avoid The Late

You might not be getting retirement benefits when you turn 65 because you are still working. In this case, you will have to sign up for Medicare when you retire and lose your employer health care coverage. When your employer coverage ends, you may have a special enrollment period to sign up for Medicare Part B without receiving a late-enrollment penalty.

Generally your monthly premium for Part B may go up 10% for each full 12-month period that you could have had Part B but didnât sign up for it. Similarly, you Part A monthly premium may go up by 10% if you didnât enroll when you were first eligible. However, most people qualify for premium-free Part A and therefore are also exempt from the Medicare Part A late-enrollment penalty.

You May Like: Does Medicare Cover Eylea Injections

Why You May Consider Signing Up For Medicare At 65

If youre approaching age 65 and are not going to keep working, you have employer coverage from an employer with fewer than 20 employees, or your spouses employer requires you to get Medicare to stay on their health plan, then you need to enroll during whats known as your Medicare Initial Enrollment Period . If you dont, youll likely face financial premium penalties for enrolling late.

Your IEP is a 7-month window that generally includes the month of your 65th birthday, the 3 months before and the 3 months after For example, if your 65th birthday is on June 20, then your IEP starts on March 1 and ends on September 30.

This is the time to learn about your Medicare coverage options and get what you do or dont need coverage for. Most who have to get Medicare at age 65 will get Part A , Part B and some form of prescription drug coverage through either a stand-alone Part D plan or a Medicare Advantage plan.

Depending on your situation such as if you still have or want to keep employer coverage you may not need every part of Medicare available. But keep in mind here a simple rule: If you are not eligible for a Medicare Special Enrollment Period you need to get Parts A, B and D when youre first eligible to avoid financial penalties. Also, if youre still working, its a good idea to check with your employer plan benefits administrator to see how Medicare might work with that coverage before making any final decisions.

What Can I Do Next

Generally, youre first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65.

Because the company has less than 20 employees, your job-based coverage might not pay for health services if you dont have both Part A and Part B.

Recommended Reading: Where To Send Medicare Payments

What If Im Not Automatically Enrolled At 65

If your Medicare enrollment at 65 is not automatic, but you want to enroll, here are some more magic numbers.

3 and 7.

To start taking advantage of Medicare at 65, you need to sign up during the three months before the birthday month you turn 65. Those are the first three months of your seven-month Initial Enrollment Period.

Unless your birthday is on the first day of the month, your Initial Enrollment Period includes the three full months before turning 65, the month you turn 65, and the three months after you turn 65. If you were born on the first day of the month, IEP is the four months before your birth month, along with your birthday month and the two months after.

If you sign up during one of the months before your 65th birthday, your coverage will begin on the first day of the month you turn 65 .

Are you eligible for cost-saving Medicare subsidies?

Medicare Eligibility For Medicare Advantage Before 65

After youre enrolled in Original Medicare, you may choose to remain with Original Medicare or consider enrollment in a Medicare Advantage plan offered by a private, Medicare-approved insurance company.

Medicare eligibility for Medicare Part C works a little differently. Youre eligible for Medicare Advantage plans if you have Part A and Part B and live in the service area of a Medicare Advantage plan. If you have End Stage Renal Disease , you usually cant enroll in a Medicare Advantage plan, but there may be some exceptions, such as a Medicare Advantage plan offered by the same insurance company as your employer-based health plan, or a Medicare Special Needs Plan .

When you enroll in a Medicare Advantage plan, youre still in the Medicare program and need to pay your monthly Medicare Part B premium and any premium the plan charges. The Medicare Advantage program offers an alternative way of receiving Original Medicare coverage but may offer additional benefits. For example, Original Medicare doesnt include prescription drug coverage or routine dental/vision care, but a Medicare Advantage plan may include these benefits and more. Benefits, availability and plan costs vary among plans.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

Recommended Reading: Do You Have To Sign Up For Medicare

What Else Do I Need To Know

- Medicare can help cover your costs for health care, like hospital visits and doctors services.

