Is Irmaa Based On Agi Or Taxable Income

An income-related monthly adjustment amount, or IRMAA, is an extra Medicare cost added to your Part B and Part D premiums. The Social Security Administration determines whether you’re required to pay an IRMAA based on the modified adjusted gross income reported on your IRS tax return from two years prior.

Who Pays The 38 Investment Tax

The net investment income tax is a 3.8% tax on investment income such as capital gains, dividends, and rental property income. This tax only applies to high-income taxpayers, such as single filers who make more than $200,000 and married couples who make more than $250,000, as well as certain estates and trusts.

Financial Planning And Health Insurance Go Hand In Hand

If your income exceeded $91,000 in 2020, your 2022 Medicare Part D and Part B premiums depend on your income. And as you can see in the tables above, the additional premiums can be substantial.

Understanding how this works including what counts as income as far as Medicare is concerned is a key part of your financial planning. And since the government will base your premiums on your income from two years ago, youll also want to have a good understanding of how to appeal an IRMAA determination, in case you experience a life change that reduces your income.

Jae W. Oh is a nationally recognized Medicare expert, frequently quoted in the national press, including on USA Today, Dow Jones, CNBC, and Nasdaq.com, as well as on radio talk shows nationwide. His book, Maximize Your Medicare, is available in print and ebook formats. Jae has appeared as a speaker in front of libraries, companies, as part of college-sponsored programs. The Managing Principal of GH2 Benefits, LLC, Jae is a Certified Financial Planner, Chartered Life Underwriter, a Chartered Financial Consultant, and a licensed insurance producer in multiple states.

You May Like: Does Medicare Cover Ambulance Fees

How Do I Reduce My Modified Adjusted Gross Income

The best way to lower your MAGI is to lower your AGI. You can do this by contributing more toward expenses that qualify as above-the-line deductions. These include HSA contributions, medical expenses exceeding 10% of your AGI, pre-tax retirement plan contributions, capital losses, mortgage interest, property taxes, and charitable contributions.

The Irs Uses Magi To Determine Ira Eligibility And More

The Balance / Bailey Mariner

Your modified adjusted gross income determines whether you are allowed to claim certain benefits on your taxes. These include whether you can deduct contributions to an individual retirement account . It also impacts what you can put in a Roth IRA each tax year.

Certain education-related tax benefits and income tax credits are based on MAGI. Under the Affordable Care Act, your household MAGI also impacts whether you can get income-based Medicaid or subsidized health insurance through the Marketplace.

In 2021, the American Rescue Plan allowed more households to access subsidized health insurance through the Marketplace. In tax years 2021 and 2022, you may be eligible for new tax credits that lower the cost of your Marketplace health insurance, even if your MAGI was too high to qualify in previous years. You will still need to file taxes at the end of the year to prove that your income was not too high for the tax credit.

The first thing to know is that your total income, modified adjusted gross income, and adjusted gross income are not the same things. Though they use most of the same base numbers, each is calculated in a slightly different way.

For tax-planning purposes, you will need to learn the differences and when to use each one.

Recommended Reading: Does Medicare Cover Retirement Home

How Social Security Works With Magi And Obamacare

Taxable and non-taxable Social Security income is counted toward MAGI for ObamaCare and affects tax credits and Medicaid eligibility, but only if a person has to file taxes.

Social Security Income includes disability payments , pension, retirement benefits, and survivor benefits, but does not include supplemental security income . . In general, everything except for SSI counts toward MAGI for ObamaCare and Medicaid.

ObamaCare counts Modified Adjusted Gross Income of the head of household and spouse and the Adjusted Gross Income of tax dependents. However, if a tax dependent doesnt have to file taxes due to falling below the tax filing threshold, then their non-taxable social security income doesnt count toward MAGI. This is because nontaxable social security income doesnt count toward the tax filing limit. So if the only income of a tax dependent is nontaxable social security income, they may want to consider not filing to maximize cost assistance eligibility limits of the household. Or conversely, they may want to file to ensure the family qualifies for a Marketplace plan with cost assistance rather than Medicaid.

