Less Common Types Of Advantage Plans

Additional options for Advantage plans may also be available to some people. Infrequently offered or accessed, they include:

-

Medical savings account plans: These combine a high-deductible health plan with a savings account that your plan deposits money in. Theyre like health savings accounts, which are offered outside of Medicare, but far less common. There are very few MSA plans offered nationwide. They dont offer prescription drug coverage.

-

HMO point-of-service plans : With a typical HMO, you must stay within your network to have medical care or services covered by your plan. An HMOPOS, like a PPO, allows you to go outside your network, provided youre willing to pay more for that care.

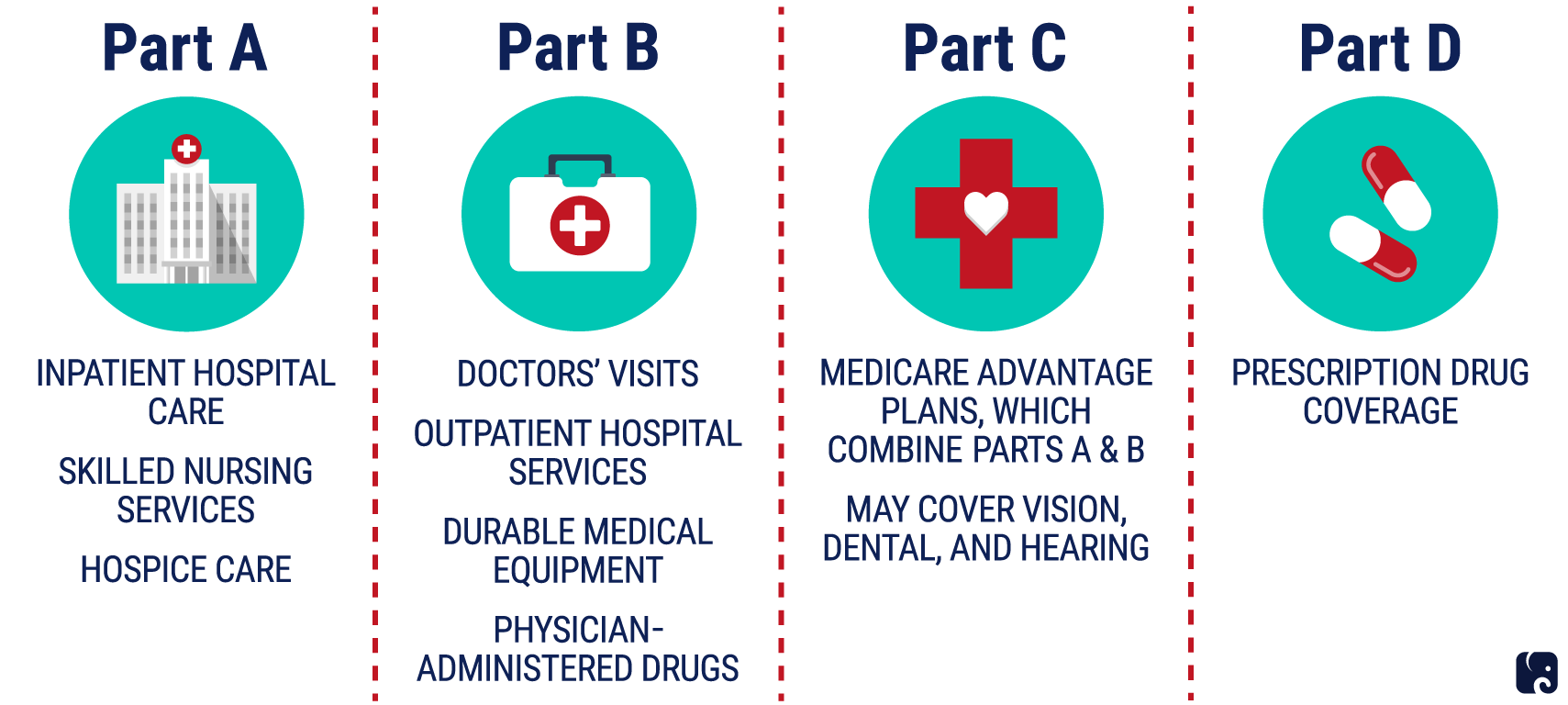

How Many Parts Of Medicare Are There

You might be wondering, How many parts of Medicare are there? Medicare is actually made up of four parts: A, B, C, and D. Heres a quick overview of what these Medicare parts cover.

