What Are Exceptions To The Part B Late

You dont have to pay a penalty if you sign up for Medicare Part B within eight months of losing your job-based coverage. There are also these other exceptions:

Less than a year without Part B. If you miss your enrollment deadline but sign up during the next GEP, and in the meantime fewer than 12 full months have lapsed, you will not pay a penalty. So, if your IEP ends May 31, 10 months will have passed before the March 31 end of the GEP.

Problems with phone signup. In 2022 you have extra time to enroll in Medicare without penalties if you had trouble signing up since the beginning of the year because of problems with the Social Security Administrations phone system. The SSA handles enrollment for Medicare parts A and B.

This equitable relief gives you until Dec. 30, 2022, to enroll, even though the GEP is over. The time between your failed attempt at enrollment in 2022 and when you signed up with equitable relief wont count toward the late-enrollment penalty.

A reset of the penalty clock. If you are younger than 65, have Medicare because of a disability and are paying Part B late penalties, you will no longer pay them after you turn 65. At that point, you become eligible for Medicare based on age instead of disability.

Medicaid. If you are enrolled in this federally financed but state-run health program for people with incomes below a certain amount, in addition to Medicare, your state pays your Part B premiums. Any late penalties are waived.

Keep in mind

A Late Enrollment Penalty

- Some people have to buy Part A because they don’t qualify for premium-free Part A.

- If you have to buy Part A, and you don’t buy it when you’re first eligible for Medicare, your monthly premium may go up 10%.

- You’ll have to pay the penalty for twice the number of years you didn’t sign up.

Example:

What If I Dont Sign Up For Medicare Part B Because I Have Other Health Insurance

There are situations where you can keep your current health insurance. You can keep your plan if you have creditable coverage through your employer, spouses employer, or a union. You will not have to pay the penalty for delaying Medicare Part B coverage.

However, if your coverage is not creditable or you lose coverage , the clock begins to tick.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Usually, you will be able to sign up for Medicare Part B right away, during a Special Enrollment Period. This is an eight-month window beginning when your employer coverage ends. If you do not enroll during this period, you will have to pay the Medicare Part B penalty. You will pay a 10% premium increase for each full 12 months you wait beyond the date the Special Enrollment Period began.

If you retire before age 65 and choose to extend your coverage using COBRA, you must end COBRA coverage once you are eligible for Medicare. COBRA is not creditable coverage to avoid the Medicare Part B penalty.

Also Check: Does Medicare Cover Family Counseling

What Is The Late Enrollment Penalty For Medicare Part B

Medicare Part B enrollment is complicated, and the wrong decision can leave you without health coverage for months and lead to lifetime premium penalties. Part B premiums increase 10% for every 12-months you were eligible for Part B but not enrolled. People who delay Part B because they were covered through their own or a spouses current job are exempt from this penalty, and can generally enroll in Part B without any delays.

However, people who delay Part B enrollment and didnt have current job-based health coverage can find themselves out of luck. They dont qualify for the Part B Special Enrollment Period and cant enroll in Part B until the next General Enrollment Period , which runs from January to March of each year, with coverage effective the month following enrollment . The GEP for the current year may have passed by the time you discover you need Part B, potentially your Part B coverage effective date by an entire year.

How To Avoid Medicare Late Enrollment

If you dont have health insurance, the simplest way to avoid Medicare Part A and Part B late enrollment penalties is to sign up during your open enrollment window.

But if you have health coverage through your or your spouses employer and want to keep it for the time being, you may qualify for a special enrollment period later on.

If youre covered under a private group plan, your Medicare Special Enrollment period is either:

- Anytime while you are still covered by the group plan.

- In the eight months beginning the month after your employment ends or the group coverage plan ends, whichever occurs first.

Recommended Reading: Is There Any Dental Coverage With Medicare

How Can I Avoid Late Enrollment Penalties

- Sign up during your IEP.

- Contact your current health insurance plan before you become eligible for Medicare if you are unsure about whether or not you qualify for a SEP.

- Enroll before your SEP ends.

- Even if you do not take prescription drugs when you become eligible for Medicare, consider enrolling in a low-cost drug plan to avoid having to pay late penalty fees later.