What is SSI?

Medicare Part D And Magi

A similar situation exists with respect to Medicare Part D, which helps pay for prescription drugs.

As with Medicare Part B, the premiums for Medicare Part D are based on your MAGI and we use the same method to calculate MAGI.

Your Medicare Part D premiums are $0 if your MAGI is below $91,000 or $182,000 . If your MAGI is above those levels, you will pay your plan premium plus an IRMAA. As before, the IRMAA is an extra charge added to your standard premium.

Read Also: Does Cigna Have A Medicare Supplement Plan

How Does Modified Agi Work

Modified AGI includes Adjusted Gross Income on your federal income tax return plus any excluded foreign income, nontaxable Social Security benefits , Supplemental Security Income , and tax-exempt interest received or accrued during the taxable year.

You wont find MAGI on your 1040, but you will find Modified AGI on Form 8962, Premium Tax Credit , the form you use for reporting Marketplace cost assistance. If you are looking at past tax returns, look at Adjusted Gross Income and take it from there. In most cases, its a similar amount.

MAGI, in most cases is simply your Adjusted Gross Income plus taxable interest found on lines 37 and 8b of your IRS from 1040. Take a look at the form. Youll see big sections on Income and Adjusted Gross Income. If you dont think your income will change, you can base everything on that information. See the full How to Calculate Modified Adjusted Gross Income video.

We cover MAGI on our subsidy calculator page, but since its so important to the ACA, we will do a detailed breakdown of MAGI and the other income types below.

FACT: When you apply for the Marketplace, all of your calculations will be done for you in regards to receiving cost assistance. That being said, knowing how all of this works will allow you to be certain that your cost assistance is right and will help you if you are filing your taxes by hand. By learning how to take advantage of tax deductions, you can save money both at tax season and when buying health insurance.

Whats Medicare Irmaa And Why It Matters For You Updated For 2022 With A Special Offer

by Springwater Wealth | Apr 29, 2022

If youre retired and have health insurance through the Affordable Care Act or Medicare, your premiums are directly related to your Modified Adjusted Gross Income . The higher your income, the higher your premiums.

Unless you prepare your own tax return, you probably dont know how your MAGI is calculated. But ignorance is definitely not bliss when it comes to your MAGI. In fact, it can cost you.

You May Like: Does Medicare Pay For Tdap Vaccine

How Do You Calculate Medicare Tax

Employers and employees split the tax. For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.

How to calculate additional Medicare tax properly?

- How To Calculate Additional Medicare Tax Properly Additional Medicare Tax Example. You must combine wages and self-employment income to determine if your income exceeds the threshold. Net Investment Tax Example. In addition to the Medicare Tax, there is also the Net Investment Income Tax an individual or couple must pay if their respective incomes are over Adjustments to Net Investment Income.

Medicare Premiums And Surcharges Examples

Below are three examples of how Medicare premiums and surcharges are computed. Understanding the calculations will help clients appreciate and understand the strategies to lessen the impact.

Example 1

B is single. He usually reports MAGI of about $75,000 per year. He is enrolled in a Medicare Part D plan. In 2017, when his other income included in MAGI is $77,500, he is considering withdrawing an additional $32,500 from his traditional IRA to purchase a car for cash, for a total MAGI of $110,000. How much more will B need to pay in 2019 for Medicare premiums?

If he makes the withdrawal, B will need to pay total Medicare costs of $3,633.60 in 2019, or $2,007.60 in excess of the base premium cost, if his MAGI is increased by the $32,500 . The excess premium will be incurred only for 2019, provided his MAGI in 2018 dropped back below $85,000. The excess premiums represent an increase in household expenses as a percentage of his 2017 income of 1.83% or 2.59% of his normal income level. In this case, B may want to try to keep his income below the $85,000 surcharge threshold by financing his purchase or leasing the car. He could withdraw enough from his IRA to service the debt and still stay below the threshold.

