I Am About To Turn 65 And Go On Medicare And My Income Is $120000 I Know That People With Higher Incomes Are Required To Pay Higher Premiums For Medicare Part B And Part D How Will These Higher Premiums Affect Me

Medicare beneficiaries with incomes above $88,000 for individuals and $176,000 for married couples are required to pay higher premiums. The amount you pay depends on your modified adjusted gross income from your most recent federal tax return. To determine your 2021 income-related premium, Social Security will use information from your tax return filed in 2020 for tax year 2019. If your income has gone down since you filed your tax return, you should contact Social Security and provide documentation regarding this change. At your current income level, in 2021, you would pay just over $4,300 in annual Medicare premiums combined for Part B and Part D .

Read Also: Does Medicare Cover Transportation To Dr Visits

A Quick Refresher On Medicare Premiums

If youre retired with health insurance through Medicare, your premiums are directly related to your income. Medicare beneficiaries pay a premium for Medicare Part B and Medicare Part D . For most retirees, premiums cover about 25% of program costs for Part B and D and the government pays the other 75%.

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or contact your local Social Security office. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services to make a correction at 1-800-MEDICARE . We receive the information about your prescription drug coverage from CMS.

Don’t Miss: Can Non Citizens Get Medicare

Keep An Eye On Capital Gains

If you have assets that could generate a taxable profit when sold i.e., investments in a brokerage account it may be worth evaluating how well you can manage those capital gains.

While you may be able to time the sale of, say, an appreciated stock to control when and how you would be taxed, some mutual funds have a way of surprising investors at the end of the year with capital gains and dividends, both of which feed into the IRMAA calculation.

“With mutual funds, you don’t have a whole lot of control because they have to pass the gains on to you,” said O’Neill, of Money Talk. “The problem is you don’t know how big those distributions are going to be until very late in the tax year.”

Depending on the specifics of your situation, it may be worth considering holding exchange-traded funds instead of mutual funds in your brokerage account due to their tax efficiency, experts say.

For investments whose sale you can time, it’s also important to remember the benefits of tax-loss harvesting as a way to minimize your taxable income.

That is, if you end up selling assets at a loss, you can use those losses to offset or reduce any gains you realized. Generally speaking, if the losses exceed the profit, you can use up to $3,000 per year against your regular income and carry forward the unused amount to future tax years.

How Does Medicare Part B Work

Before getting into the weeds of Medicare Part B premiums, lets do a quick review of Medicare Part B and its role in federal retirement health insurance.

Once you turn 65, you become eligible to enroll in Medicare, with its maddening mix of different programs, including Part A, Part B, Part C and Part D. Some of these programs charge you premiums, and some dont.

First the good news: Most Medicare enrollees arent required to pay a premium for Medicare Part A, which covers costs for inpatient hospital care, home nursing care and hospice care. That said, there are typically deductibles and copays for some Medicare Part A expenses.

Medicare Part B covers doctor appointments, outpatient tests and exams as well as medical equipment. Unless your income is very low, youll be charged a monthly premium for Medicare Part B, regardless of whether you are enrolled in Original Medicare or Medicare Advantage, the two options for receiving your Medicare benefits.

If you opt for Original Medicare, the government will cover 80% of your Part B expenses after you meet your deductible. You can purchase a separate supplemental Medigap policy from a private insurer to cover the additional 20% youre on the hook for.

Recommended Reading: Does Medicare Help Cover Assisted Living

Also Check: How Early Can You Sign Up For Medicare

What Purpose Does Magi Serve

The IRS uses MAGI to determine whether you qualify for certain tax programs and benefits. For instance, it helps determine the size of your Roth IRA contributions. Knowing your MAGI can also help you avoid facing tax penalties because over-contributing to these programs and others like them can trigger interest payments and fines. Your MAGI can also determine eligibility for certain government programs, such as the subsidized insurance plans available on the Health Insurance Marketplace.

Does Roth Conversion Affect Irmaa

If your income is on the threshold of qualifying for IRMAA treatment, a Roth Conversion could force you to start paying premiums as a percentage of your higher income. There is a two-year look-back that determines IRMAA. So, even if you perform a Roth Conversion in 2019, you may not see the impact until 2021.

Read Also: How Does Medicare Supplement Plan G Work

Why Does Magi Matter

Modified Adjusted Gross Income is a measure used by the IRS to determine if a taxpayer is eligible to use certain deductions, credits, or retirement plans. Modified Adjusted Gross Income will be used in determining eligibility for your health insurance tax credits. The IRS phases out the tax credit as your income increases. By adding MAGI factors back to your AGI, the IRS determines how much you earned. Beginning in 2014, your MAGI determines your eligibility for both premium tax credits and Cost Assistance subsidies on the new Health Insurance Marketplaces.

