Medicare Plan N Vs Plan G

When compared to Medicare supplement Plan N, Plan G provides more comprehensive coverage. Both policies will not cover the Part B deductible however, Plan N will not pay for expenses related to the Medicare Part B excess charges. Excess charges can occur when there is a difference between what is billed to Medicare for your treatment and what is actually paid by Medicare. This difference would be paid for you out of pocket if you had Plan N, for example.

However, since Plan N has less coverage, the monthly premium for the policy will be less than Plan G. For 2020, Plan N will cost between $149 and $289 per month.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Where Can I Buy Medicare Supplement Plan G

You can buy MedSup Plan G and every other MedSup plan from any insurance company that’s licensed in your state to sell Medicare Supplement coverage.

Remember, all Plan G policies must provide the same benefits or coverages. Just like all Plan F policies must provide the same benefits or coverages.

Insurers can and do charge different amounts for the MedSup Plan G policies they sell, though. Dont enroll in the first one you come across while shopping around. Compare the various costs associated with the plans sold in your area before you make your final decision.

Medicare Part A Deductible

When youre admitted to a hospital for inpatient care, you will begin whats called a benefit period. Your benefit period will continue until you have gone 60 consecutive days without receiving any inpatient care.

Each benefit period, youre required to pay a deductible before your Medicare Part A benefits kick in. In 2021, the Medicare Part A deductible is $1,484 per benefit period. You could potentially have to pay the Part A deductible more than one time in a year, depending on how often youre admitted to the hospital as an inpatient.

Medicare Supplement Plan G covers the Part A deductible in full, no matter how many times you go through a benefit period.