Example 2 concerns a couple who have not signed up for a Part D plan however, they must still pay Part D surcharges, since a former employer has enrolled them and is paying the basic cost as a fringe benefit.

Effect on premiums of an additional IRA withdrawal

Example 2

Recommended Reading: Is Nano Knee Covered By Medicare

How Much Are Part B Irmaa Premiums

If an individual makes $91,000 or more or a jointly filing household makes $182,000 or more then the IRMAA assessment increases the 2022 Part B premium to the amounts shows in Table 1.

| Table 1. Part B 2022 IRMAA |

|---|

| Individual |

Source: CMS

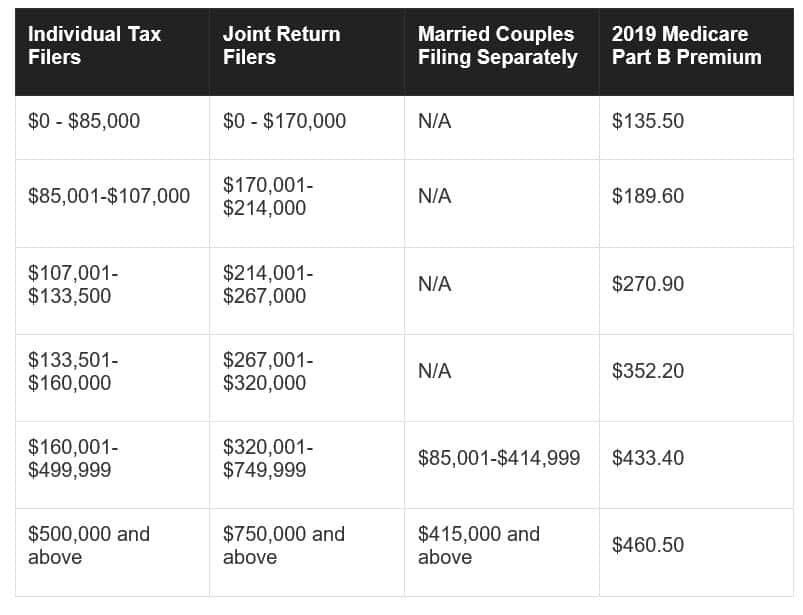

This level has risen from 2019, when the income requirements were $85,000 and $170,000 respectively. 2020 was the first year that these MAGI income requirements were adjusted for inflation. Going forward, the Modified Adjusted Income requirements will continue to be adjusted by inflation .

Planning For Medicare Taxes Premiums And Surcharges

A little foresight can reduce costs.

Medicare and budgeting for future medical expenses are important elements of personal financial planning. Sometimes, controlling Medicare premium costs is overlooked and estimating future medical out-of-pocket expenses is understated. Accordingly, this article focuses on Medicare planning issues that CPA financial planners should consider when advising clients. These issues include an overview of Medicare taxes, the determination of premium surcharges, projected future health care costs, and strategies to mitigate the impact of the escalating Medicare charges paid by many higher-income clients.

Read Also: Does Medicare Cover Palliative Care For Dementia

What Is Magi Or Modified Adjusted Gross Income

Under the Affordable Care Act, eligibility for Medicaid, premium subsidies, and cost-sharing reductions is based on modified adjusted gross income . But the calculation for that is specific to the ACA its not the same as the MAGI thats used for other tax purposes.

The details of the MAGI calculation are outlined here. For most enrollees, its the same as their adjusted gross income from Form 1040. But there are three things that have to be added to AGI to get MAGI under the ACA. If you have them, you must add in these amounts:

- Non-taxable Social Security benefits , but Supplemental Security Income does not get counted when the ACA-specific MAGI is determined)

- Tax-exempt interest

- Foreign earned income and housing expenses for Americans living abroad

What Income Is Subject To Additional Medicare Tax

What Is the Additional Medicare Tax? The Additional Medicare Tax has been in effect since 2013. Taxpayers who make over $200,000 as individuals or $250,000 for married couples are subject to an additional 0.9 percent tax on Medicare. The Additional Medicare Tax goes toward funding features of the Affordable Care Act.