How To Manage Your Magi

Now that you understand how important your MAGI is for determining your Medicare and ACA premiums, lets consider ways to manage your MAGI.

If youre age 70 1/2 or older, you can make Qualified Charitable Distributions from your IRA. The QCD will help satisfy your Required Minimum Distributions, which begin at age 72. The amount of your QCD will be excluded from your income, up to a total of $100,000. If you file a joint return, you and your spouse can both make a QCD. So, a QCD is a way to reduce your taxable income and benefit your preferred charity.

The income from a home equity conversion mortgage , also called a reverse mortgage, could be a way to generate income that isnt included in your MAGI. You could use a reverse mortgage if you need income, but want to minimize taxable distributions from your retirement or brokerage accounts.

Withdrawals from cash value life insurance may also be a way to generate income that isnt captured in the MAGI calculation. There are several ways to take money from a permanent life insurance policy. You may be able to withdraw part of your basis tax-free. You can also borrow from your life insurance. Borrowing will create a loan, and there will be interest due on the loan. So, be careful that the loan doesnt eventually cause the policy to lapse. If that were to happen, the result could be a significant taxable event.

Also Check: Will Medicare Pay For A Patient Lift

Does Social Security Count As Gross Income

In addition, a portion of your Social Security benefits are included in gross income, regardless of your filing status, in any year the sum of half your Social Security benefit plus all of your adjusted gross income, plus all of your tax-exempt interest and dividends, exceeds $25,000, or $32,000 if you are married …

What Is Social Security Increase 2022

The standard Part B premium for 2022 will be $170.10, a 14.5% increase from $148.50 last year. People who have income above certain thresholds pay an additional amount, known as an an Income Related Monthly Adjustment Amount. Monthly premium payments are often deducted directly from Social Security benefit checks.

September 14, 2021Keywords: AGI, health insurance, Medicare

Seniors age 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B that covers doctors services and Medicare Part D that covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount.

I havent seen any numbers that show how much collecting IRMAA really helps the government in the grand scheme. Im guessing very little. One report said 7% of all Medicare beneficiaries pay IRMAA. Suppose the 7% pay double the standard premium, it changes the overall split between the beneficiaries and the government from 25:75 to 27:73. Big deal?

Also Check: Is Labcorp Covered By Medicare

How Is Modified Adjusted Gross Income Calculated

I understand that my Medicare Part B premiums can be higher if my modified adjusted gross income is above a certain amount. How is MAGI calculated?

Q. I understand that my Medicare Part B premiums can be higher than the base amount if my modified adjusted gross income is above a certain amount. How is modified adjusted gross income calculated?

A. To calculate your modified adjusted gross income take your adjusted gross income and add back certain deductions. Depending on your deductions, its possible that your MAGI and your AGI could be the same. Here are the deductions you add back to your AGI in order to come up with your MAGI.

- ½ of self-employment tax

- Passive loss or passive income

- The Section 137 deduction for adoption expenses

- Student loan interest

- Income exclusion from U. S. savings bonds

- Taxable Social Security payments

Tips For Retirement Planning

- When getting started with retirement planning, it pays to have someone who knows your financial situation. A financial advisor may be able to help. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Retirement planning is easier when you have resources at your disposal to help. SmartAsset has a number of these resources, and theyre free to access on our website. Try using our free retirement calculator and get started saving today.

Dont Miss: Is Ed Medication Covered By Medicare

Also Check: When Can You Change Your Medicare Supplement Plan

What Are The Income Limits For Medicare

Summary:

There is no income limit for Medicare. But there is a threshold where you might have to pay more for your Medicare coverage.

In 2022,Medicare beneficiaries with a modified adjusted gross income above $91,000 may have an income-related monthly adjustment added to their Medicare Part B premiums.

For couples who file a joint tax return, that threshold is $182,000 per year.

Note that the government looks at your income from two years prior to determine the IRMAA amount.

An IRMAA is a surcharge for those Medicare beneficiaries with a higher gross income.

Medicare Part D Premium

Medicare Part D is optional prescription drug coverage, available as a stand-alone Medicare Prescription Drug Plan that you enroll into to augment your Original Medicare coverage or through a Medicare Advantage Prescription Drug plan.