- Keep good records of your current health insurance notices of creditable coverage and any conversations you have with agents who offer you advice.

How And When To Sign Upand Save

Meredith Mangan is a senior editor for The Balance, focusing on insurance product reviews. She brings to the job 15 years of experience in finance, media, and financial markets. Prior to her editing career, Meredith was a licensed financial advisor and a licensed insurance agent in accident and health, variable, and life contracts. Meredith also spent five years as the managing editor for Money Crashers.

David J. Rubin is a fact checker for The Balance with more than 30 years in editing and publishing. The majority of his experience lies within the legal and financial spaces. At legal publisher Matthew Bender & Co./LexisNexis, he was a manager of R& D, programmer analyst, and senior copy editor.

Aldomurillo / Getty Images

When you turn 65, youre eligible to enroll in Medicare. Most people get Part A for free. However, Part B , Part D , and Medigap arent free.

If you or your spouse are covered under another plan, you may be wondering if you have to enroll, when you should, and which parts to enroll in. If you plan to enroll in Parts A and B , you may be wondering if and when you should get a Part D prescription drug plan, a Medigap policy, or if you should bundle your Medicare coverage in a Medicare Advantage plan .

Learn how Medicare late enrollment penalties work, which Medicare parts they apply to, and how to avoid paying them.

Also Check: What Does Bcbs Medicare Supplement Cover

How To Enroll In Medicare Part A

There are 3 ways to enroll in Medicare Part A. Regardless of the option you chose, you will go through the Social Security Administration because they manage this program.

Hat Is The Medicare Part D Late Enrollment Penalty

The Medicare Part D late enrollment penalty is an additional cost on top of your monthly Medicare Part D premium. This extra charge is based on the current years average national Medicare Part D premium.

The Medicare Part D penalty is 1% of the average premium for every month you went without creditable drug coverage when first eligible for Medicare. The penalty is in place to encourage beneficiaries to enroll in a Medicare Part D plan if they lack creditable coverage, meaning drug coverage at least as good as a Medicare Part D plan.

When you first become eligible for Medicare, you receive an Initial Enrollment Period to sign up for Original Medicare. Once you have Original Medicare, you are eligible for Medicare Part D.

If you age into Medicare, your Initial Enrollment Period begins on the first day of the month, three months before your 65th birth month. It ends on the last day of the third month after your birth month. If you lack creditable coverage, you must sign up for Medicare prescription drug coverage during this window to avoid the Medicare Part D penalty.

After your Initial Enrollment Period, you will pay the Medicare Part D late penalty if you go without one of these types of drug plans for 63 days or more:

- A Medicare Part D plan

- Prescription coverage through Medicare Part C a Medicare Advantage Prescription Drug plan

- Another healthcare plan that includes prescription drug coverage that is at least as good as the coverage Medicare provides

Don’t Miss: How Much Is Medicare B Deductible

How Do I Appeal The Medicare Part B Penalty

If you feel that the Medicare Part B penalty should not apply, you may request a review. Medicare has reconsideration request forms to file an appeal.

Unfortunately, you will still pay the Medicare Part B penalty while waiting for your appeal to process. Additionally, there is no timeline by which Medicare must abide when processing your appeal.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

- Was this article helpful ?