Read Also: Does Medicare Pay For Insulin Pumps

How Medicare Supplement Insurance Plans Work With Medicare Plans

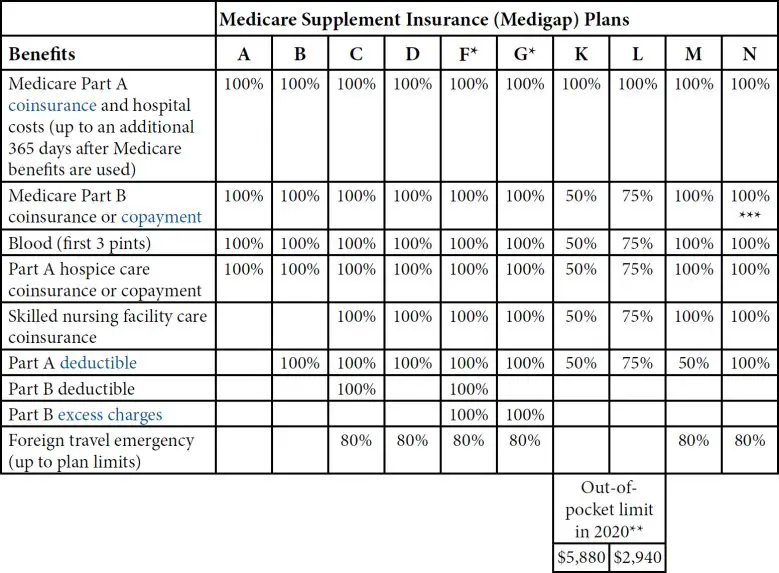

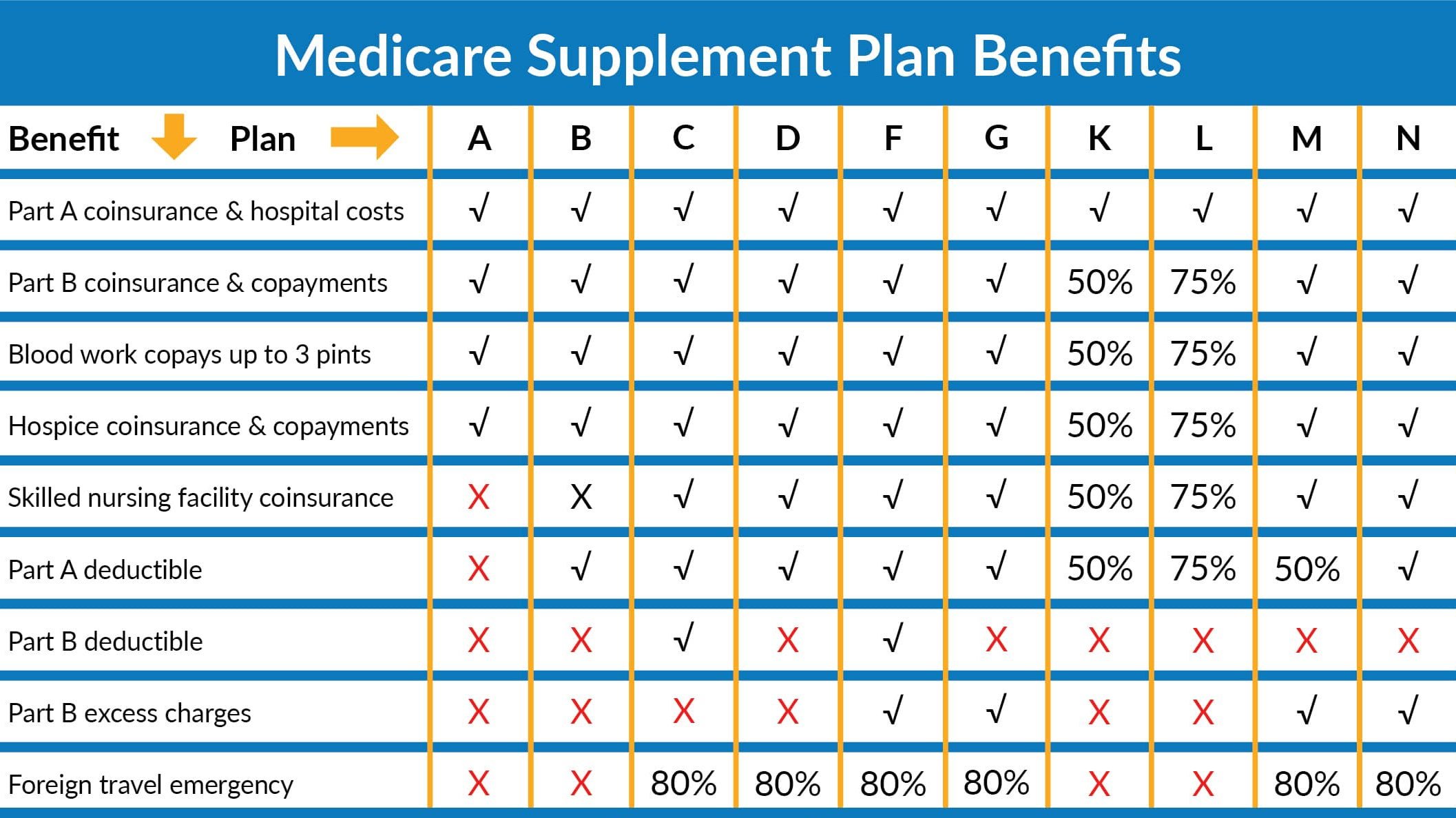

There are up to 10 standardized plans available labeled A, B, C, D, F, G, K, L, M and N that cover anywhere from four to nine of these benefits:

- Medicare Part A coinsurance for hospital costs

- Medicare Part B coinsurance, copayment

- First three pints of blood for a medical procedure

- Part A hospice care coinsurance or copayment

- Skilled nursing facility care coinsurance

- Part A deductible

- Foreign travel emergencies

Keep in mind, all 10 Medicare supplement plans cover the coinsurance and 100 percent of hospital costs for Medicare Part A, but after that, plans differ in what they cover. For example, only Medicare supplement plans C and F cover the deductible of Part B. Other examples of how Medicare supplement plans work with Medicare include:

Is Medigap Plan G Right For You

Medigap Plan G might be a good fit if youre new to Medicare as of 2020 and you want the most comprehensive Medigap coverage available.