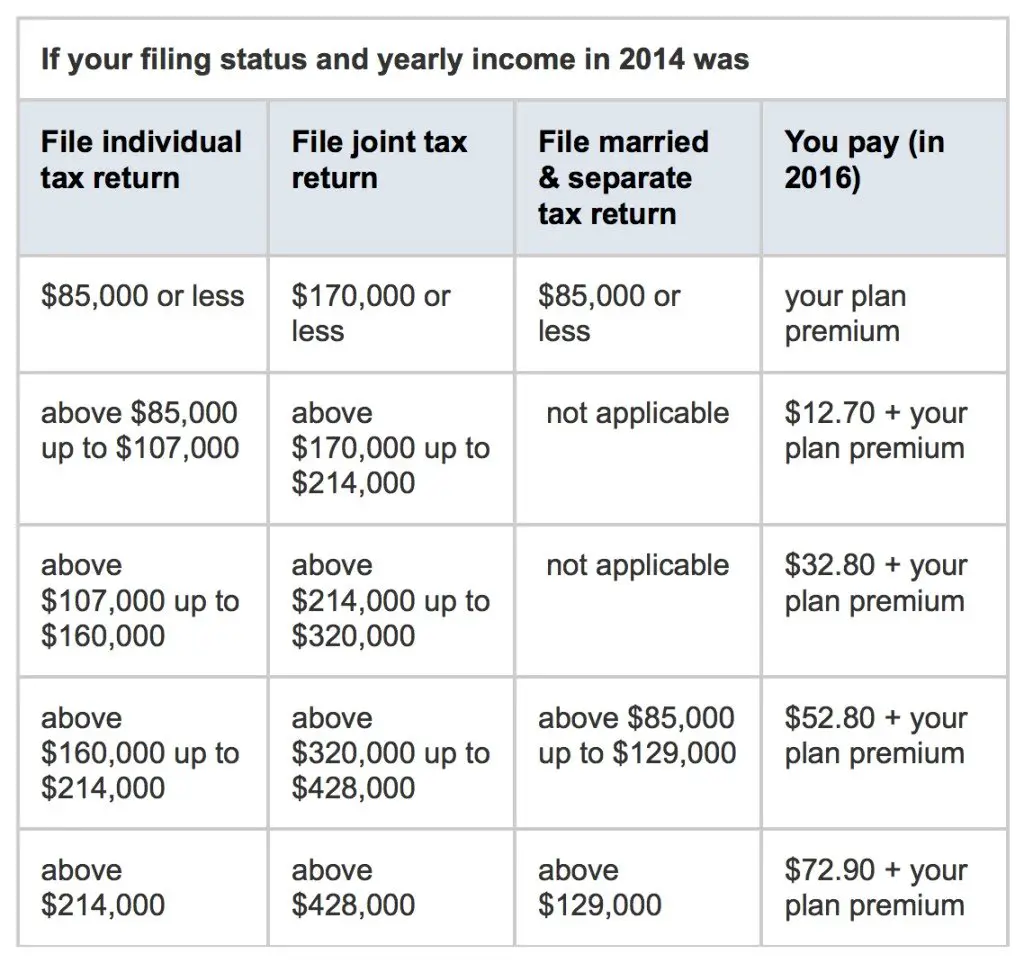

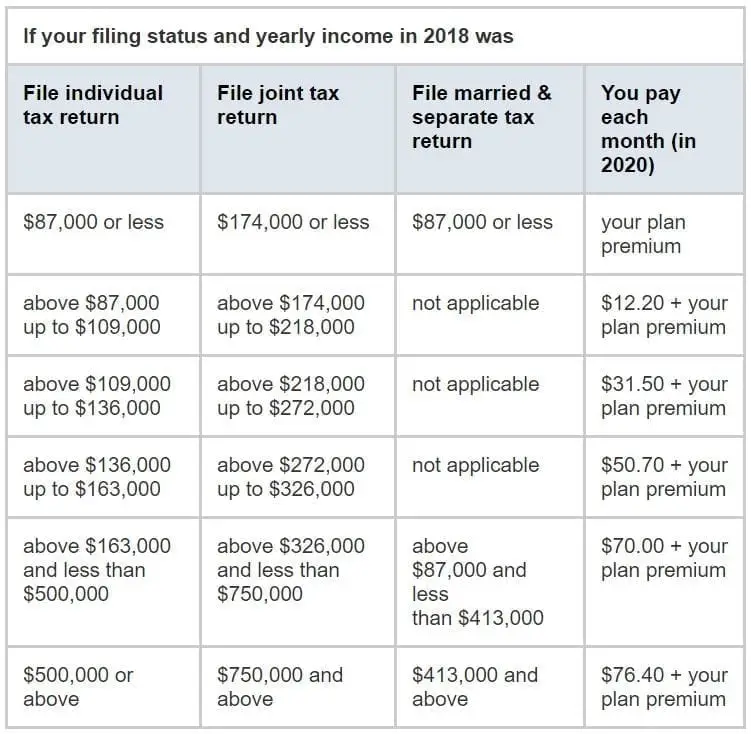

Although Medicare Part D is offered by private Medicare-contracted insurance companies, the government still sets an income-related monthly adjustment amount. Heres a breakdown of the Medicare Part D payment adjustments . Please note that you typically pay your Part D premium regardless of income level the amount in the far right column is the income adjustment payment.

| Your income if you filed an individual tax return | Your income if married and you filed a joint tax return | Your income if married and you filed a separate tax return | You pay your Medicare Part D premium, plus this amount |

| $85,000 or less | |||

| $72.90 |

Your Medicare Part D income adjustment payment is typically deducted from your monthly Social Security benefit it isnt added to the premium bill you get from the Part D Prescription Drug Plan. If you have to make an adjustment payment, youll get a notice from Social Security.

If youre charged the income adjustment payment outlined above for Medicare Part B but your income has dropped, you can contact the Social Security information and apply to reduce your adjustment amount.

You May Like: Does Medicare Pay For Assistance At Home

Medicare Premiums And Surcharges Examples

Below are three examples of how Medicare premiums and surcharges are computed. Understanding the calculations will help clients appreciate and understand the strategies to lessen the impact.

Example 1

B is single. He usually reports MAGI of about $75,000 per year. He is enrolled in a Medicare Part D plan. In 2017, when his other income included in MAGI is $77,500, he is considering withdrawing an additional $32,500 from his traditional IRA to purchase a car for cash, for a total MAGI of $110,000. How much more will B need to pay in 2019 for Medicare premiums?

If he makes the withdrawal, B will need to pay total Medicare costs of $3,633.60 in 2019, or $2,007.60 in excess of the base premium cost, if his MAGI is increased by the $32,500 . The excess premium will be incurred only for 2019, provided his MAGI in 2018 dropped back below $85,000. The excess premiums represent an increase in household expenses as a percentage of his 2017 income of 1.83% or 2.59% of his normal income level. In this case, B may want to try to keep his income below the $85,000 surcharge threshold by financing his purchase or leasing the car. He could withdraw enough from his IRA to service the debt and still stay below the threshold.