- Most people dont pay a premium for Part A, but you do pay a monthly premium for Part B.

- If you cant afford the monthly premium, there are programs to help lower your costs. Get details about cost saving programs.

When Should I Enroll

There is a seven-month period when you can first enroll in Medicare. Its called the Initial Enrollment Period and it happens three months before the month you turn age 65, the month of your 65th birthday and the three months after. If your birthday is on the 1st of the month, your coverage can begin on the first day of the previous month.

If you are disabled and under age 65, there is a seven-month period surrounding the 25th month you begin receiving Social Security Disability payments. Enrollment time frames are different for people who become eligible because of end-stage renal disease or Lou Gehrigs Disease .

You May Like: Is Mutual Of Omaha A Good Company For Medicare Supplement

Special Enrollment Period For Parts A And B

Some people with health care coverage through their job or union, or through their spouse’s job or union, wait to sign up for Medicare Part A and/or Part B . If you or your spouse are actively working for an employer with more than 20 employees when you turn 65, you can get a Special Enrollment Period to sign up for Parts A and/or B:

- Any time you’re still covered by the employer or union group health plan through you or your spouses current employment or

- During the eight months following the month the employer or union group health plan coverage ends, or when the employment ends .

If you delay enrolling even longer, you may have to wait for coverage and you may pay a lifetime late enrollment penalty surcharge on your Medicare premiums.

If you’re under age 65, and eligible for Medicare because you’re disabled and working , the SEP rules also apply to you as long as the employer has more than 100 employees.

Medicare Eligibility If You’re Turning 65 And When To Apply

Medicare covers eligible individuals 65 and older and people younger than 65 who qualify due to a disability or end stage renal disease. Once you , be aware that there are specific rules regarding when you can sign up.

Your Initial Enrollment Period for Medicare begins 3 months before the month of your 65th birthday, includes your birthday month, and continues through the 3 months after the month of your 65th birthday. That gives you 7 months to shop and compare plans before you have to commit.

If you plan to continue working after you turn 65 and you have healthcare coverage through your employer, check with the person who manages your benefits to find out if that coverage works with Medicare.

Also Check: What Does Part B Cover Under Medicare

What Information Do You Need To Apply For Medicare

According to the Social Security website, here are the documents you may need when enrolling in Medicare only:

- Your birth certificate or other proof of birth.

- Proof of United States citizenship or legal residency if not born in the US.

- Your Social Security card if you are already receiving benefits.

Medicaid Or Medicare Savings Programs

Medicare beneficiaries with limited income or very high medical costs may be eligible to receive assistance from the Medicaid program. There are also Medicare Savings Programs for other limited-income beneficiaries that may help pay for Medicare premiums, deductibles, and coinsurance. There are specified income and resources limits for both programs. Contact your local county Department of Social Services or SHIIP to apply for one of these programs.

Recommended Reading: Does Medicare Cover Knee Injections

During Your Initial Enrollment Period

This lasts for seven months, of which the fourth one is the month in which you turn 65. For example, if your 65th birthday is in June, your IEP begins March 1 and ends Sept. 30.

To avoid late penalties and delayed coverage, you need to sign up for Medicare during your IEP in these circumstances:

- You have no other health insurance

- You have health insurance that you bought yourself

- You have retiree benefits from a former employer

- You have COBRA coverage that extends the insurance you or your spouse received from an employer while working

- You have veterans benefits from the Department of Veterans Affairs health system

- Youre in a nonmarital domestic relationship with someone of the same or opposite sex and you are covered by his or her employer insurance

If you enroll during the first three months of your IEP, your Medicare coverage begins on the first day of the month you turn 65 . If you sign up during the fourth month, coverage begins on the first day of the following month. But if you leave it until the fifth, sixth or seventh month, coverage will be delayed by two or three months. For example, if your birthday is in June and you sign up in September , coverage will not begin until Dec. 1.