The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

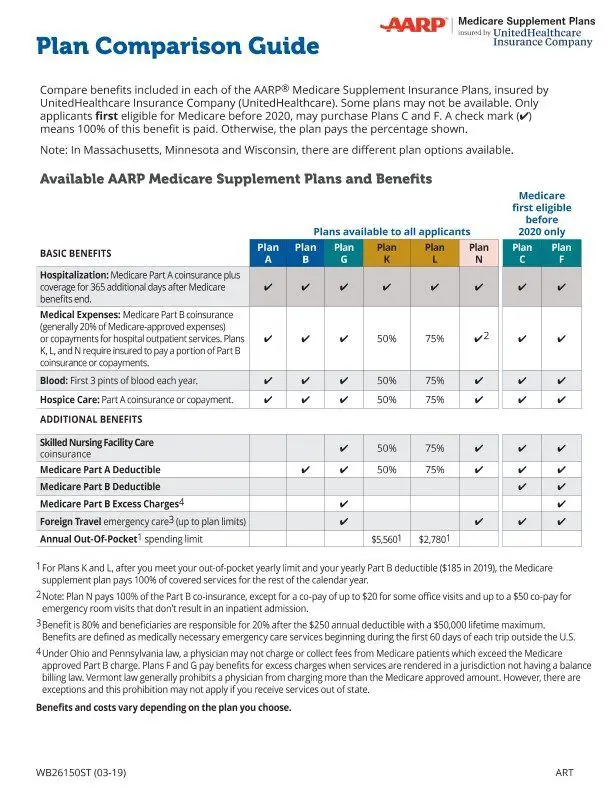

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Medicare Extra Help For Low Income Persons

For individuals who receive Part D prescription drug coverage and are low-income, there is assistance available for the costs of deductibles and co-pays. This Extra Help is also known as the Low Income Subsidy .

Who is eligible?To receive Extra Help, persons must be eligible for Medicare Part D and have income less than 100% of the Federal Poverty Level for a full benefit or less than 150% of the Poverty Level for a partial benefit.

What are the benefits?Benefits vary based on the recipients income and on living situation. In general, Extra Help will pay for a persons monthly drug plan premium for an Extra Help approved plan. It will also pay the annual deductible amount , though it will leave $99 deductible for partial subsidy recipients to pay out of pocket. Extra Help will also cover all drugs in the coverage gap, or doughnut hole, or 85% of drug costs for partial subsidy recipients. Individuals will pay $3.95/generic or multi-source drug and $9.85 for other drugs.

In the standard benefit, when Medicare beneficiaries have spent $4,430 in 2022 in prescription costs, the coverage gap begins however, individuals who are receiving Extra Help will continue to pay co-payments between $3.95 for generic or multisource drugs with a retail price under $79 and 5% for those with a retail price greater than $79. For brand-name drugs, beneficiaries would pay $9.85 for those drugs with a retail price under $197 and 5% for those with a retail price over $197.

Connect with us:

Colorado Health Insurance Consumer Help

Colorado does not operate a Consumer Assistance Program under the Affordable Care Act. The consumer protections and benefits of the law still apply to you, however.

The agencies listed below can help you take advantage of some of these protections and benefits. They can answer your questions about different types of coverage.

If you need health insurance, be sure to check out HealthCare.govs Plan Finder. It will help you find and compare health care coverage options in your area.

If you have questions about insurance you bought for yourself and/or your family or you have insurance provided by an employer who does business only in Colorado, contact:

Colorado Division of Insurance

Read Also: How Much Does Medicare Part B Cost At Age 65

How To Find A Colorado Springs Medicaid Office In Colorado

The Colorado Springs, Colorado Medicaid office is accessible to all residents who live in the area. However, keep in mind that different offices may encourage you to schedule an appointment to apply onsite with representatives.