Example 2 concerns a couple who have not signed up for a Part D plan however, they must still pay Part D surcharges, since a former employer has enrolled them and is paying the basic cost as a fringe benefit.

Effect on premiums of an additional IRA withdrawal

Example 2

Medicare Premiums By Type

Itâs important to note that most Medicare beneficiaries get Medicare Part A for free. Generally, if you paid Medicare taxes for 30-39 quarters you will not have to pay for your Medicare Part A coverage.

If you have been paying Medicare taxes for less than 39 quarters, the standard Part A premium is $274 for 2022.

f you have been paying Medicare taxes for less than 30 quarters, the standard Part A premium is $499 for 2022.

The standard Medicare Part B premium amount is $170.10 for 2022. However, if you are a Medicare beneficiary with an annual modified adjusted gross income above the IRMA threshold, you will have to pay more for your Medicare Part B coverage.

Also Check: Will Medicare Pay For Cologuard

How To Calculate Your Adjusted Gross Income

Once you have gross income, you adjust it to calculate your AGI. You make adjustments by subtracting qualified deductions from your gross income.

Adjustments can include items like some contributions to IRAs, moving expenses, alimony paid, self-employment taxes, and student loan interest.

There are many free AGI calculators available online.

What Is Counted As Income For Medicaid

Nursing home Medicaid and Medicaid waiver programs in the majority of states will have a $2,000 / month income limit by 2022. Medicaid for the elderly, blind, or disabled is typically covered in the form of an income limit of $841 per month or $1,133 per month .

MAGI is used to calculate a households income by marketplaces, Medicaid, and CHIP. MAGI is a mathematical expression that refers to modified adjusted gross income. You may also be eligible for a tax break if your income is not taxable. Medicaid does not require applicants to include this income. It is preferable to receive less tax credits if your income is high. As your MAGI grows, you will realize how much money you actually make. To calculate your MAGI, you must include foreign earned income in your gross income. The Eligibility Team is a team of government experts who assist you in selecting the best government programs for you.

Read Also: Do You Get Medicare With Ssi

Read Also: Who Is The Medicare Coverage Helpline