Medicare Part A is hospital insurance .

Medicare Part B is medical insurance .

Medicare Part C is also known as Medicare Advantage. It includes Parts A and B, which are the hospital insurance and medical insurance portions of Medicare coverage. Most Medicare Advantage plans also have prescription drug, vision, and dental coverage.

Medicare Part D is prescription drug coverage .

For more complete details on the parts of Medicare, view Medicare Parts A, B, C, and D.

Want to explore your Medicare options and see what plans work for your needs and budget? Compare plans with HealthMarkets today.

MULTIPLAN_HM_HOWMANYPARTSMEDICARE_2021_M

Find Coverage that Fits Your Needs and Budget

Your search for affordable Health, Medicare and Life insurance starts here.

HealthMarkets Insurance Agency offers the opportunity to enroll in either QHPs or off-Marketplace coverage. Please visit HealthCare.gov for information on the benefits of enrolling in a QHP. Off-Marketplace coverage is not eligible for the cost savings offered for coverage through the Marketplaces.

Low Or $0 Premium Plans Can Add Up To Real Savings

You may be surprised to learn that some Medicare Advantage plans have a monthly plan premium of $0. That’s rightzero dollars per month. And that usually includes coverage for services that arent covered under Original Medicare.

With Medicare Advantage plans, rather than pay your medical bills directly, the federal government contracts with private insurance companies to administer your plan. You still have all the rights and benefits that come with Original Medicare, but private insurerslike Humanacompete for your business with low premiums and added benefits.

Private insurance companies are able to offer zero-premium Medicare Advantage plans, in part, because:

- To help manage costs, Medicare Advantage plans usually enter into contracts with a network of doctors and hospitals.

- That means you may have to pay more money out of pocket if you see a doctor outside the plans network

Recommended Reading: Does Medicare Cover Oral Surgery Biopsy

Reimbursement For Part A Services

For institutional care, such as hospital and nursing home care, Medicare uses prospective payment systems. In a prospective payment system, the health care institution receives a set amount of money for each episode of care provided to a patient, regardless of the actual amount of care. The actual allotment of funds is based on a list of diagnosis-related groups . The actual amount depends on the primary diagnosis that is actually made at the hospital. There are some issues surrounding Medicare’s use of DRGs because if the patient uses less care, the hospital gets to keep the remainder. This, in theory, should balance the costs for the hospital. However, if the patient uses more care, then the hospital has to cover its own losses. This results in the issue of “upcoding”, when a physician makes a more severe diagnosis to hedge against accidental costs.

What The Medicare Advantage Commercials Say

Savage noted the ads often say: “Let us do everything! And we’re going to give you hearing and we’re going to give you dental and we’re going to pick you up and drive you to your doctor’s appointments. We’re going to give you a turkey on Thanksgiving! They promise so much.”

Omdahl told listeners: “Based on the commercials that are on television every day, people see something they think is going to be more cost effective and then they opt for that coverage without really knowing what they’re getting into.”

She’s right. A recent survey by the Kaiser Family Foundation found that seven in 10 Medicare beneficiaries didn’t compare coverage options during the most recent Open Enrollment period. And in a MedicareAdvantage.com survey of over 1,000 beneficiaries, three out of four called Medicare “confusing and difficult to understand.”

According to the Kaiser Family Foundation, the average Medicare beneficiary has a choice of 54 Medicare plans, there are 766 Medicare Part D prescription drug plans and a record 3,834 Medicare Advantage plans will be available in 2022 .

Here’s the bottom line from Omdahl and the “Friends Talk Money” hosts: Some of what you hear on those Medicare Advantage TV ads is true, but the fine print shows that “free” isn’t really “free.” When the commercials say “zero premium, zero deductible and zero co-pay,” that’s not the whole story.

Also Check: Are Lidocaine Patches Covered By Medicare

Access To Medicare Advantage Plans By Plan Type

As in recent years, virtually all Medicare beneficiaries have access to a Medicare Advantage plan as an alternative to traditional Medicare, including almost all beneficiaries in metropolitan areas and the vast majority of beneficiaries in non-metropolitan areas . In non-metropolitan counties, a smaller share of beneficiaries have access to HMOs or local PPOs , and a slightly larger share of beneficiaries have access to regional PPOs .