However, its also usually the most expensive Medigap coverage and costs can continue to increase each year.

Tips for how to shop for a Medigap plan

- Use Medicare.govs tool to find and compare Medigap policies. Consider your current monthly insurance costs, how much you can afford to pay, and if you have medical conditions that may increase your healthcare costs in the future.

- Contact your State Health Insurance Assistance Program . Ask for a rate-shopping comparison guide.

- Contact insurance companies recommended by friends or family . Ask for a quote for Medigap policies. Ask if they offer discounts you may qualify for .

- Contact your State Insurance Department. Ask for a list of complaint records against insurance companies, if available. This can help you weed out companies that may be problematic to their beneficiaries.

Also Check: What Is The Best Medicare Part D Plan For 2020

Standard Medicare Supplement Coverage

To make it easier for you to compare one Medicare Supplement policy to another, Indiana allows 8 standard plans to be sold. The plans are labeled with a letter, A through N. Plans H, I, and J are no longer offered, and Plans C and F are only available to people who were eligible for Medicare before January, 2020. There are high deductible versions of Plans F and G..

These 8 plans are standardized, which means that benefits will be the same no matter which company sells the policy to you. Plan A is the basic benefit package. Plan A from one company is the same as Plan A from another company. Since Medicare Supplement policies are standardized, you are free to shop for the company with the best price and customer service. To see what benefits are offered with each plan,.

Generally, Medicare Supplement policies pay most, if not all, Medicare copayment amounts, and policies may pay Medicare deductible amounts except for the Part B deductible. Although the benefits are the same for each standard plan, the premiums may vary greatly. Before purchasing a supplement policy, determine how the company calculates its premiums.

An insurance company can calculate premiums one of three ways.

- Issue Age: If you were 65 when you bought the policy, you will pay the same premium the company charges people who are 65 regardless of your age.

- Attained Age: The premium is based on your current age and will increase as you grow older.

- No Age Rating: Everyone pays the same premium regardless of age.

What Is High Deductible Plan G

This plan is a new option for new Medicare beneficiaries in 2020. HD Plan G has the same deductible as HD Plan F and works in a similar way. For example, once you meet the high deductible for HD Plan G, you will receive all the traditional benefits of a regular Plan G. We can also assume that much like the HD Plan F, the premium for this plan will be much lower than a regular Plan G because of the steep cost of the deductible.

Also Check: Does Medicare Offer Dental Plans

Medicare Supplement Plan G: Benefits Costs And Coverage

- Medicare Supplement Plan G covers more benefits than most other Medigap plans, including the Medicare Part A deductible and coinsurance. Learn more about how Plan G compares to other Medicare Supplement Insurance plans.

Medicare Supplement Plan G may soon become the most popular Medicare Supplement Insurance plan for new Medicare beneficiaries. Plan G offers more Medigap benefits than any other type of Medicare Supplement plan other than Plan F.

While Medicare Plan F is currently the most popular Medigap plan, it is no longer available for beneficiaries who become eligible for Medicare after January 1, 2020. Beneficiaries who had Plan F before 2020 or who became eligible for Medicare before 2020 may still be able to sign up for Plan F or keep their plan.

This means that Plan G offers the most benefits out of any type of Medicare Supplement plan new Medicare beneficiaries can buy. In this guide, we detail the benefits and costs that Medicare Supplement Plan G can cover.

What Part A Does Not Cover:

- $1,484 deductible when admitted for hospital stay

- Hospital inpatient days 61-90. You pay $371 per day.

- Hospital inpatient days beyond 90 days.* You pay $742 per day.

- Skilled nursing facility stay days 21-100. You pay $185.50 per day.

* You have 60 additional days to use beyond 90 days at the $742 daily rate. These are Lifetime Reserve days you can use across different Benefit Periods . There must be at least 60 days between stays to use Lifetime Reserve days.

These amounts are applied to each benefit period which is when you enter a hospital or skilled nursing facility and ends when you have not received care in those settings for 60 days in a row.