The list of Colorado Springs Medicaid offices are included below. Click on the Colorado office you want to apply at to learn that facilitys contact information. Furthermore, remember that you can also use this feature to learn the following information about the different Medicaid offices in Colorado Springs:

- The offices contact information

- Where in Colorado the facility is located

- If the Colorado Springs Medicaid office has a website

Start typing or scroll down to pick from the list of Colorado Springs Medicaid Office Locations

Special Enrollment Period In 2021 For Medigap Enrollees With Plans F Or C

Colorados Division of Insurance has finalized an important special enrollment period that will make it easier for enrollees with Medigap Plans F and C to switch to Plans G and D. Heres the backstory on this, and why this special enrollment period, which will run for the first six months of 2021, could be beneficial for Colorados Medicare population:

After the end of 2019, newly-eligible Medicare beneficiaries cannot enroll in Medigap Plans F or C. These have long been among the most popular Medigap plans, but legislation enacted in 2015 requires them to no longer be sold to newly-eligible enrollees, because lawmakers wanted to phase out Medigap plans that cover the Part B deductible .

The idea is to try to curb overutilization of health care by ensuring that Medicare beneficiaries have to spend at least some of their own money in out-of-pocket charges when they seek medical treatment .

Healthy enrollees have the option to apply for a different Medigap plan at any time, but Medigap enrollees with pre-existing conditions may find it difficult or impossible to switch plans. Applications submitted after an enrollees initial enrollment window has passed are subject to medical underwriting , and there is no annual open enrollment period for Medigap, the way there is for Medicare Part D plans and Medicare Advantage plans.

Read Also: How To Get Medicare Insurance License

Medicare Plan Options For Coloradans

Once you determine that youre eligible for Medicare in Colorado, its time to understand your options.

If you are 65 and receive benefits from Social Security or the Railroad Retirement Board, you will be automatically enrolled into what is known as Original Medicare. The two main parts of Original Medicare are Part A, which covers hospitalization care, and Part B, which covers doctor visits, lab work, and some medical devices.2

If you stay with Original Medicare, you can add to it with Part D prescription drug coverage. Original Medicare does not cover prescription drugs. You can also add a Medicare Supplement plan, which can help cover out-of-pocket expenses like deductibles and coinsurance.

Another option is Medicare Part C , the choice of over 402,413 Coloradans in 2020.2 Medicare Advantage plans are offered by private health insurance companies, and combines the benefits of Medicare Part A and B into a single bundle. Many plans also include drug, vision, and dental coverage.3

What Are The Income Requirements For Medicaid In Colorado

Since Medicaid benefits are supplied to Colorado citizens with low incomes who could otherwise not afford quality health coverage, income requirements play a large role in an applicants Medicaid eligibility. What are the income requirements for Medicaid? The Income requirements for Medicaid in Colorado are based on the Modified Gross Adjusted Income system.

The current MAGI chart takes the following patients into account: parents and caretaker relatives whose incomes do not exceed 133 percent of the federal poverty level adults whose incomes does not go over 133 percent of the federal poverty level children with household incomes that falls below 260 percent of the federal poverty level and pregnant women whose household incomes do not go over 260 percent of the federal poverty level.

Overall, the MAGI Medicaid income requirements calculator does not apply to patients with disabilities and elderly patients who are older than 65 years of age. Learn more about Medicaid requirements by .

Read Also: What Year Did Medicare Advantage Start

What Are The Medicaid Application Guidelines

Now that you qualify for Medicaid, the next step is to prepare for the Medicaid application. The application guidelines for Medicaid are quite simple. As the time approaches to file the Medicaid application, it is important to have the following items handy: citizenship documents and proof of CO residency, a Social Security Number , date of birth and contact information.

Among the necessary personal details, you must include your name, address, employer information and income paperwork and information about medical history or current health insurance, if applicable. Once you have gathered the necessary information, you will be on your way to applying for Medicaid benefits in Colorado.

If the applicant is elderly or disabled, the Medicaid application guidelines that apply them are as follows: physical condition, if the applicant requires assistance with daily activities if he or she is currently receiving any medical coverage through Medicare and unearned income statements via the Social Security Administration or Supplemental Security Income.