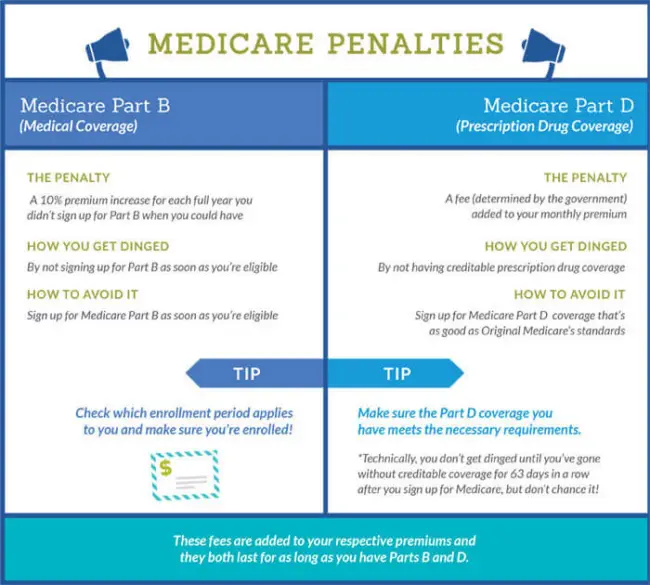

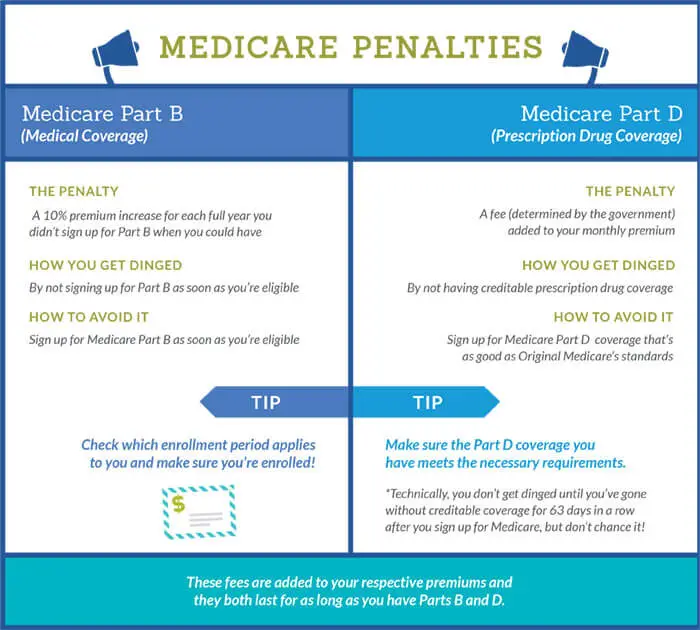

What Are Medicare’s Penalties

Medicare makes you pay extra for signing up late for its Part A , Part B , and Part D plans. Here’s what to know about those penalties:

Part A. You qualify for Part A with no premiums if you or your spouse paid Medicare taxes for at least 10 years while working. If you dont qualify, you can buy Part A coverage. But if you dont sign up during your first enrollment period , Medicare increases your premium by 10%. You pay this extra rate for twice the number of years you failed to enroll. So if you waited for 2 years, for example, you face 4 years of higher Part A premiums.

Part B. The late-enrollment penalty for Part B also is a 10% hike on premiums. But you get hit with another 10% extra for each 12-month period that passes after you’re eligible to enroll. Worse, you pay that penalty as long as you stay in Part B.Say you didnt enroll in Part B until 2 years and 3 months after your first eligibility period ended. Since two full 12-month periods passed, your penalty is an extra 20% for as long as you’re in Part B.

Part D. If you choose to buy Part D prescription drug coverage, it also pays to sign up when you’re first eligible. You pay a penalty if you go without “creditable” drug coverage, either from Medicare or through an employer, for at least 63 days after your initial enrollment period ends. “Creditable” means the coverage is at least as good as Medicare’s.

You May Like: When To Sign Up For Medicare Part D

Penalties For Not Signing Up For Medicare: Medicare Part A

Letâs say youâre not automatically enrolled in Original Medicare, Part A and Part B. In that case, you should generally enroll in Medicare Part A as soon as you qualify. Your Medicare Initial Enrollment Period usually starts 3 months before the month you turn 65, includes that month, and continues for 3 months after that. Itâs a seven-month period altogether.

You could face a late enrollment penalty for Medicare Part A if both of these are true for you:

- You didnât sign up for Part A during your IEP.

- You have to pay a Part A monthly premium. If youâve worked at least 10 years while paying Medicare taxes, you typically donât pay the Part A premium.

If you donât have to pay a Part A premium, you generally donât have to pay a Part A late enrollment penalty.

The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled.For example, suppose that:

- You were eligible for Medicare in 2020, but you didnât sign up until 2022.

- You worked for eight years while paying Medicare taxes â so you do have to pay a Part A premium.

In this example, your Part A premium in 2022 would be $274 per month plus 10% of $274 every month. In this example, youâd pay the penalty for 4 years . Be aware that the Part A premium can change from year to year, so your penalty amount might also change.