How Do I Choose A Plan

The right plan for you will depend on your budget and healthcare needs.

For example, if you take multiple prescriptions, you might want to purchase a comprehensive Part D plan with a low deductible. If you know youll need vision care services, you might want to select a Medicare Advantage plan that offers vision coverage.

The options available to you will depend on your city, region, or state, but most areas have a variety of plans to choose from at different price points.

Tips for selecting plans that meet your needs

- Assess your current and potential healthcare needs. Are there doctors, facilities, or medications that you cant compromise on for your care? This may impact your policy choice, particularly when deciding between original Medicare and Medicare Advantage.

- Consider your income. If you have a fixed or limited income, paying monthly premiums may be difficult. However, if you need care that only Medicare Advantage would cover, this might be a good option to save costs in the long run.

- Look for cost savings programs. You may qualify for certain programs to help with your costs, including Medicaid and Extra Help.

- Find the right plan. Use Medicares plan finder tool to compare available Medicare Advantage plans in your area. You can search by prescription drugs you need, as well as covered providers and services.

Don’t Miss: What Age Is For Medicare

Medicare Advantage Plans: Common Elements

- All plans have a contract with the Centers for Medicare and Medicaid Services .

- The plan must enroll anyone in the service area that has Part A and Part B, except for end-stage renal disease patients.

- Each plan must offer an annual enrollment period.

- You must pay your Medicare Part B premium.

- You pay any plan premium, deductibles, or copayments.

- All plans may provide additional benefits or services not covered by Medicare.

- There is usually less paperwork for you.

- The Centers for Medicare and Medicaid Services pays the plan a set amount for each month that a beneficiary is enrolled.

The Centers for Medicare and Medicaid Services monitors appeals and marketing plans. All plans, except for Private Fee-for-Service, must have a quality assurance program.

If you meet the following requirements, the Medicare Advantage plan must enroll you.

You may be under 65 and you cannot be denied coverage due to pre-existing conditions.

- You have Medicare Part A and Part B.

- You pay the Medicare Part B premium.

- You live in a county serviced by the plan.

- You pay the plan’s monthly premium.

- You are not receiving Medicare due to end-stage kidney disease.

Another type of Medicare Managed Health Maintenance Organization is a Cost Contract HMO. These plans have different requirements for enrollment.

Can I Get My Health Care From Any Doctor Other Health Care Provider Or Hospital

- Original Medicare

-

You can go to any doctor or hospital that takes Medicare, anywhere in the U.S.

In most cases, you don’t need a

referral

to see a specialist.

- Medicare Advantage

-

In many cases, youll need to only use doctors and other providers who are in the plans network . Some plans offer non-emergency coverage out of network, but typically at a higher cost.

You may need to get a

referral

-

You can join a separate Medicare drug plan to get Medicare drug coverage.

- Medicare Advantage

-

Medicare drug coverage is included in most plans. In most types of Medicare Advantage Plans, you cant join a separate Medicare drug plan. You can join a separate Medicare drug plan with certain types of plans that:

- Cant offer drug coverage

- Choose not to offer drug coverage

Youll be disenrolled from your Medicare Advantage Plan and returned to Original Medicare if both of these apply:

Don’t Miss: What Benefits Do You Get With Medicare

Traditional Medicare And Medicare Advantage: A Historic Divide

Beneficiaries weigh considerable trade-offs when deciding whether to enroll in Medicare Advantage plans or traditional Medicare. Unlike the latter, Medicare Advantage plans are required to place limits on enrollees out-of-pocket spending and to maintain provider networks.3 The plans also can provide benefits not covered by traditional Medicare, such as eyeglasses, fitness benefits, and hearing aids. Medicare Advantage plans are intended to manage and coordinate beneficiaries care. Some Medicare Advantage plans specialize in care for people with diabetes and other common chronic conditions, including Special Needs Plans SNPs also focus on people who are eligible for both Medicare and Medicaid and those who require an institutional level of care.