Medicare generally does not pay for Part A and B services or items outside the U.S. and U.S. territories. Medicare may, however, cover inpatient hospital care outside the U.S. under rare circumstances.

You May Like: Does Kelsey Seybold Accept Medicare

Help Me Choose A Plan

Not sure what you need? Answer a few questions to help you decide. Get started

Now that youve picked a plan, its time to enroll.

File is in portable document format . To view this file, you may need to install a PDF reader program. Most PDF readers are a free download. One option is Adobe® Reader® which has a built-in screen reader. Other Adobe accessibility tools and information can be downloaded at

You are leaving this website/app . This new site may be offered by a vendor or an independent third party. The site may also contain non-Medicare related information. In addition, some sites may require you to agree to their terms of use and privacy policy.

Also Check: How To Find Out If I Have Medicare

What Companies Sell Medigap Plan G

In recent years, with the growth in popularity of Medigap Plan G, more and more companies have begun to offer this plan. Then, with the recent announcement of the 2020 elimination of Plan F, Plan G will now be the most comprehensive plan offered .

All of this has led to a very competitive marketplace for Plan G in most locations. For example, a survey of the marketplace in ten different states shows that there are 8 or more insurance companies within $10/month premium of the lowest Medigap Plan G premium .

Some of the larger companies that are competitively priced in many markets include Aetna, CIGNA, Mutual of Omaha, United Healthcare, and Transamerica. But aside from those larger, more well-known companies, there are also other lesser-known companies that offer Plan G , including companies such as Bankers Fidelity, Liberty Bankers, New Era, Manhattan Life, Thrivent Financial and others.

As always, when comparing Medigap plans, it is crucial to get a full comparison of Medigap Plan G rates for your area when you are choosing a plan. You should target the companies that are both competitively priced and highly rated when picking a Plan G. It is both unwise and unnecessary to pay extra for the same thing.

Read Also: Can I Buy Private Health Insurance Instead Of Medicare

Medical Supplement Plans Rules To Keep In Mind

Medicare and its related costs are tricky and your choices may be confusing. What works for one applicant is not for every applicant. For example, if you are still working, you might choose to remain on your employers group policy. But that doesnt mean you cant and shouldnt sign up for Medicare when your 65th birthday comes around.

You can get a part of Medicare, the free benefits that cover some hospital services, even if you are still working and dont need the full package. That is just one example of how it pays to do your homework on Medicare and other insurance choices by researching policy information to ensure your needs match your policys benefits.

Before making any final decisions regarding Medicare and Medicare supplement insurance, speak to a policy expert professional to make sure you are covered properly and your premium is affordable for your budget.

Related Articles

A Health Care Provider Must Declare Whether Or Not They Accept Medicare Assignment

Accepting assignment means that a doctor or health care provider has agreed to accept the Medicare-approved amount as full payment for their services. The overwhelming majority of health care providers in the United States accept Medicare assignment.

If a provider chooses not to accept assignment, they may still treat Medicare patients but will be allowed to charge up to 15 percent more for their product or service. These are known as excess charges.

Recommended Reading: How To Apply For Part A Medicare Only

Local Conditions And Convenience

In some areas where physicians and hospitals are scarce, its important to check out both the networks of available Medicare Advantage plans and the locations of providers who accept regular Medicare. Are the doctors accepting new patients? Will you have to travel far to see a provider or be treated in an emergency room? Advice from local professionals, neighbors, and licensed insurance brokers can help you find Medicare Advantage plans that do business in your area. Compare plans to find one that may suit your needs.

Medicare Supplement High Deductible Plan G For 2021

High Deductible Plan G is a Medicare Supplement plan that offers the same coverage as standard Plan G. The premiums for this plan are lower than the premiums for the standard Plan G. Yet, enrollees must pay a higher deductible for coverage to kick in at 100%. Cost-sharing you pay out-of-pocket as well as the Part B deductible applies toward the high deductible amount.