Where Can I Apply For Medicaid In Colorado

Colorados Medicaid program is administered by the Colorado Department of Health . You can apply for Medicaid ABD or the MSP using this website.

Josh Schultz has a strong background in Medicare and the Affordable Care Act. He coordinated a Medicare technical assistance contract at the Medicare Rights Center in New York City, and represented clients in extensive Medicare claims and appeals. In addition to advocacy work, Josh helped implement health insurance exchanges at the technology firm hCentive. He has also held consulting roles, including at Sachs Policy Group, where he worked with hospital, insurer and technology clients.

Recommended Reading: What Is The Cheapest Medicare Plan

Medicare Part D In Colorado

Original Medicare does not cover outpatient prescription drugs. Many Medicare beneficiaries have supplemental drug coverage from an employer or Medicaid, but for those who dont, Medicare Part D plans are an important part of having full coverage. Medicare Part D prescription drug coverage was created under the Medicare Modernization Act of 2003, and can be purchased on a stand-alone basis or as part of a Medicare Advantage plan with integrated Part D coverage.

As of September 2020, there were 355,707 Colorado Medicare beneficiaries enrolled in stand-alone Medicare Part D plans, and another 350,300 beneficiaries had Medicare Part D coverage integrated with their Medicare Advantage plans. In total, 706,007 Colorado Medicare beneficiaries had Part D coverage, accounting for about three-quarters of the states Medicare population.

For 2021 coverage, there are 27 stand-alone Part D plans available in Colorado, with premiums ranging from $7 to $103 per month.

Medicare Part D enrollment follows the same schedule as Medicare Advantage plans: Beneficiaries can pick a Medicare Part D plan when they first become eligible for Medicare, and theres also an annual window each fall when Medicare beneficiaries can pick a different Part D plan or enroll for the first time . Medicare beneficiaries are encouraged to actively compare the various options each fall in order to see which one will best meet their personal prescription needs .

Medicare Advantage In Colorado

Nationwide, more than a third of all Medicare beneficiaries had Medicare Advantage plans as of 2018. In Colorado, Medicare Advantage was a little more popular, with 37 percent of the states Medicare beneficiaries enrolled in Advantage plans. And by mid-2020, in keeping with a nationwide trend of increasing Medicare Advantage enrollment, nearly 44 percent of Colorado Medicare beneficiaries were enrolled in private Medicare plans . The other 56 percent of Colorados Medicare beneficiaries had opted instead for coverage under Original Medicare.

Medicare Advantage plans are provided by private insurers, which each have their own service area, so plan availability varies by area. There are Medicare Advantage plans available in all 64 of Colorados counties in 2020, and that continues to be the case for 2021. Medicare Advantage plan availability for 2021 ranges from just two in Baca County to 46 in Douglas County.

Unlike most other states, Colorado did not see a significant increase in the number of available plans for 2021, and saw some decreases in 2020, there were 49 plans available in Douglas County. But Baca County had no available Medicare Advantage plans as of 2019. Two options became available in 2020, and thats still the case for 2021.

Recommended Reading: What Is The Difference Between Medicare Supplemental And Advantage Plans

Tips For Enrolling In Medicare In Colorado

Before you enroll in a Medicare plan, think carefully about what kind of coverage you need.

When shopping for the right plan for you, read reviews of several carriers, and analyze costs. Compare plans by looking at deductibles, drug coverage or copays, and the plan premium.

Ask yourself these questions:

- How much are my current premiums, deductibles, and other health care costs, and do I have the coverage I need?

- Am I happy with my current doctor, or would I be willing to switch to a network doctor? As part of your search, call your doctors office to ask what plans they accept. Look for a plan that will cover your doctors appointments or search for a network doctor.

- How much do I pay out of pocket per year in prescription medication? If you take regular medications, a prescription drug plan or an Advantage plan may save you money.