Medicare Part C Does Not Have A Late Enrollment Penalty

There is no late enrollment penalty for Medicare Part C . However, you may only sign up for a Medicare Advantage plan at certain times of the year.

Learn more about when you can sign up for a Medicare Advantage plan, such as during the annual Medicare Open Enrollment Period which runs from each year.

You May Like: How Do I Find My Medicare Card Number Online

Medicare Supplement Insurance Has No Late Enrollment Penalty

Medicare Supplement Insurance does not have any late enrollment penalties. However, theres a good reason to sign up for a Medigap policy when youre first eligible.

During your Medigap Open Enrollment Period , insurance companies are not allowed to use medical underwriting to determine your Medigap plan rates.

If you apply for a Medigap plan after your Medigap Open Enrollment Period, insurance companies can use your health to determine your plan premiums. They could even potentially deny you coverage altogether.

Although there is technically not a late enrollment penalty for Medigap, its easy to see how enrolling in a Medigap plan as soon as you are eligible can be beneficial.

Do I Pay A Penalty If I Don’t Enroll In Medicare And Why

As with any group insurance plan, Medicare needs healthy people paying premiums to help offset the cost of covering people who need to use more of its benefits.

If everyone waited until they needed a plan to enroll, costs would skyrocket. So you can delay enrollment in Medicare Part B or in a Part D prescription drug planand delay the monthly premiumsbut you may pay a higher premium once you decide its time to enroll.

Heres an overview based on the various parts of Medicare coverage:

- If youre not eligible for premium-free Part A based on your work history, your monthly premium may increase if you dont purchase it when you are first eligible

- In most cases, if you dont sign up for Part B when youre first eligible, youll have to pay a penaltyand not just upon enrollment. Youll continue to pay that penalty for as long as youre enrolled in Medicare Part B

There are exceptions to the rule, however. If you or your spouse is still working and has healthcare coverage through an employer or other creditable source, such as an individual healthcare plan or a state-established healthcare plan,1 you can wait to sign up for Part B or Part D without paying a penalty.

But once your employer coverage is gone, the only way to avoid a penalty is to enroll in Part B during whats called a Special Election Period . Thats an 8-month period that begins when your employer coverage ends or you stop working, whichever comes first.

Read Also: How Much Is Medicare Insurance Premium

How Much Is The Part D Late Enrollment Penalty

For each month you dont enroll or have creditable prescription drug coverage, youll accrue a 1% penalty of the average monthly drug plan cost.

Lets assume you went four years without taking drug coverage. Youll receive a 1% penalty that compounds monthly. You would have a 48% penalty. The current average Part D premium is a little more than $31.50. Your Part D penalty would be about $14 a month.

No matter which drug health plan you were to enroll in, you would pay an additional $14 a month on top of your plans premium for the rest of your life.

How To Avoid The Medicare Part D Late Enrollment Penalty

If you dont sign up for Medicare Part D prescription drug coverage, or a Medicare Advantage plan that includes drug coverage you could be stuck with a penalty if you change your mind later on.

But there are ways to avoid the penalty.

Four Ways to Avoid Medicare Part D Enrollment Penalties

Don’t Miss: Does Medicare Cover Home Health Aide Services

D Prescription Drug Coverage

Late Enrollment Penalty

This penalty is added to your monthly Medicare prescription drug plan premium for as long as you have prescription drug coverage. It may also continue to increase or decrease year-over-year as the national base beneficiary premium changes.

How much is the penalty?

One percent of the national base beneficiary premium , times the number of full, uncovered months you didnt have Part D or creditable coverage.

Example

Its 2022: Jane Smith is currently eligible for Medicare, and her Initial Enrollment Period ended on May 31, 2019. Since Jane was without creditable prescription drug coverage for 31 months from June 2019December 2021, her penalty in 2022is 31% of $33.37 . Since the monthly penalty is always rounded to the nearest $0.10, she pays $10.34 each month in addition to her plans monthly premium.

Here’s the math:

.01 x 31 months = .31 penalty.31 × $33.37 = $10.34$10.34 rounded to the nearest $0.10 = $10.30$10.30 = Jane Smiths monthly late enrollment penalty for 2022