Don’t Miss: What Type Of Insurance Is Medicare Part D

What Purpose Does Magi Serve

The IRS uses MAGI to determine whether you qualify for certain tax programs and benefits. For instance, it helps determine the size of your Roth IRA contributions. Knowing your MAGI can also help you avoid facing tax penalties because over-contributing to these programs and others like them can trigger interest payments and fines. Your MAGI can also determine eligibility for certain government programs, such as the subsidized insurance plans available on the Health Insurance Marketplace.

Dont Miss: What Is The Window To Sign Up For Medicare

How Do I Find My Magi

You won’t find your modified adjusted gross income on your tax return, but it is easy to figure out on your own.

Start with your adjusted gross income from your Form 1040. Then get a calculator, and add back:

- Any IRA deductions that you took

- Any deductions you took for student loan interest or tuition

- Passive income or loss

- Capital gains

Recommended Reading: Does Medicare Cover Mammograms After Age 70

Medicare Premiums And Surcharges

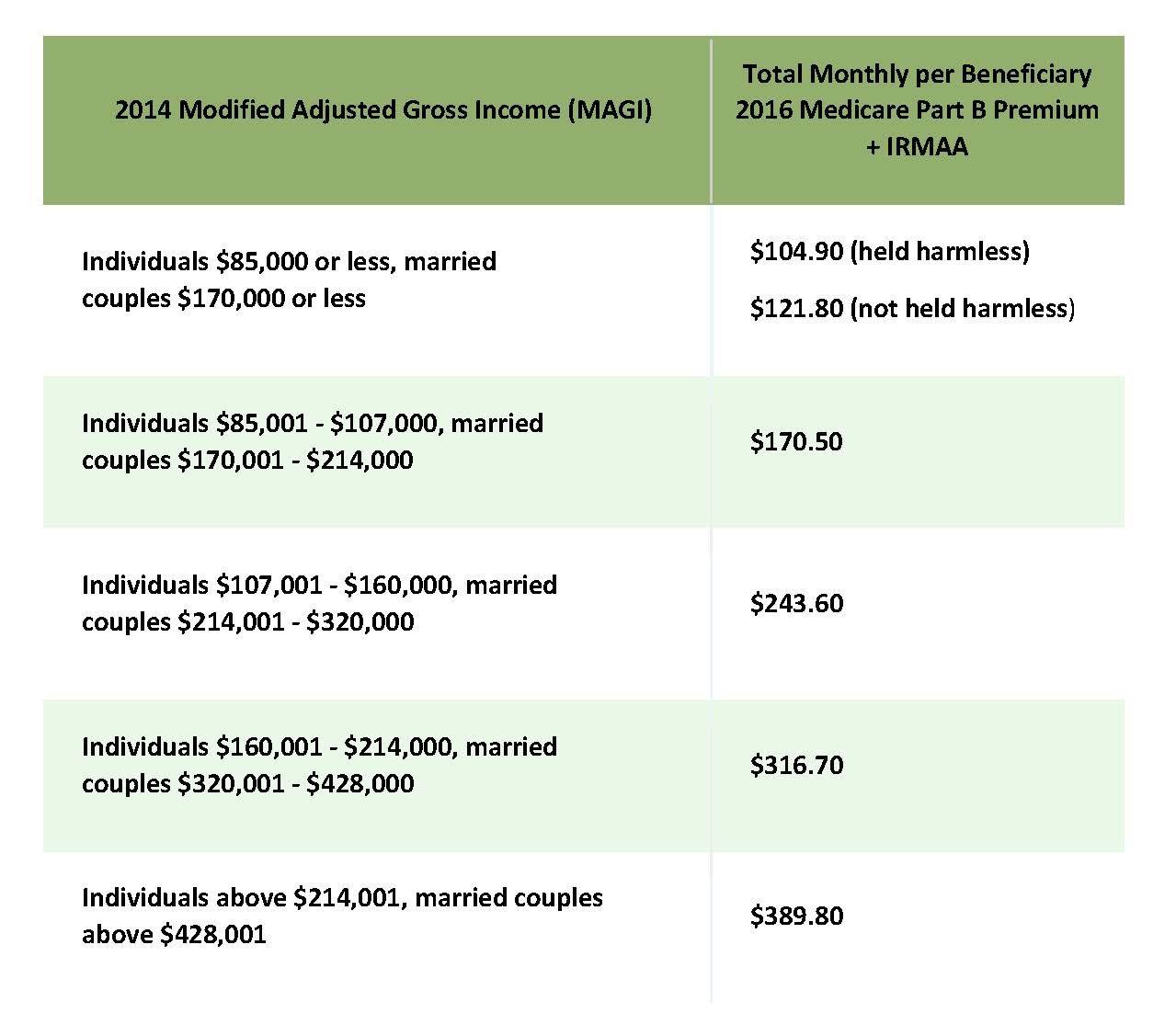

There is no premium or surcharge for Part A. Each year, the Centers for Medicare & Medicaid Services sets the following years Part B premium. As noted previously, the 2019 base Part B premium is $135.50 per month per beneficiary. Most people pay that amount. A small number of people pay a premium that is lower than the base premium because they are protected by the hold harmless rule. The hold-harmless provision protects people from having their previous years Social Security benefit level reduced by an increase in the Part B premium.

Part D coverage is provided via the individual private plan selected by the beneficiary, and base premiums depend upon the plan chosen. Wealthier taxpayers may also pay Medicare surcharges on Parts B and D in addition to the base premium for traditional Medicare or a Medicare Advantage plan. Higher-income individuals paying surcharges are not shielded by the hold-harmless provision. The table Medicare Parts B and D Premiums for 2019 shows the amounts charged for Part B and Part D at the various income thresholds for individuals and joint filers based upon MAGI from two years prior. In other words, the premiums for 2019 are based upon the reported income tax data from 2017.