- Is there a better pharmacy nearby? Switching your pharmacy can also help lower medication costs. The pharmacy on the corner is convenient, but a pharmacy across town could provide better coverage, and save you money on your prescriptions each month.

How Do I Apply For Medicare In Colorado

If you arent automatically enrolled, you can apply for Original Medicare by contacting the Social Security Administration. Once you are eligible for Medicare in Colorado, your Initial Medicare Enrollment Period takes place from three months before you turn 65, includes the month you turn 65, and lasts until three months afterward. If you miss this six-month window, you can enroll during the General Enrollment Period from January 1March 31.

You can apply for Medicare Advantage or Medicare Part D plans when you first get Medicare. You can also apply during the Medicare Annual Enrollment Period, which occurs every year from October 15December 7.

If youre ready to shop for a Medicare Advantage, Medicare Supplement, or Medicare Part D plan, start by getting your free FitScore® with HealthMarkets. Answer a few brief questions about your needs, and well rank available plans according to how well they fit you.

Also Check: When Can A Disabled Patient Enroll In Medicare Part D

Average Costs Of Medicare Advantage In Colorado

The average monthly premium for a Medicare Advantage in Colorado in 2022 is $48.51 per month, though you may be able to find Colorado Medicare plans that feature $0 premiums.

- Average in-network out-of-pocket spending limit: $5,334.17

- Average drug deductible : $342.752

The costs associated with Medicare Advantage plans in your area can vary.

The average costs and enrollment information for 2022 Colorado Medicare Advantage plans are listed by county below in this guide.

A licensed insurance agent can help you compare Medicare Advantage plan costs in your area.

Compare Colorado Medicare Advantage plan costs

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

Co Medicare Advantage Plans By Plan Type

The major types of Medicare Advantage plans include:

- HMOA Health Maintenance Organization will typically require you to only visit health care providers, hospitals and pharmacies that are in your plan network .An HMO plan will also typically require you to get a referral from a primary care doctor in order to see a specialist.

- PPOIf you have a Preferred Provider Organization , you may be able to see providers outside of your plans network, often at a higher cost.Beneficiaries of a PPO plan typically pay less out of pocket if they choose to receive medical services from providers within their plans network.PPO plans typically do not require patients to acquire a referral before going to see a specialist.

- PFFSA Private Fee-For-Service plan determines how much it will pay to health care providers and how much the patient will pay at the point when care is received.With a PFFS plan, you can typically receive care from any doctor, hospital or health care provider, as long as they accept Medicare as well as your plan terms.

- SNPA Special Needs Plan is a type of Medicare Advantage plan limited to people with certain chronic conditions and other specific characteristics, such as being dual eligible for Medicaid and Medicare.

Not all of these types of plans may be available in your area. A licensed insurance agent can help you compare the types of 2022 Colorado Medicare Advantage plans that are available where you live.

You May Like: Does Medicare Cover Mammograms After Age 70

How To Choose A Medicare Advantage Plan In Colorado

Consider these factors as you compare Medicare Advantage Plans available in your area:

| How to compare Medicare Advantage Plans in Colorado | |

| Monthly premium | This is in addition to your Part B monthly premium. so it affects your monthly cash flow. You pay whether or not you access your benefits. You should have access to at least one zero premium plan with drug coverage in your area. |

| Provider network | Check to make sure your doctors, hospitals, and pharmacies are in network to keep costs as low as possible. |

| Out-of-pocket max | This is the most youll spend not including your premium, deductible, and drug costs for Medicare-covered services as long as you follow the plans rules for in and out of network coverage. |

| Deductibles, coinsurance & copays | Also known as cost-sharing, these expenses apply when you access your benefits. Check to see what your plan charges for doctors visits, services, treatments, and prescription drugs. |

| Drug coverage/formulary | See if your drugs are on the plans formulary and how much they cost each time you fill a prescription. You may want to talk with your doctor about a generic or alternative version of a drug you need. |

| Additional benefits | Consider which additional benefits are important to you. Most plans require you to use network providers and may charge extra premiums for more comprehensive coverage. |