Traditional Medicare and Medicare Advantage enrollees have historically had different characteristics, with Medicare Advantage enrollees somewhat healthier.4 Black and Hispanic beneficiaries and those with lower incomes have tended to enroll in Medicare Advantage plans at higher rates than others.5 Traditional Medicare has historically performed better on beneficiary-reported metrics, such as provider access, ease of getting needed care, and overall care experience.6

The Fine Print Of Medicare Advantage Plans

Medicare Advantage plans, usually bundled with prescription drug coverage, typically require you to use health care providers in their network. The policies limit your annual out-of-pocket costs for covered services.

“They think ‘zero premium’ means it’s free, which it’s not.”

“People need to go beyond the commercials” to understand the fine print of Medicare Advantage plans, Omdahl said. “There are indeed zero-premium Advantage plans and many of the plans do not have any deductibles. But the zero co-pay is misleading. Zero co-pay is for your primary doctor depending on where you live, co-pays may apply in other situations.”

In addition, noted Omdahl, “start digging into the evidence of coverage and you will see that Medicare Advantage is pay-as-you go: fifty dollars to see a specialist, four hundred dollars a day for five or six days of hospitalization. So you are writing checks, and that’s what people don’t realize. They think ‘zero premium’ means it’s free, which it’s not.”

Savage said that due to the Medicare program’s rules, Medicare Advantage enrollees could wind up paying out of pocket as much as $7,500 a year more than $11,000 a year if you use out-of-network health care providers.

“These plans work best if you don’t get sick,” she said. “Once you need to see a lot of specialists, then you start paying.”

Omdahl said that before signing up for a Medicare Advantage plan, understand that anytime you want care other than an emergency, the plan has to approve it.

Recommended Reading: When Can You Get Medicare Health Insurance

Medicare Part B: Medical Insurance

Medicare Part B is medical insurance, and is the other half of Original Medicare. It pays for medically necessary services that you need to diagnose or treat your condition that meet the accepted standards of care. It also covers preventative care, such as most vaccines and early-detection screenings.

Medicare Part B coverage includes:

- Yearly wellness doctor visits

- Ground ambulance transportation

- Durable medical equipment, including blood sugar monitors and wheelchairs but not medical alert systems

Unlike Medicare Part A, which typically doesnt have a premium, you have to pay a monthly premium for Medicare Part B. According to the U.S. Centers for Medicare & Medicaid Services, the Part B premium in 2021 is $148.50 per month.