Medicare Parts B and D premiums for 2019

Recommended Reading: Are Resident Aliens Eligible For Medicare

How Does Medicare Part B Work

Before getting into the weeds of Medicare Part B premiums, lets do a quick review of Medicare Part B and its role in federal retirement health insurance.

Once you turn 65, you become eligible to enroll in Medicare, with its maddening mix of different programs, including Part A, Part B, Part C and Part D. Some of these programs charge you premiums, and some dont.

First the good news: Most Medicare enrollees arent required to pay a premium for Medicare Part A, which covers costs for inpatient hospital care, home nursing care and hospice care. That said, there are typically deductibles and copays for some Medicare Part A expenses.

Medicare Part B covers doctor appointments, outpatient tests and exams as well as medical equipment. Unless your income is very low, youll be charged a monthly premium for Medicare Part B, regardless of whether you are enrolled in Original Medicare or Medicare Advantage, the two options for receiving your Medicare benefits.

If you opt for Original Medicare, the government will cover 80% of your Part B expenses after you meet your deductible. You can purchase a separate supplemental Medigap policy from a private insurer to cover the additional 20% youre on the hook for.

Recommended Reading: Does Medicare Help Cover Assisted Living

Strategies To Keep Magi Low

Lets talk about the ways you can keep your income low. We can do this line by line on the 1040

- 1 Dont make any income! This is important.

- 2a Remember tax-exempt income is pulled back in, so interest paid by municipal bonds will count against you! Dont own Municipal bonds.

- 2b All your income from cash and bonds will be included.