Read Also: What Nursing Homes Take Medicare

Medigap Vs Medicare Advantage

Medicare supplement plans are not the same as Medicare Advantage plans.

People use Medicare Advantage plans as an alternative to Medicare parts A and B. Private companies sell and administer them, just as they do Medicare supplement plans. They provide bundled plans that may cover more than separate Medicare plans, such as dental or vision care.

However, a person cannot have parts A and B and an Advantage plan at the same time.

Medicare supplement plans are insurance coverage policies that work in addition to Medicare parts A and B.

High Deductible Plan F

This is a high deductible plan that pays the same benefits as Plan F after you have paid the calendar year deductible of $2,490 in 2022. This means ConnectiCare will not begin to pay until your covered out-of-pocket expenses exceed $2,490 in 2022.

Please note: You can only enroll in this plan if you were eligible for Medicare before January 1, 2020.

Monthly Premium – $75.00

You May Like: What Is A Medicare Advantage Medical Savings Account

How Does Medicare Part G Work

For starters, you need to be enrolled in Original Medicare, or Medicare Parts A and B. Then you can buy Medicare Part G from a private insurance company that serves your ZIP code.

Once thats out of the way, here’s how Medicare Part G works:

- You pay your monthly Medicare Part B premium. If you receive benefits from Social Security, the Railroad Retirement Board or the Office of Personnel Management, your premium will be automatically deducted from your benefit payment.

- You also pay the monthly premium for your Plan G policy.

- After you visit a healthcare provider, Medicare will pay its share of the Medicare-approved amount for covered treatments.

- Your MedSup policy then pays its share of those costs, if needed.

Plan G: Who Is It For

- People who value simplicity and convenience. With Plan G, you pay your premiums and little else. Almost all of your out-of-pocket costs are covered, with two exceptions: You will still pay your Part B deductible 2 in addition to 20% of any emergency care you receive abroad.

- People who want the flexibility to see any doctor without paying more. Plan G is one of only two supplement plans that cover Part B excess charges .

- People who frequently travel to foreign countries. Plan G covers 80% of emergency health care costs while in another country, after you pay a $250 deductible.3

Call a Licensed Agent:

Debra is 64 and plans to retire next year. She will apply for Medicare Part A and Part B. Debra loves to be outside, gardening or walking her dogs. She has had a few suspicious lesions removed recently by her dermatologist, who doesnt accept Medicare assignment. Also, Debra wants to travel the world in her early retirement and is concerned about needing care overseas. After doing some research, Debra decided to purchase Medigap Plan G, as it will cover any Part B excess charges from her dermatologist and pay for emergency services abroad.

Also Check: Is Medicare A Social Security Benefit

Switching From Medicare Advantage

If you currently have a Medicare Advantage plan and want to go with a Medigap policy, when can you switch to Plan G? You can switch to Original Medicare during the Annual Election Period from October 15 to December 7, or the Medicare Advantage OEP from January 1 to March 31. Then you can apply for a Medicare Supplement plan.

In most states you will not have guaranteed-issue rights when you switch, meaning you might face medical underwriting and higher premiums. Some states do allow it. To see what the Medigap rules are where you live, check with your state insurance department.

Medigap Policies Are Standardized

Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as “Medicare Supplement Insurance.” Insurance companies can sell you only a “standardized” policy identified in most states by letters.

All policies offer the same basic

but some offer additional benefits, so you can choose which one meets your needs. In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way.

Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

- Don’t have to offer every Medigap plan

- Must offer Medigap Plan A if they offer any Medigap policy

- Must also offer Plan C or Plan F if they offer any plan

You May Like: Does Medicare Pay For Foot Care

Are Medsup Plans Sold In Massachusetts Minnesota And Wisconsin Different

Insurance companies dont sell MedSup Plan G policies in Massachusetts, Minnesota or Wisconsin. If you live in one of these states, youll have to choose a different kind of Medicare Supplement plan.

These states only offer a few MedSup plans, so you won’t have to do much homework before you settle on one of them.