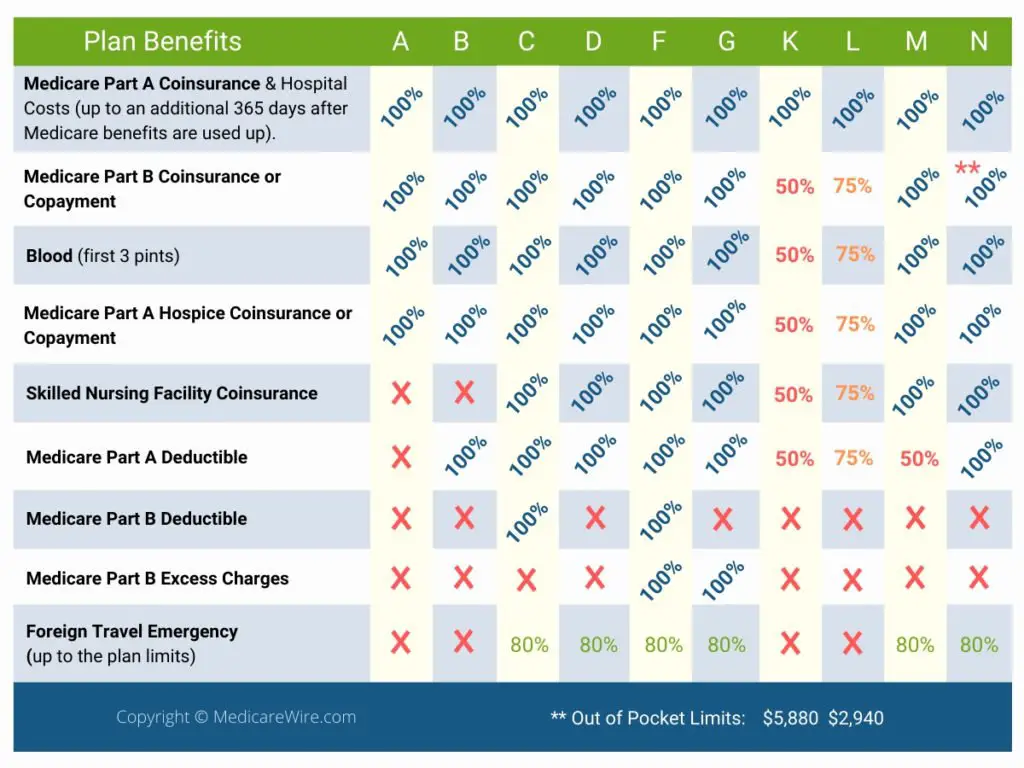

Do All Medicare Supplement Insurance Plans Pay The Same

The cost of a Medicare Supplement Insurance plan can vary from one carrier or location to the next.

However, the standardized benefits that each type of Medigap plan covers stays the same, no matter where you live or who your plan carrier may be .

That means the benefits of Ohio Medigap Plan A will be exactly the same as Texas Medigap Plan A.

The 9 standardized benefits that may be offered by a Medicare Supplement Insurance plan include the following:

You May Like: Is Ed Medication Covered By Medicare

How Many Types Of Medicare Advantage Plans Are There

Insurance companies offer six different approaches to Medicare Advantage plans, although not all of them are available in all areas: an HMO , a PPO , an HMOPOS , a PFFS , an MSA , or an SNP .

You need to choose your own primary care doctor with an SNP, HMO, or HMOPOS, but not with an MSA, a PPO, or a PFFS. HMOs and SNPs are the only plans that require a referral prior to seeing a specialist, and the HMO plan is the only plan in which you must only receive care from doctors in that network.

In most instances, prescription drug coverage is included in Medicare Advantage plans, with the exception of the MSA plan and some PFFS plans. If you want to have prescription drug coverage and youre choosing an HMO or PPO Medicare Advantage plan, its important to select a plan that includes prescription coverage , because you cant purchase stand-alone Medicare Part D if you have an HMO or PPO Advantage plan. SNPs are required to cover prescriptions. PFFS plans sometimes cover prescriptions, but if you have one that doesnt, you can supplement it with a Medicare Part D plan. MSAs do not include prescription coverage, but you can buy a Part D plan to supplement your MSA plan.

Almost 4 Million Medicare Beneficiaries Are Enrolled In Special Needs Plans In 2021

Nearly four million Medicare beneficiaries are enrolled in Special Needs Plans . SNPs restrict enrollment to specific types of beneficiaries with significant or relatively specialized care needs, or who qualify because they are eligible for both Medicare and Medicaid. The majority of SNP enrollees are in plans for beneficiaries dually eligible for Medicare and Medicaid . Another 10 percent of SNP enrollees are in plans for people with severe chronic or disabling conditions and 2 percent are in plans for beneficiaries requiring a nursing home or institutional level of care .

While D-SNPs are designed specifically for dually-eligible beneficiaries, 1.5 million Medicare beneficiaries with Medicaid were enrolled in non-SNP Medicare Advantage plans in 2019 .

Enrollment in SNPs increased from 3.3 million beneficiaries in 2020 to 3.8 million beneficiaries in 2021 , and accounts for about 15% of total Medicare Advantage enrollment in 2021, up from 11% in 2010, with some variation across states. In the District of Columbia and Puerto Rico, SNPs comprise about half of all Medicare Advantage enrollees . In eight states, SNP enrollment accounts for about one-fifth of Medicare Advantage enrollment . Nearly 95% of C-SNP enrollees are in plans for people with diabetes or cardiovascular conditions in 2021. Enrollment in I-SNPs has been increasing but slightly declined in 2021 and is still fewer than 100,000.

You May Like: Is It Mandatory To Have Medicare Part D

Medicare Advantage Plan Annual Prices By Location

Most Medicare drug plans have a coverage gap called the donut hole, which means theres a temporary limit on what the drug plan will cover. A person gets limited coverage while in the donut hole. whether on a Medicare Advantage plan or a separate Part D plan, says Antinea Martin-Alexander, founder of Advocate Insurance Group in South Carolina. The individual will pay no more than 25% of the cost of the medication in the donut hole until a total out of $6,550 in out of pocket expenses is reached. There are different items that contribute to the out-of-pocket expenses while in the donut hole: any yearly drug deductible you may have, copays for any and all your medications, what the manufacturers discount is on that medication and what the insurance company pays for that medication, she says.