- 3b Ordinary dividends will be pulled in. If you buy and sell stocks, mutual funds, or ETFs frequently , this can hurt!

- 4b Pension income will fully count against you, as will ALL or part of social security. If you want ACA Premium Tax Credits, delay taking pensions and social security until age 65. In addition, pre-tax accounts should not be accessed for income. This includes Roth Conversions!

- Schedule 1 Again, check out the sources of income you want to avoid on schedule 1. Note that you include capital gain harvesting here!

What Is Social Security Increase 2022

The standard Part B premium for 2022 will be $170.10, a 14.5% increase from $148.50 last year. People who have income above certain thresholds pay an additional amount, known as an an Income Related Monthly Adjustment Amount. Monthly premium payments are often deducted directly from Social Security benefit checks.

You May Like: Can You Apply For Medicare At 64

Medicare Part B Part D Irmaa Premium Brackets

September 14, 2021Keywords: AGI, health insurance, Medicare

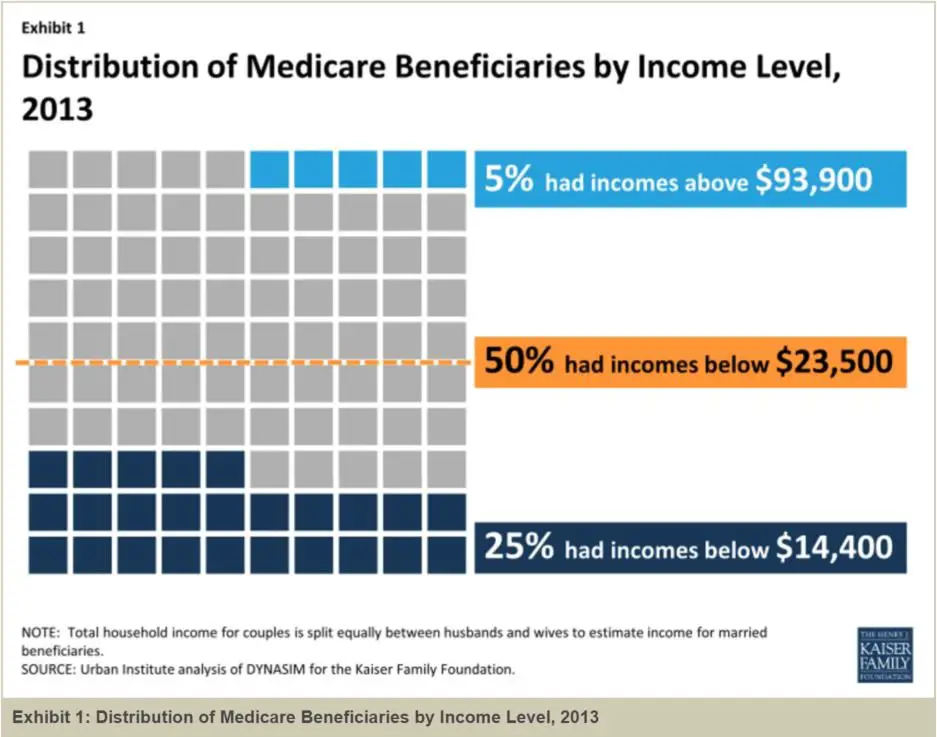

Seniors age 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B that covers doctors services and Medicare Part D that covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount.

I havent seen any numbers that show how much collecting IRMAA really helps the government in the grand scheme. Im guessing very little. One report said 7% of all Medicare beneficiaries pay IRMAA. Suppose the 7% pay double the standard premium, it changes the overall split between the beneficiaries and the government from 25:75 to 27:73. Big deal?

The income used to determine IRMAA is your AGI plus muni bond interest from two years ago. Your 2020 income determines your IRMAA in 2022. Your 2021 income determines your IRMAA in 2023. The untaxed Social Security benefits arent included in the income for determining IRMAA.

* The last bracket on the far right isnt displayed in the chart.